Market Overview

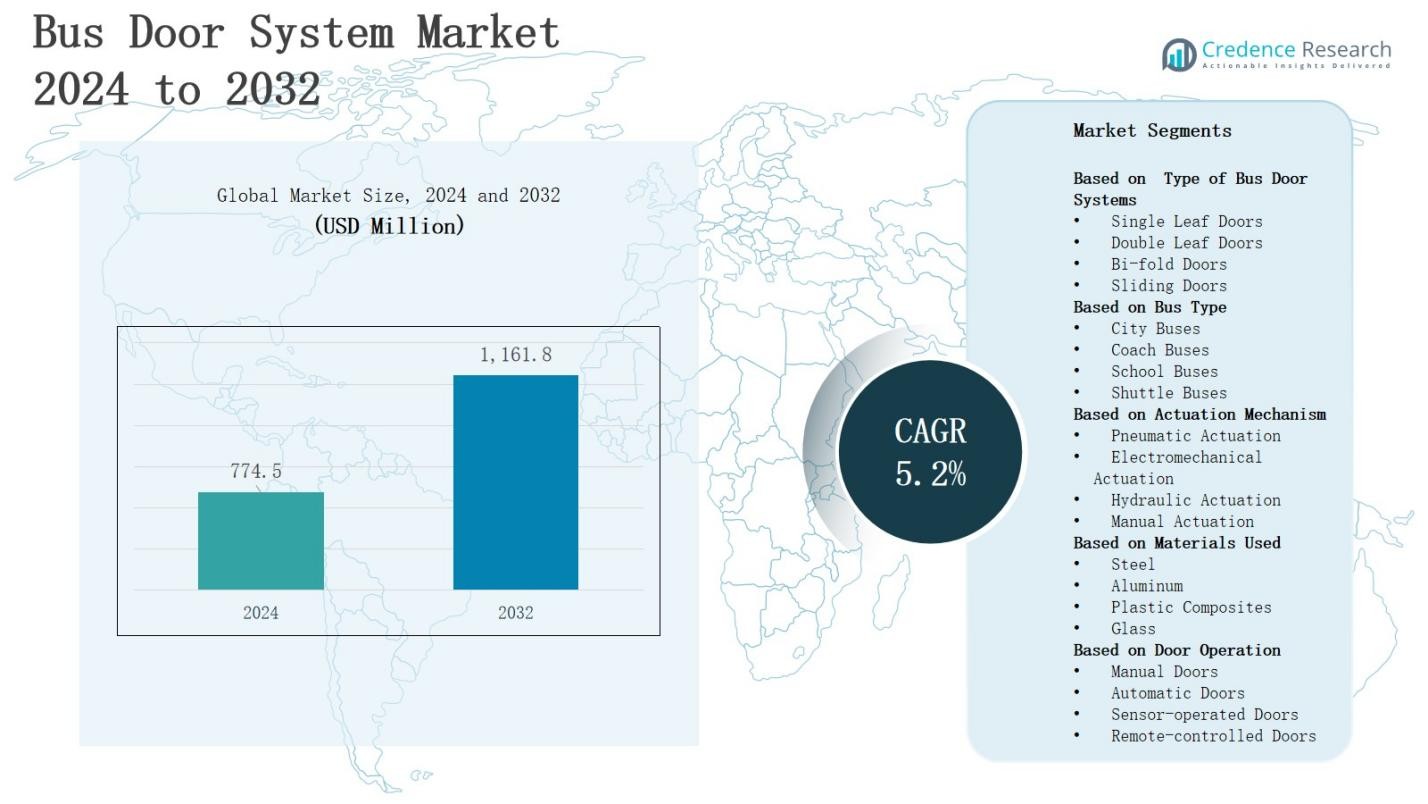

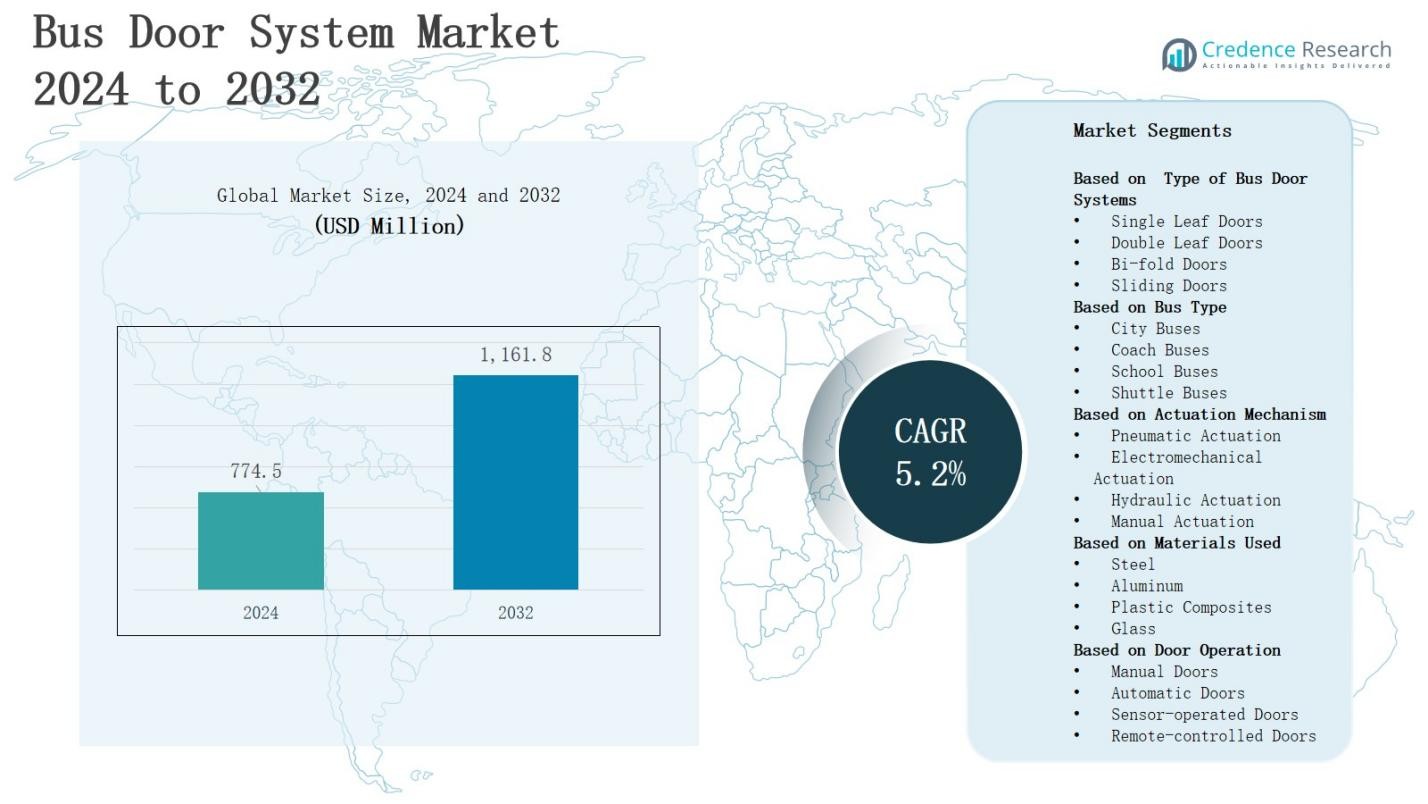

The bus door system market is projected to grow from USD 774.5 million in 2024 to USD 1,161.8 million by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bus Door System Market Size 2024 |

USD 774.5 Million |

| Bus Door System Market, CAGR |

5.2% |

| Bus Door System Market Size 2032 |

USD 1,161.8 Million |

The bus door system market is driven by rising demand for public transportation, growing emphasis on passenger safety, and increasing adoption of electric and automated buses. Urbanization and government initiatives to modernize transit fleets are accelerating the replacement of conventional manual doors with advanced pneumatic and electric systems. Trends include integration of sensor-based obstacle detection, lightweight materials for improved energy efficiency, and modular designs for easier maintenance. The shift toward contactless and rapid-access systems in response to passenger convenience and operational efficiency is shaping product innovation, while smart door control technologies are enhancing reliability and lifecycle performance.

The bus door system market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing to global growth through distinct drivers. North America focuses on fleet modernization and advanced safety compliance, while Europe emphasizes sustainable, lightweight designs and electric mobility. Asia-Pacific leads with large-scale production, urban transit expansion, and electric bus adoption. The Rest of the World shows steady growth through infrastructure upgrades and cost-effective solutions. Key players include Masats, Zhengzhou Yutong Bus Co. Ltd, Schaltbau Holding, Rotex Automation, Continental, Ventura Systems, and Bode Sud.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The bus door system market is projected to grow from USD 774.5 million in 2024 to USD 1,161.8 million by 2032, registering a CAGR of 5.2% during the forecast period.

- Rising public transportation demand, stricter safety regulations, and the shift toward electric and automated buses are driving adoption of advanced pneumatic and electric systems.

- Integration of smart sensors, obstacle detection, and lightweight materials is enhancing efficiency, reliability, and passenger convenience.

- High maintenance costs, operational downtime, and vulnerability to harsh weather remain key operational challenges.

- Asia-Pacific leads with 38% share, followed by Europe at 27%, North America at 22%, and Rest of the World at 13%.

- Urbanization and smart city projects are boosting demand for modular, durable, and user-friendly bus door solutions in emerging markets.

- Key players include Masats, Zhengzhou Yutong Bus Co. Ltd, Schaltbau Holding, Rotex Automation, Continental, Ventura Systems, and Bode Sud.

Market Drivers

Rising Public Transportation Demand

The bus door system market benefits from the growing reliance on public transport in urban and semi-urban areas. It supports increasing passenger volumes by ensuring safety, accessibility, and operational efficiency. Governments are investing in modernizing fleets, replacing outdated mechanical doors with advanced pneumatic and electric systems. It responds to rising commuter expectations for faster boarding and alighting. Expanding metro city networks and intercity bus services further drive the adoption of automated, durable, and low-maintenance door solutions.

- For instance, Transport for London (TfL) has upgraded bus fleets with new electric door systems to enhance passenger safety and speed up boarding amid rising ridership.

Government Regulations and Safety Standards

The bus door system market is influenced by strict safety regulations aimed at protecting passengers and operators. It incorporates features such as anti-pinch sensors, emergency release mechanisms, and compliance with accessibility laws. Authorities mandate safety upgrades, prompting fleet operators to invest in reliable door technologies. Growing awareness of passenger safety boosts demand for systems with advanced monitoring and control. Integration of safety sensors and fail-safe designs strengthens market adoption and regulatory compliance.

- For instance, Ventura Systems CV, based in the Netherlands, invests in innovative automatic door solutions with features like expansive openings, ramps, and safety sensors. These advancements ensure compliance with safety regulations and improve accessibility for passengers with disabilities.

Technological Advancements and Automation

The bus door system market is advancing with innovations in automation, sensors, and control systems. It benefits from the integration of smart features, including obstacle detection and automated closing systems. Manufacturers are adopting lightweight composite materials to reduce vehicle weight and improve fuel efficiency. The shift toward electric buses supports the development of energy-efficient door mechanisms. Enhanced diagnostics and predictive maintenance capabilities improve operational uptime and reduce lifecycle costs for operators.

Urbanization and Infrastructure Development

The bus door system market grows alongside rapid urbanization and expansion of public transit infrastructure. It addresses the need for efficient passenger flow in congested city routes. Large-scale projects for metro buses and intercity coaches create steady demand for advanced door systems. Fleet modernization programs in emerging economies support higher adoption rates. Rising investments in sustainable and smart city initiatives promote technologically advanced, durable, and user-friendly bus door solutions across regions.

Market Trends

Integration of Smart and Sensor-Based Technologies

The bus door system market is witnessing increased adoption of smart technologies that enhance safety, efficiency, and user experience. It features advanced sensors for obstacle detection, automated control units, and predictive maintenance alerts. These systems improve operational reliability while reducing downtime for operators. Integration with fleet management platforms allows real-time monitoring and diagnostics. The shift toward data-driven performance optimization is enabling operators to maintain higher safety standards and reduce total cost of ownership.

- For instance, B-Tracker employs ultrasonic sensors to detect obstacles during bus motion or stops, helping to prevent accidents during passenger boarding and alighting, thereby securing the environment for students.

Shift Toward Lightweight and Energy-Efficient Designs

The bus door system market is evolving with a focus on lightweight materials and energy-efficient mechanisms. It adopts aluminum alloys, composites, and optimized engineering to reduce vehicle weight, contributing to better fuel economy and lower emissions. Electric and pneumatic door systems are being refined for minimal power consumption. These designs support electric bus deployment, where energy savings directly impact vehicle range. Manufacturers are prioritizing durability without compromising environmental sustainability or operational performance.

- For instance, Wabtec’s Ameriview® Bus Door Panels utilize aircraft-quality aluminum for narrow door-frame members, maximizing glazing area while keeping the doors lightweight yet sturdy and durable for transit buses and autonomous vehicles.

Growing Demand for Customization and Modular Configurations

The bus door system market is moving toward modular and customizable designs to meet diverse operator requirements. It offers flexible configurations for city buses, intercity coaches, and specialized transport vehicles. Modular systems simplify installation, replacement, and upgrades, reducing downtime and maintenance costs. Operators can select features such as double-leaf, sliding, or plug doors based on route conditions. This adaptability ensures compatibility with varying passenger capacities, accessibility needs, and evolving transportation infrastructure.

Adoption Driven by Electric and Autonomous Buses

The bus door system market is expanding due to the global shift toward electric and autonomous public transportation. It incorporates advanced automation, seamless integration with vehicle control systems, and AI-based safety features for driverless operations. Electric buses demand optimized door mechanisms to conserve energy and maximize range. Autonomous fleets require doors with self-diagnostic and remote control capabilities. This trend is accelerating the development of intelligent, highly reliable door systems for future-ready transit solutions.

Market Challenges Analysis

High Maintenance Costs and Operational Downtime

The bus door system market faces challenges related to the high maintenance requirements of automated and sensor-equipped systems. It demands regular inspections, component replacements, and calibration to ensure consistent performance. Unexpected failures can lead to costly downtime, disrupting fleet schedules and passenger services. Complex electronic and pneumatic components require skilled technicians, increasing service expenses for operators. Limited availability of specialized spare parts in certain regions further extends repair timelines, reducing operational efficiency and impacting profitability for transit authorities and private operators.

Vulnerability to Harsh Operating Conditions

The bus door system market is impacted by performance limitations in extreme weather and challenging environmental conditions. It must withstand high humidity, dust, and temperature fluctuations without compromising reliability. Exposure to snow, ice, or heavy rain can affect door sealing, sensor accuracy, and opening mechanisms. Corrosion and wear accelerate in coastal or industrial areas, increasing maintenance needs. Operators in emerging markets face difficulties in maintaining advanced systems due to limited infrastructure support. These environmental factors challenge consistent operation and long-term durability.

Market Opportunities

Expansion of Electric and Autonomous Bus Fleets

The bus door system market is positioned to benefit from the rapid global expansion of electric and autonomous bus fleets. It supports the need for energy-efficient, lightweight, and intelligent door mechanisms that align with the operational demands of next-generation public transport. Autonomous buses require advanced safety sensors, remote monitoring, and automated diagnostics, creating demand for highly integrated door solutions. Government incentives for electric mobility and sustainable transit infrastructure accelerate adoption. This shift opens opportunities for manufacturers to design innovative, future-ready products with enhanced performance and lower lifecycle costs.

Rising Demand in Emerging Markets and Urban Transit Projects

The bus door system market has strong growth potential in emerging economies undergoing rapid urbanization and expanding public transportation networks. It can capitalize on large-scale investments in metro buses, intercity coaches, and smart city projects that prioritize safety, accessibility, and efficiency. Upgrades to aging fleets present opportunities for retrofitting with modern door technologies. Demand for customizable and modular systems will grow as operators adapt to varying passenger volumes and infrastructure needs. Strategic partnerships with local manufacturers can strengthen market penetration and improve cost competitiveness in high-growth regions.

Market Segmentation Analysis:

By Type of Bus Door Systems

The bus door system market includes single leaf doors, double leaf doors, bi-fold doors, and sliding doors, each serving distinct operational needs. Single leaf doors are preferred for smaller buses or narrow entry points, while double leaf doors enhance passenger flow in high-capacity transit systems. Bi-fold doors offer space-saving benefits for compact routes, and sliding doors provide modern aesthetics and smooth operation. It meets varying design and space requirements through these specialized configurations.

- For instance, Double leaf doors are exemplified by the Enviro500 double-decker bus, which employs inward gliding and outward sliding double leaf doors to enhance quick passenger boarding in high-capacity transit.

By Bus Type

The bus door system market serves city buses, coach buses, school buses, and shuttle buses, each demanding tailored door solutions. City buses prioritize rapid passenger entry and exit, making automated double or sliding doors common. Coach buses focus on comfort and noise reduction with robust sealing systems. School buses require high safety standards and manual override capabilities. Shuttle buses emphasize compact, lightweight doors for efficient short-distance transit, supporting both passenger safety and operational efficiency.

- For instance, the Singapore Enviro500 double-decker city bus uses a combination of inward gliding double leaf front doors and rapid outward sliding doors to optimize passenger flow and boarding efficiency.

By Actuation Mechanism

The bus door system market segments into pneumatic, electromechanical, hydraulic, and manual actuation mechanisms. Pneumatic systems dominate urban fleets for their reliability and quick operation. Electromechanical systems are gaining traction in electric and hybrid buses for energy efficiency. Hydraulic systems serve heavy-duty applications requiring strong force, while manual systems remain relevant in cost-sensitive or rural operations. It addresses diverse operational conditions by offering actuation technologies that balance performance, maintenance needs, and cost considerations.

Segments:

Based on Type of Bus Door Systems

- Single Leaf Doors

- Double Leaf Doors

- Bi-fold Doors

- Sliding Doors

Based on Bus Type

- City Buses

- Coach Buses

- School Buses

- Shuttle Buses

Based on Actuation Mechanism

- Pneumatic Actuation

- Electromechanical Actuation

- Hydraulic Actuation

- Manual Actuation

Based on Materials Used

- Steel

- Aluminum

- Plastic Composites

- Glass

Based on Door Operation

- Manual Doors

- Automatic Doors

- Sensor-operated Doors

- Remote-controlled Doors

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The bus door system market in North America holds a 22% share, driven by the adoption of advanced safety technologies and modernization of public transport fleets. It benefits from stringent regulatory standards that mandate safety sensors, emergency mechanisms, and accessibility compliance. Electric and hybrid bus adoption is increasing, prompting demand for energy-efficient door systems. Investments in urban transit infrastructure across the United States and Canada support steady growth. Replacement of aging fleets with automated, low-maintenance doors is a key focus, supported by strong presence of domestic and international manufacturers.

Europe

The bus door system market in Europe accounts for 27% of the global share, supported by high public transport usage, stringent environmental regulations, and a strong push toward electric mobility. It emphasizes lightweight, energy-efficient designs to meet sustainability goals. Countries such as Germany, France, and the UK are leading adopters of smart door technologies with advanced obstacle detection systems. Investments in intercity and city bus networks drive consistent demand. Retrofit opportunities in older fleets also contribute to market expansion, with manufacturers focusing on customizable and modular door solutions.

Asia-Pacific

The bus door system market in Asia-Pacific represents 38% of the global share, experiencing rapid growth due to large-scale urbanization, infrastructure expansion, and government-backed public transit projects. It benefits from high production and deployment of buses in China, India, and Japan. Rising adoption of electric buses drives demand for lightweight and power-efficient door mechanisms. Competitive manufacturing capabilities in the region help lower costs and accelerate innovation. Strong domestic demand and export opportunities position Asia-Pacific as the largest contributor to global market revenue.

Rest of the World

The bus door system market in the Rest of the World segment holds a 13% share, covering Latin America, the Middle East, and Africa, where investments in public transportation are growing steadily. It serves both urban modernization projects and rural connectivity programs. Countries are focusing on fleet upgrades, safety enhancements, and improved passenger accessibility. Challenges such as limited infrastructure and budget constraints are driving demand for cost-effective and durable door systems. Local assembly and partnerships with global suppliers are helping improve product availability and affordability in these markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Xiamen Golden Dragon Bus Co.

- Rotex Automation

- Ventura Systems

- Zhengzhou Yutong Bus Co. Ltd

- Bode Sud

- Masats

- Continental

- Anhui Ankai Automobile Co. Ltd.

- Xiamen King Long United Automotive Industry Co. Ltd.

- Schaltbau Holding

Competitive Analysis

The bus door system market is characterized by strong competition among global and regional manufacturers focusing on safety, efficiency, and technological innovation. It features established players such as Masats, Zhengzhou Yutong Bus Co. Ltd, Schaltbau Holding, Xiamen King Long United Automotive Industry Co. Ltd., Rotex Automation, Xiamen Golden Dragon Bus Co., Continental, Anhui Ankai Automobile Co. Ltd., Ventura Systems, and Bode Sud, each leveraging product differentiation and strategic partnerships to strengthen market presence. Companies are investing in advanced materials, smart sensors, and automated control systems to meet rising demand for energy-efficient and low-maintenance solutions. Expansion into electric and autonomous bus segments is driving new product development, with manufacturers offering customized door configurations to suit diverse transit needs. Strategic mergers, technology collaborations, and expansion into emerging markets are enabling players to capture larger shares of the growing public transportation sector. Competitive positioning relies on cost efficiency, compliance with safety regulations, and the ability to deliver durable, high-performance systems that reduce operational downtime and enhance passenger experience across varied transportation environments.

Recent Developments

- On June 30, 2025, Ventura Systems announced it will supply custom door systems for 40 electric buses, 50 city buses, and 70 articulated buses in Dubai.

- In October 2023, ZF Friedrichshafen AG partnered with Masai Automation to develop and integrate next-generation AI-powered automatic bus door systems with enhanced safety features and predictive maintenance capabilities.

- In January 2023, Masats launched a new product division focused on station infrastructure with technological products aimed at improving mobility, safety, reliability, availability, and maintainability.

- On September 11, 2023, Ventura Systems unveiled a new door system concept at Busworld Europe, designed with fewer wearing parts, lower noise levels, improved sealing, and a capacitive non-touch sensitive edge.

Market Concentration & Characteristics

The bus door system market exhibits moderate concentration, with a mix of global leaders and regional manufacturers competing through technological innovation, product customization, and cost efficiency. It is characterized by a strong focus on safety compliance, energy efficiency, and integration of advanced automation technologies. Leading players maintain a competitive edge through strategic partnerships, global distribution networks, and continuous R&D investments. The market caters to diverse bus types and operational environments, requiring solutions that balance durability, ease of maintenance, and passenger convenience. Demand is driven by public transportation growth, electric bus adoption, and fleet modernization programs, while competition intensifies with the entry of new players offering specialized and modular systems. Established brands differentiate through quality, regulatory compliance, and aftersales support, while regional players leverage localized manufacturing and pricing strategies. The evolving emphasis on smart, lightweight, and sustainable designs continues to shape competitive dynamics and influence purchasing decisions across key markets.

Report Coverage

The research report offers an in-depth analysis based on Type of Bus Door Systems, Bus Type, Actuation Mechanism, Material Used, Door Operationand Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and lightweight door systems will rise with the growth of electric and hybrid bus fleets.

- Integration of AI-enabled obstacle detection and predictive maintenance will become standard in new installations.

- Modular and customizable designs will gain preference to meet diverse operational and infrastructure requirements.

- Retrofitting opportunities will expand as operators upgrade aging fleets with advanced automated door systems.

- Adoption of smart connectivity features will improve remote monitoring and operational control.

- Growth in urban transit projects and smart city developments will drive higher procurement of advanced door solutions.

- Emerging markets will witness increased local manufacturing and partnerships to improve cost competitiveness.

- Autonomous bus deployment will accelerate demand for fully automated, self-diagnostic door systems.

- Stricter safety regulations will drive continuous innovation in fail-safe and emergency release mechanisms.

- Global supply chain optimization will influence pricing strategies and product availability across regions.