Market Overview:

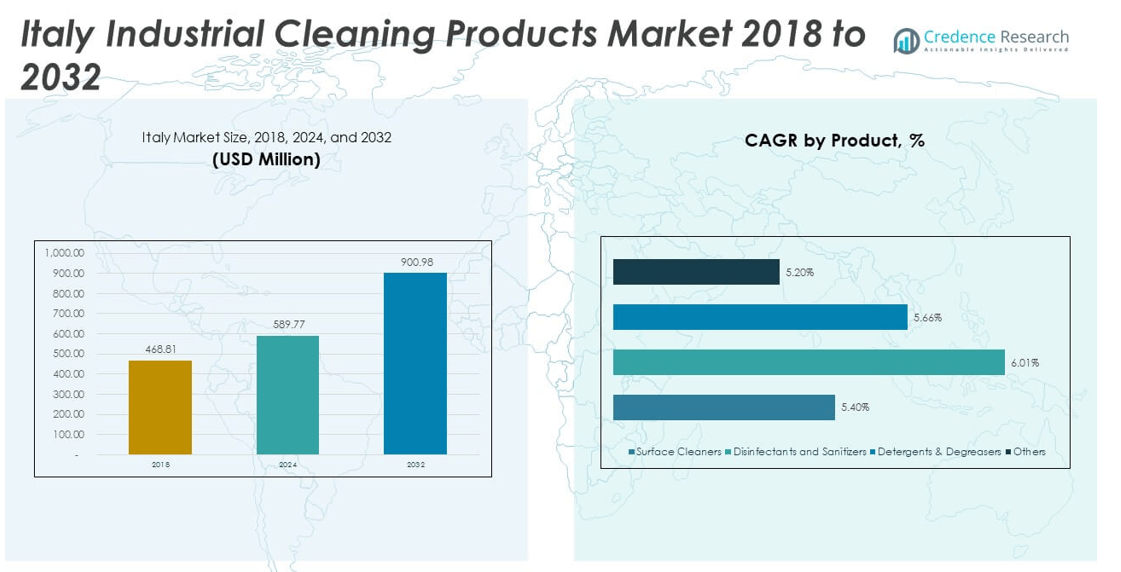

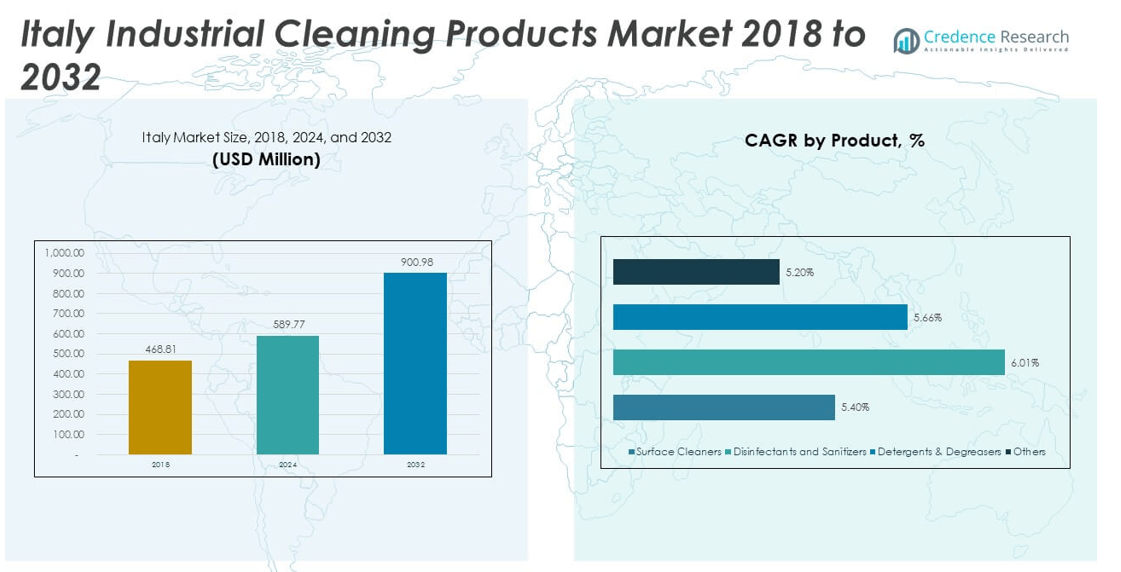

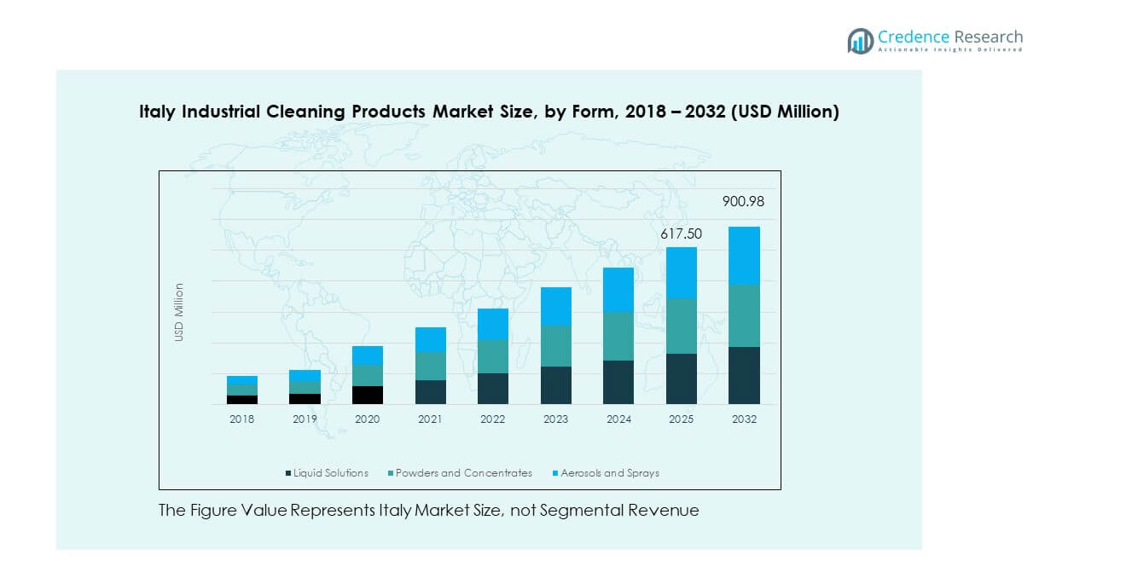

The Italy Industrial Cleaning Products Market size was valued at USD 468.81 million in 2018 to USD 589.77 million in 2024 and is anticipated to reach USD 900.98 million by 2032, at a CAGR of 5.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Industrial Cleaning Products Market Size 2024 |

USD 589.77 million |

| Italy Industrial Cleaning Products Market, CAGR |

5.44% |

| Italy Industrial Cleaning Products Market Size 2032 |

USD 900.98 million |

The market is expanding due to stricter hygiene regulations and sustainability standards across manufacturing, healthcare, and food processing industries. Companies are adopting certified cleaning agents to maintain operational safety and meet compliance requirements. Growth is also influenced by the rising use of automation, eco-friendly cleaning technologies, and advanced formulations that reduce chemical waste. Industrial facilities focus on efficiency, safety, and sustainability, driving continuous demand for high-performance cleaning solutions across Italy’s major sectors.

Northern Italy dominates the market owing to its dense manufacturing and industrial clusters, supported by well-developed logistics and supply networks. Central Italy follows, with institutional and food processing sectors contributing strongly to demand. Southern Italy is emerging as a key growth region with rising investments in industrial infrastructure, utilities, and public facilities. The balanced expansion across regions reflects increasing awareness of hygiene standards and a growing preference for sustainable cleaning solutions nationwide.

Market Insights

- The Italy Industrial Cleaning Products Market size was valued at USD 468.81 million in 2018, USD 589.77 million in 2024, and is anticipated to reach USD 900.98 million by 2032, growing at a CAGR of 5.44% during the forecast period.

- Northern Italy leads the market with 42% share due to its industrial base, followed by Central Italy with 33%, driven by food processing and healthcare. Southern Italy is emerging with 25% share, supported by infrastructure development and government initiatives.

- The fastest-growing region is Southern Italy, with expanding industrial infrastructure and increased investments in utilities, expected to grow at a higher rate due to favorable EU funding and regional development.

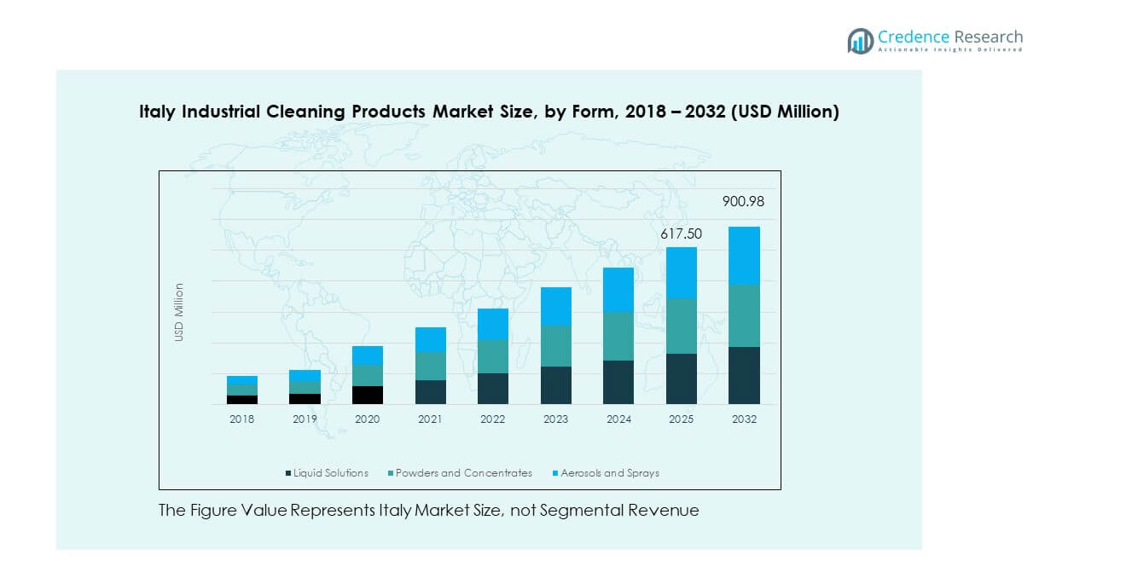

- In 2024, Liquid Solutions held the largest segment share at 51%, followed by Powders and Concentrates at 28%. Aerosols and Sprays represented 21% of the market, showing steady growth.

- By form, Liquid Solutions dominate with a 51% share, reflecting demand for versatile cleaning products, while Powders and Concentrates maintain a 28% share, driven by their cost-effectiveness and bulk usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Industrial Hygiene Regulations and Standardization of Cleaning Protocols

The Italy Industrial Cleaning Products Market is witnessing strong growth due to stricter hygiene and sanitation regulations across industrial sectors. Government authorities and industry associations are enforcing compliance with workplace safety standards, pushing companies to adopt certified cleaning products. The manufacturing, healthcare, and food processing industries are leading adopters, ensuring consistent hygiene and contamination prevention. Companies are prioritizing disinfection and residue-free cleaning to align with ISO and EU standards. Regulatory enforcement has encouraged innovation in eco-safe and low-toxicity cleaning formulations. The focus on risk prevention and health assurance drives product diversification. Businesses now allocate higher budgets to sanitation products. This structural shift toward compliance and performance reliability supports sustained market expansion.

- For example, Kärcher S.p.A. offers an extensive range of industrial cleaning machines and detergents developed to meet ISO 9001 and ISO 14001 standards for quality and environmental management. Their Italian facility maintains these certifications, and Kärcher’s detergents are specifically formulated for industrial sectors where compliance with strict hygiene protocols (such as ISO 22000 for food safety) is required.

Expansion of Manufacturing and Food Processing Facilities Across Key Regions

The market experiences growth through the expansion of Italy’s manufacturing and food processing facilities. Industrial and food-grade cleaning products are critical for production line maintenance and hygiene control. Continuous growth in packaged food production and export-oriented processing units strengthens demand. Manufacturers rely on industrial cleaners for machinery upkeep, reducing downtime and maintaining equipment efficiency. Hygiene assurance in dairy, meat, and beverage processing plants remains a top operational goal. The need for standardized cleanliness across supply chains has raised consumption of specialized detergents and degreasers. The growth in industrial output drives bulk procurement from institutional suppliers. It reinforces the market’s role in supporting operational sustainability.

- For example, Diversey’s Clean-in-Place (CIP) solutions are actively deployed in Italy’s major dairy and food processing plants to support production line hygiene and efficiency. The company’s public technical data for its CIP systems documents up to double-digit percent reductions in water and chemical consumption in operational case studies and highlights specific partnerships with Italian food manufacturers in press communications.

Growing Shift Toward Sustainable and Environmentally Friendly Cleaning Solutions

The adoption of biodegradable and non-toxic cleaning chemicals continues to rise among Italian industries. Companies seek products with low volatile organic compounds and certified eco-labels to meet sustainability targets. The transition toward green cleaning products aligns with Italy’s circular economy initiatives. Local manufacturers invest in renewable-based surfactants and waste-minimizing packaging. The push for green industrial cleaning has attracted government incentives and partnerships. Energy and manufacturing sectors lead in adopting products that ensure both efficiency and environmental compliance. The demand for eco-certified brands continues to strengthen corporate social responsibility frameworks. It reflects a long-term shift toward responsible consumption within industrial cleaning operations.

Rising Adoption of Automated Cleaning Equipment and Smart Maintenance Systems

Automation has become a major growth driver in industrial cleaning operations across Italy. Facilities adopt robotic scrubbers, automated vacuum systems, and IoT-enabled maintenance solutions to optimize labor use. The growing trend toward Industry 4.0 encourages integration of smart cleaning equipment with centralized monitoring systems. This transformation reduces operational costs and ensures consistency in hygiene standards. Industrial plants with large floor areas prefer machine-assisted cleaning for time efficiency. Automation providers collaborate with cleaning chemical firms to deliver system-compatible products. The trend supports productivity improvement and waste reduction. It highlights how technology and industrial cleaning chemistry are evolving together in modern operations.

Market Trends

Integration of Digital Monitoring Systems in Industrial Cleaning Operations

Digitalization is reshaping how industrial cleaning processes are managed and audited. The Italy Industrial Cleaning Products Market benefits from the rise of smart monitoring tools that track cleaning frequency, resource use, and compliance. Industrial facilities use data analytics for predictive maintenance and cost optimization. Cloud-based cleaning management software ensures transparency and accountability. Remote supervision tools are now standard across healthcare and logistics sectors. This trend enhances operational accuracy while reducing inefficiencies. The integration of sensors and automated alerts enables consistent hygiene control. It reflects a deeper fusion between facility management and industrial cleaning performance technologies.

Growth in Demand for Specialty Cleaning Chemicals and Customized Formulations

Industrial clients increasingly prefer tailor-made cleaning products suited to their equipment and process requirements. Manufacturers develop specialized formulas to remove complex residues like lubricants, metal dust, and chemical coatings. The growing sophistication of production lines in Italy drives this customization demand. Specialty products with corrosion inhibitors, enzyme-based cleaning agents, and anti-microbial additives are gaining traction. Companies focus on extending equipment life and ensuring production quality. Laboratory-tested formulations provide measurable cleaning efficiency and material compatibility. This trend underscores a shift from generic to performance-based cleaning solutions. It also elevates competition among domestic and international suppliers offering premium-grade products.

- For instance, Ecolab’s Klercide Cleanroom Quat is formulated for use in high-grade cleanrooms in Italy, featuring efficacy as a broad-spectrum disinfectant and sanitizer at low concentrations, produced under ISO Class 5 cleanroom conditions, 0.2 micron-filtered, and double-bagged for contamination control. Each batch is supported with a Certificate of Analysis and Sterility.

Expansion of Private Label and Contract Manufacturing in Cleaning Chemicals

The rise of private-label cleaning brands has strengthened competition in Italy’s industrial supply chain. Distributors and wholesalers are investing in product formulation under their own branding to serve niche industrial clients. Contract manufacturing partnerships between chemical producers and packaging firms help meet bulk demand efficiently. Local enterprises gain access to cost-effective solutions without compromising on quality standards. This trend encourages product diversification across cleaning agents, disinfectants, and maintenance chemicals. Industrial clients benefit from flexible pricing structures and supply security. It reduces dependency on traditional global brands. The trend continues to democratize product access within the industrial cleaning landscape.

- For instance, Christeyns, a supplier with extensive contract manufacturing capacity, is ISO 14001 certified for its European production plants, which includes Italy, enabling tailored product development and compliance with international standards for private-label cleaning chemicals.

Increasing Role of Workplace Hygiene in Corporate Sustainability Reporting

Corporate entities are embedding workplace hygiene as part of their ESG and sustainability goals. The Italy Industrial Cleaning Products Market reflects this transformation in industrial procurement behavior. Firms now highlight cleaning practices as indicators of employee well-being and operational integrity. The hygiene metrics are tracked in annual sustainability disclosures and compliance audits. Clean workplace environments directly contribute to brand reputation and workforce safety. Industrial cleaning suppliers leverage this visibility to promote certified and low-impact solutions. The trend strengthens cross-sector cooperation between manufacturers and facility managers. It shows that cleaning performance is now a measurable sustainability benchmark.

Market Challenges Analysis

Rising Raw Material Costs and Volatile Supply Chain Structures Impacting Profitability

Volatile prices of petrochemical derivatives and surfactant ingredients remain a significant challenge for producers. The Italy Industrial Cleaning Products Market faces cost pressures due to fluctuating raw material supply. Energy costs and import dependencies on key chemical feedstocks affect production margins. Small and medium enterprises find it difficult to absorb these input fluctuations without raising product prices. Supply chain disruptions linked to geopolitical events have increased lead times and procurement risks. Manufacturers must balance quality with cost efficiency to stay competitive. The high transportation costs further strain profitability. It compels the industry to seek local sourcing and recycling-based material recovery solutions.

Compliance Burden and Increasing Complexity of Environmental Regulations

The market contends with growing regulatory complexity in chemical classification, labeling, and waste disposal. Italian and EU laws mandate extensive documentation for industrial cleaning product safety and composition. Companies invest in R&D and testing to maintain regulatory approval for chemical formulations. Frequent updates to REACH and CLP frameworks demand continuous adaptation. SMEs often lack the technical resources to meet compliance standards efficiently. Non-compliance risks include financial penalties and product recalls. It also delays product launches and market entry for new players. The rising documentation load slows innovation cycles and raises the cost of doing business across the sector.

Market Opportunities

Adoption of Green Chemistry and Biobased Cleaning Innovations Across Industries

The shift toward sustainability presents major growth opportunities for biobased cleaning agents and eco-certified solutions. The Italy Industrial Cleaning Products Market can leverage green chemistry innovations to expand its product portfolio. Biodegradable surfactants, enzyme-based formulations, and water-efficient concentrates appeal to industries with environmental commitments. Manufacturers investing in recyclable packaging and renewable ingredient sourcing gain competitive strength. Public procurement programs promoting eco-friendly products further boost market expansion. Companies developing low-carbon and safe-to-use cleaning solutions find opportunities in institutional contracts. It signals a clear transition toward environment-driven growth strategies within industrial cleaning ecosystems.

Expansion of E-Commerce Distribution Channels and Industrial Direct Sales Models

The accelerated shift toward online procurement opens new opportunities for cleaning product suppliers. E-commerce platforms simplify industrial buying with transparency and bulk-order capabilities. Manufacturers establish direct sales channels to reach specialized clients faster. Online catalogs and product configurators improve accessibility for small and medium buyers. The trend enables better price control and customer engagement. It also expands the market reach of domestic producers across regional clusters. It helps suppliers streamline logistics and inventory management while enhancing brand visibility nationwide.

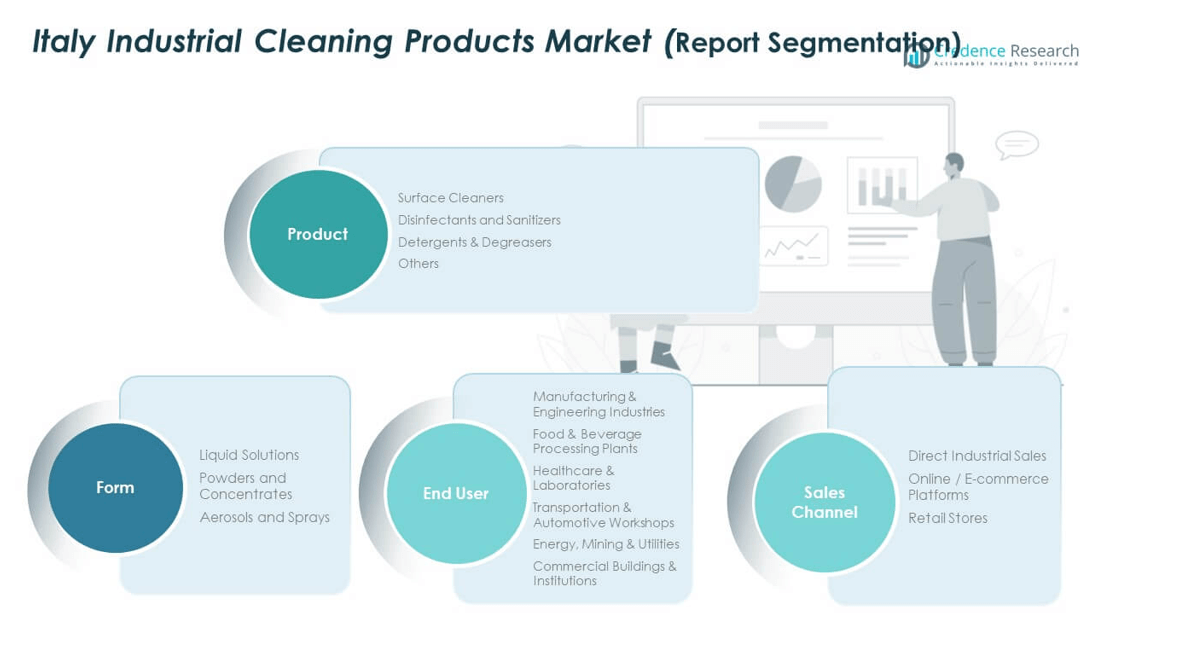

Market Segmentation Analysis

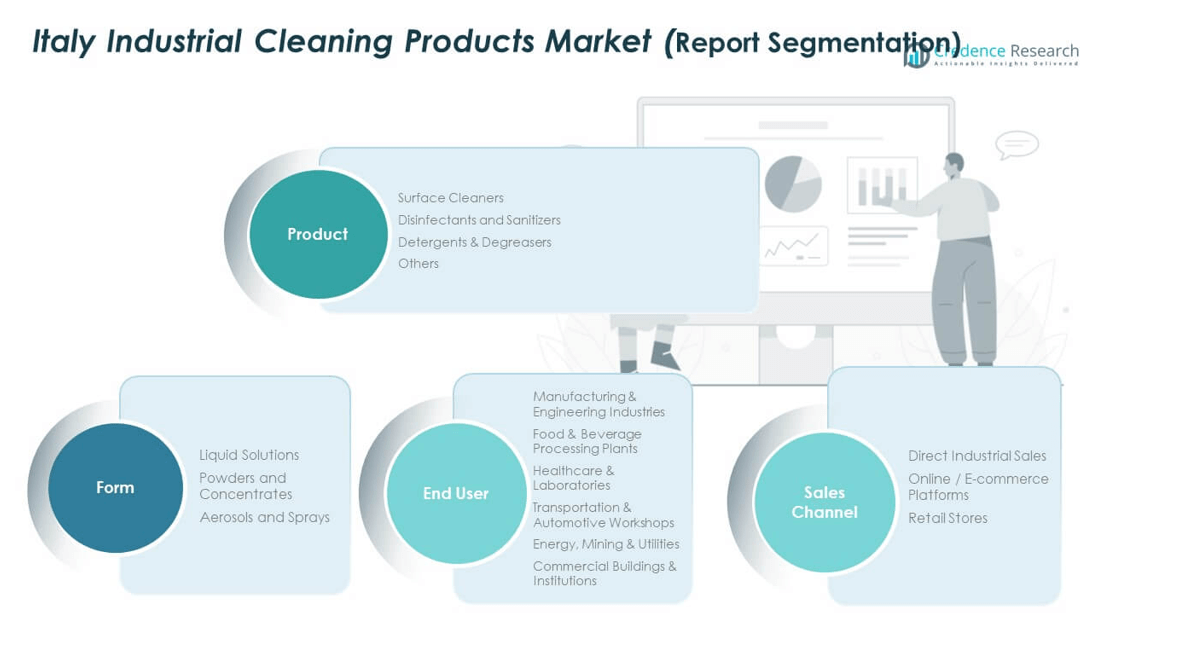

By Product Type

Surface cleaners dominate due to their widespread use in industrial and commercial maintenance applications. Disinfectants and sanitizers hold a large share driven by hygiene compliance in healthcare and food sectors. Detergents and degreasers remain vital in machinery upkeep and industrial process maintenance. The “others” category includes specialty cleaners for glass, electronics, and high-pressure applications. The Italy Industrial Cleaning Products Market benefits from the product variety that caters to both heavy-duty and sensitive-use requirements across industrial environments.

- For instance, Diversey’s SoftCare Des E surface disinfectant meets the EN 14476 European standard for virucidal activity, demonstrating 99.99% efficacy against viruses like Poliovirus and Adenovirus. Certified lab test reports confirm its performance in Italy’s healthcare and food sectors, ensuring compliance with strict hygiene requirements.

By Form

Liquid solutions are preferred for their versatility and ease of application across multiple surfaces. Powders and concentrates offer economic and high-volume cleaning benefits for large industrial operations. Aerosols and sprays are gaining use in precision cleaning tasks within laboratories and electronics manufacturing. Each form supports distinct cleaning needs depending on application scale and residue sensitivity. It shows how product format diversity enables suppliers to meet user-specific preferences and regulatory standards across sectors.

By End User

Manufacturing and engineering industries represent the leading end-user category due to consistent maintenance and machinery cleaning requirements. Food and beverage processing plants rely on strict hygiene control systems supported by certified disinfectants. Healthcare and laboratories use advanced formulations to ensure contamination-free environments. Transportation and automotive workshops depend on degreasers and surface agents for maintenance efficiency. Energy, mining, and utilities emphasize durable cleaning products for equipment longevity. Commercial buildings and institutions represent an expanding user base due to rising facility management standards. It indicates strong multi-sector adoption of professional cleaning solutions across Italy.

- For instance, Christeyns’ dairy hygiene systems, used by major European dairy processors, comply with food safety protocols like EN 1276. In Italian dairies, these products are validated through hygiene audits and industry awards, ensuring bacterial contamination is eliminated to meet third-party standards.

By Sales Channel

Direct industrial sales continue to dominate due to long-term supplier relationships and customized bulk procurement. Online and e-commerce platforms record rapid growth, supported by digitalization and industrial B2B sales integration. Retail stores cater mainly to smaller commercial clients and facility service providers. The multi-channel approach enhances distribution efficiency and market accessibility. It ensures manufacturers can serve both enterprise-level contracts and small-scale users with equal agility. The balanced channel structure strengthens the overall competitiveness of Italy’s industrial cleaning supply network.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

Northern Italy – Industrial Core with Strong Manufacturing Concentration (42% Market Share)

Northern Italy leads the Italy Industrial Cleaning Products Market with 42% share, supported by its dense industrial and commercial infrastructure. The Lombardy, Veneto, and Emilia-Romagna regions host leading automotive, machinery, and food-processing plants requiring high hygiene standards. These industries generate consistent demand for disinfectants, surface cleaners, and degreasers. The concentration of pharmaceutical and electronics production strengthens the market for specialized cleaning chemicals. The presence of global manufacturers and export-focused operations encourages bulk procurement of certified cleaning agents. It benefits from advanced logistics networks and developed supplier ecosystems that enhance product accessibility and delivery efficiency.

Central Italy – Expanding Institutional and Food Processing Demand (33% Market Share)

Central Italy holds 33% market share, driven by the growing food processing, hospitality, and public healthcare sectors. The Lazio and Tuscany regions are expanding their cleaning product consumption through institutional and commercial facility maintenance. Public hygiene programs and private facility contracts stimulate large-scale demand for sustainable cleaning solutions. The growth of tourism and hospitality in Rome and Florence further fuels consumption of industrial-grade cleaners. Industrial plants in these regions increasingly adopt automated cleaning systems to meet evolving sanitation norms. The steady expansion of mixed-use industrial estates supports product penetration. It reinforces Central Italy’s role as a key demand hub for diversified cleaning applications.

Southern Italy – Emerging Markets with Increasing Industrial Investments (25% Market Share)

Southern Italy accounts for 25% share, supported by new infrastructure and industrial development projects. Campania, Puglia, and Sicily are witnessing rising adoption of cleaning products in logistics, utilities, and public institutions. Local governments prioritize hygiene and environmental safety, encouraging procurement of certified cleaning chemicals. The manufacturing base is gradually diversifying, creating fresh demand for detergents and equipment maintenance solutions. It benefits from EU-backed regional funding that promotes modernization of industrial facilities. The strengthening of transportation and warehouse networks further increases product distribution efficiency. It reflects the region’s potential to become a competitive contributor within the national industrial cleaning landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pharmatek PMC Srl

- Dow Inc.

- Gard Chemicals

- Evonik Industries AG

- Proquimia

- Stepan Company

- Ecolab Inc.

- 3M

- BASF SE

- KEM ONE

Competitive Analysis

The Italy Industrial Cleaning Products Market features a mix of multinational and domestic players focused on quality, innovation, and sustainability. Key companies include Diversey Holdings Ltd., Ecolab Inc., Reckitt Benckiser Group, Henkel AG & Co. KGaA, and Kärcher GmbH & Co. KG. Local manufacturers such as Italchimica, Interchem Italia, and Allegrini S.p.A. also hold a strong presence, catering to regional and institutional clients. Competition centers on product differentiation, environmental certifications, and performance efficiency. Global firms invest heavily in R&D for eco-safe formulations and advanced cleaning technologies. Domestic producers emphasize cost efficiency, local distribution, and customized solutions for industrial and commercial users. Strategic collaborations, product launches, and acquisitions strengthen brand visibility. It remains characterized by technological advancements, digitalization of supply chains, and growing emphasis on sustainable chemistry to retain market competitiveness.

Recent Developments

- In October 2025, Nouryon introduced a new suite of sustainable cleaning‑ingredient technologies at the SEPAWA Congress, including surfactants and chelates for industrial cleaning applications. These innovations support more environmentally friendly formulations in the Europe‑based industrial cleaning sector.

- In September 2025, Ecolab Inc. launched its Ecolab® CIP IQ™ platform and announced a strategic partnership with 4T2 Sensors. This solution targets food and beverage industry clean‑in‑place operations with AI‑enabled fluid sensing technology. The move strengthens Ecolab’s digital hygiene offerings in France and beyond.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Industrial Cleaning Products Market will witness sustained expansion supported by growing hygiene mandates in industrial and commercial sectors.

- Demand for eco-labeled and biodegradable cleaning products will strengthen as industries align with sustainability frameworks.

- The adoption of automation and smart cleaning technologies will optimize resource use and labor efficiency.

- Expanding industrial infrastructure and logistics hubs will create consistent product demand across the country.

- E-commerce and direct industrial sales platforms will become primary distribution channels for professional buyers.

- Increasing focus on infection prevention in healthcare and laboratories will accelerate disinfectant and sanitizer usage.

- Continuous R&D investments in non-toxic surfactants and water-saving formulations will reshape product innovation.

- Collaboration between global suppliers and Italian distributors will enhance supply chain efficiency and product reach.

- Industrial modernization initiatives in southern regions will broaden the customer base for cleaning solutions.

- Environmental compliance, digital integration, and sustainability reporting will remain key growth catalysts shaping future market dynamics.