Market Overview

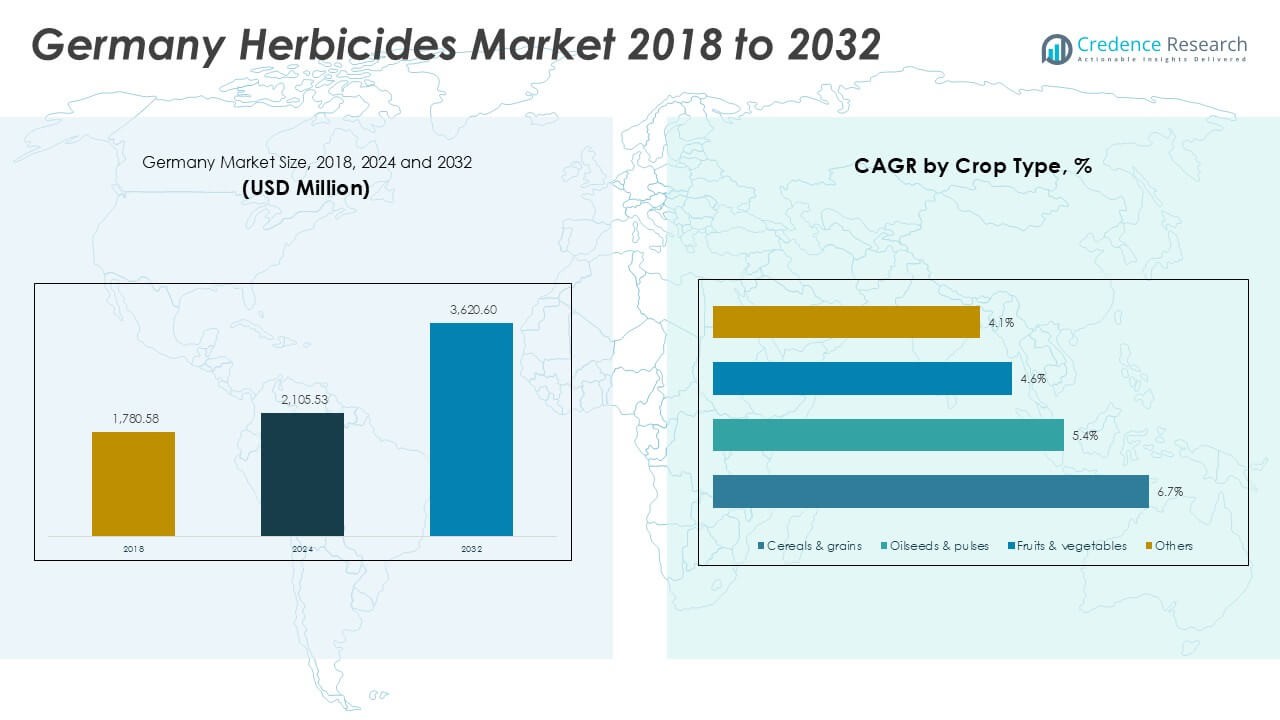

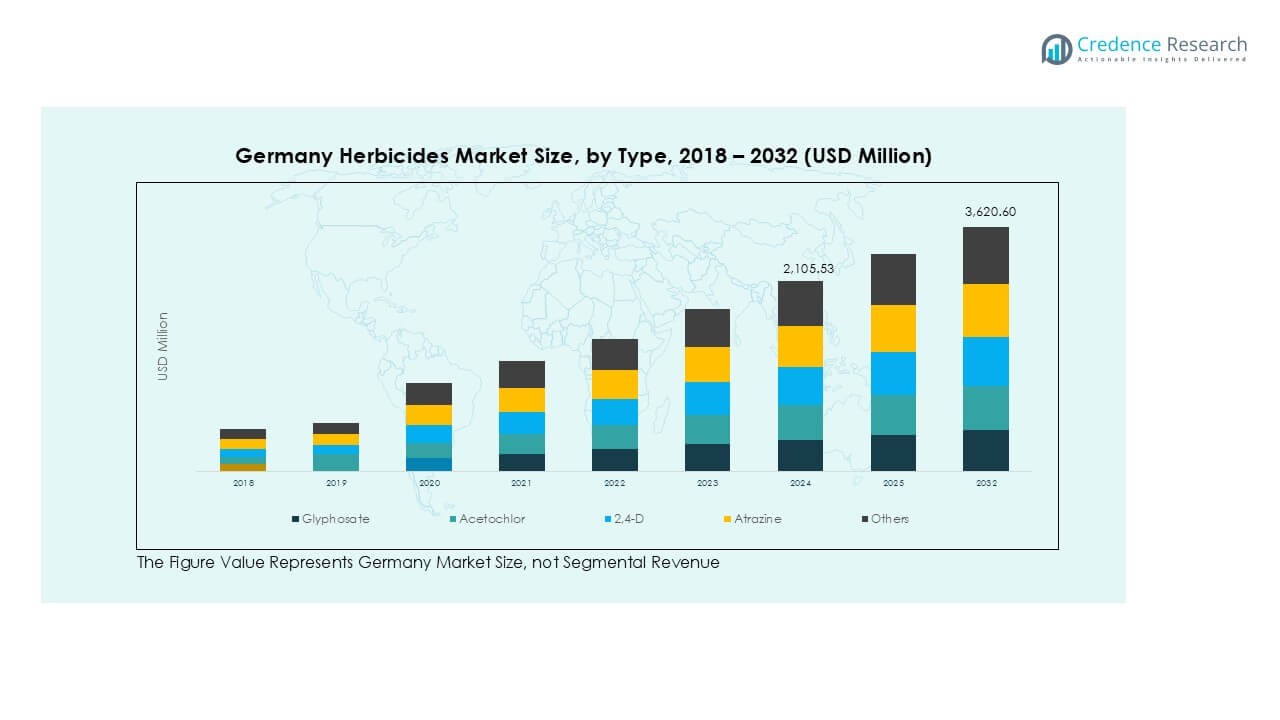

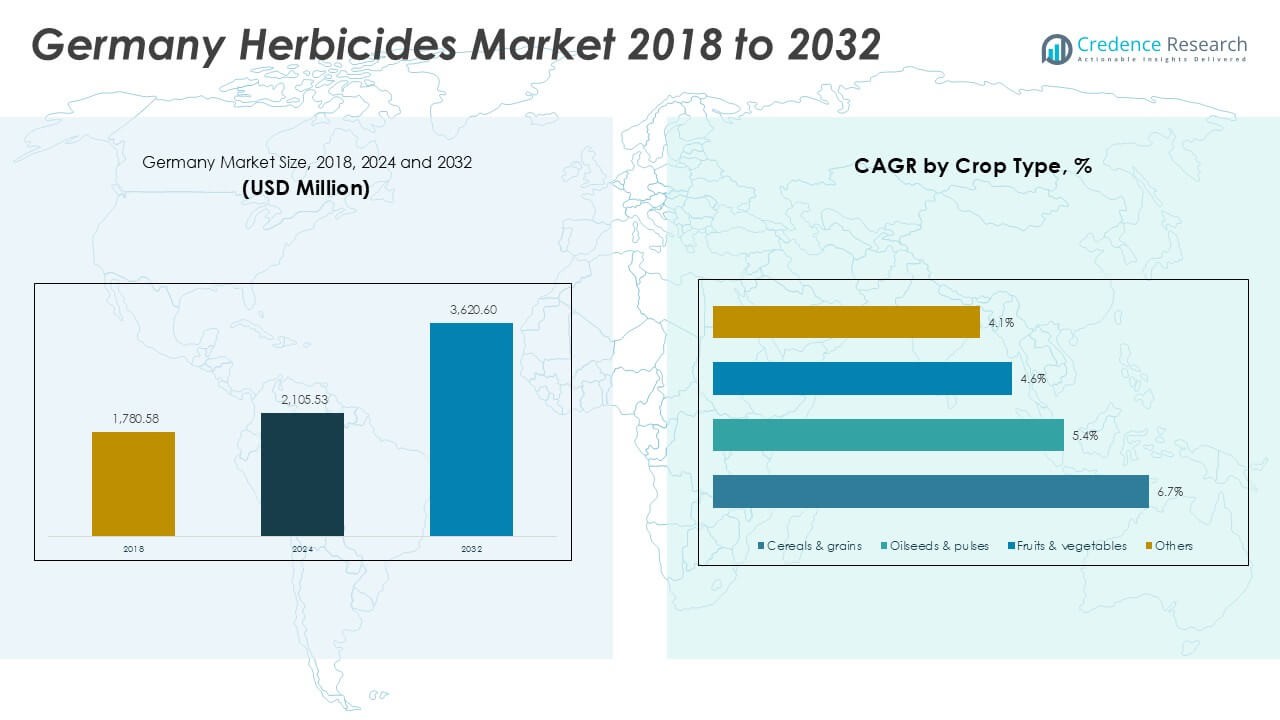

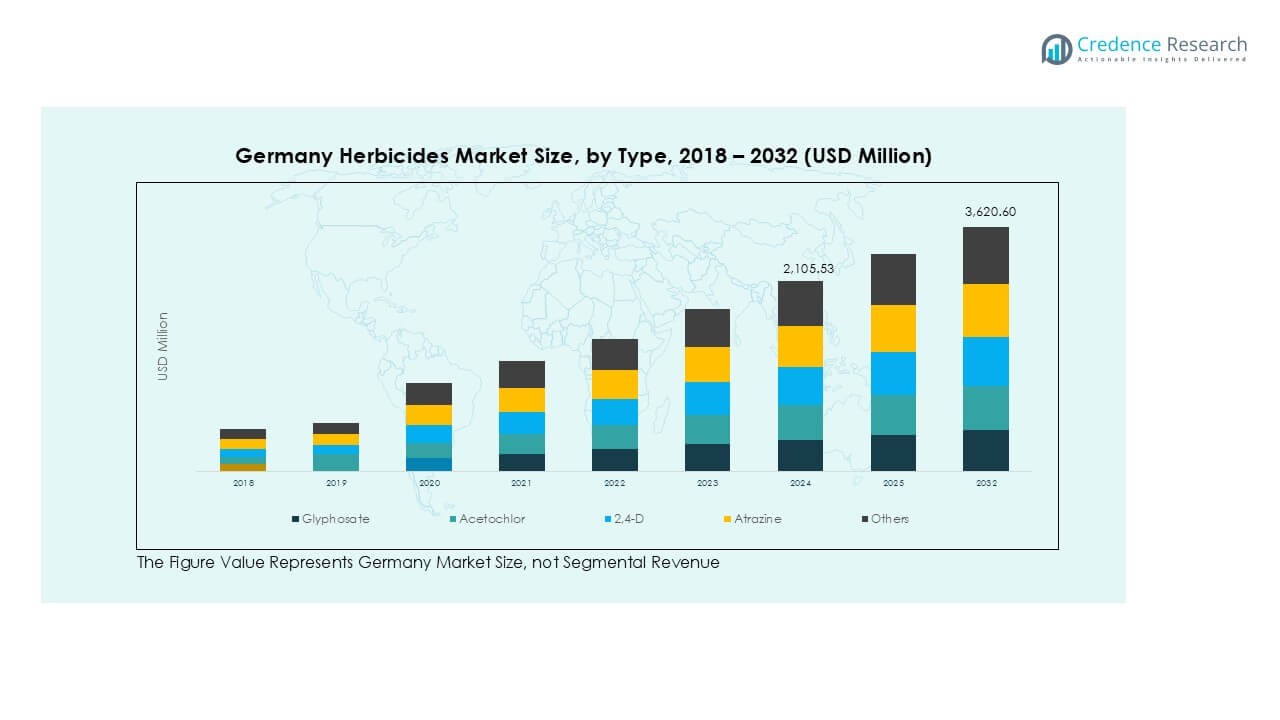

Germany Herbicides Market size was valued at USD 1,780.58 million in 2018 and grew to USD 2,105.53 million in 2024. The market is anticipated to reach USD 3,620.60 million by 2032, registering a CAGR of 7.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Herbicides Market Size 2024 |

USD 2,105.53 Million |

| Germany Herbicides Market, CAGR |

7.01% |

| Germany Herbicides Market Size 2032 |

USD 3,620.60 Million |

BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group dominate the Germany herbicides market with strong portfolios of glyphosate, selective herbicides, and innovative formulations. These companies leverage advanced R&D, precision application technologies, and strategic partnerships to strengthen their market presence. Nufarm Ltd, ADAMA Agricultural Solutions, FMC Corporation, UPL Limited, and Sumitomo Chemical Co. Ltd expand competitiveness through bio-based and low-residue herbicide solutions. Regionally, North Germany leads with over 35% share, supported by extensive cereal and rapeseed cultivation. South Germany follows with nearly 30% share, driven by high-value crop production, while East and West Germany contribute 20% and 15% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Germany herbicides market was valued at USD 2,105.53 million in 2024 and is projected to reach USD 3,620.60 million by 2032, growing at a CAGR of 7.01%.

- Rising cereal and rapeseed production, coupled with adoption of precision farming, drives demand for glyphosate and selective herbicides across major crop categories.

- Key trends include development of bio-based, low-residue formulations and integration of digital farming tools for targeted weed management, improving efficiency and sustainability.

- BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group dominate the market with advanced product portfolios, while Nufarm, FMC, UPL, and ADAMA expand offerings with eco-friendly solutions.

- North Germany leads with over 35% share, followed by South Germany with nearly 30%, East Germany with 20%, and West Germany at 15%; by type, glyphosate holds over 40% share, and foliar application dominates with more than 50% share in 2024.

Market Segmentation Analysis:

By Type

Glyphosate dominated the Germany herbicides market in 2024, accounting for over 40% share. Its broad-spectrum weed control and cost-effectiveness make it the preferred choice across major crop categories. High adoption in no-till and conservation agriculture systems supports demand growth. Acetochlor and 2,4-D also hold notable shares due to their effectiveness in selective weed control for corn and cereal crops. Atrazine remains a niche but essential product in specific crop rotations. Rising concerns over herbicide resistance are encouraging innovation in glyphosate-based formulations, driving sustained usage despite regulatory scrutiny.

- For instance, Germany cultivates millions of hectares of wheat annually. However, the country has banned or severely restricted the use of glyphosate for stubble management and pre-sowing weed control, with a total ban entering effect in 2024 (though temporarily lifted for six months at the start of that year).

By Application

Foliar application led the market with over 50% share in 2024, driven by its rapid action and precise weed targeting. Farmers prefer foliar sprays for post-emergence weed management in cereals and oilseeds. Fertigation is gaining traction, particularly in high-value horticulture, as it allows uniform herbicide distribution through irrigation systems. Soil application continues to serve as a preventive measure, especially for pre-emergence weed control. Growing emphasis on sustainable farming and efficient input utilization is supporting the use of foliar and fertigation techniques, which improve herbicide efficiency and reduce overall chemical usage.

- For instance, according to German field trials conducted by research institutions like the Julius Kühn Institute (JKI), foliar herbicide programs can significantly increase winter wheat yields compared to untreated plots. While the specific yield increase is highly variable and depends on environmental factors and weed pressure, some studies have reported increases in the range of 6–10% or more under certain conditions.

By Crop Type

Cereals & grains held the largest share of more than 45% in 2024, fueled by extensive wheat and barley cultivation in Germany. Consistent demand for high-yield cereal crops drives herbicide use to protect against broadleaf and grass weeds. Oilseeds & pulses follow closely, with rapeseed being a key driver of herbicide consumption. Fruits and vegetables also contribute significantly, supported by rising horticultural production and demand for residue-free produce. The push for food security, coupled with precision farming adoption, ensures strong herbicide demand across all crop categories, with cereals maintaining dominance through the forecast period.

Key Growth Drivers

Expansion of Cereal and Grain Production

Germany’s rising cereal and grain production drives significant herbicide demand, with wheat and barley being major contributors. Farmers rely on effective weed control to maintain high yields and ensure food security. The adoption of herbicide-tolerant crop varieties is further boosting glyphosate and selective herbicide use. Government support for modern farming practices and improved seed technology encourages growers to invest in crop protection solutions. Increasing export demand for grains also motivates farmers to focus on productivity, sustaining herbicide consumption across major agricultural regions.

- For instance, in 2025, Germany is projected to harvest approximately 22 million metric tons of winter wheat from nearly 2.8 million hectares. This follows a challenging 2024 season with a smaller harvest of about 18.8 million metric tons from a reduced area of 2.6 million hectares.

Adoption of Advanced Farming Practices

The shift toward precision agriculture and conservation tillage is a key growth driver for the herbicides market. Farmers are using GPS-guided sprayers and automated systems to optimize herbicide application, reducing waste and increasing efficiency. No-till and minimum-till practices require effective herbicide programs to manage weed pressure, further supporting demand. These practices improve soil health and reduce erosion, aligning with EU sustainability goals. Adoption of integrated weed management systems also complements chemical herbicides, ensuring consistent market growth while promoting responsible usage across large and small farms.

- For example, German farms using precision spraying technologies report chemical savings of up to 20% and improved weed control consistency across large cereal fields.

Rising Demand for High-Value Crops

Germany’s growing horticulture sector and demand for residue-free fruits and vegetables fuel herbicide use. Producers adopt pre- and post-emergence solutions to maintain weed-free fields, protecting crop quality and yield. The popularity of organic and sustainable production systems is encouraging the development of bio-herbicides and low-residue formulations. Consumers’ preference for high-quality produce motivates farmers to invest in effective weed control strategies. Increasing greenhouse cultivation also supports targeted herbicide usage, driving sales of foliar and soil-applied products designed for high-value crop segments.

Key Trends & Opportunities

Shift Toward Sustainable Herbicides

Growing environmental awareness is driving the development of eco-friendly herbicide formulations. Manufacturers are focusing on biodegradable, low-toxicity, and residue-free products that comply with EU Green Deal objectives. This trend creates opportunities for bio-based herbicide producers targeting organic and integrated farming systems. Sustainable solutions also reduce regulatory risks and improve farmer acceptance. Companies are investing in R&D to develop herbicides that minimize impact on pollinators and soil biodiversity, aligning with Germany’s national strategy to cut chemical pesticide use by 50% by 2030, fueling innovation and market expansion.

- For instance, Germany’s national pesticide reduction plan targets a 50% cut in chemical pesticide use by 2030, prompting companies like BASF to expand their bioherbicide portfolio.

Integration of Digital Farming Technologies

Digital tools and precision farming technologies are becoming integral to herbicide application. Farmers use drones, sensors, and AI-powered analytics to identify weed hotspots and apply herbicides selectively. This targeted approach reduces costs, minimizes chemical use, and improves efficiency. Data-driven solutions help farmers plan rotations and avoid herbicide resistance, creating opportunities for agritech providers. Partnerships between chemical manufacturers and agri-tech companies are growing, providing integrated solutions that combine chemical and digital weed management. This integration enhances farm productivity while supporting sustainability goals in Germany’s agriculture sector.

Key Challenges

Regulatory Restrictions and Compliance Costs

Stringent EU regulations on herbicide use pose a challenge for manufacturers and farmers. Bans on certain active ingredients and tightening residue limits increase compliance costs. Glyphosate’s regulatory uncertainty creates market instability, forcing companies to reformulate products and farmers to seek alternatives. Lengthy product approval processes delay the launch of new solutions, slowing innovation. Compliance with environmental protection laws also adds financial burden to growers, potentially reducing herbicide application rates and impacting overall market growth in the medium term.

Rising Herbicide Resistance

The increasing occurrence of herbicide-resistant weed species is a major challenge in Germany. Continuous and repetitive use of glyphosate and other herbicides has led to resistant populations in key crops like wheat and rapeseed. This resistance reduces product effectiveness, requiring higher doses or multiple applications, increasing production costs. Farmers must adopt integrated weed management strategies, combining chemical, mechanical, and cultural practices. The challenge creates pressure on manufacturers to develop novel modes of action, adding to R&D costs and extending product development timelines.

Regional Analysis

North Germany

North Germany held the largest share of over 35% in the herbicides market in 2024. The region’s dominance is driven by extensive cereal and rapeseed cultivation, requiring consistent weed management. Large-scale farms in Lower Saxony and Schleswig-Holstein adopt glyphosate and selective herbicides to maintain yields. The presence of advanced agribusiness infrastructure and cooperative farming networks supports efficient product distribution. Favorable climate and soil conditions encourage intensive agriculture, sustaining herbicide demand. Adoption of precision farming and integrated weed management programs further strengthens market growth, making North Germany a key revenue contributor in the forecast period.

South Germany

South Germany accounted for nearly 30% of the herbicides market share in 2024, supported by diverse crop production including cereals, vegetables, and vineyards. Bavaria and Baden-Württemberg lead demand due to high-value crop cultivation, which requires targeted weed control solutions. Farmers in this region increasingly prefer foliar and soil-applied herbicides to protect crop quality. Strong focus on sustainable farming practices drives adoption of bio-based and low-residue products. The presence of research institutions and agricultural cooperatives fosters innovation and promotes advanced herbicide usage, ensuring steady market expansion across South Germany during the forecast period.

East Germany

East Germany captured around 20% market share in 2024, driven by large agricultural holdings and mechanized farming operations. Brandenburg and Saxony play a major role in cereals and grains production, supporting strong demand for glyphosate and pre-emergence herbicides. The region benefits from fertile soils and favorable government support for modern agricultural practices. Adoption of precision spraying technology and integrated pest management systems is growing, improving herbicide efficiency. Ongoing investment in irrigation infrastructure also enhances productivity, encouraging steady herbicide usage across multiple crop categories, positioning East Germany as a fast-growing contributor to the national market.

West Germany

West Germany represented close to 15% of the herbicides market share in 2024, making it the smallest but steadily expanding region. North Rhine-Westphalia and Hesse contribute significantly through mixed farming systems and vegetable cultivation. Demand is driven by the need for residue-free solutions for horticulture and protected cultivation. Farmers are adopting advanced foliar sprays and fertigation-based herbicides to maximize efficiency and reduce chemical runoff. Growing focus on organic farming and EU-driven sustainability targets is promoting bio-herbicide usage. West Germany’s market is expected to expand steadily as specialty crop production and greenhouse farming gain momentum.

Market Segmentations:

By Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Others

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany herbicides market is highly competitive, with global and regional players focusing on innovation and sustainable solutions. BASF SE and Bayer AG lead the market with extensive product portfolios, strong distribution networks, and ongoing investments in R&D for advanced formulations. Corteva Agriscience and Syngenta Group emphasize integrated weed management systems and digital farming partnerships to strengthen their market position. Companies such as Nufarm Ltd, ADAMA Agricultural Solutions, and FMC Corporation are expanding bio-based and low-residue herbicide offerings to meet EU regulatory requirements. UPL Limited and Sumitomo Chemical Co. Ltd focus on expanding their market reach through strategic alliances and localized production. Emerging players like Wynca Group are gaining traction by offering cost-competitive products. Intense competition drives continuous product development, precision farming integration, and sustainability initiatives, ensuring that companies remain compliant with environmental standards while addressing farmers’ demand for effective and efficient weed control solutions across multiple crop categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Nufarm Ltd

- ADAMA Agricultural Solutions Ltd

- FMC Corporation

- UPL Limited

- Sumitomo Chemical Co. Ltd

- Wynca Group

Recent Developments

- In December 2023, ADAMA introduced its most advanced cross-spectrum herbicide called Kampai for the grain business. The new product provides the broadest application window for broadleaf and narrow-leaf weed control for cereal crops.

- In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC’s global expansion efforts, aimed at enhancing its presence in the European market.

- In July 2023, ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.

- In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

- In January 2023, Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for herbicides in Germany will continue to rise with expanding cereal and grain cultivation.

- Adoption of precision farming and digital spraying tools will improve herbicide efficiency and reduce waste.

- Bio-based and low-residue herbicides will gain popularity due to EU sustainability targets and consumer demand.

- Glyphosate use may face stricter regulations, pushing innovation in alternative weed control solutions.

- Integrated weed management systems combining chemical and mechanical methods will see stronger adoption.

- Investment in R&D for new active ingredients will remain a priority for leading manufacturers.

- Farmers will increasingly adopt foliar and fertigation methods to maximize application accuracy and yield.

- Resistance management strategies will drive the use of herbicide mixtures and rotation programs.

- Growth in horticulture and greenhouse farming will support demand for specialized herbicide formulations.

- North and South Germany will remain the key revenue-generating regions due to large-scale farming operations.