| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Medical Device Contract Manufacturing Market Size 2024 |

USD 3,381.05 Million |

| Latin America Medical Device Contract Manufacturing Market, CAGR |

10.23% |

| Latin America Medical Device Contract Manufacturing Market Size 2032 |

USD 7,369.02 Million |

Market Overview

Latin America Medical Device Contract Manufacturing Market size was valued at USD 3,381.05 million in 2024 and is anticipated to reach USD 7,369.02 million by 2032, at a CAGR of 10.23% during the forecast period (2024-2032).

The Latin America Medical Device Contract Manufacturing market is driven by several key factors, including the increasing demand for high-quality medical devices, rising healthcare expenditures, and a growing aging population. Cost efficiency and the need for specialized expertise have led many companies to outsource manufacturing to contract manufacturers, facilitating market growth. Additionally, advancements in medical technologies, such as wearable devices, diagnostic equipment, and minimally invasive surgical tools, are fueling demand for contract manufacturing services. The region’s improving regulatory framework, which aligns with international standards, also contributes to market expansion by ensuring product quality and safety. Moreover, the trend toward localized production to minimize supply chain disruptions and reduce costs is gaining momentum. As a result, Latin American contract manufacturers are poised to play a pivotal role in meeting the region’s increasing demand for innovative and cost-effective medical solutions.

Geographically, Latin America offers diverse opportunities for medical device contract manufacturing, with key players spread across several countries. Brazil remains the dominant market due to its large healthcare demand and manufacturing infrastructure, while Mexico serves as a significant hub for North American outsourcing. Argentina, Chile, and Colombia also contribute to the region’s growth with their developing medical device industries and increasingly aligned regulatory frameworks. Major players in the Latin American medical device contract manufacturing space include MicroVention-Terumo, Medtronic, Boston Scientific, Proquident, and Biolinks. These companies leverage the region’s cost advantages, skilled workforce, and regulatory improvements to expand their presence. As the demand for high-quality medical devices rises in Latin America, global and regional companies are capitalizing on the region’s strategic location, advanced manufacturing capabilities, and favorable trade agreements to strengthen their competitive position and expand market access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Latin America Medical Device Contract Manufacturing market size was valued at USD 3,381.05 million in 2024 and is expected to reach USD 7,369.02 million by 2032, growing at a CAGR of 10.23% during the forecast period (2024-2032).

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Increasing healthcare demand in the region is a major driver, spurred by an aging population and expanding healthcare infrastructure.

- Outsourcing trends from North American and European companies are boosting contract manufacturing in the region, driven by cost advantages and skilled labor.

- Advancements in manufacturing technologies, such as automation and 3D printing, are shaping the industry and improving production capabilities.

- Regulatory improvements and alignment with international standards are enhancing the competitiveness of Latin American manufacturers.

- Economic instability, including inflation and currency fluctuations, poses challenges to the market.

- Brazil, Mexico, and Argentina are the key players, with Brazil holding the largest market share at approximately 45%.

Report Scope

This report segments the Latin America Medical Device Contract Manufacturing market as follows:

Market Drivers

Growing Demand for Healthcare Services

The Latin American medical device contract manufacturing industry is experiencing robust growth, primarily driven by the increasing demand for healthcare services. With a rising population and greater access to healthcare, the need for medical devices has surged across the region. For instance, Latin America’s medical device market is expanding due to increased healthcare investments in countries like Brazil and Mexico. As a result, the demand for advanced medical devices, including diagnostic tools, surgical instruments, and monitoring equipment, has increased. Local manufacturers are partnering with global companies to meet the heightened demand, propelling the market forward.

Cost Efficiency and Outsourcing Trends

Another key driver is the growing trend of outsourcing among medical device companies. For instance, Latin America is becoming a preferred outsourcing destination for medical device companies from North America and Europe. The region offers a competitive cost structure, lower labor costs, and favorable exchange rates, making it an attractive destination for outsourcing production. By outsourcing to Latin American manufacturers, companies can optimize their operations, increase production efficiency, and achieve significant cost savings. This trend of outsourcing is especially beneficial for small- and medium-sized enterprises (SMEs) that need to scale production without incurring substantial upfront investment.

Regulatory Compliance and Expertise

Latin America has made significant strides in regulatory harmonization, which is crucial for the medical device sector. Countries like Brazil, Mexico, and Argentina are aligning their regulations with international standards, such as those set by the U.S. FDA and the European Medicines Agency (EMA). This regulatory compliance ensures that medical devices manufactured in Latin America are of high quality and meet the necessary safety standards. Additionally, Latin American manufacturers have developed specialized expertise in meeting complex regulatory requirements, making them reliable partners for global medical device companies. This growing regulatory expertise boosts the attractiveness of the region as a hub for contract manufacturing.

Technological Advancements and Innovation

The Latin American medical device contract manufacturing market is also being driven by technological advancements and innovation in production techniques. Latin American manufacturers are adopting cutting-edge technologies, such as 3D printing, automation, and advanced materials, to improve the quality and efficiency of medical devices. These innovations not only enhance the manufacturing process but also enable the production of sophisticated, high-precision devices. Moreover, the adoption of digital solutions for supply chain management, quality control, and product design is further strengthening the competitive position of Latin American manufacturers. As the demand for technologically advanced devices rises, manufacturers in the region are well-equipped to support this trend with innovation-driven solutions.

Market Trends

Expansion of Outsourcing Partnerships

A prominent trend in Latin America’s medical device contract manufacturing sector is the expansion of outsourcing partnerships between regional manufacturers and international medical device companies. As global manufacturers look to reduce operational costs, Latin America has emerged as a key outsourcing destination due to its competitive labor costs, favorable exchange rates, and proximity to North American and European markets. This trend is particularly noticeable in countries like Mexico and Brazil, where established manufacturing infrastructure and experienced workforce capabilities offer a robust foundation for contract manufacturing. Outsourcing allows companies to focus on core competencies while leveraging the region’s cost-effective production advantages.

Rising Focus on Regulatory Compliance

Another significant trend is the increasing emphasis on regulatory compliance in Latin America’s medical device manufacturing processes. For instance, Latin American countries are aligning their medical device regulations with international standards such as ISO 13485, FDA, and CE mark requirements. This is crucial as medical devices require compliance with rigorous safety and quality standards. Regulatory bodies in countries like Brazil and Mexico have enhanced their regulatory frameworks in recent years, offering greater confidence to global manufacturers looking to source products from Latin America. As the region continues to adhere to international regulatory standards, it solidifies its position as a reliable manufacturing hub for medical devices.

Technological Integration in Manufacturing

Technology integration is revolutionizing the Latin American medical device contract manufacturing industry. For instance, Latin American manufacturers are integrating 3D printing, automation, and robotics into medical device production. These technologies enable the production of complex and high-precision devices, meeting the growing demand for advanced medical equipment. Additionally, the use of automation is enhancing production speed, reducing errors, and lowering labor costs. As more companies in the region embrace digital transformation, Latin American manufacturers are becoming more competitive in the global medical device market, offering innovative solutions to international clients.

Emphasis on Sustainability and Green Manufacturing

Sustainability is emerging as a key trend in the medical device contract manufacturing sector in Latin America. Environmental concerns and regulatory pressures are pushing manufacturers to adopt greener practices, focusing on reducing waste, minimizing energy consumption, and utilizing eco-friendly materials. Manufacturers are increasingly investing in sustainable production technologies to comply with global environmental standards and appeal to environmentally-conscious consumers. As sustainability becomes a focal point for businesses worldwide, Latin American medical device manufacturers are incorporating eco-friendly practices into their production processes, helping to align with the growing demand for sustainable medical products. This trend is likely to continue as environmental responsibility becomes integral to the competitive landscape of global manufacturing.

Market Challenges Analysis

Regulatory and Compliance Challenges

One of the most significant challenges faced by the Latin American medical device contract manufacturing sector is navigating the complex and varied regulatory landscape across different countries. While there has been progress in aligning with international standards, such as ISO 13485 and the FDA, the regulatory frameworks can still be fragmented. For instance, Latin America’s medical device sector operates under diverse regulatory frameworks, with countries like Brazil and Argentina maintaining distinct approval processes.. The inconsistency in regulations across the region can make it difficult for companies to streamline operations, especially when dealing with multiple markets. Additionally, frequent changes in regulatory requirements can create uncertainty, making it harder for manufacturers to remain compliant without incurring significant administrative overhead.

Economic Instability and Supply Chain Disruptions

Economic instability remains a critical challenge for Latin American medical device contract manufacturers. Fluctuations in exchange rates, inflation, and periods of economic downturn can significantly affect production costs and pricing strategies. Manufacturers in the region are vulnerable to these economic shifts, which can impact their ability to maintain consistent production schedules and profitability. Furthermore, Latin America’s supply chains are often vulnerable to disruptions, whether due to geopolitical factors, natural disasters, or logistical challenges. The COVID-19 pandemic further highlighted vulnerabilities in the supply chain, causing delays in raw material shipments and final product distribution. These challenges can hinder manufacturers’ ability to meet the growing demand for medical devices, especially for global companies relying on timely deliveries and stable supply networks.

Market Opportunities

The Latin American medical device contract manufacturing market presents significant opportunities due to several factors, including the region’s increasing healthcare demand and its competitive cost advantages. As Latin American countries, particularly Brazil, Mexico, and Argentina, invest in healthcare infrastructure and expand access to medical services, the demand for medical devices has surged. With a rising middle class and an aging population, there is a growing need for advanced healthcare solutions, which in turn drives the demand for medical devices such as diagnostic tools, surgical instruments, and patient monitoring systems. Global medical device companies are increasingly turning to contract manufacturers in Latin America to meet this growing demand while taking advantage of lower production costs, skilled labor, and proximity to North American markets. This creates a valuable opportunity for regional manufacturers to establish long-term partnerships with global players and expand their market share.

Additionally, there is an increasing opportunity for Latin American manufacturers to capitalize on the region’s improving regulatory standards and alignment with international compliance norms. Many Latin American countries are harmonizing their regulatory frameworks with global standards such as ISO 13485, FDA, and CE, which increases the competitiveness of the region in the global medical device market. By adhering to these stringent standards, Latin American manufacturers can appeal to international companies looking for reliable, high-quality production partners. Moreover, advancements in technology, such as automation and 3D printing, are opening new doors for innovation in the production of complex medical devices. As these technological capabilities improve, Latin American manufacturers are well-positioned to offer cutting-edge solutions and meet the evolving needs of the medical device industry, further strengthening their role as key players in global contract manufacturing.

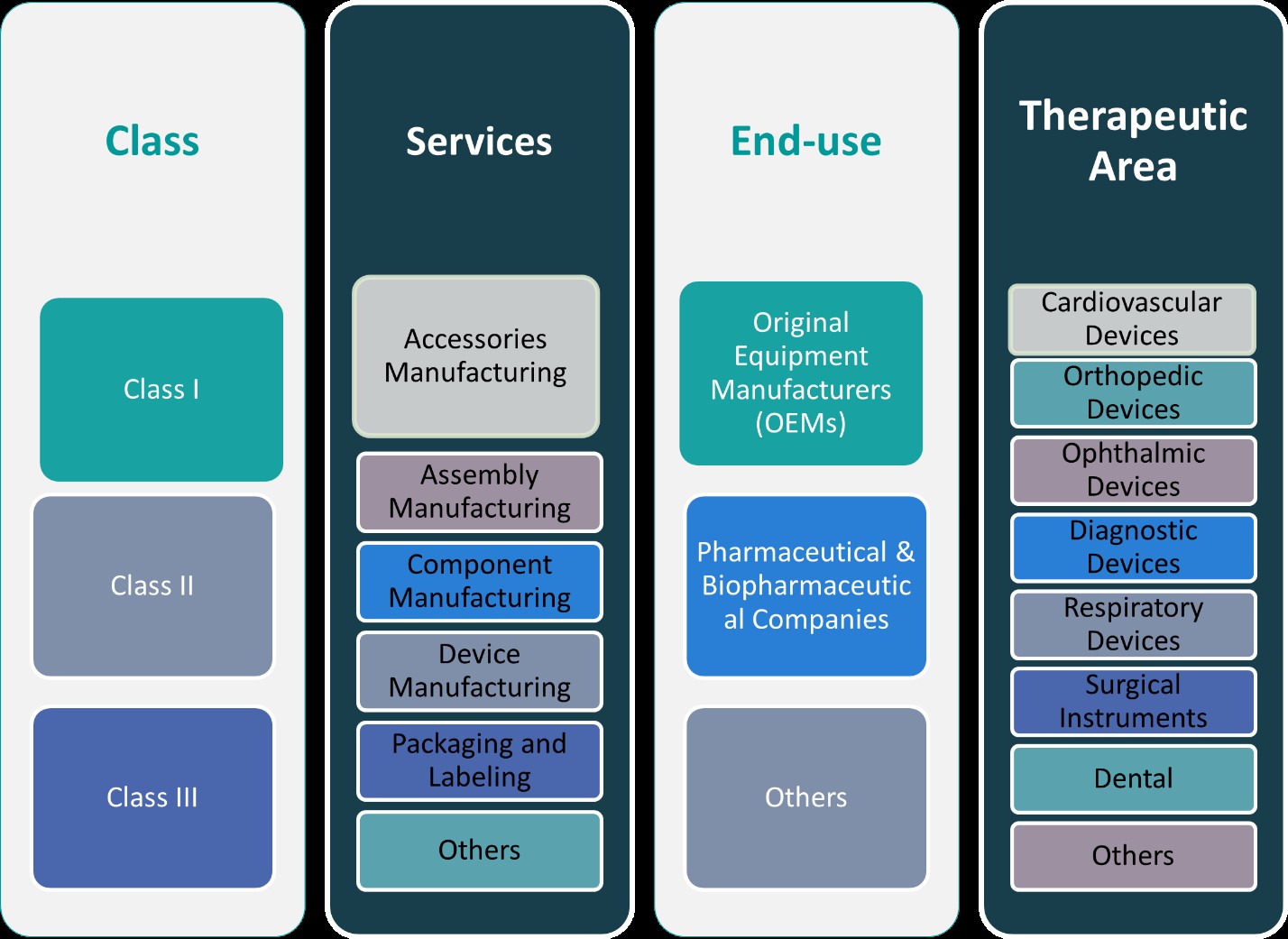

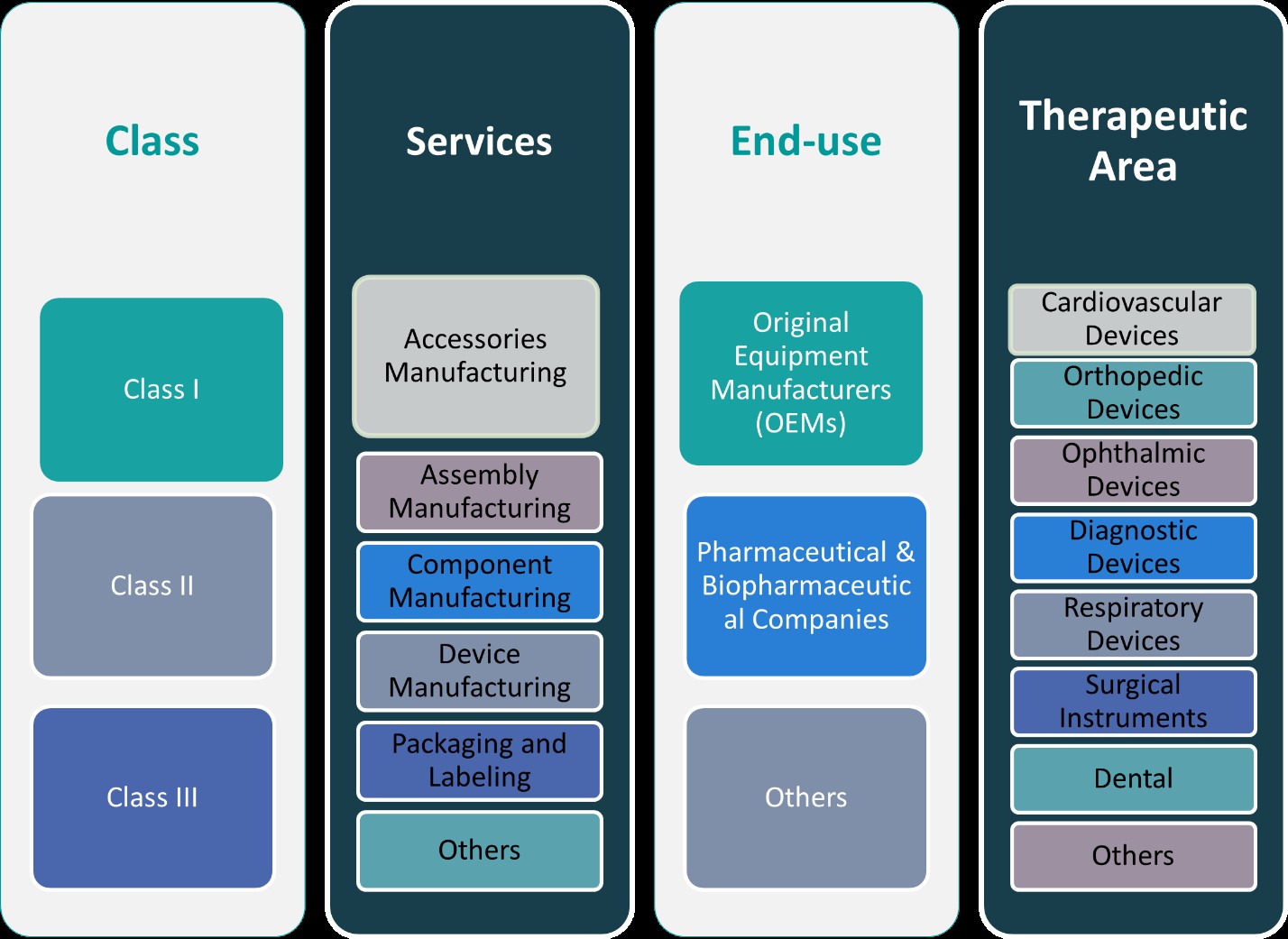

Market Segmentation Analysis:

By Class:

The Latin American medical device contract manufacturing market can be divided into three key segments based on device classification: Class I, Class II, and Class III devices. Class I devices, which are considered low risk and include products such as bandages and non-invasive devices, dominate the market in terms of volume. These devices generally require less stringent regulatory oversight and are easier to manufacture, making them attractive for local manufacturers. Class II devices, including diagnostic equipment, powered wheelchairs, and infusion pumps, represent the mid-range of risk and demand higher levels of precision and regulatory compliance. This segment is expanding rapidly as demand for advanced diagnostic and therapeutic devices grows. Class III devices, such as pacemakers, implantable devices, and life-support equipment, require the highest level of regulatory scrutiny and sophisticated manufacturing processes. Although this segment has a smaller market share, it is growing in importance due to increasing healthcare investments and demand for high-tech medical solutions in Latin America.

By Services:

In terms of services, the Latin American medical device contract manufacturing market offers a broad array of specialized services. Accessories manufacturing is a significant segment, encompassing the production of ancillary components like tubing, connectors, and sensors, which are vital to medical devices. Assembly manufacturing, which involves the integration of parts into finished products, plays a crucial role in meeting the rising demand for functional, ready-to-use devices. Component manufacturing, including precision-engineered parts such as electronic circuits and mechanical elements, is a core service, as these components are essential for high-quality devices. Device manufacturing covers the entire production of medical devices, from design to final product, and is growing due to the increasing demand for sophisticated medical equipment. Packaging and labeling services are also critical, as they ensure that devices comply with global standards for safety and traceability. Finally, other services, including testing, sterilization, and supply chain management, are increasingly in demand as manufacturers seek to streamline operations and ensure product safety across all stages of production.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Regional Analysis

Brazil

Brazil is the largest market for medical device contract manufacturing in Latin America, holding a significant market share of approximately 45%. The country’s large population, growing middle class, and increasing healthcare needs drive this dominance. Brazil has made substantial investments in healthcare infrastructure, which has fueled the demand for medical devices across various segments, including diagnostics, therapeutic devices, and surgical instruments. Additionally, Brazil’s strong regulatory framework, which aligns with international standards, makes it an attractive destination for global medical device companies seeking contract manufacturing partnerships. The established manufacturing infrastructure, skilled workforce, and proximity to both North American and European markets further contribute to Brazil’s dominant position in the region.

Argentina

Argentina accounts for around 15% of the Latin American medical device contract manufacturing market. The country has become an important player due to its well-developed manufacturing base and specialized capabilities in producing high-quality medical devices. While Argentina faces some economic volatility, its regulatory framework has aligned increasingly with global standards, making it an attractive market for medical device production. The demand for medical devices is driven by both public and private healthcare initiatives, particularly in the fields of diagnostics and patient care. However, inflationary pressures and occasional currency fluctuations can pose challenges to growth in the Argentine market, though the country’s capabilities remain a key asset in the regional market.

Peru

Peru’s medical device contract manufacturing market represents about 8% of the regional market share. While smaller compared to Brazil and Argentina, Peru’s market is growing steadily due to the rising healthcare demands from its expanding population. The government is focusing on enhancing healthcare access and improving the quality of medical services, which directly translates to a higher demand for medical devices. The country benefits from favorable trade agreements, especially with the United States and other countries in Latin America, which enhance its potential as an outsourcing hub. Though the regulatory environment is still evolving, the increasing adoption of global standards presents opportunities for manufacturers in Peru.

Chile

Chile holds approximately 7% of the medical device contract manufacturing market in Latin America. While Chile’s market share is modest compared to Brazil or Argentina, the country’s stable economy, strong healthcare infrastructure, and highly skilled workforce make it an attractive location for medical device manufacturing. Chile’s focus on innovation and technological advancement, along with its growing reputation as a hub for high-quality production, positions it well in the market. Furthermore, Chile’s alignment with international regulatory standards, such as those from the FDA and CE, boosts its credibility and appeal to global medical device companies. The country’s free trade agreements with various regions also open up valuable opportunities for growth in the contract manufacturing sector.

Rest of Latin America

The rest of Latin America, which includes countries such as Mexico, Colombia, and others, makes up the remaining 25% of the market share. Mexico, with its proximity to the U.S. and established manufacturing industry, holds a significant portion of this share. Other countries like Colombia and Central American nations are gradually expanding their footprint in the medical device contract manufacturing market. As healthcare investments increase across the region and regulations continue to align with international standards, this segment is expected to grow, creating additional opportunities for manufacturers in Latin America.

Key Player Analysis

- MicroVention-Terumo

- Medtronic

- Boston Scientific

- Proquident

- Biolinks

Competitive Analysis

The competitive landscape of the Latin American medical device contract manufacturing market is shaped by several leading players, including MicroVention-Terumo, Medtronic, Boston Scientific, Proquident, and Biolinks. These companies dominate the market by leveraging their global presence, extensive product portfolios, and strong manufacturing capabilities. Companies with established manufacturing capabilities in the region are increasingly focusing on streamlining operations and adopting advanced technologies like automation, robotics, and 3D printing to improve efficiency, quality, and production speed. Manufacturers are also competing by aligning with international regulatory standards, which enhances their ability to serve global medical device companies. Regulatory frameworks in Latin America are continuously evolving to meet the requirements of major markets such as the U.S. and Europe, which is boosting the region’s competitiveness. In addition, the ability to offer value-added services, such as assembly, packaging, and labeling, allows manufacturers to differentiate themselves and attract more diverse client bases. Despite the advantages, challenges like economic volatility, fluctuating exchange rates, and supply chain disruptions remain significant barriers. Companies are focusing on strategic partnerships and outsourcing agreements to mitigate these risks and expand their market reach. This competitive environment is expected to intensify as demand for medical devices grows, making innovation and operational efficiency key drivers of success in the region.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

The market concentration of Latin America’s medical device contract manufacturing sector is relatively moderate, with a mix of global giants and regional players vying for market share. A few large multinational corporations dominate the industry, leveraging their vast resources, extensive product portfolios, and established distribution networks to maintain a strong foothold in the region. However, several smaller regional players also contribute to the market by offering specialized services and catering to niche segments, particularly in diagnostics, dental, and personal care devices. The market is characterized by a growing focus on cost efficiency, with manufacturers increasingly investing in automation and advanced production technologies to stay competitive. Additionally, regulatory compliance with international standards is a critical characteristic, as manufacturers aim to meet the stringent requirements of global markets. This combination of large-scale players and specialized local manufacturers creates a competitive yet fragmented market structure, with opportunities for innovation and growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Latin American medical device contract manufacturing market is expected to continue its robust growth, driven by increasing healthcare demand and rising population.

- Advancements in production technologies like automation and 3D printing will play a crucial role in enhancing manufacturing efficiency and product quality.

- Regulatory alignment with international standards will strengthen the region’s competitiveness, attracting more global companies to outsource manufacturing.

- As the region focuses on improving healthcare infrastructure, the demand for medical devices, especially diagnostic and therapeutic equipment, will rise.

- Economic factors, including inflation and exchange rate fluctuations, may pose challenges but will also drive cost-effective manufacturing solutions.

- The trend of outsourcing manufacturing to Latin America is expected to grow as companies seek cost-effective production and proximity to North American markets.

- There will be increasing collaboration between global companies and regional manufacturers, fostering innovation and expanding the market reach.

- Sustainability will become a more significant focus, with companies investing in green manufacturing practices and eco-friendly materials.

- Smaller and specialized manufacturers will continue to thrive by catering to niche markets, offering unique solutions tailored to specific medical needs.

- Latin America is poised to become a hub for high-quality medical device production, leveraging its skilled labor force and competitive production costs.