Market Overview

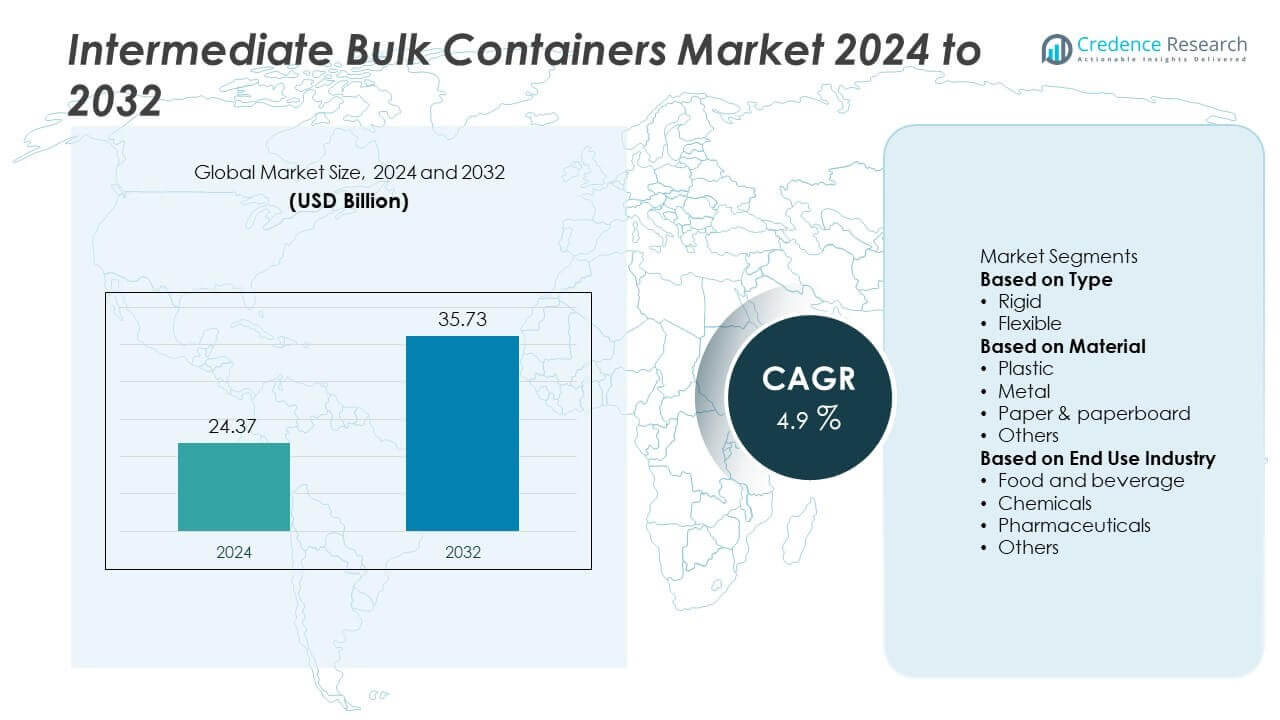

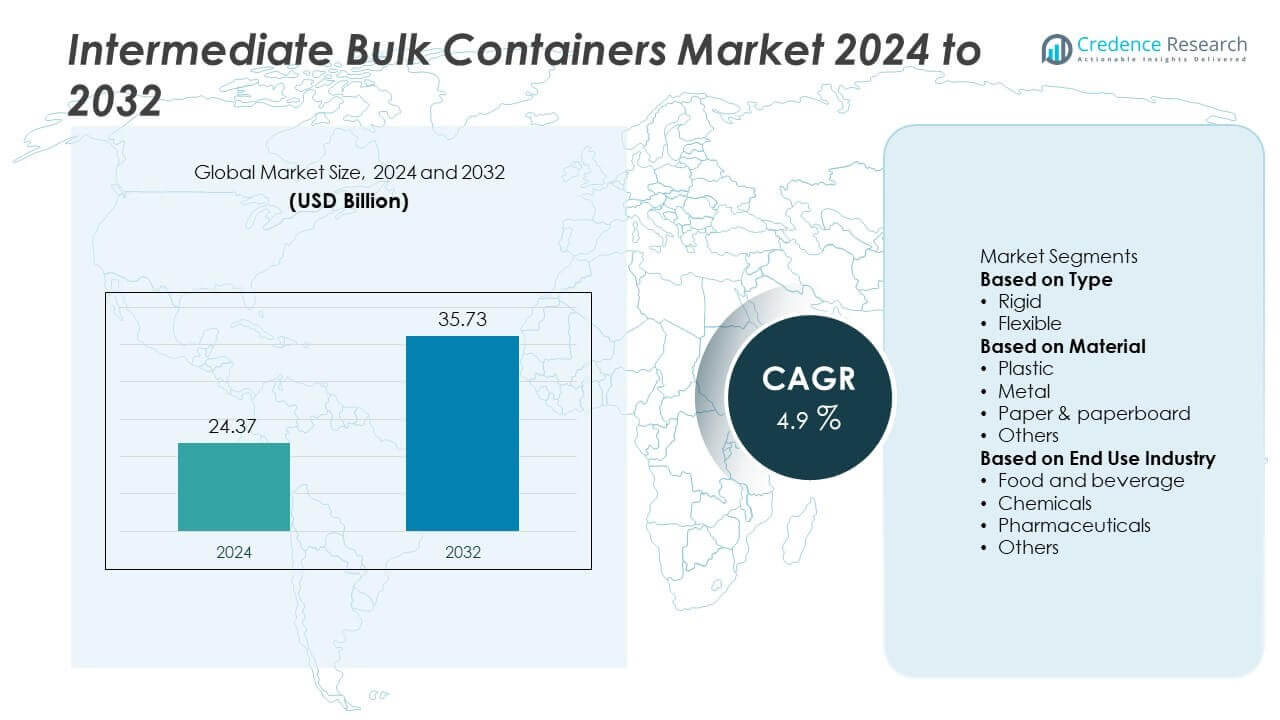

The Intermediate Bulk Containers Market was valued at USD 24.37 billion in 2024 and is projected to reach USD 35.73 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intermediate Bulk Containers Market Size 2024 |

USD 24.37 Billion |

| Intermediate Bulk Containers Market, CAGR |

4.9% |

| Intermediate Bulk Containers Market Size 2032 |

USD 35.73 Billion |

The Intermediate Bulk Containers Market is driven by rising demand for cost-efficient, durable, and reusable packaging solutions across industries such as chemicals, food and beverage, pharmaceuticals, and oil and gas. IBCs provide safe storage, efficient handling, and reduced transportation costs compared to conventional packaging.

The Intermediate Bulk Containers Market shows diverse growth across regions, shaped by industrial and regulatory dynamics. North America leads with strong adoption in chemical, pharmaceutical, and food sectors, supported by advanced logistics and strict safety standards. Europe emphasizes sustainable packaging practices and compliance with circular economy goals, driving widespread use of reusable and recyclable IBCs. Asia-Pacific is the fastest-growing region, propelled by rapid industrialization, expansion of food processing, and government-backed infrastructure programs in China, India, and Southeast Asia. Latin America is witnessing steady adoption in agriculture and food exports, while the Middle East and Africa benefit from rising oil and gas applications alongside improving trade infrastructure. Key players such as Greif, Mauser Packaging Solutions, DS Smith, and Mondi focus on innovation in materials, expansion of reusable product portfolios, and strategic partnerships with global distributors. Their efforts ensure reliable supply, regulatory compliance, and stronger positioning in competitive global markets.

Market Insights

- The Intermediate Bulk Containers Market was valued at USD 24.37 billion in 2024 and is projected to reach USD 35.73 billion by 2032, growing at a CAGR of 4.9%.

- Rising demand for cost-efficient, reusable, and durable bulk packaging solutions across chemicals, food and beverage, and pharmaceuticals is a major driver of market growth.

- Key market trends include increased adoption of sustainable and recyclable materials, integration of smart tracking technologies, and growing demand from emerging economies with rapid industrialization.

- Competitive landscape features players such as Greif, Mauser Packaging Solutions, DS Smith, Mondi, and LC Packaging, who focus on product innovation, reusable systems, and expansion of global distribution networks.

- Market restraints include high raw material costs, regulatory complexities across regions, and challenges in handling and maintaining IBCs to ensure safety and compliance.

- North America shows strong growth driven by chemical, pharmaceutical, and food industries, Europe emphasizes sustainability and regulatory compliance, while Asia-Pacific is the fastest-growing region supported by industrial expansion and infrastructure development.

- Emerging opportunities arise from expanding agricultural exports in Latin America, oil and gas activities in the Middle East, and growing electrification and food processing industries in Africa, which enhance adoption of IBCs in diverse applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Cost-Effective and Efficient Packaging Solutions

The Intermediate Bulk Containers Market is driven by growing demand for packaging that balances cost efficiency and durability. IBCs reduce transportation and storage costs compared to smaller containers or traditional drums. Their standardized designs allow easy handling, stacking, and compatibility with automated systems. It creates strong adoption across industries where efficiency is prioritized in logistics operations. Businesses seek packaging that minimizes waste and maximizes space utilization, further enhancing IBC demand. The ability to reuse containers multiple times strengthens their economic appeal.

- For instance, Mauser Packaging Solutions opened a new facility in Tarragona, Spain, in June 2025, that reconditions Intermediate Bulk Containers (IBCs) and produces high-quality post-consumer resin (PCR) from used industrial plastic packaging.

Expansion of Chemical and Industrial Applications

The Intermediate Bulk Containers Market benefits from rising demand in the chemical, oil and gas, and industrial sectors. Hazardous and non-hazardous liquids require secure containment, and IBCs provide robust protection against leaks and contamination. Their durable construction ensures safe handling of aggressive substances under strict safety regulations. It supports compliance with international standards governing transportation of chemicals and fuels. Growing industrial output worldwide fuels steady consumption of bulk containers. Strong chemical trade further amplifies the role of IBCs in supply chains.

- For instance, Greif opened a new Intermediate Bulk Container (IBC) manufacturing plant in Pasir Gudang, Malaysia, in September 2024 to support supply chains in the Asia-Pacific region.

Increasing Use in Food, Beverage, and Pharmaceutical Sectors

The Intermediate Bulk Containers Market experiences strong adoption in food, beverage, and pharmaceutical applications due to hygiene and safety requirements. IBCs designed with food-grade materials ensure safe storage and transport of edible liquids and ingredients. Pharmaceutical companies utilize them for bulk handling of solvents and raw materials. It enables industries to streamline operations and maintain product integrity. Rising global demand for packaged foods and beverages further enhances consumption. Compliance with strict health and safety standards strengthens the adoption of high-quality IBCs in sensitive sectors.

Focus on Sustainability and Reusable Packaging Systems

The Intermediate Bulk Containers Market is supported by the global emphasis on sustainability and waste reduction. Companies favor reusable packaging that aligns with circular economy principles. IBCs offer long service life, reducing reliance on single-use packaging and lowering environmental impact. It aligns with corporate sustainability initiatives and government-backed regulations targeting eco-friendly materials. Innovations in recyclable plastics and composite designs further expand market opportunities. Growing demand for sustainable packaging ensures continuous investment in IBC technologies.

Market Trends

Shift Toward Reusable and Sustainable Packaging Solutions

The Intermediate Bulk Containers Market is witnessing a strong trend toward reusable and eco-friendly packaging systems. Companies adopt IBCs made from recyclable plastics and composite materials to reduce environmental impact. It aligns with global sustainability goals and corporate social responsibility initiatives. Growing regulatory support for minimizing packaging waste further drives this transition. Reusable containers also offer cost savings by extending service life and lowering disposal requirements. This trend positions IBCs as a core solution in the shift toward circular economy models.

- For instance, SCHÜTZ GmbH & Co. KGaA introduced its Green Layer IBC with a plastic inner bottle featuring a middle layer made of recycled HDPE, which represents 30% of the bottle’s material and increases the total recycled plastic content to as high as 73% in a version with a full-plastic pallet. The inner and outer layers of the bottle are made from new (virgin) HDPE to ensure no recycled material contacts the product.

Adoption of Advanced Materials and Smart Technologies

The Intermediate Bulk Containers Market is influenced by the adoption of high-performance materials and digital features. Manufacturers use high-density polyethylene (HDPE), metal composites, and hybrid materials to enhance strength and chemical resistance. It ensures safety during transport of hazardous and sensitive goods. Smart technologies, including RFID tags and IoT sensors, are integrated to improve tracking and monitoring. These innovations provide real-time data on container condition and location. The use of advanced materials and smart systems strengthens IBC reliability in global supply chains.

- For instance, THIELMANN partnered with BASF and NXTGN Solutions to launch IBC trackers featuring patented acoustic signal analysis and IoT-connected sensors, capable of recording container fill level and shock load with a resolution of 0.2 liters and monitoring up to 500 IBCs simultaneously in active fleets

Rising Demand from Food, Beverage, and Pharmaceutical Sectors

The Intermediate Bulk Containers Market benefits from growing adoption across food, beverage, and pharmaceutical industries. Rising demand for packaged and processed food increases the need for hygienic bulk storage solutions. Food-grade IBCs ensure compliance with safety regulations and protect product integrity. It enables large-scale movement of liquids like juices, edible oils, and syrups. Pharmaceutical companies also rely on IBCs for solvent storage and chemical handling under strict quality standards. Expanding demand in these sectors reinforces long-term market growth.

Growth in Cross-Border Trade and Global Supply Chains

The Intermediate Bulk Containers Market is shaped by rising international trade and globalized supply networks. Businesses require standardized packaging that ensures efficiency in shipping and handling across borders. IBCs support this demand with stackable designs and compatibility with modern logistics systems. It helps reduce transportation costs while maximizing cargo space utilization. Growth in e-commerce and international trade of chemicals, food, and industrial liquids accelerates adoption. This trend highlights IBCs as a critical component in strengthening global supply chain resilience.

Market Challenges Analysis

High Material Costs and Price Sensitivity Across End-User Industries

The Intermediate Bulk Containers Market faces challenges due to rising raw material costs and intense price sensitivity among buyers. High-density polyethylene, steel, and composite materials used in IBC production are subject to global price fluctuations. It directly impacts manufacturing costs and puts pressure on profit margins. End-user industries, particularly in developing regions, often prioritize lower-cost alternatives, which limits premium IBC adoption. Manufacturers struggle to balance cost efficiency with product quality while maintaining competitiveness. These factors restrict wider market penetration in cost-sensitive segments.

Regulatory Barriers and Complex Handling Requirements

The Intermediate Bulk Containers Market is affected by strict regulations and complex handling processes. Compliance with safety standards for transporting hazardous chemicals and food-grade products increases production costs and requires continuous testing. It creates challenges for smaller manufacturers who lack resources to meet diverse international certifications. Improper handling during filling, storage, or transport may lead to damage, leakage, or contamination, discouraging adoption in some sectors. Variations in regional regulations complicate standardization and global supply chain efficiency. These challenges slow adoption in certain applications despite the growing need for safe bulk packaging.

Market Opportunities

Expansion in Food, Beverage, and Pharmaceutical Applications

The Intermediate Bulk Containers Market holds strong opportunities in the food, beverage, and pharmaceutical sectors where demand for safe and hygienic packaging continues to grow. Food-grade IBCs support bulk handling of edible oils, juices, dairy products, and syrups while ensuring compliance with global safety standards. Pharmaceutical companies rely on IBCs for efficient storage and transport of solvents, chemicals, and liquid formulations. It enables bulk processing and reduces packaging waste in these regulated industries. Rising consumer demand for processed and packaged food, coupled with increasing pharmaceutical output, will expand adoption across these sectors. Manufacturers investing in advanced, certified, and hygienic IBC designs can capture significant market share.

Growth in Sustainable Packaging and Circular Economy Initiatives

The Intermediate Bulk Containers Market benefits from opportunities created by the global push toward sustainable and reusable packaging. Companies adopt IBCs to lower environmental impact and reduce dependence on single-use packaging. It supports corporate sustainability strategies while addressing regulatory requirements for eco-friendly practices. Reusable and recyclable IBCs align with circular economy initiatives across industries. Innovations in lightweight yet durable materials improve efficiency while extending container lifespan. Growing interest in sustainable logistics solutions offers long-term opportunities for manufacturers who focus on green product development and closed-loop systems.

Market Segmentation Analysis:

By Type

The Intermediate Bulk Containers Market is segmented by type into rigid and flexible containers. Rigid IBCs dominate demand due to their strong structural integrity, durability, and suitability for transporting hazardous chemicals, food-grade liquids, and industrial products. They are widely used in industries where safety and regulatory compliance are critical. Flexible IBCs, also known as bulk bags or FIBCs, are gaining traction in agriculture, chemicals, and construction due to their lightweight design and ease of handling. It supports efficient bulk movement of powders, granules, and semi-solids. Both types contribute to diversified applications, with rigid IBCs favored for long-term reusability and flexible IBCs chosen for cost efficiency and short-cycle uses.

- For instance, Fluid-Bag produces flexible IBCs available in 900-liter and 1,000-liter sizes with inner bags weighing about 5 kilograms of material each. Both types contribute to diversified applications, with rigid IBCs favored for long-term reusability and flexible IBCs chosen for cost efficiency and short-cycle uses.

By Material

The Intermediate Bulk Containers Market, by material, includes plastic, metal, and composite designs. Plastic IBCs, particularly those made from high-density polyethylene (HDPE), lead adoption due to cost-effectiveness, lightweight design, and chemical resistance. They dominate applications in food, beverage, and pharmaceuticals. Metal IBCs, often made from stainless steel, are used in hazardous materials, flammable liquids, and high-value chemical applications where strength and safety are paramount. Composite IBCs combine plastic liners with metal cages, offering a balance of affordability, safety, and durability. It ensures compatibility with a broad range of products while meeting international transport regulations.

- For instance, a composite intermediate bulk container (IBC) consists of an HDPE bottle encased in a galvanized steel cage. Such containers are commonly available in standard sizes, including 275-gallon and 330-gallon capacities. A properly certified IBC ensures compatibility with a broad range of products and can meet international transport regulations, such as UN and DOT certifications, depending on its specific design and construction.

By End Use Industry

The Intermediate Bulk Containers Market is segmented by end-use into chemicals, food and beverage, pharmaceuticals, oil and gas, and others. Chemicals represent the largest share, supported by rising global trade and the need for secure bulk handling of hazardous and non-hazardous liquids. Food and beverage applications are expanding rapidly, with IBCs used for edible oils, syrups, dairy, and juices. It ensures hygienic storage and compliance with food safety standards. Pharmaceuticals adopt IBCs for solvents, active ingredients, and sterile products, prioritizing safety and quality. Oil and gas industries rely on metal IBCs for fuels, lubricants, and chemicals used in exploration and refining. Other sectors, including agriculture and construction, use flexible IBCs for bulk powders and raw materials, reinforcing the versatility of IBC adoption.

Segments:

Based on Type

Based on Material

- Plastic

- Metal

- Paper & paperboard

- Others

Based on End Use Industry

- Food and beverage

- Chemicals

- Pharmaceuticals

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for around 36% of the Intermediate Bulk Containers Market share in 2024, making it the leading region. The region benefits from a mature industrial base, strong demand from chemical and pharmaceutical sectors, and early adoption of sustainable packaging solutions. The United States leads growth due to large-scale food and beverage processing, chemical exports, and advanced logistics infrastructure. Canada contributes through rising investments in industrial packaging, while Mexico shows steady expansion supported by manufacturing growth and export-driven industries. It also benefits from strong regulatory enforcement on safe transportation of hazardous goods, which promotes the use of certified IBCs. Increasing adoption of reusable containers and smart logistics systems further strengthens North America’s position.

Europe

Europe holds about 28% of the Intermediate Bulk Containers Market share in 2024. Countries such as Germany, France, and the United Kingdom dominate regional demand with a strong focus on food-grade, pharmaceutical, and industrial applications. The region emphasizes compliance with strict EU safety and sustainability regulations, which drive the use of recyclable and reusable IBCs. Southern and Eastern European countries are gradually expanding adoption, supported by growing trade activities and investments in industrial production. It also benefits from ongoing renewable energy projects that use IBCs for bulk liquid transport and storage. The region’s alignment with circular economy initiatives reinforces the growing preference for eco-friendly and reusable packaging formats.

Asia-Pacific

Asia-Pacific represents nearly 25% of the Intermediate Bulk Containers Market share in 2024 and is the fastest-growing region. China drives regional growth with strong demand from chemicals, oil and gas, and expanding food processing industries. Japan and South Korea contribute with advanced manufacturing and high-quality pharmaceutical packaging requirements. India is emerging as a major growth hub due to rapid industrialization, rising disposable incomes, and government-backed infrastructure programs. It benefits from strong demand for bulk packaging across agriculture, construction, and industrial chemicals. Southeast Asian economies also expand adoption through export-oriented industries and cost-effective logistics. Asia-Pacific’s diverse industrial base, combined with increasing trade volumes, positions it as a critical growth engine for the IBC market.

Latin America

Latin America holds close to 6% of the Intermediate Bulk Containers Market share in 2024. Brazil leads adoption due to its strong food and beverage sector, particularly in edible oils, juices, and agricultural exports. Mexico also contributes significantly with growing industrial activity and cross-border trade with North America. Argentina, Chile, and Colombia expand demand through food processing and chemicals packaging industries. It faces challenges related to price sensitivity and fluctuating economic conditions but benefits from improving logistics and rising urbanization. Investments in sustainable packaging solutions and regional trade agreements further support long-term growth opportunities in Latin America.

Middle East and Africa

The Middle East and Africa together account for about 5% of the Intermediate Bulk Containers Market share in 2024. The Middle East, led by Saudi Arabia, the United Arab Emirates, and Qatar, shows strong adoption driven by oil and gas, petrochemical, and industrial packaging needs. Africa demonstrates gradual growth, with South Africa, Nigeria, and Egypt being key contributors through agriculture, construction, and food industries. It faces challenges such as affordability and limited logistics infrastructure, but ongoing electrification and industrial expansion enhance market potential. Rising investments in export-driven industries and renewable energy projects are expected to increase armored bulk container demand. The growing push for reusable packaging also creates new opportunities across this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LC Packaging

- Hazmatpac

- Mauser Packaging Solutions

- CL Smith

- Mondi

- Denios

- DS Smith

- ILC Dover

- Greif

- IDEX

Competitive Analysis

The competitive landscape of the Intermediate Bulk Containers Market is shaped by leading players including Greif, Mauser Packaging Solutions, DS Smith, Mondi, LC Packaging, Denios, CL Smith, Hazmatpac, IDEX, and ILC Dover. These companies compete by offering a wide range of rigid and flexible IBCs tailored to the needs of industries such as chemicals, food and beverage, pharmaceuticals, and oil and gas. Their strategies emphasize innovation in materials, including recyclable plastics, hybrid composites, and stainless steel, to improve durability, safety, and compliance with international standards. Many players invest in reusable and eco-friendly designs that align with global sustainability initiatives and circular economy principles. Expansion of global distribution networks, coupled with partnerships with logistics providers and industrial clients, strengthens their ability to serve international markets. Technological integration, such as RFID tags and IoT-enabled monitoring, is also being adopted to enhance traceability and supply chain efficiency. Continuous R&D investment supports product diversification, regulatory compliance, and cost optimization. The market remains highly competitive, with companies focusing on value-added services, tailored solutions, and regional manufacturing facilities to reduce costs and improve responsiveness. This competition ensures that industry leaders remain positioned to capture growing demand across developed and emerging markets.

Recent Developments

- In June 2025, Mauser Packaging Solutions: commissioned a new plant in Tarragona, Spain, to recondition used IBCs and extract recyclates, certified to handle hazardous goods.

- In May 2025, Mauser Packaging Solutions: expanded product range with a new line of stainless steel IBCs.

- In September 2024, Greif, opened a new IBC manufacturing facility in Pasir Gudang, Johor, Malaysia for food, chemicals, lubricants etc.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reusable and durable bulk packaging will continue to expand across industries.

- Adoption of sustainable and recyclable materials will grow under stricter environmental regulations.

- Smart tracking systems with RFID and IoT integration will enhance supply chain visibility.

- Food and beverage sectors will drive significant growth with rising packaged food demand.

- Pharmaceutical applications will expand due to strict safety and hygiene requirements.

- Asia-Pacific will remain the fastest-growing region, supported by industrialization and infrastructure development.

- North America and Europe will lead innovation in eco-friendly and certified IBC designs.

- Growth in cross-border trade will strengthen the need for standardized bulk packaging solutions.

- Manufacturers will focus on lightweight yet durable materials to reduce transport costs.

- Strategic collaborations with distributors and logistics providers will improve global market reach.