Market Overview:

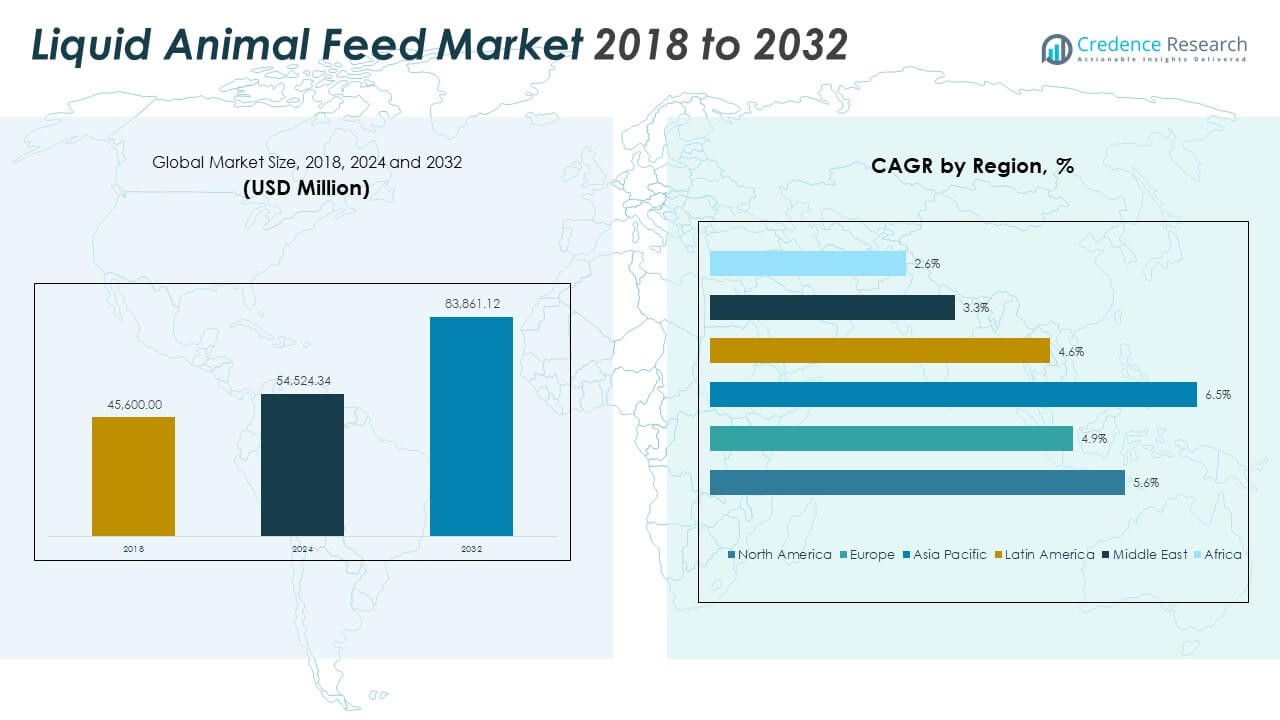

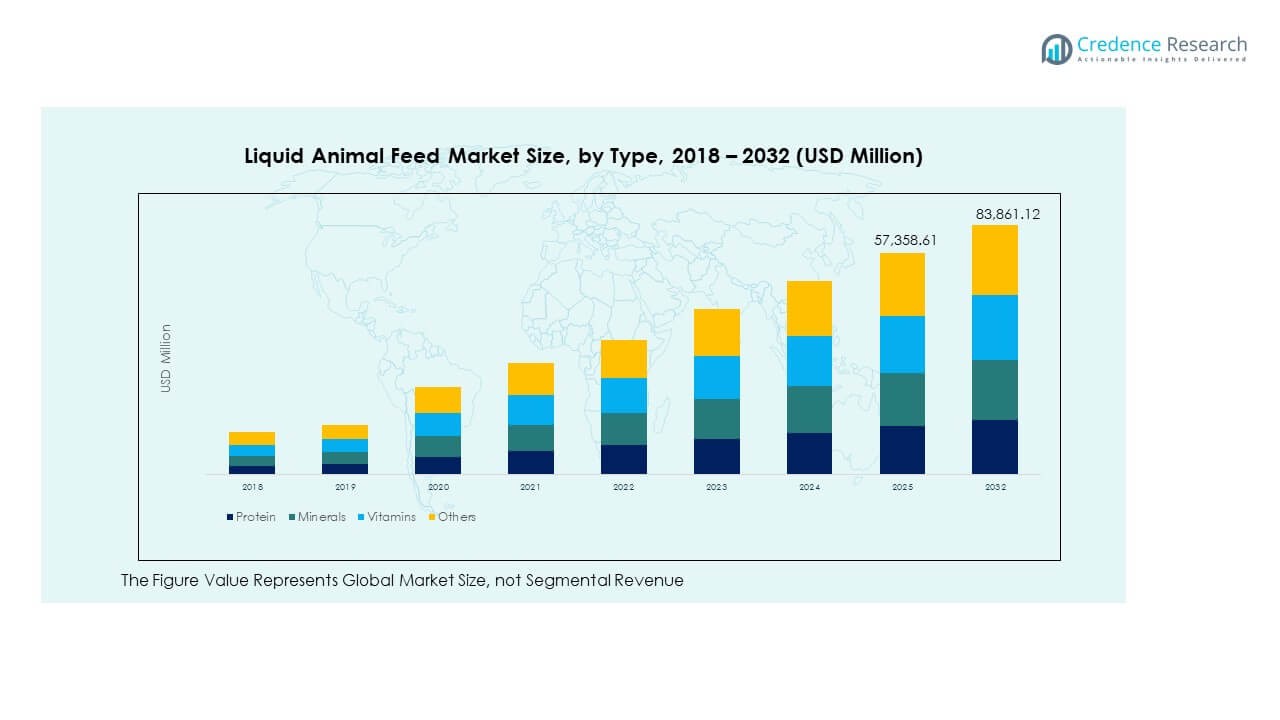

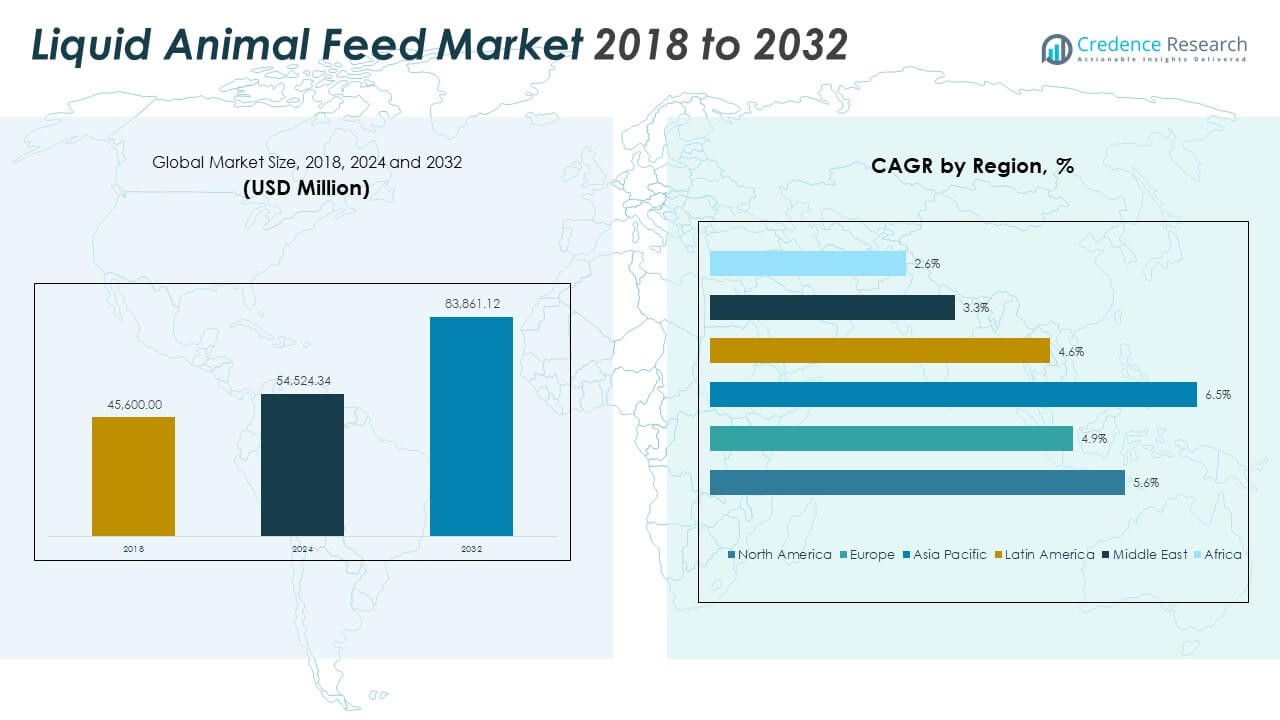

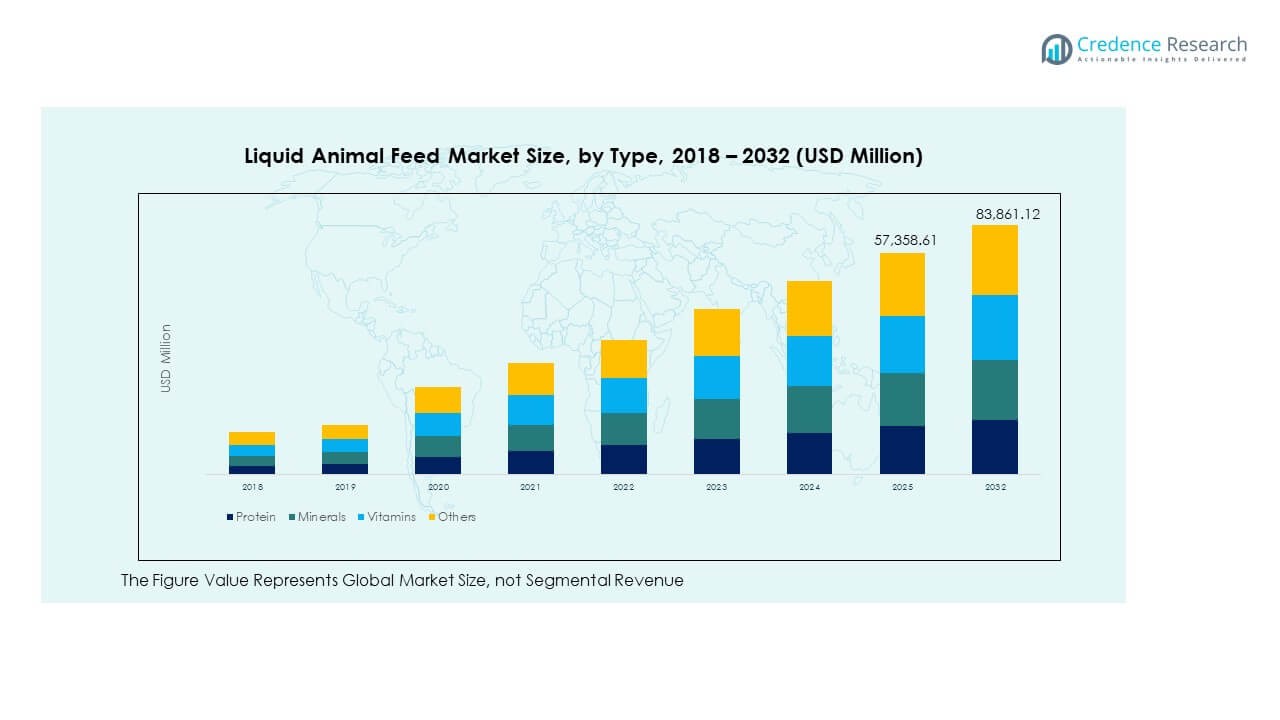

The Liquid Animal Feed Market size was valued at USD 45,600.00 million in 2018 to USD 54,524.34 million in 2024 and is anticipated to reach USD 83,861.12 million by 2032, at a CAGR of 5.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Animal Feed Market Size 2024 |

USD 54,524.34 Million |

| Liquid Animal Feed Market, CAGR |

5.58% |

| Liquid Animal Feed Market Size 2032 |

USD 83,861.12 Million |

Rising livestock populations and the increasing focus on nutrient-dense feed formulations are key drivers for market growth. Liquid feeds improve digestibility, enhance nutrient absorption, and reduce wastage compared to traditional dry feed. Farmers are adopting molasses-based and protein-enriched formulations to support higher milk yields, weight gain, and overall animal health. Growing awareness of feed efficiency, coupled with the need for sustainable livestock nutrition, is pushing feed producers to innovate and expand product portfolios targeting dairy, poultry, and swine production systems.

Asia Pacific dominates the global market, led by expanding dairy and poultry industries in China, India, and Southeast Asia. North America follows due to strong industrial livestock production and advanced feed technologies. Europe maintains steady growth driven by sustainability initiatives and regulated feed quality standards. Latin America is emerging as a promising region supported by growing meat exports, while the Middle East and Africa show gradual adoption supported by government-led livestock productivity programs and increasing focus on food security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Liquid Animal Feed Market was valued at USD 45,600.00 million in 2018, reached USD 54,524.34 million in 2024, and is projected to hit USD 83,861.12 million by 2032, growing at a CAGR of 5.58%.

- Asia Pacific leads with a 35.3% share, driven by strong dairy, poultry, and aquaculture sectors in China and India. North America follows with 27.4%, supported by advanced feed technologies, while Europe holds 24.5% due to sustainable livestock practices.

- Asia Pacific remains the fastest-growing region with a 35.3% share, fueled by rapid urbanization, expanding livestock production, and government initiatives promoting efficient feed usage.

- Protein dominates segmental distribution with an estimated 40% share, reflecting its vital role in animal growth and feed efficiency.

- Minerals and vitamins collectively contribute nearly 45%, showing rising demand for balanced nutrition and fortified liquid feed formulations across livestock sectors.

Market Drivers

Rising Livestock Population and Demand for Nutrient-Enriched Feed

Liquid Animal Feed Market benefits from increasing livestock numbers across dairy, poultry, and swine sectors. Farmers are prioritizing nutrient-rich feed to enhance growth performance and production output. The ease of absorption in liquid feeds improves animal health and feed conversion rates. Molasses-based supplements remain popular due to their palatability and energy density. The growing demand for sustainable animal protein sources supports the feed industry’s evolution. Governments are promoting efficient feed practices to boost productivity. Livestock owners seek cost-effective and nutrient-balanced products. It continues to gain traction among intensive livestock farms globally.

- For example, Cargill Incorporated developed the SilvAir™ nutritional solution that reduces enteric methane production by up to 10 % while maintaining performance in cattle. It also launched the Reach4Reduction™ initiative offering farmers a framework to integrate emissions-reduction strategies linked to feed and nutrition.

Growing Awareness of Feed Efficiency and Animal Health Management

Feed efficiency plays a vital role in achieving profitability and sustainability in livestock farming. The Liquid Animal Feed Market is expanding as producers focus on performance optimization and disease prevention. Nutrient-enriched formulations reduce feed waste while maintaining balanced animal diets. Liquid supplements allow precise nutrient delivery and faster digestion. Rising awareness of gut health and immunity in animals increases the adoption of fortified feed solutions. Manufacturers invest in R&D to create protein and amino acid blends that enhance growth. Improved livestock performance helps reduce antibiotic dependency. It promotes animal welfare and long-term productivity improvements.

- For instance, feed additives containing Lactiplantibacillus plantarum strains DSM 18112, DSM 18113, and DSM 18114 were officially evaluated by the European Food Safety Authority (EFSA) in 2025. The EFSA assessment, published on PubMed Central, confirmed their safety and functional use as silage additives for all animal species, supporting improved fermentation quality and feed preservation.

Technological Advancements in Feed Processing and Formulation

Modern feed processing technologies are reshaping the production of liquid animal feed. The Liquid Animal Feed Market benefits from automation, precision mixing, and real-time nutrient tracking. These innovations ensure consistent quality and optimized nutrient profiles. Companies are integrating digital monitoring systems for improved traceability and performance analysis. Advanced emulsifiers and stabilizers enhance feed shelf life and nutritional retention. Feed manufacturers are leveraging biotechnology to enhance protein synthesis and digestibility. Continuous improvements in formulation methods reduce material loss and energy consumption. It supports scalable, high-efficiency feed production across commercial farms.

Shift Toward Sustainable and Cost-Effective Livestock Nutrition

Sustainability in feed production is becoming a strategic priority for producers and regulators. The Liquid Animal Feed Market supports this shift by promoting low-waste, energy-efficient feeding systems. The use of co-products such as molasses and condensed distillers solubles enhances circular economy practices. Manufacturers adopt eco-friendly ingredients that reduce environmental footprints. Cost efficiency is achieved through flexible formulation and easy on-site blending. Farmers increasingly prefer liquid feeds that simplify handling and storage. This trend reduces packaging waste and transportation emissions. It strengthens the position of liquid feed as a sustainable alternative to dry feed products.

Market Trends

Integration of Smart Farming and Digital Feed Monitoring Systems

Smart farming adoption drives innovation in livestock nutrition and feeding practices. The Liquid Animal Feed Market benefits from IoT-enabled sensors that track consumption patterns and nutrient intake. Real-time monitoring helps farmers maintain feed consistency and efficiency. Predictive analytics tools identify nutrient deficiencies early, optimizing feed ratios. Automation in mixing and dispensing systems minimizes manual errors. Data-driven insights improve herd health and production outcomes. Integration with farm management software enhances operational control. It enables precision feeding strategies for improved yield and profitability.

- For instance, BinSentry, in collaboration with Soracom, deployed IoT-enabled sensors across over 40,000 feed bins in 2025, capturing more than 500,000 real-time consumption data points daily. The deployment, reported by IoT World Today and Soracom’s official releases, helps livestock producers in North America and Europe optimize feed delivery and minimize manual tracking errors.

Increasing Use of By-Products and Natural Ingredients in Feed Formulation

Feed manufacturers are turning to agricultural and food industry by-products to enhance sustainability. The Liquid Animal Feed Market embraces molasses, corn steep liquor, and glycerin as valuable feed inputs. These materials improve palatability and energy content while reducing waste. Natural additives such as herbal extracts and enzymes support digestion and immunity. Farmers prefer eco-friendly and non-GMO formulations that align with consumer expectations. Innovation in fermentation technologies enhances ingredient bioavailability. The trend also supports compliance with green certification standards. It encourages resource-efficient feed production across regions.

Expansion of Livestock Integration and Contract Farming Models

Integrated livestock production models are influencing global feed demand patterns. The Liquid Animal Feed Market grows as vertically integrated farms standardize feeding protocols. Large producers secure consistent supply through contract manufacturing partnerships. This integration ensures quality control and cost efficiency. Collaboration between feed producers and livestock farmers improves nutrient management. Enhanced supply chain coordination reduces inventory losses. Contract farming promotes consistent feed quality and traceability. It establishes reliable distribution networks for large-scale liquid feed adoption.

- For instance, Smithfield Foods operates one of the largest integrated pork production systems globally, with most hogs raised under long-term grower contracts. This integrated model allows consistent feed quality control and efficient resource management across its production network, as documented in Smithfield’s sustainability disclosures and USDA livestock contracting reports.

Growing Preference for Customized and Species-Specific Feed Solutions

Demand for tailored nutritional programs is reshaping product development strategies. The Liquid Animal Feed Market supports precision nutrition targeting cattle, poultry, and swine needs. Custom formulations help meet productivity goals across varied farm environments. Companies develop feed blends with optimal amino acid, vitamin, and mineral ratios. Personalized feeding solutions improve conversion efficiency and reduce waste. This customization trend attracts both small and large-scale farmers. Data analytics and laboratory testing enhance formulation accuracy. It ensures species-specific performance improvement across different production stages.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatile raw material prices affect production costs for feed manufacturers. The Liquid Animal Feed Market faces margin pressure due to dependence on molasses, corn, and oilseed by-products. Disruptions in global trade and transportation raise procurement risks. Seasonal variations in crop yields limit ingredient availability. Feed producers struggle to maintain consistent quality under fluctuating input costs. Small-scale farmers face affordability issues during high-cost cycles. Supply chain interruptions can delay distribution and impact product freshness. It challenges manufacturers to stabilize pricing and ensure uninterrupted supply.

Regulatory Compliance and Product Standardization Issues

Strict regulations on feed additives and safety limit product formulation flexibility. The Liquid Animal Feed Market must comply with labeling, quality testing, and residue control standards. Differences in regional policies increase complexity for exporters. Compliance costs rise with frequent updates in feed ingredient guidelines. Maintaining uniformity across international markets becomes difficult for global producers. Lack of awareness among small manufacturers results in inconsistent quality output. Certification procedures delay market entry for new formulations. It increases operational burden and slows product innovation cycles.

Market Opportunities

Rising Demand for Protein-Rich Diets and Efficient Feed Systems

Global demand for high-quality animal protein continues to expand. The Liquid Animal Feed Market can capitalize on this through advanced protein-based feed formulations. Efficient feeding systems improve digestibility and reduce waste. Growth in meat, dairy, and aquaculture sectors creates consistent opportunities. Nutrient-rich liquid feed supports faster animal weight gain and reproductive health. Adoption among developing economies accelerates due to rising income levels. Feed companies investing in amino acid research gain a competitive edge. It paves the way for long-term expansion in the livestock nutrition sector.

Expansion in Emerging Markets and Product Diversification

Emerging economies present new opportunities for liquid feed adoption. The Liquid Animal Feed Market benefits from industrial livestock farming expansion in Asia Pacific, Africa, and Latin America. Farmers seek innovative and cost-efficient feeding methods. Growing awareness of feed efficiency drives adoption of fortified solutions. Manufacturers diversify offerings through probiotic, mineral, and enzyme-based variants. Strategic alliances with local distributors help expand regional presence. Evolving dietary preferences boost livestock sector investments. It strengthens market prospects and supports global product penetration.

Market Segmentation Analysis:

The Liquid Animal Feed Market is segmented by type, ingredients, and livestock, reflecting its diverse application across global animal nutrition systems.

By type, protein-based feed dominates due to its critical role in muscle growth and milk production. High-protein formulations support better feed conversion ratios and overall animal performance. Mineral and vitamin segments also hold strong positions, meeting essential dietary requirements that improve metabolism and immunity. The others segment includes additives that enhance feed palatability and nutrient absorption, supporting farm productivity.

By ingredients, molasses leads the segment due to its affordability, energy content, and blending compatibility. It serves as a base for most liquid feed formulations. Corn follows closely, valued for its carbohydrate richness that promotes growth and energy supply. Urea contributes as a non-protein nitrogen source, improving protein synthesis in ruminants. The others segment includes glycerin and by-products, offering flexibility and cost efficiency.

- For instance, Westway Feed Products documented in field trials that its RumaWAY® LAUNCH molasses-based liquid feed supplement increased dry matter intake (DMI) by 2–4 lbs in pre-fresh cows due to enhanced palatability. The supplement supports more consistent feed intake and improved transition health before calving, as reported in Westway’s official product data.

By livestock, ruminants represent the largest share, driven by strong demand from dairy and beef producers. Poultry shows rapid adoption supported by modern feed management practices and nutrient-focused formulations. Swine and aquaculture segments are expanding due to higher protein needs and efficient feed conversion. The others category covers goats, sheep, and niche livestock where liquid feed adoption is rising. It continues to gain momentum across all livestock categories, driven by the need for cost-efficient, high-performance feeding solutions that enhance productivity and sustainability.

- For instance, De Heus Animal Nutrition reported measurable improvements in milk yield and feed efficiency in dairy cows through its optimized feeding programs. According to the company’s documented trials, higher concentrate rations and balanced nutrient formulations have enhanced milk protein content and overall production performance in commercial dairy operations.

Segmentation:

By Type

- Protein

- Minerals

- Vitamins

- Others

By Ingredients

- Molasses

- Corn

- Urea

- Others

By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Liquid Animal Feed Market size was valued at USD 13,087.20 million in 2018 to USD 15,408.25 million in 2024 and is anticipated to reach USD 23,657.37 million by 2032, at a CAGR of 5.6% during the forecast period. North America holds a 27.4% share of the global market, supported by strong livestock farming and advanced feed technologies. The U.S. leads due to high dairy and beef production coupled with large-scale adoption of precision feeding. Canada and Mexico show steady growth driven by rising poultry and swine industries. Technological adoption in feed formulation and farm automation strengthens market presence. Sustainable and nutrient-efficient feed production remains a regional focus. It benefits from strong regulatory frameworks and high investments in animal nutrition research. The region’s established agribusiness infrastructure ensures consistent liquid feed supply and distribution.

Europe

The Europe Liquid Animal Feed Market size was valued at USD 12,608.40 million in 2018 to USD 14,518.34 million in 2024 and is anticipated to reach USD 21,154.19 million by 2032, at a CAGR of 4.9% during the forecast period. Europe accounts for a 24.5% share, supported by well-developed dairy and swine industries. Germany, France, and the Netherlands lead adoption due to advanced livestock management systems. Strict EU feed regulations encourage innovation in safe and traceable formulations. Growth is driven by a preference for high-quality animal nutrition and sustainable practices. The market benefits from strong demand for molasses-based and vitamin-enriched feeds. R&D initiatives in alternative proteins and bio-based ingredients create new opportunities. It continues to expand through modernization and integration of automated feed blending technologies.

Asia Pacific

The Asia Pacific Liquid Animal Feed Market size was valued at USD 15,276.00 million in 2018 to USD 18,857.01 million in 2024 and is anticipated to reach USD 31,221.56 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific leads with a 35.3% share, driven by rapid expansion in dairy, poultry, and aquaculture sectors. China and India are key contributors due to population growth and protein consumption rise. Feed manufacturers focus on cost-effective and high-yield formulations to support large-scale farming. Strong government initiatives promoting livestock productivity drive market growth. Japan, South Korea, and Southeast Asia witness adoption of advanced feed technologies. Urbanization and demand for processed animal products sustain long-term growth. It continues to gain momentum through regional feed integration and expanding agribusiness investments.

Latin America

The Latin America Liquid Animal Feed Market size was valued at USD 2,781.60 million in 2018 to USD 3,292.72 million in 2024 and is anticipated to reach USD 4,685.32 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America holds a 7.1% share, supported by growth in cattle and poultry sectors. Brazil leads the market with its large-scale livestock exports and feed production capabilities. Argentina and Mexico also contribute through expanding dairy and meat industries. Increasing adoption of nutrient-rich feed and modernization of farming practices enhance efficiency. Feed producers emphasize cost-effective and energy-dense formulations suitable for tropical conditions. Government focus on agricultural exports supports feed manufacturing investments. It remains a key growth region due to improving farm mechanization and feed quality standards.

Middle East

The Middle East Liquid Animal Feed Market size was valued at USD 1,094.40 million in 2018 to USD 1,177.37 million in 2024 and is anticipated to reach USD 1,518.35 million by 2032, at a CAGR of 3.3% during the forecast period. The region represents a 3.0% share, driven by growing poultry and dairy production in GCC countries. Feed imports dominate due to limited domestic grain supply. The market benefits from rising investments in modern livestock infrastructure and food security programs. Saudi Arabia and the UAE lead adoption through government-backed initiatives promoting self-sufficiency. Demand for molasses-based and fortified feeds supports nutritional efficiency. Regional players focus on partnerships with global feed producers to reduce dependency. It continues to evolve through sustainable feed innovations and localized formulation efforts.

Africa

The Africa Liquid Animal Feed Market size was valued at USD 752.40 million in 2018 to USD 1,270.64 million in 2024 and is anticipated to reach USD 1,624.33 million by 2032, at a CAGR of 2.6% during the forecast period. Africa holds a 2.7% share, with South Africa leading in dairy and poultry feed production. Feed adoption remains low in rural regions due to limited infrastructure and awareness. Growth is emerging in Nigeria, Kenya, and Egypt, supported by government livestock initiatives. Local feed manufacturers are exploring cost-effective raw materials to improve affordability. Urban population growth and demand for animal protein drive gradual market expansion. Global feed companies are entering through joint ventures and training programs. It is steadily developing with focus on improving feed quality and nutrient balance across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Land O’Lakes, Inc.

- Double S Liquid Feed Services, Inc.

- Foster Farms

- Midwest Liquid Feeds

- Alliance Liquid Feeds Inc.

- Performance Seeds LLC

- Quality Liquid Feeds Inc.

- Westway Feed Products LLC

- BASF SE

- DLG Group

- GrainCorp Limited

- Ridley Corporation

- Masterfeeds LP

- Alltech Inc.

- Sugar Corporation of Malawi Limited

- Industrias Bachoco S.A.B. de C.V.

Competitive Analysis:

The Liquid Animal Feed Market is characterized by strong competition among global and regional producers focusing on product innovation, nutrient efficiency, and sustainability. Leading companies such as Cargill Incorporated, Archer Daniels Midland Company (ADM), Land O’Lakes, Inc., and BASF SE invest heavily in R&D to enhance feed formulations and production efficiency. Mid-sized firms like Quality Liquid Feeds Inc. and Westway Feed Products LLC strengthen their presence through partnerships and distribution expansion. Companies are adopting advanced blending technologies and digital monitoring to ensure consistent quality. Strategic mergers, acquisitions, and ingredient diversification support market consolidation. It emphasizes tailored solutions for livestock nutrition, with manufacturers prioritizing customized protein, mineral, and vitamin blends. Growing focus on cost optimization and sustainable sourcing practices enhances competitiveness among key market participants.

Recent Developments:

- In October 2025, Cargill launched a new line of plant-based feed additives for poultry and swine which feature natural compounds designed to improve gut health and feed conversion rates. This product launch comes at a time when the liquid animal feed market is increasingly focused on sustainability and animal welfare, aligning Cargill’s portfolio with industry trends favoring environmentally-friendly feed solutions as well as efficient nutrition delivery systems for livestock producers.

- In September 2025, Archer Daniels Midland Company (ADM) and Alltech Inc. announced a significant joint venture focused on the North American animal feed market. This partnership aims to combine ADM’s animal feed business with Alltech’s Hubbard Feeds and Masterfeeds, operating a total of 44 feed mills across the U.S. and Canada.

- In February 2025, Zoetis finalized a deal to sell its medicated-feed-additive portfolio to Phibro Animal Health for $350 million. With this transaction, Zoetis aims to concentrate its resources on vaccines and biologics, while Phibro expands its presence in the feed additive and liquid animal feed space, enhancing its product offerings and reach in livestock nutrition.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredients and Livestock. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for nutrient-rich feed solutions will strengthen due to rising livestock productivity goals worldwide.

- Adoption of digital feed monitoring and precision nutrition systems will enhance formulation accuracy.

- Expansion in aquaculture and poultry sectors will drive continuous demand for liquid feed products.

- Sustainable feed practices using co-products and natural ingredients will shape future product strategies.

- Collaborations between feed producers and livestock farms will improve supply chain integration.

- Technological advancements in enzyme and amino acid blends will improve feed conversion efficiency.

- Emerging economies will witness rising feed adoption supported by modernization of animal farming.

- Manufacturers will invest in automated blending and storage systems to maintain consistent quality.

- Regulatory focus on traceable, eco-friendly feed formulations will accelerate innovation in product development.

- It will continue to evolve through strong R&D investments and partnerships targeting performance-driven livestock nutrition.