Market Overview:

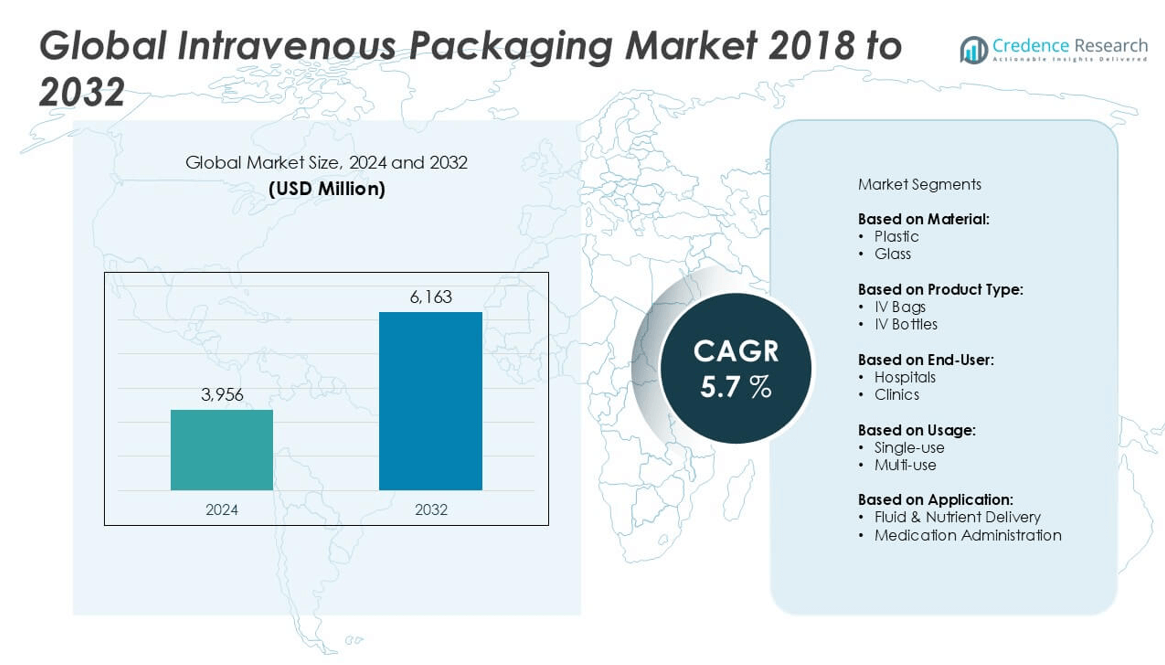

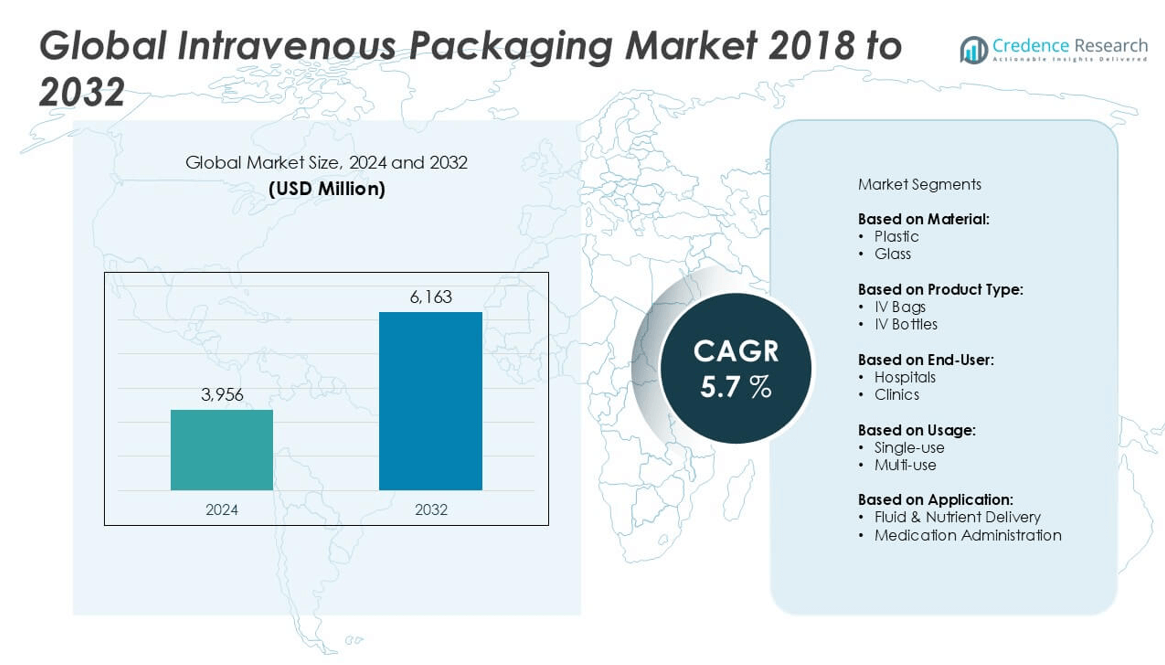

The Intravenous Packaging market size was valued at USD 3,956 million in 2024 and is anticipated to reach USD 6,163 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous Packaging Market Size 2024 |

USD 3,956 million |

| Intravenous Packaging Market, CAGR |

5.7% |

| Intravenous Packaging Market Size 2032 |

USD 6,163 million |

Leading players in the intravenous packaging market include Baxter, Amcor, Technoflex, Nipro, and SSY Group Limited. These companies hold significant market positions due to their advanced manufacturing capabilities, strong distribution networks, and commitment to product innovation. Baxter leads with a comprehensive portfolio of IV bags and systems, while Amcor and Technoflex emphasize material innovation and sustainable packaging. Nipro and SSY Group strengthen the market landscape with competitive pricing and regional manufacturing strength. North America emerged as the dominant region in 2024, accounting for 35% of the global market share, driven by advanced healthcare infrastructure, high adoption of single-use IV systems, and stringent regulatory standards. Europe followed closely, supported by its strong pharmaceutical industry and environmental packaging regulations. Competitive intensity remains high as global players continue expanding their footprint through strategic partnerships and regional players leverage localized production to meet growing demand in emerging markets.

Market Insights

- The Intravenous Packaging market was valued at USD 3,956 million in 2024 and is projected to reach USD 6,163 million by 2032, growing at a CAGR of 5.7% during the forecast period.

- Market growth is driven by increasing demand for sterile, single-use IV systems in hospitals and home-care settings, alongside rising chronic disease cases and an aging population.

- A key trend includes the shift toward eco-friendly, recyclable materials and the integration of smart packaging technologies like RFID and tamper-evident features.

- The market is moderately consolidated, with players such as Baxter, Amcor, and Technoflex focusing on product innovation and global expansion, while regional firms offer cost-effective solutions.

- North America held the largest regional share at 35%, followed by Europe at 27%; the plastic material segment and IV bags dominated their respective categories due to their widespread use and safety features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The plastic segment held the dominant share in the Intravenous Packaging market in 2024, accounting for over 70% of the total market. Its dominance is driven by the lightweight, cost-effective, and shatterproof nature of plastic materials, particularly polyvinyl chloride (PVC) and polypropylene. These materials provide strong chemical resistance and flexibility, making them ideal for mass production of IV containers. Additionally, the increasing demand for single-use and disposable medical supplies across healthcare facilities has accelerated the adoption of plastic over glass, which is heavier, more fragile, and costlier to handle.

- For instance, Baxter International utilizes DEHP-free PVC in more than 400 million IV bags it manufactures annually, meeting global safety and sustainability standards while maintaining high production efficiency.

By Product Type:

IV bags emerged as the leading product type in 2024, commanding approximately 65% of the market share. This dominance is primarily due to the widespread preference for flexible packaging solutions that reduce the risk of contamination and improve ease of storage and disposal. IV bags offer enhanced safety, sterility, and portability, making them the preferred option for fluid and medication delivery. Moreover, advancements in polymer-based bag manufacturing and a growing shift from rigid to flexible packaging in hospitals and clinics have further propelled demand for IV bags over IV bottles.

- For instance, Technoflex produces over 120 million flexible IV bags per year using multilayer polyolefin films, optimizing product safety and usability across more than 50 countries.

By End-User:

Hospitals represented the largest end-user segment in 2024, contributing nearly 60% of the Intravenous Packaging market. Their high market share is attributed to the extensive volume of intravenous treatments administered in hospital settings, ranging from hydration to medication infusions. The rising number of hospital admissions, especially among geriatric and critical care patients, has increased the demand for reliable and sterile IV packaging. Additionally, hospitals’ preference for ready-to-use intravenous systems that comply with stringent safety regulations supports their dominance over clinics, which operate on a smaller scale.

Market Overview

Rising Demand for Sterile and Safe Drug Delivery Systems

The increasing emphasis on infection control and patient safety in healthcare settings is driving the adoption of sterile intravenous (IV) packaging. Hospitals and clinics require packaging that prevents contamination and ensures accurate dosing of fluids and medications. IV packaging, especially single-use sterile bags and bottles, offers enhanced safety for patients by minimizing exposure to external pathogens. Regulatory bodies such as the FDA and EMA have also imposed stringent guidelines to ensure sterility, further encouraging pharmaceutical and packaging companies to invest in advanced IV packaging solutions.

- For instance, Nipro Corporation operates 14 sterile manufacturing plants globally, including a 35,000-square-meter sterile facility in Japan dedicated to producing IV sets and containers in ISO Class 5 environments.

Growth in Geriatric Population and Chronic Diseases

The growing global elderly population and the rising prevalence of chronic conditions such as cancer, diabetes, and cardiovascular diseases are increasing the need for intravenous therapies. Aging individuals often require prolonged or repeated IV treatments, including hydration, pain management, and nutritional support. This demographic shift is driving higher consumption of IV packaging products in both hospital and home-care settings. As healthcare systems across developing and developed economies expand their treatment capacities, the demand for safe, efficient, and cost-effective IV packaging continues to grow.

- For instance, EuroLife Healthcare supplies over 90 million infusion and IV therapy units annually, directly supporting geriatric care initiatives across Asia, Africa, and Eastern Europe.

Expansion of Home Healthcare and Outpatient Services

The shift toward decentralized care models, including home infusion therapy and outpatient services, has created new growth avenues for IV packaging manufacturers. Patients now increasingly receive treatments at home due to cost-effectiveness, convenience, and improved patient compliance. This transition demands packaging that is lightweight, portable, and easy to use without professional supervision. As a result, manufacturers are developing user-friendly and tamper-evident IV packaging formats suitable for non-clinical environments, accelerating market expansion across non-traditional healthcare settings.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging Innovations

Sustainability has emerged as a key trend in the IV packaging market, driven by global concerns over plastic waste and environmental impact. Manufacturers are investing in the development of recyclable and biodegradable materials to replace traditional plastic-based IV containers. Innovations in polymer science are enabling the creation of high-performance eco-friendly IV bags that meet regulatory standards without compromising safety or durability. Companies that prioritize green packaging solutions are likely to gain a competitive edge in markets where environmental regulations and consumer preferences are shifting toward sustainability.

- For instance, Amcor developed EcoLam™, a polyolefin-based IV bag film that reduces carbon footprint by 70 metric tons per million units produced compared to conventional multi-material films.

Technological Integration in Packaging Design

The integration of smart and advanced packaging technologies presents promising opportunities for IV packaging providers. Features such as tamper-evidence, RFID tagging, and real-time temperature monitoring are being incorporated into IV containers to enhance traceability, compliance, and safety. These advancements improve supply chain efficiency and help ensure proper storage and administration of IV products. As healthcare moves toward digitalization and data-driven systems, the demand for technologically enhanced IV packaging is expected to rise, especially in critical care and specialty drug segments.

- For instance, Sippex has introduced RFID-enabled IV bags that can store up to 2 kilobytes of medical data per bag, streamlining drug authentication and administration protocols in clinical settings.

Key Challenges

Stringent Regulatory Approvals and Compliance

Compliance with global regulatory standards remains a significant hurdle for IV packaging manufacturers. Stringent quality control, sterilization validation, and material safety standards enforced by bodies like the FDA, EMA, and WHO can delay product approvals and increase costs. Packaging used for injectable drugs must pass rigorous tests to prove compatibility, stability, and non-toxicity. For smaller companies, these compliance requirements can be particularly burdensome, restricting market entry and slowing down innovation timelines.

Fluctuations in Raw Material Prices

Volatility in the prices of raw materials, particularly medical-grade plastics and polymers, poses a major challenge for IV packaging producers. As these materials are derived from petrochemicals, their prices are susceptible to global oil price fluctuations, supply chain disruptions, and geopolitical tensions. This unpredictability directly impacts production costs and profit margins, especially for manufacturers operating in price-sensitive markets. Additionally, the increasing pressure to shift toward sustainable materials can further raise input costs in the short term.

Regional Analysis

North America

North America dominated the intravenous packaging market in 2024, accounting for approximately 35% of the global revenue share. The region’s leadership is attributed to its advanced healthcare infrastructure, high per capita healthcare spending, and widespread adoption of single-use IV systems. The U.S. drives the majority of demand due to its robust pharmaceutical manufacturing sector and strict regulatory compliance regarding sterile packaging. Additionally, the increasing prevalence of chronic diseases and the rise in home-based care solutions are bolstering the market. Key players continue to invest in sustainable and technologically advanced packaging, further consolidating the region’s competitive position.

Europe

Europe held around 27% of the global intravenous packaging market share in 2024, driven by stringent regulatory standards and a growing focus on patient safety. Countries such as Germany, France, and the UK lead market growth, supported by a well-established hospital network and pharmaceutical production base. The region is also witnessing a surge in demand for eco-friendly and recyclable IV packaging in response to EU sustainability initiatives. Rising geriatric populations and increased incidence of hospital-acquired infections are accelerating the shift toward sterile, single-use packaging formats. Collaborations between healthcare providers and packaging firms are shaping the European market landscape.

Asia Pacific

Asia Pacific accounted for approximately 22% of the global market share in 2024 and is expected to witness the fastest growth during the forecast period. Expanding healthcare infrastructure, increasing government investment in public health, and a growing patient pool are primary growth drivers in countries such as China, India, and Japan. The rising incidence of infectious diseases and chronic conditions has boosted demand for IV therapies, supporting higher consumption of intravenous packaging products. Moreover, the growing pharmaceutical manufacturing base and improving regulatory frameworks are attracting global packaging firms to invest in this rapidly developing market.

Latin America

Latin America captured about 8% of the global intravenous packaging market in 2024, with Brazil and Mexico emerging as key contributors. The market in this region is supported by expanding access to healthcare services and growing demand for cost-effective drug delivery systems. Economic development, combined with public and private sector healthcare initiatives, is enhancing the availability of intravenous treatments. However, limited technological advancement and inconsistent regulatory enforcement remain barriers to faster adoption. Despite these challenges, the growing presence of international healthcare firms is expected to enhance product quality and supply chain capabilities in the region.

Middle East & Africa (MEA)

The Middle East & Africa region held nearly 8% of the global intravenous packaging market share in 2024. Market growth is driven by increasing investments in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, and rising demand for advanced medical care. The growing burden of chronic illnesses such as diabetes and kidney diseases has increased the need for intravenous therapies. South Africa and Saudi Arabia are key markets showing strong demand for sterile and safe IV packaging. However, limited local manufacturing capacity and supply chain constraints continue to challenge the full potential of the region’s growth.

Market Segmentations:

By Material:

By Product Type:

By End-User:

By Usage:

By Application:

- Fluid & Nutrient Delivery

- Medication Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The intravenous packaging market is moderately consolidated, with key players focusing on product innovation, regulatory compliance, and strategic collaborations to strengthen their market position. Companies such as Baxter, Amcor, and Technoflex lead the market by offering a broad range of sterile, durable, and eco-friendly IV packaging solutions tailored to hospital and home-care needs. These firms invest significantly in R&D to develop advanced materials and improve barrier properties, shelf life, and user safety. Regional players like Forlong Medical and MRK Healthcare contribute to market competitiveness by offering cost-effective solutions in emerging markets. Mergers, acquisitions, and partnerships with pharmaceutical companies are common strategies aimed at expanding geographic reach and product portfolios. Additionally, manufacturers are aligning their offerings with sustainability goals, developing recyclable and bio-based packaging alternatives to meet evolving regulatory and consumer demands. As the market evolves, technological integration and customization are expected to be key differentiators among competitors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EuroLife Healthcare

- MRK Healthcare

- Technoflex

- Sippex IV bag

- Amcor

- Forlong Medical

- SSY Group Limited

- Nipro

- Baxter

Recent Developments

- In March 2025, Mallinckrodt and Endo announced a merger to create a diversified pharmaceuticals leader with pro forma revenue of USD 3.6 billion and Adjusted EBITDA of USD 1.2 billion, integrating their sterile injectables and generics businesses to enhance manufacturing infrastructure and generate substantial operating synergies.

- In February 2025, Baxter International completed the sale of its Kidney Care business as part of strategic transformation, enabling focus on core IV solutions and infusion therapy segments while anticipating operational sales growth of 4-5% annually post-sale.

- In October 2024, B. Braun Medical announced the plan to ramp up production of intravenous (IV) saline fluids by 20% at its plants in Irvine, California, and Daytona Beach, Florida.

- In July 2024, Amneal Pharmaceuticals, Inc. received U.S. Food and Drug Administration (FDA) approval for a new formulation of potassium phosphates in 0.9% sodium chloride injection, available in ready-to-use intravenous (IV) bags. This sterile presentation streamlines the administration process by minimizing the compounding steps typically clinicians require.

Market Concentration & Characteristics

The Intravenous Packaging Market exhibits a moderate level of market concentration, with a mix of global and regional players operating across diverse segments. It features a blend of well-established firms such as Baxter, Amcor, and Technoflex, which hold substantial market shares due to their broad product portfolios, regulatory expertise, and global distribution networks. It is characterized by high regulatory compliance requirements, especially concerning sterility, material safety, and compatibility with intravenous solutions. Product differentiation is driven by factors such as material innovation, ease of use, and sustainability, with companies focusing on recyclable and bio-compatible packaging formats. The market also reflects growing demand for customized solutions suited for home-care and ambulatory settings, encouraging smaller players to offer region-specific alternatives. Price competition remains significant, especially in emerging markets, while strategic alliances and acquisitions continue to shape the competitive dynamics. It maintains stable long-term demand due to the essential role of intravenous therapy in clinical and home-based care.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, End-User, Usage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by increasing demand for sterile and single-use IV systems in both hospitals and home-care settings.

- Manufacturers will continue investing in sustainable and recyclable packaging materials to meet environmental regulations.

- Technological advancements such as tamper-evident designs and RFID-enabled smart packaging will gain broader adoption.

- The rise in chronic illnesses and aging populations globally will sustain the long-term need for intravenous packaging solutions.

- Home infusion therapy and outpatient services will significantly boost demand for portable and user-friendly IV packaging formats.

- Regulatory compliance will remain a key focus, influencing material selection and product development.

- Asia Pacific will emerge as the fastest-growing region due to improving healthcare infrastructure and increased patient access.

- Customization and flexible packaging solutions will become critical differentiators among key players.

- Strategic mergers and acquisitions will shape competitive dynamics and expand product portfolios.

- Regional manufacturers will gain ground by offering cost-effective and compliant alternatives in emerging markets.