| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Digital Payment Market Size 2024 |

USD 7040.78 Million |

| Japan Digital Payment Market, CAGR |

11.38% |

| Japan Digital Payment Market Size 2032 |

USD 16675.47 Million |

Market Overview:

The Japan Digital Payment Market is projected to grow from USD 7040.78 million in 2024 to an estimated USD 16675.47 million by 2032, with a compound annual growth rate (CAGR) of 11.38% from 2024 to 2032.

The growth of Japan’s digital payment market is driven by several key factors. Technological advancements have played a major role, with innovations such as biometric authentication, contactless payments, and blockchain technology enhancing the security and efficiency of digital payment systems. This has fostered consumer trust and facilitated widespread adoption. The Japanese government has also been instrumental in promoting a cashless society, setting ambitious targets for cashless transactions and offering incentives to both businesses and consumers. This policy-driven approach has accelerated the transition to digital payments. Additionally, the continued expansion of e-commerce has significantly increased the demand for seamless and secure online payment methods. Consumers are increasingly prioritizing convenience, with mobile wallets and digital payment apps gaining popularity, particularly among younger demographics. These factors collectively contribute to the robust growth of the digital payment market in Japan.

Japan’s digital payment market exhibits regional variation in terms of adoption and growth. The Kanto region, which includes the capital city of Tokyo, stands as the dominant player due to its high population density, advanced technological infrastructure, and concentration of financial and tech companies. Tokyo, as a global financial hub, is at the forefront of digital payment adoption. Other regions such as Kansai, which includes cities like Osaka and Kyoto, and Chubu, encompassing Nagoya, are also witnessing increased adoption of digital payment systems, driven by regional economic growth, government incentives, and rising consumer awareness. While Kanto remains the leader, the expansion of digital payment solutions across various regions ensures that Japan is progressively becoming a more cashless society, with digital payments available to consumers nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Digital Payment Market is projected to grow significantly, with a compound annual growth rate (CAGR) of 11.38% from 2024 to 2032.

- Technological advancements, including biometric authentication, contactless payments, and blockchain, are enhancing the security and efficiency of digital transactions, contributing to widespread adoption.

- The Japanese government’s initiatives to promote a cashless society, such as subsidies and tax incentives, are accelerating the shift towards digital payments.

- E-commerce growth is a key driver, with consumers demanding secure and seamless digital payment options for online transactions.

- Changing consumer behavior, particularly among younger generations, is fueling the adoption of mobile wallets and digital payment applications for everyday transactions.

- Regional disparities exist, with urban centers like Tokyo leading in adoption, while rural areas face infrastructure challenges that limit digital payment accessibility.

- Data privacy and security concerns remain a barrier, as consumers worry about the safety of their personal information in digital payment systems.

Market Drivers:

Technological Advancements

The rapid pace of technological innovation is one of the primary drivers fueling the growth of Japan’s digital payment market. Advances in mobile technology, such as the widespread adoption of smartphones and the development of secure payment apps, have made digital payments more accessible and convenient for consumers. The integration of biometric authentication, including facial recognition and fingerprint scanning, has further enhanced the security of digital transactions, reassuring users and encouraging wider adoption. For instance, LIFE CARD, a leading Japanese credit card issuer, recently launched biometric payment cards to improve security and ease of use. Additionally, innovations in blockchain technology have improved the transparency and security of transactions, contributing to greater consumer confidence in digital payment systems. These technological advancements continue to evolve, making digital payments faster, more secure, and increasingly attractive to both consumers and businesses.

Government Support and Policies

Government policies and initiatives have been instrumental in driving the adoption of digital payments across Japan. The Japanese government has set ambitious targets to promote a cashless society, aiming to increase the proportion of cashless payments to 40% by 2025. To achieve this, the government has introduced a variety of incentives for businesses and consumers, such as offering subsidies to small and medium-sized enterprises (SMEs) that adopt digital payment solutions and providing tax benefits for cashless transactions. The government has also implemented measures to ensure the safety and security of digital payment systems, creating a regulatory framework that fosters trust among users. These government-driven initiatives have played a critical role in accelerating the shift towards digital payments in the country.

E-commerce Growth

The expansion of e-commerce has been another key driver in the growth of Japan’s digital payment market. As online shopping continues to grow in popularity, the demand for seamless and secure online payment methods has surged. For instance, digital wallets like PayPay and LINE Pay are increasingly being used for online shopping due to their convenience and security. Moreover, buy-now-pay-later (BNPL) services such as Paidy have gained traction among younger consumers for their flexible payment options. Consumers increasingly expect quick, secure, and convenient payment options when making online purchases, which has led to a broader adoption of digital payment solutions. This trend is further supported by the rising number of Japanese consumers embracing e-commerce platforms and the increasing frequency of online transactions, thereby accelerating the demand for digital payment solutions.

Changing Consumer Behavior

Changing consumer behavior is a significant factor contributing to the growth of the digital payment market in Japan. There has been a marked shift in consumer preferences towards more convenient and efficient payment methods. Younger generations, in particular, are increasingly favoring digital wallets and mobile payment applications due to their ease of use and the convenience of making transactions without the need for physical cash or cards. Furthermore, the COVID-19 pandemic accelerated this shift, as many consumers turned to contactless and digital payment options to reduce physical interaction and avoid the handling of cash. As a result, the adoption of digital payment methods has become deeply embedded in the daily lives of Japanese consumers, with a growing preference for cashless and cardless transactions across various sectors.

Market Trends:

Expansion of Mobile Payment Platforms

Japan’s digital payment landscape is witnessing significant growth in mobile payment platforms. Services such as PayPay, Rakuten Pay, and Line Pay have seen substantial increases in user adoption. For instance, PayPay has experienced significant growth in its user base. As of August 2024, the mobile payment service reported having over 65 million registered users, making it one of Japan’s most popular mobile wallets. highlighting the widespread acceptance of mobile wallets. This surge is attributed to user-friendly interfaces, attractive incentives, and seamless integration with various retail and online platforms. As consumers increasingly prefer the convenience of mobile payments, these platforms are becoming integral to daily transactions.

Integration of Advanced Payment Technologies

The integration of advanced payment technologies is transforming Japan’s digital payment market. The adoption of contactless payments, enabled by near-field communication (NFC) technology, has streamlined the payment process, reducing transaction times and enhancing user convenience. This technology’s seamless experience has led to its widespread acceptance among consumers and merchants alike, contributing to the growth of cashless transactions. Additionally, the exploration of central bank digital currencies (CBDCs) reflects Japan’s commitment to staying at the forefront of payment innovations, aiming to enhance the efficiency and security of digital transactions.

Rise of E-commerce and Online Transactions

The rise of e-commerce has greatly supported the growth of the digital payment market in Japan. The expansion of online shopping, combined with a strong e-commerce infrastructure, has increased consumer trust in digital transactions and highlighted the convenience of using digital payment options. As more consumers opt for online platforms to purchase goods and services, the need for efficient and secure digital payment solutions continues to grow, driving further development in the market. Additionally, advancements in mobile payment technologies and the widespread adoption of smartphones have further accelerated this trend.

Government Initiatives Towards a Cashless Society

The Japanese government’s proactive initiatives have significantly influenced the digital payment market’s growth. Efforts to promote a cashless society include setting targets to increase cashless payments and providing incentives for businesses and consumers to adopt digital payment methods. For instance, through initiatives like the “Cashless Vision,” it aims to achieve 40% cashless transactions by 2025. As of 2023, These measures aim to enhance transaction efficiency, reduce costs associated with cash handling, and stimulate economic activity. By investing in digital infrastructure and supporting policies, the government fosters an environment conducive to the expansion of digital payment solutions, aligning with broader goals of economic modernization and technological advancement.

Market Challenges Analysis:

Cultural Preference for Cash Transactions

Despite the global shift towards digital payments, Japan’s deep-rooted cultural affinity for cash poses a significant challenge to the widespread adoption of digital payment methods. Cash is often perceived as secure and tangible, leading many consumers, especially older generations, to favor it over digital alternatives. This preference results in a slower transition to cashless transactions compared to other developed nations.

Data Privacy and Security Concerns

As digital payment adoption increases, so do concerns about data privacy and security. Japanese consumers express apprehension over potential data breaches, unauthorized access to personal information, and vulnerabilities within digital payment platforms. These security concerns hinder full trust and confidence in digital payment systems, slowing their adoption rate.

Infrastructure Disparities

While urban centers like Tokyo and Osaka experience a surge in digital payment usage, rural areas and smaller businesses often lack the necessary infrastructure to support these systems. The absence of adequate digital payment facilities in these regions limits the convenience and accessibility of cashless transactions, contributing to a digital divide within the country.

Regulatory and Standardization Challenges

Japan’s digital payment market faces complexities due to a fragmented regulatory environment and the need for standardization. The coexistence of various payment platforms, each with unique features and compatibility requirements, can lead to confusion among consumers and merchants. For instance, recent regulatory updates, such as the mandate for EMV 3-D Secure (3DS) by March 2025, aim to enhance security but may increase compliance costs for businesses. Aligning these systems under unified standards is essential for seamless interoperability and broader acceptance of digital payment methods.

Market Opportunities:

The continued growth of e-commerce presents a significant opportunity for the Japan digital payment market. As online shopping continues to gain traction among consumers, there is an increasing demand for secure, efficient, and seamless payment solutions. With Japan’s e-commerce market projected to grow steadily in the coming years, digital payment systems are well-positioned to capture a larger share of the market. Additionally, the rise of online services, such as streaming platforms, online education, and digital entertainment, further boosts the need for convenient digital payment methods. By offering tailored solutions to meet the needs of e-commerce platforms and online service providers, digital payment companies can tap into a growing segment of the market, ensuring a steady demand for their services.

The Japanese government’s strong commitment to promoting a cashless society offers a significant market opportunity for digital payment providers. Through initiatives like subsidies for small businesses adopting cashless payment systems and nationwide campaigns encouraging digital transactions, the government is actively fostering an environment conducive to digital payment adoption. As more businesses, particularly in the retail and hospitality sectors, integrate digital payment solutions to meet customer demands, there is an opportunity for payment providers to expand their presence. Furthermore, the potential introduction of central bank digital currencies (CBDCs) presents an additional opportunity to innovate and provide a secure, state-backed alternative to existing payment solutions. These factors create a favorable market environment for continued expansion and innovation in the digital payment space.

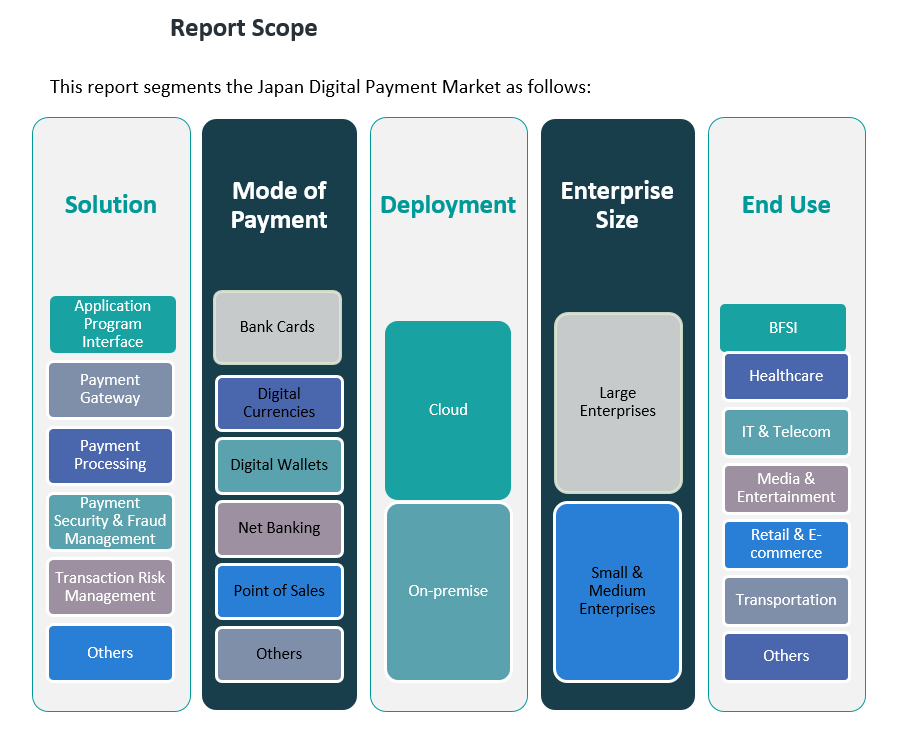

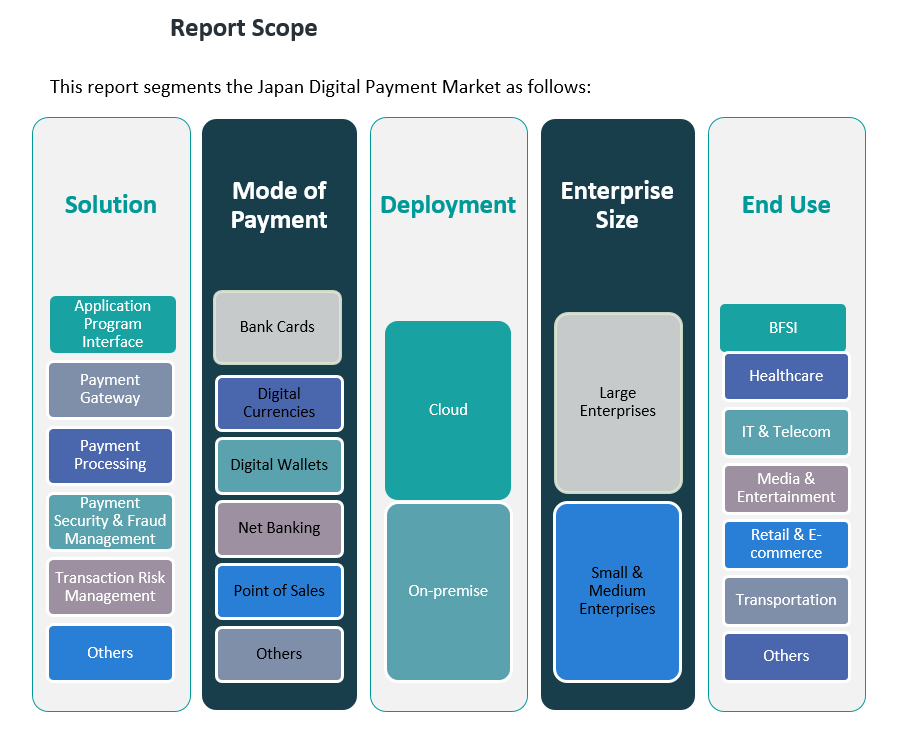

Market Segmentation Analysis:

The Japan Digital Payment Market is segmented across various dimensions, each contributing uniquely to its growth.

By Solution Segment:

The market is categorized into several solutions. The Mode of Payment Program Interface and Payment Gateway are essential for enabling secure transactions across various platforms. Payment Processing plays a pivotal role in ensuring seamless transactions, while Payment Security & Fraud Management focuses on safeguarding digital transactions, addressing security concerns. The Others segment includes emerging solutions and services that cater to niche needs.

By Mode of Payment Segment:

This segment includes Bank Cards, a traditional and widely used method for digital payments. Digital Currencies are gaining traction as alternative payment methods, driven by growing interest in cryptocurrencies. Digital Wallets continue to experience rapid adoption, especially among younger consumers. Net Banking remains a popular choice for online payments, particularly for larger transactions, while the Others category includes payment methods like buy-now-pay-later services.

By Deployment Segment:

Digital payments are primarily deployed in two forms: Cloud, offering flexibility and scalability, and On-premise solutions, preferred by enterprises seeking full control over their payment systems.

By Enterprise Size Segment:

The market is segmented into Large Enterprises, which have the resources to integrate comprehensive payment solutions, and Small & Medium Enterprises, which are increasingly adopting digital payment methods to enhance efficiency and cater to changing consumer preferences.

By End-Use Segment:

Key sectors such as BFSI (Banking, Financial Services, and Insurance), Healthcare, IT & Telecom, and Media & Entertainment drive digital payment adoption, with the Others segment representing industries like retail and education that also leverage digital payments for enhanced customer experience.

Segmentation:

By Solution Segment:

- Mode of Payment Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Others

By Mode of Payment Segment:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

By Deployment Segment:

By Enterprise Size Segment:

- Large Enterprises

- Small & Medium Enterprises

By End-Use Segment:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT & Telecom

- Media & Entertainment

- Others

Regional Analysis:

Japan’s digital payment market exhibits significant regional disparities, with certain areas demonstrating higher adoption rates due to factors such as population density, technological infrastructure, and economic activity.

Kanto Region

The Kanto region, encompassing Tokyo, Yokohama, and Chiba, leads Japan’s digital payment landscape, accounting for approximately 45% of the market share. This dominance is attributed to its dense population, advanced digital infrastructure, and the presence of numerous financial and technological institutions. The region’s tech-savvy populace and high smartphone penetration have fostered widespread acceptance of digital payment solutions.

Kansai Region

The Kansai region, which includes Osaka, Kyoto, and Kobe, holds about 25% of the digital payment market share. Known for its vibrant commercial activities and cultural significance, Kansai has seen a growing adoption of digital payments among both consumers and businesses. Major retailers and small enterprises are increasingly implementing digital payment systems to cater to the evolving preferences of a tech-aware customer base.

Chubu Region

The Chubu region, featuring cities like Nagoya, represents a significant portion of Japan’s digital payment market. Renowned for its robust manufacturing and commercial sectors, Chubu’s diverse economy has led to a steady increase in digital payment adoption. Both industrial and service industries are embracing digital transactions, contributing to the region’s growing market share.

Other Regions

Regions such as Kyushu-Okinawa, Tohoku, Chugoku, and Shikoku are experiencing gradual growth in digital payment adoption. Urban centers and tourist destinations within these areas are witnessing increased usage of mobile payments and contactless transactions. For instance, cities like Fukuoka and Naha are benefiting from tourism, which drives demand for convenient payment options. Similarly, regions like Tohoku and Chugoku are observing a shift towards digital payments as younger, tech-savvy populations seek convenience.

Key Player Analysis:

- Rakuten Pay

- LINE Pay

- Origami

- PayPal Holdings, Inc.

- Smartpay Bank Direct

Competitive Analysis:

Japan’s digital payment market is characterized by a dynamic competitive landscape, featuring a blend of established financial institutions and innovative fintech startups. Key players include LINE Pay, Rakuten Pay, Origami, and Mitsubishi UFJ Financial Group. These companies are actively enhancing their services through strategic partnerships and technological advancements to meet the evolving demands of consumers and businesses. The market is also witnessing significant investments and expansions. For instance, Rakuten Card aims to nearly double its annual operating profit to 100 billion yen by expanding into the largely untapped business-to-business payments sector. Similarly, Digital Wallet Group has expanded its international money transfer service, Smiles Mobile Remittance, to multiple countries, enhancing its global footprint. These developments underscore the competitive vigor within Japan’s digital payment sector, as companies strive to innovate and capture a larger market share

Recent Developments:

- In January 2024, PayPay Corporation expanded its cashless payment services to support international users from South Korea, Singapore, Malaysia, and Macau. This integration enables tourists to use their native payment apps like Naver Pay and Toss in Japan via the “user scan method.” This initiative is part of Japan’s broader efforts to streamline digital payments under the New Tourism Nation Promotion Basic Plan launched in April 2023. The adoption of standardized QR codes (JPQR), expected by 2025, further supports cross-border payment acceptance and enhances tourist experiences.

Market Concentration & Characteristics:

Japan’s digital payment market is experiencing significant growth, driven by technological advancements and changing consumer preferences. The market is characterized by the increasing adoption of digital wallets, mobile payments, and contactless transactions as more consumers shift toward cashless solutions. This trend is further fueled by the expansion of e-commerce platforms and the broader acceptance of digital payment methods across various sectors. The competitive landscape in Japan’s digital payment market is moderately concentrated, with a few dominant players holding substantial market shares. Major companies such as LINE Pay, Rakuten Pay, and Origami are actively innovating and offering user-friendly payment solutions, contributing to market expansion. These companies are continuously enhancing their services through strategic partnerships, technological advancements, and incentives to attract and retain consumers. Additionally, government initiatives aimed at promoting a cashless society have further accelerated the adoption of digital payments across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Solution Segment, By Mode of Payment Segment, By Deployment Segment, By Enterprise Size Segment and By End-Use Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan digital payment market is expected to continue expanding at a robust pace, driven by technological advancements and increasing consumer adoption of cashless transactions.

- Mobile payment platforms like LINE Pay and Rakuten Pay will increasingly dominate the market as consumers prefer the convenience of smartphone-based payments.

- Government initiatives will play a critical role in promoting digital payments through policies encouraging cashless transactions and offering incentives for adoption.

- Contactless payment methods will become more widespread, particularly in public transportation and retail environments.

- Increased e-commerce activity will further drive the demand for secure and seamless online payment solutions.

- The rise of cross-border payments will lead to more global digital payment systems operating within Japan, expanding market options for consumers.

- The growing influence of fintech startups will introduce more innovative and specialized payment solutions in the market.

- Integration of advanced security features like biometric authentication will enhance consumer confidence in digital payment systems.

- Regional disparities in digital payment adoption will gradually narrow as rural areas and smaller businesses embrace cashless solutions.

- Ongoing collaboration between financial institutions and tech companies will continue to improve payment infrastructure, increasing overall market efficiency.