Market Overview:

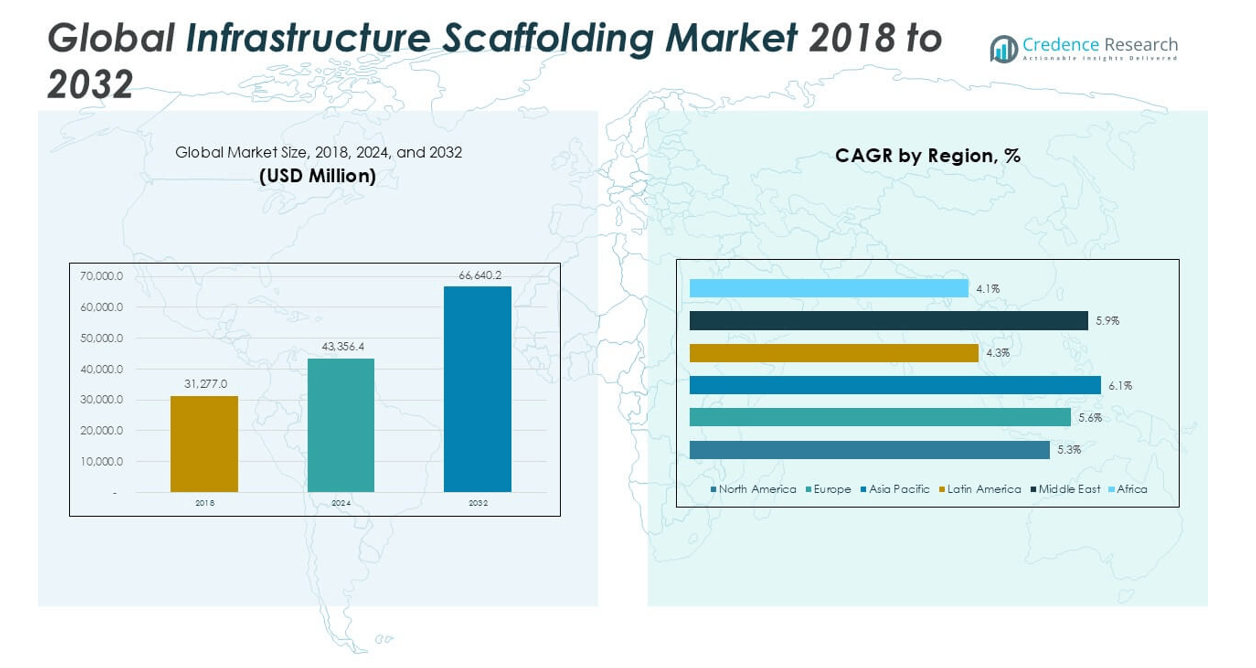

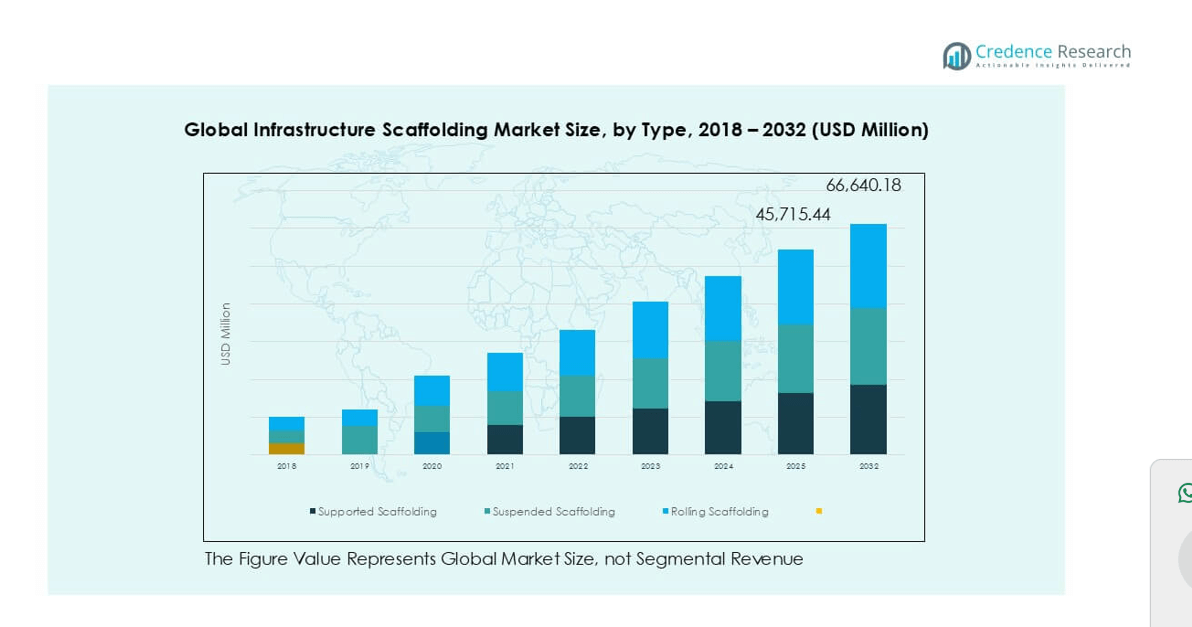

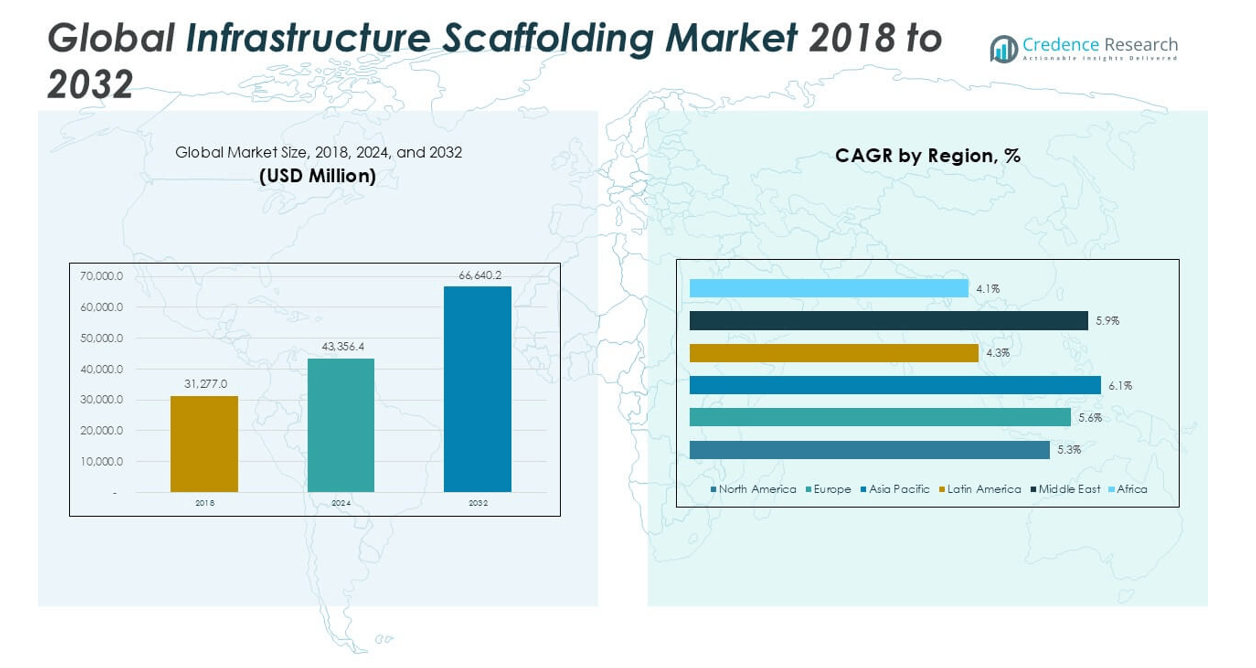

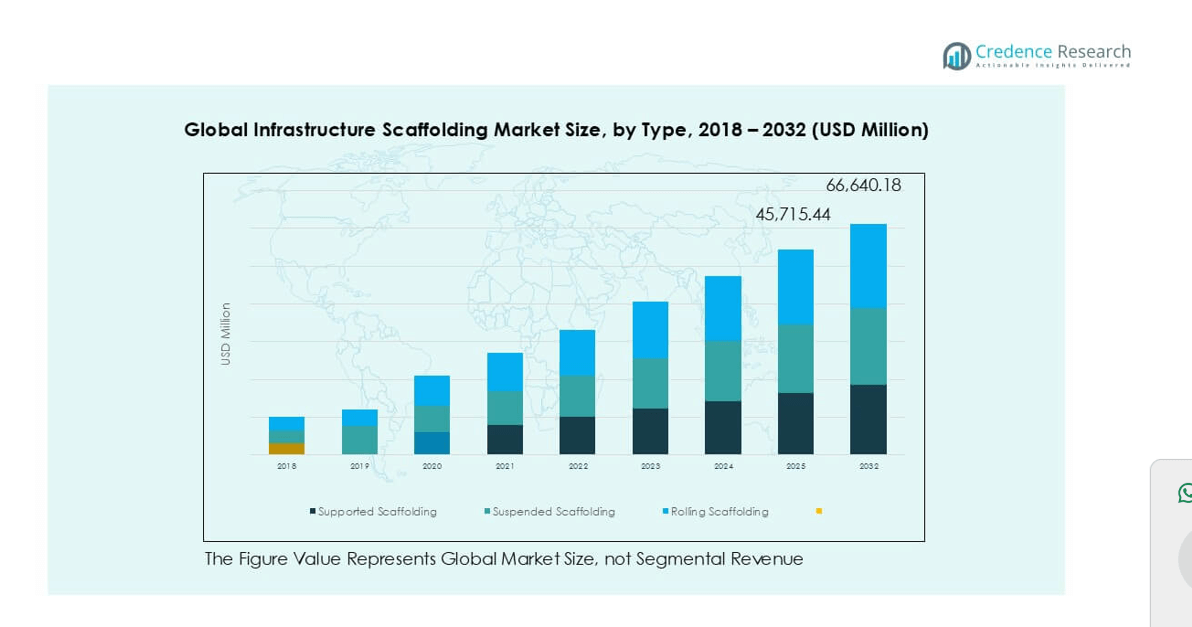

The Infrastructure Scaffolding market size was valued at USD 31,277.0 million in 2018, reached USD 43,356.4 million in 2024, and is anticipated to reach USD 66,640.2 million by 2032, at a CAGR of 5.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Infrastructure Scaffolding Market Size 2024 |

USD 43,356.4 million |

| Infrastructure Scaffolding Market, CAGR |

5.35% |

| Infrastructure Scaffolding Market Size 2032 |

USD 66,640.2 million |

The Infrastructure Scaffolding market is led by prominent players such as Layher GmbH & Co. KG, Safway Group Holding LLC, PERI Group, Altrad Group, BrandSafway, Waco Equipment, ADTO Group Xiang, MJ Gerüst GmbH, Hitech Scaffolding Pvt Ltd, and Atlantic Pacific Equipment Inc. These companies dominate the global landscape through innovative modular systems, strong distribution networks, and compliance with international safety standards. Asia Pacific emerges as the leading regional market, commanding 32.4% of the global share in 2024, driven by rapid urbanization, infrastructure investments, and government-backed development projects across countries like China and India.

Market Insights

- The Infrastructure Scaffolding market was valued at USD 43,356.4 million in 2024 and is projected to reach USD 66,640.2 million by 2032, growing at a CAGR of 5.53% during the forecast period.

- Market growth is primarily driven by rising global infrastructure development, including highways, bridges, railways, and energy projects, with supported scaffolding and steel materials dominating due to their durability and load-bearing capabilities.

- A key trend is the increasing adoption of modular and lightweight aluminum scaffolding systems, along with the growing demand for rental-based scaffolding services for cost efficiency.

- The market is competitive with major players like Layher GmbH, PERI Group, and BrandSafway focusing on innovation, strategic partnerships, and safety compliance, while regional firms offer localized and cost-effective solutions.

- Asia Pacific holds the largest regional share at 32.4%, followed by North America at 27.2% and Europe at 23.8%, with bridges & flyovers being the top application segment globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

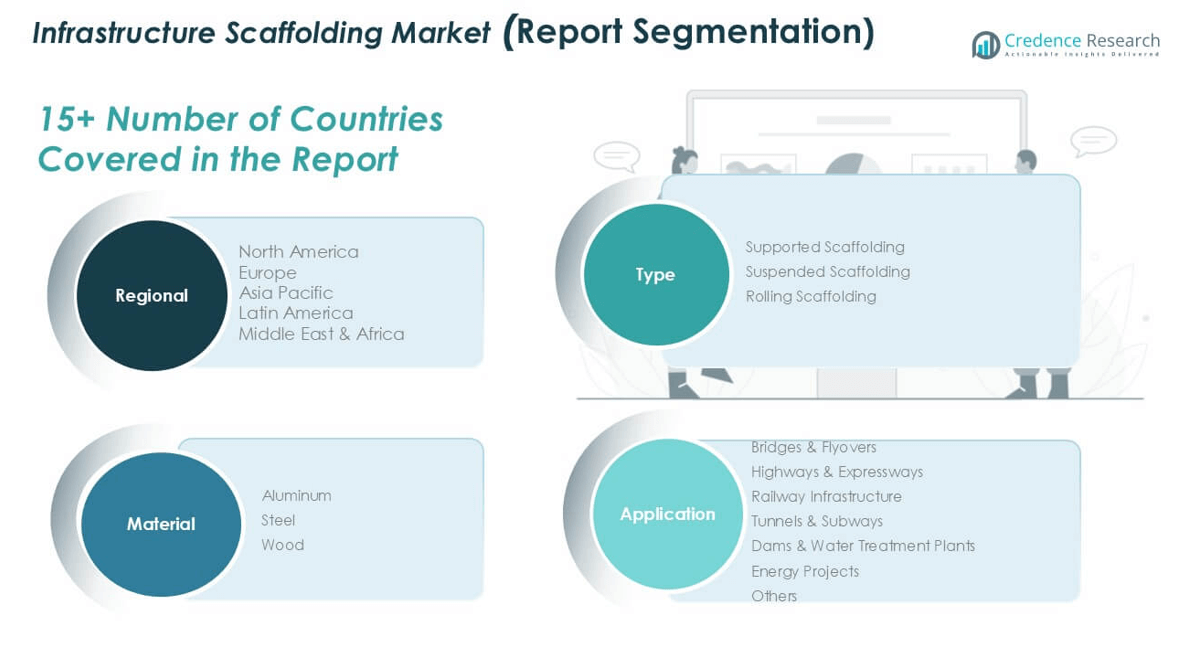

By Type

The Infrastructure Scaffolding market, segmented by type, is dominated by supported scaffolding, accounting for the largest market share in 2024. This dominance is primarily due to its widespread use in large-scale infrastructure projects such as bridges and highways, where stability and load-bearing capacity are critical. Supported scaffolding offers ease of assembly and cost-effectiveness, making it a preferred choice for contractors. Additionally, growing investments in public infrastructure and urban expansion projects across developing regions are further propelling demand for this type over suspended and rolling scaffolding.

- For instance, Layher GmbH & Co. KG has deployed over 150,000 metric tons of its Allround® Scaffolding system across global infrastructure projects, renowned for its bolt-free wedge-head connection technology that enables faster assembly and enhanced load stability.

By Material

Steel scaffolding leads the material segment, holding the highest revenue share in the Infrastructure Scaffolding market. Its superior strength, durability, and load-bearing capacity make it ideal for high-rise and heavy-duty infrastructure projects. The segment’s growth is driven by increasing demand for long-lasting and secure scaffolding solutions in complex construction environments. While aluminum scaffolding is gaining traction due to its lightweight properties and corrosion resistance, especially in maintenance and mobile applications, it remains secondary to steel. Wood scaffolding continues to decline due to safety concerns and limited applicability in modern infrastructure.

- For instance, PERI Group’s modular steel scaffolding solution, PERI UP Flex, supports load classes up to 6, offering proven structural stability in projects like the 1,776-foot One World Trade Center during its façade renovation phase.

By Application

Among applications, bridges & flyovers represent the dominant sub-segment, contributing the largest share to the Infrastructure Scaffolding market in 2024. This growth is fueled by ongoing development and rehabilitation of aging transportation infrastructure worldwide. The complexity and scale of such projects require extensive scaffolding for support, safety, and efficient construction workflows. Highways & expressways and railway infrastructure also form significant portions of the market, driven by government investments and national development plans. Additionally, projects like tunnels, dams, and energy facilities are expanding the scope of scaffolding applications across diverse engineering landscapes.

Market Overview

Expansion of Infrastructure Development Projects

Rapid urbanization and increasing government investments in infrastructure development are major growth drivers for the Infrastructure Scaffolding market. Large-scale construction projects such as highways, railways, bridges, and energy plants demand reliable and flexible scaffolding solutions for safety and efficiency. Emerging economies, particularly in Asia-Pacific and the Middle East, are heavily investing in transport and utility infrastructure to support economic growth, which significantly fuels market demand. The growing emphasis on smart cities and modernization of public facilities further supports the increased adoption of scaffolding systems.

- For instance, BrandSafway has supplied over 1.8 million linear feet of scaffolding to infrastructure upgrades in the Kingdom of Saudi Arabia under the Vision 2030 initiative, providing tailored access solutions for metro, bridge, and utility construction.

Rising Focus on Worker Safety and Regulatory Compliance

Stricter safety regulations and growing awareness about worker safety in the construction industry are driving the adoption of standardized and engineered scaffolding systems. Regulatory bodies globally have introduced stringent construction safety norms, compelling contractors to opt for high-quality, certified scaffolding products. This trend is shifting preferences from traditional wooden platforms to steel and aluminum structures that offer enhanced safety, structural stability, and compliance with global safety standards. As construction site risks remain high, the need for dependable scaffolding systems continues to increase.

- For instance, Altrad Group has implemented digital monitoring systems across more than 2,000 scaffold structures in Europe using RFID-tagging and real-time safety inspections, significantly reducing incident rates during critical shutdown and maintenance operations.

Technological Advancements and Modular Designs

Innovation in scaffolding technology, including modular and pre-engineered systems, has enhanced productivity and reduced assembly time, acting as a key growth catalyst. Lightweight materials, quick-lock mechanisms, and mobile scaffolding units are streamlining construction operations and reducing labor dependency. The integration of digital tools such as Building Information Modeling (BIM) further supports precision in scaffolding design and planning. These advancements make scaffolding more efficient, cost-effective, and adaptable to complex architectural requirements, thereby driving adoption across various infrastructure projects.

Key Trends & Opportunities

Growing Demand for Sustainable and Lightweight Materials

A shift towards sustainable construction practices has accelerated demand for recyclable and lightweight scaffolding materials like aluminum. These materials offer advantages in terms of reduced environmental impact, corrosion resistance, and ease of transport and handling. The trend aligns with global sustainability goals and provides opportunities for manufacturers to innovate eco-friendly scaffolding products. Additionally, lightweight scaffolding systems reduce installation time and improve operational efficiency, making them attractive for infrastructure and maintenance projects with tight deadlines.

- For instance, ADTO Group has introduced a proprietary aluminum alloy scaffolding line used in over 3,500 mobile scaffolding units across Southeast Asia, resulting in 30% lower installation time and improved carbon footprint across projects.

Increased Adoption of Rental Scaffolding Services

The rise of scaffolding rental services presents a key opportunity in the market, particularly among small to mid-size construction companies looking to reduce capital expenditure. Renting scaffolding allows contractors to access modern and compliant equipment without the burden of ownership costs, storage, and maintenance. This model also supports scalability, enabling businesses to adjust scaffolding requirements based on project size and duration. The growing construction activity across emerging markets is likely to further bolster demand for rental-based scaffolding solutions.

- For instance, MJ Gerüst GmbH operates over 60 rental hubs across Germany and Eastern Europe, supplying scaffolding solutions for more than 12,000 projects annually, with real-time logistics support and pre-assembly options

Key Challenges

High Cost of Advanced Scaffolding Systems

Despite their advantages, modern scaffolding systems made from steel or aluminum involve higher initial costs, which can be a barrier for cost-sensitive markets. Small contractors or projects with limited budgets may continue to rely on traditional or makeshift solutions, which impedes the overall market penetration of engineered scaffolding. Additionally, investment in trained labor for installation and compliance with safety standards adds to the overall project cost, limiting adoption in certain regions.

Labor Shortages and Skill Gaps

The global construction industry is experiencing a shortage of skilled labor, particularly in scaffolding erection and dismantling. Scaffolding setup requires specialized knowledge to ensure structural stability and worker safety. The lack of trained personnel can lead to delays, safety risks, and increased operational costs. Moreover, the complexity of advanced scaffolding systems necessitates ongoing training, which many small companies may overlook due to resource constraints, further compounding the challenge.

Regulatory Variability Across Regions

Diverse and often inconsistent safety regulations across regions pose a challenge for manufacturers and service providers operating in multiple geographies. While some countries enforce strict scaffolding standards, others may have limited enforcement or outdated regulations. This variability complicates product standardization and increases compliance costs. Manufacturers must tailor their solutions to meet local requirements, which can hinder economies of scale and delay market entry into new regions.

Regional Analysis

North America

North America held a significant share of the global Infrastructure Scaffolding market in 2024, accounting for approximately 27.2% of the global market, with a value of USD 11,794.81 million, rising from USD 8,619.93 million in 2018. The market is projected to reach USD 17,812.92 million by 2032, growing at a CAGR of 5.3% during the forecast period. The region’s growth is driven by consistent investments in transportation infrastructure, urban redevelopment projects, and stringent safety regulations promoting the use of advanced scaffolding systems. The U.S. remains the primary contributor due to large-scale construction and infrastructure modernization programs.

Europe

Europe accounted for around 23.8% of the global Infrastructure Scaffolding market in 2024, with a market size of USD 10,305.21 million, up from USD 7,403.26 million in 2018. It is projected to reach USD 15,927.00 million by 2032, expanding at a CAGR of 5.6%. The region benefits from strong regulatory frameworks promoting worker safety and quality construction practices. The demand is fueled by continuous renovation of aging infrastructure, especially in Western Europe, and the expansion of sustainable and energy-efficient building projects. Germany, the UK, and France are key contributors to market growth in this region.

Asia Pacific

Asia Pacific emerged as the largest regional market, commanding a 32.4% share in 2024, with a market size of USD 14,064.83 million, up from USD 9,836.61 million in 2018. The market is anticipated to reach USD 22,497.73 million by 2032, registering the highest CAGR of 6.1% during the forecast period. This growth is attributed to rapid urbanization, industrial expansion, and heavy government investments in infrastructure development across countries like China, India, and Southeast Asia. Major infrastructure programs, including smart city initiatives and transportation upgrades, continue to drive robust demand for reliable and scalable scaffolding solutions.

Latin America

Latin America represented approximately 9.6% of the Infrastructure Scaffolding market in 2024, with a market size of USD 4,140.54 million, rising from USD 3,193.38 million in 2018. It is expected to reach USD 5,777.70 million by 2032, growing at a moderate CAGR of 4.3%. The region’s growth is supported by public infrastructure development in Brazil, Mexico, and Colombia, focusing on transport, energy, and sanitation projects. However, the market faces challenges due to economic fluctuations and inconsistent regulatory enforcement. Despite these constraints, infrastructure initiatives under government stimulus packages are creating new opportunities for scaffolding manufacturers and service providers.

Middle East

The Middle East accounted for a 4.9% share of the global market in 2024, with a valuation of USD 2,113.32 million, up from USD 1,495.04 million in 2018. It is projected to reach USD 3,332.01 million by 2032, advancing at a CAGR of 5.9%. The region’s market expansion is driven by large-scale urban and infrastructural projects under national visions such as Saudi Arabia’s Vision 2030 and the UAE’s smart city developments. Demand is also supported by ongoing construction in oil and gas, transportation, and tourism sectors, requiring durable scaffolding systems capable of supporting high-risk, high-value infrastructure work.

Africa

Africa accounted for around 2.2% of the global Infrastructure Scaffolding market in 2024, with a market value of USD 937.74 million, growing from USD 728.75 million in 2018. The market is projected to reach USD 1,292.82 million by 2032, registering a CAGR of 4.1%. Growth is supported by rising investments in basic infrastructure such as roads, water treatment, and energy projects, particularly in Sub-Saharan Africa. However, limited capital availability, skilled labor shortages, and political instability in certain regions hinder faster growth. Despite these challenges, international aid and foreign direct investments in large infrastructure projects are gradually improving market potential.

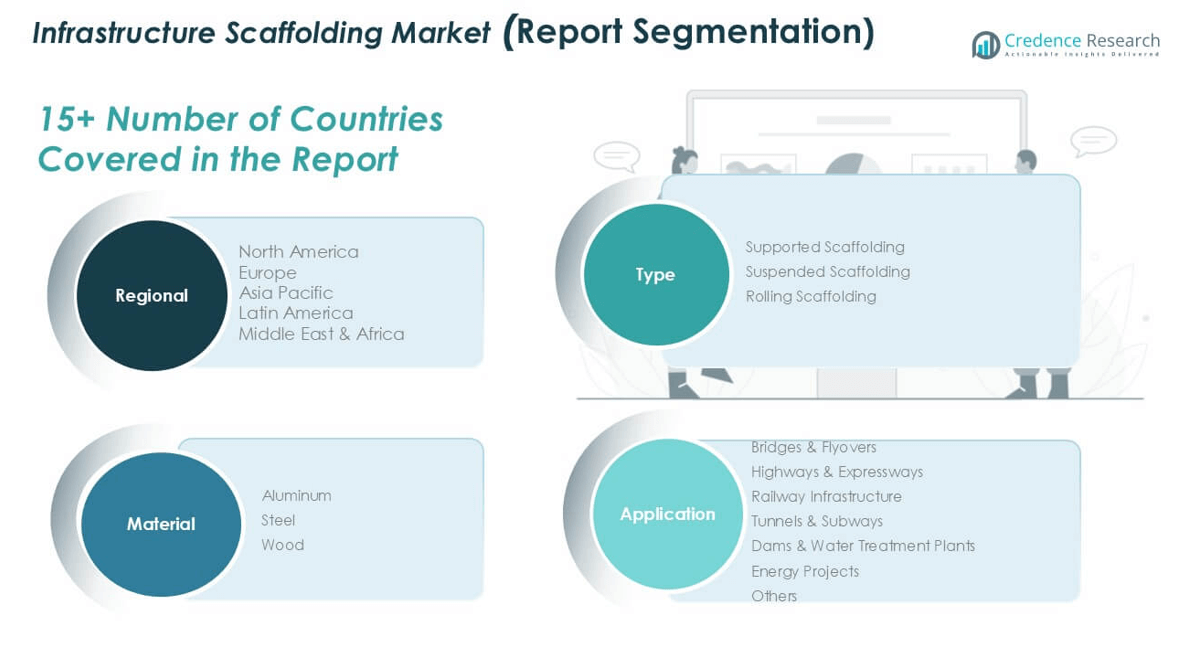

Market Segmentations:

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

By Application

- Bridges & Flyovers

- Highways & Expressways

- Railway Infrastructure

- Tunnels & Subways

- Dams & Water Treatment Plants

- Energy Projects

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Infrastructure Scaffolding market is characterized by the presence of several global and regional players competing on the basis of product innovation, service reliability, safety standards, and project execution capabilities. Leading companies such as Layher GmbH & Co. KG, Safway Group Holding LLC, PERI Group, and Altrad Group dominate the market due to their strong international presence, extensive product portfolios, and long-standing partnerships in the construction and infrastructure sectors. These players focus on offering modular and customizable scaffolding systems that comply with stringent safety regulations, enhancing their appeal in large-scale infrastructure projects. Meanwhile, regional players like Hitech Scaffolding Pvt Ltd and MJ Gerüst GmbH cater to niche markets by offering cost-effective and location-specific solutions. Strategic mergers, acquisitions, and partnerships remain common tactics for expanding geographic reach and strengthening technical capabilities. The rising demand for rental scaffolding services has also intensified competition, pushing companies to differentiate through efficient logistics, maintenance, and on-site support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Layher GmbH & Co. KG

- Safway Group Holding LLC

- PERI Group

- Altrad Group

- BrandSafway

- Waco Equipment

- ADTO Group Xiang

- MJ Gerüst GmbH

- Hitech Scaffolding Pvt Ltd

- Atlantic Pacific Equipment Inc

Recent Developments

- In April 2025, Layher opened a new, highly automated and energy-efficient production facility, “Plant 3”, in Gueglingen-Eibensbach, Germany. This plant is dedicated to manufacturing Allround Scaffolding components. It is designed to enhance delivery speed and product quality for clients in large-scale construction, industrial, and event technology sectors. The facility incorporates advanced automation, digitalization, and sustainability features, including photovoltaic systems and waste heat recovery.

- In January 2024, Renta Group acquired Scaffolding Group, a Polish scaffolding company catering to industrial customers in Southern Poland. The acquisition allows the company to enter the Polish industrial scaffolding market and continue to scale the operations geographically and further expand the customer base of the company.

- In August 2022, United Scaffolding Inc., a provider of scaffold rental and sales rebranded to ScaffSource. Under the new brand, the organization offers customers a network for the rental and sales of scaffolding and shoring materials, as well as project design /management services.

- In July 2022, StepUp Scaffold UK, a Glasgow-based subsidiary of the StepUp Scaffold Group in Memphis (US), which offers scaffolding and access equipment in the UK market, has finalized the acquisition of MP House ApS, which is located just outside Copenhagen. MP House is a market leader in the supply of tools, equipment, and accessories to Danish scaffolding operators.

- In July 2022, Doka, a provider of formwork, solutions, and services to the construction industry, has reinforced its existing partnership with renowned American scaffolding manufacturer AT-PAC by acquiring a significant investment in the US-based company. Doka and AT-PAC developed an initial relationship in 2020 to provide comprehensive building site solutions, and the partnership has been increasing ever since.

Market Concentration & Characteristics

The Infrastructure Scaffolding Market exhibits a moderately consolidated structure, with several key players dominating global revenues while regional firms serve niche markets. Large companies such as Layher GmbH, BrandSafway, and PERI Group hold significant shares due to their strong international presence, product diversity, and compliance with global safety standards. It reflects a market where innovation in modular scaffolding systems, material efficiency, and safety features creates competitive differentiation. Entry barriers remain moderately high due to capital requirements, regulatory compliance, and the need for skilled labor. The market favors suppliers that offer value-added services such as rental options, on-site support, and customization. Demand patterns closely align with public and private infrastructure investments, which influence procurement cycles. The market also shows a strong preference for steel and supported scaffolding, indicating a need for high load capacity and structural stability. Regional differences in safety regulations and construction practices shape product design and distribution strategies across markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by large-scale infrastructure development across emerging and developed economies.

- Supported scaffolding will continue to dominate due to its versatility, cost-effectiveness, and widespread use in major projects.

- Steel scaffolding will retain its market leadership owing to its strength and durability in complex infrastructure environments.

- Demand for lightweight aluminum scaffolding is expected to rise, particularly in projects requiring quick assembly and mobility.

- Government initiatives focused on urbanization and smart city development will significantly boost market expansion.

- Rental scaffolding services will grow in popularity, offering cost-effective and flexible solutions for contractors.

- Adoption of modular and pre-engineered scaffolding systems will improve installation efficiency and site productivity.

- Asia Pacific will remain the leading regional market due to ongoing investments in transportation and energy infrastructure.

- Stricter safety regulations will drive innovation in product design and material standards.

- Strategic collaborations and acquisitions among key players will shape the competitive landscape.