Market Overview

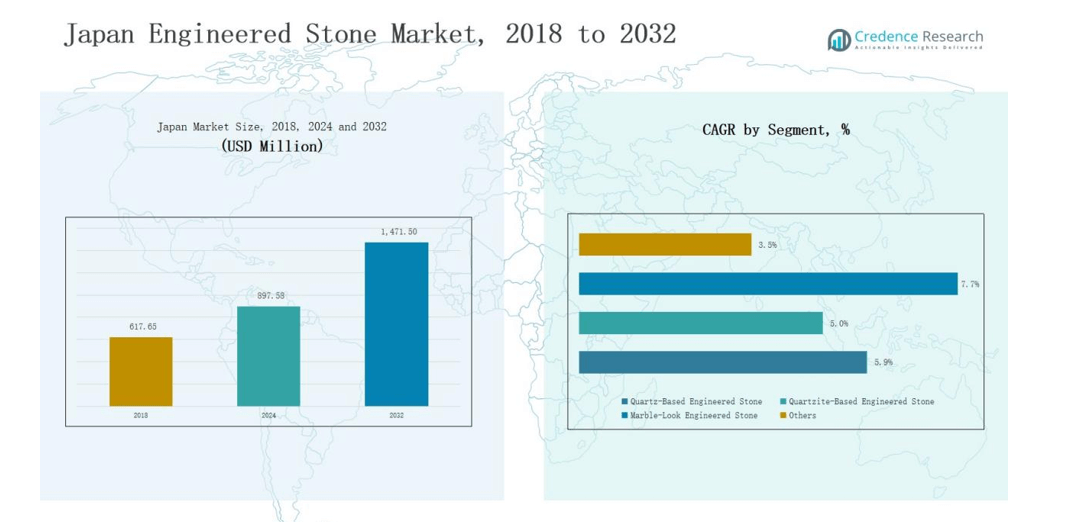

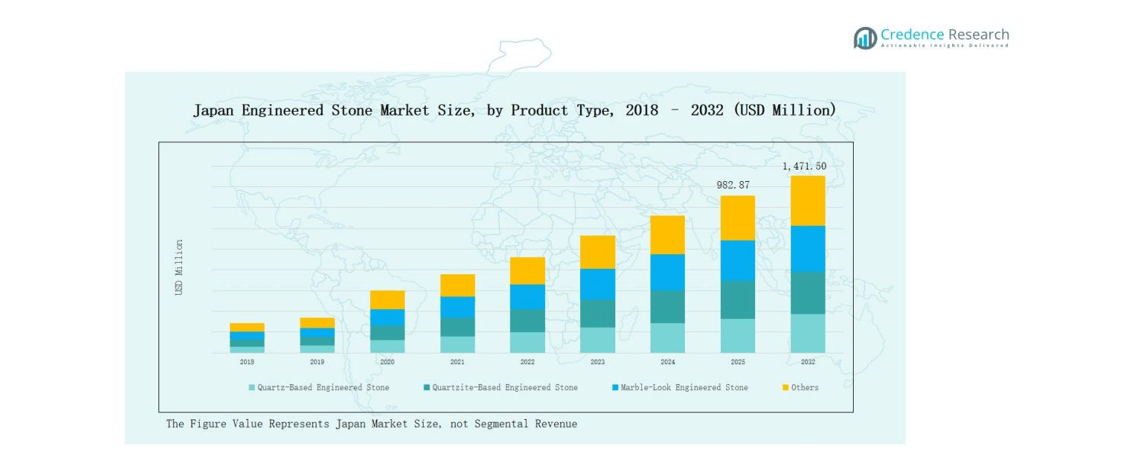

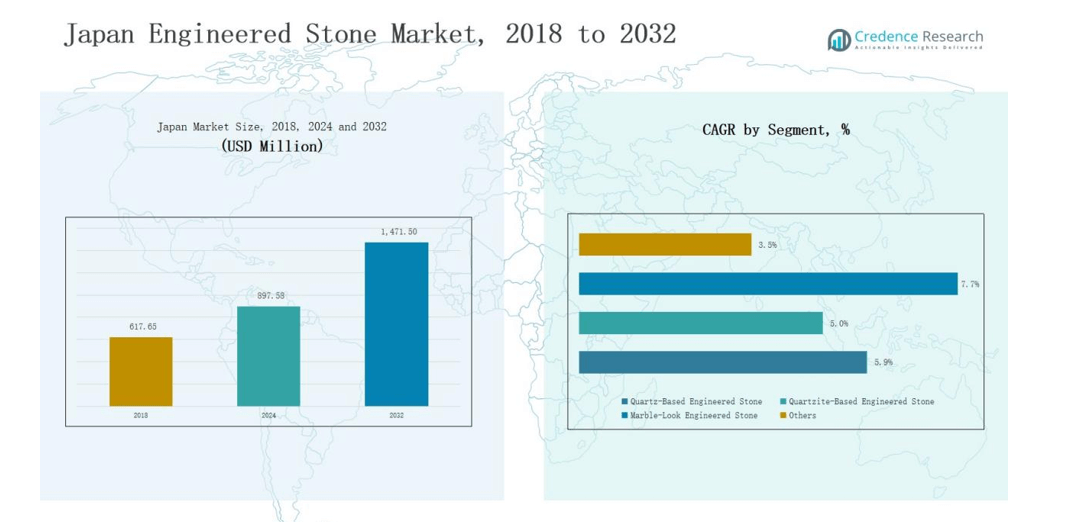

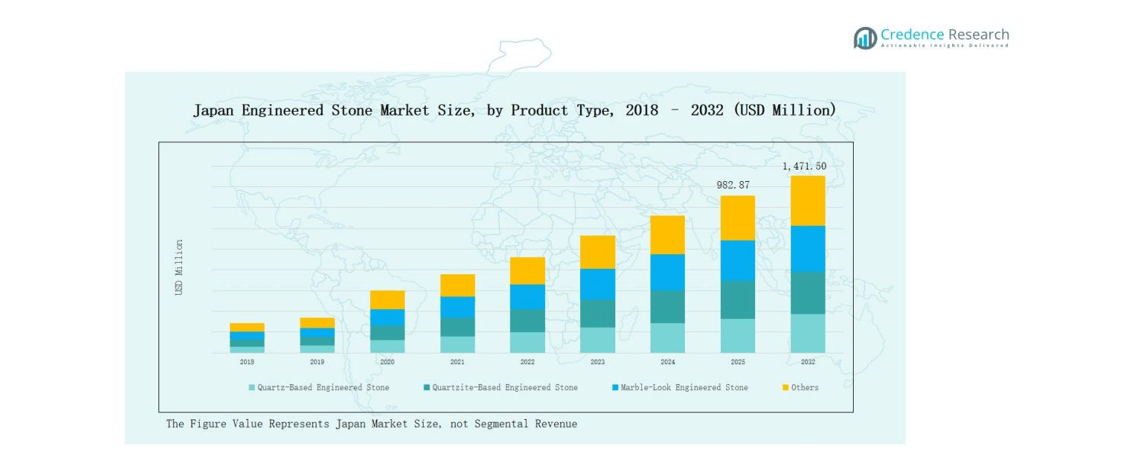

Japan Engineered Stone Market size was valued at USD 617.65 million in 2018, reached USD 897.58 million in 2024, and is anticipated to reach USD 1,471.50 million by 2032, growing at a CAGR of 5.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Engineered Stone Market Size 2024 |

USD 897.58 million |

| Japan Engineered Stone Market, CAGR |

5.93% |

| Japan Engineered Stone Market Size 2032 |

USD 1,471.50 million |

The Japan Engineered Stone Market features strong competition among global leaders and domestic specialists focusing on product innovation, sustainability, and tailored solutions. Prominent players include Caesarstone, Cosentino (Silestone, Dekton), Smartstone, Quantum Quartz, Hanstone Quartz, WK Marble & Granite, Essa Stone, Laminex Japan, Lapitec, and Vicostone, each strengthening their presence through premium quartz-based surfaces, eco-friendly offerings, and strategic partnerships with contractors, architects, and distributors. Among regions, Kanto commanded the largest share of 38% in 2024, supported by luxury housing projects, commercial infrastructure, and strong demand for durable, low-maintenance surfaces in Tokyo and Yokohama.

Market Insights

- The Japan Engineered Stone Market reached USD 897.58 million in 2024 and is expected to hit USD 1,471.50 million by 2032, growing steadily at 5.93%.

- Quartz-based engineered stone dominated with a 62% share in 2024, driven by durability, stain resistance, and versatile design options appealing to both residential and commercial projects.

- Kitchen countertops led applications with a 48% share, followed by bathroom vanities at 20%, while flooring, wall cladding, and decorative uses steadily expanded adoption across premium projects.

- The residential sector commanded 55% share in 2024, supported by urban housing modernization, while commercial projects held 32% and institutional uses 13%, highlighting diverse demand drivers.

- Kanto remained the largest region with 38% share, followed by Kansai at 27%, Chubu at 18%, and Kyushu and others at 17%, reflecting balanced regional growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Quartz-based engineered stone dominated the Japan market in 2024, accounting for nearly 62% share. Its popularity stems from superior durability, stain resistance, and wide design options, making it the preferred choice for residential and commercial surfaces. Marble-based engineered stone captured around 25%, driven by premium interior projects demanding elegance. Other materials such as granite blends and recycled content held the remaining 13%, supported by growing sustainability initiatives and demand for cost-effective alternatives.

- For instance, Trend Group has an engineered stone portfolio with recycled glass surfaces. The company’s catalogues and sustainability information detail their engineered stone products, including the etherium line, which is made using a significant percentage of post-consumer recycled glass.

By Application

Kitchen countertops led the application segment in 2024 with a 48% market share, fueled by Japan’s rising housing renovations, luxury apartment demand, and preference for durable, low-maintenance surfaces. Bathroom vanities followed with 20%, supported by upscale residential designs. Flooring and wall cladding contributed 15%, while furniture and decorative applications accounted for 10%, targeting niche aesthetic markets. Other uses, including commercial and institutional projects, made up 7%, driven by hotels, offices, and healthcare facilities adopting engineered stone surfaces.

- For instance, LIXIL Corporation introduced high-end bathroom vanities in Japan, integrating engineered stone surfaces to align with luxury apartment projects.

By End User

The residential sector held the largest share of 55% in 2024, underpinned by rising urban housing projects, modernization of interiors, and consumer preference for stylish, durable materials. The commercial sector followed with 32%, driven by retail outlets, offices, and hospitality projects emphasizing premium surfaces. Industrial and institutional users contributed around 13%, supported by hospitals, universities, and large facilities prioritizing hygiene and durability. Growing investment in residential remodeling continues to position the residential segment as the primary market driver.

Market Overview

Rising Demand for Residential Renovation and Remodeling

The Japanese housing market is witnessing a surge in renovation and remodeling activities, particularly in urban regions like Tokyo, Osaka, and Nagoya. Homeowners increasingly prefer engineered stone for kitchen countertops and bathroom vanities due to its durability, stain resistance, and aesthetic appeal. Growing disposable incomes and lifestyle upgrades further drive adoption in premium and mid-range homes. The demand for modern, low-maintenance surfaces positions engineered stone as the preferred choice, fueling steady growth in the residential segment across the country.

- For instance, Cosentino expanded its Silestone and Dekton ranges in Japan to cater to demand for sustainable, low-maintenance engineered surfaces.

Expansion of Commercial and Hospitality Projects

Japan’s commercial construction sector, especially retail outlets, offices, and hospitality establishments, is driving engineered stone demand. High-end hotels, shopping malls, and office spaces prioritize engineered stone for its blend of luxury, hygiene, and long-term durability. Government-backed infrastructure projects and private sector investments are fueling new developments, increasing the material’s penetration in the commercial segment. This trend aligns with rising international tourism and demand for premium hospitality facilities, positioning engineered stone as a strategic material for modern urban infrastructure.

Focus on Sustainability and Eco-Friendly Surfaces

Environmental consciousness is shaping consumer and corporate preferences in Japan’s construction industry. Engineered stone manufacturers are increasingly adopting recycled content, sustainable resins, and energy-efficient processes to meet strict environmental standards. Demand for eco-friendly and low-carbon building materials is rising among developers and institutional projects. This sustainability focus is not only aligning with Japan’s decarbonization targets but also providing manufacturers with opportunities to differentiate through green certifications and innovative product launches, thereby strengthening their competitive edge in the domestic market.

- For instance, BASF Japan introduced Hydrofluoroolefin (HFO)-blown PIR technology that improves energy efficiency in sandwich panels while substantially lowering global warming potential and enhancing fire safety compliance.

Key Trends & Opportunities

Growing Popularity of Quartz-Based Engineered Stone

Quartz-based engineered stone is emerging as the dominant material due to its superior performance characteristics, representing more than half of the market share in 2024. Japanese consumers value its resistance to scratches, stains, and heat, making it ideal for busy kitchens and high-traffic areas. The segment is also benefiting from growing product innovation in colors, finishes, and textures tailored for modern interiors. This trend reflects the rising preference for durable, aesthetic, and versatile surfaces in both residential and commercial applications.

- For instance, Caesarstone Japan expanded its portfolio with the Pebbles Collection, offering five neutral-toned surface designs inspired by natural landscapes to match modern interiors.

Expansion of Online and Specialty Store Distribution

The distribution landscape for engineered stone in Japan is evolving with increasing reliance on specialty stores and online platforms. Specialty stores cater to customized design requirements and offer technical expertise to contractors and homeowners, while online platforms improve accessibility and convenience. The shift toward digital channels is supported by consumer demand for product comparisons and visualization tools before purchase. These evolving sales strategies present significant opportunities for manufacturers and distributors to expand market reach and strengthen customer engagement.

- For instance, Cosentino expanded its digital showroom concept in Japan, allowing customers to explore surface materials virtually with 3D visualization tools.

Key Challenges

High Competition from Natural Stone and Alternative Materials

Engineered stone faces stiff competition from natural stone options such as granite and marble, which continue to appeal to premium customers seeking exclusivity. In addition, alternative materials like ceramics, laminates, and solid surfaces are capturing cost-sensitive buyers. These substitutes often provide comparable aesthetics at lower prices, limiting engineered stone’s penetration in certain market segments. Overcoming this challenge requires manufacturers to emphasize unique value propositions such as durability, consistency, and eco-friendliness to retain competitive advantage in Japan.

Price Sensitivity and Installation Costs

The relatively high cost of engineered stone, coupled with specialized installation expenses, poses a barrier for wider adoption in Japan’s price-sensitive consumer market. While premium customers are willing to pay for durability and aesthetics, mid-range buyers often seek cheaper alternatives. Installation challenges further add to project costs, discouraging some residential and small commercial buyers. Addressing this challenge requires cost optimization, expanded financing options, and awareness campaigns emphasizing engineered stone’s long-term value compared to short-term savings from substitutes.

Dependence on Imports and Supply Chain Constraints

A significant portion of engineered stone in Japan is imported, making the market vulnerable to supply chain disruptions, currency fluctuations, and global trade dynamics. Any disruption in sourcing raw materials or finished slabs can affect pricing and timely availability for local projects. Dependence on imports also reduces the bargaining power of domestic distributors. This challenge underscores the need for developing local manufacturing capabilities, strengthening regional partnerships, and diversifying supply sources to ensure market stability and long-term growth.

Regional Analysis

Kanto

Kanto led the Japan Engineered Stone Market in 2024 with a 38% share. The region benefits from high urban density, luxury housing projects, and commercial developments in Tokyo and Yokohama. Strong demand for premium kitchen countertops and bathroom vanities continues to support growth. Developers and homeowners prioritize durable, low-maintenance surfaces to meet modern design preferences. The region’s hospitality and retail sectors also adopt engineered stone to enhance functionality and aesthetics. Ongoing real estate investments further strengthen Kanto’s position as the leading regional market.

Kansai

Kansai accounted for 27% share of the Japan Engineered Stone Market in 2024. Osaka and Kyoto drive demand through a mix of residential remodeling and expanding commercial projects. Rising tourism in Kyoto has spurred the use of engineered stone in hotels and restaurants. Homeowners in Osaka increasingly prefer quartz-based products for kitchens and bathrooms. The market benefits from government-backed infrastructure upgrades that include public and institutional buildings. Kansai maintains strong momentum due to its balance of residential and commercial demand.

Chubu

Chubu held 18% share of the Japan Engineered Stone Market in 2024. Nagoya anchors growth with demand from both housing and industrial projects. Rising adoption in office buildings and retail facilities boosts the market’s regional strength. Residential customers in the area prefer engineered stone for durability and design versatility. The presence of large contractors and steady investments in urban housing support stable growth. Chubu continues to strengthen its role through a mix of residential and commercial adoption.

Kyushu and Others

Kyushu and other regions collectively captured 17% share of the Japan Engineered Stone Market in 2024. The region records growing demand from mid-scale housing and public infrastructure projects. Rising use in institutional facilities, hospitals, and universities supports expansion. Tourism-driven developments in southern prefectures create additional opportunities for commercial applications. The market also benefits from rising awareness of sustainable and eco-friendly surfaces. Kyushu and others remain secondary contributors but provide steady growth opportunities through regional construction activities.

Market Segmentations:

By Product Type

- Quartz-based engineered stone

- Marble-based engineered stone

- Others (granite blends, recycled content)

By Application

- Kitchen countertops

- Bathroom vanities

- Flooring & wall cladding

- Furniture & decorative applications

- Others (commercial surfaces, institutional projects)

By End User

- Residential

- Commercial

- Industrial/Institutional

By Distribution Channel

- Specialty stores

- Direct sales (fabricators, contractors)

- Online platforms

- Others (distributors, wholesalers)

By Region

- Kanto (Tokyo, Yokohama)

- Kansai (Osaka, Kyoto)

- Chubu (Nagoya)

- Kyushu & Others

Competitive Landscape

The Japan Engineered Stone Market is characterized by the presence of global leaders and strong domestic players competing across product innovation, distribution reach, and brand positioning. International brands such as Caesarstone and Cosentino maintain significant visibility, leveraging premium quartz-based product portfolios and established relationships with contractors, architects, and distributors. Domestic companies like WK Marble & Granite, Laminex Japan, and Essa Stone focus on catering to localized demand through tailored designs, cost-efficient offerings, and faster supply networks. Players emphasize sustainability by introducing recycled content and eco-friendly surfaces to align with Japan’s environmental goals. Partnerships with specialty stores and online channels strengthen customer access, while collaborations with construction firms enhance project-based adoption. Intense competition pushes companies to differentiate through aesthetics, durability, and customization, making innovation a key driver of long-term positioning in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone

- Cosentino (Silestone, Dekton)

- Smartstone

- Quantum Quartz

- Hanstone Quartz

- WK Marble & Granite

- Essa Stone

- Laminex Japan

- Lapitec

- Vicostone

Recent Developments

- l In July 2025, Caesarstone launched Caesarstone ICON, a new line of advanced fusion surfaces with a crystalline silica-free formula and eight new colors.

- In early 2024, Smartstone announced plans to introduce its Sintered Collection, a silica-free alternative to traditional engineered stone.

- In 2024, HanStone Quartz introduced its Next Generation Quartz (NGQ) technology, designed to cut crystalline silica content and enhance sustainability.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will continue to dominate residential and commercial projects.

- Kitchen countertops will remain the leading application driven by urban housing renovations.

- Bathroom vanities will record steady adoption supported by premium home designs.

- Commercial projects in retail, offices, and hospitality will expand the market footprint.

- Eco-friendly and recycled-content engineered stone will gain traction due to sustainability targets.

- Specialty stores and online platforms will play a stronger role in distribution.

- Local players will strengthen competitiveness through tailored designs and cost-efficient offerings

- Kanto will remain the largest regional market supported by dense urbanization.

- Kansai and Chubu will see stable growth driven by infrastructure and tourism-led projects.

- Supply chain diversification and regional manufacturing will reduce dependence on imports.