Market Overview:

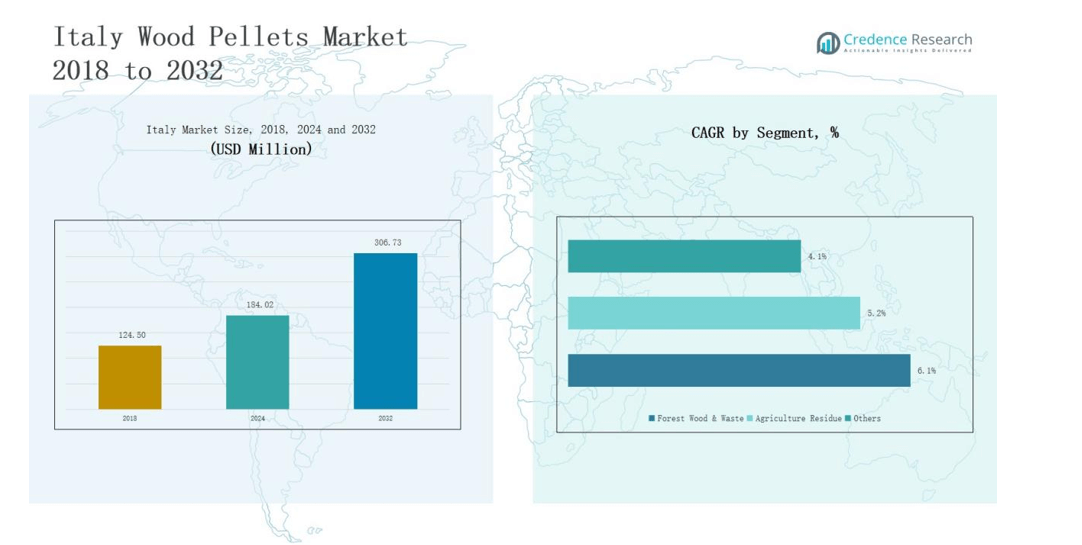

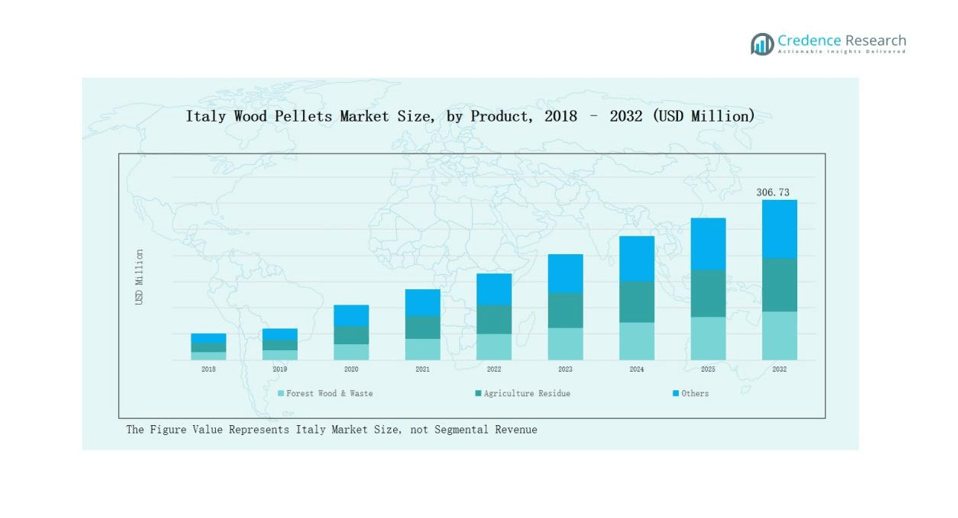

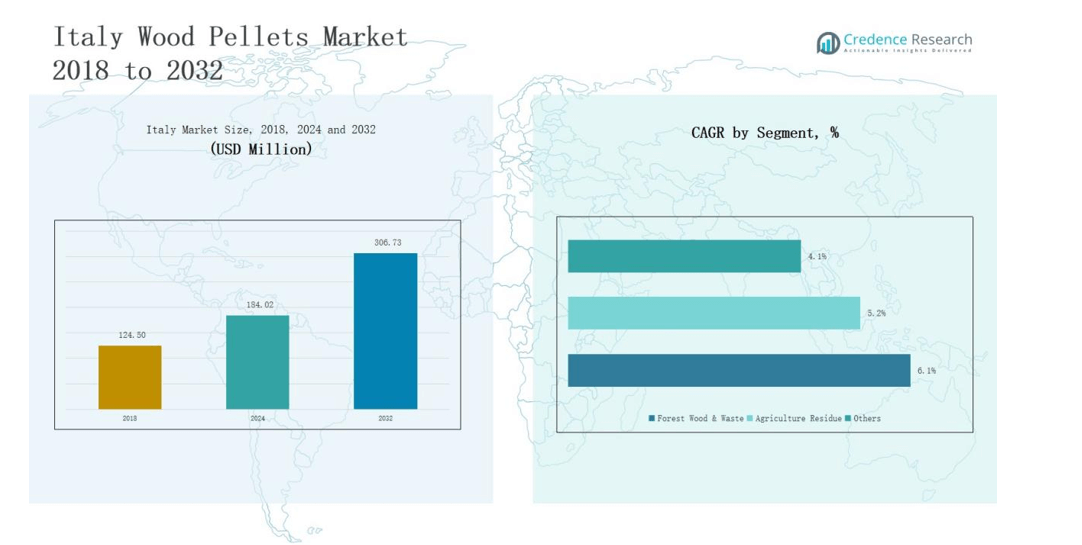

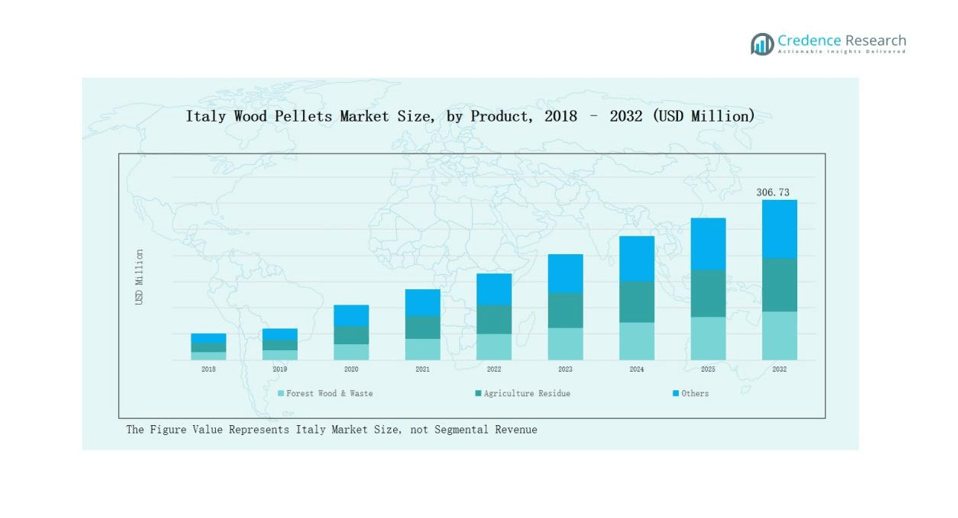

Italy Wood Pellets Market size was valued at USD 124.50 million in 2018 to USD 184.02 million in 2024 and is anticipated to reach USD 306.73 million by 2032, at a CAGR of 6.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Wood Pellets Market Size 2024 |

USD 184.02 million |

| Italy Wood Pellets Market, CAGR |

6.14% |

| Italy Wood Pellets Market Size 2032 |

USD 306.73 million |

The Italy Wood Pellets Market is shaped by a mix of established producers and regional suppliers focusing on sustainability, product quality, and distribution efficiency. Leading companies such as Gruppo Euroenergy, Biopellet Massa, Elegreen S.p.A., Gruppo Burgagna, Italiana Biomasse, Pellettificio del Garda, Pellets Italia S.r.l., and Cadel Energy play a central role in meeting rising demand for both industrial and residential pellets. These players strengthen their market positions through ENplus-certified products, long-term contracts, and strategic investments in production capacity. Regionally, Northern Italy leads the market with a 38% share in 2024, supported by advanced pellet processing facilities, abundant forestry resources, and a well-developed district heating infrastructure that ensures high consumption and reliable supply.

Market Insights

- The Italy Wood Pellets Market grew from USD 124.50 million in 2018 to USD 184.02 million in 2024 and is forecasted to reach USD 306.73 million by 2032, expanding at 6.14% CAGR.

- Forest wood & waste led the market with 67% share in 2024, supported by strong forestry resources and efficient processing, while agriculture residue held 23% and others 10%

- By application, industrial pellets for CHP/district heating dominated with 46% share in 2024, followed by residential/commercial heating at 27%, co-firing at 21%, and others at 6%.

- Northern Italy led regionally with 38% share in 2024, driven by forestry resources, biomass plants, and district heating networks, followed by Central Italy at 27%, Southern Italy at 20%, and Islands at 15%.

- Key players including Gruppo Euroenergy, Biopellet Massa, Elegreen S.p.A., Gruppo Burgagna, Italiana Biomasse, Pellettificio del Garda, Pellets Italia S.r.l., and Cadel Energy are strengthening positions through certification, long-term contracts, and production investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Forest wood & waste dominates the Italy Wood Pellets Market, accounting for nearly 67% share in 2024. Its leadership is driven by Italy’s strong forestry resources, efficient wood processing facilities, and well-established supply chains that ensure consistent raw material availability. Agriculture residue holds around 23% share, supported by growing use of crop waste for renewable fuel in rural regions. The remaining 10% share is captured by other sources, including mixed biomass and recycled materials, reflecting the industry’s diversification efforts.

- For instance, ENEA (Italian National Agency for New Technologies, Energy, and Sustainable Economic Development) has piloted projects utilizing pruning residues from vineyards and olive groves for pellet production in southern Italy.

By Application

Industrial pellets for CHP/district heating lead the market with 46% share in 2024, supported by Italy’s expanding district heating networks and government incentives promoting renewable heat generation. Industrial pellets for co-firing hold about 21% share, largely driven by coal-to-biomass transition in energy plants. Pellets for heating residential and commercial purposes account for 27% share, reflecting strong consumer demand for cost-efficient and eco-friendly heating systems. Other niche applications make up the remaining 6% share, covering small-scale industrial and institutional uses.

- For instance, A2A, Italy’s largest district heating operator, added over 50 km of new district heating pipelines in 2023, integrating biomass and waste-to-energy plants into Milan’s network.

Market Overview

Rising Demand for Renewable Heating Solutions

Italy’s focus on decarbonization and energy independence is driving the adoption of wood pellets as a renewable heating source. Increasing investments in biomass-based systems for residential and industrial heating are boosting consumption. Supportive government incentives and EU renewable targets are further accelerating the shift toward sustainable energy. Wood pellets offer cost-efficiency and carbon neutrality, making them a preferred alternative to fossil fuels. This growing reliance on clean heating solutions continues to strengthen Italy’s wood pellets market.

- For instance, MCZ Group, an Italian heating systems manufacturer, has expanded its range of pellet stoves that integrate with home automation systems, highlighting innovation in renewable heating technology.

Expansion of District Heating Networks

The expansion of district heating systems across Italian cities is creating strong demand for industrial pellets. Local municipalities and energy utilities are actively integrating biomass-based heating solutions to reduce emissions and improve efficiency. Government-backed projects focusing on renewable-based CHP installations are strengthening consumption volumes. Industrial pellets, with their consistent quality and large-scale supply capability, are positioned as the backbone of these networks. This infrastructure growth is expected to sustain long-term market expansion.

- For instance, in Bolzano, the municipal utility Alperia operates a biomass-fueled district heating plant that provides heat to more than 9,000 households while cutting CO₂ emissions by over 30,000 tons annually.

Utilization of Agricultural Residues

Italy’s strong agricultural base supports the growth of biomass fuel from crop residues. Increasing adoption of agricultural waste for pellet production helps diversify raw material sources and lowers production costs. This trend also addresses waste management challenges while promoting circular economy practices. Farmers and producers benefit from new revenue streams, while energy providers gain access to reliable biomass inputs. The dual advantage of sustainability and cost-effectiveness is making agricultural residue-based pellets an important growth driver in Italy.

Key Trends & Opportunities

Shift Toward Premium Pellet Quality

The Italian market is witnessing a clear shift toward premium ENplus-certified pellets. Rising consumer awareness regarding combustion efficiency, lower ash content, and reduced emissions is pushing demand for certified products. Manufacturers are investing in advanced processing technologies to ensure consistent quality standards. This trend is creating opportunities for producers to capture higher-value segments, particularly in residential heating. The focus on quality assurance is likely to strengthen Italy’s position as a leading European consumer of high-grade pellets.

- For instance, Fiemme Energia’s partnership with local district heating plants demonstrates how residential and community demand for certified pellets supports the premium segment.

Integration with Carbon Neutrality Goals

Italy’s long-term commitment to EU carbon neutrality targets is expanding opportunities for wood pellet adoption. Utilities and industries are increasingly co-firing biomass with coal to cut emissions. Residential users are adopting pellet stoves and boilers, encouraged by tax incentives and subsidies. This alignment with climate goals is expected to attract new investments in pellet manufacturing and distribution networks. The integration of biomass energy into national sustainability strategies presents significant growth potential for market players.

- For instance, Enel has tested biomass co-firing in its Fusina power plant near Venice, demonstrating the potential of biomass to replace part of coal-fired generation

Key Challenges

Supply Chain Dependence on Imports

Despite domestic production, Italy remains heavily dependent on imported wood pellets, especially from Eastern Europe. This reliance exposes the market to price volatility, logistics disruptions, and geopolitical risks. Fluctuations in supply often impact consumer affordability and hinder long-term planning for utilities and industries. Addressing this challenge requires strengthening domestic production capacity and building resilient sourcing partnerships. Reducing dependence on imports will be essential for achieving sustainable market growth.

High Competition from Alternative Renewables

Italy’s renewable energy landscape is highly competitive, with solar, wind, and geothermal gaining strong traction. Government subsidies and consumer interest in these technologies sometimes overshadow biomass-based solutions. The convenience and scalability of other renewables limit the growth potential of wood pellets in certain segments. This competitive pressure challenges pellet producers to differentiate their products through cost efficiency, quality, and environmental benefits. Strategic positioning will be crucial to maintaining relevance against rival renewable sources.

Stringent Sustainability Regulations

The Italy Wood Pellets Market faces regulatory pressure related to sustainability and emissions. EU directives and national policies demand strict compliance on raw material sourcing, certification, and production standards. Smaller producers often struggle to meet these requirements due to high costs. Non-compliance risks penalties, reduced market access, and loss of consumer trust. Balancing compliance with profitability remains a critical challenge for many stakeholders, particularly in a market where sustainability is central to long-term growth.

Regional Analysis

Northern Italy

Northern Italy holds the largest share of the Italy Wood Pellets Market with 38% in 2024. The region benefits from strong forestry resources, advanced pellet processing facilities, and a high concentration of biomass power plants. District heating systems are widely established, driving large-scale consumption of industrial pellets. Cross-border trade with Central Europe further strengthens supply security. Residential users in alpine and colder areas also prefer pellets for cost-effective heating. Northern Italy continues to lead market growth through infrastructure, logistics, and proximity to major production hubs.

Central Italy

Central Italy accounts for 27% share in 2024, driven by a mix of industrial and residential demand. The region hosts several medium-sized pellet producers that focus on both domestic use and export. Expanding adoption of pellet stoves and boilers in rural households is fueling growth. Government incentives for renewable heating systems are improving affordability for consumers. Central Italy’s balanced mix of agricultural residue and forest wood use supports production diversity. It remains an important contributor to Italy’s pellet supply chain.

Southern Italy

Southern Italy represents 20% share in 2024, with growth supported by rising residential demand and gradual adoption in small industries. The warmer climate limits pellet usage compared to northern regions, but adoption is increasing due to cost savings over fossil fuels. Import reliance is higher in the south due to weaker local production capacity. Expanding logistics networks and subsidies are expected to strengthen adoption rates. Agricultural residues provide a potential raw material source, improving local supply prospects. The region is gradually gaining importance in the national market landscape.

Islands (Sicily and Sardinia)

The islands of Sicily and Sardinia hold 15% share in 2024, mainly driven by residential heating needs and seasonal demand. Supply challenges due to geographic isolation increase reliance on imports and raise costs for consumers. Despite these barriers, the islands are adopting pellet-based heating to reduce dependence on traditional fuels. Local governments are promoting renewable energy projects that include biomass integration. Growing environmental awareness is also encouraging the use of ENplus-certified pellets. The islands’ contribution, though smaller, remains essential for nationwide market coverage.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By region

- Northern Italy

- Central Italy

- Southern Italy

Competitive Landscape

The Italy Wood Pellets Market is moderately fragmented, with a mix of established producers, regional suppliers, and specialized biomass companies competing for market share. Leading players such as Gruppo Euroenergy, Biopellet Massa, Elegreen S.p.A., and Gruppo Burgagna dominate through strong production capacities, robust distribution networks, and long-term supply agreements with industrial users. Companies like Italiana Biomasse and Pellettificio del Garda focus on sustainable sourcing and ENplus-certified premium pellets, catering to the rising demand in residential heating. Smaller firms including Pellets Italia S.r.l. and Cadel Energy compete by serving niche regional markets and emphasizing cost efficiency. Market participants are investing in technological upgrades, production expansion, and certification compliance to maintain competitiveness under strict EU sustainability regulations. With increasing reliance on biomass for both district heating and residential use, competition is intensifying, driving innovation, partnerships, and diversification of raw material sourcing strategies to secure long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Gruppo Euroenergy

- Biopellet Massa

- Elegreen S.p.A.

- Gruppo Burgagna

- Italiana Biomasse

- Pellettificio del Garda

- Pellets Italia S.r.l.

- Cadel Energy

- Others

Recent Developments

- In June 2025, Green Alliance, an Italian renewable energy distributor, announced the acquisition of BioEnergy Europe – Pellet and Fire, a Sicily-based biomass distributor. The deal is aimed at strengthening Green Alliance’s presence in southern Italy and enhancing its role in the woody biomass energy sector.

- In September 2023, Enel Green Power announced upgrades to its biomass processing facilities in Italy. The improvements aim to enhance efficiency in pellet production and support the country’s renewable energy objectives.

- In January 2025, Cadel Energy highlighted its focus on innovative pellet stove solutions during an interview with CEO Massimo Daruos.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium ENplus-certified pellets will increase due to rising consumer awareness.

- Expansion of district heating projects will continue to drive industrial pellet consumption.

- Government incentives will support wider adoption of pellet stoves and boilers in households.

- Domestic production capacity will expand to reduce dependence on imported pellets.

- Agricultural residues will gain greater use as a sustainable raw material source.

- Investments in logistics infrastructure will improve distribution efficiency across all regions.

- Producers will adopt advanced processing technologies to ensure consistent product quality.

- Strategic partnerships will strengthen supply security and enhance market competitiveness.

- Environmental regulations will push companies to improve sourcing transparency and certification.

- Rising preference for cost-effective renewable heating will sustain long-term market growth.