Market Overview

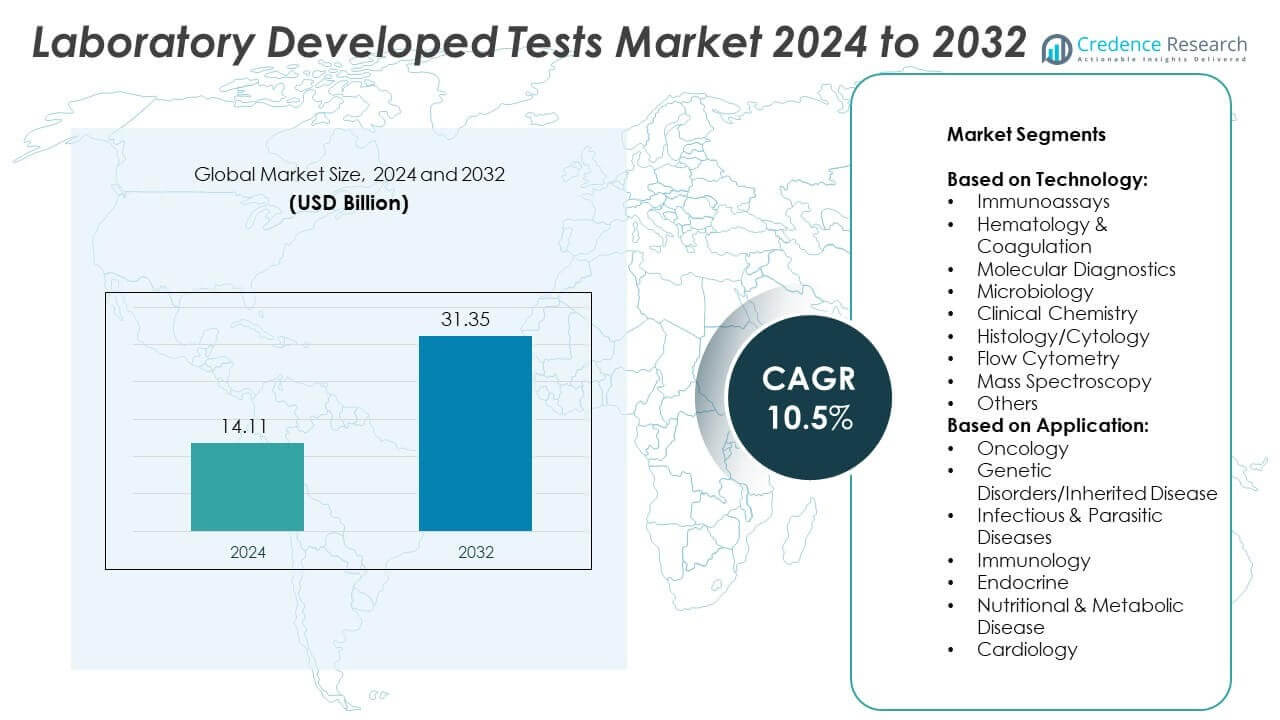

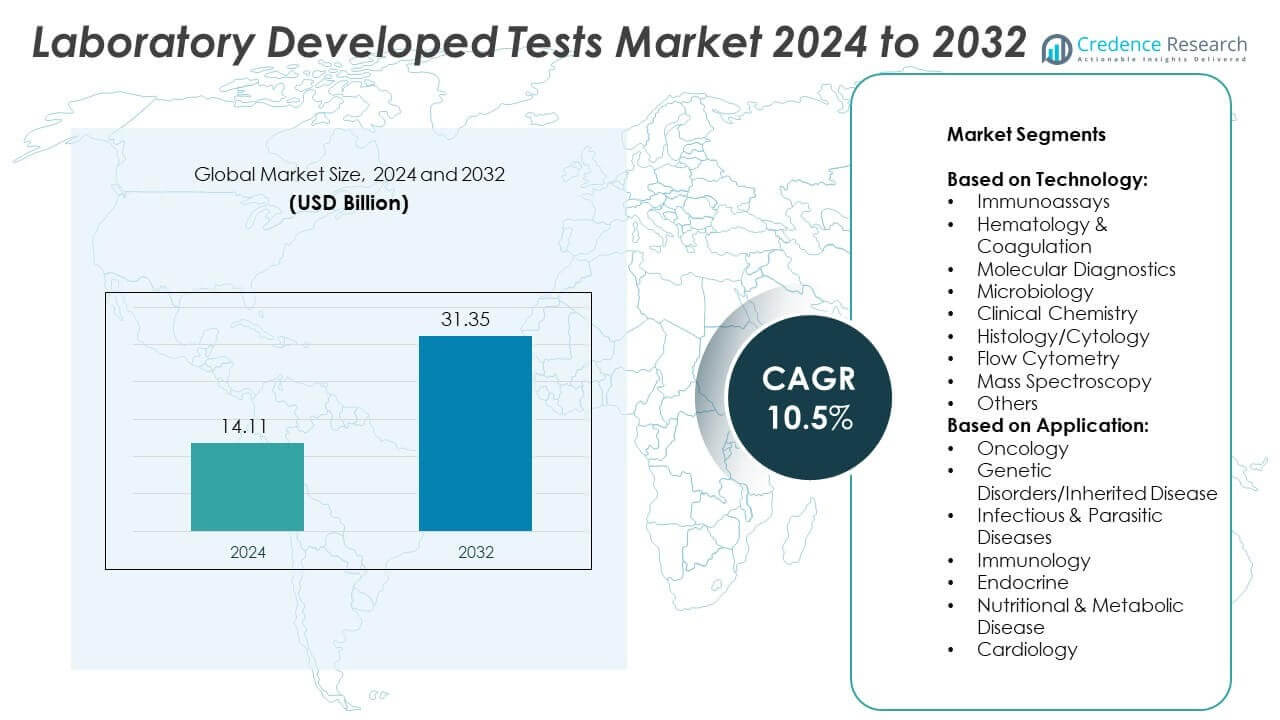

Laboratory Developed Tests Market size was valued at USD 14.11 Billion in 2024 and is anticipated to reach USD 31.35 Billion by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Developed Tests Market Size 2024 |

USD 14.11 Billion |

| Laboratory Developed Tests Market, CAGR |

10.5% |

| Laboratory Developed Tests Market Size 2032 |

USD 31.35 Billion |

The Laboratory Developed Tests market grows due to rising demand for personalized diagnostics, rapid response to emerging diseases, and flexibility in test development. Labs adopt advanced molecular platforms, AI integration, and digital workflows to enhance accuracy and speed. Oncology, genetic disorders, and infectious diseases remain key application areas. Regulatory flexibility and unmet clinical needs further support adoption. It enables healthcare providers to tailor diagnostics, reduce turnaround time, and improve patient outcomes in diverse clinical environments.

North America leads the Laboratory Developed Tests market due to strong healthcare infrastructure, advanced labs, and early adoption of molecular diagnostics. Europe follows with expanding genomic initiatives and regulatory frameworks supporting clinical testing. Asia-Pacific shows rapid growth driven by rising disease burden, government investments, and growing lab networks. Latin America and the Middle East & Africa witness steady adoption supported by public health needs and diagnostic gaps. Key players include QIAGEN, Siemens Healthineers AG, Illumina, and Quest Diagnostics Incorporated.

Market Insights

- The Laboratory Developed Tests market was valued at USD 14.11 Billion in 2024 and is projected to reach USD 31.35 Billion by 2032, growing at a CAGR of 10.5%.

- Rising demand for personalized medicine, oncology profiling, and genetic screening drives market expansion globally.

- Trends include growing adoption of molecular diagnostics, AI integration, and decentralized testing platforms for rapid diagnostics.

- Major players invest in next-generation sequencing, digital workflows, and strategic partnerships to enhance competitiveness.

- Unclear regulatory frameworks, lack of standardization, and reimbursement limitations act as key restraints for market scalability.

- North America leads due to advanced healthcare infrastructure, strong lab networks, and early use of high-complexity tests.

- Europe and Asia-Pacific show steady and fast growth respectively, while Latin America and Middle East & Africa adopt LDTs to fill diagnostic gaps.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Personalized Medicine Fuels Expansion Across Clinical Applications

Laboratory Developed Tests market grows steadily due to increasing demand for personalized and precision medicine. Healthcare providers use LDTs to tailor diagnostics and treatments based on patient-specific biomarkers. Oncology, rare disease detection, and pharmacogenomics represent key areas benefiting from this shift. These tests offer flexibility in developing and validating assays outside rigid regulatory frameworks. Hospitals and labs prefer LDTs to respond faster to emerging clinical needs and mutations. It allows for innovation in response to unmet diagnostic gaps.

- For instance, In 2023, Guardant Health reported processing a total of 172,900 tests for clinical customers and an additional 29,900 tests for biopharmaceutical customers. These figures cover all of the company’s tests, including Guardant360, Guardant360 CDx, Guardant360 TissueNext, Guardant360 Response, GuardantOMNI, and Guardant Reveal.

Technological Advancements in Genomic and Molecular Platforms Drive Market Innovation

The Laboratory Developed Tests market benefits from rapid improvements in molecular diagnostics, next-generation sequencing, and automation. Labs can now develop complex assays with higher accuracy and faster turnaround. Improved bioinformatics platforms support large-scale data analysis, boosting test utility. It supports better disease classification, risk assessment, and prognosis monitoring. These tools enable multiplexed testing and higher throughput without compromising precision. The market continues to grow with adoption of integrated platforms and point-of-care molecular systems.

- For instance, Illumina’s NovaSeq X Plus system, has the capacity to generate over 20,000 whole genomes per year under optimal conditions, using its highest capacity 25B flow cells. The system features a 2.5-fold increase in throughput over previous sequencers and a 90% reduction in packaging weight and waste. In its first quarter of 2023, Illumina exceeded 200 orders for the NovaSeq X system

Regulatory Flexibility Encourages Clinical Lab Innovation and Customized Test Deployment

Regulatory pathways for LDTs remain less stringent compared to in-vitro diagnostic kits, especially in the U.S. under CLIA certification. This flexibility allows hospital labs and academic centers to develop tests tailored to their specific patient populations. The Laboratory Developed Tests market thrives on this freedom to innovate quickly and address localized health concerns. It helps institutions validate and use tests that may not yet have FDA approval but meet urgent clinical demand. Labs can adapt testing protocols in response to disease outbreaks or new variants. This agility supports clinical preparedness and operational resilience.

Chronic Disease Burden and Aging Population Support Market Adoption in Routine Diagnostics

Chronic illnesses such as cancer, cardiovascular disease, and diabetes require ongoing monitoring and early detection. The Laboratory Developed Tests market supports this need with flexible and customizable assays. Aging populations drive demand for diagnostic tools that detect genetic risk factors and manage long-term care. It creates opportunities for tailored screening protocols and disease stratification. LDTs also support proactive care models and reduce dependence on centralized reference labs. Clinical settings benefit from deploying these tools to improve patient outcomes and reduce treatment delays.

Market Trends

Increased Focus on Oncology and Genetic Screening Expands Clinical Use Cases

Clinical laboratories prioritize oncology and hereditary disease detection using advanced LDT platforms. Demand grows for tumor profiling, minimal residual disease monitoring, and companion diagnostics. The Laboratory Developed Tests market reflects a shift toward early and individualized cancer detection strategies. It also supports pre-symptomatic genetic screening for inherited conditions. Labs create tailored panels for specific populations or conditions, expanding LDT relevance beyond general diagnostics. These focused applications gain adoption across academic centers, hospitals, and specialty labs.

- For instance, In 2023, Mayo Clinic Laboratories launched numerous new tests and updated existing ones to address patient-specific diagnostic needs, in March 2023 alone, the laboratory announced 29 new tests, covering areas from infectious diseases to hematology.

Integration of Artificial Intelligence and Bioinformatics Enhances Diagnostic Performance

AI and advanced data analytics are transforming diagnostic workflows for LDTs. Machine learning models improve interpretation of complex molecular and genomic datasets. The Laboratory Developed Tests market adopts AI-enabled platforms to assist in risk prediction, result validation, and workflow automation. It enables labs to reduce manual errors and improve report turnaround time. AI also supports continuous learning, refining models using clinical feedback and real-world data. This integration boosts confidence in LDT results and accelerates adoption in clinical decision-making.

- For instance, Quest Diagnostics is a leading provider of diagnostic information services that supports chronic disease management through a wide range of tests, including advanced molecular and laboratory-developed tests (LDTs). In 2023, Quest Diagnostics reported approximately $9.03 billion in base business revenue, which represented a 7.1% increase over 2022 and accounted for the vast majority of its total annual revenue.

Expansion of Point-of-Care and At-Home Testing Supports Decentralized Diagnostics

Shifting patient expectations and telehealth trends push demand for accessible diagnostic options. The Laboratory Developed Tests market responds with assays suited for near-patient or remote settings. It supports chronic disease monitoring, infectious disease screening, and reproductive health testing from home. Labs are optimizing workflows for rapid processing, digital integration, and mobile reporting. Decentralized models reduce load on centralized labs while improving patient engagement. This trend aligns with growing interest in preventative care and personalized wellness tracking.

Rise in Infectious Disease Surveillance and Emerging Pathogen Detection Spurs Development

Global outbreaks, such as COVID-19 and new viral threats, increase reliance on rapid assay development. The Laboratory Developed Tests market plays a critical role in early outbreak response through lab-driven innovation. It enables timely validation of diagnostic protocols before commercial kits are available. Labs use LDTs to test for variants, co-infections, and vaccine responses. This flexibility is vital for adapting to evolving pathogen landscapes. Demand remains strong for scalable, multiplexed solutions across public health and clinical sectors.

Market Challenges Analysis

Uncertain Regulatory Landscape Creates Barriers for Widespread Clinical Adoption

The Laboratory Developed Tests market faces challenges from evolving and unclear regulatory frameworks. Uncertainty around potential FDA oversight raises concerns for labs investing in test development. It creates hesitation among smaller labs lacking resources to meet stricter compliance requirements. Some stakeholders fear new regulations may delay innovation or increase operational costs. Differences in regulatory policies across regions further complicate global test deployment. Labs must navigate complex requirements without clarity on long-term enforcement.

Quality Control Variability and Limited Reimbursement Impact Market Scalability

Inconsistent quality control across laboratories affects confidence in LDT performance and limits standardization. The Laboratory Developed Tests market encounters difficulty in ensuring uniform validation procedures across diverse clinical settings. It hampers interoperability and cross-institutional test adoption. Reimbursement policies also remain inconsistent, with many insurers reluctant to cover unapproved or unstandardized tests. Labs often absorb these costs, affecting sustainability and pricing models. It places financial strain on clinical laboratories aiming to scale innovative diagnostic offerings.

Market Opportunities

Growing Demand for Precision Diagnostics Across Rare Diseases and Complex Conditions Creates Expansion Pathways

Rising focus on rare genetic disorders, neurological diseases, and autoimmune conditions opens new clinical avenues. The Laboratory Developed Tests market supports tailored assays for niche populations with unmet diagnostic needs. It enables rapid prototyping and deployment of novel tests when commercial options remain unavailable. Specialized LDTs allow clinicians to identify disease subtypes and optimize treatment pathways. Labs gain opportunities by targeting underserved conditions that require customized molecular approaches. It strengthens the role of academic and specialty labs in advancing precision diagnostics.

Expansion into Emerging Markets and Decentralized Healthcare Models Drives Adoption

Healthcare systems in Asia-Pacific, Latin America, and the Middle East seek flexible, cost-effective diagnostic tools. The Laboratory Developed Tests market can scale in these regions through public-private partnerships and localized innovation. It meets diagnostic gaps where traditional IVD test access remains limited or delayed. Growth of decentralized care models supports adoption of LDTs in regional hospitals and community labs. Investments in digital infrastructure improve connectivity and data sharing across networks. This shift expands market access beyond large urban centers.

Market Segmentation Analysis:

By Technology:

Molecular diagnostics holds the largest share due to its high accuracy and versatility in identifying genetic material. It supports a broad range of clinical applications, including cancer, infectious diseases, and inherited conditions. The Laboratory Developed Tests market benefits from the adaptability of molecular platforms in developing personalized assays. Immunoassays follow closely, favored for their ability to detect proteins, hormones, and infectious agents with speed and sensitivity. Clinical chemistry and hematology & coagulation segments remain essential in routine diagnostics, especially for metabolic and cardiovascular disorders. Flow cytometry and mass spectroscopy support advanced research and oncology profiling, offering high-throughput capabilities and detailed analysis. Histology, cytology, microbiology, and others serve specialized needs in tissue-based testing and microbial identification.

- For instance, NeoGenomics reported an 18% increase in Clinical Services revenue for the full year 2023. The average revenue per clinical test was $441 in the fourth quarter of 2023, during which clinical test volume increased by 6% year-over-year.

By Application:

Oncology leads due to the rising demand for personalized cancer diagnostics and monitoring. Labs use LDTs to assess tumor markers, genetic mutations, and treatment response. It supports oncology centers with flexible protocols that adapt to rapidly changing clinical needs. Genetic disorders and inherited diseases also represent a strong segment, with increasing focus on early diagnosis and family screening. Infectious and parasitic diseases continue to drive demand, especially in outbreak response, travel medicine, and hospital-acquired infections. Immunology and endocrine applications benefit from ongoing chronic disease management, while nutritional and metabolic diseases rely on LDTs for early detection and treatment optimization. Cardiology applications are expanding with tests for biomarkers that support preventive care and heart failure management. These segments contribute to the growth of hospital and reference labs offering tailored diagnostics across diverse patient populations.

- For instance, Siemens Healthineers integrates artificial intelligence into its diagnostic platforms, including Atellica, to enhance efficiency. some Atellica analyzers can deliver results for over 50 critical assays within 14 minutes, compared to conventional systems, which can take 22 to 40 minutes.

Segments:

Based on Technology:

- Immunoassays

- Hematology & Coagulation

- Molecular Diagnostics

- Microbiology

- Clinical Chemistry

- Histology/Cytology

- Flow Cytometry

- Mass Spectroscopy

- Others

Based on Application:

- Oncology

- Genetic Disorders/Inherited Disease

- Infectious & Parasitic Diseases

- Immunology

- Endocrine

- Nutritional & Metabolic Disease

- Cardiology

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Laboratory Developed Tests market, accounting for 47.2% in 2024. The region’s dominance is driven by a well-established clinical laboratory network, high healthcare spending, and supportive regulatory frameworks under CLIA (Clinical Laboratory Improvement Amendments). The U.S. leads adoption with a strong presence of academic medical centers, reference labs, and integrated delivery networks that rely heavily on LDTs for oncology, pharmacogenomics, and infectious disease testing. It also benefits from early uptake of advanced diagnostic technologies, including next-generation sequencing and liquid biopsy platforms. Continued investment in precision medicine and favorable reimbursement for high-complexity tests supports expansion. Canada contributes with growing genomic testing initiatives and public-private collaborations in rare disease diagnostics, further strengthening the regional outlook.

Europe

Europe captures 24.5% of the global Laboratory Developed Tests market, led by demand in countries such as Germany, the UK, France, and the Netherlands. The region benefits from strong academic research infrastructure and public health systems that incorporate LDTs for genetic screening, oncology, and metabolic disorders. Laboratories across Europe increasingly use LDTs for population-scale genomic initiatives and personalized treatment programs. Regulatory developments under the European In Vitro Diagnostic Regulation (IVDR) are shaping how LDTs are validated and monitored, influencing investment strategies for clinical labs. It pushes institutions to adopt rigorous quality control while expanding capabilities in decentralized testing. Growing focus on early disease detection, aging population needs, and rising prevalence of chronic conditions continue to support regional demand.

Asia-Pacific

Asia-Pacific holds a 17.3% share of the Laboratory Developed Tests market, with rapid growth driven by expanding healthcare infrastructure, population size, and increasing disease burden. China, Japan, India, South Korea, and Australia emerge as key markets, supported by government-led genomics programs and cancer screening initiatives. Labs in the region deploy LDTs to close diagnostic gaps, especially where commercial tests are limited or unavailable. The rise of private diagnostic chains and digital health platforms contributes to test accessibility across urban and semi-urban centers. It also reflects increasing collaboration between global IVD companies and regional labs to introduce advanced molecular technologies. Public health surveillance and infectious disease management remain key drivers for LDT adoption across Asia-Pacific.

Latin America

Latin America accounts for 6.1% of the global Laboratory Developed Tests market in 2024. Countries such as Brazil, Mexico, Argentina, and Chile show growing interest in LDTs for oncology, infectious disease, and metabolic testing. Limited access to commercial test kits and slow regulatory approval timelines make LDTs a practical choice for local labs. Public and private healthcare providers adopt LDTs to enhance diagnostics in under-resourced regions. Labs in urban centers lead development efforts, supported by academic institutions and diagnostic start-ups. Government efforts to expand personalized medicine and improve lab accreditation standards contribute to the segment’s momentum. It also allows flexibility in responding to emerging public health threats, such as dengue and Zika virus.

Middle East & Africa

The Middle East & Africa region holds a 4.9% share in the Laboratory Developed Tests market. The growth is driven by the rising incidence of genetic disorders, cancer, and infectious diseases across Gulf Cooperation Council (GCC) nations and parts of Sub-Saharan Africa. Countries like Saudi Arabia, UAE, and South Africa invest in diagnostic infrastructure, including molecular labs and pathology networks. LDTs are used to fill gaps in diagnostic capabilities where commercial kits are not viable due to cost or regulatory constraints. Increasing collaborations with international health agencies and diagnostic providers accelerate adoption. It also supports local capacity-building through workforce training, equipment upgrades, and digital reporting systems. Growth is steady but constrained by uneven healthcare access and limited reimbursement frameworks across rural areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QIAGEN

- Quentrix

- Siemens Healthineers AG

- Guardant Health

- Hoffmann-La Roche Ltd.

- NeoGenomics Laboratories

- Illumina, Inc.

- 23andMe, Inc.

- Abbott

- Quest Diagnostics Incorporated

Competitive Analysis

The Laboratory Developed Tests market features strong competition among key players including QIAGEN, Quentrix, Siemens Healthineers AG, Guardant Health, F. Hoffmann-La Roche Ltd., NeoGenomics Laboratories, Illumina, Inc., 23andMe, Inc., Abbott, and Quest Diagnostics Incorporated. These companies compete on technological innovation, test accuracy, turnaround time, and clinical application range. Major diagnostic firms continue to expand LDT portfolios with advanced molecular platforms, next-generation sequencing, and liquid biopsy tools. They focus on oncology, rare disease, and infectious disease applications to meet growing demand for personalized diagnostics. Firms invest in AI-enabled tools to automate data interpretation and improve clinical workflow efficiency. Strategic partnerships with hospitals, research institutions, and digital health firms help expand market reach and validate new assays. Companies also strengthen regional presence through lab expansions, acquisitions, and regulatory compliance upgrades. High-complexity LDTs remain a focus for differentiation, especially in specialized pathology and genomics. Players target both centralized reference labs and decentralized clinical settings with scalable testing solutions. Competitive positioning now depends on test customization, digital integration, and adaptability to regulatory changes.

Recent Developments

- In June 2025, Abbott introduced a lab-based blood test to help evaluate concussion.

- In March 2025, Guardant Health received Advanced Diagnostic Laboratory Test (ADLT) status from CMS for the Shield™ blood test, enabling Medicare reimbursement

- In July 2022, Quanterix launched the first TDTs for the diagnostic test of Alzheimer’s disease for clinical diagnostics and research applications in the US

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increased adoption of personalized diagnostics in oncology and rare diseases.

- Demand for molecular and genetic testing will drive innovation in assay development and automation.

- Regulatory reforms may tighten validation requirements, prompting labs to invest in quality systems.

- AI and machine learning will improve test accuracy, interpretation speed, and clinical decision support.

- Point-of-care and at-home LDTs will expand due to rising demand for decentralized diagnostics.

- Public health agencies will rely on LDTs for rapid response to emerging infectious disease threats.

- Collaborations between labs, biotech firms, and hospitals will support test development pipelines.

- Developing regions will adopt LDTs to close diagnostic gaps in under-resourced healthcare systems.

- Cloud-based platforms and digital integration will enhance lab operations and data reporting.

- Rising chronic disease burden and aging populations will support ongoing use of LDTs in preventive care.