Market Overview

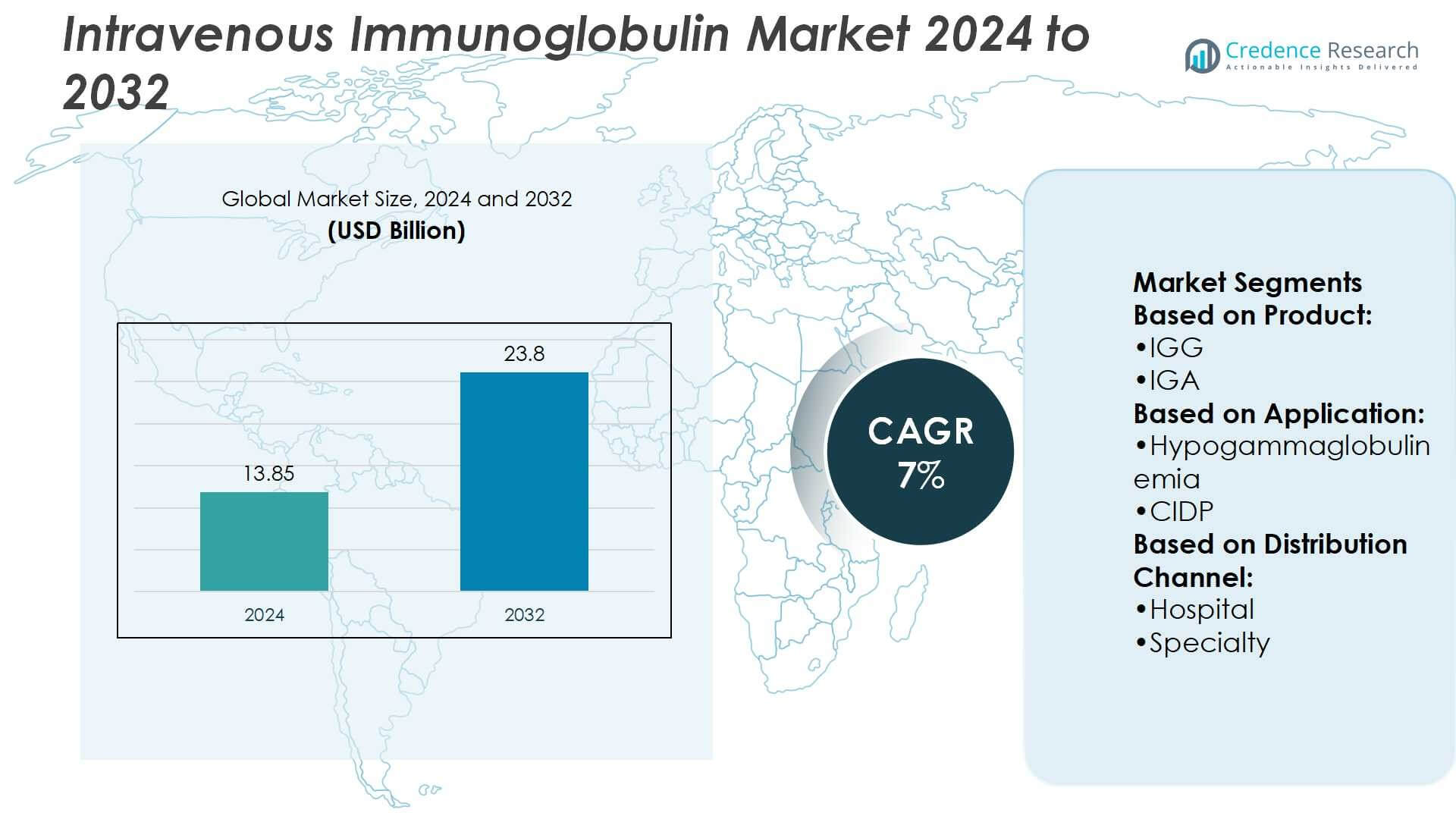

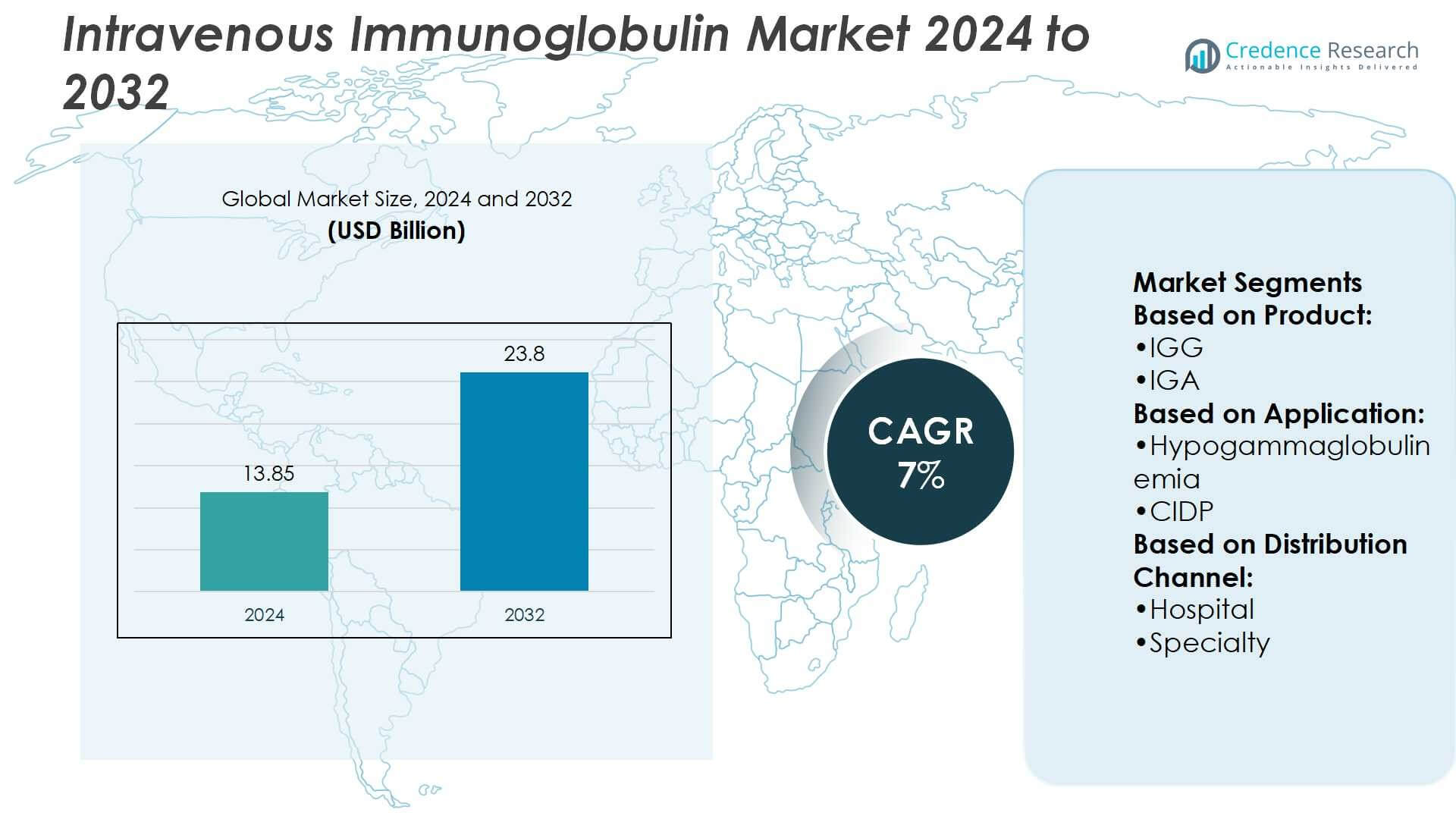

Intravenous Immunoglobulin Market size was valued at USD 13.85 billion in 2024 and is anticipated to reach USD 23.8 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous Immunoglobulin Market Size 2024 |

USD 13.85 Billion |

| Intravenous Immunoglobulin Market, CAGR |

7% |

| Intravenous Immunoglobulin Market Size 2032 |

USD 23.8 Billion |

The Intravenous Immunoglobulin Market grows through strong drivers and evolving trends that shape global demand. Rising prevalence of immunodeficiency, autoimmune, and neurological disorders fuels steady adoption, supported by expanding geriatric populations and higher diagnosis rates. It gains momentum from technological advances in purification, ready-to-use formulations, and high-concentration products that improve safety and patient compliance. Increasing preference for specialty infusion centers and home-based care reflects a shift toward patient-centric delivery models. Expanding clinical research continues to validate new therapeutic indications, while strategic collaborations and supportive healthcare policies strengthen market access, ensuring sustained growth across developed and emerging regions.

The Intravenous Immunoglobulin Market shows strong geographical diversity, with North America holding the largest share, followed by Europe and rapidly growing Asia-Pacific. Latin America and the Middle East & Africa represent smaller yet steadily expanding markets supported by improving healthcare infrastructure. Key players actively shaping the market include Takeda Pharmaceutical Company Limited, CSL Behring, Grifols SA, Octapharma AG, Baxter International Inc., Kedrion Biopharma, LFB Biotechnologies, China Biologics Products Inc., ADMA Biologics, and Intas Pharmaceuticals, all competing through innovation, capacity expansion, and strategic partnerships.

Market Insights

- Intravenous Immunoglobulin Market size was valued at USD 13.85 billion in 2024 and is anticipated to reach USD 23.8 billion by 2032, at a CAGR of 7%.

- Rising prevalence of immunodeficiency, autoimmune, and neurological disorders drives steady demand.

- Growing geriatric population and higher diagnosis rates strengthen long-term adoption.

- Technological advances in purification and ready-to-use formulations improve safety and patient compliance.

- Competition remains high, with leading players focusing on innovation, capacity expansion, and strategic partnerships.

- Supply constraints, high manufacturing complexity, and pricing pressures create significant market restraints.

- North America holds the largest share, Europe follows, Asia-Pacific grows rapidly, while Latin America and Middle East & Africa show steady progress.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Immunodeficiency and Autoimmune Disorders

The Intravenous Immunoglobulin Market benefits strongly from rising cases of immunodeficiency and autoimmune disorders. Physicians use IVIG therapies to restore immune function in patients with primary and secondary immunodeficiency. Increasing recognition of autoimmune diseases, including multiple sclerosis and myasthenia gravis, supports steady uptake. It provides a critical treatment pathway for patients with limited therapeutic alternatives. Growing diagnosis rates and enhanced access to specialized healthcare facilities also accelerate adoption. The rising patient pool continues to serve as a powerful driver for market expansion.

- For instance, Kedrion Biopharma’s CARES10 Phase III trial enrolled 47 adult patients across 11 U.S. sites to test a 10 % IVIG formulation in individuals with Primary Immunodeficiency Disease.

Expanding Geriatric Population and Chronic Disease Burden

The Intravenous Immunoglobulin Market gains traction from the expanding elderly population and growing chronic disease burden. Older patients face greater vulnerability to immune dysfunction and neurological conditions that require IVIG treatment. It plays a central role in addressing age-related health complications, particularly in high-income regions. The surge in chronic diseases such as hematological malignancies further reinforces demand. Healthcare providers increasingly integrate IVIG into long-term treatment protocols. Strong alignment between demographic shifts and therapeutic needs sustains market growth.

- For instance, Baxter International conducted the GAP (Gammaglobulin Alzheimer’s Partnership) Phase III trial involving 390 patients aged 50 to 89 with mild to moderate Alzheimer’s disease.

Technological Advancements and Product Development Innovations

The Intravenous Immunoglobulin Market advances through continuous innovations in production, purification, and delivery technologies. Manufacturers invest in advanced fractionation methods to improve purity and safety profiles. It ensures higher efficacy while reducing risks of viral contamination and side effects. Development of subcutaneous immunoglobulin options expands treatment flexibility. Companies introduce ready-to-use formulations to improve patient compliance and reduce hospital stays. These innovations strengthen confidence among clinicians and patients, supporting wider adoption across healthcare systems.

Growing Healthcare Expenditure and Access to Advanced Therapies

The Intravenous Immunoglobulin Market strengthens with rising global healthcare expenditure and expanding access to advanced therapies. Governments and insurers allocate larger budgets toward rare disease management and immunotherapy coverage. It improves affordability and ensures broader patient access across both developed and emerging economies. Increased hospital infrastructure and infusion centers also drive higher treatment volumes. Policies that support reimbursement and inclusion of IVIG in essential drug lists amplify utilization. The combined effect of funding and accessibility continues to reinforce market growth momentum.

Market Trends

Increasing Adoption of IVIG in Neurological and Autoimmune Indications

The Intravenous Immunoglobulin Market observes a strong trend of expanding use in neurological and autoimmune disorders. Physicians prescribe IVIG for conditions such as Guillain-Barré syndrome, chronic inflammatory demyelinating polyneuropathy, and lupus. It provides critical therapeutic benefits where conventional treatments show limited effectiveness. Rising clinical research continues to validate broader indications, driving stronger clinical confidence. Patient advocacy groups and research institutions also highlight its role in rare disease management. These factors reinforce IVIG’s positioning as a versatile therapy across multiple specialties.

- For instance, Grifols’ pivotal Study No. 100538 (the ICE trial) involving 117 CIDP patients treated with its 10% IVIG product. The dosing regimen was a 2 g/kg loading dose administered over 2-5 consecutive days, followed by 1 g/kg maintenance infusions every three weeks.

Growing Demand for Specialty Infusion Centers and Home-Based Therapies

The Intravenous Immunoglobulin Market reflects a growing preference for specialty infusion centers and home-based treatment models. Patients benefit from reduced hospital visits and improved convenience through at-home administration. It enables healthcare providers to address rising patient volumes without overburdening hospital resources. Specialty infusion networks deliver cost savings and expand treatment capacity in developed markets. The trend aligns with patient-centric care models and supports improved therapy adherence. This shift represents a structural change in the delivery of immunoglobulin therapies.

- For instance, Octapharma USA published research in The Journal of Clinical Immunology on its Cutaquig® (16.5% subcutaneous immunoglobulin) solution showing the majority of 56 primary immunodeficiency patients tolerated increased infusion rate, increased infusion volume per site, and extended intervals between infusions.

Development of High-Purity and Ready-to-Use Formulations

The Intravenous Immunoglobulin Market advances with strong momentum toward high-purity, ready-to-use formulations. Manufacturers invest in advanced purification methods to improve safety and consistency. It minimizes infusion-related side effects and enhances tolerability for patients. Ready-to-use preparations simplify administration and reduce the need for extensive hospital preparation. Companies also focus on stabilizing formulations to extend shelf life and improve logistics. This trend supports global access while maintaining high clinical standards.

Strategic Collaborations and Expanding Research on Rare Diseases

The Intravenous Immunoglobulin Market trends toward stronger collaborations between pharmaceutical companies, research institutions, and healthcare providers. Partnerships aim to advance clinical trials and explore new therapeutic applications. It strengthens the evidence base for rare disease treatment and improves regulatory approvals. Expanding research on rare immunological disorders broadens the scope of IVIG adoption. Companies also engage in joint ventures to expand distribution networks and enhance market penetration. This collaborative approach ensures sustained innovation and wider treatment availability worldwide.

Market Challenges Analysis

Supply Constraints and High Manufacturing Complexity

The Intravenous Immunoglobulin Market faces persistent challenges from supply limitations and complex production requirements. IVIG products rely on human plasma, creating dependence on a limited donor pool. It requires sophisticated fractionation and purification processes that increase costs and restrict large-scale availability. Supply shortages often lead to price volatility and delayed patient access. Healthcare providers face difficulties in maintaining steady treatment regimens during scarcity. The challenge intensifies with rising global demand, placing pressure on manufacturers to expand plasma collection and improve efficiency.

Pricing Pressures and Reimbursement Barriers

The Intravenous Immunoglobulin Market encounters significant hurdles from pricing pressures and reimbursement complexities. IVIG therapies remain expensive, limiting access for patients in low- and middle-income economies. It often requires strong insurance or government support to ensure affordability. Reimbursement policies vary widely across regions, creating uneven access and limiting adoption. Hospitals and clinics face budget constraints when integrating IVIG into treatment protocols. These financial and policy-related barriers continue to restrict equitable distribution, slowing broader market penetration despite proven clinical benefits.

Market Opportunities

Expansion into Emerging Healthcare Markets and Growing Patient Awareness

The Intravenous Immunoglobulin Market holds strong opportunities in emerging economies with improving healthcare infrastructure. Rising investments in hospital networks and infusion centers enhance patient access to advanced therapies. It aligns with increasing awareness about immunodeficiency and autoimmune conditions in these regions. Governments in Asia Pacific, Latin America, and the Middle East are prioritizing rare disease management, creating favorable conditions for IVIG adoption. Pharmaceutical companies are expanding distribution channels to capture untapped demand. This expansion supports wider availability and long-term growth potential across developing markets.

Innovation in Formulations and Expansion of Therapeutic Indications

The Intravenous Immunoglobulin Market benefits from opportunities tied to innovation in formulations and broader therapeutic applications. Development of high-concentration, ready-to-use products improves patient comfort and reduces infusion times. It opens possibilities for expanding homecare treatment models, which align with patient-centric healthcare strategies. Ongoing clinical trials aim to validate new indications in neurological, infectious, and rare diseases. Companies investing in advanced research can strengthen regulatory approvals and broaden their market reach. The convergence of innovation and expanding indications provides a strong growth pathway for the industry.

Market Segmentation Analysis:

By Product

The Intravenous Immunoglobulin Market divides by product into IgG, IgA, IgM, IgD, and IgE. IgG dominates the segment due to its established role in treating immunodeficiency and autoimmune disorders. It accounts for the majority of global demand, supported by extensive clinical validation and wide therapeutic use. IgA and IgM represent smaller shares, but they serve critical roles in niche applications involving mucosal immunity and infection control. IgD and IgE remain limited in usage, reflecting ongoing research into broader indications. The dominance of IgG highlights the continued reliance on this immunoglobulin class in routine medical practice.

- For instance, Patients in the study received 0.5 g per kg body weight per week of IgPro20 for a period of 16 weeks. This dosage was administered over two sessions per week.

By Application

The Intravenous Immunoglobulin Market categorizes by application into hypogammaglobulinemia, chronic inflammatory demyelinating polyneuropathy (CIDP), immunodeficiency diseases, myasthenia gravis, multifocal motor neuropathy (MMN), and immune thrombocytopenic purpura (ITP). Hypogammaglobulinemia and immunodeficiency diseases represent the largest segments, driven by strong clinical demand for immune system support. It remains the frontline therapy for patients with recurrent infections linked to antibody deficiencies. CIDP and MMN have gained prominence with growing neurological applications, while myasthenia gravis and ITP highlight IVIG’s role in autoimmune and hematological conditions. Expanding clinical evidence and rising diagnosis rates strengthen adoption across these applications.

- For instance, ADMA operates ten FDA-licensed plasma collection facilities (via ADMA BioCenters) in the U.S., each collecting approximately 30,000 to 50,000 liters of source plasma per center annually.

By Distribution Channel

The Intravenous Immunoglobulin Market further segments by distribution channel into hospitals and specialty clinics. Hospitals command the largest share due to their established infrastructure, infusion facilities, and broad patient base. It provides immediate access for critical cases requiring supervised administration. Specialty clinics are expanding rapidly, supported by patient demand for convenient, cost-effective, and personalized care. Growth of infusion centers and homecare-supported models strengthens this channel’s position, particularly in developed markets. Together, hospitals and specialty providers ensure a balanced ecosystem for patient access and treatment delivery.

Segments:

Based on Product:

Based on Application:

- Hypogammaglobulinemia

- CIDP

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the dominant position in the Intravenous Immunoglobulin Market with a 46%–47% share in 2024. The United States leads due to advanced healthcare infrastructure, strong plasma collection capacity, and high awareness of immunodeficiency and autoimmune disorders. It benefits from favorable reimbursement policies, which support patient affordability and hospital adoption. Canada contributes steadily with increasing usage in neurological and hematological conditions. Continuous clinical research in CIDP, myasthenia gravis, and ITP strengthens therapeutic expansion. North America’s strong foundation ensures it remains the largest contributor throughout the forecast period.

Europe

Europe represents the second-largest share of the Intravenous Immunoglobulin Market with 20%–25% in 2024. Major countries such as Germany, France, and the United Kingdom drive adoption through structured reimbursement systems and established specialty infusion networks. It shows consistent demand in autoimmune and neurological conditions with a growing elderly population. Strong regulatory standards ensure product quality, which supports patient confidence. Plasma collection initiatives across EU countries also sustain availability. Europe maintains steady growth through balanced demand across both public and private healthcare systems.

Asia-Pacific

Asia-Pacific accounts for 15%–18% of the global share in 2024 and shows the fastest growth, with a CAGR above 7%. China, Japan, and India represent the core markets, driven by improving healthcare access and rising awareness of immunodeficiency. It benefits from rapid expansion of hospital infrastructure and private specialty clinics. Government policies in China and Japan encourage rare disease management, supporting broader IVIG use. Growing medical tourism in Southeast Asia further expands treatment opportunities. Asia-Pacific’s accelerating demand positions it as a key growth engine for the global market.

Latin America

Latin America holds a smaller portion of the Intravenous Immunoglobulin Market with 6%–8% in 2024. Brazil and Mexico drive most of the regional share, supported by rising healthcare investments and increased availability of infusion therapies. It shows demand growth in immunodeficiency and autoimmune treatments, though reimbursement limitations constrain full adoption. Gradual expansion of private healthcare providers enhances access. Rising middle-class healthcare spending also strengthens IVIG usage. Latin America represents a steady growth region with untapped potential in specialty care services.

Middle East & Africa

The Middle East & Africa region contributes 4%–5% of the global share in 2024. Gulf countries such as Saudi Arabia and the UAE lead with expanding hospital infrastructure and government-led healthcare initiatives. It experiences rising demand from immunodeficiency and rare disease patients, though high therapy costs and limited plasma collection challenge adoption. South Africa shows gradual growth with private-sector involvement in specialty care. International collaborations improve access to advanced formulations. While the share is modest, improving awareness and funding will drive incremental growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kedrion Biopharma

- Baxter International Inc

- Grifols SA

- Intas Pharmaceuticals

- Octapharma AG

- LFB Biotechnologies

- CSL Behring

- China Biologics Products Inc.

- Takeda Pharmaceutical Company Limited

- ADMA Biologics

Competitive Analysis

The Intravenous Immunoglobulin Market companies include Takeda Pharmaceutical Company Limited, Grifols SA, CSL Behring, ADMA Biologics, Octapharma AG, Baxter International Inc., LFB Biotechnologies, China Biologics Products Inc., Kedrion Biopharma, and Intas Pharmaceuticals. The Intravenous Immunoglobulin Market is characterized by intense competition, driven by continuous advancements in plasma collection, purification technologies, and treatment innovations. Companies compete by expanding manufacturing capacity, strengthening global distribution networks, and developing high-purity formulations to enhance safety and efficacy. Strategic priorities include broadening therapeutic indications across neurological, autoimmune, and rare diseases while addressing patient demand for convenient delivery models such as home-based infusions. Competitive strategies also emphasize collaborations with research institutions, regulatory bodies, and healthcare providers to secure approvals and accelerate market adoption. Pricing pressures, supply challenges, and reimbursement variations further shape the competitive environment, pushing firms to balance affordability with innovation. The market remains dynamic, with leadership determined by the ability to combine scientific expertise, operational scale, and patient-focused solutions.

Recent Developments

- In June 2025, the Human Normal Immunoglobulin for Intravenous Use (IVIG) with 5% solution developed by Bharat Serums and Vaccines was approved for conducting phase 3 clinical trials by the Subject Expert Committee (SEC), which functions under the Central Drug Standard Control Organization (CDSCO).

- In July 2024, Grifols received FDA sign-off for expanded XEMBIFY labeling that allows treatment-naïve primary immunodeficiency patients to start with subcutaneous dosing.

- In March 2024, Argenx SE announced that Japan’s Ministry of Health, Labour, and Welfare (MHLW) approved VYVGART (efgartigimod alfa) for intravenous (IV) use in adults with primary immune thrombocytopenia (ITP).

- In January 2024, the FDA approved GAMMAGARD LIQUID for treating neuromuscular disability in adults with chronic inflammatory demyelinating polyneuropathy (CIDP). It is used as induction therapy, followed by maintenance doses.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising prevalence of immunodeficiency and autoimmune disorders.

- Demand will increase through growing adoption in neurological and hematological applications.

- Plasma collection capacity will remain central to meeting global therapy needs.

- Technological improvements will enhance purification, safety, and product consistency.

- Ready-to-use and high-concentration formulations will support patient comfort and compliance.

- Specialty infusion centers and home-based care models will gain stronger traction.

- Emerging economies will present growth opportunities through improved healthcare access.

- Strategic collaborations will accelerate research and broaden therapeutic indications.

- Reimbursement support and policy reforms will strengthen patient access worldwide.

- Competitive intensity will rise as companies focus on innovation and market expansion.