Market Overview

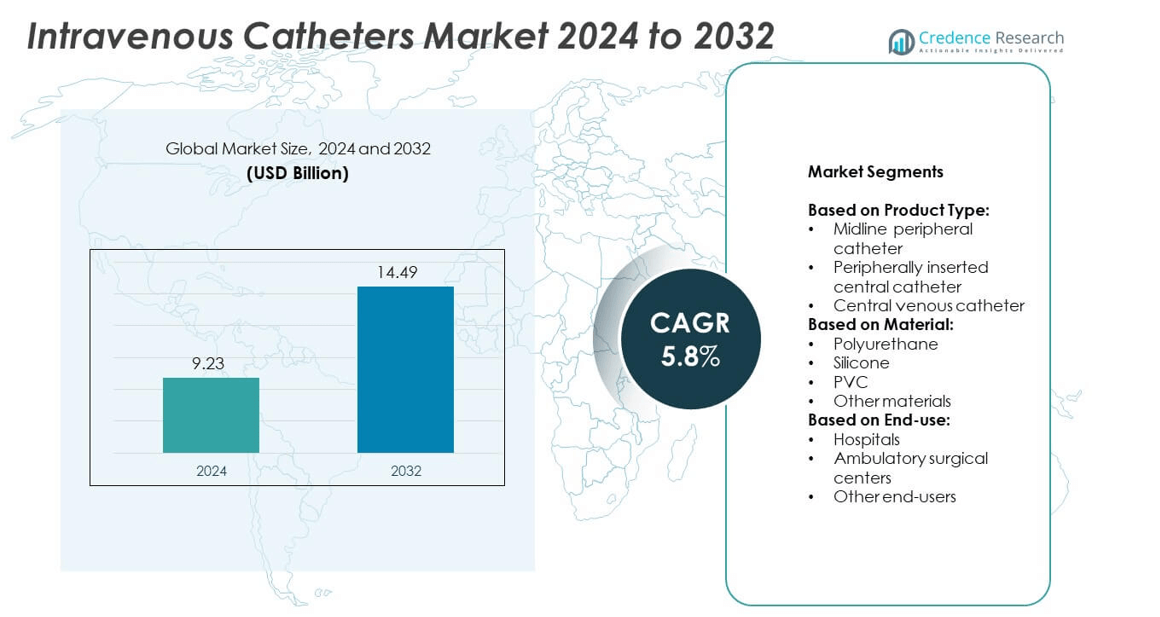

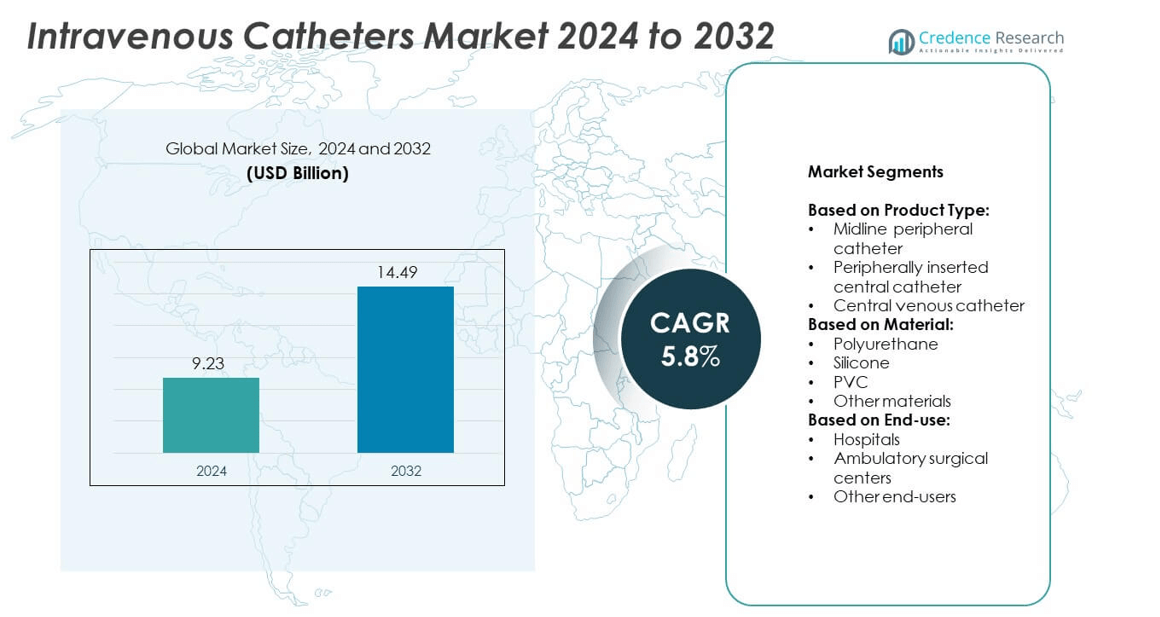

The Intravenous Catheters Market was valued at USD 9.23 billion in 2024 and is projected to reach USD 14.49 billion by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous Catheters Market Size 2024 |

USD 9.23 billion |

| Intravenous Catheters Market, CAGR |

5.8% |

| Intravenous Catheters Market Size 2032 |

USD 14.49 billion |

The Intravenous Catheters market is driven by rising hospital admissions, growing prevalence of chronic diseases, and increasing demand for reliable vascular access in critical care. Technological advancements such as antimicrobial coatings and closed-system designs enhance patient safety and reduce infection risks. It benefits from expanding home infusion therapies and the shift toward minimally invasive treatments. Digital monitoring solutions and training programs for healthcare professionals further support market growth, ensuring better clinical outcomes and higher adoption across hospitals and ambulatory settings.

North America leads the Intravenous Catheters market due to advanced healthcare infrastructure and strong adoption of safety-engineered devices. Europe follows with high focus on infection control standards and rising surgical procedures. Asia Pacific shows fastest growth supported by expanding hospital networks and increasing healthcare investments. Key players driving innovation and competition include Medtronic plc, ICU Medical, Becton, Dickinson and Company, and Terumo Corporation, who focus on product development, regulatory compliance, and partnerships to strengthen global presence and meet growing demand.

Market Insights

- The Intravenous Catheters market was valued at USD 9.23 billion in 2024 and is projected to reach USD 14.49 billion by 2032, growing at a CAGR of 5.8%.

- Rising hospital admissions, aging population, and increasing chronic disease cases are driving higher demand for reliable IV access devices.

- Safety-engineered catheters, antimicrobial coatings, and closed-system designs are key trends improving patient outcomes and reducing infection risks.

- The market is competitive with leading players focusing on R&D, partnerships, and new product launches to expand presence.

- High device costs, risk of catheter-related bloodstream infections, and reimbursement limitations remain significant restraints for manufacturers and healthcare providers.

- North America leads due to strong infrastructure and regulatory standards, Europe follows with high infection control focus, while Asia Pacific shows fastest growth with rising healthcare investments.

- Growing adoption of home infusion therapy, technological advancements, and sustainability-focused designs present strong future opportunities for market expansion across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Hospital Admissions and Surgical Procedures Driving Demand

The Intravenous Catheters market benefits from increasing hospital admissions and surgical procedures worldwide. Growing prevalence of chronic diseases such as cancer and cardiovascular disorders increases the need for IV therapy. It plays a critical role in administering fluids, medications, and nutrition to patients requiring immediate intervention. The aging population contributes to a higher rate of hospitalizations and surgeries, boosting catheter use. Rapid urbanization and expanding healthcare infrastructure in developing nations support rising demand. Increasing patient awareness about early treatment encourages higher utilization in clinical settings.

- For instance, BD’s Dual Port catheter (18 G, 44 mm length) has a gravity flow rate of 79 mL/min and a pressure rating of 300 psi.

Growing Adoption of Minimally Invasive Treatments Enhancing Utilization

Healthcare providers prefer minimally invasive techniques that require reliable vascular access for infusion therapies. The Intravenous Catheters market gains from this shift toward less invasive options that improve patient recovery time. It supports targeted drug delivery and reduces complications compared to traditional methods. Rising use of outpatient and homecare infusion therapies expands catheter applications beyond hospitals. Manufacturers develop user-friendly designs to ensure safe insertion and minimize infection risks. Increasing investment in training healthcare staff on vascular access procedures further improves adoption rates.

- For instance, the Smiths Medical Protectiv® Plus 16G x 1.25 in catheter has a flow rate of 215 mL/min, and the ViaValve™ Safety IV Catheter 16G x 1.25 in is rated for 220 mL/min.

Technological Advancements Improving Safety and Efficiency

Continuous product innovation enhances patient safety and clinical outcomes. The Intravenous Catheters market witnesses advances such as safety-engineered needles and antimicrobial coatings. It reduces the risk of bloodstream infections and needle-stick injuries among healthcare professionals. Development of power-injectable catheters supports use in diagnostic imaging procedures, including CT scans. Improved materials enhance flexibility, reducing vein irritation and patient discomfort. Growing collaboration between manufacturers and research institutions accelerates the launch of next-generation solutions.

Regulatory Support and Quality Standards Strengthening Market Growth

Government initiatives promoting infection control protocols strengthen demand for advanced IV catheters. The Intravenous Catheters market benefits from strict compliance requirements in hospitals and clinics. It ensures adoption of high-quality, standardized devices for patient care. Regulatory agencies encourage innovation through faster approval pathways for safety-enhanced products. Rising procurement of single-use sterile catheters supports infection prevention efforts globally. Strong focus on patient safety drives continuous upgrades in manufacturing practices and quality control.

Market Trends

Shift Toward Safety-Engineered and Closed System Devices

Healthcare providers increasingly adopt safety-engineered and closed IV catheter systems to minimize infection risk. The Intravenous Catheters market sees rising preference for devices with integrated needle-stick prevention features. It supports compliance with global safety regulations and improves workplace protection for clinicians. Demand for prefilled and closed-system catheters grows in intensive care units and oncology wards. Manufacturers focus on integrating antimicrobial technology to reduce catheter-related bloodstream infections. Hospitals prioritize products that enhance patient outcomes and reduce overall treatment costs.

- For instance, BD Insyte Autoguard BC 22 G × 1.00 in catheter has a flow rate of 37 mL/min, while 20 G × 1.00 in flows approx 63 mL/min for saline

Expansion of Home Infusion Therapy Applications

The demand for home-based healthcare continues to increase due to cost efficiency and patient comfort. The Intravenous Catheters market benefits from this trend by supporting safe administration of long-term therapies at home. It encourages development of lightweight, easy-to-use catheters for patients and caregivers. Rising incidence of chronic illnesses such as diabetes and cancer fuels continuous infusion needs outside hospitals. Technological improvements simplify device handling and reduce the need for frequent hospital visits. Growing partnerships between infusion therapy providers and device makers drive wider adoption.

- For instance, Teleflex markets 20G (1.1 mm) catheters with flow rates near 60 mL/min, making them a common choice for routine IV fluid and medication administration.

Integration of Digital Monitoring and Smart Technologies

Smart catheter systems with sensors and wireless connectivity are entering clinical use. The Intravenous Catheters market experiences innovation that enables real-time monitoring of flow rates and early detection of complications. It improves clinical decision-making and reduces catheter failure incidents. Integration of digital platforms supports data tracking for infection control programs. Hospitals adopt connected systems to improve operational efficiency and patient safety. Increasing investment in medical IoT devices drives further technological enhancements.

Growing Focus on Sustainable and Eco-Friendly Designs

Manufacturers explore recyclable materials and energy-efficient production methods for catheter development. The Intravenous Catheters market benefits from sustainability initiatives led by hospitals and regulators. It drives demand for products with reduced environmental footprint without compromising performance. Companies invest in low-waste packaging and biocompatible materials to meet green standards. Healthcare facilities favor suppliers with strong sustainability commitments. Rising awareness of environmental impact pushes continuous innovation in product design.

Market Challenges Analysis

Risk of Catheter-Related Infections and Complications

Catheter-associated bloodstream infections remain a major concern for healthcare facilities worldwide. The Intravenous Catheters market faces pressure to deliver devices with superior safety profiles. It must address issues like phlebitis, thrombosis, and infiltration that impact patient outcomes. Poor insertion practices and prolonged catheter use increase complication risks. Hospitals spend significant resources on infection prevention and staff training. Regulatory authorities enforce strict guidelines to ensure compliance, raising operational challenges for manufacturers. Failure to meet safety standards can limit product adoption and damage brand reputation.

High Cost of Advanced Devices and Reimbursement Limitations

Pricing pressure restricts access to technologically advanced IV catheters, particularly in developing markets. The Intravenous Catheters market struggles with balancing innovation and affordability for healthcare providers. It faces reimbursement gaps that discourage hospitals from adopting premium products. Budget-constrained facilities often rely on low-cost alternatives that may compromise safety. Rising raw material and production costs create margin challenges for manufacturers. Competition intensifies among suppliers, leading to price wars and reduced profitability. Market players must optimize supply chains and explore cost-efficient production methods to stay competitive.

Market Opportunities

Rising Demand from Emerging Economies and Expanding Healthcare Access

Emerging markets offer strong growth potential due to expanding healthcare infrastructure and increasing patient access to treatment. The Intravenous Catheters market benefits from government investments in hospitals, clinics, and rural healthcare programs. It enables higher adoption of IV therapies for chronic and acute conditions. Growing health insurance coverage supports affordability and encourages timely medical intervention. Medical tourism in countries like India and Thailand drives demand for high-quality infusion devices. Rising awareness of infection prevention standards pushes hospitals to upgrade to advanced catheter systems.

Innovation in Materials, Design, and Digital Integration

Product innovation creates new opportunities for market expansion across multiple care settings. The Intravenous Catheters market sees growth through antimicrobial coatings, power-injectable devices, and closed systems. It promotes patient safety and reduces hospital-acquired infection rates. Integration of digital tracking solutions offers value-added services for healthcare providers. Smart catheters with monitoring features improve therapy accuracy and enhance workflow efficiency. Manufacturers investing in R&D and collaborating with healthcare institutions position themselves to capture future demand.

Market Segmentation Analysis:

By Product Type:

The Intravenous Catheters market is segmented into midline peripheral catheters, peripherally inserted central catheters (PICCs), and central venous catheters (CVCs). Midline catheters gain traction for patients requiring intermediate-term therapy, reducing repeated needle insertions. PICCs hold significant share due to their suitability for long-term medication delivery, such as chemotherapy and antibiotic therapy. CVCs are preferred in critical care and hemodialysis applications where high-volume fluid administration is needed. It supports complex treatments in intensive care units and emergency settings. Rising use of ultrasound-guided placement enhances safety and adoption across all product types.

- For instance, Smisson-Cartledge Biomedical’s ThermaCor® 1200 rapid infusion system paired with an 8.5F RIC catheter can deliver up to 1,200 mL/min crystalloid flow, supporting emergency resuscitation.

By Material:

Materials play a vital role in performance, durability, and patient comfort. Polyurethane dominates due to its strength and ability to withstand high-pressure infusions. The Intravenous Catheters market benefits from polyurethane’s compatibility with power-injectable systems used in imaging. Silicone catheters are valued for their flexibility, making them ideal for patients requiring extended use. PVC continues to serve cost-sensitive markets where affordability is key. Other materials, including hybrid composites, see rising interest for their improved biocompatibility and infection control properties. It drives manufacturers to innovate with coatings and antimicrobial features for better clinical outcomes.

- For instance, B. Braun Medical reported in a multicenter French study (>22 million safety devices purchased) only 2.05 needlestick injuries per 100,000 devices, highlighting safety-engineered device effectiveness.

By End-Use:

Hospitals remain the largest end-use segment, driven by high patient inflow and demand for continuous IV therapy. The Intravenous Catheters market supports applications in emergency departments, operating rooms, and ICUs. Ambulatory surgical centers adopt advanced catheters to support outpatient surgeries and shorter recovery times. Other end-users, including home healthcare providers and specialty clinics, see rising demand for portable and user-friendly catheters. It supports the growing trend of home infusion therapy and chronic disease management outside hospitals. Expanding training programs for nurses and caregivers enhances adoption in these settings.

Segments:

Based on Product Type:

- Midline peripheral catheter

- Peripherally inserted central catheter

- Central venous catheter

Based on Material:

- Polyurethane

- Silicone

- PVC

- Other materials

Based on End-use:

- Hospitals

- Ambulatory surgical centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Intravenous Catheters market, accounting for 38% of global revenue in 2024. Strong healthcare infrastructure, high hospitalization rates, and rapid adoption of advanced vascular access devices drive demand in the region. It benefits from strict regulatory standards that encourage hospitals to use safety-engineered and infection-preventive products. Growing prevalence of chronic conditions such as cancer and cardiovascular diseases supports consistent catheter use. Rising focus on reducing catheter-associated bloodstream infections pushes providers toward closed-system and antimicrobial-coated catheters. Investment in training programs for clinicians and nurses ensures proper insertion and maintenance practices. Increasing home infusion therapies and ambulatory care services further strengthen market penetration.

Europe

Europe represents the second-largest regional market, contributing 27% of total revenue. The region benefits from strong government support for infection control initiatives and high standards of patient safety. It has a mature hospital network with high adoption of advanced intravenous therapy solutions. Growing geriatric population and rising surgical procedures continue to fuel demand across major countries such as Germany, France, and the UK. Manufacturers introduce innovative catheter designs to meet stringent EU regulations, improving patient comfort and reducing complications. Expansion of outpatient and day-care surgical centers supports steady consumption of catheters. Public and private reimbursement systems encourage adoption of premium devices that enhance clinical outcomes.

Asia Pacific

Asia Pacific accounts for 22% of the global Intravenous Catheters market and shows the fastest growth during the forecast period. Rising healthcare expenditure, expanding hospital infrastructure, and growing awareness of infection prevention drive adoption across China, India, and Southeast Asia. It benefits from government programs focused on improving rural healthcare access and supporting affordable infusion therapies. Increasing prevalence of lifestyle-related diseases such as diabetes and kidney disorders boosts demand for long-term vascular access solutions. Medical tourism in Thailand, India, and Singapore contributes to higher consumption of high-quality IV catheters. Local manufacturers enter partnerships with global players to meet growing demand and offer cost-effective solutions. Expanding training initiatives improve procedural success rates and reduce complications, encouraging further adoption.

Latin America

Latin America contributes 8% of global market share, supported by gradual improvements in healthcare infrastructure and increased availability of infusion products. Brazil, Mexico, and Argentina lead adoption due to higher healthcare spending and hospital expansions. It experiences rising demand for cost-efficient peripheral and midline catheters suitable for basic IV therapies. Growing burden of infectious diseases and chronic illnesses encourages hospitals to adopt reliable infusion systems. Manufacturers focus on offering competitively priced solutions to address budget constraints in public healthcare systems. Partnerships between international suppliers and local distributors improve market reach and availability of advanced devices. Training programs for nurses and caregivers are gaining traction, reducing insertion errors and improving patient outcomes.

Middle East & Africa

Middle East & Africa holds 5% share of the Intravenous Catheters market, with potential for steady growth. GCC countries invest heavily in upgrading healthcare infrastructure and introducing modern infusion devices. It gains from increasing number of private hospitals and specialty clinics adopting international care standards. Rising incidence of chronic illnesses and higher surgical procedure rates create consistent demand. South Africa and Egypt show growing focus on infection prevention, encouraging adoption of closed catheter systems. Limited access to skilled professionals in some regions poses challenges, but ongoing education initiatives aim to bridge this gap. International suppliers expand presence through partnerships and government contracts to capture emerging opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic plc

- ICU Medical, Inc.

- Becton, Dickinson and Company

- Vygon

- Hamilton Company

- Poly Medicure Ltd.

- Argon Medical Devices

- Terumo Corporation

- AngioDynamics, Inc.

- Medilivescare Manufacturing Pvt. Ltd.

- Nipro Corporation

- Boston Scientific Corporation

- Teleflex Incorporated

- Braun Melsungen AG

Competitive Analysis

The Intravenous Catheters market is highly competitive with key players including Medtronic plc, ICU Medical, Inc., Becton, Dickinson and Company, Vygon, Hamilton Company, Poly Medicure Ltd., Argon Medical Devices, Terumo Corporation, AngioDynamics, Inc., Medilivescare Manufacturing Pvt. Ltd., Nipro Corporation, Boston Scientific Corporation, Teleflex Incorporated, and B. Braun Melsungen AG. These companies focus on expanding their product portfolios with advanced safety-engineered and antimicrobial-coated catheters to meet rising infection control requirements. The market witnesses strong competition based on product innovation, clinical performance, and regulatory compliance. Companies invest in R&D to develop closed-system and power-injectable devices that reduce complication risks and improve patient outcomes. Strategic collaborations with hospitals, distributors, and research institutions help expand market presence and strengthen customer loyalty. Several players are enhancing their manufacturing capacity and leveraging automation to improve cost efficiency and meet growing demand in emerging economies. Regional expansion remains a key strategy, with manufacturers targeting Asia Pacific and Latin America for growth opportunities driven by rising healthcare expenditure. The competitive landscape continues to evolve with mergers, acquisitions, and product launches aimed at gaining a technological and geographical edge. This dynamic environment ensures continuous product upgrades and improved clinical adoption rates

Recent Developments

- In 2024, Medtronic received FDA approval of the Affera Mapping and Ablation System with Sphere-9 Catheter.

- In 2023, Teleflex launched the Arrow® VPS Rhythm® DLX Device and NaviCurve™ Stylet in the United States to improve PICC insertion and reduce complications.

- In 2023, Becton, Dickinson and Company launched new peripheral IV catheter technologies focusing on safety and ease of us

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with rising hospital admissions and surgical procedures.

- Demand will increase for safety-engineered catheters with infection-prevention features.

- Home infusion therapy adoption will expand, boosting sales of user-friendly catheter systems.

- Technological innovation will focus on antimicrobial coatings and closed system designs.

- Digital monitoring and smart catheter solutions will gain wider clinical integration.

- Emerging economies will offer strong opportunities through healthcare infrastructure development.

- Manufacturers will invest in sustainable materials and low-waste production methods.

- Training programs for healthcare professionals will improve insertion success rates.

- Collaborations between global and regional players will expand market reach.

- Regulatory support for high-quality and safe devices will continue to strengthen adoption.