| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Automotive Smart Keys Market Size 2023 |

USD 345.98 Million |

| Italy Automotive Smart Keys Market, CAGR |

7.35% |

| Italy Automotive Smart Keys Market Size 2032 |

USD 655.42 Million |

Market Overview

Italy Automotive Smart Keys Market size was valued at USD 345.98 million in 2023 and is anticipated to reach USD 655.42 million by 2032, at a CAGR of 7.35% during the forecast period (2023-2032).

The growth of the Italy Automotive Smart Keys market is primarily driven by the increasing demand for enhanced vehicle security, convenience, and technology integration. As consumers seek advanced features such as keyless entry, remote start, and proximity sensing, smart key systems are becoming more popular in both luxury and mass-market vehicles. The rise in automotive innovation, including the integration of smart keys with connected car technologies and smartphone apps, is further boosting market expansion. Additionally, stricter regulations regarding vehicle security and the growing awareness of anti-theft solutions are driving the adoption of smart key technologies. As electric vehicles (EVs) and autonomous vehicles gain traction in Italy, the need for more sophisticated and secure key systems is expected to rise. Moreover, trends toward personalization and digitalization in the automotive industry are fueling market growth, offering new opportunities for smart key system providers.

The geographical analysis of the Italy Automotive Smart Keys market reveals significant regional variations, with Northern Italy leading the adoption of advanced automotive technologies due to its concentration of luxury vehicle buyers and automotive manufacturers. Key cities such as Milan, Turin, and Venice drive demand in this region. Southern Italy, including Naples and Palermo, shows slower adoption but is growing due to increasing awareness and infrastructure improvements. Central Italy, particularly Rome, Florence, and Bologna, sees steady growth in smart key adoption, driven by both passenger and commercial vehicles. Key players in the Italian market include prominent companies like Huf Hulsbeck & Furst GmbH & Co, Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, and Denso Corporation. These companies dominate the market with innovative solutions ranging from advanced security features to multi-functional smart key systems, catering to both high-end and mass-market vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Automotive Smart Keys market was valued at USD 345.98 million in 2023 and is projected to reach USD 655.42 million by 2032, growing at a CAGR of 7.35% during the forecast period (2023-2032).

- The Global Automotive Smart Keys market was valued at USD 12,499.00 million in 2023 and is projected to reach USD 26,481.41 million by 2032, growing at a CAGR of 8.70% from 2023 to 2032.

- Increasing demand for enhanced vehicle security, convenience, and keyless entry systems are the primary drivers of the market.

- Growing integration of connected car technologies and smartphone compatibility is boosting the demand for smart key systems in Italy.

- Rising adoption of electric and autonomous vehicles presents opportunities for smart key innovation and increased market demand.

- Major players such as Huf Hulsbeck & Furst GmbH & Co, Continental AG, and Denso Corporation dominate the market with advanced, multi-functional solutions.

- Market restraints include security risks associated with smart key systems, such as relay attacks, and high costs for advanced technologies.

- Northern Italy holds the largest market share, with significant adoption in regions like Milan and Turin, while Southern Italy and Central Italy show steady growth.

Report Scope

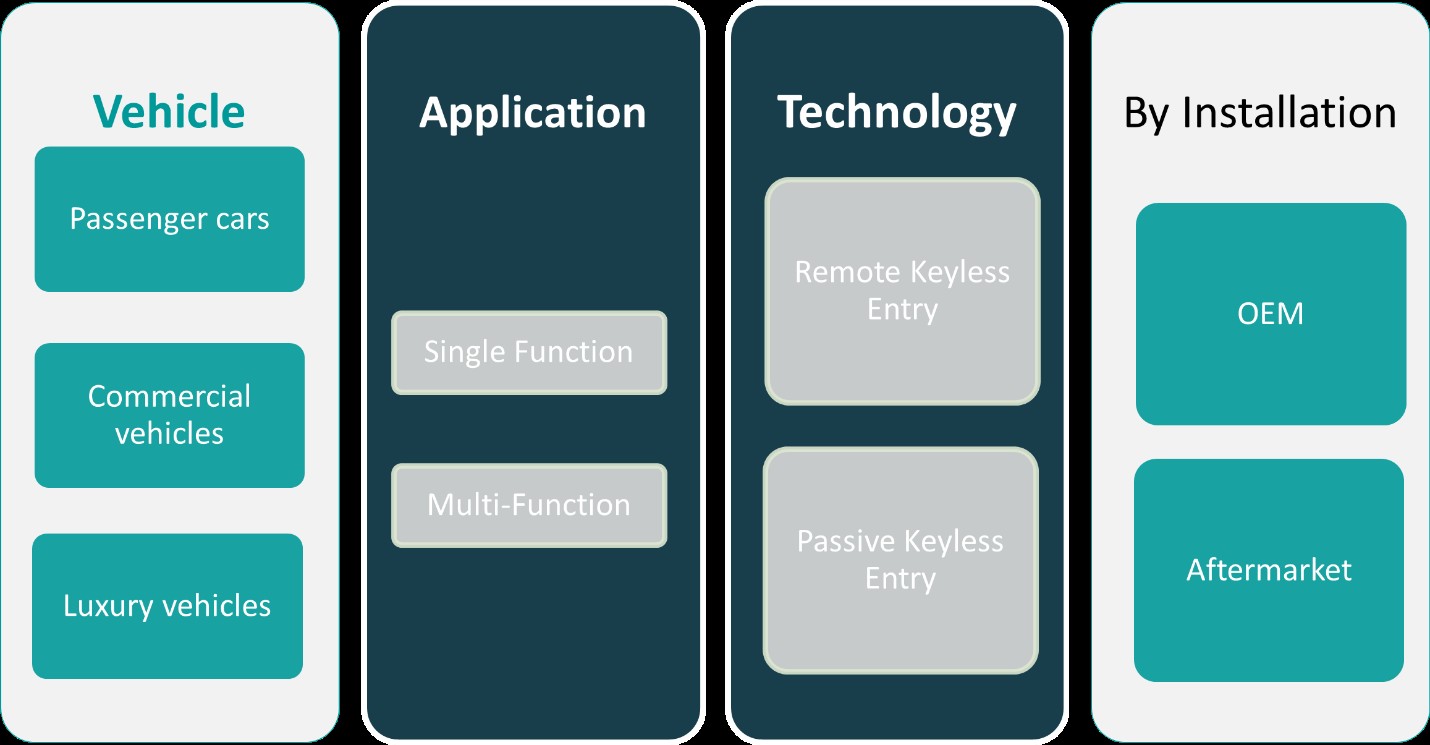

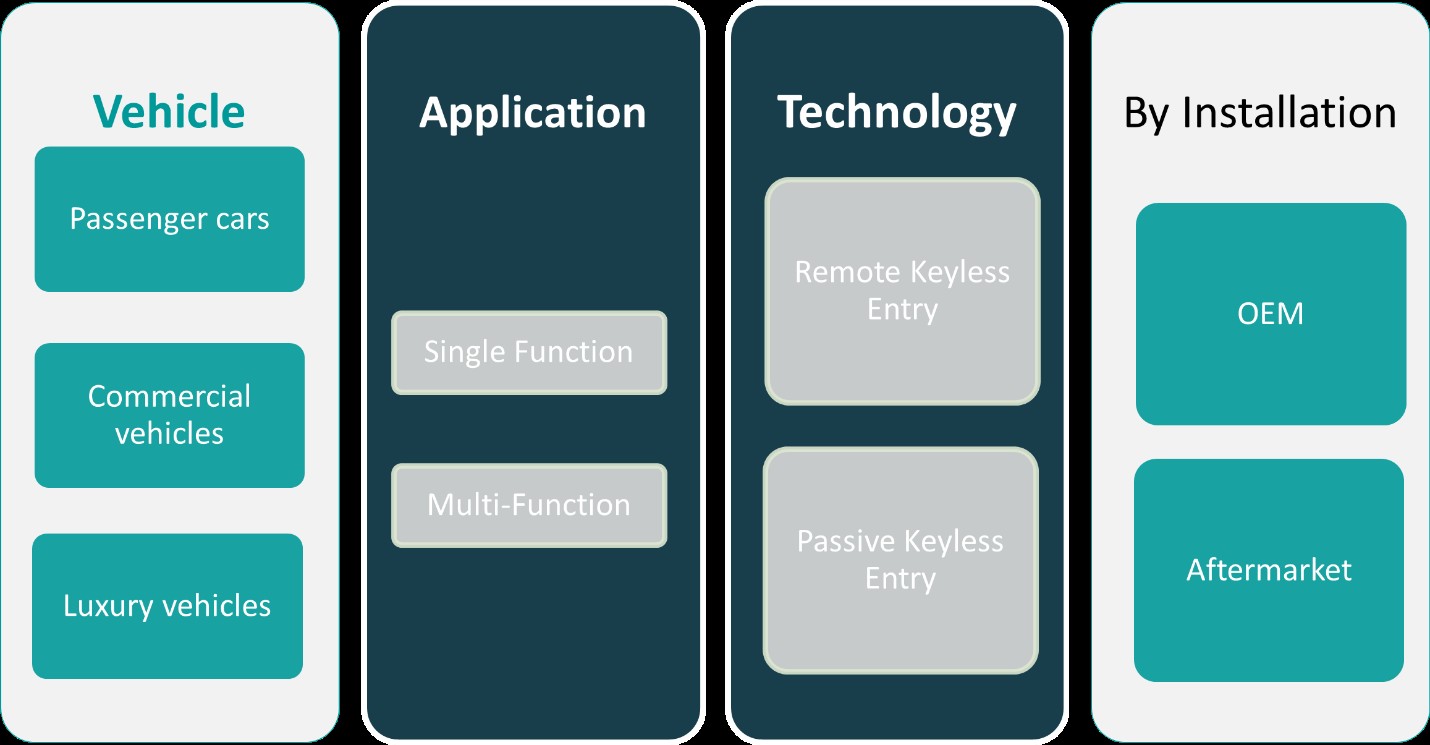

This report segments the Italy Automotive Smart Keys Market as follows:

Market Drivers

Rising Demand for Enhanced Vehicle Security

One of the key drivers of the Italy Automotive Smart Keys market is the growing demand for enhanced vehicle security. For instance, a report by the European Union Agency for Cybersecurity (ENISA) highlights the effectiveness of encrypted signals and advanced authentication mechanisms in reducing vehicle theft rates. As vehicle theft rates continue to rise, consumers are increasingly seeking more sophisticated security systems. Traditional mechanical keys are becoming obsolete due to their vulnerability to hacking and duplication. In response, automotive manufacturers are increasingly integrating smart key technologies that offer better protection against unauthorized access. This growing concern over security, combined with the need for more reliable anti-theft systems, is driving the adoption of automotive smart keys across the Italian market.

Growing Popularity of Electric and Autonomous Vehicles

The increasing adoption of electric vehicles (EVs) and the rise of autonomous vehicles are significantly contributing to the demand for advanced automotive key systems. For instance, a report by the International Energy Agency (IEA) emphasizes the compatibility of smart key systems with EVs, which rely heavily on digital integration for user authentication and security. Smart keys allow for keyless entry, remote vehicle control, and enhanced security, which are essential features for EVs, where traditional ignition systems are becoming obsolete. Similarly, as autonomous vehicles emerge, the need for more secure and user-friendly access systems is becoming more critical. Smart keys offer seamless integration with autonomous features, allowing owners to unlock their vehicles, activate remote controls, and manage vehicle settings from a distance. As Italy continues to adopt EVs and explore autonomous vehicle technology, the demand for smart key systems is expected to grow accordingly, providing further market opportunities.

Increasing Integration of Connected Car Technologies

Another major driver is the integration of connected car technologies, which is transforming the automotive industry. As vehicles become more digitally integrated, the demand for seamless connectivity and convenience is increasing. Automotive smart keys are playing a pivotal role in this transformation, as they enable vehicles to connect with smartphones and other smart devices, allowing for remote control functions such as unlocking, remote start, and location tracking. Additionally, many smart keys can now interface with in-car infotainment systems, allowing for personalized settings, such as driver preferences for seating and climate control. The ongoing shift toward more connected and digitized vehicles is fueling the growth of the automotive smart key market, particularly as manufacturers strive to offer innovative solutions that meet consumer expectations for convenience and efficiency.

Government Regulations and Industry Standards

Government regulations and industry standards are also driving the adoption of smart key systems in Italy. With rising concerns about vehicle security and safety, regulatory bodies are increasingly imposing stricter requirements for vehicle anti-theft systems. Many of these regulations mandate the inclusion of advanced security measures, including smart keys, in newly manufactured vehicles. For instance, the European Union has implemented regulations requiring all new vehicles to be equipped with immobilizers and other anti-theft devices, which are often integrated with smart key technology. As a result, automotive manufacturers are incentivized to adopt smart key systems in order to comply with these regulations and enhance the security of their vehicles. This regulatory push is helping to expand the use of automotive smart keys in the Italian market.

Market Trends

Integration of Biometric Authentication

A notable trend in the Italian automotive smart key market is the incorporation of biometric authentication methods, such as fingerprint and facial recognition technologies. For instance, a report by the Biometrics Institute highlights the growing adoption of fingerprint and facial recognition technologies in vehicles, emphasizing their role in enhancing security and personalization. This advancement enhances security by ensuring that only authorized individuals can access and operate the vehicle. Biometric systems also offer personalized experiences, adjusting vehicle settings to individual preferences upon recognition. As consumers increasingly prioritize safety and customization, manufacturers are investing in these technologies to meet evolving expectations.

Shift Towards Remote Keyless Entry Systems

Remote Keyless Entry (RKE) systems are gaining prominence in Italy due to their cost-effectiveness and simplicity. These systems allow drivers to lock and unlock their vehicles without inserting a physical key, enhancing convenience. For instance, data from the Open Government Data (OGD) Platform India highlights the increasing adoption of RKE systems in mid-range vehicles, driven by their cost-effectiveness and reliability. Their straightforward design contributes to reliability and lower maintenance costs, making them appealing across various vehicle segments, including mid-range and entry-level models. This trend reflects a consumer preference for accessible and user-friendly automotive technologies.

Emphasis on Advanced Connectivity Features

The integration of advanced connectivity features in smart key systems is transforming vehicle access and control. By connecting vehicles to the internet, drivers can remotely access and manage functions such as locking/unlocking doors, starting the engine, and adjusting climate controls via smartphone apps or web portals. This connectivity not only enhances convenience but also allows for real-time vehicle health monitoring, contributing to proactive maintenance and improved safety. The growing demand for seamless digital experiences is driving this trend in the Italian market.

Security Challenges Amidst Technological Advancements

As smart key systems become more prevalent, addressing security vulnerabilities has become a critical focus. There have been instances where relay attacks have exploited weaknesses in keyless entry systems, leading to unauthorized vehicle access. To counteract such threats, manufacturers are implementing enhanced encryption methods and developing advanced security protocols. This includes integrating technologies like ultra-wideband communication to prevent relay attacks, ensuring that smart key systems remain secure against emerging threats.

Market Challenges Analysis

Security Risks and Vulnerabilities

One of the significant challenges facing the Italy automotive smart key market is the growing concern over security vulnerabilities. As smart key systems become more advanced, they are increasingly targeted by cybercriminals seeking to exploit weaknesses in the technology. Relay attacks, where thieves amplify signals from smart keys to unlock vehicles, have become a rising threat, particularly in urban areas. These attacks pose serious security risks and undermine the reliability of keyless entry systems. While manufacturers are continually enhancing encryption methods and introducing new security protocols, the rapid pace of technological innovation means that cyber threats often evolve faster than protective measures can be implemented. Ensuring that smart key systems remain secure against increasingly sophisticated hacking techniques is a major challenge for both manufacturers and consumers.

High Costs of Advanced Technologies

The adoption of advanced smart key technologies often involves higher costs, which can be a barrier for widespread adoption in the Italian automotive market, especially for lower-end vehicle models. For instance, data from the Italian Ministry of Economic Development highlights the financial burden of integrating features like biometric authentication and remote vehicle management into vehicles. Additionally, reports from the European Automobile Manufacturers’ Association (ACEA) emphasize the challenges faced by manufacturers in balancing affordability with the integration of cutting-edge technologies, which often require continuous updates and maintenance.

Market Opportunities

The Italy Automotive Smart Keys market presents significant opportunities for growth, driven by the increasing demand for enhanced vehicle security and convenience. As consumers seek more advanced and secure access systems, automotive manufacturers are capitalizing on the opportunity to integrate cutting-edge technologies, such as biometric authentication, advanced encryption, and remote keyless entry systems. The shift toward connected car technologies, where smart keys interact with smartphones and other devices, also opens new avenues for innovation. These connected features not only provide convenience through remote access and control but also allow for better vehicle management, including real-time monitoring of vehicle status and maintenance alerts. Manufacturers can explore these technologies to cater to the growing demand for smarter, more secure automotive systems.

Furthermore, the rise of electric and autonomous vehicles presents a unique opportunity for the automotive smart key market in Italy. As electric vehicles (EVs) gain popularity, the need for seamless, keyless entry and advanced security systems becomes more pronounced. Smart key systems that enable remote vehicle control and are integrated with digital platforms offer EV owners an enhanced driving experience. Similarly, as autonomous vehicles continue to evolve, the integration of smart keys with self-driving technologies could offer significant opportunities for growth. This alignment with emerging trends in the automotive industry positions the smart key market to tap into the expanding consumer base for both EVs and autonomous vehicles. With innovation and strategic partnerships, companies can expand their product offerings and cater to an evolving, tech-savvy customer segment.

Market Segmentation Analysis:

By Vehicle:

The Italy Automotive Smart Keys market is segmented by vehicle type into passenger cars, commercial vehicles, and luxury vehicles. The passenger car segment dominates the market, driven by the widespread adoption of smart key technologies in mid-range and economy vehicles. As consumers increasingly prioritize convenience and security, smart key systems are becoming a standard feature in most new passenger cars, offering features such as keyless entry, remote start, and proximity sensing. The commercial vehicle segment, though smaller, is expected to experience growth, particularly with the adoption of smart keys for fleet management and enhanced security. Commercial vehicles benefit from the added convenience of managing multiple vehicles with integrated access and monitoring systems. Meanwhile, the luxury vehicle segment is a significant driver of innovation in the smart key market, with high-end manufacturers offering multi-functional smart keys with advanced features like biometric authentication, personalized settings, and remote control. The demand for these sophisticated systems in luxury vehicles is expected to increase as consumers seek premium and personalized driving experiences.

By Application:

The Italy Automotive Smart Keys market can also be segmented based on application into single-function and multi-function systems. Single-function smart keys primarily offer basic features such as keyless entry and ignition, typically found in entry-level and mid-range vehicles. These systems cater to consumers seeking convenience and security without the need for additional features, making them more cost-effective. However, the multi-function segment is expected to witness the highest growth, driven by increasing consumer demand for advanced features. Multi-function smart keys allow for the integration of various capabilities, such as remote start, vehicle tracking, and customization of driver preferences (e.g., seat and climate control settings). These systems are particularly popular in luxury vehicles and higher-end models, where advanced technology and personalization are highly valued. The growing trend of connected car technologies, where smart keys are integrated with mobile apps and cloud services, further accelerates the demand for multi-function systems, offering consumers a seamless, digital experience.

Segments:

Based on Vehicle:

- Passenger cars

- Commercial vehicles

- Luxury vehicles

Based on Application:

- Single Function

- Multi-Function

Based on Technology:

- Remote Keyless Entry

- Passive Keyless Entry

Based on Distribution Channel:

Based on the Geography:

- Northern Italy

- Milan

- Turin

- Venice

- Southern Italy

- Naples

- Palermo

- Bari

- Central Italy

- Rome

- Florence

- Bologna

Regional Analysis

Northern Italy

Northern Italy, which includes cities like Milan, Turin, and Venice, holds the largest market share, accounting for approximately 45% of the total market. This region is a hub for automotive innovation, with major automotive manufacturers, technology firms, and a high concentration of premium vehicle buyers. The demand for smart keys in Northern Italy is driven by the region’s strong automotive industry presence, including luxury brands and electric vehicle adoption. The region’s advanced infrastructure, higher disposable incomes, and consumer preference for cutting-edge technology further contribute to the dominance of smart key systems.

Southern Italy

Southern Italy, including Naples, Palermo, and Bari, accounts for about 25% of the market share in the Italy Automotive Smart Keys sector. The region’s market growth is slower compared to the north due to relatively lower income levels and a larger concentration of budget-conscious consumers. However, as vehicle security concerns rise and the demand for convenience grows, the adoption of automotive smart keys in Southern Italy is expected to increase. This growth is facilitated by improvements in infrastructure and increasing awareness of the benefits of smart key technology. The region’s expanding middle class and rising demand for both passenger cars and commercial vehicles will continue to drive market development.

Central Italy

Central Italy, comprising cities like Rome, Florence, and Bologna, holds a market share of approximately 20%. The adoption of automotive smart keys in Central Italy is steady, driven by the region’s capital city, Rome, which has a significant consumer base and a growing interest in connected car technologies. The region is home to many mid-range and luxury vehicle owners who are more inclined to embrace modern security and convenience features, driving the market forward. The high level of tourism and public transportation use in cities like Florence and Bologna also boosts the demand for smart key systems in rental and commercial vehicles, creating niche opportunities.

Key Player Analysis

- Huf Hulsbeck & Furst GmbH & Co

- Continental AG

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- Silca Group

- Tokai Rika Co

- Denso Corporation

- ALPHA Corporation

- Valeo SA

- Robert Bosch GmbH

- Marquardt

Competitive Analysis

The Italy Automotive Smart Keys market is highly competitive, with key players focusing on innovation, security, and integration of advanced technologies. Leading companies such as Huf Hulsbeck & Furst GmbH & Co, Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, Silca Group, Tokai Rika Co, Denso Corporation, ALPHA Corporation, Valeo SA, Robert Bosch GmbH, and Marquardt are at the forefront of the market. These companies offer a wide range of smart key solutions, including basic keyless entry systems and more advanced multi-functional keys with biometric authentication, remote vehicle control, and integration with connected car technologies. These players are heavily investing in R&D to enhance the security features of their products, addressing concerns like relay attacks and hacking vulnerabilities. Moreover, they are working on making their smart keys compatible with electric and autonomous vehicles, which is a growing segment in the automotive industry. As the demand for personalized and secure vehicle access systems rises, these companies are well-positioned to lead the market through continuous innovation and strategic partnerships. Competitive pressure is driving rapid technological advancements, ensuring that Italy’s automotive sector benefits from the latest in smart key solutions.

Recent Developments

- In January 2025, Honda Lock, now owned by MinebeaMitsumi, expanded its product line to include advanced keyless entry systems with mobile connectivity and IoT features, aligning with the automotive industry’s trend towards electrification and automation.

- In December 2024, Hyundai Mobis announced plans to expand its card-type smart key to major Hyundai models like the Santa Fe and Tucson. This key uses UWB for enhanced functionality and wireless charging capabilities.

- In April 2024, Continental developed a smart device-based access solution for Mercedes-Benz E-Class cars. This system utilizes ultra-wideband (UWB) technology, transceivers, and intelligent software to enhance security and convenience for luxury vehicles.

- In December 2023, Huf introduced a groundbreaking smart key that combines UWB, BLE, and NFC technologies in compliance with Car Connectivity Consortium (CCC) standards. This innovation enhances anti-theft security and convenience while allowing integration with “Phone as a Key” systems.

Market Concentration & Characteristics

The Italy Automotive Smart Keys market exhibits moderate concentration, with a few dominant players leading the industry while allowing room for smaller companies to innovate. Major players like Huf Hulsbeck & Furst GmbH & Co, Continental AG, ZF Friedrichshafen AG, and Denso Corporation hold substantial market shares, leveraging their established reputations and advanced technological capabilities to drive product development. These companies focus on high-value, multi-functional smart key systems, incorporating features such as biometric authentication and remote connectivity to meet the evolving demands for security and convenience in vehicles. The market characteristics are defined by rapid technological advancements, with key players emphasizing R&D to stay ahead of emerging trends like electric and autonomous vehicles. Additionally, as smart key systems become increasingly integrated with connected car technologies, competition intensifies. Smaller companies contribute by offering cost-effective solutions and specialized products, fostering innovation while catering to niche markets within the broader automotive ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Application, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Automotive Smart Keys market is expected to continue its growth, driven by increasing demand for enhanced vehicle security and convenience.

- Technological advancements such as biometric authentication and remote vehicle management will become more prevalent in smart key systems.

- The rise of electric and autonomous vehicles will create new opportunities for smart key technologies, requiring more advanced and integrated solutions.

- Connected car systems will see greater integration with smart key solutions, enabling seamless vehicle access and control via smartphones and other devices.

- Manufacturers will focus on enhancing the security features of smart keys to prevent vulnerabilities like relay attacks and hacking.

- As consumer preference for personalized vehicle experiences grows, smart key systems will incorporate more customizable features, such as automatic seat and climate control settings.

- Increased adoption of smart key technologies in both luxury and mid-range vehicles will drive market expansion across different segments.

- The cost of advanced smart key systems will gradually decrease as technology becomes more widespread and production processes become more efficient.

- Regulatory requirements for enhanced vehicle security will continue to push the adoption of smart key technologies in the automotive industry.

- Regional market expansion in Southern and Central Italy will increase as infrastructure improves and consumer awareness of smart key benefits grows.