Market Overview

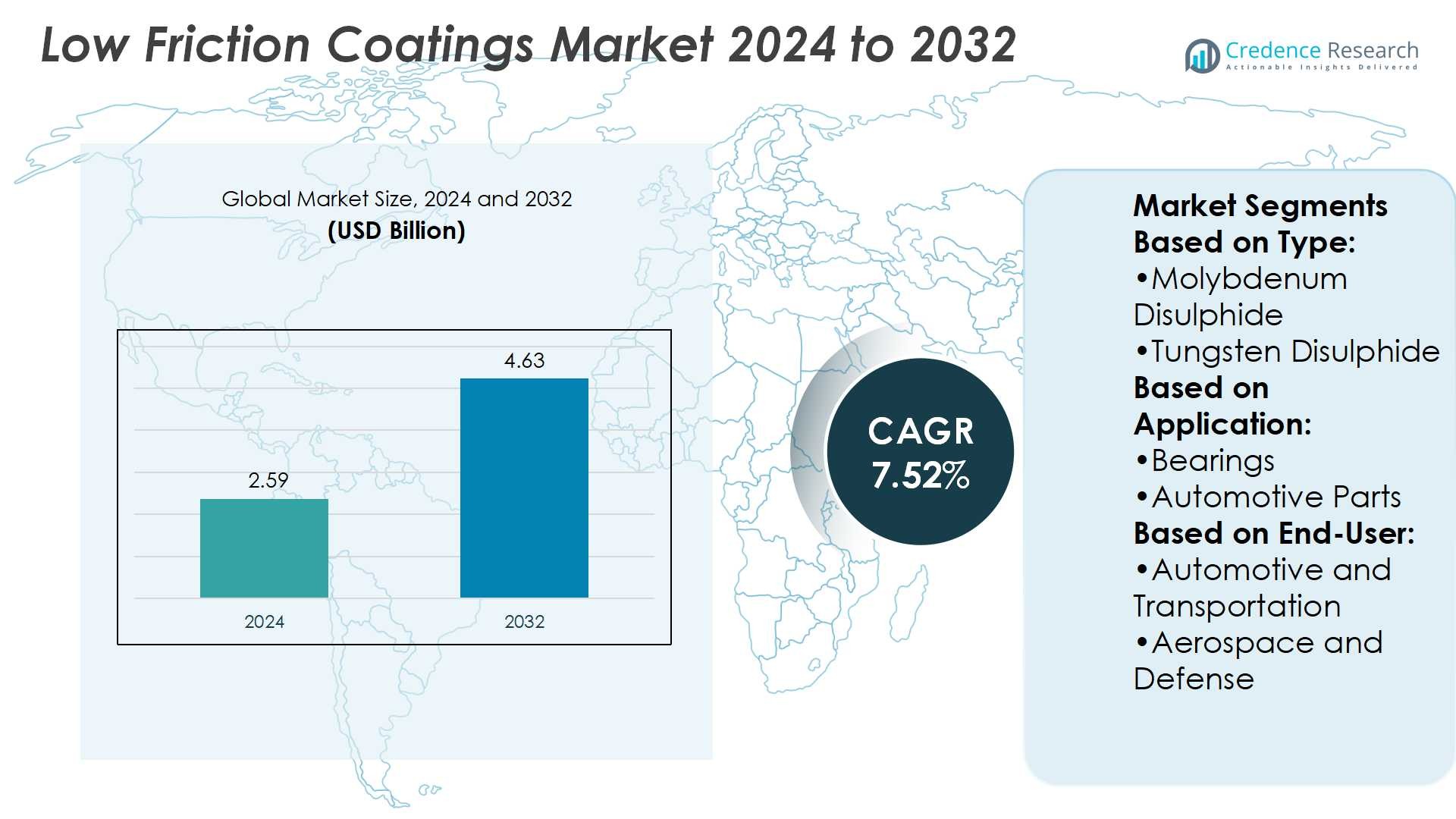

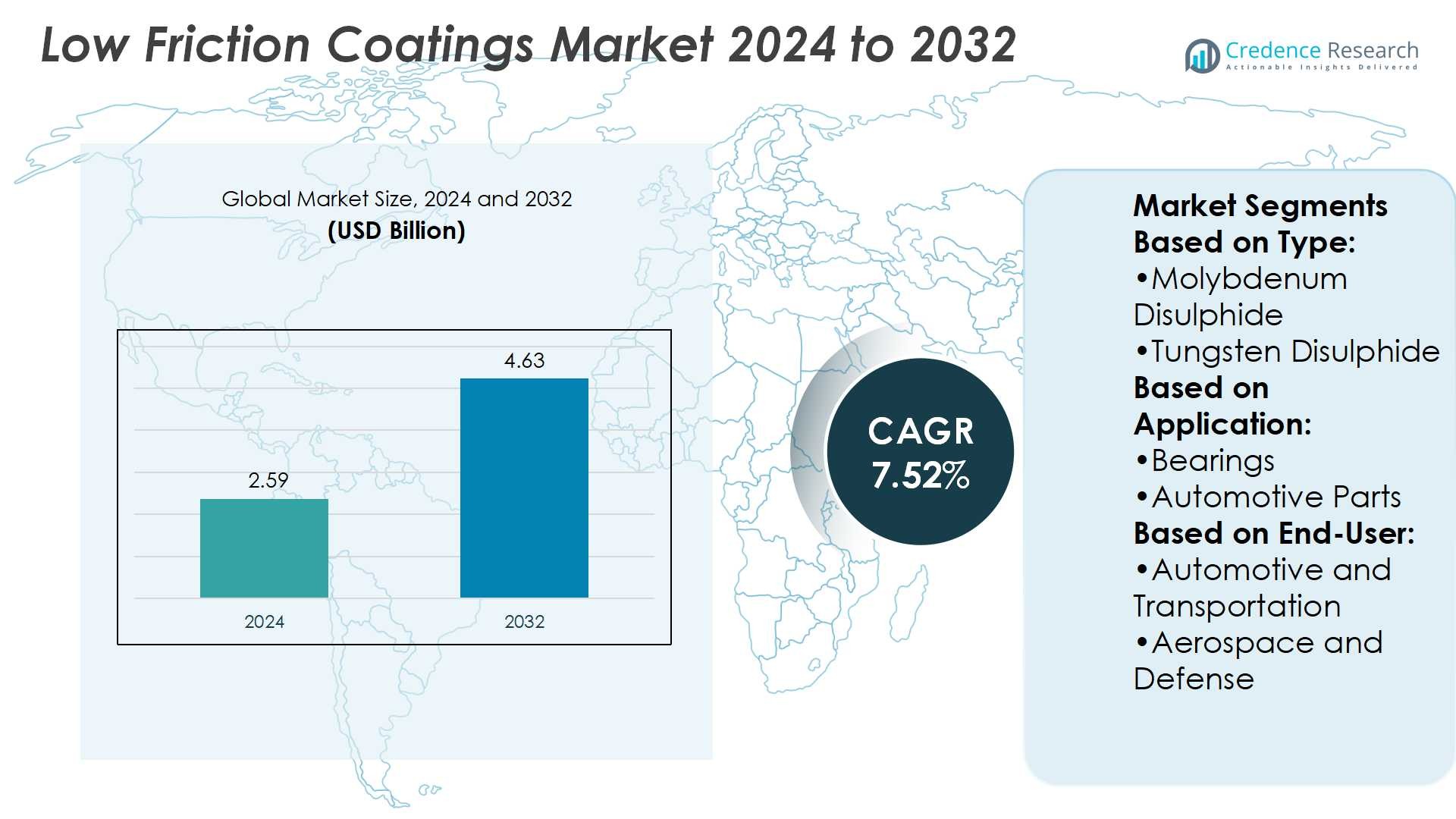

Low Friction Coatings Market size was valued at USD 2.59 billion in 2024 and is anticipated to reach USD 4.63 billion by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Friction Coatings Market Size 2024 |

USD 2.59 Billion |

| Low Friction Coatings Market, CAGR |

7.52% |

| Low Friction Coatings Market Size 2032 |

USD 4.63 Billion |

The Low Friction Coatings Market grows with rising demand for durable, efficient, and sustainable surface solutions across industries. Automotive and aerospace sectors drive adoption to reduce wear, enhance fuel efficiency, and meet emission standards. Healthcare relies on biocompatible coatings for safer surgical instruments and diagnostic devices. Energy, oil, and gas operators integrate coatings to extend equipment life under harsh environments. Trends highlight a shift toward eco-friendly, solvent-free formulations that comply with global regulations. Integration with digital monitoring systems supports predictive maintenance, while hybrid coating innovations strengthen performance. Expanding applications in renewable energy and electronics further reinforce long-term market momentum.

North America holds the largest share of the Low Friction Coatings Market, supported by strong aerospace, automotive, and energy sectors. Europe follows with robust demand driven by strict regulatory standards and advanced manufacturing. Asia-Pacific shows rapid growth due to expanding automotive production and industrialization in China, Japan, and India. Latin America and the Middle East & Africa present steady opportunities in oil, gas, and transportation. Key players include Du Pont, Magnaplate, Poeton Industries, Endura Coating, and Bechem Lubrication Technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Low Friction Coatings Market size was valued at USD 2.59 billion in 2024 and is anticipated to reach USD 4.63 billion by 2032, at a CAGR of 7.52%.

- Strong demand for durable and efficient surface solutions in automotive and aerospace industries drives adoption.

- Trends highlight eco-friendly and solvent-free formulations that align with global regulatory requirements.

- Competitive landscape remains active with companies focusing on advanced formulations and customized application-specific solutions.

- High production costs and technical challenges in extreme environments act as restraints for wider adoption.

- North America holds the largest share supported by aerospace, automotive, and energy sectors, while Europe follows with strict standards and advanced industries.

- Asia-Pacific records rapid growth through industrialization in China, Japan, and India, whereas Latin America and the Middle East & Africa maintain steady demand from oil, gas, and transportation applications.

Market Drivers

Rising Industrial Demand for Enhanced Wear Resistance and Equipment Longevity

The Low Friction Coatings Market benefits from industries seeking durable solutions for machinery and components. Manufacturers use coatings to reduce wear on moving parts, extending service life. Automotive and aerospace sectors depend on these technologies for engines, bearings, and hydraulic systems. It reduces maintenance intervals and supports higher operational efficiency across critical equipment. Industrial buyers view coatings as an investment that lowers downtime costs. Their adoption grows where reliability and performance standards remain high.

- For instance, Poeton Industries Ltd developed its Apticote 350 coating, a polymer-enhanced hard anodizing composite, to significantly improve wear and friction resistance. The coating is used in aerospace applications to extend the service life of components like actuators, providing enhanced corrosion protection and very low wear in sliding and adhesive situations.

Growing Automotive and Transportation Applications Across Global Supply Chains

The Low Friction Coatings Market gains traction in vehicles requiring improved fuel efficiency and durability. Coatings reduce drag on engine components, lowering energy loss and enhancing power output. Transmission parts, gears, and braking systems also benefit from reduced heat generation. It contributes to lower emissions and compliance with stricter environmental regulations. Railway and heavy-duty truck manufacturers adopt these solutions to manage high mechanical loads. Market growth reflects broad demand across transport supply chains.

- For instance, ASV Multichemie Private Limited offers its DF 8221 coating, which operates across a service-temperature range from –180 °C to +450 °C, and is designed to eliminate metal-to-metal contact on tools such as mills and drills, thereby extending tool life under high stress and temperature environments.

Expanding Use in Medical Devices and Healthcare Equipment

The Low Friction Coatings Market supports medical devices where precision and safety are critical. Catheters, surgical tools, and diagnostic instruments require coatings that reduce friction for smooth operation. Biocompatible coatings ensure patient safety while maintaining mechanical performance. It improves handling during minimally invasive procedures, where precision is essential. Healthcare suppliers prioritize materials that reduce risks of damage during use. Growth in medical technology expands the scope of coating applications.

Increasing Demand from Energy, Oil, and Gas Operations

The Low Friction Coatings Market grows with adoption in oil, gas, and renewable energy systems. Pipelines, turbines, and drilling tools depend on coatings to reduce friction under extreme conditions. It supports energy producers seeking efficiency improvements and reduced wear on costly assets. Offshore and subsea applications use specialized coatings that resist corrosion and mechanical stress. Wind and solar equipment also integrate these solutions for longer operational lifespans. Demand rises where performance under harsh environments is essential.

Market Trends

Shift Toward Advanced Coating Materials for Greater Performance and Reliability

The Low Friction Coatings Market experiences a strong push toward advanced materials such as fluoropolymers, molybdenum disulfide, and tungsten disulfide. These compounds deliver higher wear resistance and improved thermal stability compared to conventional coatings. It enables manufacturers to meet demanding performance requirements in aerospace, automotive, and heavy machinery. Research centers and companies invest in developing formulations that balance durability with cost efficiency. Growing expectations for reliability across industries drive adoption of these high-performance materials. The trend strengthens as industries pursue longer equipment lifespans with minimal maintenance.

- For instance, DuPont introduced MOLYKOTE® 3402-C LF Anti-Friction Coating, using molybdenum disulfide (MoS₂) as its solid lubricant. This coating remains effective in temperatures ranging from –200 °C to +315 °C, making it suitable for extreme conditions.

Increasing Focus on Sustainable and Environmentally Compliant Coating Solutions

The Low Friction Coatings Market witnesses demand for eco-friendly options aligned with global environmental policies. Manufacturers design coatings that minimize volatile organic compound content and comply with REACH and RoHS directives. It ensures compliance while reducing risks tied to harmful emissions. Industry leaders highlight solvent-free and water-based solutions to address customer needs. Government incentives and regulatory frameworks accelerate the development of sustainable formulations. This trend shows how environmental responsibility becomes a driver of product innovation.

- For instance, Magnaplate’s 10K Series water-based coating (10K2) contains zero VOCs and withstands temperatures up to 950 °F (510 °C). It offers anti-stick, low friction, and hydrophobic performance without fluoropolymers or PFOAs.

Integration of Coating Technologies with Digital Monitoring Systems

The Low Friction Coatings Market moves toward integration with Industry 4.0 technologies for predictive maintenance. Sensors embedded in machinery monitor friction levels and signal when coating performance declines. It allows real-time tracking of efficiency and equipment wear. Companies reduce unexpected downtime by combining coatings with digital diagnostic tools. This convergence highlights how advanced coatings support smart manufacturing systems. The trend reflects strong interest in performance visibility and operational control.

Expansion of Applications Across Emerging Sectors and Niche Industries

The Low Friction Coatings Market expands beyond traditional sectors into medical devices, renewable energy, and electronics. Surgical tools, wind turbines, and semiconductor equipment increasingly adopt friction-reducing layers for precision and longevity. It supports reliability where failure carries high costs or safety risks. Manufacturers explore specialty coatings tailored to niche industries demanding high-performance surfaces. This broadening of applications diversifies market opportunities across multiple value chains. The trend signals ongoing evolution in how coatings deliver value across industries.

Market Challenges Analysis

High Production Costs and Technical Limitations Restricting Wider Adoption

The Low Friction Coatings Market faces challenges linked to high production and application costs. Specialized raw materials such as fluoropolymers and molybdenum disulfide increase overall expenses. It limits adoption in cost-sensitive industries that prioritize budget-friendly solutions. Application processes demand advanced equipment and skilled labor, raising barriers for smaller manufacturers. Uniform coating thickness and adhesion remain technical hurdles across different substrates. These challenges slow large-scale deployment, particularly in industries with limited capital resources.

Regulatory Pressures and Performance Constraints in Extreme Environments

The Low Friction Coatings Market also contends with stringent regulations on environmental and chemical safety. Compliance with REACH and RoHS rules restricts the use of certain solvents and additives. It forces manufacturers to redesign formulations while maintaining performance standards. Coatings often degrade under extreme heat, high load, or corrosive conditions, limiting effectiveness in oil, gas, and aerospace sectors. Market participants must balance environmental responsibility with technical durability. These limitations create a challenge for consistent global adoption across diverse industries.

Market Opportunities

Expanding Applications in Renewable Energy and Medical Technology

The Low Friction Coatings Market presents strong opportunities in renewable energy and healthcare. Wind turbines and solar tracking systems benefit from coatings that reduce wear under variable loads. It supports longer operational lifespans and improved energy efficiency in clean power assets. In medical technology, catheters, surgical instruments, and diagnostic equipment rely on friction reduction for precision. Biocompatible coatings ensure patient safety while enhancing performance in minimally invasive procedures. Growth in these high-value sectors creates a clear path for new product development.

Rising Demand from Emerging Economies and Industrial Modernization Programs

The Low Friction Coatings Market also benefits from rising industrialization in Asia-Pacific, Latin America, and the Middle East. Infrastructure growth in automotive, aerospace, and manufacturing sectors fuels interest in advanced coating solutions. It enables companies to improve efficiency and extend equipment durability in competitive markets. Public investments in smart factories and industrial upgrades expand opportunities for adoption. Partnerships with local distributors and technology providers help global players capture this demand. These developments highlight strong long-term opportunities for market expansion in emerging economies.

Market Segmentation Analysis:

By Type

The Low Friction Coatings Market divides into molybdenum disulphide, tungsten disulphide, polytetrafluoroethylene (PTFE), and others. Molybdenum disulphide coatings are widely used for reducing wear in heavy-load machinery and automotive systems. Tungsten disulphide coatings deliver extreme resistance under high temperature and pressure conditions, supporting aerospace and defense applications. PTFE coatings remain dominant due to their chemical resistance and low coefficient of friction, making them ideal for industrial and medical uses. It also expands through hybrid formulations that combine polymers with inorganic compounds to enhance durability. The others category includes graphite and advanced fluoropolymer blends, each serving specialized environments.

- For instance, Asahi Glass Company markets Fluon® P-63P PFA—a perfluoropolymer with a Shore D hardness of 60, tensile strength at break of 32 MPa, ultimate tensile strength of 8 MPa at 250 °C, and elongation at break of 600 % at 250 °C, with a dynamic coefficient of friction of 0.20.

By Application

The Low Friction Coatings Market finds strong application in bearings, automotive parts, power transmission items, and more. Bearings represent a major segment where coatings extend service life under continuous motion. Automotive parts such as pistons, gears, and engine valves benefit from reduced drag and improved fuel efficiency. Power transmission items, including chains and couplings, adopt these coatings to improve reliability and reduce wear. It continues to gain traction in electronics, consumer goods, and industrial equipment where friction reduction is essential. Growth in multi-sector applications reinforces the importance of coatings in performance-driven industries.

- For instance, IKV Tribology markets its TRIBOCHAIN chain oils that function continuously at temperatures from 170 °C to 280 °C, preserving chain integrity even under extreme heat.Their TRIBOSTAR ELK 22 grease, engineered for bearings and journals, operates effectively from –50 °C up to +130 °C, offering long-life lubrication under high speed and low torque conditions.

By End-User

The Low Friction Coatings Market serves automotive and transportation, aerospace and defense, healthcare, and other industries. Automotive and transportation remain leading end-users where coatings improve durability, fuel efficiency, and emissions performance. Aerospace and defense sectors adopt coatings for critical components exposed to extreme environments, ensuring safety and precision. Healthcare integrates these solutions into catheters, surgical devices, and diagnostic instruments to ensure safe and smooth operation. It also gains importance in energy, oil and gas, and manufacturing sectors where efficiency and equipment life are critical. End-user diversification broadens the market scope and creates opportunities for tailored coating solutions.

Segments:

Based on Type:

- Molybdenum Disulphide

- Tungsten Disulphide

Based on Application:

- Bearings

- Automotive Parts

Based on End-User:

- Automotive and Transportation

- Aerospace and Defense

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 32% of the Low Friction Coatings Market, supported by advanced industrial sectors and strict regulatory standards. The United States leads adoption through automotive, aerospace, and defense applications that rely on precision-engineered components. Coatings are applied to bearings, engine systems, and critical aerospace parts to improve efficiency and extend lifespans. Canada also contributes with energy and oilfield equipment requiring reliable friction management under extreme operating conditions. Strong research ecosystems and high spending on technology development reinforce the region’s leadership. It maintains steady growth due to continuous upgrades in manufacturing facilities and widespread focus on sustainability compliance.

Europe

Europe holds 28% of the Low Friction Coatings Market, with Germany, France, and the United Kingdom as major contributors. Automotive hubs in Germany and France drive demand for coatings that improve engine efficiency and reduce emissions. Aerospace manufacturers in the UK and France adopt coatings for turbines and flight systems, emphasizing reliability under extreme conditions. Healthcare applications grow as medical device producers integrate biocompatible coatings for surgical and diagnostic tools. It aligns with strict EU regulations such as REACH and RoHS, encouraging sustainable formulations. The presence of established automotive and aerospace OEMs ensures Europe remains a strong contributor to global growth.

Asia-Pacific

Asia-Pacific represents 25% of the Low Friction Coatings Market, driven by industrial expansion in China, Japan, South Korea, and India. China emerges as a major consumer, with rapid growth in automotive manufacturing and electronics production fueling coating adoption. Japan and South Korea focus on aerospace and advanced machinery, integrating coatings to ensure precision and durability. India strengthens its presence through infrastructure and transportation projects, where coatings improve equipment longevity. Healthcare applications also expand across the region due to rising demand for advanced surgical instruments. It stands out for offering cost-competitive manufacturing alongside growing domestic demand, positioning Asia-Pacific as a key growth hub.

Latin America

Latin America captures 8% of the Low Friction Coatings Market, with Brazil and Mexico driving most demand. Automotive assembly plants in Mexico adopt coatings for parts requiring durability and reduced energy loss. Brazil’s oil and gas sector relies on coatings for pipelines and drilling equipment to manage high mechanical stress. The region also shows rising interest in renewable energy projects, where coatings support longer service life of turbines and solar systems. Healthcare adoption remains gradual but shows promise with investments in medical equipment manufacturing. It continues to strengthen its market role through industrial modernization and regional investments.

Middle East & Africa

The Middle East and Africa account for 7% of the Low Friction Coatings Market, supported mainly by oil, gas, and energy projects. Countries such as Saudi Arabia, the UAE, and South Africa invest in equipment reliability to sustain large-scale industrial operations. Coatings are applied to pipelines, drilling rigs, and heavy machinery exposed to extreme environments. Aerospace demand grows with regional airlines upgrading fleets and integrating advanced coating technologies. Healthcare adoption remains limited but gradually increases with medical infrastructure investments. It positions the region as an emerging market where energy and industrial projects remain the primary growth engines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Poeton Industries Ltd

- ASV Multichemie Private Limited

- Du Pont

- Magnaplate

- Asahi Glass Company

- IKV Tribology

- Endura Coating

- Ellsworth Adhesive

- Bechem Lubrication Technology

- AFT Fluorotech

Competitive Analysis

The Low Friction Coatings Market include Poeton Industries Ltd, ASV Multichemie Private Limited, Du Pont, Magnaplate, Asahi Glass Company, IKV Tribology, Endura Coating, Ellsworth Adhesive, Bechem Lubrication Technology, and AFT Fluorotech. The Low Friction Coatings Market remains highly competitive, with companies investing in advanced formulations and new material technologies to secure market share. Manufacturers focus on enhancing wear resistance, thermal stability, and chemical durability while keeping production costs manageable. Global firms expand their portfolios with PTFE, molybdenum disulphide, and tungsten disulphide coatings tailored for automotive, aerospace, healthcare, and energy sectors. Regional companies strengthen competitiveness by offering localized solutions that meet strict environmental and regulatory requirements. Strategic collaborations, research partnerships, and technology licensing agreements drive innovation across applications from bearings and power transmission to medical devices and renewable energy systems. The competitive landscape emphasizes sustainability, customization, and performance reliability as key differentiators shaping long-term growth.

Recent Developments

- In May 2024, DuPont introduced MOLYKOTE D-6804 and MOLYKOTE D-6818 low-friction coatings engineered for wear resistance and alternative fuel compatibility.

- In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT from M&I Materials Ltd. The products of the latter two will be produced and distributed as part of Shell’s Lubricants portfolio. The acquisition will help Shell to strengthen its position in Transformer Oils, which finds use in offshore wind parks, utility companies, and power distribution.

- In November 2023, TotalEnergies Lubrifiants accelerated the inclusion of recycled plastics (50% PCR high-density polyethylene) in its lubricant’s bottles, following a pilot project launched in 2021 called Quartz Xtra bottles. This aims at contributing to a circular economy and in decline of usage of virgin plastic.

- In April 2023, Afton Chemical launched its “Dicyclopentadiene (DCPD) Friction Modifier” with a focus on enhancing fuel efficiency and providing enhanced wear protection for automotive engines.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for advanced automotive and aerospace components.

- Coatings will gain importance in renewable energy equipment to enhance durability and efficiency.

- Healthcare adoption will increase with growing use in surgical devices and diagnostic tools.

- Sustainable and eco-friendly coating formulations will dominate new product development pipelines.

- Integration with digital monitoring systems will support predictive maintenance in industrial machinery.

- Demand from emerging economies will strengthen due to industrialization and infrastructure growth.

- Research will focus on hybrid coatings that combine polymers with inorganic compounds.

- Miniaturized electronics and wearable devices will create fresh opportunities for specialized coatings.

- Defense and space programs will require coatings designed for extreme environments and precision.

- Competitive strategies will emphasize innovation, regulatory compliance, and customized application-specific solutions.