Market Overview

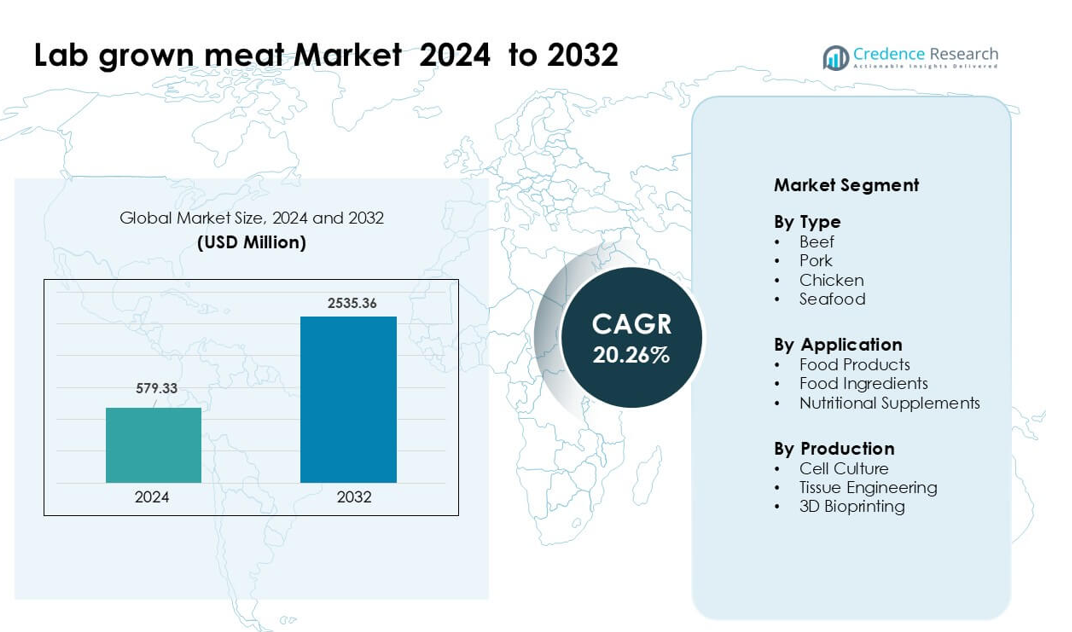

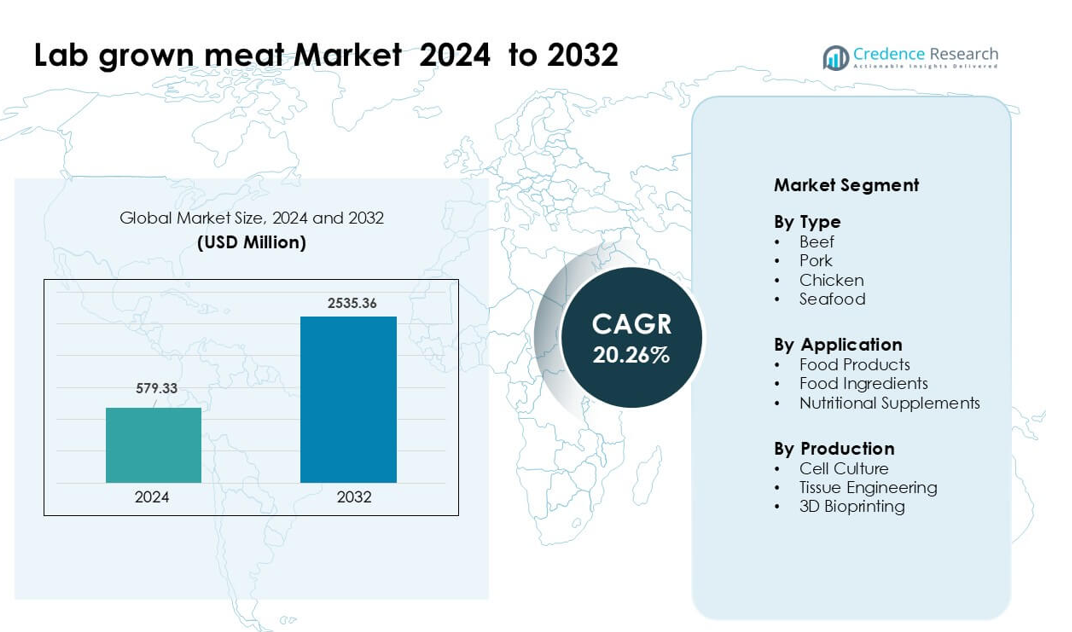

Lab grown meat Market was valued at USD 579.33 million in 2024 and is anticipated to reach USD 2535.36 million by 2032, growing at a CAGR of 20.26 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lab Grown Meat Market Size 2024 |

USD 579.33 million |

| Lab Grown Meat Market, CAGR |

20.26% |

| Lab Grown Meat Market Size 2032 |

USD 2535.36 million |

Leading players in the lab-grown meat market include Mosa Meat, Avant Meats, SCiFi Foods, Aleph Farms, BlueNalu, Future Meat Technologies, BioCraft Pet Nutrition, Shiok Meats, Meatable, and Eat Just. These companies accelerate commercialization through advances in cell culture, scalable bioreactors, and serum-free media that lower production costs. Firms also expand into beef, chicken, pork, and seafood to strengthen product reach and attract food-service partners. North America remained the leading region in 2024 with about 41% share, supported by strong investment, active regulatory pathways, and rapid pilot-scale adoption across restaurant and retail channels.

Market Insights

- The lab-grown meat market was valued at USD 33 million in 2024 and is projected to reach USD 2535.36 million by 2032 at a CAGR of 20.26%.

- Demand grew due to rising interest in sustainable and ethical protein, with beef leading the type segment at 38% share in 2024 because consumers favored low-emission alternatives.

- Major trends include rapid advances in cell culture, bioreactors, and hybrid products that mix cultured cells with plant proteins, helping companies reduce costs and improve texture for early commercial launches.

- The competitive landscape features strong activity from Mosa Meat, Aleph Farms, BlueNalu, Eat Just, Meatable, Shiok Meats, Avant Meats, Future Meat Technologies, SCiFi Foods, and BioCraft Pet Nutrition, all working to secure regulatory approvals and scale infrastructure.

- North America led the market with 41% share in 2024, followed by Europe at 30% and Asia Pacific at 22%, supported by rising trials, regulatory progress, and strong investment across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Beef held the dominant position in 2024 with about 38% share in the lab-grown meat market. This category advanced due to strong demand for premium protein and growing interest in sustainable alternatives to conventional beef. Producers focused on developing cell lines that deliver real-meat texture, which improved acceptance among restaurants and retail partners. Chicken and pork gained pace, but beef stayed ahead because consumer trials showed stronger willingness to pay for cruelty-free and low-emission beef products. Wider investment from food-tech firms also strengthened development pipelines for cultured beef.

- For instance, Mosa Meat, a Dutch company, reported that from a single sample of less than one gram of bovine muscle cells, they can theoretically produce 10,000 kg of cultured beef.

By Application

Food products led the application segment in 2024 with nearly 52% share. Rising adoption of burgers, nuggets, and minced formats created strong momentum as brands targeted flexitarian shoppers looking for familiar taste and lower environmental impact. Manufacturers prioritized ready-to-cook formats because these products require minimal processing changes and show faster regulatory acceptance. Food ingredients and supplements grew slowly, but food products maintained leadership due to clear use-case visibility, expanding pilot launches, and strong partnerships with restaurant chains for market testing.

- For instance, SuperMeat, an Israeli cell-cultured chicken firm, opened a test restaurant adjacent to its pilot plant in Ness Ziona where diners could try meal-ready chicken pieces grown from its cell lines.

By Production

Cell culture dominated the production segment in 2024 with close to 57% share. This method remained preferred because it supports scalable biomass generation and offers lower production variability compared to tissue engineering or 3D bioprinting. Companies invested in optimized growth media and bioreactor systems that help reduce cost per kilogram. Tissue engineering showed promise for structured cuts, while 3D bioprinting advanced niche applications, but cell culture remained in front due to higher maturity, broader commercial trials, and strong backing from large food-tech investors aiming for early mass-market entry.

Key Growth Drivers

Rising Demand for Sustainable Protein

Growing demand for sustainable and ethical protein strongly accelerates the lab-grown meat market. Consumers seek options that lower greenhouse gas emissions and reduce land and water use compared to conventional livestock. Many countries also promote climate-friendly protein sources through food innovation grants and pilot approvals. This support encourages startups to scale cell lines that deliver real-meat taste without raising animals. Rising awareness of animal welfare strengthens adoption among flexitarian and health-conscious shoppers. The push for net-zero goals by global food companies further boosts investment in cultivated meat, making sustainability a major growth force.

- For instance, the foundational 2011 life-cycle assessment (LCA) by Tuomisto and Teixeira de Mattos, based on a hypothetical large-scale production model, projected that cultured meat production could yield 78–96% lower greenhouse gas emissions, use up to 99% less land, and 82–96% less water compared to conventionally produced European meat.

Advances in Cell Culture and Biomanufacturing

Rapid improvements in cell culture media, bioreactors, and scaffolding methods drive strong cost reduction in cultivated meat. Food-tech companies work on serum-free media that cut production expenses while improving cell growth efficiency. New bioreactors allow higher-density cultivation, enabling stable yields at pilot and commercial scale. Structured tissue engineering techniques also help producers match the texture of beef, chicken, and seafood. These advancements attract venture capital and corporate funding, helping firms progress toward regulatory approvals. The continued shift from lab protocols to industrial processes remains a major catalyst for mass-market readiness.

- For instance, Bene Meat Technologies has developed serum-free growth media and cell-line protocols as part of its technological ecosystem, enabling industry partners to scale without using fetal bovine serum.

Supportive Regulatory Developments

Regulatory progress in regions such as the U.S., Singapore, and Israel creates confidence for global expansion of cultivated meat. Agencies now evaluate cell lines, production systems, and safety datasets, which encourages investment in commercial facilities. Early approvals for cultivated chicken help brands run controlled launches with restaurant partners. Clearer rulebooks guide firms on labeling, safety testing, and quality standards, reducing uncertainty for new entrants. Governments fund food-innovation centers that support testing and scale-up, strengthening regional ecosystems. As regulatory clarity expands, companies accelerate commercialization plans and secure new distribution partnerships.

Key Trend & Opportunity

Expansion of Hybrid Meat Products

Hybrid meat products that combine cultured cells with plant proteins create a strong opportunity for cost reduction and faster market entry. These blends offer improved texture compared to plant-only formats while keeping prices closer to mainstream meat alternatives. Companies explore hybrid nuggets, patties, and sausages because these formats need simpler structure and allow flexible cell-to-plant ratios. Grocery chains express interest in stocking such products due to better affordability and easier regulatory approval. This trend helps producers build brand visibility while full-cultured products continue scaling.

- For instance, GOOD Meat (division of Eat Just) launched a hybrid protein product in Singapore containing 3% cultivated chicken blended with plant-based proteins.

Growth of Biomanufacturing Infrastructure

Global investment in biomanufacturing facilities opens large opportunities for industrial-scale production of cultivated meat. New plants in the U.S., Europe, and Asia support higher-capacity bioreactors, downstream processing units, and pilot lines for structured cuts. Shared fermentation hubs reduce capital requirements for startups and enable faster R&D cycles. Governments and large food companies form partnerships to expand regional bio-manufacturing clusters. This infrastructure growth supports lower costs, reliable supply, and wider product testing across retail and food-service sectors, creating long-term market opportunities.

- For instance, in China, a new protein-innovation base in Beijing includes a 200-litre cell culture line plus a 2,000-litre bioreactor line, with plans to add more pilot facilities

Diversification Across New Meat Categories

Producers expand beyond chicken and beef to develop cultured seafood, pork, and premium meats like wagyu and bluefin tuna. These categories offer higher price tolerance, making early commercialization more viable. Seafood receives strong attention because many species face overfishing and contamination risks, giving cultivated alternatives clear value. Companies also explore niche meats to build brand differentiation and partner with fine-dining restaurants for early adoption. This diversification broadens revenue streams and expands consumer exposure to cultured meat options.

Key Challenge

High Production Costs and Scale Limitations

High production cost remains a major barrier to mass adoption of cultivated meat. Cell culture media, growth factors, and bioreactor operations demand significant expense, keeping prices above conventional meat. Scaling biomass production without compromising texture or flavor requires advanced equipment that only a few companies can access. The transition from lab-scale to industrial manufacturing also increases operational risk. Limited availability of food-grade bioreactors and skilled personnel slows expansion. Unless costs fall sharply, retail penetration will remain limited to premium or hybrid products in early years.

Regulatory and Consumer Acceptance Hurdles

Regulatory approvals progress slowly across many regions, delaying large-scale launches. Agencies require extensive safety data, which increases time and cost for producers. Consumer acceptance also varies due to concerns about “lab-made” food, unfamiliar production methods, and perceived unnaturalness. Clear communication and transparent labeling remain essential to build trust. Lack of standardized naming rules complicates marketing efforts across countries. Without strong education campaigns and regulatory harmonization, adoption of cultivated meat may face resistance in mainstream markets.

Regional Analysis

North America

North America held about 41% share in the lab-grown meat market in 2024. Strong startup activity increased product launches across pilot stores and restaurants. Supportive regulations improved testing of chicken and beef alternatives. Venture funding raised large facilities for cell culture growth. Consumers showed high interest in sustainable proteins. Food chains tested hybrid formats in major cities. Universities backed new bioreactor designs and low-cost media. These factors kept the region in a clear leadership position.

Europe

Europe accounted for nearly 30% share due to strong investment in food-tech innovation. The region pushed strict safety rules that shaped product testing. Governments funded cellular agriculture hubs across major countries. Food companies explored hybrid products for early adoption. Sustainability goals increased demand for low-impact proteins. Research labs advanced tissue engineering for structured cuts. Retail chains partnered with startups for limited trials. Europe maintained steady growth momentum through coordinated public and private programs.

Asia Pacific

Asia Pacific captured close to 22% share with rising focus on food security. Countries invested in local production to cut reliance on imported meat. Urban consumers supported cultured chicken and seafood. Governments funded biomanufacturing plants for large-scale trials. Startups used fast-growing cell lines to lower costs. Food brands explored premium seafood like tuna and snapper. Strong population density boosted long-term demand. The region remained a major growth hotspot.

Latin America

Latin America held roughly 4% share, supported by rising awareness of sustainable meat. Regional producers explored cultured beef due to strong local demand. Universities studied new cell media using local ingredients. Restaurants showed interest in hybrid patties for future menus. Funding remained limited but increased each year. Climate concerns pushed interest in low-impact protein sources. Supply chains improved through small pilot labs. Growth stayed steady but at an early stage.

Middle East & Africa

Middle East & Africa accounted for about 3% share, driven by food security needs. Governments studied cultivated meat for long-term supply stability. Import-dependent nations explored local bioreactor setups. Premium restaurants tested early samples through global partners. Climate limits supported interest in land-saving protein solutions. Funding grew mainly from Gulf countries. Research groups worked on serum-free media. Adoption remained slow but showed clear future potential.

Market Segmentations:

By Type

- Beef

- Pork

- Chicken

- Seafood

By Application

- Food Products

- Food Ingredients

- Nutritional Supplements

By Production

- Cell Culture

- Tissue Engineering

- 3D Bioprinting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the lab-grown meat market features leading innovators such as Aleph Farms, Mosa Meat, BlueNalu, Meatable, Eat Just, Shiok Meats, Future Meat Technologies, Avant Meats, SCiFi Foods, and BioCraft Pet Nutrition at the forefront of commercialization. These companies advance cell culture, tissue engineering, and bioreactor technologies to reduce production costs and scale pilot facilities into commercial plants. Many firms focus on serum-free media and hybrid meat formats to accelerate regulatory approvals and improve affordability. Partnerships with food-service chains, biotech suppliers, and government-backed research centers help expand testing and expand early retail presence. Firms also diversify product portfolios across beef, chicken, pork, and seafood to target premium and high-demand categories. Strong venture funding, IP development, and national regulatory progress shape competition, while companies race to achieve price parity, scalable output, and stable quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mosa Meat (Netherlands)

- Avant Meats (Hong Kong)

- SCiFi Foods (United States)

- Aleph Farms (Israel)

- BlueNalu (United States)

- Future Meat Technologies (Israel)

- BioCraft Pet Nutrition (United States)

- Shiok Meats (Singapore)

- Meatable (Netherlands)

- Eat Just (United States)

Recent Developments

- In March 2025, Aleph Farms (Israel) Raised US$29 M and announced cost-reduction modifications to its whole-cut cultivated beef technology

- In February 2025, Mosa Meat (Netherlands) announced a move toward Switzerland commercialization by submitting a novel food authorization dossier for its cultivated beef fat.

- In June 2024, SCiFi Foods (United States) Company announced it was shutting down operations due to inability to raise required capital

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Production and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as large food companies invest in commercial-scale bioreactors.

- Production costs will decline as serum-free media and high-density cell systems improve.

- Hybrid products will gain traction and support early retail penetration across major cities.

- Regulatory approvals will increase across Asia, Europe, and North America.

- Cultivated seafood will grow quickly due to strong demand for safe and sustainable options.

- Structured cuts like steaks and fillets will move from pilot trials to limited commercial launches.

- Partnerships between biotech firms and restaurant chains will speed consumer acceptance.

- Regional biomanufacturing hubs will reduce supply bottlenecks and support faster scaling.

- Branding and transparent labeling will shape consumer trust and long-term adoption.

- Investment in automation and AI-driven cell optimization will boost yield consistency and quality.