Market Overview

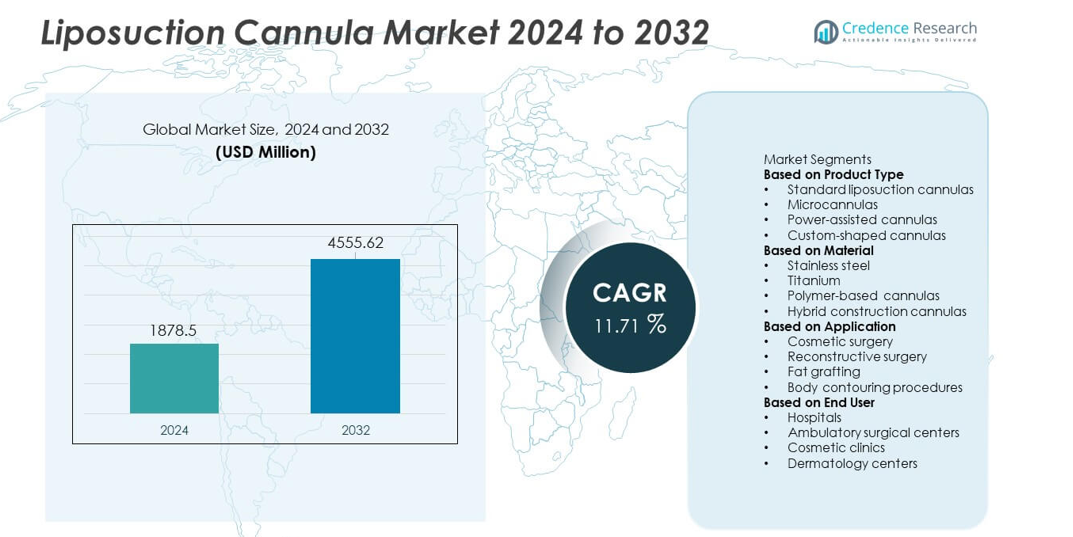

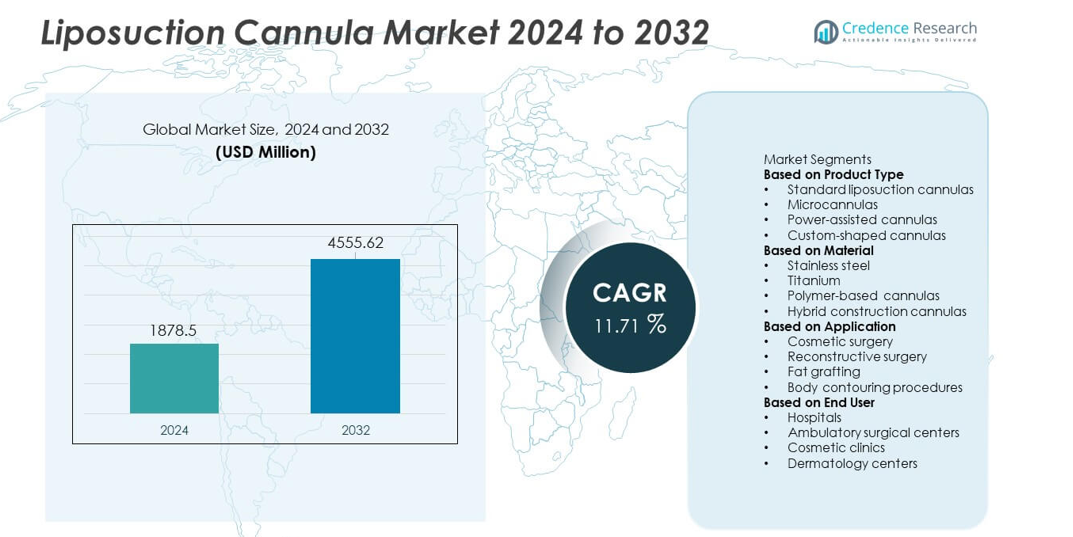

The Liposuction Cannula market was valued at USD 1,878.5 million in 2024 and is projected to reach USD 4,555.62 million by 2032, registering a CAGR of 11.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liposuction Cannula Market Size 2024 |

USD 1,878.5 million |

| Liposuction Cannula Market, CAGR |

11.71% |

| Liposuction Cannula MarketSize 2032 |

USD 4,555.62 million |

The top players in the Liposuction Cannula market include Mentor Worldwide LLC, MicroAire Surgical Instruments LLC, Sorensen Research, Wells Johnson Co., HK Surgical Inc., Byron Medical, Innovia Medical, Black & Black Surgical, Tulip Medical Products, and Medtronic plc. These companies strengthen their market presence through advanced cannula designs, ergonomic improvements, and strong clinic partnerships. North America leads the global landscape with a 41% market share, driven by high procedural volume, strong aesthetic awareness, and widespread adoption of precision-engineered cannulas. Europe follows with a 29% share, supported by established cosmetic surgery networks and strict quality standards that maintain steady product demand.

Market Insights

- The Liposuction Cannula market reached USD 1,878.5 million in 2024 and will hit USD 4,555.62 million by 2032 at a CAGR of 11.71%, driven by rising demand for minimally invasive body-contouring procedures.

- Strong growth comes from increased adoption of precision-engineered cannulas, with standard cannulas holding a 38% share and stainless steel leading materials with a 44% share, supported by clinics upgrading to advanced surgical tools.

- Key trends include the shift toward microcannulas and custom-shaped designs as surgeons seek better contour accuracy, along with growing demand for power-assisted systems that improve fat-removal efficiency.

- Competitive activity intensifies as major players expand portfolios with lightweight designs, improved ergonomics, and wider compatibility; however, regulatory requirements and surgeon training needs act as notable restraints.

- Regional growth is led by North America at 41%, followed by Europe at 29% and Asia Pacific at 21%, reflecting strong clinic networks and rising aesthetic preferences across major markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Standard liposuction cannulas hold a 38% share and lead this segment due to consistent performance, ease of use, and broad compatibility with common liposuction techniques. Surgeons rely on these cannulas for reliable fat removal and predictable procedural outcomes. Microcannulas gain traction for precision shaping in facial and delicate contouring tasks. Power-assisted cannulas see wider adoption as clinics seek faster fat extraction and reduced surgeon fatigue. Custom-shaped cannulas also grow in specialized body-sculpting cases. Demand increases as patients choose minimally invasive procedures that require high-quality and versatile cannula options.

- For instance, MicroAire Surgical Instruments introduced a PAL cannula system with a 4,000-cycles-per-minute drive speed, which improves fat disruption efficiency and lowers operator strain in long cases. The system supports more than 20 interchangeable cannula tips and maintains controlled oscillation in high-density areas.

By Material

Stainless-steel cannulas dominate with a 44% share, supported by superior durability, structural stability, and proven surgical reliability. Clinics select stainless steel for its sharp edges, high tensile strength, and safe sterilization. Titanium cannulas expand within premium clinics because they offer lighter weight and improved maneuverability during long procedures. Polymer-based cannulas gain users seeking disposable designs that lower contamination risks. Hybrid construction models grow as surgeons look for a balance of rigidity and flexibility in complex cases. Rising focus on performance, safety, and workflow efficiency influences material choice across surgical centers.

- For instance, Tulip Medical Products engineered a line of cannulas with an exclusive CellFriendly™ coating that reduces friction during procedures. This finish gives the instruments a smooth, lubricious action, which creates less stress and damage to the tissue for a better patient outcome and less fatigue to the surgeon during the procedure.

By Application

Cosmetic surgery leads with a 52% share, driven by strong global demand for body-sculpting and aesthetic improvement. Surgeons use cannulas widely for abdominal, thigh, arm, and flank contouring, supporting high procedure volume. Reconstructive surgery remains important for trauma correction and functional repair needs. Fat grafting expands as clinics perform more volume-restoration procedures in the face, breast, and buttocks. Body-contouring procedures gain adoption due to growing patient preference for minimally invasive solutions. The segment advances as better designs improve precision, safety, and overall aesthetic outcomes.

Key Growth Drivers

Rising Demand for Minimally Invasive Body Contouring

Global interest in minimally invasive cosmetic procedures strengthens demand for advanced liposuction cannulas. Patients choose fat-reduction treatments that offer shorter recovery times and lower surgical risks. Clinics adopt improved cannula designs that support smoother fat extraction and better contour precision. Rising awareness of aesthetic enhancement, driven by social media and expanding beauty standards, boosts procedural volume. Surgeons also rely on high-performance cannulas to achieve uniform results across different body regions. This widespread preference for less invasive body-shaping methods continues to drive rapid market expansion.

- For instance, Wells Johnson Co. developed an aspirator system, such as the Hercules, which is designed for efficient fat evacuation. The design includes durable components, ensuring reliability.

Advancements in Cannula Design and Surgical Techniques

Manufacturers invest in next-generation cannula designs that improve precision, ergonomics, and tissue safety. Power-assisted, vibration-supported, and micro-engineered cannulas enhance fat removal speed and reduce surgeon fatigue. New materials also support better durability and lighter handling during long procedures. Clinics adopt these innovations to achieve smoother contouring outcomes with fewer complications. Enhanced surgical techniques, such as high-definition liposuction and fat-preservation methods, further accelerate the use of specialized cannulas. These advancements strengthen clinician confidence and support higher procedure success rates across cosmetic and reconstructive treatments.

- For instance, Black & Black Surgical offers various stainless-steel instruments designed for specific procedures, with features intended to provide necessary rigidity and performance.

Expansion of Aesthetic Clinics and Medical Tourism

The global rise of aesthetic clinics and medical tourism widens access to liposuction services. Countries with strong cosmetic surgery industries attract international patients seeking cost-effective and high-quality procedures. Clinic networks expand in urban regions, increasing the number of trained surgeons who rely on specialized cannulas. Growing disposable income and rising acceptance of body-shaping treatments also push procedural volume upward. This expansion improves equipment turnover rates and strengthens demand for advanced cannula systems. As more clinics adopt modern techniques, the market experiences sustained growth momentum.

Key Trends & Opportunities

Shift Toward High-Precision Cannulas and Custom Solutions

A major trend is the growing use of microcannulas, custom-shaped cannulas, and ergonomically engineered models. Surgeons choose high-precision instruments to deliver smoother contouring and improved sculpting accuracy. This shift creates strong opportunities for manufacturers offering tailored cannula geometries for specific body areas. Personalized tools support advanced procedures such as high-definition liposuction and facial sculpting. Rising demand for aesthetic refinement encourages innovation in cannula size, shape, rigidity, and surface finish. This trend positions specialty cannulas as a major opportunity area in premium cosmetic practices.

- For instance, leading medical device manufacturers produce microcannulas for a range of procedures. These devices feature smooth designs to minimize tissue trauma during use. The product lines include various sizes, often measured in gauge (G), to accommodate different clinical needs and flow rates, ranging from 14G to 27G.

Growth of Technology-Enabled Liposuction Platforms

Technology-assisted systems such as power-assisted, laser-assisted, and ultrasound-assisted liposuction support higher adoption of advanced cannulas. Surgeons value these platforms for their ability to reduce tissue trauma, improve fat emulsification, and increase procedural efficiency. Integration of these tools creates opportunities for manufacturers to design cannulas optimized for specific energy-based systems. Clinics also upgrade equipment to meet rising patient expectations for faster recovery and smoother aesthetic outcomes. This technological shift encourages procurement of compatible cannulas and expands opportunities across surgical centers.

- For instance, Mentor Worldwide LLC offers a complete portfolio of aspiration cannulae and accessories in various sizes and tip styles designed for use with their PSI-TEC III Aspiration System in body-contouring procedures.

Key Challenges

Risk of Complications and Regulatory Compliance Requirements

The market faces challenges linked to surgical risks such as uneven fat removal, contour irregularities, and tissue trauma. Regulatory frameworks require strict adherence to safety standards, sterility controls, and performance testing. Manufacturers must meet evolving compliance expectations that vary across regions. These requirements increase development costs and slow product approvals. Clinics also demand high-quality assurance due to patient safety concerns. Managing complications and maintaining regulatory alignment remain key challenges that shape design, manufacturing, and product positioning strategies.

High Dependence on Skilled Surgeons and Training Needs

Liposuction outcomes depend heavily on surgeon expertise, creating a challenge in regions with limited training infrastructure. Advanced cannulas require proper handling techniques to achieve uniform fat removal and avoid procedural errors. Clinics also invest time and resources in training programs to ensure consistent results. Skill gaps can slow technology adoption and reduce the effectiveness of advanced cannula systems. This challenge highlights the need for structured training, standardized protocols, and ongoing professional development to support wider market adoption

Regional Analysis

North America

North America leads the Liposuction Cannula market with a 41% share, driven by high demand for aesthetic procedures and strong adoption of advanced body-contouring technologies. The region benefits from a large network of cosmetic clinics, experienced surgeons, and early uptake of innovative cannula designs. Patients seek minimally invasive treatments, which increases procedural volume across major cities. Rising interest in body sculpting among younger age groups further supports growth. Continuous innovation in cannula materials and enhanced surgical techniques strengthens market expansion, making North America a key center for ongoing product development and adoption.

Europe

Europe holds a 29% share, supported by rising demand for aesthetic enhancement and established medical infrastructure. Growth is driven by increasing acceptance of cosmetic surgery and wider availability of trained plastic surgeons. Countries such as Germany, France, Italy, and the UK lead regional adoption as clinics upgrade to precision-based cannulas. Regulatory emphasis on high-quality surgical instruments ensures strong product standards and consistent usage. Medical tourism in Eastern Europe also contributes to market expansion. The combination of strong clinical expertise, rising aesthetic interest, and strict quality controls solidifies Europe’s position in the global market.

Asia Pacific

Asia Pacific accounts for a 21% share and represents the fastest-growing regional market due to expanding aesthetic awareness and rising disposable income. Countries such as South Korea, Japan, China, and India show strong procedural growth as urban populations adopt body-shaping treatments. Medical tourism hubs, especially in Thailand and South Korea, attract international patients seeking advanced and cost-effective liposuction services. Clinics invest in modern cannula technologies to meet demand for high-precision contouring. The region’s young demographic and high social media influence support rapid adoption, positioning Asia Pacific as a major future growth contributor.

Latin America

Latin America captures a 6% share, driven by strong aesthetic culture and rising preference for body-contouring procedures. Brazil and Mexico lead the region due to well-developed cosmetic surgery sectors and experienced surgeons. Medical tourism grows as patients travel for affordable liposuction using modern cannula systems. Clinics invest in high-precision cannulas to deliver improved shaping outcomes. Economic challenges limit wide-scale adoption in some countries, but increasing procedure volumes in major urban centers support steady market expansion. The region’s strong beauty-driven consumer base continues to create stable opportunities for advanced surgical tools.

Middle East & Africa

The Middle East & Africa region holds a 3% share, supported by rising cosmetic procedure adoption in Gulf countries. The UAE, Saudi Arabia, and Qatar drive demand as premium clinics expand and invest in specialized cannulas. High-income populations and strong medical tourism support surgical growth in key cities. Africa sees gradual adoption due to improving healthcare infrastructure, though access remains uneven. Clinics in developing markets focus on cost-effective instruments, while Gulf facilities prefer premium cannula designs. Growing aesthetic awareness and expanding private healthcare networks continue to shape long-term demand in this region.

Market Segmentations:

By Product Type

- Standard liposuction cannulas

- Microcannulas

- Power-assisted cannulas

- Custom-shaped cannulas

By Material

- Stainless steel

- Titanium

- Polymer-based cannulas

- Hybrid construction cannulas

By Application

- Cosmetic surgery

- Reconstructive surgery

- Fat grafting

- Body contouring procedures

By End User

- Hospitals

- Ambulatory surgical centers

- Cosmetic clinics

- Dermatology centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as Mentor Worldwide LLC, MicroAire Surgical Instruments LLC, Sorensen Research, Wells Johnson Co., HK Surgical Inc., Byron Medical, Innovia Medical, Black & Black Surgical, Tulip Medical Products, and Medtronic plc. These companies focus on product innovation, precision engineering, and enhanced ergonomics to meet rising demand for minimally invasive body-contouring procedures. Manufacturers invest in advanced materials, improved cannula geometries, and compatibility with power-assisted and energy-based systems. Many players also expand global distribution networks to strengthen clinic access and support rising procedure volumes. Strategic moves include product upgrades, surgeon-training programs, and partnerships with aesthetic clinics to increase adoption. As competition intensifies, companies differentiate through quality, safety compliance, and customized solutions for high-precision body sculpting.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mentor Worldwide LLC

- MicroAire Surgical Instruments LLC

- Sorensen Research

- Wells Johnson Co.

- HK Surgical Inc.

- Byron Medical

- Innovia Medical

- Black & Black Surgical

- Tulip Medical Products

- Medtronic plc

Recent Developments

- In 2025, MicroAire Surgical Instruments, LLC released an updated version of its PAL® liposuction cannula line (document titled LIT-PAL-CANNULAS Rev G). The update shows detailed cannula sizes and port/tip configurations, including specifics for multi-use and single-use models such as the Mercedes, Double Mercedes, and Single-Port styles.

- In 2025, Tulip Medical Products continues listing a broad range of cannula products in its online catalog, under its cannula collection.

- In 2025, Tulip Medical’s catalog confirms availability of both single-use and reusable cannulas.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive body-contouring procedures will continue to rise across major regions.

- Clinics will adopt more precision-engineered cannulas to improve shaping accuracy and patient outcomes.

- Microcannulas will gain wider use as surgeons focus on refined contouring and smaller entry points.

- Power-assisted and energy-based liposuction systems will drive adoption of compatible advanced cannulas.

- Manufacturers will invest in lighter, more durable materials to enhance surgeon comfort and procedural efficiency.

- Customized cannula designs will expand as high-definition liposuction becomes more common.

- Training programs for surgeons will increase to support safe use of advanced cannula technologies.

- Regulatory compliance and quality standards will push companies toward higher-performance product development.

- Medical tourism will support strong growth in Asia Pacific, the Middle East, and Latin America.

- Rising global aesthetic awareness will sustain long-term demand for premium liposuction cannula solutions.