Market Overview

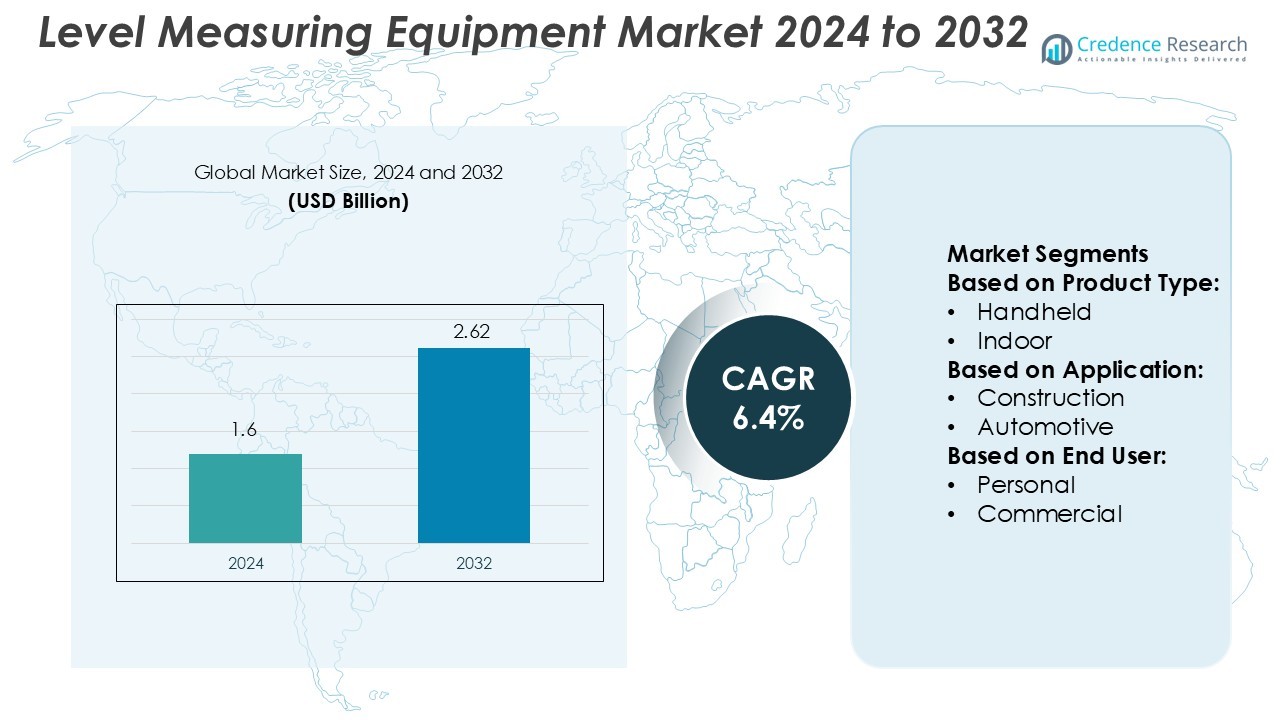

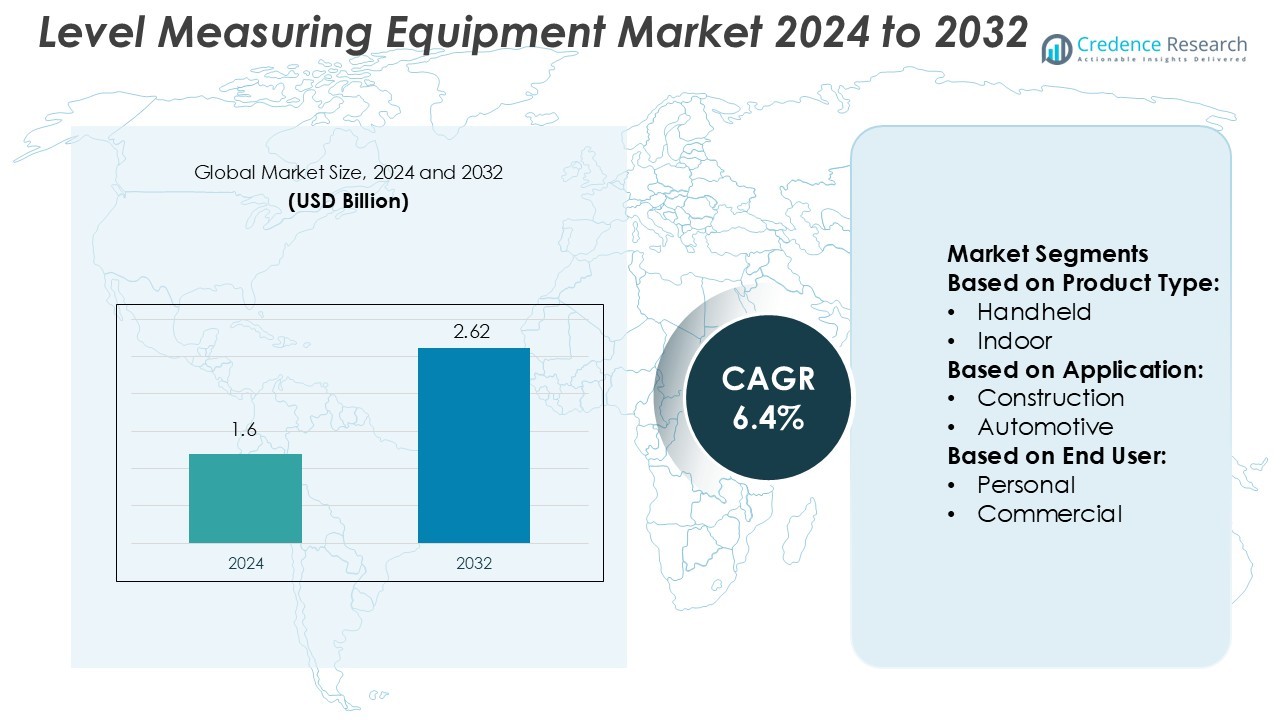

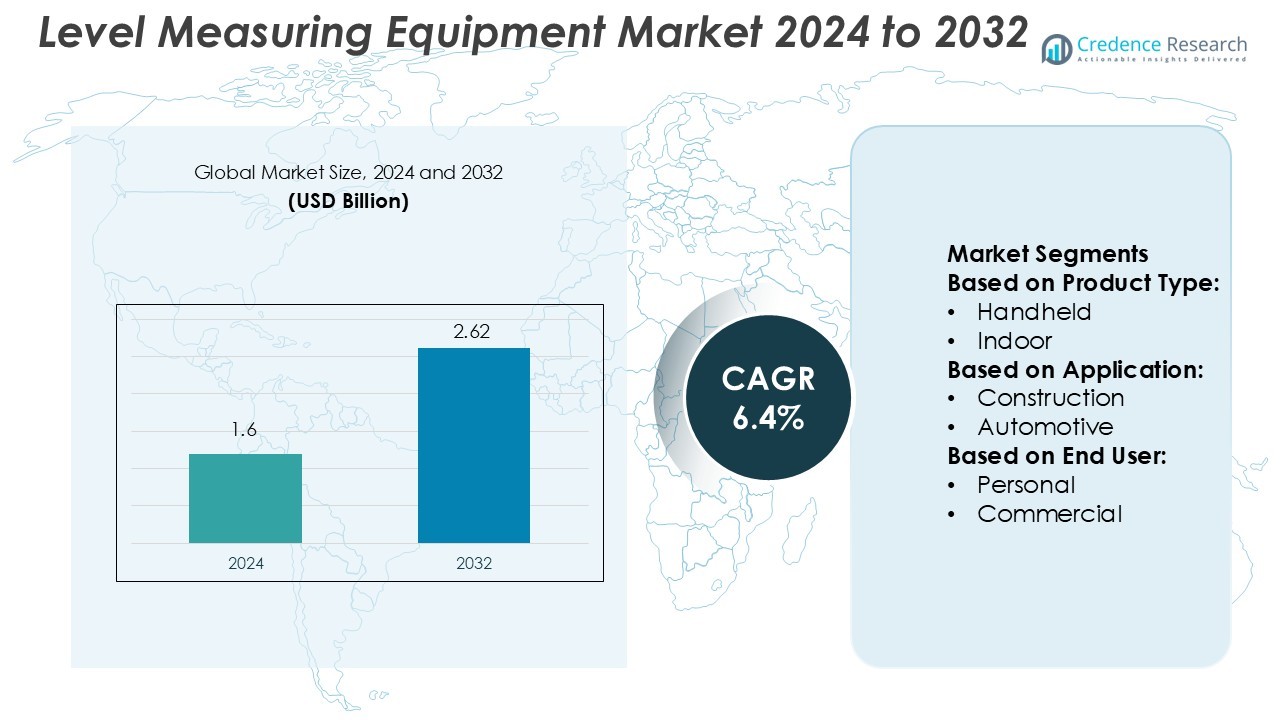

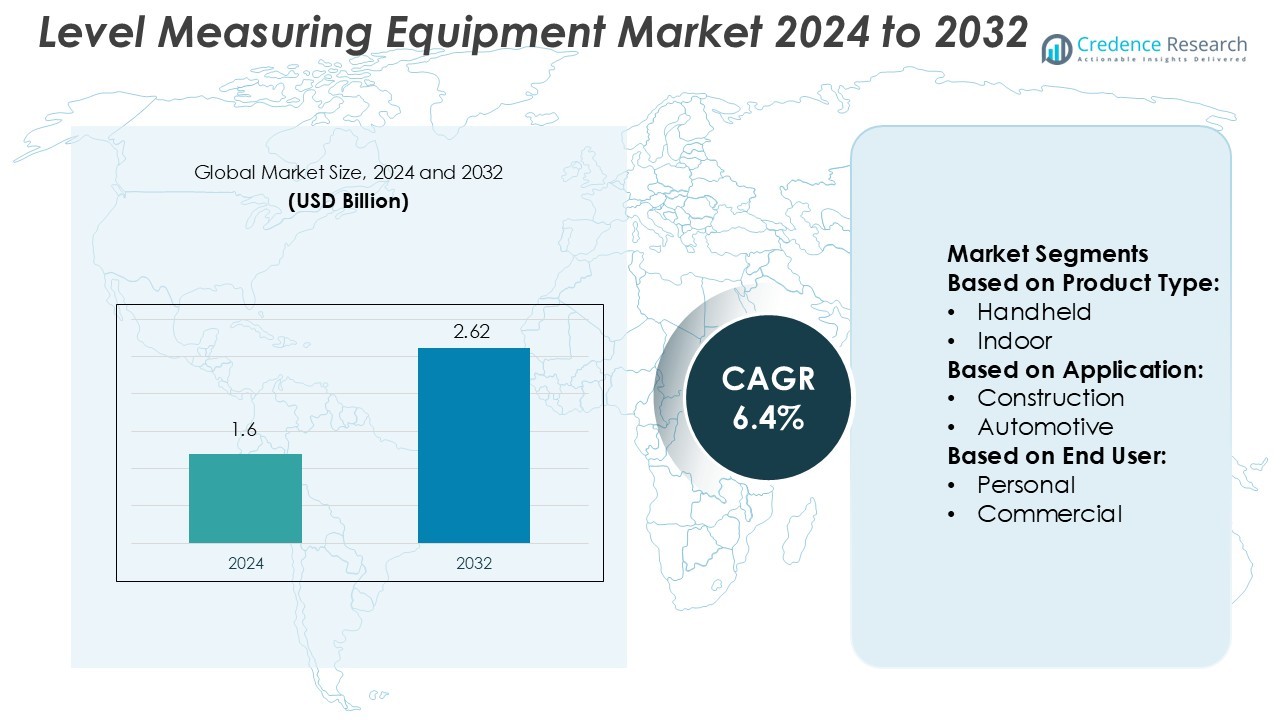

Level Measuring Equipment Market size was valued USD 1.6 billion in 2024 and is anticipated to reach USD 2.62 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Level Measuring Equipment Market Size 2024 |

USD 1.6 Billion |

| Level Measuring Equipment Market, CAGR |

6.4% |

| Level Measuring Equipment Market Size 2032 |

USD 2.62 Billion |

The Level Measuring Equipment Market features prominent players including Leica Geosystems, RIDGID, Makita Corporation, Spectra Precision, Ryobi Limited, Hilti Corporation, Emerson Electric, Fluke Corporation, Robert Bosch GmbH, and Johnson Level & Tool Company. These companies dominate through innovation, product reliability, and broad application coverage across industrial, construction, and commercial sectors. Continuous advancements in laser, radar, and ultrasonic technologies strengthen market competitiveness. North America leads the global market with a 34% share, driven by strong industrial automation, infrastructure modernization, and early adoption of digital measurement solutions. Regional manufacturers focus on integrating IoT-based systems and durable designs to enhance precision, safety, and operational efficiency across multiple industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Level Measuring Equipment Market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.62 billion by 2032, growing at a CAGR of 6.4% during the forecast period.

- Increasing automation in industrial and construction sectors drives market growth, supported by demand for accurate and digital level measurement systems.

- Advancements in laser, radar, and ultrasonic technologies enhance precision, while IoT integration boosts data connectivity and monitoring capabilities.

- Market competition intensifies as leading companies focus on innovation, durable product design, and global expansion through partnerships and R&D investments.

- North America leads with a 34% regional share, followed by Europe at 28%, while the industrial segment dominates overall applications, accounting for the largest share due to continuous process automation and safety requirements.

Market Segmentation Analysis:

By Product Type

The handheld segment dominates the Level Measuring Equipment Market with the largest market share. Its popularity comes from portability, ease of use, and suitability for field operations. Industries such as construction and manufacturing rely heavily on handheld laser and ultrasonic level meters for quick, precise measurements. Compact designs and wireless connectivity improve efficiency and safety in confined spaces. Continuous upgrades in Bluetooth-enabled models and real-time data logging further drive adoption. The indoor and outdoor segments grow steadily, supported by infrastructure automation and environmental monitoring systems.

- For instance, Leica Geosystems introduced the DISTO X6 laser distance meter with a measuring range of up to 250 meters and ±1 mm accuracy. The model features Bluetooth Smart data transfer and IP65 protection, allowing seamless integration with mobile devices and reliable performance in rugged conditions.

By Application

The construction segment holds the leading market share in the Level Measuring Equipment Market. The rise in smart infrastructure projects, 3D mapping, and structural inspections fuels this dominance. Construction professionals depend on laser and optical level devices for accuracy in alignment and grading. Automated measuring systems minimize errors and save project time. The automotive and manufacturing industries also show strong demand for precision tools used in component testing and process calibration. Aerospace, defense, and telecommunication applications are expanding due to the need for advanced sensors and non-contact level detection.

- For instance, RIDGID’s own product information and various retailers, state the maximum range as 70 meters (229 feet). Some product listings incorrectly mention 100 m (328 ft), but the 70 m figure is the official and most consistently cited specification.

By End-User

The industrial segment accounts for the highest market share in the Level Measuring Equipment Market. Industries such as oil & gas, chemicals, and water treatment use these devices for tank monitoring, flow measurement, and production control. The integration of IoT-based sensors enables continuous level tracking and predictive maintenance. Commercial users adopt these systems for building automation and HVAC management. The personal segment remains smaller but is growing with the availability of user-friendly, portable level measurement tools for DIY, interior design, and small-scale engineering tasks.

Key Growth Drivers

Expanding Industrial Automation

The growing adoption of industrial automation drives demand for advanced level measuring equipment. Automated process industries, including oil and gas, chemical, and water treatment, rely on continuous, real-time level monitoring for safety and efficiency. Integration with PLC and SCADA systems enhances operational control and reduces manual intervention. Manufacturers are focusing on precision instruments with digital interfaces to meet Industry 4.0 standards. This trend accelerates adoption across sectors, boosting the overall market growth and improving process reliability in industrial environments.

- For instance, Makita’s model SK312GD demonstrates a leveling accuracy of ±1 mm at 10 m, with a self-levelling range of ±2°, and continuous illumination of up to 28 hours in high-visibility mode with the BL1041B battery.

Rising Infrastructure and Construction Projects

Global expansion in infrastructure and commercial construction fuels market demand for level measuring instruments. Builders increasingly use laser and ultrasonic devices for site grading, volume measurement, and alignment tasks. These tools improve accuracy, reduce human error, and save project time. Rapid urbanization and smart city projects further expand product usage in surveying and architectural planning. Advanced models offering high accuracy and wireless data transfer are gaining traction, driving adoption in large-scale construction and civil engineering projects.

- For instance, Hilti’s operating instructions, indicates a typical accuracy of ±1.0 mm under standard deviation. Some sources still display the less common ±1.5 mm figure.

Technological Advancements in Sensor Design

Technological innovation significantly enhances level measuring equipment performance. Modern sensors use radar, laser, and ultrasonic technologies to provide precise, non-contact measurements. Integration with IoT and cloud-based analytics supports remote monitoring and predictive maintenance. Compact and energy-efficient designs also enable wider use in constrained spaces and harsh environments. These advancements improve operational safety and lower maintenance costs, making next-generation level sensors a key driver for market expansion in industrial and commercial sectors.

Key Trends & Opportunities

Integration of IoT and Wireless Connectivity

IoT-enabled level measuring systems are becoming mainstream, enabling real-time data tracking and remote diagnostics. Wireless communication simplifies integration into existing process networks and enhances maintenance efficiency. Industries benefit from predictive analytics, which reduce downtime and improve productivity. Manufacturers are investing in smart level meters compatible with cloud-based platforms for remote access and control. This digital transformation opens opportunities for software-driven growth and long-term service contracts in process automation industries.

- For instance, Emerson’s own product information and white papers explicitly state that their WirelessHART mesh technology delivers “99.99% data reliability” for industrial applications.

Growing Demand for Non-Contact Measurement Technologies

The market is witnessing a strong shift toward non-contact level measurement solutions. Radar and ultrasonic systems provide accurate readings without physical contact, ideal for corrosive or hazardous environments. These technologies minimize contamination risk and reduce equipment wear, improving operational lifespan. Their adoption is increasing across chemical processing, pharmaceuticals, and food industries. Continued innovation in frequency modulation and signal processing offers opportunities for manufacturers to expand into high-precision industrial segments.

- For instance, Fluke’s industrial imaging tool the “ii900 Acoustic Imager” uses 64 digital MEMS microphones across a frequency band of 2 kHz to 52 kHz and can detect a leak of 0.005 CFM at 100 PSI from up to 10 meters.

Expansion in Renewable Energy and Water Management

Level measuring equipment plays a crucial role in renewable energy and water resource management projects. In hydropower, wastewater treatment, and solar energy systems, accurate fluid level control is essential for efficiency. Government investments in sustainability and environmental monitoring boost demand for advanced sensors. Companies developing eco-friendly, energy-efficient devices gain a competitive advantage. This expansion into green sectors offers long-term opportunities for technological advancement and market penetration.

Key Challenges

High Installation and Maintenance Costs

The high cost of advanced level measuring systems limits adoption, particularly among small and medium-sized enterprises. Non-contact and radar-based instruments require specialized calibration and periodic maintenance, increasing operational expenses. Integrating these devices with existing legacy systems also demands skilled personnel and technical infrastructure. This cost barrier restricts widespread deployment, especially in developing regions with budget constraints and limited technical expertise.

Environmental and Operational Limitations

Extreme environmental conditions pose significant challenges for sensor performance. Factors like high temperature, pressure fluctuations, and electromagnetic interference can affect accuracy and reliability. In industries handling corrosive materials or dusty environments, sensor degradation remains a concern. Manufacturers must invest in durable materials and advanced protective coatings to address these limitations. Despite technological improvements, maintaining consistent accuracy under harsh operational conditions continues to challenge market growth.

Regional Analysis

North America

North America holds the largest market share of 34% in the Level Measuring Equipment Market. The region benefits from strong industrial automation adoption across oil and gas, chemical, and manufacturing sectors. The U.S. drives demand through modernization of process plants and advanced sensor deployment. Rising investments in smart infrastructure and renewable energy projects further support market expansion. Key manufacturers focus on integrating IoT-enabled solutions for precision and efficiency. Canada and Mexico contribute through growing construction and water management applications, reinforcing North America’s leadership in technology adoption and equipment innovation.

Europe

Europe accounts for a 28% market share, supported by advanced manufacturing and strict regulatory standards. Countries such as Germany, the U.K., and France lead adoption across automotive, food, and chemical industries. The region emphasizes sustainability and energy efficiency, driving the use of non-contact radar and ultrasonic level sensors. Expanding wastewater treatment and renewable energy projects increase demand for reliable level monitoring systems. European manufacturers invest heavily in automation and process safety technologies. This consistent technological focus and export-oriented production strengthen Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific holds a 25% market share and is the fastest-growing region in the Level Measuring Equipment Market. Rapid industrialization in China, India, and Japan boosts demand across construction, manufacturing, and energy sectors. Government-backed smart city and industrial modernization initiatives drive large-scale sensor installations. Increasing use of automation in process industries improves operational accuracy and efficiency. Local manufacturers are expanding production capabilities to meet domestic and export requirements. Rising adoption of IoT-integrated level monitoring devices positions Asia Pacific as a major hub for cost-effective and scalable equipment innovation.

Latin America

Latin America represents a 7% market share, driven by construction, oil and gas, and mining industries. Brazil and Mexico dominate due to industrial expansion and infrastructure development projects. The need for accurate level measurement in refining and water management processes fuels demand. Regional manufacturers focus on affordable, durable instruments suited to local conditions. Adoption of radar and ultrasonic technologies is gradually increasing, supported by foreign partnerships. Despite economic fluctuations, ongoing modernization in industrial operations positions Latin America as a developing market with steady growth potential.

Middle East & Africa

The Middle East & Africa collectively account for a 6% market share in the Level Measuring Equipment Market. The Middle East leads adoption through large-scale oil and gas operations and desalination projects. Countries such as Saudi Arabia and the UAE invest in advanced process control systems for energy efficiency. In Africa, South Africa and Egypt show increasing adoption in construction and manufacturing sectors. Rising demand for automation in resource management and industrial plants drives steady market growth. Continuous infrastructure investments and industrial diversification sustain long-term regional expansion.

Market Segmentations:

By Product Type:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Level Measuring Equipment Market is highly competitive, featuring key players such as Leica Geosystems, RIDGID, Makita Corporation, Spectra Precision, Ryobi Limited, Hilti Corporation, Emerson Electric, Fluke Corporation, Robert Bosch GmbH, and Johnson Level & Tool Company. The Level Measuring Equipment Market is characterized by intense competition and steady technological innovation. Companies emphasize precision engineering, automation, and digital integration to meet diverse industrial requirements. The market increasingly favors advanced laser and ultrasonic measurement tools offering higher accuracy and user convenience. Integration of IoT and wireless connectivity enhances real-time monitoring, supporting predictive maintenance and data-driven decision-making. Manufacturers invest in compact, durable, and energy-efficient models designed for harsh operating conditions. Growing demand from construction, manufacturing, and energy sectors continues to drive product development, while R&D initiatives and strategic collaborations shape future market growth.

Key Player Analysis

- Leica Geosystems

- RIDGID

- Makita Corporation

- Spectra Precision

- Ryobi Limited

- Hilti Corporation

- Emerson Electric

- Fluke Corporation

- Robert Bosch GmbH

- Johnson Level & Tool Company

Recent Developments

- In April 2025, Bosch launched a new range of electrical testing equipment designed specifically for professionals. The lineup includes devices like non-contact voltage testers, clamp meters, and digital multimeters.

- In April 2025, JM Test Systems, a leading provider of test equipment solutions and calibration services, announced the acquisition of Alabama Scale & Instrument, Inc. (ASI), expanding its presence in the Southeast and enhancing its capabilities in test equipment services.

- In January 2025, Teradyne and Infineon Technologies announced a strategic partnership to advance power semiconductor testing. As part of the collaboration, Teradyne will acquire Infineon’s automated test equipment (ATE) technology and the associated development team based in Regensburg, Germany.

- In December 2023, Mileseey, a Chinese brand of electronic measurement tools, announced the launch of the D9 Pro laser measure that features industry-first visual aligning indicator.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand for smart, IoT-enabled level measuring devices.

- Automation in manufacturing and construction will continue to drive equipment adoption.

- Non-contact technologies such as radar and laser systems will gain wider preference.

- Integration with cloud platforms will enable real-time data access and analytics.

- Miniaturized and energy-efficient designs will improve portability and usability.

- Growth in renewable energy and water management projects will support long-term demand.

- Manufacturers will focus on developing rugged, weather-resistant, and durable instruments.

- Wireless connectivity and mobile app integration will enhance remote monitoring.

- Partnerships and acquisitions will expand product portfolios and global presence.

- Emerging markets in Asia Pacific and Latin America will offer strong growth opportunities.