Market Overview

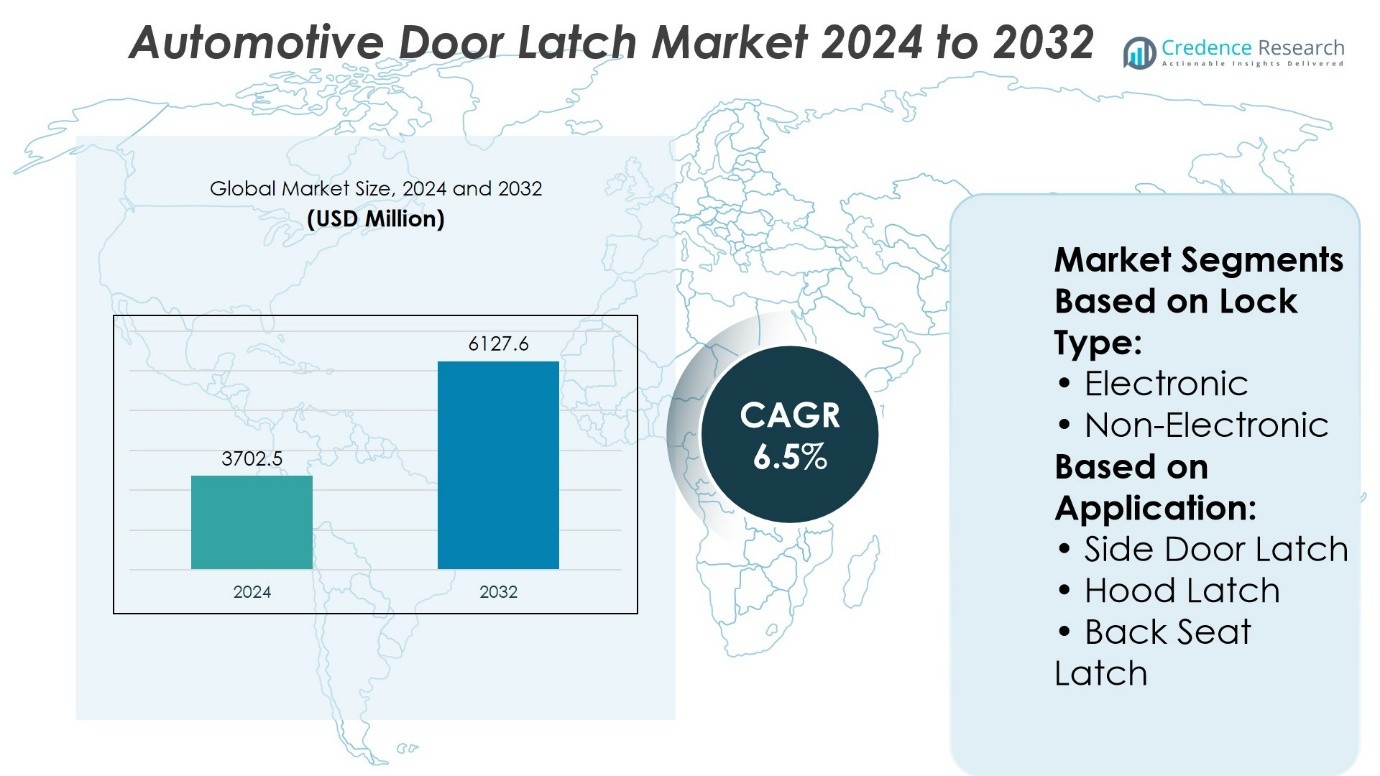

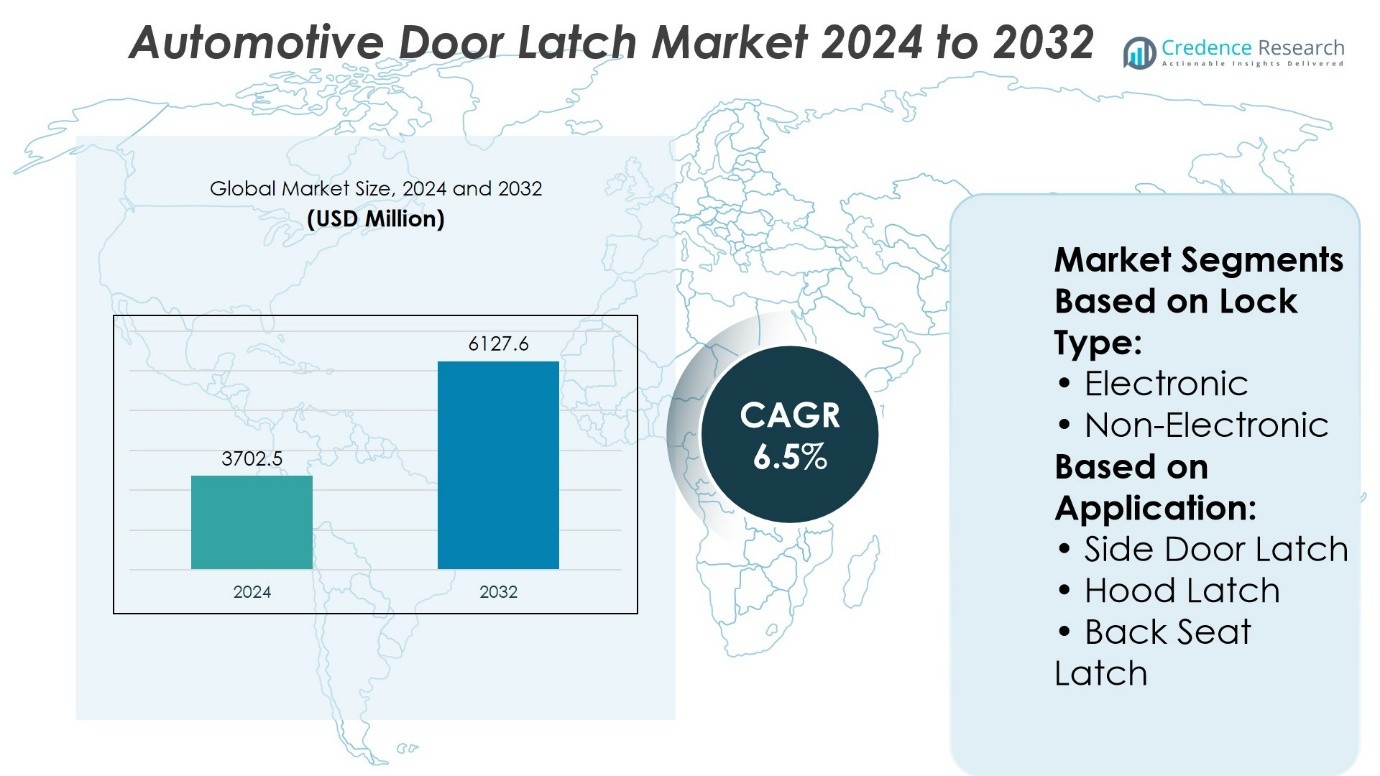

Automotive Door Latch Market size was valued at USD 3702.5 million in 2024 and is anticipated to reach USD 6127.6 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Door Latch Market Size 2024 |

USD 3702.5 Million |

| Automotive Door Latch Market, CAGR |

6.5% |

| Automotive Door Latch Market Size 2032 |

USD 6127.6 Million |

The Automotive Door Latch Market grows through rising demand for advanced safety features, lightweight components, and enhanced vehicle security systems. Automakers adopt electronic and mechatronic latch solutions to meet stringent safety regulations and improve user convenience. Expanding electric vehicle production accelerates integration of smart access technologies, while increasing consumer preference for premium and connected vehicles supports innovation in latch design. Global OEM-supplier collaborations strengthen product development, and the aftermarket benefits from replacement demand in aging fleets. The market also adapts to trends in autonomous mobility, where contactless entry and remote-controlled locking systems gain prominence across diverse vehicle segments.

The Automotive Door Latch Market has a strong presence across Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, with Asia Pacific holding the largest share due to high vehicle production and OEM concentration. North America and Europe follow, driven by advanced safety regulations and technological adoption. Key players include Aisin Corporation, Kiekert AG, Mitsui Kinzoku ACT, Magna International Inc., and Inteva Products LLC, all leveraging global manufacturing networks and innovation capabilities to maintain competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Door Latch Market was valued at USD 3702.5 million in 2024 and is projected to reach USD 6127.6 million by 2032, at a CAGR of 6.5%.

- Rising demand for advanced safety features, lightweight materials, and improved vehicle security drives market growth.

- Adoption of electronic and mechatronic latch systems supports compliance with safety regulations and enhances user convenience.

- Intense competition among leading players focuses on innovation, global manufacturing presence, and strong OEM partnerships.

- High manufacturing costs and complex integration in advanced latch systems restrain market expansion.

- Asia Pacific holds the largest share, followed by North America and Europe, with growth supported by vehicle production and technology adoption.

- Increasing electric vehicle production and autonomous mobility trends boost demand for smart, contactless, and remotely controlled latch solutions.

Market Drivers

Increasing Demand for Advanced Vehicle Safety Features

The Automotive Door Latch Market benefits from the growing integration of advanced safety technologies in passenger and commercial vehicles. Consumers and regulators emphasize enhanced occupant protection, pushing manufacturers to adopt high-performance latching systems. It supports side-impact protection, child safety locks, and anti-theft mechanisms that comply with global safety standards. Automakers focus on integrating electronic and power latches to improve operational reliability. The demand for latches compatible with advanced driver-assistance systems strengthens its relevance. Continuous safety testing and certification drive innovation and product refinement in this segment.

Shift Toward Electrification and Smart Vehicle Architectures

The Automotive Door Latch Market gains momentum from the rapid shift toward electric and connected vehicles. Electric vehicle manufacturers require lightweight and electronically controlled latching systems to optimize performance and energy efficiency. It enables seamless integration with central locking, keyless entry, and remote-control features. Smart door latches support over-the-air software updates, enhancing long-term functionality. Automakers explore sensor-based systems that detect obstruction and adjust closing force accordingly. These technological advancements align with the industry’s movement toward fully autonomous vehicle designs.

- For instance, ZF has manufactured over 3.0 million electric motors used globally in electric vehicle powertrains—technology that underpins seamless integration of electronically actuated door latch systems with core vehicle control networks.

Rising Vehicle Production in Emerging Markets

The Automotive Door Latch Market expands through increased vehicle production in Asia-Pacific, Latin America, and parts of Africa. Rising disposable incomes and urbanization stimulate demand for new passenger and light commercial vehicles. It drives original equipment manufacturers to establish local production facilities for cost efficiency and faster delivery. Domestic suppliers benefit from strategic partnerships with global automotive brands. Government policies encouraging automotive manufacturing investment further support growth. The rising middle-class population fuels sustained demand for vehicles equipped with advanced door latch systems.

- For instance, Toyota produced 10.3 million vehicles worldwide in 2023, with over 5.8 million of those manufactured in India and other Asia‑Pacific locations—highlighting the region’s crucial role in overall output.

Focus on Durability, Lightweight Materials, and Cost Efficiency

The Automotive Door Latch Market experiences growth through innovations in materials and manufacturing processes. Manufacturers adopt high-strength polymers, aluminum alloys, and composite materials to reduce weight without compromising durability. It ensures corrosion resistance and operational reliability under extreme environmental conditions. Automation in manufacturing improves precision and reduces production costs. Suppliers emphasize modular designs that simplify assembly and maintenance. Long-term cost efficiency supports wider adoption across entry-level and premium vehicle segments. Continuous research into wear-resistant coatings enhances product longevity and performance.

Market Trends

Adoption of Electronic and Power-Operated Latching Systems

The Automotive Door Latch Market is shifting toward electronic and power-operated solutions to meet modern vehicle design and safety requirements. Automakers integrate advanced latches with keyless entry, power sliding doors, and central locking systems. It supports seamless operation, improved user convenience, and better integration with onboard electronics. Electronic latches also enhance anti-theft capabilities through programmable locking functions. The trend aligns with the growth of electric and autonomous vehicles, where mechanical simplicity and electronic control are prioritized. Manufacturers invest in compact, lightweight electronic latch modules to optimize design flexibility.

- For instance, Inteva Products produces approximately 65.0 million door latch units annually, including electronic and power-operated models, supplying major OEMs worldwide.

Integration with Advanced Driver Assistance Systems (ADAS)

The Automotive Door Latch Market benefits from the increasing integration of latches with ADAS platforms. Sensors embedded in latch systems detect obstructions and prevent door closure accidents. It enables features such as automatic door locking at certain speeds and safety alerts for improperly closed doors. Connectivity with vehicle diagnostic systems allows predictive maintenance and fault detection. Automakers use these integrated solutions to enhance overall vehicle safety ratings. The fusion of latch technology with ADAS creates a competitive advantage for OEMs in premium and mid-range segments.

- For instance, Mobileye technologies—such as the EyeQ SoC integrated into ADAS modules—have been deployed in more than 200 million vehicles worldwide to date.

Focus on Lightweight Materials and Enhanced Durability

The Automotive Door Latch Market is trending toward the use of high-strength polymers, aluminum alloys, and composite materials. This shift reduces overall vehicle weight, contributing to fuel efficiency and lower emissions. It also ensures corrosion resistance and long-term reliability in diverse environmental conditions. Manufacturers develop wear-resistant coatings and surface treatments to extend latch service life. Testing protocols focus on extreme temperature and vibration endurance. These innovations cater to both conventional and electric vehicle platforms.

Growth in Customization and Modular Latch Designs

The Automotive Door Latch Market is seeing rising demand for customizable latch systems tailored to different vehicle categories. Modular designs allow quick adaptation for sedans, SUVs, trucks, and specialty vehicles. It enables faster production cycles and reduced tooling costs for manufacturers. OEMs request design variations to accommodate unique styling and functionality requirements. Custom finishes and ergonomic enhancements improve user experience and brand differentiation. This trend supports flexibility in meeting global market needs while maintaining cost efficiency.

Market Challenges Analysis

High Cost of Advanced Latch Technologies and Integration

The Automotive Door Latch Market faces challenges related to the rising cost of advanced electronic and smart latch systems. Integration with keyless entry, central locking, and ADAS platforms increases design complexity and production expenses. It becomes difficult for manufacturers to balance innovation with affordability, especially in cost-sensitive vehicle segments. OEMs must manage the challenge of adopting new technologies without significantly raising vehicle prices. The need for extensive testing and compliance with global safety standards adds to development timelines. Smaller suppliers often struggle to invest in the R&D required for next-generation latch systems. This cost barrier can slow adoption in emerging markets.

Stringent Regulatory Standards and Supply Chain Disruptions

The Automotive Door Latch Market must comply with strict safety, durability, and environmental regulations across multiple regions. Meeting these standards requires precision engineering and high-quality materials, which can strain supply chains. It faces risks from global disruptions such as semiconductor shortages, raw material price volatility, and transportation delays. Geopolitical tensions and trade restrictions further complicate component sourcing. Any delays in procurement can impact production schedules and OEM deliveries. Maintaining consistent quality while managing these external pressures remains a persistent challenge for manufacturers. Strategic supplier partnerships and localized sourcing are increasingly necessary to mitigate these risks.

Market Opportunities

Rising Demand for Smart and Connected Vehicle Features

The Automotive Door Latch Market has strong opportunities driven by the shift toward smart, connected, and autonomous vehicles. Automakers increasingly adopt electronic latches integrated with keyless entry, remote operation, and sensor-based safety features. It can leverage this demand by offering solutions compatible with advanced driver-assistance systems and vehicle connectivity platforms. Integration with over-the-air update capabilities creates long-term service potential. Growing consumer preference for convenience and security supports the adoption of intelligent latch systems. Suppliers that develop compact, lightweight, and energy-efficient electronic latches can secure a competitive position in future vehicle programs.

Growth Potential in Emerging Automotive Markets

The Automotive Door Latch Market can expand in regions experiencing rapid vehicle production growth, such as Asia-Pacific, Latin America, and parts of Africa. Rising disposable incomes and urbanization fuel demand for both entry-level and premium vehicles. It can benefit from OEM investments in local manufacturing, which require reliable and cost-effective latch systems. Suppliers that offer modular designs adaptable to multiple vehicle types can address diverse market needs efficiently. Partnerships with regional automakers and component distributors can accelerate market penetration. These opportunities align with the broader trend of increasing automotive safety and comfort standards worldwide.

Market Segmentation Analysis:

By Lock Type:

The Automotive Door Latch Market separates into electronic and non‑electronic (mechanical) lock types. Electronic latches integrate functions such as keyless entry, remote access and compatibility with advanced safety systems. It captures interest in modern, connected, and electric vehicles seeking added convenience and security Claight+9Verified Market Research+9MAXIMIZE MARKET RESEARCH+9Reanin. Non‑electronic latches remain integral to budget models and markets where simplicity and cost-efficiency drive demand Suppliers adjust their portfolios to support both segments and to transition clients toward hybrid latch technologies.

- For instance, Kiekert AG manufactures approximately 50.0 million door latch systems annually, with a significant share being electronically actuated models supplied to global OEMs.

By Application:

The Automotive Door Latch Market addresses both passenger cars and commercial vehicles. Passenger cars command a larger share due to high production volumes and consumer demand for convenience and safety features Data Bridge Market Research+8Verified Market Research+8Reanin+8. Commercial vehicles demand robust latch systems due to frequent use and harsher operating environments Reanin.

- For instance, Aisin, a leading door latch supplier, significantly contributes to the global automotive industry. Specifically, they are involved in the production of approximately 700 million door latch units for passenger vehicles annually.

Segments:

Based on Lock Type:

- Electronic

- Non-Electronic

Based on Application:

- Side Door Latch

- Hood Latch

- Back Seat Latch

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America occupies 25% of the global latch market, holding a significant third-place share. Automotive safety, smart access features, and aftermarket replacement cycles underpin its importance. Rampant adoption of SUVs and pickup trucks has expanded demand for power‑closing side and tailgate latches. Automakers and tier‑1 suppliers continuously refine latch designs—integrating sensors, ECUs, and remote‑entry solutions to satisfy consumer preferences and regulatory norms. Meanwhile, mature aftermarket channels sustain replacement volume in high‑mileage fleets and older vehicles.

Europe

Europe contributes 30% of the market share, earning the second-largest regional position. The region’s market supports luxury, premium, and electric vehicle segments, which increasingly feature lightweight and electronically actuated latch systems. Europe’s rigorous vehicle safety and anti-theft standards uphold strong demand for sophisticated latch designs. Suppliers such as Brose, Aisin, and Magna advance mechatronic latch technologies, maintaining reliability while meeting stringent crash and locking regulations. Electrification trends—especially in hatchbacks and SUVs—further drive demand for power-operated tailgate and hood latches.

Asia Pacific

Asia Pacific commands 40% of the global automotive door latch market, positioning it as the dominant region worldwide vehicle production in nations like China and India drives this leadership. Manufacturers prioritize high-volume, mechanically reliable latch systems for compact and mass-market vehicles. Simultaneously, urbanization and rapid growth in electric vehicle segments fuel demand for smarter, flush‑mount power latches. OEMs in the region capitalize on operational scale, deploying advanced manufacturing techniques to meet the high demand and evolving technology preferences.

Latin America

Latin America accounts for 3% of the global automotive door latch market Although a smaller share, the region shows growth potential. Brazil and Mexico host emerging assembly operations, and expanding domestic vehicle demand drives both OEM fitments and aftermarket latch needs. Market participants often focus on cost-effective mechanical latch systems for entry-level passenger cars and light commercial vehicles—balancing affordability with functionality under shifting economic conditions.

Middle East & Africa

The Middle East & Africa region represents 2% of the global market its absolute volume remains modest, growth is gaining traction in luxury and specialty vehicle segments within Gulf Cooperation Council (GCC) markets, where demand for electronically equipped, high-security latches is rising. In Africa, a sizable share of used and imported vehicles drives aftermarket replacement activity—favoring durable mechanical latch systems suited to challenging environments and heavy usage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magna

- WITTE Automotive

- Huf Hülsbeck & Fürst

- U-Shin

- Brose Fahrzeugteile

- Shiroki Corporation

- Kiekert AG

- AISIN Corporation

- Inteva Products

- Mitsui Kinzoku ACT

Competitive Analysis

The Automotive Door Latch Market, highlighting the key players Aisin Corporation; Kiekert AG; Mitsui Kinzoku ACT; Magna International Inc.; Inteva Products LLC. The automotive door latch market is highly competitive, with companies focusing on technological advancements, lightweight designs, and enhanced safety features to gain market advantage. Manufacturers are investing in mechatronic and electronic latch systems that integrate seamlessly with vehicle access and security modules, meeting both consumer preferences and stringent regulatory standards. The shift toward electric vehicles and autonomous driving is accelerating demand for smart latch solutions with sensor integration, remote operation, and advanced anti-theft functions. Global production networks and localized manufacturing enable rapid response to regional demand, while strong aftermarket channels support consistent revenue streams. Strategic partnerships with automakers, along with sustained R&D investment, remain critical to maintaining product differentiation and market presence in this evolving landscape.

Recent Developments

- In October 2024, Mitsubishi Electric Mobility Corporation and AISIN CORPORATION (related suppliers ecosystem) announced a business partnership to develop next-generation door latch components for electric vehicles.

- In June 2024, Magna International launched the Comfort+ door latch, designed to enhance vehicle efficiency and reduce noise. This innovative latch converts sliding friction into rolling friction, facilitating smoother operation and contributing to a quieter cabin environment.

- In February 2024, Minda VAST Access Systems inaugurated a new production plant in Pune, India, to scale up its manufacturing capacity for car door latches and smart locking systems.

- In November 2023, AISIN Corporation unveiled a new lightweight latch system specifically designed to meet the efficiency needs of electric vehicles. This innovation aligns with the broader trend of developing components specifically tailored for electric vehicle (EV) technology to improve performance and energy consumption.

Market Concentration & Characteristics

The Automotive Door Latch Market shows a moderately concentrated structure, with a mix of global tier-1 suppliers and specialized regional manufacturers holding significant influence over supply and innovation. It features established companies with long-term OEM partnerships that secure consistent demand and high entry barriers for new entrants. Competition centers on technological capability, quality assurance, and compliance with strict safety regulations. It emphasizes product differentiation through advancements in mechatronic and electronic latch systems, offering enhanced security, weight reduction, and integration with smart vehicle access platforms. Strong OEM relationships allow leading players to maintain pricing power, while their global manufacturing footprints support efficient delivery to diverse markets. The industry also reflects a high level of design customization to meet varying automaker requirements, with suppliers investing in R&D to align latch performance with trends in electrification, autonomous driving, and advanced driver assistance systems.

Report Coverage

The research report offers an in-depth analysis based on Lock Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for electronic and smart latch systems with integrated sensors.

- Lightweight latch designs will gain adoption to improve vehicle efficiency.

- Growth in electric vehicle production will boost need for advanced closure solutions.

- OEMs will seek suppliers that offer high customization and modular latch platforms.

- Safety regulations will drive continuous innovation in latch locking mechanisms.

- Autonomous vehicle development will create opportunities for contactless access systems.

- Expansion of global manufacturing footprints will improve supply chain resilience.

- Aftermarket sales will grow as vehicle fleets age and require replacements.

- Collaboration between latch suppliers and automakers will intensify to speed innovation.

- Emerging markets will increase adoption of upgraded latch technologies in mass-market vehicles.