Market Overview:

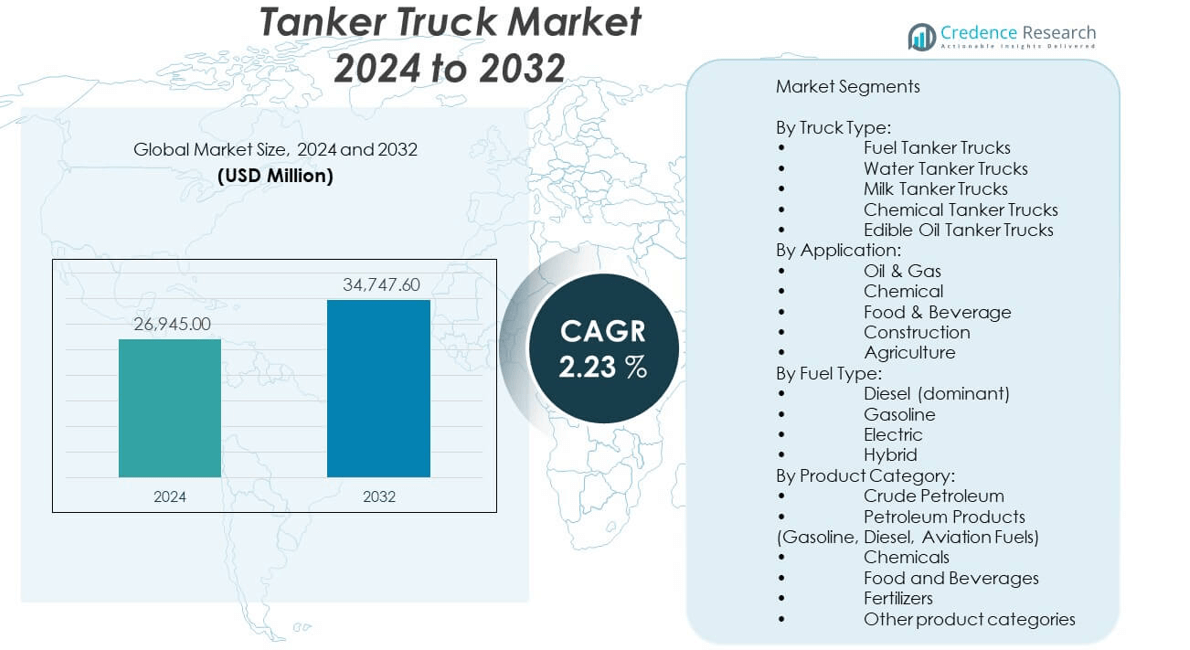

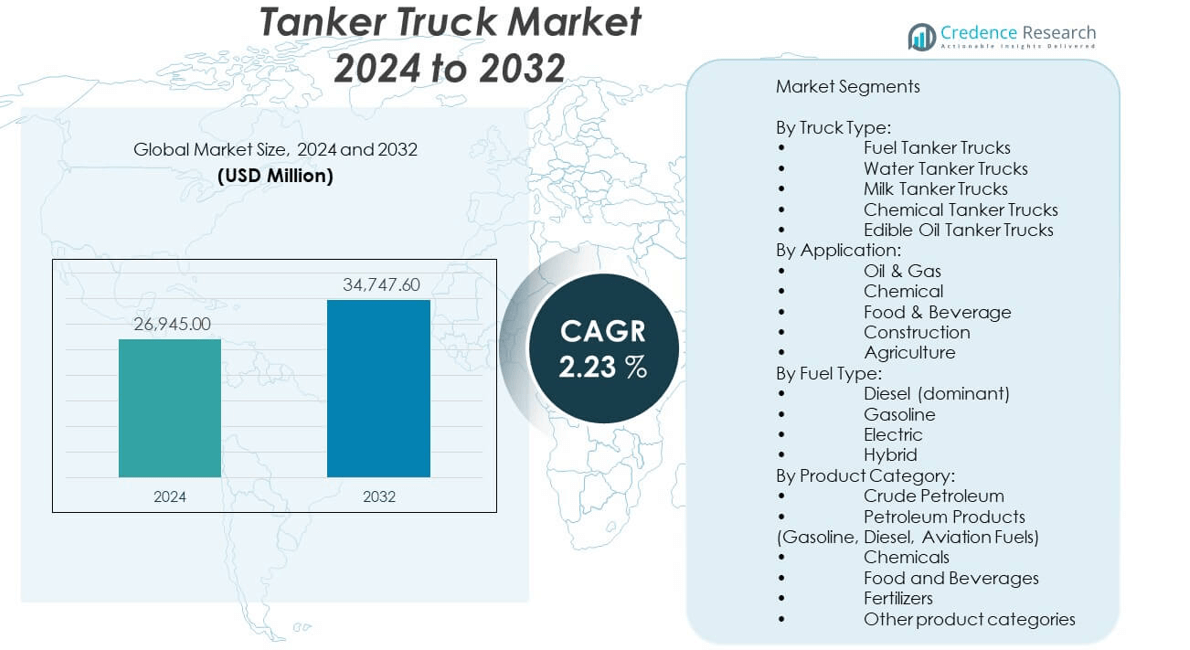

The Tanker truck market is projected to grow from USD 26,945 million in 2024 to an estimated USD 34,747.6 million by 2032, reflecting a compound annual growth rate (CAGR) of 3.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tanker Truck Market Size 2024 |

USD 26,945 million |

| Tanker Truck Market, CAGR |

3.23% |

| Tanker Truck Market Size 2032 |

USD 34,747.6 million |

The market growth is driven by the increasing need for safe and efficient transportation of liquids, gases, and hazardous materials across industrial sectors. Rapid industrialization, especially in emerging economies, is boosting demand for specialized tanker trucks with enhanced safety and environmental compliance features. Technological advancements, including lightweight materials, improved fuel efficiency, and smart fleet management systems, are enabling operators to optimize delivery routes and reduce operating costs. Additionally, stringent regulations regarding hazardous material transportation are encouraging the adoption of modern, compliant tanker truck fleets.

North America leads the market, supported by a mature oil & gas sector, advanced logistics infrastructure, and high adoption of technological innovations in fleet management. Europe follows closely, driven by strict safety regulations and sustainable transportation initiatives. The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrial expansion, infrastructure development, and increasing energy demand in countries like China and India. Latin America and the Middle East & Africa are also witnessing growth due to rising investments in petrochemical and agricultural sectors, creating new opportunities for tanker truck deployment.

Market Insights:

- The tanker truck market was valued at USD 26,945 million in 2024 and is projected to reach USD 34,747.6 million by 2032, growing at a CAGR of 3.23% during the forecast period.

- Rising demand for efficient bulk transportation in oil and gas, chemical, and food and beverage industries is driving steady fleet expansion.

- Technological advancements, including lightweight materials, fuel-efficient engines, and advanced telematics, enhance operational efficiency and safety compliance.

- High capital investment requirements and fluctuating fuel prices create challenges for fleet operators in maintaining profitability.

- Stringent regulatory standards for hazardous material transport increase operational complexity and compliance costs.

- North America holds the largest market share, driven by robust logistics infrastructure and strong petroleum product demand, followed by Europe’s regulatory-led fleet modernization.

- Asia-Pacific is the fastest-growing region, supported by industrial expansion, rising energy consumption, and infrastructure development in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Demand for Bulk Liquid Transportation Across Multiple Sectors:

The tanker truck market benefits from the expanding requirement for efficient bulk transportation in industries such as oil and gas, chemicals, agriculture, and food and beverage. Global industrial growth drives higher volumes of liquid and gas shipments, increasing reliance on specialized tanker fleets. It supports seamless distribution networks, enabling timely delivery to domestic and international markets. Operators adopt advanced tanker designs to meet evolving safety and capacity requirements. Technological upgrades in chassis design and materials reduce vehicle weight and improve efficiency. Governments enforce stringent regulations for hazardous goods transport, pushing companies toward compliant fleets. The rising demand for cross-border trade enhances the need for robust transportation solutions. This shift strengthens the role of tanker trucks in global supply chains.

- For instance, Volvo Trucks introduced its FMX model specially tailored for heavy-duty liquid transport, featuring a chassis that is 200 kg lighter than its predecessor, improving payload capacity and fuel efficiency, which has been adopted widely in European cross-border operations.

Technological Advancements Enhancing Fleet Efficiency and Safety Standards:

Continuous innovation in tanker truck technology strengthens operational efficiency and safety compliance. It incorporates lightweight yet durable materials, improving payload capacity without compromising structural integrity. Advanced braking systems and electronic stability controls reduce accident risks, particularly when handling hazardous cargo. Digital fleet management platforms help operators monitor vehicle performance and optimize routes. Integration of GPS tracking enhances cargo security and delivery reliability. Increasing environmental concerns push manufacturers toward fuel-efficient engines and reduced emission technologies. Operators gain competitive advantages through predictive maintenance systems that minimize downtime. Such innovations elevate service quality while aligning with global safety regulations.

- For instance, Daimler Trucks’ integration of its FleetBoard telematics system allows monitoring of over 75,000 vehicles worldwide, reducing maintenance-related downtime by up to 30% and improving route optimization for hazardous liquid transport.

Expanding Energy and Chemical Sectors Fueling Transportation Requirements:

The growth of energy exploration, petrochemicals, and chemical production drives the need for specialized tanker transport. The tanker truck market serves critical roles in moving refined fuels, liquefied gases, and hazardous chemicals. It ensures safe and timely delivery from production facilities to refineries, storage hubs, and distribution points. Rising fuel consumption across developing nations heightens demand for tanker fleets. Increased investments in LNG infrastructure create additional transportation needs. Regulations mandate strict containment standards for hazardous goods, prompting fleet modernization. The energy sector’s expansion in emerging economies adds to market momentum. Companies that can meet these sector-specific demands strengthen their market position.

Strategic Infrastructure Development Supporting Long-Haul Logistics Growth:

Infrastructure upgrades, including road expansions and better highway connectivity, increase the operational scope of tanker fleets. The tanker truck market benefits from these improvements through faster transit times and lower operating costs. It enables more efficient long-haul distribution to remote industrial and commercial hubs. Governments prioritize logistics infrastructure to support trade competitiveness. Investments in port facilities improve tanker truck access to import and export cargoes. Industrial zones located far from ports depend heavily on tanker transport for critical supplies. Stronger logistics corridors between urban and rural areas create new service routes. These advancements bolster the role of tanker transport in national and regional economies.

Market Trends:

Adoption of Sustainable and Eco-Friendly Transportation Solutions:

Manufacturers focus on developing tanker trucks with lower emissions and better fuel efficiency. The tanker truck market increasingly integrates hybrid and alternative fuel technologies to meet environmental goals. It reflects regulatory pressure to cut greenhouse gas output and operational costs. Lightweight composite materials reduce energy consumption while maintaining durability. Operators explore biofuel compatibility to align with sustainability objectives. Demand grows for vehicles capable of meeting stringent emission norms in key markets. Technological developments in aerodynamic designs further enhance efficiency. Sustainability-oriented purchasing decisions reshape fleet procurement strategies globally.

- For instance, Tesla’s Semi truck, designed for long-haul tanker transportation, promises a 30% reduction in energy consumption compared to traditional diesel trucks, supporting fleets aiming to meet California’s stringent emission regulations.

Integration of Digitalization and Smart Fleet Management Tools:

Digital transformation reshapes fleet operations with real-time monitoring and predictive analytics. The tanker truck market adopts IoT-enabled sensors to track cargo temperature, pressure, and security conditions. It improves transparency in logistics chains and builds client trust. Automated dispatching tools streamline delivery scheduling and reduce idle times. Predictive maintenance systems identify potential mechanical issues before breakdowns occur. Data analytics optimize routing for fuel savings and faster deliveries. Cloud-based platforms enable centralized fleet control for multinational operators. This digital shift increases competitiveness in a service-driven transport environment.

- For instance, TuSimple’s autonomous trucking platform employs real-time IoT data combined with AI for route planning and predictive diagnostics, operating pilot autonomous tanker.

Growing Customization for Industry-Specific Transport Needs:

Operators demand tanker trucks tailored for specific liquids, gases, and hazardous materials. The tanker truck market responds with modular designs and specialized coatings to prevent contamination or corrosion. It enables compliance with stringent handling standards across industries. Temperature-controlled tankers serve sensitive food-grade and chemical cargoes. Manufacturers offer multi-compartment configurations for mixed-load deliveries. Industry-specific engineering enhances safety, durability, and operational efficiency. Growth in niche cargo segments such as edible oils and specialty chemicals accelerates this trend. Customization strengthens brand positioning in competitive markets.

Expansion of Cross-Border and Long-Distance Trade Routes:

The rise in global trade increases demand for reliable long-distance transportation solutions. The tanker truck market benefits from stronger trade corridors connecting industrial hubs to ports. It enables greater access to international markets for bulk liquid exports and imports. Regional trade agreements encourage investment in transnational logistics infrastructure. Fleet operators expand service coverage to capitalize on these routes. Better border facilities reduce delays, enhancing delivery consistency. Demand grows for vehicles capable of meeting diverse regulatory standards in multiple countries. Cross-border trade continues to shape fleet deployment strategies worldwide.

Market Challenges Analysis:

Impact of Volatile Fuel Prices on Operational Profitability:

Fluctuating fuel prices create financial uncertainty for fleet operators. The tanker truck market faces cost pressures when fuel expenses rise unexpectedly. It affects pricing strategies and reduces profitability in competitive markets. Operators struggle to maintain consistent margins while offering competitive freight rates. Fuel-efficient technologies partially offset these impacts but require significant investment. Smaller operators are more vulnerable to volatility due to limited economies of scale. Price instability also disrupts long-term contract negotiations with clients. Effective cost-control measures become essential to sustaining business performance in such conditions.

Regulatory Compliance and Safety Mandates Increasing Operational Complexity:

Stringent safety and environmental regulations increase compliance costs for operators. The tanker truck market must adapt to evolving rules on hazardous material transport and emissions. It requires fleet upgrades, driver training, and periodic inspections. These measures improve safety but raise capital and operating expenses. Smaller companies often face difficulties meeting complex regulatory requirements. Variations in rules between regions complicate cross-border operations. Operators that fail to comply risk penalties, license suspensions, or reputational damage. Maintaining compliance readiness demands ongoing investment and strong operational discipline.

Market Opportunities:

Rising Demand for Tanker Trucks in Emerging Economies:

Rapid industrialization in developing countries creates significant growth prospects. The tanker truck market gains from expanding manufacturing, agriculture, and energy sectors in these regions. It plays a key role in delivering bulk liquids to remote and underdeveloped areas. Governments invest heavily in infrastructure, improving transport accessibility. Increasing trade activity boosts the need for efficient road-based logistics. Demand for modern, compliant tanker fleets grows with industrial safety awareness. Companies entering these markets can capture substantial growth opportunities. Strategic partnerships with local distributors enhance market penetration.

Advancements in Alternative Fuel and Electric Tanker Truck Development:

Ongoing research in electric and alternative fuel-powered tanker trucks opens new market segments. The tanker truck market benefits from rising adoption of clean energy vehicles to meet environmental targets. It positions manufacturers as innovators in sustainable transport solutions. Growing regulatory incentives support adoption in urban and regional distribution. Electric tankers reduce emissions and noise, making them suitable for densely populated areas. Advances in battery capacity extend vehicle range for commercial viability. Early adopters can secure competitive advantages in sustainability-focused contracts. This shift aligns with global decarbonization strategies in the logistics sector.

Market Segmentation Analysis:

By Capacity

In the tanker truck market, the 5,000 to 10,000 gallons segment holds the largest share due to its balance between payload efficiency and operational flexibility, making it ideal for long-haul and regional transport. Fleets under 1,000 gallons cater to short-distance and urban distribution, while the 1,000 to 5,000 gallons range is suited for medium-haul routes. Units exceeding 10,000 gallons focus on bulk, long-distance transportation, particularly in oil and gas logistics.

- For instance, Trucks in this segment are designed to reduce operational costs and improve productivity by minimizing the frequency of trips required to transport liquids such as fuel, water, or industrial chemicals.

By Truck Type

Fuel tanker trucks dominate demand, driven by the consistent need for petroleum product distribution. Water tanker trucks support municipal supply and construction sectors, while milk tanker trucks meet dairy industry hygiene standards. Chemical tanker trucks are engineered for hazardous cargo, and edible oil tanker trucks serve food processing and distribution networks.

- For instance, Milk tanker trucks are specially designed for maintaining high hygiene standards critical in the dairy industry—these trucks undergo rigorous cleaning and sanitization protocols including temperature controls to ensure milk safety during transport.

By Application

Oil and gas lead the market, supported by global energy consumption and refining activities. The chemical segment requires specialized safety and material handling features. Food and beverage applications demand sanitary and temperature-controlled transport. Construction and agriculture sectors use tankers for water, liquid fertilizers, and other bulk liquids.

By Fuel Type

Diesel-powered trucks remain dominant for their reliability and range, while gasoline variants cater to lighter operations. Electric and hybrid tankers are emerging for urban and regulated markets, driven by sustainability goals.

By Fleet Type

For-hire fleets hold a strong share due to operational flexibility and market reach. Private fleets serve dedicated supply chains, ensuring consistent service.

By Product Category

Key categories include crude petroleum, petroleum products, chemicals, food and beverages, fertilizers, and other liquids, each requiring tailored tanker specifications.

Segmentation:

By Capacity:

- Less than 1,000 gallons

- 1,000 to 5,000 gallons

- 5,000 to 10,000 gallons (largest share)

- More than 10,000 gallons

By Truck Type:

- Fuel Tanker Trucks

- Water Tanker Trucks

- Milk Tanker Trucks

- Chemical Tanker Trucks

- Edible Oil Tanker Trucks

By Application:

- Oil & Gas

- Chemical

- Food & Beverage

- Construction

- Agriculture

By Fuel Type:

- Diesel (dominant)

- Gasoline

- Electric

- Hybrid

By Fleet Type:

By Product Category:

- Crude Petroleum

- Petroleum Products (Gasoline, Diesel, Aviation Fuels)

- Chemicals

- Food and Beverages

- Fertilizers

- Other product categories

Regional Analysis:

North America

North America holds the largest share of the tanker truck market at approximately 34%, supported by a well-developed logistics infrastructure and strong demand from the oil and gas, chemical, and food and beverage sectors. It benefits from a mature fleet base with advanced safety and telematics systems. The United States leads regional growth, driven by high petroleum consumption, refined fuel distribution, and chemical transportation needs. Canada contributes significantly through its energy exports and agricultural liquid transport. Stringent regulatory standards push operators to adopt compliant, modern fleets. It also benefits from a strong presence of global and domestic manufacturers offering advanced tanker designs. Investments in LNG infrastructure further expand the scope for specialized tanker applications.

Europe

Europe accounts for around 28% of the tanker truck market, with demand fueled by strict safety and environmental regulations. Germany, France, and the United Kingdom are leading markets due to industrial activity and chemical production. The region emphasizes sustainable transport, with growing interest in electric and hybrid tanker trucks. It benefits from dense trade networks and strong cross-border logistics integration within the EU. Upgrades in road infrastructure improve efficiency for long-haul transport across multiple nations. Growth in the food and beverage sector supports increased demand for hygienic, temperature-controlled tankers. The regulatory focus on reducing emissions accelerates fleet modernization and adoption of alternative fuels.

Asia-Pacific

Asia-Pacific captures nearly 25% of the tanker truck market and is the fastest-growing region, supported by rapid industrialization and expanding energy demand. China and India lead in consumption of petroleum products, chemicals, and agricultural liquids. Infrastructure investments improve connectivity between industrial hubs, ports, and rural markets. It benefits from rising domestic manufacturing of tanker trucks, offering cost advantages and tailored designs. The food and beverage sector’s growth also boosts demand for specialized sanitary tankers. Regional operators increasingly invest in larger-capacity vehicles to meet growing long-haul transport needs. Government initiatives to expand oil refining and petrochemical capacity strengthen tanker demand across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Volvo Group

- MAN Truck & Bus AG

- Mercedes (Daimler)

- Iveco

- Scania AB

- Freightliner Trucks

- Tata Motors Limited

- Hyundai Motor Company

- Navistar International Corporation

- Kenworth

- Polar Tank Trailer

- Trimac Transportation

- Quality Carriers

- Groendyke Transport

- Kenan Advantage Group

Competitive Analysis:

The tanker truck market is highly competitive, with global manufacturers and specialized fleet operators vying for market share through product innovation, geographic expansion, and compliance-driven upgrades. Established players such as Volvo Group, MAN Truck & Bus AG, Mercedes (Daimler), Scania AB, and Tata Motors focus on integrating advanced safety, fuel efficiency, and telematics technologies into their offerings. It features a mix of OEMs producing high-capacity, custom-built vehicles and transport companies providing tailored logistics solutions. Competition intensifies with regional manufacturers offering cost-effective alternatives and niche customization. Strategic partnerships, after-sales service networks, and compliance with evolving safety regulations remain key differentiators influencing buyer preference.

Recent Developments:

- In June 2025, Volvo Group made a significant advancement in the North American market by deploying 80 all-new Volvo VNL 860 trucks to Silchuk Transport. This deployment aims to boost fleet safety, reduce fuel costs, and enhance driver retention, featuring innovations such as an overdrive automated I-Shift transmission and a Volvo Parking Cooler system to minimize engine idling and emissions.

- In June 2025, Mack Trucks, a Volvo Group brand, launched the all-new Mack Anthem designed for regional haul applications. This truck emphasizes improved fuel efficiency, driver comfort, and advanced telematics via Mack Connect, which reduces downtime by 37%. It also features predictive maintenance reducing unplanned stops by 20%. The Anthem is positioned for weight-sensitive applications and will be available for order in August 2025, with production starting in January 2026.

- Also in June 2025, Volvo Group and Daimler Truck launched Coretura, a joint venture based in Gothenburg, Sweden, focused on developing a standardized software-defined vehicle platform for commercial vehicles. Coretura aims to enable smarter, more connected, and efficient trucks and buses through an open commercial vehicle operating system and centralized high-performance control units. This venture marks a strategic collaboration to lead industry digitalization and efficiency improvements.

- In March 2025, Volvo Trucks unveiled the all-new Volvo VNR for the North American regional haul market. Built on a new platform, this model boasts a 90% redesign with fuel consumption and CO2 emissions reductions of up to 7.5%, achieved through aerodynamic improvements, powertrain technology, and Eco-roll technology. This platform is future-proofed to accommodate battery-electric, fuel cell, and renewable fuel engines, positioning it as a versatile solution in regional and urban transport.

Market Concentration & Characteristics:

The tanker truck market exhibits moderate to high concentration, with a handful of multinational OEMs dominating global production while regional players cater to localized needs. It combines capital-intensive manufacturing with stringent regulatory compliance, creating high entry barriers. Product differentiation focuses on capacity range, specialized build for various liquids, and integration of safety and fleet management technologies. Market growth depends on industrial activity, infrastructure development, and cross-border trade. Established brands maintain long-term customer relationships through reliability, customization, and global service networks.

Report Coverage:

The research report offers an in-depth analysis based on capacity, truck type, application, fuel type, fleet type, and product category. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of alternative fuel and electric tanker trucks to meet emission standards.

- Rising demand for large-capacity tankers in oil and gas logistics.

- Integration of advanced telematics and IoT for real-time monitoring.

- Expansion of tanker fleets in emerging economies driven by industrialization.

- Growing need for temperature-controlled and hygienic tankers in food transport.

- Upgrades in fleet design to meet stricter safety regulations.

- Increased investments in LNG and chemical transportation infrastructure.

- Emergence of modular and customizable tanker designs.

- Strategic collaborations between OEMs and logistics providers.

- Rising importance of predictive maintenance to reduce downtime.