Market Overview:

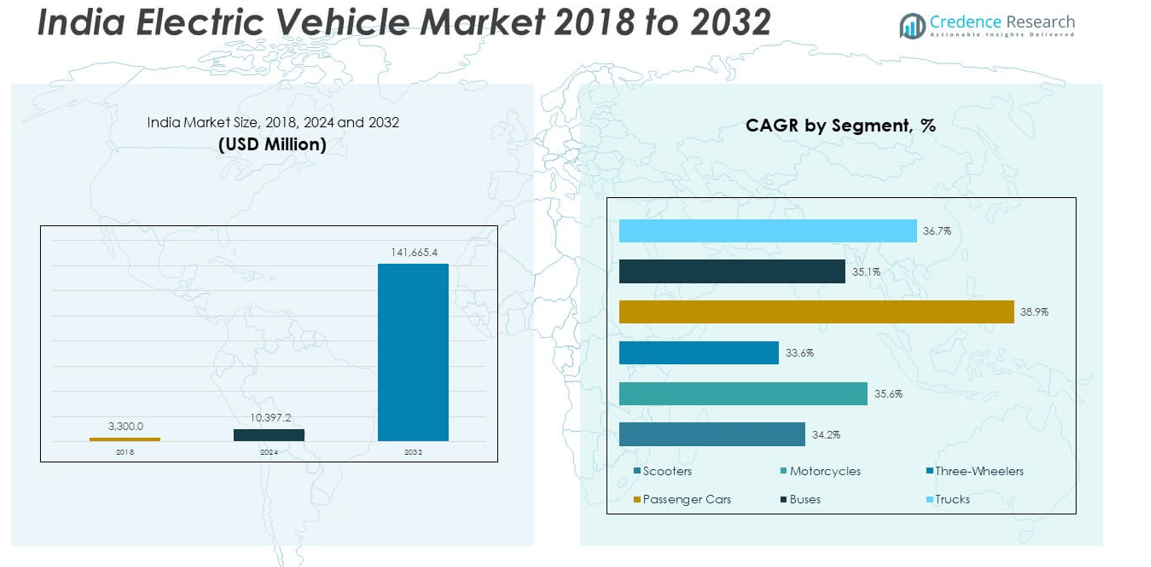

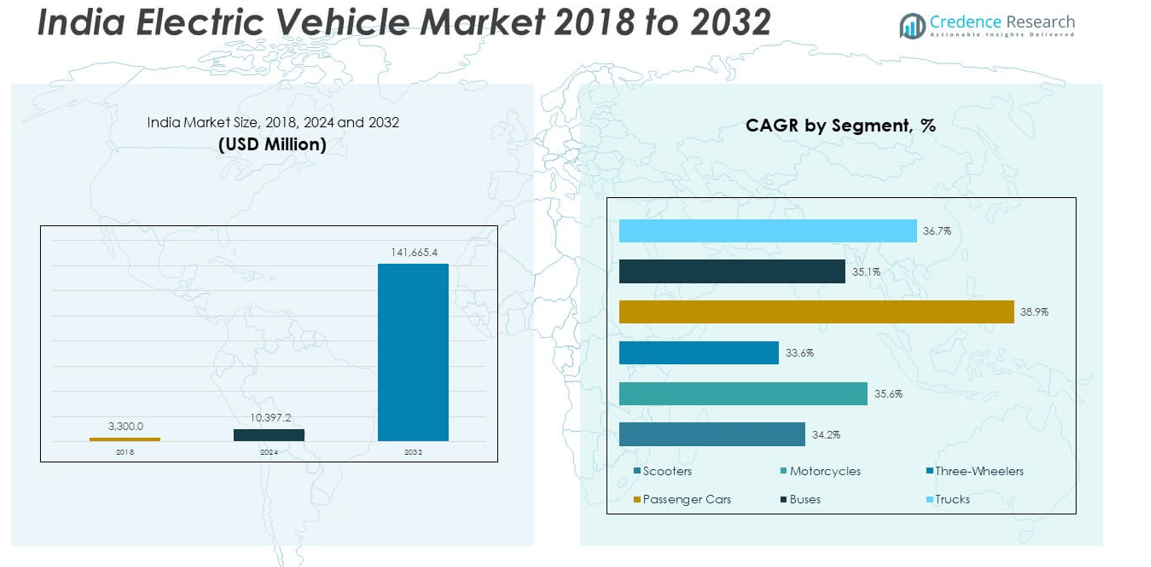

The India Electric Vehicles Market size was valued at USD 3,300.0 million in 2018 to USD 10,397.2 million in 2024 and is anticipated to reach USD 1,41,665.4 million by 2032, at a CAGR of 38.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Electric Vehicles Market Size 2024 |

USD 10,397.2 million |

| India Electric Vehicles Market, CAGR |

38.7% |

| India Electric Vehicles Market Size 2032 |

USD 1,41,665.4 million |

The electric vehicle market in India is surging, propelled by widespread adoption of clean mobility, technological breakthroughs, and expanding supportive infrastructure. Consumers and businesses alike are increasingly switching to EVs in response to government incentives and rising energy costs, while manufacturers aggressively innovate and scale to meet demand. Moreover, booming investments in charging networks and battery technologies are reinforcing consumer confidence, spurring further market expansion, and fostering a dynamic ecosystem that continues to accelerate EV uptake across segments.

Geographically, metropolitan hubs like Delhi and Mumbai dominate India’s EV adoption due to superior infrastructure, dense urban populations, and strong policy backing. Meanwhile, emerging states such as Karnataka, Tamil Nadu, and Gujarat are gaining ground thanks to proactive state-level incentives, burgeoning manufacturing ecosystems, and rising consumer consciousness. Rural and tier‑2 regions are gradually catching up, supported by expanding charging networks and local EV initiatives that are making electric mobility increasingly accessible nationwide.

Market Insights:

- The India Electric Vehicles Market was valued at USD 10,397.2 million in 2024 and is projected to reach USD 1,41,665.4 million by 2032, growing at a CAGR of 38.7%.

- Government incentives under FAME II and state-level EV policies continue to drive large-scale adoption across multiple vehicle categories.

- High upfront costs and limited financing options remain key barriers to widespread adoption, especially in rural and semi-urban markets.

- North India led the market with a 38% share in 2024, supported by strong policy enforcement, infrastructure, and dense population.

- Battery Electric Vehicles (BEVs) dominate the propulsion segment due to cost-efficiency and lower maintenance requirements.

- Scooters and three-wheelers held the highest share among type segments, favored for affordability and high daily usage.

- Charging infrastructure gaps and consumer awareness issues continue to slow down penetration in non-metro regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Policy Framework and Government Incentives Drive Market Expansion

The government’s focused policy support remains the backbone of growth in the India Electric Vehicles Market. Central schemes like FAME II have significantly reduced the cost burden for consumers through upfront subsidies, spurring vehicle adoption across income groups. State-specific policies offer complementary benefits such as tax exemptions, free permits, and priority registration, accelerating regional deployment. The Production Linked Incentive (PLI) scheme encourages domestic manufacturing of EVs and advanced chemistry cells. These programs improve ecosystem stability and lower entry barriers for new players. It also ensures strategic visibility and financial backing for stakeholders across the value chain. Government-led procurement of electric buses for public transport increases fleet-scale adoption. Institutional clarity and dedicated policy roadmaps offer confidence to investors and developers. The alignment between central and state-level strategies reinforces a unified national vision for e-mobility.

Escalating Fuel Costs and Favorable Cost Economics Promote Transition

Fluctuating fuel prices and long-term savings potential are key motivators behind rising consumer interest in EVs. The India Electric Vehicles Market benefits from the comparative cost advantage EVs hold over internal combustion vehicles in the long run. Electric two-wheelers and three-wheelers demonstrate significantly lower operating costs, making them ideal for delivery, commuting, and intra-city logistics. For commercial fleet operators, the reduction in per-kilometer cost directly translates into higher margins. Over time, the break-even point for electric vehicles is shortening due to battery cost declines and improved powertrain efficiency. It makes EVs economically viable for cost-sensitive Indian consumers and businesses. Bulk buyers in sectors like ride-hailing, e-commerce, and urban logistics prefer electric fleets for long-term savings and sustainability mandates. Tax rebates and low maintenance requirements add to their appeal. The economic case for electric mobility continues to strengthen across sectors.

- For example, Ola’s S1 X model runs at approximately ₹315 per month for 50 km daily travel on electricity, against around ₹2,850 monthly fuel cost for comparable petrol scooters.

Advancements in Technology and Product Efficiency Reshape the Industry

Technological breakthroughs are enhancing the appeal and performance of electric vehicles across all segments. The India Electric Vehicles Market has witnessed significant progress in lithium-ion battery technology, increasing range and durability while reducing charging time. Improvements in energy density, thermal management, and battery safety have addressed key consumer concerns. Fast-charging infrastructure, vehicle-to-grid systems, and regenerative braking add new levels of functionality. Automakers now integrate smart features like AI-based diagnostics, GPS tracking, and smartphone connectivity into EV platforms. These innovations cater to tech-savvy users who demand performance, comfort, and control. It allows OEMs to differentiate through software-driven services and user engagement. Advanced manufacturing techniques reduce production costs and support modular design flexibility. The technology edge enhances consumer trust and accelerates mainstream adoption.

Expanding Charging Network and Ecosystem Maturity Support Adoption

Infrastructure development is a cornerstone in accelerating electric vehicle deployment. The India Electric Vehicles Market is experiencing rapid investments in both public and private charging solutions. Government programs support the creation of charging corridors across highways and urban centers. Startups and energy providers are establishing fast-charging stations at malls, offices, and fuel stations. It addresses range anxiety and enables convenient access for end-users. Battery swapping services and mobile charging vans are gaining ground among commercial fleets. Residential societies and real estate projects increasingly integrate EV infrastructure in new constructions. Charging aggregators are offering app-based station locators, bookings, and payments to improve user experience. The convergence of infrastructure, technology, and service innovation enhances ecosystem reliability. It creates a user-centric environment critical for sustained EV growth.

- For example, Tata Power has established chargers across major cities from Srinagar to Bengaluru, including 1.2 lakh home chargers and 1,200 chargers dedicated to electric buses.

Market Trends

Growth in Electric Two-Wheelers and Micro-Mobility Segments

Electric two-wheelers are emerging as the dominant segment in the India Electric Vehicles Market due to affordability, convenience, and high urban usability. Consumer preference is shifting toward lightweight, compact vehicles that support quick commuting in congested cities. Startups and leading brands offer a range of models tailored to students, office-goers, and gig workers. Mobile app integration, swappable batteries, and low running costs add further appeal. Urban dwellers find electric scooters practical for last-mile connectivity and daily errands. Shared mobility operators are adopting electric bikes to reduce fuel expenses and emissions. Product launches in this space are accelerating, targeting both low-cost and performance-oriented user bases. It indicates an ongoing trend of value-segment growth. The rapid expansion of electric two-wheeler adoption signals a foundational shift in urban transport behavior.

Increasing EV Penetration in Commercial Logistics and Corporate Fleets

Commercial applications are driving a large portion of new demand in the India Electric Vehicles Market. E-commerce giants and logistics firms are rapidly electrifying last-mile delivery fleets to achieve cost efficiency and sustainability targets. Electric three-wheelers and light commercial vehicles are being adopted for intra-city transport. Companies are entering long-term leasing and supply agreements with OEMs to maintain operational continuity. It helps businesses meet environmental, social, and governance (ESG) standards while reducing delivery costs. Smart fleet management software and telematics systems further optimize energy usage and route planning. Dedicated EV fleets are now a core part of sustainability reporting for major logistics and retail brands. Custom-built electric delivery vehicles are being introduced to serve dense urban and tier-2 city routes. Fleet electrification is evolving into a long-term logistics strategy.

Emergence of Battery Swapping and Subscription-Based Energy Access

Battery swapping is gaining momentum in the India Electric Vehicles Market, particularly among delivery fleets and urban transport operators. It offers a faster alternative to charging, improving vehicle uptime for commercial use. Companies are deploying modular battery systems that allow quick exchange at fixed stations. It reduces vehicle purchase cost by separating battery ownership from the vehicle body. Startups are experimenting with battery-as-a-service models that include financing, warranties, and maintenance. Subscription-based energy access lowers the entry barrier for low-income users and micro-entrepreneurs. These business models appeal to businesses with high asset turnover and predictable usage cycles. Standardization of battery size and interface is underway, improving interoperability across brands. The trend redefines how energy is consumed and monetized in the EV value chain.

- For instance, SUN Mobility has deployed over 500 battery swapping stations across India, enabling swapping times under five minutes and supporting more than 30,000 electric vehicles in commercial use through its subscription model, helping reduce upfront costs by up to 20%.

Smart Vehicle Technologies Redefine User Experience

Smart technology integration is becoming a standard feature in electric vehicles sold in India. The India Electric Vehicles Market is adopting intelligent telematics, predictive diagnostics, and remote control features. Vehicle owners benefit from mobile apps that monitor battery status, charging history, and location tracking. OEMs provide over-the-air software updates to improve vehicle performance post-sale. EVs are increasingly compatible with home automation systems and smart grids. AI-driven driver assistance systems and real-time navigation improve safety and efficiency. These connected technologies enhance the total value proposition of electric vehicles. It transforms EVs into digital mobility platforms rather than just transport units. The shift toward smart, software-integrated EVs is reshaping consumer expectations across segments.

- For instance, TVS Motor’s iQube electric scooter offers real-time vehicle diagnostics and remote control capabilities via its mobile app and supports over-the-air updates; it has reported over 100,000 connected vehicles on the road as of early 2025, significantly enhancing user engagement and vehicle uptime.

Market Challenges Analysis

High Upfront Costs, Supply Chain Constraints, and Affordability Barriers

The initial cost of electric vehicles remains a major concern for mass-market adoption in India. The India Electric Vehicles Market faces a mismatch between consumer expectations and vehicle pricing, especially in rural and semi-urban areas. Limited localization of high-value components such as batteries, controllers, and advanced electronics keeps production costs elevated. Heavy reliance on imported cells and raw materials also introduces currency and trade risks. Price-sensitive consumers delay purchases despite long-term benefits. Financing options for EVs are limited and often lack the favorable interest rates seen in conventional vehicles. The absence of a robust second-hand EV market further limits resale value and consumer confidence. It creates an affordability gap for many potential first-time buyers. Bridging this cost differential remains essential for broad-based market penetration.

Infrastructure Deficiencies and Awareness Gaps Impede Mass Adoption

Charging infrastructure in India is concentrated around Tier-1 cities, limiting EV use in smaller towns and remote areas. The India Electric Vehicles Market suffers from inconsistent access to fast-charging networks across regions. Fragmented service providers, non-standard connector types, and lack of real-time availability tracking create friction for users. Many consumers remain unaware of EV features, operating costs, or maintenance practices. Dealership networks often lack trained personnel to provide EV-specific guidance. Myths around battery lifespan, replacement cost, and safety continue to affect buyer sentiment. Public awareness campaigns remain sporadic and disconnected from actual purchase behavior. Without substantial investment in infrastructure and outreach, adoption outside urban centers remains slow.

Market Opportunities

Strategic Manufacturing Incentives and Localization Momentum

India’s growing manufacturing capacity under the PLI scheme and Make in India mission opens new growth avenues for EV stakeholders. The India Electric Vehicles Market stands to gain from cost reductions as domestic cell production scales up. Localization of EV components such as batteries, e-axles, controllers, and power electronics reduces dependency on imports. It creates long-term cost competitiveness while enhancing supply chain resilience. OEMs and component suppliers are forming joint ventures and tech-transfer agreements to build capacity. States are offering capital subsidies and land incentives for battery giga-factories and EV parks. This environment encourages innovation and job creation, especially in industrial clusters. Domestic manufacturing ensures faster delivery timelines and price stability, improving value for both OEMs and end users.

Untapped Rural Demand and Tier-2 Electrification Potential

The rural and semi-urban landscape presents a significant untapped opportunity for electric mobility. The India Electric Vehicles Market can unlock growth by targeting low-cost, efficient two- and three-wheeler solutions for these regions. Electrification programs in villages and small towns are expanding grid access and enabling EV charging. Localized assembly and dealership networks can support demand in smaller markets. Affordable financing schemes and government subsidies improve access for self-employed and small-business users. It allows the market to grow beyond urban centers and create a broader socio-economic impact. Companies focusing on low-speed electric vehicles and cargo rickshaws will find early success. Tier-2 cities will likely lead the next growth phase for EV penetration.

Market Segmentation Analysis:

By Type

The India Electric Vehicles Market, segmented by vehicle type, reflects strong demand across both personal and commercial applications. Scooters dominate the market due to affordability, low maintenance, and ease of use, especially in urban mobility. Three-wheelers also hold a significant share, serving as essential modes of transport for last-mile connectivity and cargo delivery. Motorcycles are steadily emerging with improved speed, power, and battery range, targeting younger demographics. Passenger cars continue to grow, fueled by model launches, policy incentives, and rising environmental awareness. Electric buses are gaining adoption through government procurement in public transportation. Trucks are still at an early stage, but adoption is expected to rise for short-haul freight in logistics hubs.

By Propulsion Type

In terms of propulsion, Battery Electric Vehicles (BEVs) lead the India Electric Vehicles Market, supported by favorable pricing, simpler mechanics, and reduced maintenance needs. BEVs are increasingly accessible across scooters, cars, and commercial vehicles. Plug-in Hybrid Electric Vehicles (PHEVs) appeal to buyers who prefer flexibility in fuel choice and extended driving range, although adoption remains moderate. Fuel Cell Electric Vehicles (FCEVs) are in the early development stage, with limited models and infrastructure in India, yet they are expected to play a role in long-range heavy-duty transport in the long term.

- For example, companies like TVS Motor and Bajaj Auto are leading India’s electric two-wheeler (BEV) segment. In June 2025, the TVS iQube captured approximately 24% of the electric scooter market with 25,274 units sold.

By Drive Type

Drive configuration preferences vary across segments in the India Electric Vehicles Market. Front-Wheel Drive (FWD) systems dominate due to their suitability in compact vehicles and two-wheelers. They offer efficient performance for city driving and are cost-effective to manufacture. Rear-Wheel Drive (RWD) is commonly used in commercial EVs and premium electric sedans that require higher torque. All-Wheel Drive (AWD) is gaining traction in luxury electric cars and high-performance vehicles, offering improved traction and driving dynamics for a better user experience.

- For example, the Mahindra e‑Verito is a front-wheel-drive (FWD) electric sedan designed for reliable urban commuting and widely used in taxi fleets. It delivers a maximum torque of around 91 Nm, offering sufficient acceleration and driving performance for city use.

By Speed

Speed segmentation reveals consumer preferences for practical, efficient electric mobility. EVs with speeds under 100 MPH lead the market, particularly among scooters and affordable passenger vehicles. They meet urban transport needs while offering better battery life and charging convenience. Vehicles ranging from 100 MPH to 125 MPH attract buyers seeking a balance between performance and price, often found in mid-range cars and motorcycles. The above 125 MPH category targets performance enthusiasts and luxury buyers, indicating a rising niche segment in India’s evolving EV landscape.

By Vehicle Class

In terms of vehicle class, the India Electric Vehicles Market is led by the low-priced and mid-priced segments, which align with the spending capacity of the majority of Indian consumers. These segments benefit from government subsidies, rising fuel costs, and increased awareness. The mid-price category includes most two-wheelers, entry-level passenger EVs, and e-rickshaws. The high-price segment includes premium cars, high-speed motorcycles, and luxury EVs, targeting a smaller but growing base of early adopters and environmentally conscious high-income consumers. It reflects a market gradually expanding toward wider affordability and diversified preferences.

Segmentation:

By Type

- Scooters

- Motorcycles

- Three-Wheelers

- Passenger Cars

- Buses

- Trucks

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Drive Type

- Front-Wheel Drive (FWD)

- Rear-Wheel Drive (RWD)

- All-Wheel Drive (AWD)

By Speed

- Less Than 100 MPH

- 100 MPH to 125 MPH

- Above 125 MPH

By Vehicle Class

- Low Priced

- Mid-Price

- High Price

Regional Analysis:

North India holds the largest share of the India Electric Vehicles Market, accounting for nearly 38% of the total market in 2024. The region benefits from strong policy implementation, high population density, and an early push toward public transport electrification. States like Delhi and Uttar Pradesh lead in electric bus deployment and two-wheeler sales due to robust government incentives and urban demand. Delhi’s EV policy, including road tax waivers and charging station subsidies, has significantly influenced adoption. Private players and startups actively deploy shared mobility solutions and battery-swapping networks in the region. It remains a dominant contributor due to its strong alignment with policy, infrastructure, and consumer demand.

Western India follows closely with a market share of 27%, driven by manufacturing strength, proactive state policies, and rising urban EV penetration. Maharashtra and Gujarat lead in localized EV production, component manufacturing, and infrastructure development. Gujarat’s capital subsidies and Maharashtra’s dedicated EV policies promote private investment and innovation. The presence of leading automotive and battery manufacturers strengthens the supply chain and reduces costs. It contributes significantly to fleet electrification and commercial EV adoption in logistics and delivery segments. Western India maintains momentum through industrial synergies, robust policy alignment, and evolving urban mobility needs.

Southern India holds a market share of 22%, supported by a technology-driven consumer base and early adoption of electric two-wheelers. States like Tamil Nadu and Karnataka lead in EV R&D, charging network expansion, and startup participation. Bengaluru serves as a key hub for EV innovation, supported by a large pool of skilled workforce and tech companies. State initiatives to integrate EVs into public transport systems enhance regional growth. It benefits from a growing ecosystem of battery manufacturers, software providers, and energy solution firms. Southern India continues to emerge as a strategic zone for innovation and sustainable mobility within the India Electric Vehicles Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ola Electric

- TVS Motors

- Bajaj Auto Limited

- Ather Energy

- Hero MotoCorp Limited

- Greaves Electric Mobility Private Limited

- Mahindra & Mahindra Limited

- Piaggio Vehicles Pvt. Ltd.

- TI Clean Mobility Private Limited

- Euler Motors

- Altigreen

- Saera Electric Auto

- Citylife Electric Vehicles

- Tata Motors Limited

Competitive Analysis:

The India Electric Vehicles Market features a dynamic competitive landscape with a mix of established automakers and emerging startups. Key players such as Tata Motors, Mahindra Electric, Ola Electric, Ather Energy, and Hero Electric dominate the space with strong product portfolios and localized manufacturing. Foreign entrants like Hyundai and MG Motor are expanding their EV lines to meet growing demand. Companies invest heavily in R&D, battery innovation, and charging infrastructure to differentiate offerings. Strategic partnerships, joint ventures, and government collaborations strengthen market presence. It supports continuous product evolution and faster go-to-market strategies. Competitive intensity remains high in the two-wheeler and commercial segments, driven by pricing and innovation.

Recent Developments:

- In July 2025, Bajaj Auto is poised to launch a new electric rickshaw as part of the GoGo range. This initiative aims to set new benchmarks in the three-wheeler segment, focusing on advanced lithium-ion battery packs, improved range efficiency, and passenger comfort, with the official rollout scheduled for early July 2025.

- In June 2025, TVS Motors unveiled the 2025 Apache RTR 200 4V, a major update featuring advanced technology and emission compliance, aimed at enhancing both performance and safety. TVS has also confirmed the launch of the highly anticipated Apache RTX 300 in August 2025 and electric scooters under the Jupiter line in October 2025—demonstrating TVS’s ongoing expansion in electric mobility.

Market Concentration & Characteristics:

The India Electric Vehicles Market exhibits moderate-to-high concentration, especially in the two-wheeler and passenger vehicle segments. A few major players control significant market share, supported by strong brand recognition and government-backed incentives. It favors vertically integrated manufacturers with in-house capabilities in batteries, powertrains, and connected systems. Entry barriers remain high due to capital requirements and regulatory compliance. The market shows fast-paced innovation cycles, with startups disrupting traditional models through tech-driven solutions and agile distribution. Consumer demand focuses on cost-efficiency, range, and post-sale support, shaping competitive strategies. It evolves around affordability, sustainability, and digital integration.

Report Coverage:

The research report offers an in-depth analysis based on Type, Propulsion Type, Drive Type, Speed and Vehicle Class. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Government-led policy continuity and expansion of incentive schemes will remain a core catalyst for long-term electric vehicle adoption.

- Domestic battery manufacturing and localized supply chains are expected to reduce costs and improve production scalability.

- The rollout of nationwide charging infrastructure will support greater intercity and rural EV usage.

- Growth in electric two- and three-wheelers will dominate the volume-driven market, especially in Tier-2 and Tier-3 regions.

- Corporate fleet electrification across logistics, mobility services, and government operations will contribute significantly to demand.

- Emerging technologies such as battery swapping, solid-state batteries, and smart energy management will enhance product efficiency.

- Increased private investment in EV startups and tech innovation will expand market diversity and consumer options.

- Integration of connected vehicle features, AI-enabled diagnostics, and software-driven platforms will redefine user experience.

- Strategic collaborations between OEMs, battery suppliers, and energy companies will strengthen the EV ecosystem.

- The India Electric Vehicles Market will transition from early adoption to mass-market penetration, supported by affordability and consumer awareness.