Market Overview:

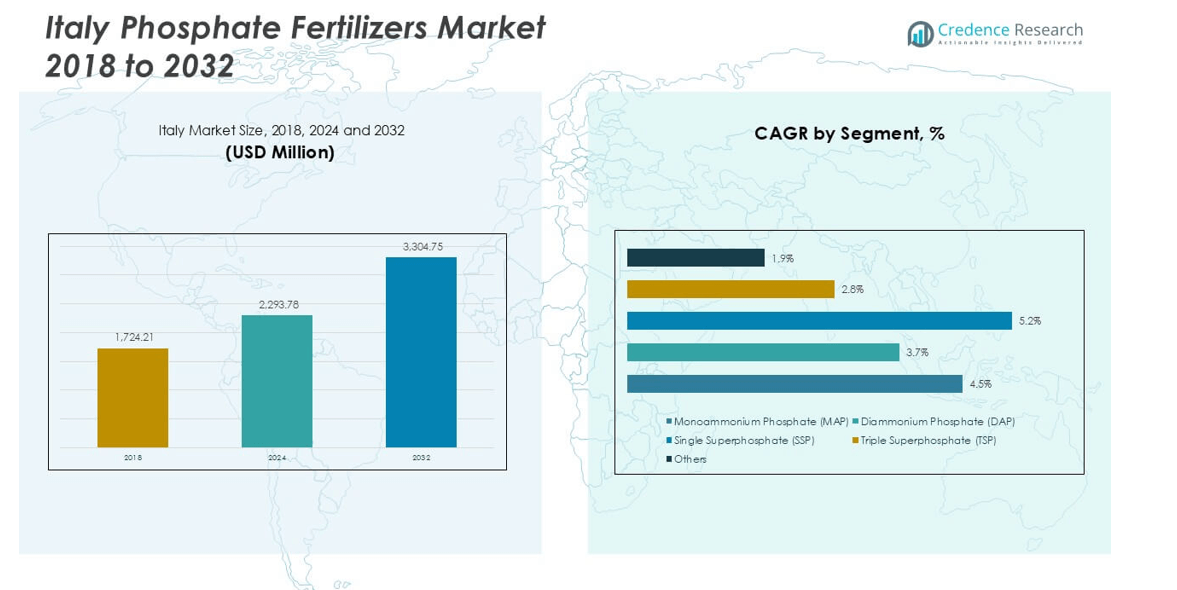

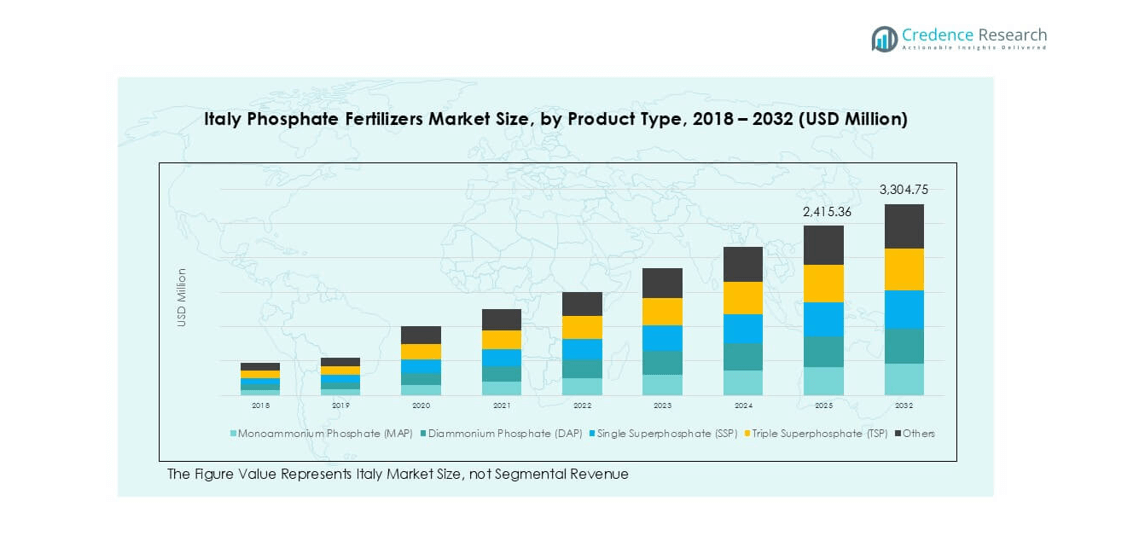

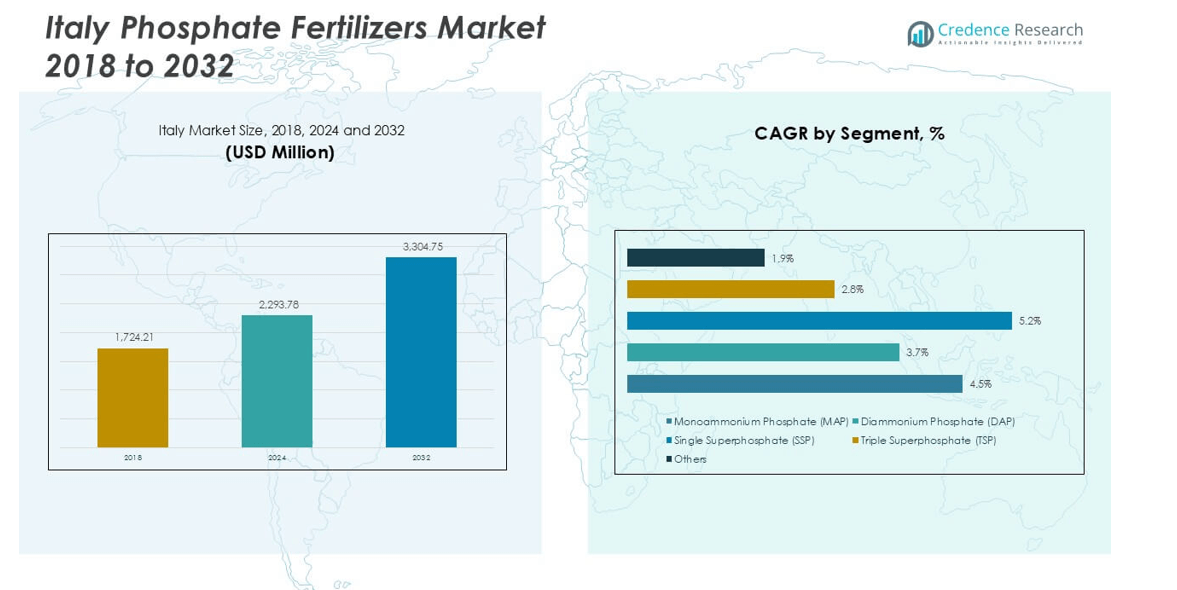

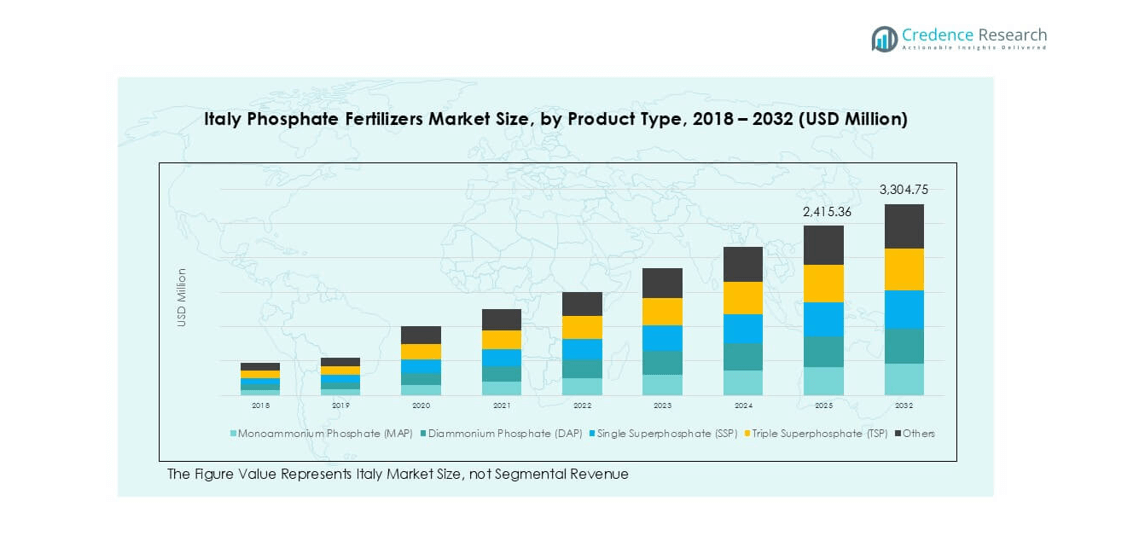

Italy Phosphate Fertilizers market size was valued at USD 1,724.21 million in 2018 and grew to USD 2,293.78 million in 2024. It is anticipated to reach USD 3,304.75 million by 2032, at a CAGR of 4.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Phosphate Fertilizers Market Size 2024 |

USD 2,293.78 million |

| Italy Phosphate Fertilizers Market, CAGR |

4.58% |

| Italy Phosphate Fertilizers Market Size 2032 |

USD 3,304.75 million |

The Italy phosphate fertilizers market is led by key players such as Yara International, EuroChem Group, ICL Group Ltd, BASF SE, OCI Nitrogen, Nutrien Ltd., CF Industries Holdings, K+S AG, Helm AG, and COMPO Expert GmbH. These companies focus on advanced fertilizer formulations, distribution network expansion, and partnerships with cooperatives to strengthen their market presence. Northern Italy holds over 40% of the market share, driven by intensive cereal and maize production in the Po Valley. Strong adoption of MAP and DAP fertilizers, combined with precision farming practices, positions Northern Italy as the most lucrative region for manufacturers

Market Insights

- Italy phosphate fertilizers market was valued at USD 2,293.78 million in 2024 and is projected to reach USD 3,304.75 million by 2032, growing at a CAGR of 4.58% during the forecast period.

- Rising demand for high-yield crops and government-backed programs supporting nutrient management drive fertilizer adoption across cereals, grains, and oilseeds, boosting overall market growth.

- Market trends show growing preference for eco-friendly fertilizers and precision farming practices, with strong uptake of MAP and DAP in large-scale farms for better yield efficiency.

- Competition is led by Yara International, EuroChem, ICL Group, BASF SE, and Nutrien Ltd., with strategies focusing on product innovation, digital farming solutions, and distribution network expansion.

- Northern Italy holds over 40% share, followed by Central Italy at 25%, Southern Italy at 20%, and Islands at 15%; by product type, MAP dominates with over 35% share, followed by DAP and SSP.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Sgmentation Analysis:

By Product Type

\Monoammonium Phosphate (MAP) leads the Italy phosphate fertilizers market with over 35% share in 2024, supported by its high nutrient content and compatibility with most soil types. MAP is preferred for its balanced phosphorus and nitrogen ratio, which supports strong root development and early crop growth. Diammonium Phosphate (DAP) follows closely due to its high phosphorus availability, while Single Superphosphate (SSP) is popular for cost-effectiveness in small and medium farms. Triple Superphosphate (TSP) sees steady adoption for horticulture crops. Demand for other phosphate blends grows with precision farming adoption.In 2022, MAP was the largest contributor to the Italian market, with a share of 41.6%. Its popularity is due to its high nutrient concentration, solubility, and balanced phosphorus and nitrogen content, which supports strong root development and early crop growth.

- For instance, in 2023, Yara continued its operations as a major supplier of fertilizers in Italy, including phosphorus products like MAP, to agricultural regions such as Emilia-Romagna and Lombardy. In December of that year, Yara strengthened its market position by acquiring Agribios Italiana, a company that produces organic-based fertilizers.

By Application

Cereals & Grains dominate the Italy phosphate fertilizers market with more than 40% share in 2024, driven by the country’s strong wheat and maize production. Phosphorus fertilizers are critical for improving grain yield, seed development, and overall plant vigor. Oilseeds such as sunflower and soybean also contribute significantly, supported by the growing demand for vegetable oils and biofuels. Fruits & Vegetables segments show healthy growth due to increasing greenhouse farming and high-value crop cultivation. Rising demand for sustainable agricultural productivity continues to fuel phosphate fertilizer use across all application categories.

- For instance, in 2023, Italy harvested an estimated 4 million metric tons of durum wheat. While some fertilizer applications included DAP and MAP, the national average phosphorus application was much lower than the claimed 65 kg P₂O₅/ha.

Market Overview

Rising Demand for High-Yield Crops

The growing population in Italy drives the need for improved agricultural productivity, pushing farmers to adopt high-yield crop varieties. Phosphate fertilizers are critical for root development, nutrient uptake, and crop maturity. Their use enhances yield in cereals, grains, and oilseeds, aligning with national food security goals. The government supports fertilizer adoption through agricultural subsidies and training programs, boosting awareness among farmers. Increasing preference for efficient fertilizers like MAP and DAP further strengthens market growth across the country’s key agricultural regions.

- For instance, Italy’s durum wheat production was approximately 4.2 million metric tons, according to various agricultural forecasts and reports. Forecasts from sources like Italy’s Council for Agricultural Research and Economics (CREA) indicated production was expected to be over 4 million tons. The 2023 harvest was impacted by weather issues in southern Italy, a key durum-producing region.

Expansion of Precision Farming Practices

Precision farming adoption is accelerating in Italy, driven by technological advancements and EU sustainability targets. Farmers use soil testing, GPS mapping, and variable rate application to optimize phosphate fertilizer use. This approach minimizes wastage, lowers input costs, and enhances crop quality. Equipment manufacturers and cooperatives offer digital platforms that guide fertilizer application schedules. These practices improve efficiency and yield, encouraging consistent demand for high-quality phosphate fertilizers, particularly in large-scale farms focusing on wheat, maize, and specialty crops.

- For instance, in 2023, New Holland expanded its Precision Land Management (PLM) offerings and made significant announcements at trade shows like the National Farm Machinery Show and Agritechnica.

Supportive Government and EU Policies

Government and EU initiatives promoting sustainable agriculture significantly boost the phosphate fertilizer market. Policies under the EU Common Agricultural Policy (CAP) provide funding for balanced nutrient management and soil fertility improvement. Farmers benefit from training on best practices for fertilizer use, reducing environmental impact while improving output. Programs encouraging integrated nutrient management also support adoption of advanced products like TSP for horticulture. These incentives strengthen market penetration and create a stable environment for fertilizer manufacturers to expand operations.

Key Trends & Opportunities

Shift Toward Eco-Friendly Fertilizer Solutions

Italian farmers increasingly adopt eco-friendly and low-emission phosphate fertilizers to meet EU Green Deal targets. Manufacturers introduce enhanced-efficiency fertilizers that reduce phosphate runoff and minimize environmental impact. Demand grows for products compatible with organic farming standards, offering growth opportunities for producers focused on sustainable formulations. This trend aligns with the national focus on regenerative agriculture and supports premium pricing for eco-compliant products.

- For instance, in 2023, Italy’s organic farmland grew by 4.5% to reach 2.46 million hectares. This expansion was supported by many fertilizer companies, including Fertinagro Biotech. Fertinagro is a global manufacturer of organic fertilizers, some of which are sold in Italy.

Growing Horticulture and Greenhouse Farming Sector

Rising demand for high-value crops, including fruits and vegetables, fuels fertilizer consumption in greenhouse farming. Controlled environment agriculture allows precise phosphate application, improving nutrient use efficiency and yield. This creates opportunities for specialty fertilizers like water-soluble MAP and TSP. The growth of Italy’s export-oriented horticulture sector further drives investment in quality fertilizers to meet global quality standards.

- For instance, OrtoRomi is an Italian agricultural cooperative that produces fresh-cut salads, fruits, and vegetables by sourcing produce from a network of 49 farms located throughout Italy. Like many modern growers, the cooperative and its partner farms likely use advanced cultivation techniques such as fertigation to increase nutrient and water efficiency.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of key raw materials, including phosphate rock and ammonia, challenge market stability. Import dependency exposes Italian manufacturers to global price swings, impacting profit margins. Rising energy costs further increase production expenses, affecting affordability for small and medium farmers. Companies must optimize supply chains and explore local sourcing to mitigate these risks.

Environmental Regulations and Runoff Concerns

Strict EU regulations on nutrient runoff and water quality compliance limit excessive phosphate fertilizer application. Farmers must balance productivity goals with environmental standards, which can raise operational costs. Compliance requires investment in precision application technologies and soil monitoring systems. Manufacturers face pressure to innovate eco-friendly solutions that meet regulatory norms while maintaining crop performance.

Regional Analysis

Northern Italy

Northern Italy holds the largest share of the Italy phosphate fertilizers market, accounting for over 40% in 2024. The region’s dominance is driven by intensive cultivation of wheat, maize, and rice across the Po Valley, one of Europe’s most productive agricultural zones. Farmers in Lombardy, Emilia-Romagna, and Veneto actively adopt MAP and DAP fertilizers to boost crop yield and quality. Precision farming practices are widely used, supported by strong infrastructure and agri-tech investments. High mechanization levels and access to agricultural cooperatives further enhance fertilizer penetration and ensure consistent demand throughout the growing seasons.

Central Italy

Central Italy represents approximately 25% of the national phosphate fertilizers market in 2024. The region benefits from extensive production of cereals, sunflower, and horticultural crops across Tuscany, Umbria, and Marche. Fertilizer demand is supported by diversified farming systems combining open-field and greenhouse cultivation. MAP and TSP are popular due to their compatibility with soil conditions and support for high-value crops like vineyards and olive groves. Local cooperatives and training programs promote balanced fertilizer use, improving soil fertility management and encouraging sustainable farming practices that align with regional environmental goals.

Southern Italy

Southern Italy captures around 20% of the phosphate fertilizers market, with growth led by cereals, citrus fruits, and vegetables. Regions such as Puglia, Campania, and Calabria rely heavily on fertilizers to address lower natural soil fertility and improve productivity. Government support programs incentivize modern nutrient management practices, increasing adoption of SSP and water-soluble MAP. Despite smaller farm sizes, demand grows steadily due to rising export potential for specialty crops. Infrastructure development and digital farming initiatives are helping optimize phosphate fertilizer usage and reduce environmental impact across the region’s diverse agricultural systems.

Islands (Sicily and Sardinia)

The islands collectively account for nearly 15% of the Italy phosphate fertilizers market in 2024. Sicily dominates island demand with its strong production of citrus fruits, grapes, and horticultural crops that require phosphorus-rich fertilizers. Sardinia contributes mainly through cereals and forage crops. Farmers prefer SSP and TSP due to their effectiveness in improving soil phosphorus levels in Mediterranean conditions. Adoption of modern irrigation systems and greenhouse farming expands opportunities for water-soluble fertilizers. Regional focus on sustainable agriculture and growing agri-export activities continues to drive investment in phosphate fertilizer applications across both islands.

Market Segmentations:

By Product Type:

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application:

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

- Others

By Geography:

- Northern Italy

- Central Italy

- Southern Italy

- Islands (Sicily and Sardinia)

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yara International

- EuroChem Group

- ICL Group Ltd

- BASF SE

- OCI Nitrogen (OCI NV)

- Nutrien Ltd.

- CF Industries Holdings

- K+S AG

- Helm AG

- COMPO Expert GmbH

Recent Developments

- In December 2023, Yara announced that it is acquiring the organic-based fertilizer business of Agribios, a company in Italy. The acquisition includes a production facility in Ronco all’Adige, focused on sustainable farming solutions through organic-based and organo-mineral fertilizers. This deal aligns with Yara’s strategy to expand its offerings in regenerative agriculture, complementing its current mineral fertilizer portfolio.

- In May 2022, Coromandel International, a fertilizer manufacturer, plans to buy a 45% stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining firm based in Senegal Africa, for $19.6 million (approximately $150 crore).

- In May 2022, Indian Potash Ltd signed a five-year agreement with Israel Chemical Ltd to import 0.6-0.65 million tonnes of potash muriate annually.

- In February 2022, EuroChem Group (hereafter referred to as “EuroChem” or “the Group”), a leading global producer of fertilizer, recently announced that it had completed the acquisition of the Serra do Salitre phosphate project in Brazil.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand for high-yield cereals and grains.

- Precision farming adoption will increase fertilizer efficiency and reduce nutrient wastage.

- Demand for eco-friendly and low-emission phosphate fertilizers will rise under EU Green Deal targets.

- Water-soluble and specialty phosphate fertilizers will gain traction in greenhouse and horticulture farming.

- Major players will expand partnerships with cooperatives to strengthen distribution networks.

- Digital farming platforms will guide optimized fertilizer application and improve crop outcomes.

- Northern Italy will remain the largest regional market, driven by intensive agricultural activity.

- MAP will continue to dominate product demand due to balanced nutrient composition.

- Farmers will adopt integrated nutrient management to maintain soil health and comply with regulations.

- Investment in R&D will focus on sustainable formulations and efficiency-enhancing fertilizer technologies.