Market Overview:

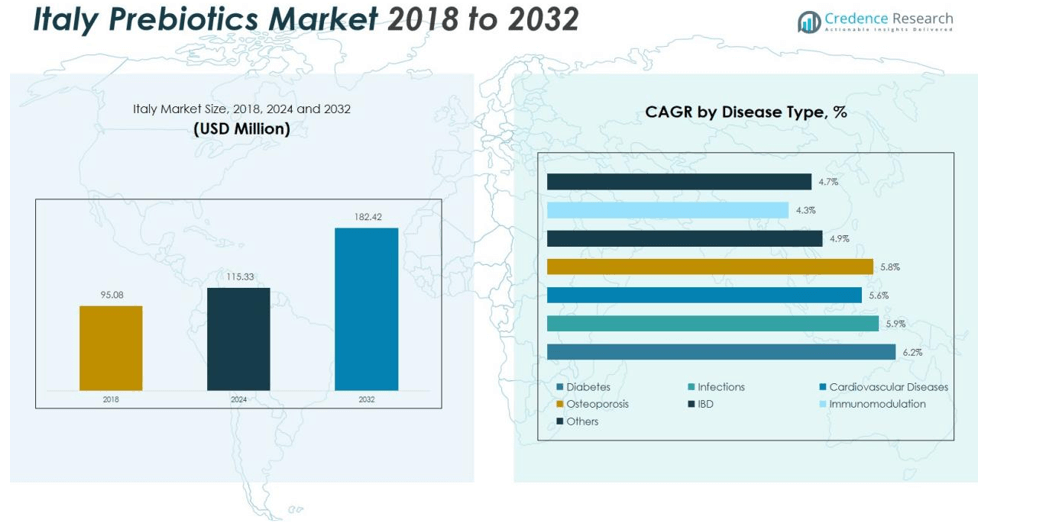

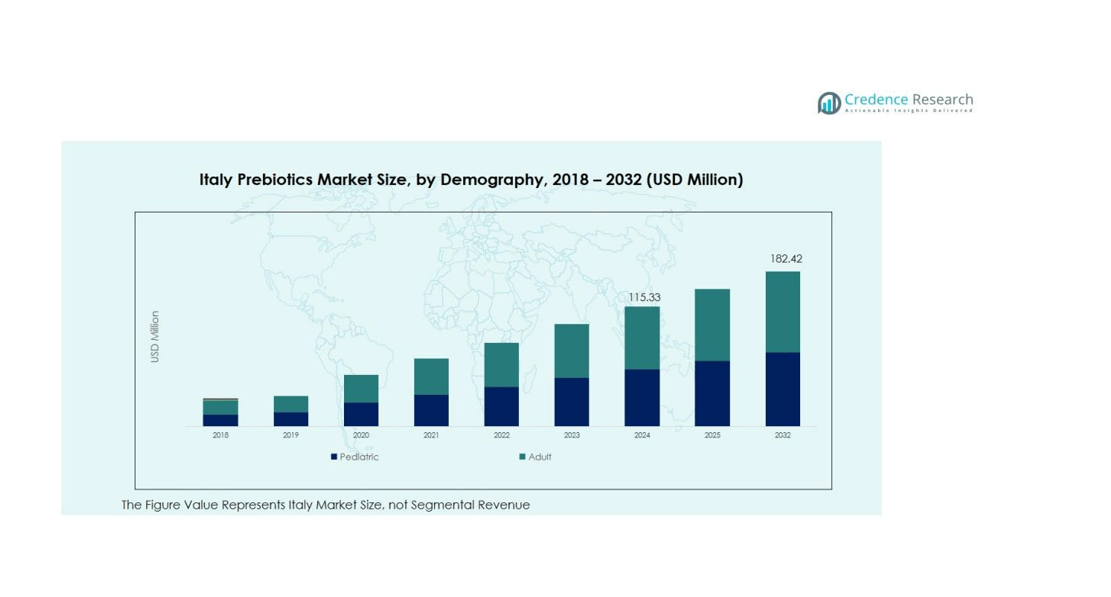

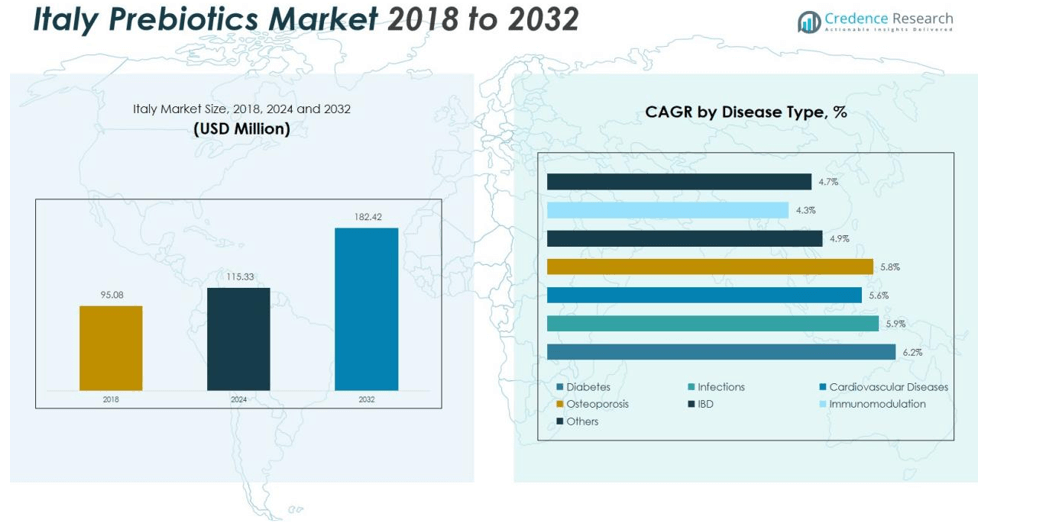

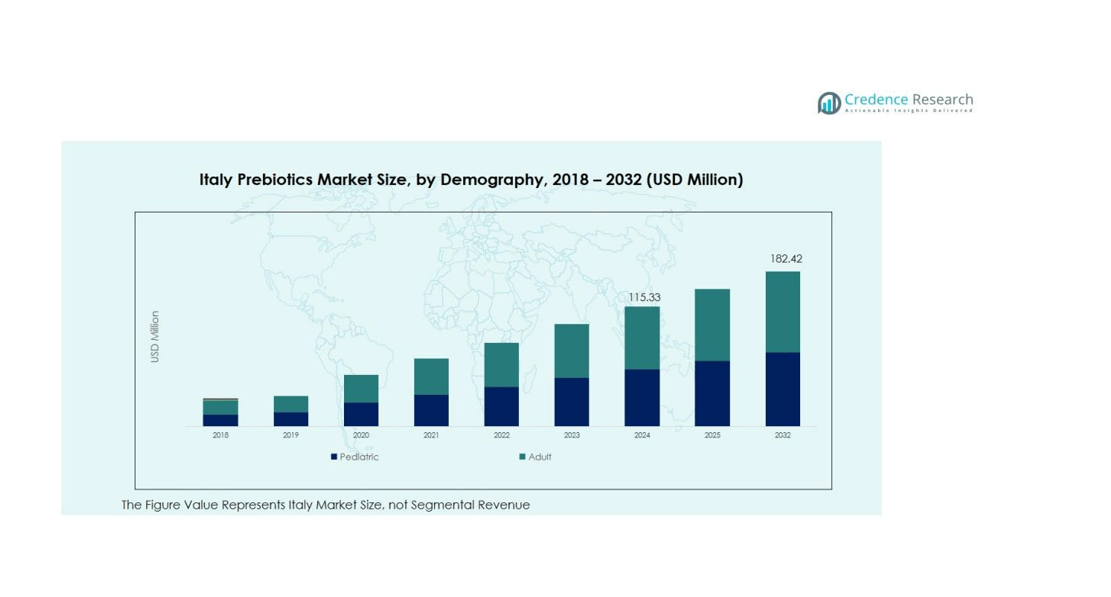

The Italy Prebiotics Market size was valued at USD 95.08 million in 2018 to USD 115.33 million in 2024 and is anticipated to reach USD 182.42 million by 2032, at a CAGR of 5.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Prebiotics Market Size 2024 |

USD 115.33 million |

| Italy Prebiotics Market, CAGR |

5.90% |

| Italy Prebiotics Market Size 2032 |

USD 182.42 million |

Strong consumer interest in digestive wellness and immunity enhancement remains a key driver of the Italy Prebiotics Market. The demand for clean-label and natural ingredients has encouraged manufacturers to integrate inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) into everyday food products. Supportive EU regulations for health claims and robust R&D investments by domestic and international firms continue to foster new product launches and technological advancements.

Regionally, Northern Italy dominates due to its established food processing sector, advanced retail networks, and high awareness of preventive healthcare. Central regions show increasing product adoption driven by urban lifestyles and rising disposable incomes. Southern Italy is emerging as a fast-growing area, supported by expanding nutraceutical distribution and growing acceptance of fortified food products.

Market Insights:

- The Italy Prebiotics Market was valued at USD 95.08 million in 2018, reaching USD 115.33 million in 2024, and is projected to attain USD 182.42 million by 2032, registering a CAGR of 5.90% during the forecast period.

- Northern Italy holds the largest share of 48% due to its advanced food processing industry, mature retail networks, and high consumer awareness of preventive health.

- Central Italy accounts for 32% of the market, supported by growing disposable incomes, urban lifestyles, and rising adoption of fortified food and nutraceutical products.

- Southern Italy, with a 20% share, is the fastest-growing region driven by improving retail infrastructure, nutraceutical expansion, and government-led health awareness initiatives.

- Among product segments, inulin leads with a 35% share, followed by fructo-oligosaccharides (FOS) at 28%, supported by their strong demand in dairy, bakery, and beverage applications promoting digestive health.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Digestive Health and Preventive Nutrition

Growing awareness of digestive wellness and immunity has become a major driver in the Italy Prebiotics Market. Consumers are increasingly choosing food products that promote gut microbiota balance and overall health. Manufacturers are introducing prebiotic ingredients such as inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) in functional foods. It benefits from the expanding demand for clean-label and naturally derived products aligned with preventive healthcare trends. The focus on wellness and disease prevention continues to shape consumer choices across Italy.

- For Instance, BENEO invested €90 million to boost chicory root fibre capacity by 30% while reducing specific energy consumption by 35% at its Pemuco production plant to meet rising demand for digestive health ingredients

Growing Integration of Prebiotics in Food and Beverage Products

The inclusion of prebiotics in dairy, bakery, and beverage segments has strengthened product portfolios for leading food manufacturers. Companies are reformulating existing product lines to meet rising consumer interest in functional nutrition. It enables the market to capitalize on the increasing preference for fortified and plant-based food alternatives. Strong partnerships between food producers and ingredient suppliers are enhancing prebiotic use in mainstream products. This trend supports higher consumption rates and long-term market expansion.

- For Instance, Danone launched its Oikos Fusion yogurt drink, enriched with 5 grams of prebiotic fiber and 23 grams of protein per 7-ounce bottle. This launch follows the Oikos brand’s 40% retail sales increase in 2024, which was driven by rising demand for gut-health and high-protein dairy products.

Regulatory Support and Innovation Encouraging Market Growth

Supportive European Union health regulations have accelerated product approvals and innovation in Italy. Favorable policies allow manufacturers to make health claims that build consumer trust. It encourages companies to invest more in research and development to create advanced formulations. Local and international brands are expanding portfolios with clinically tested ingredients. The stable regulatory environment continues to strengthen Italy’s position as a competitive prebiotics market in Europe.

Rising Investments in Nutraceutical and Pharmaceutical Applications

Increasing applications in nutraceuticals and pharmaceuticals are broadening the scope of prebiotic use. Companies are focusing on developing prebiotic-based supplements targeting immunity, digestion, and metabolism. It helps the market diversify beyond traditional food sectors. Strong R&D collaboration between Italian and global firms supports innovation in advanced formulations. This expansion toward healthcare-oriented products is expected to sustain long-term demand across the nation.

Market Trends:

Expansion of Functional and Clean-Label Food Formulations

The Italy Prebiotics Market is witnessing a steady shift toward functional and clean-label product innovations. Consumers are demanding transparency, minimal processing, and natural ingredient sourcing in prebiotic formulations. Manufacturers are reformulating dairy, bakery, and beverage products to integrate inulin and oligosaccharides that support gut health. It benefits from the growing popularity of plant-based and vegan diets that emphasize digestive wellness and sustainability. Food companies are introducing new fortified and low-sugar options to attract health-conscious buyers. The trend is also shaping private-label growth in supermarkets, supported by higher awareness of preventive health nutrition.

- For instance, Chr. Hansen launched its BB-12 + FOS 10 ml prebiotic-probiotic shot in Italy—each dose delivers 1 × 10⁹ CFU and boasts a 24-month shelf life for enhanced digestive support.

Technological Advancements and Diversification Across Applications

Continuous advancements in extraction and formulation technologies are enabling wider use of prebiotics across sectors. Companies are adopting advanced enzymatic and fermentation processes to enhance ingredient stability and bioavailability. It supports the development of multifunctional products combining prebiotics with probiotics or fibers. The pharmaceutical and nutraceutical industries are also expanding prebiotic applications in supplements and medical nutrition. Collaborations between R&D centers and food-tech startups are driving innovation in personalized nutrition solutions. The trend reflects a broader transition toward science-backed, multifunctional health products tailored to evolving Italian consumer needs.

- For Instance, IFF, which acquired DuPont’s Nutrition & Biosciences business in 2021, owns the HOWARU® brand focused on probiotic strains. The company’s strains are supported by extensive research, including the NCFM® strain with over 100 clinical studies.

Market Challenges Analysis:

High Production Costs and Complex Supply Chain Management

The Italy Prebiotics Market faces challenges from high production costs and complex sourcing processes. Extraction and purification of inulin, FOS, and GOS require advanced technology, raising operational expenses. It increases the final product cost, making price competitiveness difficult for small and medium manufacturers. Dependence on imported raw materials further exposes producers to currency fluctuations and trade barriers. Limited domestic sourcing capacity continues to pressure margins and slow scalability for local companies. Supply chain disruptions also impact timely product delivery and availability in retail channels.

Low Consumer Awareness and Limited Market Penetration in Southern Regions

Consumer awareness about the long-term benefits of prebiotics remains lower in some regions of Italy. Rural and southern markets exhibit slower adoption due to limited education on digestive health and preventive nutrition. It restricts market penetration and reduces sales of fortified or functional foods outside major cities. Retailers often prioritize mainstream food categories, delaying the introduction of premium prebiotic products. The lack of structured marketing campaigns and limited distribution networks also hinder awareness. Addressing these gaps is essential to ensure balanced growth across all regions.

Market Opportunities:

Growing Potential in Functional and Fortified Food Development

The Italy Prebiotics Market holds strong opportunities in the functional and fortified food category. Rising consumer interest in gut-friendly, low-sugar, and clean-label foods is driving product innovation. It creates new avenues for manufacturers to integrate prebiotic fibers into dairy, bakery, and beverage products. Expanding vegan and plant-based diets further support market penetration among health-conscious consumers. Collaboration between ingredient suppliers and food brands can lead to diversified product portfolios. The increasing availability of prebiotic-enriched snacks, cereals, and drinks is expected to boost consumption across urban regions.

Expanding Use in Nutraceutical and Pharmaceutical Applications

Growing demand for digestive and immune health supplements is opening new opportunities in healthcare-focused applications. The Italy Prebiotics Market benefits from the rising popularity of nutraceutical formulations that combine prebiotics with probiotics. It allows manufacturers to address specific health issues such as metabolism regulation and nutrient absorption. Pharmaceutical companies are exploring prebiotic-based solutions for targeted gut therapies and clinical nutrition. Technological innovation and rising R&D investments support the creation of high-quality formulations with better efficacy. These advancements position prebiotics as key ingredients in Italy’s evolving preventive healthcare industry.

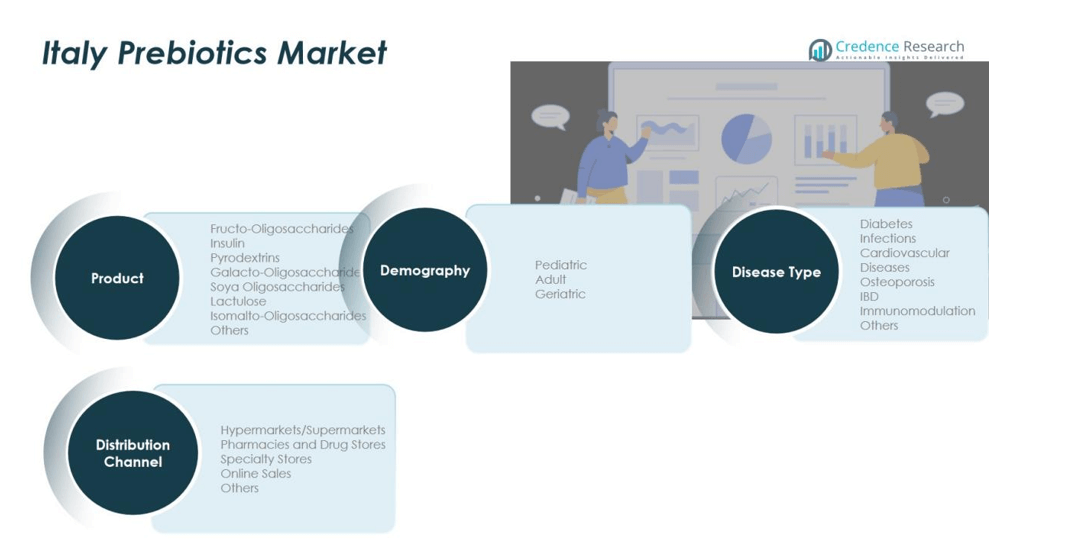

Market Segmentation Analysis:

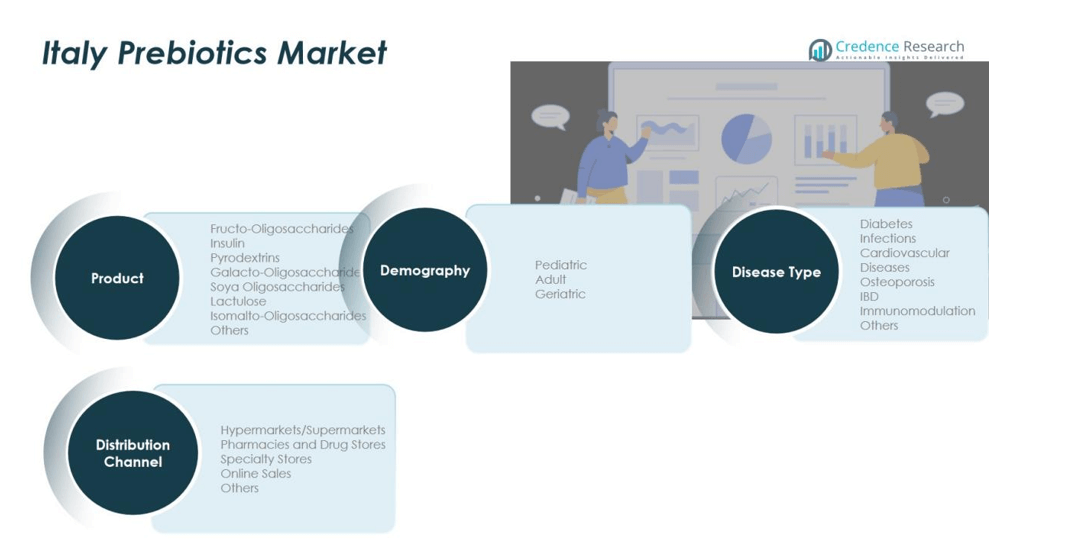

By Product Segment

The Italy Prebiotics Market demonstrates strong growth across multiple product categories, led by inulin and fructo-oligosaccharides (FOS). These segments dominate due to their extensive use in dairy, bakery, and beverage applications. It benefits from the versatility of galacto-oligosaccharides (GOS) and pyrodextrins, which enhance gut health and metabolic function. Lactulose and soya oligosaccharides are gaining traction in functional food formulations targeting digestive wellness. The demand for isomalto-oligosaccharides and other innovative compounds is also rising, supported by increased awareness of prebiotic benefits and growing product diversification.

- For instance, Italy’s inulin and FOS market is expected to be valued at approximately USD 62.72 million in 2025, with applications in dairy and bakery sectors driving a steady growth rate of 5.7% CAGR.

By Disease Type Segment

Prebiotics are increasingly used in managing chronic and lifestyle-related diseases in Italy. The Italy Prebiotics Market sees high adoption in diabetes management and cardiovascular health support. It also finds applications in immunity strengthening, osteoporosis prevention, and inflammatory bowel disease (IBD) care. Demand for immunomodulation-based formulations is expanding due to a shift toward preventive healthcare. Continuous clinical research and product validation reinforce the credibility of prebiotics as a functional ingredient for long-term health management.

- For Instance, Inulin supplementation has been shown to improve glycemic control and reduce HbA1c levels in meta-analyses and clinical trials involving individuals with prediabetes and type 2 diabetes.

By Distribution Channel Segment

Distribution diversification plays a vital role in expanding prebiotic access across Italy. Hypermarkets and supermarkets lead sales due to strong retail networks and visibility. Pharmacies and drug stores account for a growing share supported by nutraceutical demand. It benefits from rapid online expansion, where digital platforms promote functional food awareness. Specialty stores further enhance availability of premium and niche prebiotic brands across major Italian cities.

Segmentations:

By Product Segment

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type Segment

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- IBD (Inflammatory Bowel Disease)

- Immunomodulation

- Others

By Demography Segment

- Pediatric

- Adult

- Geriatric

By Distribution Channel Segment

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

Regional Analysis:

Dominance of Northern Italy Driven by Advanced Food and Beverage Industry

Northern Italy holds the largest share of the Italy Prebiotics Market, supported by strong industrial infrastructure and advanced manufacturing capabilities. The region benefits from a concentration of major food and beverage producers adopting prebiotic ingredients in functional and fortified foods. It maintains leadership through a mature retail network, high consumer awareness, and consistent demand for wellness-focused products. Cities such as Milan, Turin, and Bologna serve as innovation centers for product development and research. The presence of global brands and R&D investments further strengthens the region’s contribution to national market growth.

Emerging Growth in Central Italy Supported by Urban and Lifestyle Changes

Central Italy shows steady expansion, driven by increasing health awareness and changing dietary habits. The Italy Prebiotics Market in this region benefits from higher disposable incomes and growing interest in preventive nutrition. Consumers in cities like Rome and Florence are adopting functional foods and supplements containing inulin and oligosaccharides. Pharmacies and online stores are expanding distribution, enhancing accessibility across urban and suburban areas. It also reflects the growing alignment of consumer behavior with broader European wellness and sustainability trends.

Southern Italy and Islands Offering Untapped Market Potential

Southern Italy, including Sicily and Sardinia, represents a developing but promising region for future growth. The demand for prebiotics is increasing due to rising awareness about digestive and immune health. It is supported by expanding nutraceutical retail networks and growing availability of affordable fortified food products. Government health initiatives and educational campaigns are helping spread knowledge about dietary fibers and gut health. The gradual modernization of retail and healthcare infrastructure positions southern regions as important future contributors to national market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Nestlé S.A.

- OptiBac Probiotics Ltd.

- Archer Daniels Midland Company

- BioGaia AB

- Lallemand Inc.

- Kerry Group plc

- Hansen Holding A/S

- DuPont Nutrition & Biosciences

Competitive Analysis:

The Italy Prebiotics Market features strong competition among global and regional players focused on innovation, product quality, and distribution reach. Key companies include Danone S.A., Yakult Honsha Co., Ltd., Nestlé S.A., OptiBac Probiotics Ltd., Archer Daniels Midland Company, BioGaia AB, and Lallemand Inc. It remains highly competitive due to continuous advancements in formulation, growing consumer demand for functional foods, and regulatory support for health-based claims. Companies are investing in research and product diversification to strengthen their brand positioning and target different consumer segments. Strategic partnerships with local distributors and nutraceutical firms enhance market penetration and brand visibility. The focus on sustainable sourcing and clean-label formulations further differentiates market leaders in Italy’s evolving prebiotics landscape.

Recent Developments:

- In October 2025, Yakult Honsha completed a merger between Yakult Europe B.V. and Yakult Oesterreich GmbH, effective October 1, 2025, to enhance operational efficiency and strengthen sales activities across Austria.

- In August 2025, Nestlé entered a partnership with IBM Research to develop sustainable food packaging using generative AI, aiming to reduce plastic use through advanced, data‑driven material science.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Disease Type, Demography and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Prebiotics Market is expected to witness strong growth driven by rising health awareness and lifestyle changes.

- Demand for functional and clean-label foods will continue to expand across all age groups.

- Manufacturers will focus on integrating prebiotics into dairy, bakery, beverage, and plant-based food products.

- Technological innovations in extraction and formulation will improve ingredient stability and bioavailability.

- Pharmaceutical and nutraceutical sectors will increasingly adopt prebiotics for digestive and immune health applications.

- Online retail platforms will play a growing role in driving consumer access and brand visibility.

- Collaborations between ingredient suppliers, food manufacturers, and research institutions will enhance product innovation.

- Sustainable sourcing and eco-friendly production methods will gain greater emphasis among leading companies.

- Regional growth will intensify in Central and Southern Italy due to improving retail and healthcare infrastructure.

- The evolving preference for preventive healthcare and natural nutrition will secure long-term market stability.