Market Overview:

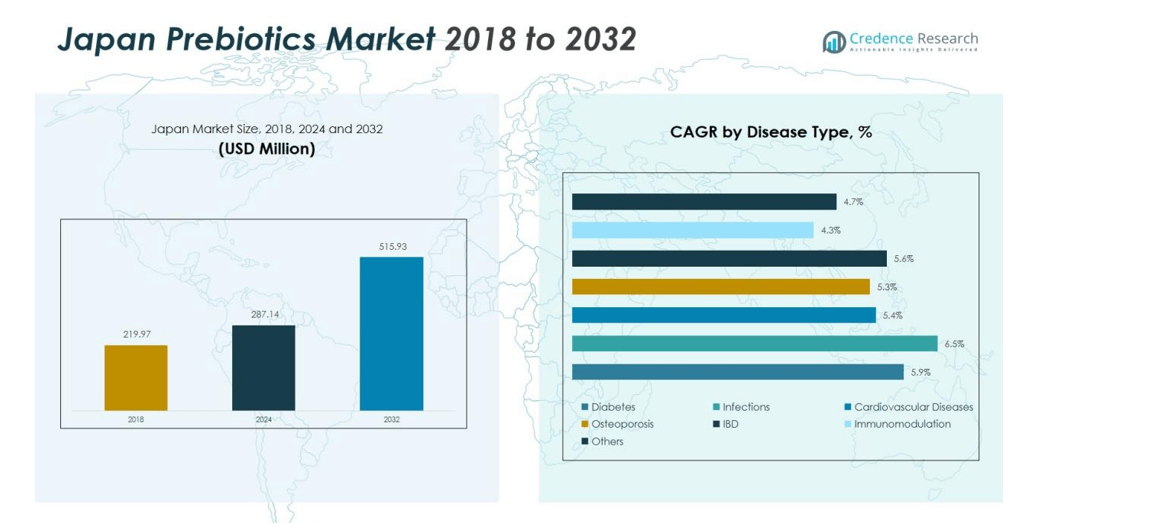

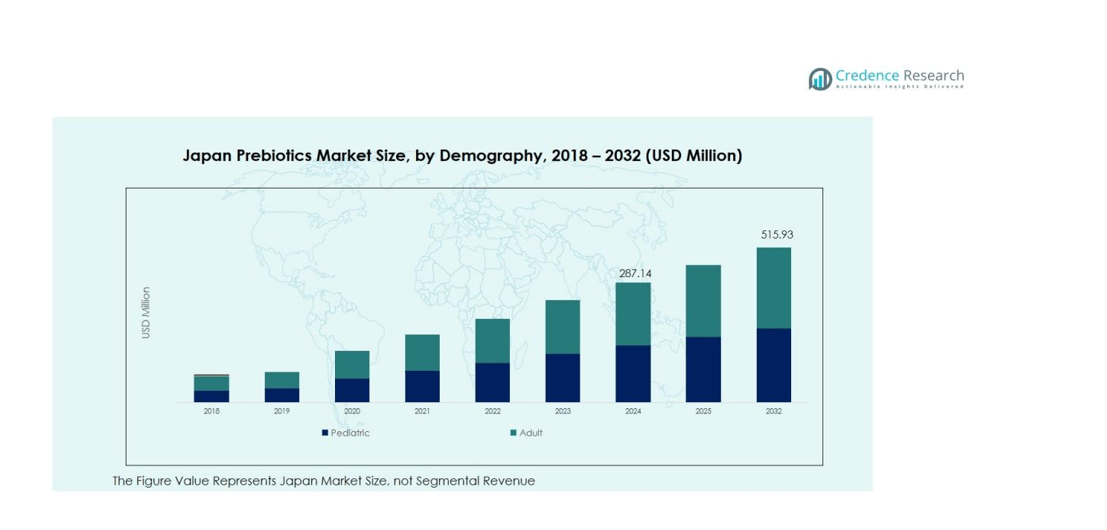

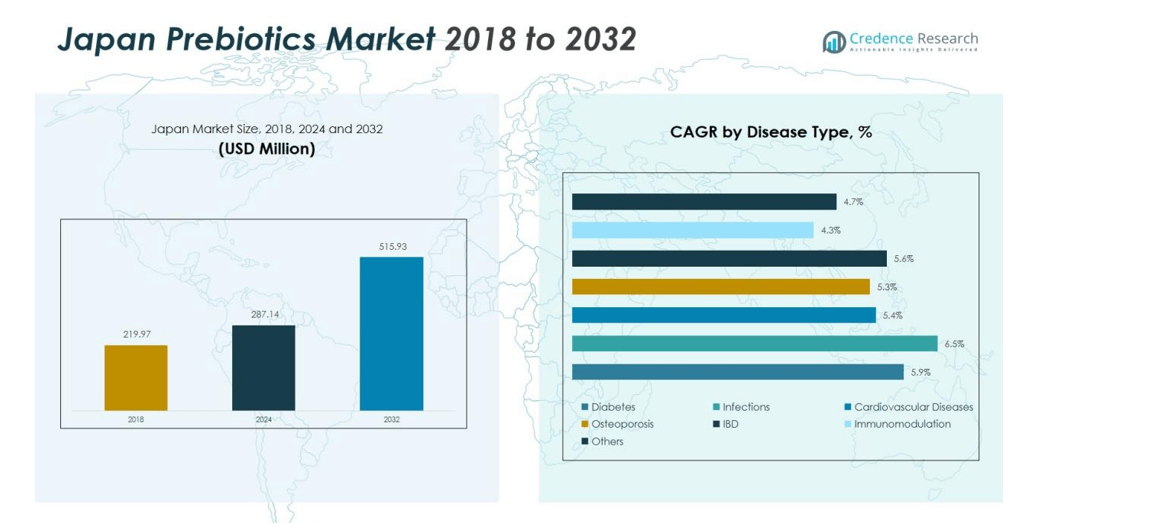

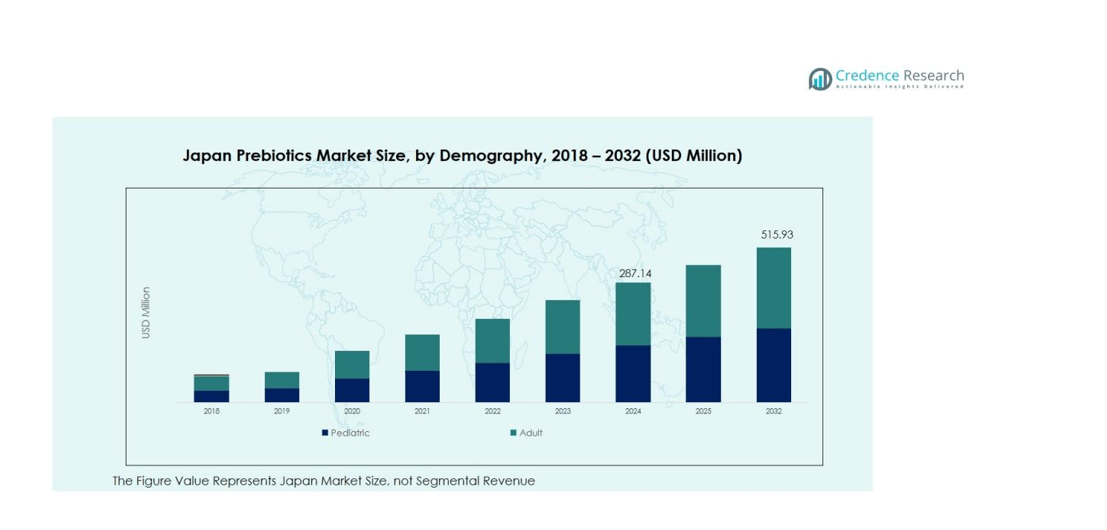

The Japan Prebiotics Market size was valued at USD 219.97 million in 2018 to USD 287.14 million in 2024 and is anticipated to reach USD 515.93 million by 2032, at a CAGR of 7.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Prebiotics Market Size 2024 |

USD 287.14 million |

| Japan Prebiotics Market, CAGR |

7.60% |

| Japan Prebiotics Market Size 2032 |

USD 515.93 million |

Market growth is driven by strong consumer awareness of digestive health and preventive nutrition. Rising prevalence of gastrointestinal issues and lifestyle diseases is pushing demand for fiber-enriched products. Food manufacturers are focusing on clean-label and plant-based formulations to cater to health-conscious consumers. Active R&D efforts and regulatory support for functional food claims further encourage innovation in Japan’s prebiotic product landscape.

Regionally, Kanto and Kansai dominate the Japan Prebiotics Market due to dense urban populations, high income levels, and established food processing industries. Hokkaido and Kyushu are emerging growth areas, driven by the increasing consumption of fortified dairy and beverages. Expanding retail networks and e-commerce platforms continue to improve accessibility, supporting nationwide market growth.

Market Insights:

- The Japan Prebiotics Market was valued at USD 219.97 million in 2018, growing to USD 287.14 million in 2024, and is projected to reach USD 515.93 million by 2032 at a CAGR of 7.60%.

- Kanto holds the largest regional share at 38%, followed by Kansai at 27% and Chubu at 14%, supported by dense urban populations, high income levels, and advanced food processing industries.

- Hokkaido is the fastest-growing region with a 9% share, driven by increasing demand for fortified dairy products, availability of natural raw materials, and expanding health-focused retail networks.

- By product, fructo-oligosaccharides account for 32% of the market share, while inulin represents 27%, supported by strong adoption in functional food and beverage applications.

- By disease type, diabetes leads with 30% share, followed by immunomodulation at 22%, reflecting the country’s growing focus on metabolic health and immune system support through gut wellness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Digestive Wellness and Preventive Health

The Japan Prebiotics Market is driven by rising consumer awareness of digestive wellness and its link to overall health. Increasing cases of lifestyle-related disorders have encouraged consumers to adopt fiber-enriched and gut-friendly products. Manufacturers are incorporating inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) in food and beverage formulations to enhance nutritional benefits. It continues to benefit from government initiatives promoting preventive healthcare and dietary improvement across the country.

- For Instance, Morinaga Milk Industry Co., Ltd. reported an operating profit of ¥29.7 billion, a 6.5% year-on-year increase driven by domestic and global business growth.

Rising Demand for Clean-Label and Functional Food Products

Consumer preference for natural, clean-label, and plant-based products is propelling demand across Japan. The growing focus on food transparency and ingredient safety is leading to a shift from synthetic additives to natural prebiotic sources. Food manufacturers are developing formulations that combine taste, functionality, and nutritional value to appeal to health-conscious buyers. It supports innovation across categories such as dairy, bakery, and beverages.

- For instance, Yakult’s Y1000 series, which contains over 100 billion live probiotics per bottle, achieved average daily sales of 3 million bottles in Japan, underscoring strong consumer uptake of naturally fortified products.

Expansion of Nutraceuticals and Functional Beverages Sector

Strong growth in Japan’s nutraceutical and functional beverage sectors supports the expanding use of prebiotic ingredients. Companies are launching new formulations aimed at improving gut microbiota and immunity. The integration of prebiotics into ready-to-drink and dietary supplement formats caters to on-the-go lifestyles. It reflects the growing role of prebiotics in preventive health management.

Regulatory Support and Research Advancements in Functional Ingredients

Supportive regulatory frameworks for functional food claims strengthen product acceptance in Japan. Government-approved health claims encourage brand credibility and consumer trust. Continuous investments in R&D by domestic and global companies drive innovation in prebiotic extraction and formulation technologies. It enables the development of high-quality products that meet evolving consumer health expectations.

Market Trends:

Growing Integration of Prebiotics in Functional Foods and Beverages

The Japan Prebiotics Market is witnessing strong growth due to the integration of prebiotics into everyday food and beverage products. Manufacturers are enriching dairy, bakery, and beverage categories with inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) to enhance digestive health benefits. Rising health awareness among consumers is pushing the adoption of functional foods that promote gut balance and immunity. The demand for convenient, ready-to-consume products is also accelerating innovation in prebiotic-based drinks and snacks. It continues to gain momentum through collaborations between food producers and research institutions aimed at developing novel prebiotic formulations.

- For instance, Yakult Health Foods’ My Green Juice stick packs deliver 2.7 g of dietary fiber (prebiotic) per 8 g serving, supporting gut microbiota balance with β-carotene (800 μg) and polyphenols (52 mg) in each pack.

Technological Innovation and Product Diversification in Prebiotic Applications

Rapid advancements in biotechnology and extraction methods are driving product innovation in Japan. Companies are focusing on improving prebiotic stability, solubility, and compatibility with different food matrices. The expansion of prebiotic applications into pharmaceuticals, animal nutrition, and cosmetics is diversifying revenue streams. Increasing consumer preference for plant-based and sustainable ingredients supports new product development using natural sources such as chicory root and soy fiber. It benefits from Japan’s strong R&D ecosystem, which encourages cross-industry innovation and continuous improvement in product quality and efficacy.

- For instance, Fuji Oil Group advanced plant-based innovation by developing a soy milk cream butter using oil and fat separation technologies, achieving stable solidification and melt-in-the-mouth properties. The company recorded ¥5.9 billion in R&D expenditure and 7,628 cumulative patent applications as of March 2024 to drive sustainable food ingredient innovation.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The Japan Prebiotics Market faces cost challenges due to complex extraction and purification methods. Manufacturing high-purity inulin, FOS, and GOS requires advanced equipment and skilled operations, raising overall production expenses. Small and mid-sized producers struggle to maintain price competitiveness against imported alternatives. Limited domestic raw material sources further increase reliance on imports, impacting cost stability. It must address these challenges through technological efficiency and local sourcing initiatives to maintain profitability and market growth.

Low Consumer Awareness in Rural Regions and Market Fragmentation

Despite strong urban demand, awareness of prebiotic benefits remains limited in rural Japan. Many consumers outside major cities lack understanding of gut health and functional nutrition. Market fragmentation caused by numerous small-scale brands creates inconsistency in product quality and labeling. This weakens consumer trust and slows category expansion. It requires stronger educational campaigns, unified labeling standards, and wider retail access to ensure consistent market development across all regions.

Market Opportunities:

Rising Demand for Functional and Personalized Nutrition Solutions

The Japan Prebiotics Market offers strong opportunities in functional and personalized nutrition. Growing awareness of gut microbiota and immunity is driving interest in customized dietary products. Food and nutraceutical companies are exploring prebiotic blends designed for specific health outcomes such as metabolic balance, digestive comfort, and immune resilience. The integration of digital health platforms and nutritional apps supports personalized product recommendations. It can leverage this trend by developing prebiotic solutions tailored to individual lifestyles and health goals.

Expansion Across Pharmaceuticals, Pet Nutrition, and Cosmeceuticals

Expanding applications beyond traditional food segments present new growth prospects for Japanese manufacturers. Prebiotics are gaining traction in pharmaceutical formulations aimed at improving gastrointestinal and immune health. The pet nutrition industry is adopting prebiotic ingredients to enhance digestive well-being in companion animals. Cosmeceutical brands are also incorporating prebiotic compounds to promote skin microbiome balance. It can benefit from cross-sector innovation and collaborative R&D efforts that extend prebiotic use across diverse product categories.

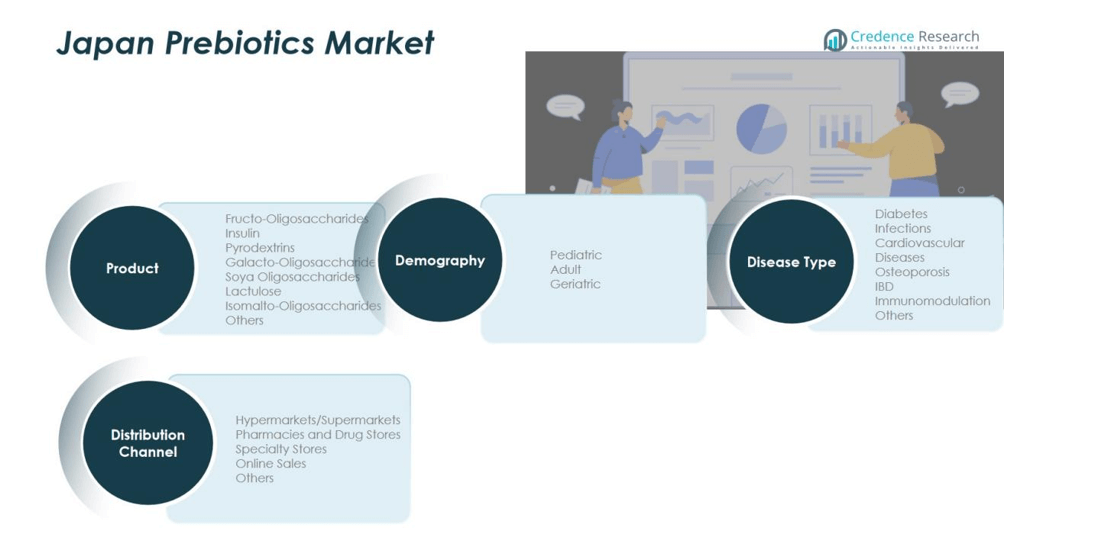

Market Segmentation Analysis:

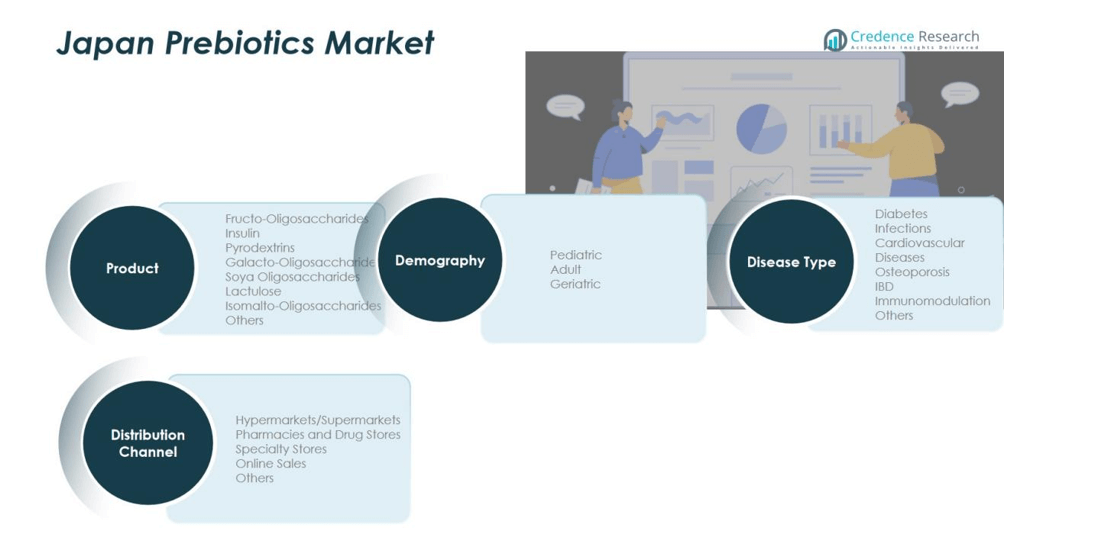

By Product Segment

The Japan Prebiotics Market is segmented into fructo-oligosaccharides, inulin, pyrodextrins, galacto-oligosaccharides, soya oligosaccharides, lactulose, isomalto-oligosaccharides, and others. Inulin and fructo-oligosaccharides lead the segment due to their widespread use in dairy, bakery, and beverage applications. Growing preference for natural and clean-label ingredients supports their demand among functional food manufacturers. Galacto-oligosaccharides are gaining momentum in infant nutrition and dietary supplements, driven by their digestive and immune benefits. It continues to benefit from innovation in formulation and application diversity.

- For Instance, Calbee’s personalized nutrition service “Body Granola,” launched in April 2023, recommends three prebiotic toppings out of six options based on an individual’s gut microbiome analysis. Inulin is one of these six available options. As of June 2025, the service had been adopted by over 30,000 users, demonstrating the scalability of inulin and other prebiotic-based precision nutrition programs.

By Disease Type Segment

The market covers diabetes, infections, cardiovascular diseases, osteoporosis, inflammatory bowel disease (IBD), immunomodulation, and others. The diabetes segment dominates due to Japan’s growing aging population and rising metabolic health concerns. Prebiotics are increasingly used to regulate blood glucose and support gut microbiota balance. The immunomodulation and IBD segments are expanding with new clinical studies linking gut health to immune response. It benefits from strong R&D activity supporting the therapeutic use of prebiotics.

- For instance, a 16-week randomized controlled trial by Juntendo University and Yakult Honsha involving 70 Japanese type 2 diabetes patients showed that daily consumption of Lactobacillus casei strain Shirota-fermented milk significantly lowered the total count of gut bacteria in the blood—a marker of bacterial translocation—by 1.8 log units compared to the control group, demonstrating its role in improving gut barrier integrity and reducing systemic inflammation.

By Demography Segment

The market is segmented into pediatric, adult, and geriatric populations. The adult segment holds the largest share due to high consumption of functional foods and supplements. Geriatric consumers represent a key growth area owing to rising demand for digestive health and preventive nutrition. Pediatric applications are growing through fortified baby food and formula innovations. It continues to expand across all age groups with increased awareness of gut and immune health.

Segmentations:

By Product Segment:

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type Segment:

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography Segment:

- Pediatric

- Adult

- Geriatric

By Distribution Channel Segment:

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

Regional Analysis:

Strong Market Presence Across Industrialized Regions

The Japan Prebiotics Market demonstrates strong growth across developed regions such as Kanto and Kansai. These regions dominate due to their dense populations, high disposable incomes, and advanced food processing infrastructure. Tokyo and Osaka serve as key innovation hubs, attracting major food, beverage, and nutraceutical companies investing in prebiotic formulations. The concentration of research institutions and health-conscious consumers in these areas accelerates product testing and market penetration. It benefits from robust retail networks and established supply chains that ensure widespread availability.

Emerging Growth Opportunities in Hokkaido and Kyushu

Hokkaido and Kyushu are emerging as promising regions for market expansion. Increasing consumer focus on digestive wellness and preventive nutrition is driving demand for prebiotic-enriched foods. The availability of natural raw materials such as chicory root supports local manufacturing opportunities. Rising investments in health food stores and specialty nutrition outlets further encourage prebiotic adoption. It continues to expand its footprint in these regions through targeted marketing and improved distribution strategies.

Regional Diversification Driven by E-commerce and Functional Food Demand

Rising e-commerce activity is reshaping the regional distribution landscape in Japan. Consumers across semi-urban and smaller cities now have easier access to functional and fortified products through online channels. Expanding online retail platforms are bridging supply gaps and supporting nationwide awareness campaigns on gut health. The growing popularity of wellness-oriented diets is strengthening prebiotic consumption across diverse demographic groups. It benefits from digital transformation and increasing nationwide interest in personalized health and nutrition solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Prebiotics Market is highly competitive, characterized by strong domestic and international participation. Major companies include Yakult Honsha Co., Ltd., Groupe Danone, Asahi Group Holdings, Ltd., Nissin Food Products Co., Ltd., Meiji Co., Ltd., and Nestlé S.A. These players focus on product innovation, clean-label formulations, and functional food development to strengthen brand positioning. It emphasizes extensive R&D to enhance the nutritional and therapeutic value of prebiotic ingredients. Partnerships with research institutions and universities are helping companies expand their product applications in dietary supplements and dairy-based foods. The market is witnessing steady investment in advanced manufacturing technologies, digital marketing, and sustainable sourcing to meet consumer expectations. Competitive advantage relies on brand trust, product differentiation, and a strong retail presence across Japan’s major urban centers.

Recent Developments:

- In October 2025, Yakult Honsha completed a merger between Yakult Europe B.V. and Yakult Oesterreich GmbH, effective October 1, 2025, to enhance operational efficiency and strengthen sales activities across Austria.

- In August 2025, Nestlé entered a partnership with IBM Research to develop sustainable food packaging using generative AI, aiming to reduce plastic use through advanced, data‑driven material science.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Disease Type Segment, Demography Segment and Distribution Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Prebiotics Market will continue to grow due to rising consumer awareness of digestive and immune health.

- Manufacturers will focus on developing prebiotic blends that target specific health needs such as metabolism, immunity, and gut balance.

- Functional food and beverage innovations will expand across dairy, bakery, and plant-based categories.

- Collaborations between food companies and research institutions will enhance clinical validation and product credibility.

- Digital health platforms and personalized nutrition apps will promote tailored prebiotic consumption.

- Domestic production will increase through sustainable sourcing and improved extraction technologies.

- Pharmaceutical and nutraceutical companies will integrate prebiotics into advanced therapeutic formulations.

- The market will experience rising adoption among aging populations seeking preventive health solutions.

- E-commerce will strengthen nationwide product accessibility and consumer engagement.

- It will evolve toward a balanced ecosystem where innovation, regulation, and consumer education drive long-term growth and competitiveness.