Market Overview:

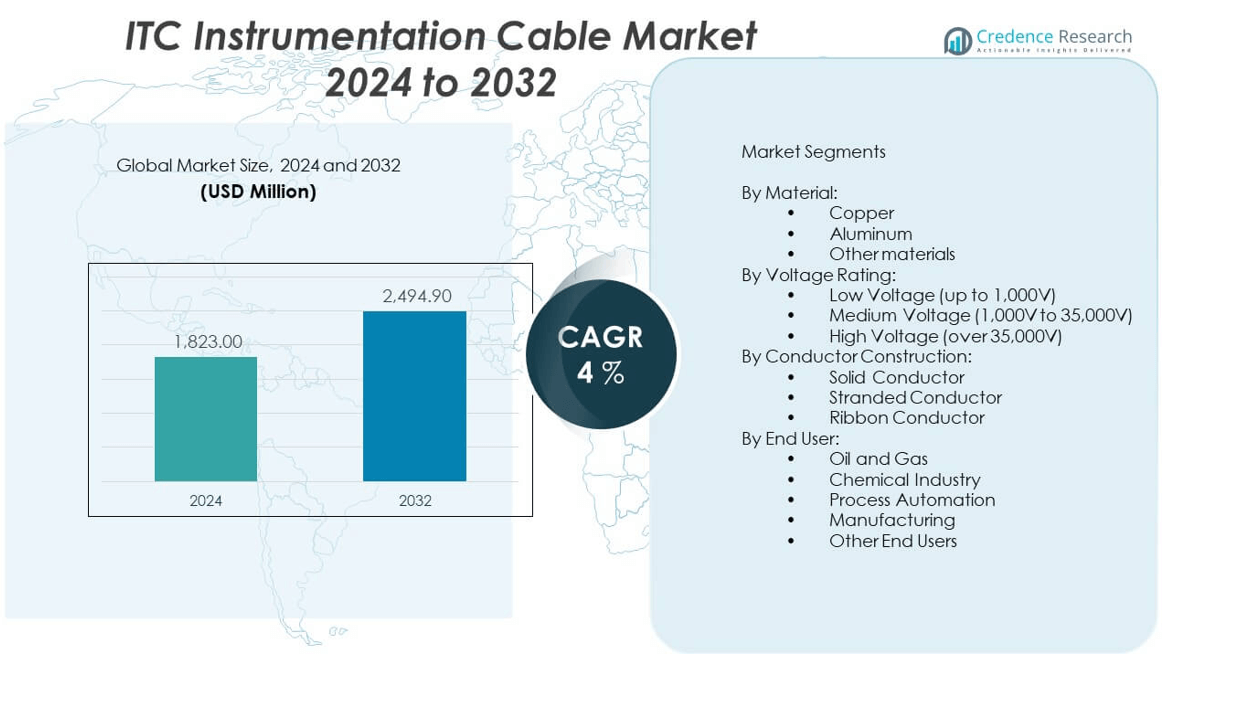

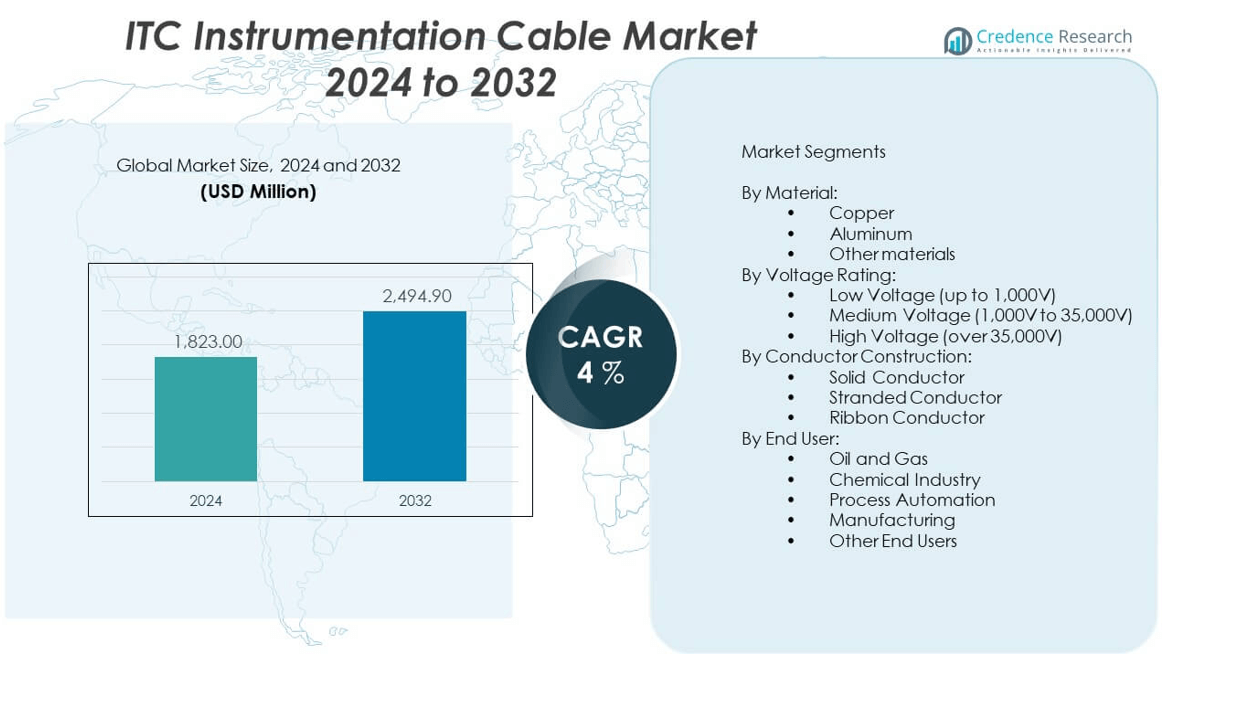

The ITC instrumentation cable market is projected to grow from USD 1,823 million in 2024 to an estimated USD 2,494.9 million by 2032, with a compound annual growth rate (CAGR) of 4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| ITC instrumentation cable market Size 2024 |

USD 1,823 million |

| ITC instrumentation cable market, CAGR |

4% |

| ITC instrumentation cable market Size 2032 |

USD 2,494.9 million |

The market is witnessing steady growth driven by rising demand for reliable signal transmission in industrial environments. As industries across sectors such as oil & gas, manufacturing, and utilities modernize their operations, the need for robust instrumentation and control (ITC) cables has surged. These cables support data acquisition, control signals, and automation systems, ensuring safety and performance. Technological advancements, increasing automation, and stringent safety regulations are collectively fostering broader adoption of ITC instrumentation cables in mission-critical applications.

Geographically, North America and Europe lead the market due to well-established industrial infrastructure, extensive automation, and stringent regulatory frameworks supporting high-quality cable installations. The United States, Germany, and the United Kingdom remain at the forefront due to strong demand in energy and industrial sectors. In contrast, Asia-Pacific is emerging as the fastest-growing region, fueled by rapid industrialization in China, India, and Southeast Asian countries. Investments in smart factories, energy projects, and infrastructure expansion are intensifying demand across these developing markets, positioning the region as a critical growth hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The ITC instrumentation cable market is projected to grow from USD 1,823 million in 2024 to USD 2,494.9 million by 2032, registering a CAGR of 4% during the forecast period.

- Rising automation across oil & gas, manufacturing, and utilities is driving demand for reliable signal transmission solutions, boosting adoption of ITC instrumentation cables.

- Strict industrial safety regulations and increased use of remote monitoring systems are accelerating the need for shielded, fire-resistant cables.

- High initial installation costs and material price fluctuations, especially in copper and polymers, limit profitability and procurement in budget-constrained projects.

- The market faces restraints due to the lack of standardized global cable specifications, leading to complex compliance requirements across regions.

- North America and Europe dominate the market share due to advanced industrial bases, frequent retrofitting, and adherence to stringent safety codes.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization, infrastructure investments, and expanding automation in China, India, and Southeast Asia.

Market Drivers:

Surge in Industrial Automation Across Critical Sectors Fuels Cable Demand:

Industries across manufacturing, oil and gas, and utilities are adopting automated control systems at a faster pace. These systems require precise and uninterrupted signal transmission, which increases the reliance on instrumentation cables. The ITC instrumentation cable market benefits from this automation shift, particularly in applications demanding strict monitoring and safety. Automation reduces manual intervention and enhances efficiency, which aligns with the capabilities of ITC cables. Industrial expansions in sectors like chemical processing and water treatment facilities also raise cable installation requirements. Safety-critical zones require shielded cables with high thermal and chemical resistance, making ITC cables the preferred choice. With rising global energy demand, plants are scaling their automation systems, further supporting cable deployment. The ITC instrumentation cable market remains integral to meeting these industrial connectivity standards.

- For instance, Sumitomo Electric’s PureAccess series optical cables boast ultra-low attenuation of ≤0.32dB/km at 1,310nm, enabling high-performance data transfer in modern automated industrial plants, with fiber counts scaling up to 6,912 fibers per cable to fit large-scale installations.

Strict Safety Standards and Regulatory Requirements Drive Cable Usage:

Government and industry bodies enforce strict safety and fire-resistance standards for electrical installations. Instrumentation cables must comply with these to ensure safe signal transmission in hazardous and non-hazardous environments. The ITC instrumentation cable market is directly influenced by these regulatory frameworks, particularly in sectors like oil and gas. Operators in such fields need cables with low smoke, zero halogen, and fire-retardant properties to reduce the risk of failure. Compliance with NEC, IEC, and UL standards has pushed manufacturers to innovate and improve cable performance. Regulatory audits and certifications encourage industries to replace outdated wiring with compliant alternatives. The need to meet operational safety thresholds accelerates the demand for tested and certified cables. It continues to support infrastructure upgrades in refineries, power plants, and process industries.

- For instance, Prysmian Group’s Seaflame™ Ultra Fire Resistant Cables are certified to maintain circuit integrity at temperatures up to 1,050 °C for six hours and withstand offshore jet fires at 1,200 °C for 30 minutes, far surpassing IEC 60311-21 requirements for critical oil, gas, and petrochemical installations.

Expansion of Power Generation and Transmission Infrastructure Stimulates Demand:

Global investment in energy generation—particularly in renewables and transmission systems—is expanding. These projects require reliable instrumentation for measurement, control, and communication within distributed systems. The ITC instrumentation cable market supports this demand by offering rugged solutions that withstand harsh outdoor and industrial conditions. Power plants and substations use these cables to maintain operational stability and signal integrity. Renewable energy installations like solar and wind farms require long-distance data transmission, prompting greater use of shielded ITC cables. Infrastructure upgrades in aging grids in Europe and North America present replacement opportunities. New grid development in emerging regions opens up further application scope. It helps deliver the connectivity backbone for modern energy systems across utility networks.

Growth of Smart Cities and Infrastructure Modernization Enhances Cable Installations:

Urban development projects focusing on intelligent transport, water systems, and energy efficiency require advanced cabling. The ITC instrumentation cable market gains traction from such smart infrastructure initiatives. These projects demand continuous monitoring and remote control through robust data cables. Instrumentation cables enable real-time feedback in building automation, utility metering, and public safety systems. It supports complex interconnections among IoT-enabled devices in urban networks. Smart lighting, surveillance, and communication frameworks rely on stable and shielded signal transmission. Countries across Asia and the Middle East invest heavily in next-gen cities, opening up strong cable demand. Infrastructure modernization in older cities also drives retrofitting with updated cable solutions. It ensures operational reliability across expanding smart city frameworks.

Market Trends:

Rising Demand for Fire-Resistant and Low-Smoke Cable Variants:

Fire safety concerns are driving investments in cables that limit toxic emissions during combustion. The ITC instrumentation cable market is experiencing rising demand for low-smoke zero-halogen (LSZH) and fire-retardant cables. These cables help protect human life and critical assets in the event of a fire, especially in confined industrial areas. Regulatory norms across regions are pushing utilities and manufacturers to replace standard cables with safer alternatives. It encourages product innovation focused on insulation and sheath materials that meet safety thresholds. Public infrastructure projects and hospitals particularly prioritize such cables to reduce risk exposure. LSZH cables are also gaining preference in transportation hubs such as airports and rail stations. The demand trend supports long-term shifts toward safety-centric installations. It signals a transition toward performance beyond just signal transmission.

- For instance, Polycab India Limited’s FR-LSH (Flame Retardant Low Smoke and Halogen) instrumentation cables provide low smoke emission and high shielding efficiency, meeting BS EN 50288-7 standards, and are engineered for process industries where toxic smoke reduction is critical, with maximum DC resistance of 36.7Ω/km for 0.5sq.mm copper conductors ensuring dependable signal transmission in emergencies

Adoption of Pre-Terminated and Plug-and-Play Cable Systems:

Time and labor cost pressures have prompted industries to adopt factory-terminated cables that simplify installation. The ITC instrumentation cable market reflects this trend through rising adoption of plug-and-play systems. These pre-assembled cable kits help reduce downtime during commissioning or maintenance. It helps industries shorten project timelines and reduce human error in complex installations. Contractors and system integrators prefer such products to meet fast-track project needs. Pre-configured cables are gaining traction in modular plants and mobile substations. This trend aligns with the broader movement toward lean manufacturing and process agility. Growth in prefabricated and skid-mounted industrial units reinforces the relevance of such cable offerings. It supports higher productivity without compromising system integrity.

- For instance, Nexans’ plug-and-play cable harnesses for offshore wind turbines reduce installation times by up to 30% and increase reliability, supporting multi-gigabit data speeds and allowing for core counts and cable lengths adapted precisely to project requirements, thus minimizing human error and downtime during deployment in utility and renewable energy sectors

Integration of Digital Twins and Remote Monitoring Drives Advanced Cabling:

The use of digital twins in process industries has increased demand for high-integrity, real-time data transmission. The ITC instrumentation cable market responds to this trend by providing shielded, noise-resistant cables compatible with smart instrumentation. Industries simulate and monitor physical assets through real-time data, requiring uninterrupted cable performance. It facilitates integration of remote condition monitoring systems across multiple assets. High-frequency, low-noise cables support connectivity in distributed digital systems. The trend reflects the shift toward predictive maintenance and digital control. Oil rigs, chemical plants, and utilities deploy these systems to improve efficiency and reduce downtime. Advanced cabling systems enable these digital transformations in critical infrastructure. It elevates the strategic value of instrumentation cable installations.

Sustainability and Circular Economy Principles Shape Material Choices:

Corporate sustainability mandates are influencing cable manufacturers to explore greener materials. The ITC instrumentation cable market is seeing a trend toward recyclable sheath and insulation compounds. Buyers seek to reduce environmental impact without compromising mechanical and electrical performance. It drives investment in halogen-free compounds and bio-based polymers. Regulatory pressure to reduce e-waste and promote recycling enhances focus on material circularity. Green building certifications and ESG benchmarks encourage project owners to select sustainable cabling solutions. It creates differentiation in the cable supply chain and influences product design strategy. Lifecycle assessment and end-of-life recyclability become product selection criteria. The trend supports a broader shift toward environmentally conscious cable procurement and deployment.

Market Challenges Analysis:

Fluctuating Raw Material Prices Disrupt Supply Stability and Cost Control:

Cable manufacturers rely on metals like copper and aluminum and polymers like PVC and PE, all of which are subject to price volatility. The ITC instrumentation cable market faces profitability pressures when raw material prices fluctuate. Manufacturers often struggle to balance long-term supply agreements with sudden material cost spikes. It complicates inventory management and pricing strategies across global distribution networks. Geopolitical risks, trade restrictions, and supply chain disruptions amplify this challenge. Smaller cable manufacturers lack the purchasing power to hedge against commodity fluctuations. End users may delay procurement during periods of high prices, impacting overall market momentum. Unpredictable material costs weaken the consistency of contract bids and project timelines. The market must find efficient sourcing and price stabilization mechanisms to mitigate this issue.

Limited Standardization Across Regions Delays Adoption in Global Projects:

Instrumentation cable standards vary widely across geographies, posing compliance and interoperability issues. The ITC instrumentation cable market must navigate differing regulatory expectations, certifications, and approval processes. Lack of global harmonization slows down cross-border deployments, particularly in multinational projects. Manufacturers need to produce region-specific variants to meet country-level codes, which increases production complexity. End-users may face compatibility challenges when integrating global systems. Project delays often occur due to third-party certification bottlenecks or mismatched technical specifications. It affects product rollout and inventory consolidation for OEMs and contractors. The absence of unified standards also raises testing costs and approval lead times. It limits economies of scale for global suppliers in the instrumentation cable segment.

Market Opportunities:

Expanding Investment in Renewable Energy and Smart Grid Modernization:

Global energy transition goals are prompting large-scale investments in wind, solar, and grid modernization. The ITC instrumentation cable market benefits from these initiatives as each system requires robust signal transmission infrastructure. It enables control, protection, and measurement systems within renewable and distributed energy setups. These cables play a critical role in ensuring reliability across high-voltage and data-sensitive operations. Emerging economies building their energy backbone present strong opportunity zones. The rise of microgrids and battery energy storage systems further expands the scope for ITC cable deployment. It supports intelligent infrastructure growth within sustainable energy transitions.

Growth of Automation in Water and Wastewater Treatment Infrastructure:

Urbanization and environmental regulation are driving investment in water and wastewater automation. The ITC instrumentation cable market stands to gain from this shift, given its role in enabling sensor, control, and monitoring systems in treatment plants. It supports remote data acquisition, flow control, and process optimization in decentralized systems. Many cities upgrade old infrastructure and adopt smart metering, boosting the need for instrumentation cables. Industrial users are also increasing their treatment capacity to meet discharge regulations. It creates scalable demand across both municipal and private sectors.

Market Segmentation Analysis:

By Material: Copper Leads with Specialized Materials Gaining Ground

The ITC instrumentation cable market is primarily dominated by copper due to its superior conductivity, durability, and performance in critical environments. Aluminum serves as a cost-efficient substitute where weight or budget constraints are present but offers lower conductivity and flexibility. Other materials—including fiber optic, composite, silver-plated, nickel-plated, and hybrid variants—are gaining traction in demanding applications that require enhanced shielding, corrosion resistance, or high-frequency performance. These specialty cables find relevance in sectors such as aerospace, data infrastructure, and precision automation.

- For instance, Aluminum serves as a cost-efficient substitute where weight or budget constraints are present but offers lower conductivity and flexibility. Other materials—including fiber optic, composite, silver-plated, nickel-plated, and hybrid variants—are gaining traction in demanding applications. For instance, LS Cable & System’s enhanced single-mode optical fibers support transmission across the full spectrum from 1,260nm to 1,625nm, providing a 50% increase in usable spectral range and facilitating high-speed data in precision automation and aerospace.

By Voltage Rating: Low Voltage Segment Holds Majority Share

Low voltage (up to 1,000V) cables command the largest market share, supported by widespread use in standard industrial instrumentation and control systems. Medium voltage (1,000V to 35,000V) solutions cater to high-insulation and longer-distance applications, typically in energy-intensive or large-scale operations. High voltage (above 35,000V) instrumentation cables are used selectively in specialized segments such as utility networks or substation monitoring where enhanced power and signal control is critical.

- For instance, LAPP Tannehill’s Type ITC tray cable is UL 2250 certified for 300V operation, tailored for sensitive control and instrumentation signals in industrial automation—backed by broad code compliance and application across the oil, gas, and process sectors.

By Conductor Construction: Stranded Conductors Remain the Preferred Choice

Stranded conductor cables dominate the ITC instrumentation cable market due to their flexibility, ease of handling, and resistance to vibration and mechanical stress. Solid conductors offer higher structural stability and are suited to static installations. Ribbon conductors, while niche, are used in compact or layered installations such as in modular control panels and industrial enclosures where space optimization is essential.

By End User: Oil and Gas Sector Drives Strong, Sustained Demand

The oil and gas industry is the leading consumer of ITC instrumentation cables, requiring high-reliability signal transmission in hazardous zones. The chemical industry also drives significant demand, with a focus on process safety and monitoring. Process automation across manufacturing sectors continues to grow cable requirements for sensor, actuator, and control integration. Other end users, including power generation and telecommunications, rely on these cables to ensure stable communication and monitoring across complex infrastructure systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Material:

- Copper

- Aluminum

- Other materials

By Voltage Rating:

- Low Voltage (up to 1,000V)

- Medium Voltage (1,000V to 35,000V)

- High Voltage (over 35,000V)

By Conductor Construction:

- Solid Conductor

- Stranded Conductor

- Ribbon Conductor

By End User:

- Oil and Gas

- Chemical Industry

- Process Automation

- Manufacturing

- Other End Users

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Dominates the Market with Strong Industrial and Infrastructure Growth

Asia-Pacific holds the largest share of the ITC instrumentation cable market, accounting for approximately 34.5% of global revenue. Rapid industrialization across China, India, South Korea, and Southeast Asia drives demand for instrumentation cables in process automation, manufacturing, and energy infrastructure. These countries are heavily investing in refinery expansions, chemical processing, and smart factories. Public infrastructure development and government-led energy diversification programs further support widespread cable deployment. It benefits from strong local production, export competitiveness, and growing adoption of automation in water treatment, power, and telecom sectors. The region remains central to long-term volume growth and manufacturing scalability.

Europe and North America Maintain Strong Positions with Mature Industrial Bases

Western and Eastern Europe together contribute approximately 25.2% to the global ITC instrumentation cable market, driven by stringent industrial standards, ongoing retrofitting, and focus on energy efficiency. Germany, the UK, France, and Poland lead in cable installations across process industries and power distribution. Regulatory mandates surrounding fire safety and operational reliability encourage frequent cable upgrades. North America follows with a market share of around 21.8%, supported by stable demand from oil and gas operations, refineries, and utilities in the U.S. and Canada. It benefits from high replacement cycles and consistent investment in automation across both public and private sectors. Both regions rely heavily on certified, performance-grade cables tailored to complex operational environments.

Middle East, South America, and Africa Exhibit Steady and Emerging Growth Patterns

The Middle East accounts for approximately 8.6% of the global ITC instrumentation cable market, largely supported by investments in oil, gas, and water infrastructure. Countries such as Saudi Arabia and the UAE prioritize advanced control systems in refining, desalination, and power projects. South America contributes around 6.3%, with Brazil and Argentina witnessing moderate growth from refinery upgrades, mining operations, and regional manufacturing. Africa holds the smallest share at roughly 3.6%, but represents long-term growth potential through industrial development, electrification, and smart grid projects. It continues to see gradual adoption as energy access and industrial automation improve across key economies.

Key Player Analysis:

- Polycab India Limited

- Sumitomo Electric Industries Ltd.

- Southwire Company LLC

- Nexans S.A.

- LS Cable & System

- Belden Inc.

- Prysmian Group

- Turck Inc.

- Mueller Electric

- Bahra Advanced Cable Manufacture Co. Ltd.

- Shawflex

- Lapp Tannehill Inc.

- Northwire Inc.

- Multi Cable Corporation

- TE Wire And Cable LLC

- Caledonian Cables Ltd.

Competitive Analysis:

The ITC instrumentation cable market is moderately consolidated, with a mix of global giants and regional specialists competing on quality, customization, and compliance. Key players such as Prysmian Group, Nexans, Belden Inc., and Polycab India Limited lead through diversified portfolios, large-scale production, and robust distribution networks. These companies invest in fire-resistant, low-smoke, and halogen-free technologies to meet evolving safety regulations. Emerging manufacturers focus on high-performance variants and localized supply to serve niche applications. It maintains intense competition driven by contract-based industrial procurement, regulatory certifications, and technical differentiation. Continuous innovation and cost-efficiency remain central to market positioning.

Recent Developments:

- In March 2025, Sumitomo Electric Industries, Ltd. announced a high-profile partnership with 3M to advance expanded beam optical interconnect technology for data centers. The collaboration will enable Sumitomo Electric to offer optical fiber connectivity products featuring 3M’s Expanded Beam Optical (EBO) Interconnect technology, targeting next-generation data center applications and boosting their portfolio and technological innovation in the field of fiber and cable assembly.

- On July 30, 2025, Prysmian Group received the Gold Innovators’ Award at ISE EXPO 2025 for its SiroccoXT™ Microduct Cable, setting new benchmarks in fiber density and reliability for the telecommunications and ITC instrumentation cable market. The company has also invested substantially in expanding its fiber optic cable manufacturing capabilities, including a $30 million investment in its Jackson, Tennessee plant.

- On July 1, 2025, LS Cable & System USA expanded its partnership with Mountain States Agency to include the Busway Division, strengthening its distribution network and reaching more industrial and infrastructure customers. This move supports LS Cable’s objective of broadening its footprint in the instrumentation and specialized cable market through robust regional representation.

- In May 2025, Prysmian Group also introduced OneSolar, an integrated offering for the solar industry featuring advanced photovoltaic and optical fiber cabling to meet the growing needs of renewable energy projects—industries increasingly reliant on reliable instrumentation and ITC cables. The launch was showcased during Cleanpower 2025 in Phoenix, Arizona.

Market Concentration & Characteristics:

The ITC instrumentation cable market features a moderate to high concentration, with leading firms controlling a significant share through global reach and technical capabilities. It exhibits characteristics of a mature market with steady demand from automation-intensive industries and critical infrastructure. Product differentiation hinges on insulation type, shielding, voltage capacity, and compliance standards. Innovation centers around safety, sustainability, and digital integration. Procurement cycles tend to be project-driven, favoring suppliers with customization, certification, and delivery reliability. Entry barriers include technical expertise, testing facilities, and regulatory adherence.

Report Coverage:

The research report offers an in-depth analysis based on type, voltage rating, conductor construction, end-user industry, and regional distribution. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise with increased automation in energy and manufacturing sectors.

- Smart grid and renewable energy projects will expand cable usage.

- Adoption of fire-resistant and halogen-free variants will accelerate.

- Asia-Pacific will continue leading growth due to industrial investments.

- Partnerships with automation firms will strengthen product integration.

- Digital twin systems and remote monitoring will increase cable sophistication.

- Material innovation will drive demand for hybrid and composite cables.

- Retrofitting in mature economies will create steady replacement demand.

- Sustainability initiatives will shape insulation and packaging trends.

- Compliance with evolving safety standards will guide product development.