Market Overview

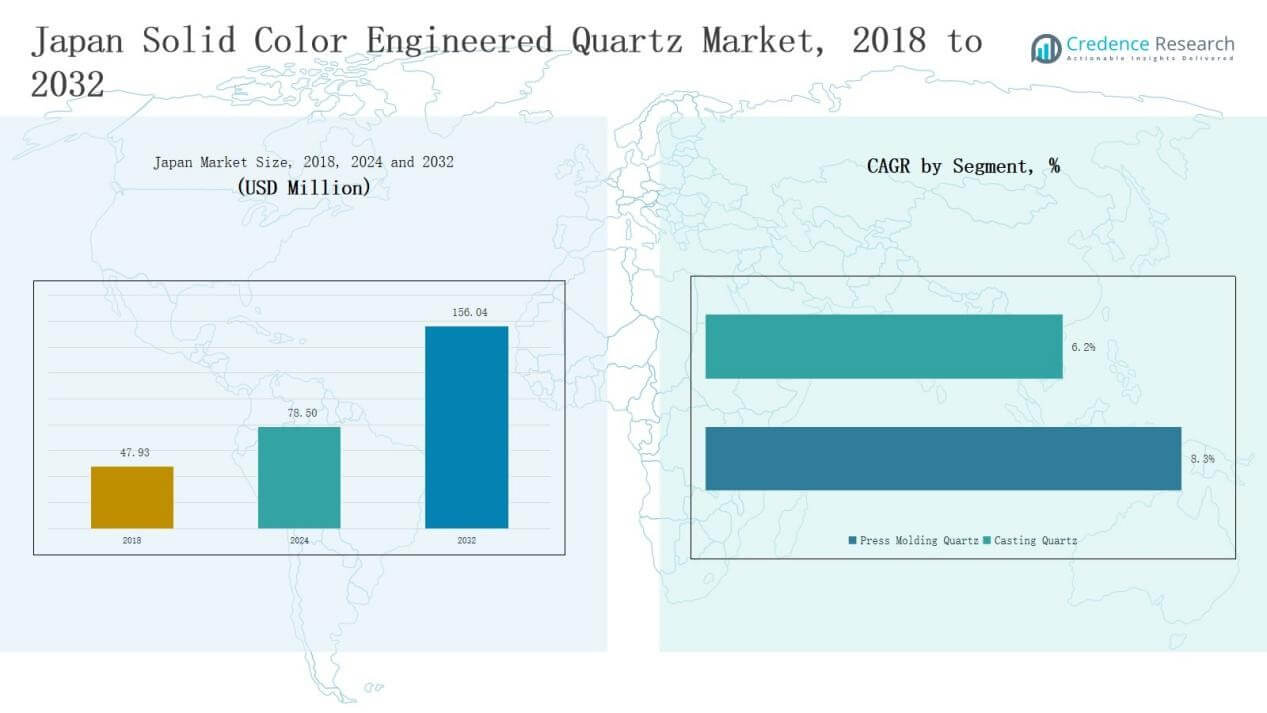

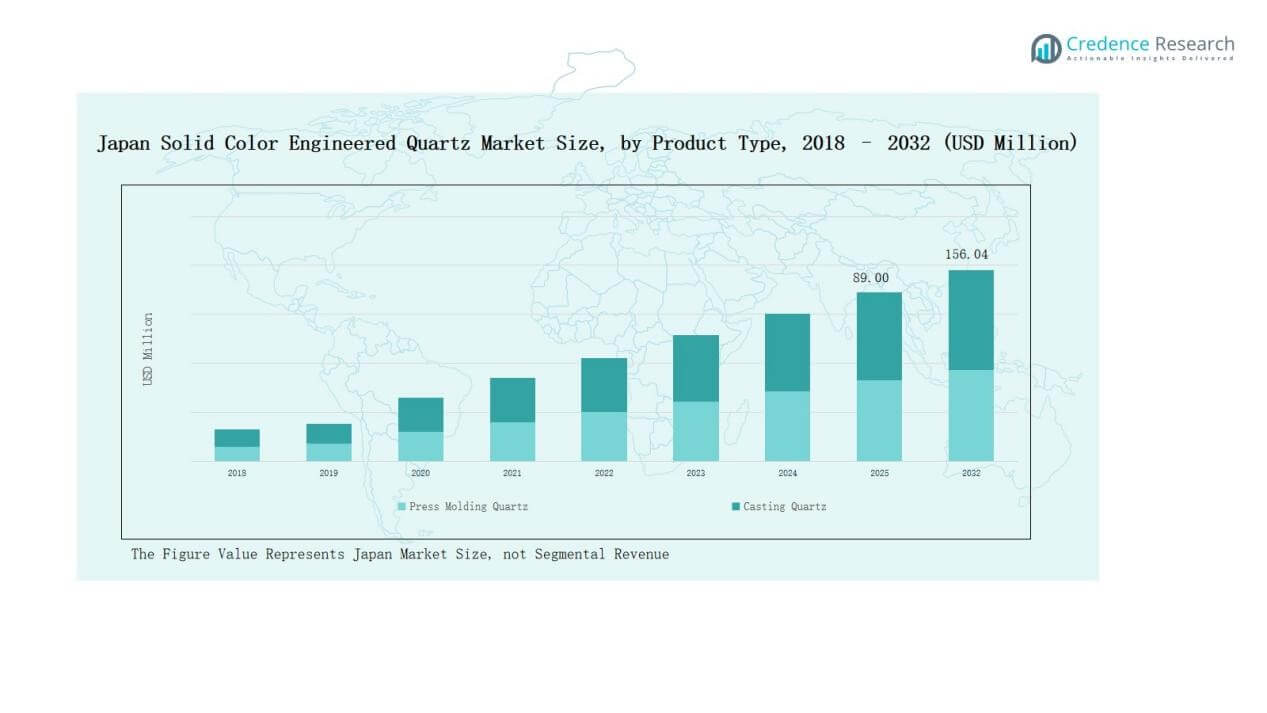

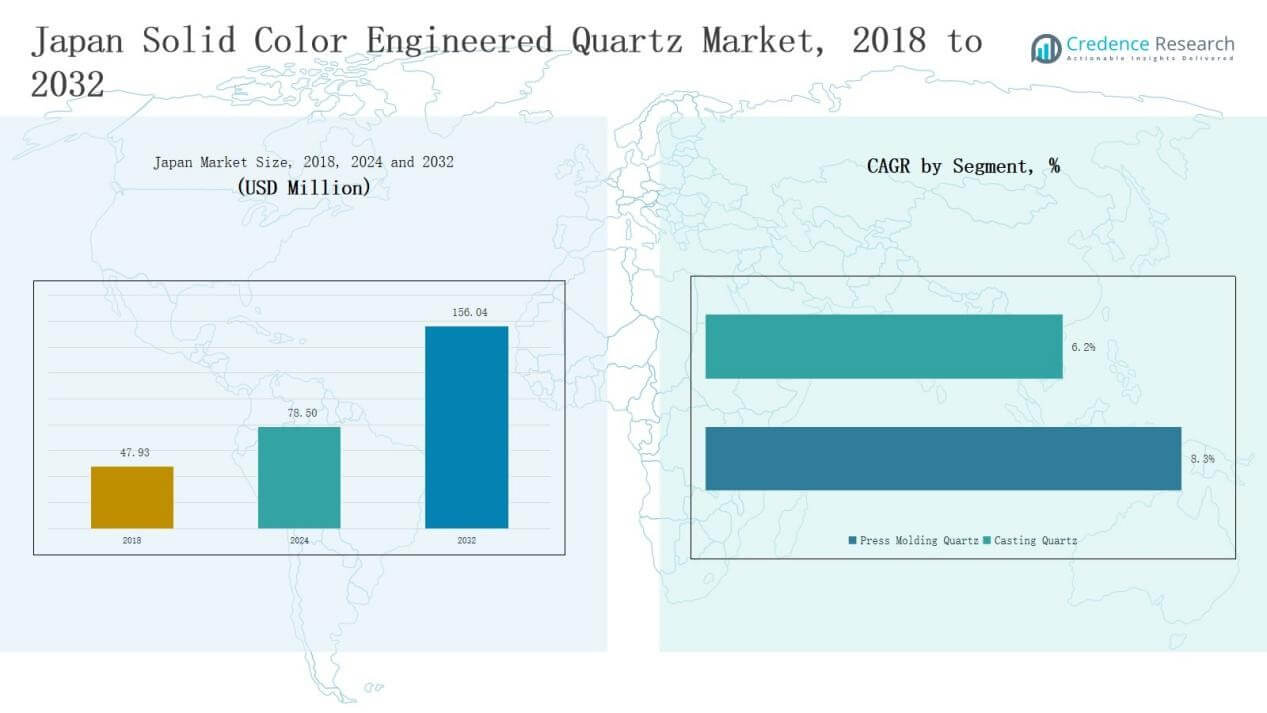

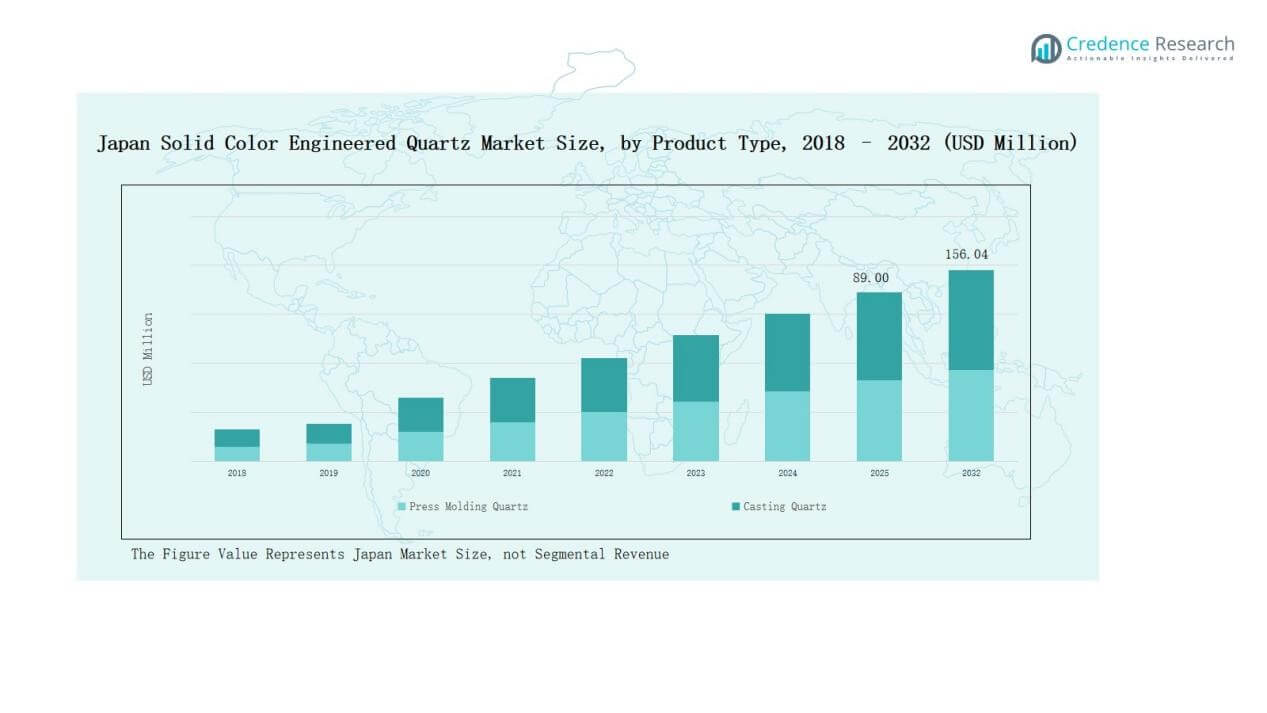

The Japan Engineered Quartz Stone (EQS) Market size was valued at USD 104.14 million in 2018, reached USD 179.15 million in 2024, and is anticipated to reach USD 375.07 million by 2032, growing at a CAGR of 9.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Engineered Quartz Stone (EQS) Market Size 2024 |

USD 179.15 Million |

| Japan Engineered Quartz Stone (EQS) Market, CAGR |

9.01% |

| Japan Engineered Quartz Stone (EQS) Market Size 2032 |

USD 375.07 Million |

The Japan Engineered Quartz Stone (EQS) Market is highly competitive, led by key domestic and international players driving innovation and distribution. Tostem Corporation (LIXIL), INAX (LIXIL Group), and Toto Ltd. dominate the local landscape with strong brand recognition, established dealer networks, and deep understanding of consumer preferences. International companies including Cosentino Japan, Caesarstone Japan, Vicostone Japan, HanStone Quartz Japan, Technistone Japan, Quarella, and Wilsonart expand their presence through premium finishes, advanced customization, and sustainable solutions. Kanto region commands the largest market share at 38% in 2024, fueled by Tokyo’s urban development, luxury housing projects, and high demand for durable, aesthetically versatile kitchen countertops and bathroom vanities. This concentration underscores the strategic importance of Kanto for both domestic and international players in expanding market penetration and brand visibility.

Market Insights

Market Insights

- The Japan Engineered Quartz Stone (EQS) Market was valued at USD 179.15 million in 2024 and is projected to reach USD 375.07 million by 2032, growing at a CAGR of 9.01%.

- Kitchen countertops held the largest application share at 47% in 2024, driven by demand for durable, hygienic, and aesthetically versatile surfaces.

- Distributors and dealers dominated the distribution channel with 41% share, ensuring wide accessibility across urban and regional markets.

- Kanto region led the market with 38% share, supported by Tokyo’s urban development, luxury housing projects, and high-end commercial infrastructure.

- Kansai, Chubu, and other regions contributed 27%, 18%, and 17% respectively, reflecting growing adoption in residential renovations and mid-sized commercial projects nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Application

Kitchen countertops held the largest share of 47% in the Japan Engineered Quartz Stone (EQS) Market in 2024. Their dominance stems from rising demand for durable, non-porous, and aesthetically versatile surfaces in residential and commercial kitchens. Japanese households prioritize premium finishes that combine hygiene with long service life, driving strong adoption. Bathroom vanities accounted for 22% share, supported by luxury housing trends, while flooring, wall cladding, and other applications collectively contributed the remaining portion through niche architectural use.

For instance, Cosentino introduced its Silestone Ethereal Collection in Japan, blending natural stone aesthetics with quartz durability, which gained traction among high-end kitchen builders.

By Distribution Channel

Distributors and dealers dominated the Japan Engineered Quartz Stone (EQS) Market with 41% share in 2024. Their leadership is driven by wide networks that ensure product accessibility across urban and regional markets. These channels enable consistent supply for contractors, interior designers, and retailers. Direct sales captured 28% share, supported by strong relationships with large-scale builders and commercial projects. Home improvement retailers represented 19% share, reflecting rising do-it-yourself culture and retail adoption, while other smaller outlets added to overall distribution diversity.

For instance, Cosentino leverages its global distribution channels to maintain steady supply lines to contractors and interior designers in Japan.

Key Growth Drivers

Rising Demand for Premium Residential Renovations

The Japan Engineered Quartz Stone (EQS) Market is fueled by increasing demand for luxury housing and high-end renovations. Homeowners prefer quartz over natural stone for its durability, stain resistance, and aesthetic consistency. With urban households investing in modern kitchen and bathroom designs, quartz countertops and vanities have gained strong traction. The shift toward quality finishes, combined with Japan’s focus on compact but functional spaces, ensures engineered quartz remains the material of choice for residential interior upgrades.

For instance, Quantum Zero, a brand of recycled surfaces from the distributors of Quantum Quartz, has been formulated with up to 90% recycled glass and is a crystalline-silica-free alternative to traditional engineered stone.

Commercial Infrastructure Development

Strong growth in commercial construction, including hotels, restaurants, and office spaces, drives market adoption. Engineered quartz is increasingly preferred for high-traffic areas such as reception counters, flooring, and wall cladding due to its performance reliability. Developers value its low maintenance requirements, uniform appearance, and long service life, aligning with operational cost efficiency. The emphasis on creating premium interiors in hospitality and corporate facilities directly supports quartz stone penetration, positioning it as a strategic material in Japan’s evolving commercial landscape.

For instance, Hilton Hotels partnered with Cosentino to install Silestone quartz in its lobby areas and food service counters, citing ease of cleaning and resistance to stains.

Shift Toward Sustainable and Hygienic Materials

Environmental awareness and health-conscious preferences shape demand for sustainable, hygienic building materials. Engineered quartz offers a non-porous surface that prevents bacterial growth, aligning with Japan’s strict cleanliness standards. Manufacturers are also adopting eco-friendly processes, including recycled raw material usage and energy-efficient production, which strengthens consumer confidence. With increasing government and consumer focus on green building certifications, quartz stone benefits from its alignment with sustainability objectives, driving its adoption across residential and commercial projects seeking compliance and long-term value.

Key Trends & Opportunities

Key Trends & Opportunities

Integration of Smart Manufacturing and Customization

Technological advancements in engineered quartz production allow greater customization in colors, finishes, and slab sizes, catering to Japan’s design-focused consumer base. The use of smart manufacturing techniques ensures precision and efficiency, meeting demand for personalized interior solutions. Builders and homeowners seek tailored designs that balance aesthetics with performance. This trend opens new opportunities for manufacturers to expand offerings and collaborate with architects, driving wider adoption in residential and commercial applications.

For instance, Caesarstone introduced its Pebbles Collection to the Asia-Pacific market, featuring engineered quartz surfaces with organic textures aimed at homeowners seeking bespoke, natural-inspired finishes.

Growing Retail Expansion and Online Distribution

The rise of home improvement retailers and e-commerce platforms enhances product accessibility for consumers and contractors. Japan’s growing DIY culture supports quartz adoption through retail formats, while online channels improve visibility for premium finishes and new product launches. Manufacturers increasingly leverage digital platforms to highlight product durability and design variety, strengthening brand positioning. This trend creates opportunities for broader market reach, particularly among younger homeowners seeking convenient purchase options and design inspiration.

For instance, Cainz, Japan’s leading DIY retailer, has expanded its footprint with innovative store formats and a robust online presence, contributing to its position as a market leader in home improvement retail.

Key Challenges

High Initial Cost Compared to Alternatives

Engineered quartz is costlier than laminates, ceramic tiles, or certain natural stones, limiting adoption among price-sensitive consumers. The higher upfront investment often restricts its use in budget-conscious residential projects despite its long-term durability benefits. Competing low-cost materials maintain a significant presence in Japan’s remodeling market. Manufacturers must address this challenge by offering flexible pricing strategies, tiered product lines, or financing options to expand quartz accessibility while retaining its premium positioning.

Dependence on Import of Raw Materials

Japan’s engineered quartz production heavily relies on imported quartz crystals and resins, exposing the market to supply chain volatility. Fluctuations in raw material prices and global logistics disruptions can significantly affect production costs and profitability. This dependence creates uncertainty for manufacturers and distributors, especially during geopolitical tensions or trade restrictions. Developing local sourcing strategies or diversifying suppliers will be essential for stabilizing operations and ensuring consistent supply in the long term.

Intense Competition and Brand Differentiation

The Japan Engineered Quartz Stone (EQS) Market faces intense competition from both domestic companies and global players offering similar products. With a wide range of designs and finishes already available, creating clear product differentiation remains challenging. Aggressive marketing by established brands puts pressure on smaller players to sustain visibility. To overcome this, companies must focus on unique design innovations, sustainable offerings, and strategic collaborations with architects and retailers to build stronger brand loyalty in a crowded market.

Regional Analysis

Kanto

Kanto dominated the Japan Engineered Quartz Stone (EQS) Market with 38% share in 2024. Strong urban development in Tokyo and neighboring prefectures drives significant demand for premium kitchen countertops and bathroom vanities. Luxury housing projects and commercial infrastructure expansion contribute to consistent adoption. The region’s large population base and high disposable income levels favor investments in durable and stylish surfaces. It remains the preferred hub for both domestic and international players, strengthening market growth through strong distribution and design innovation.

Kansai

Kansai accounted for 27% share of the market in 2024, supported by Osaka, Kyoto, and Kobe’s expanding residential and commercial sectors. Renovation of older housing stock fuels demand for engineered quartz in flooring and wall cladding applications. Developers and homeowners seek materials that combine resilience with aesthetic appeal, positioning quartz as a competitive option. The presence of hospitality and retail infrastructure further enhances demand. It remains a strategic region where design-focused consumers drive adoption of innovative and premium finishes.

Chubu

Chubu captured 18% share in 2024, with Nagoya and surrounding areas contributing strongly to residential projects. The region benefits from steady industrial growth, which creates demand for commercial facilities that integrate engineered quartz in interiors. Rising urbanization and middle-class income levels support kitchen and bathroom applications. Local contractors prefer quartz for its reliability and low maintenance. It continues to serve as a growing market with expanding opportunities for both distributors and home improvement retailers across mid-sized cities.

Other Regions

Other regions, including Hokkaido, Kyushu, and Shikoku, held 17% share in 2024. Demand stems from ongoing regional housing developments and smaller-scale commercial projects. Consumers in these areas increasingly recognize the value of engineered quartz for its hygiene, durability, and design flexibility. Distribution channels, especially dealers and retail outlets, play a vital role in expanding access. It demonstrates steady growth momentum, with rising adoption in both residential and commercial segments, contributing to nationwide market expansion.

Market Segmentations:

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

- Kanto

- Kansai

- Chubu

- Others

Competitive Landscape

The competitive landscape of the Japan Engineered Quartz Stone (EQS) Market is characterized by a mix of domestic leaders and global players, each strengthening their positions through innovation and distribution strategies. Companies such as Tostem Corporation (LIXIL), INAX, and Toto Ltd. dominate the local landscape with strong brand recognition, established dealer networks, and a deep understanding of consumer preferences. International players including Cosentino, Caesarstone, Vicostone, HanStone Quartz, and Technistone have expanded their presence by offering premium finishes, advanced customization, and sustainable solutions. Competition is further intensified by Wilsonart and Quarella, which emphasize design flexibility and global design integration. Players increasingly invest in eco-friendly production, collaboration with architects, and retail expansion to capture demand from residential and commercial projects. Intense rivalry compels companies to differentiate through aesthetics, durability, and service support, ensuring that the market remains dynamic and innovation-driven while catering to Japan’s high-quality construction and renovation needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In Apr 2025, Tostem (LIXIL) strengthened a partnership with Schüco in Japan to reduce CO₂ in construction. The move targets lower-emission building envelopes and processes.

- In Oct 2024, INAX (LIXIL Group) won Good Design Awards 2024 for SATIS X and Shower Toilet VA. The awards highlight design and technology leadership.

- In May 2025, Technistone introduced the La Natura 2025 collection with five designs.

- In July 2025, HanStone Quartz debuted a 2025 collection with three new surfaces.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium kitchen countertops will continue to drive strong market adoption.

- Bathroom vanities will expand as luxury housing projects increase across major cities.

- Flooring applications will gain momentum in commercial spaces seeking durable surfaces.

- Wall cladding usage will rise in hotels and office interiors to enhance aesthetics.

- Direct sales will strengthen through partnerships with large builders and contractors.

- Distributors and dealers will remain vital to ensure nationwide product accessibility.

- Home improvement retailers will grow in influence with expanding DIY culture.

- Sustainable and eco-friendly engineered quartz products will attract environmentally conscious buyers.

- Global brands will increase investments to compete with established domestic companies.

- Customization in designs, finishes, and slab sizes will shape future consumer preferences.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: