Market Overview

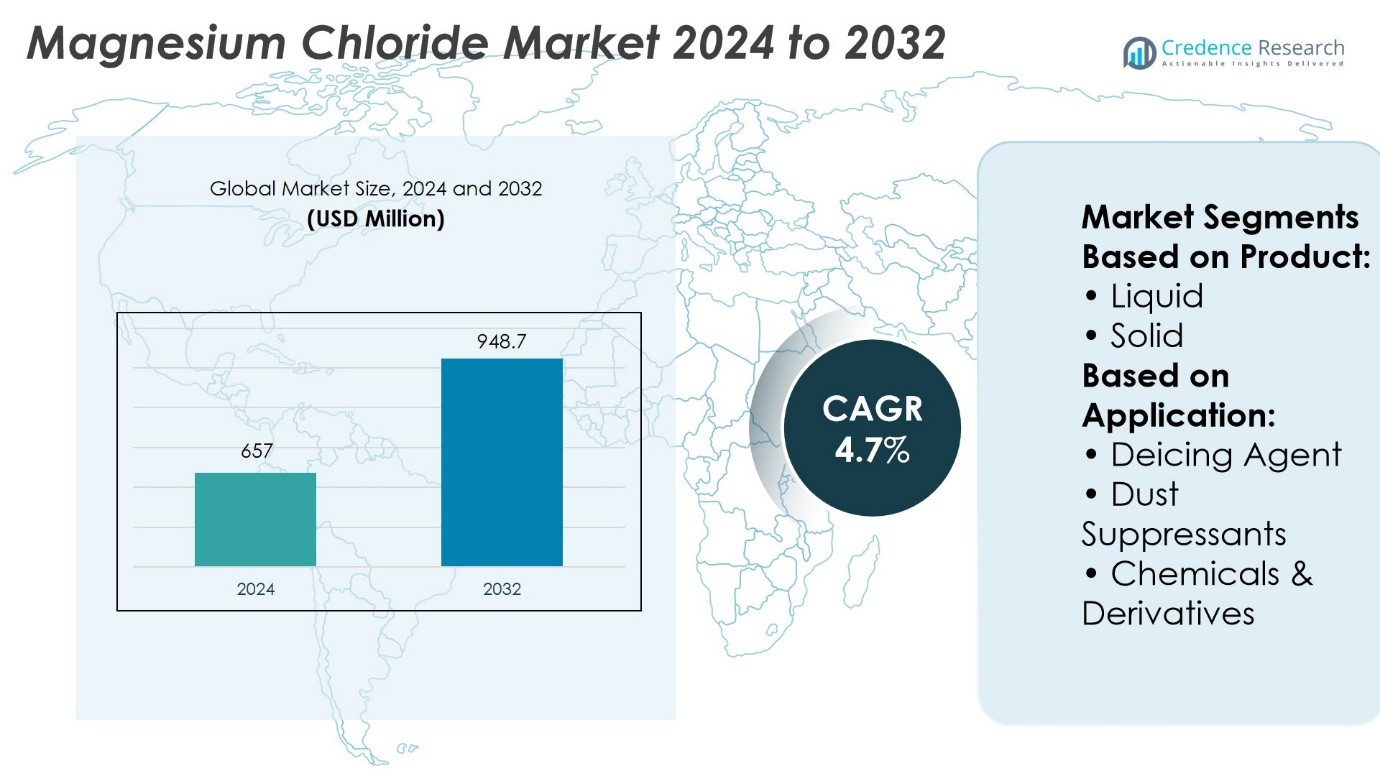

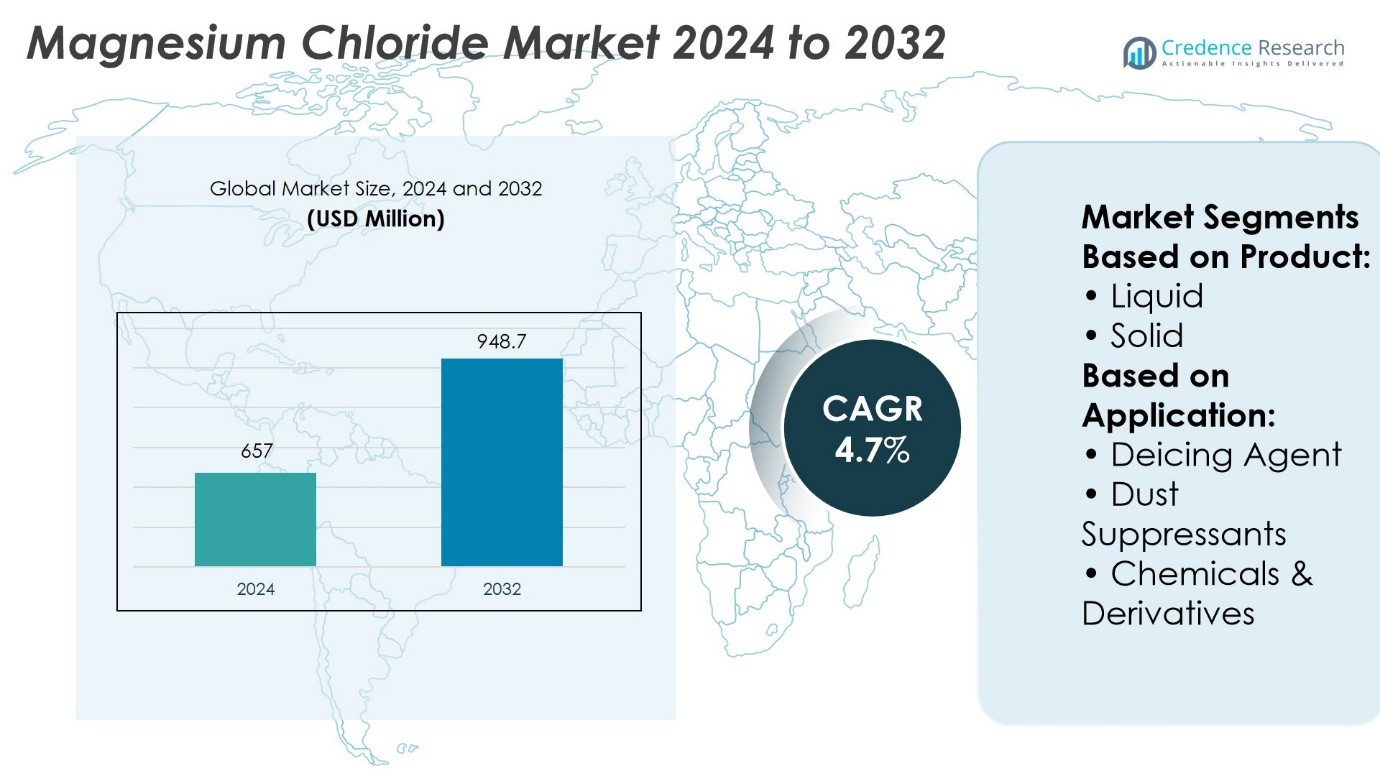

Magnesium Chloride Market size was valued at USD 657 million in 2024 and is anticipated to reach USD 948.7 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnesium Chloride Market Size 2024 |

USD 657 Million |

| Magnesium Chloride Market, CAGR |

4.7% |

| Magnesium Chloride Market Size 2032 |

USD 948.7 Million |

The Magnesium Chloride Market grows through strong demand in de-icing, dust suppression, construction, agriculture, and pharmaceuticals, driven by its efficiency, cost-effectiveness, and versatility. It supports road safety in snow-prone regions, enhances concrete durability, improves soil fertility, and addresses mineral deficiencies in healthcare. Industrial sectors adopt it for chemical derivatives, textiles, and pulp processing, reinforcing its multi-sector relevance. Key trends highlight a shift toward eco-friendly road treatment solutions, rising integration in nutraceuticals, and expanding adoption in sustainable farming practices. It benefits from technological improvements, regulatory support for greener alternatives, and steady demand from both developed and emerging markets.

The Magnesium Chloride Market shows strong geographical presence, with Asia Pacific leading through large-scale production and cost advantages, North America and Europe maintaining demand for de-icing and industrial uses, and Latin America along with the Middle East & Africa emerging with infrastructure-driven growth. Key players include Compass Minerals International, K+S Aktiengesellschaft, Israel Chemicals Ltd., Shandong Haihua Group, Huitai Investment Group, Intrepid Potash, Tianjin Changlu Haiging Group, DEUSA International GmbH, Nedmag B.V., and Nikomag OJSC, all competing on efficiency, quality, and global reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Magnesium Chloride Market size was valued at USD 657 million in 2024 and is projected to reach USD 948.7 million by 2032, at a CAGR of 4.7%.

- Demand is driven by applications in de-icing, dust suppression, construction, agriculture, and pharmaceuticals due to efficiency and cost-effectiveness.

- Key trends include adoption of eco-friendly road treatment solutions, integration in nutraceuticals, and expansion in sustainable farming practices.

- Competition is shaped by global and regional players focusing on production capacity, product quality, and diversified applications.

- Market restraints include environmental concerns related to soil and water contamination, as well as volatility in raw material supply.

- Asia Pacific leads with large-scale production and exports, North America and Europe maintain strong demand, while Latin America and Middle East & Africa expand with infrastructure growth.

- Leading companies include Compass Minerals International, K+S Aktiengesellschaft, Israel Chemicals Ltd., Shandong Haihua Group, and other regional producers.

Market Drivers

Expanding Utilization in Construction and Infrastructure Development

The Magnesium Chloride Market strengthens its position through rising adoption in construction and infrastructure projects. It improves concrete durability, reduces setting time, and enhances dust control on unpaved roads. Municipalities and contractors prefer it for stabilizing road surfaces and extending pavement life. Its ability to reduce maintenance costs makes it a preferred choice in large-scale projects. Infrastructure growth in emerging economies supports consistent demand. It plays a vital role in ensuring structural reliability under diverse environmental conditions.

- For instance, Compass Minerals supplied over 180,000 tons of magnesium chloride in 2023 for dust control and road stabilization projects across North America, including large-scale applications in Colorado and Utah, where it was used to treat more than 12,000 miles of unpaved roads.

Increasing Demand in Pharmaceuticals and Healthcare Applications

The Magnesium Chloride Market gains momentum from its growing use in pharmaceuticals and nutraceuticals. It functions as a key mineral supplement that supports cardiovascular health, bone density, and nerve function. Manufacturers incorporate it into oral and injectable formulations for addressing magnesium deficiency. Healthcare providers emphasize its clinical benefits, which strengthens adoption in preventive healthcare. Rising consumer awareness of mineral supplements accelerates its market relevance. It ensures a reliable source of essential nutrition across diverse healthcare segments.

- For instance, Nedmag B.V. produces of high-purity magnesium chloride annually, of which more than 12 million kilograms are directed to pharmaceutical and nutraceutical applications across Europe, ensuring consistent supply for clinical-grade formulations.

Expanding Role in Agriculture for Soil Enrichment and Crop Yield Improvement

The Magnesium Chloride Market advances through its application in modern agriculture. Farmers use it to replenish magnesium levels in depleted soils and improve nutrient absorption. Its role in promoting chlorophyll formation supports higher crop yields in intensive farming regions. Governments encourage adoption through soil improvement initiatives that enhance food security. Agrochemical companies integrate it into balanced fertilizer formulations to meet diverse crop needs. It aligns with sustainable farming practices that prioritize efficiency and long-term productivity.

Rising Industrial Adoption Across Chemicals, Textiles, and Pulp Processing

The Magnesium Chloride Market grows through its wide-ranging industrial applications. It serves as a feedstock in producing magnesium metal, catalysts, and flame-retardant chemicals. Textile manufacturers apply it during dyeing processes to improve fabric absorption and color consistency. Pulp and paper industries value it for water treatment and processing efficiency. Its versatility supports innovation across chemical formulations and industrial operations. It sustains strong demand by addressing performance and cost-effectiveness across multiple sectors.

Market Trends

Rising Preference for Eco-Friendly De-icing and Dust Control Solutions

The Magnesium Chloride Market reflects a clear trend toward sustainable de-icing and dust suppression practices. Municipalities favor it over traditional salts due to its lower environmental footprint and reduced corrosive impact. Its effectiveness at lower temperatures strengthens its role in winter road maintenance programs. Contractors adopt it in dust control for unpaved roads and construction sites, reducing air quality issues. Transportation agencies expand its use in regions with severe winter conditions. It continues to gain traction where environmental standards shape procurement decisions.

- For instance, Shandong Haihua Group Co., Ltd. reported an annual output capacity of 1.2 million tons of magnesium chloride, with over 210 million kilograms supplied in 2023 specifically for eco-friendly de-icing and dust suppression projects across northern China and export markets in Europe.

Growing Integration into Health and Wellness Products

The Magnesium Chloride Market shows increasing presence in nutraceuticals and healthcare formulations. Consumers recognize its role in supporting cardiovascular health, bone strength, and muscle recovery. Manufacturers expand product lines with tablets, capsules, and liquid supplements containing the mineral. Its clinical acceptance as a safe and effective magnesium source enhances adoption in preventive healthcare. Rising awareness of mineral deficiencies drives consistent demand in developed and emerging markets. It strengthens its position within the expanding wellness industry.

- For instance, Intrepid Potash, Inc. reported production of 369 million kilograms of magnesium chloride in 2023, with more than 25 million kilograms supplied to U.S. nutraceutical companies for use in dietary supplements, tablets, and electrolyte formulations targeting mineral deficiency prevention.

Expanding Use in Sustainable Agriculture Practices

The Magnesium Chloride Market advances with its integration into sustainable agriculture. Farmers use it to restore soil balance and boost crop productivity in magnesium-deficient regions. It supports chlorophyll development, which improves photosynthesis efficiency and yield quality. Agrochemical companies formulate blends containing magnesium chloride for large-scale farming operations. Governments promote soil enrichment programs that highlight its benefits for food security. It aligns with global initiatives that encourage efficient use of fertilizers and eco-friendly farming inputs.

Increasing Industrial Application in Chemicals and Manufacturing

The Magnesium Chloride Market evolves with rising industrial use across chemicals, textiles, and pulp processing. Chemical manufacturers employ it for producing catalysts, magnesium metal, and flame-retardant materials. Textile sectors utilize it for enhancing dye absorption and fabric finish consistency. Paper and pulp industries adopt it for water treatment and process optimization. Its cost-effectiveness and multifunctional properties support its broad industrial relevance. It continues to expand across supply chains that require reliable, scalable raw materials.

Market Challenges Analysis

Concerns Over Environmental Impact and Corrosive Nature

The Magnesium Chloride Market faces challenges linked to its environmental and material effects. Road authorities raise concerns over soil and water contamination when used extensively for de-icing. It increases chloride concentration in groundwater, which threatens aquatic ecosystems and agricultural land quality. Its corrosive impact on vehicles, bridges, and infrastructure creates additional maintenance costs. These issues lead municipalities and industries to evaluate alternative compounds with lower environmental risk. Regulatory agencies tighten guidelines for road treatment chemicals, which pressures suppliers to invest in safer formulations. It limits large-scale adoption in regions with strict ecological regulations.

Volatility in Raw Material Supply and Rising Production Costs

The Magnesium Chloride Market encounters supply chain constraints that affect pricing and availability. Extraction of raw materials from brine and natural deposits depends heavily on weather and regional mining capacity. Disruptions in supply create cost fluctuations that impact downstream industries such as chemicals, textiles, and construction. Energy-intensive production processes further elevate manufacturing expenses. It forces companies to balance cost efficiency with product quality while maintaining competitiveness. Import-dependent markets remain vulnerable to geopolitical risks and logistical bottlenecks. It underscores the need for diversified sourcing strategies and technological improvements in production efficiency.

Market Opportunities

Expansion Potential in Sustainable Infrastructure and Road Safety Solutions

The Magnesium Chloride Market presents significant opportunities in infrastructure and road maintenance sectors. It offers an effective alternative for de-icing, delivering safer winter road conditions while meeting stricter environmental standards. Municipalities explore its use in dust control for unpaved roads, supporting cleaner air in urban and rural regions. Construction industries adopt it for concrete durability enhancement, which reduces long-term maintenance costs. Rising investment in sustainable infrastructure creates favorable conditions for expanded usage. It positions itself as a versatile solution for governments and private contractors seeking eco-friendly and efficient materials.

Growing Scope in Healthcare, Agriculture, and Industrial Applications

The Magnesium Chloride Market gains opportunities from its expanding role in healthcare, agriculture, and industrial processes. Demand for mineral supplements in preventive healthcare continues to rise, where it supports cardiovascular health and bone strength. Farmers adopt it to improve soil balance, increase crop yields, and meet global food security goals. Industrial sectors explore its application in chemical production, textile dyeing, and pulp processing, where it ensures cost-effective performance. It benefits from technological innovation that enhances production efficiency and widens application areas. Increasing cross-industry adoption secures growth potential across diverse global markets.

Market Segmentation Analysis:

By Product

The Magnesium Chloride Market divides into liquid and solid forms, each serving distinct end-user requirements. Liquid magnesium chloride finds widespread use in de-icing and dust suppression due to its easy application and rapid effectiveness on road surfaces. It ensures consistent performance in cold climates where safety and road maintenance are priorities. Municipalities and construction firms prefer the liquid form for large-scale spraying and treatment operations. Solid magnesium chloride, available in flakes or pellets, offers advantages in storage stability and transport efficiency. It supports longer shelf life and is suitable for blending with other materials in industrial processes. The demand for both forms grows as industries balance operational convenience with logistical efficiency.

- For instance, K+S Aktiengesellschaft produced 520 million kilograms of magnesium chloride in 2023, with approximately 185 million kilograms supplied as liquid solutions for European municipalities.

By Application

The Magnesium Chloride Market demonstrates wide application across multiple sectors, reflecting its versatility and functional benefits. It dominates in de-icing due to its ability to perform effectively at lower temperatures, ensuring road safety in snow-prone regions. Dust suppression represents another critical use, where it reduces airborne particles in mining, construction, and rural road environments. In chemical industries, it serves as a precursor for magnesium metal, catalysts, and flame-retardant compounds, supporting diverse industrial supply chains. Building material applications highlight its role in enhancing concrete durability and stabilizing road foundations. Pharmaceutical companies adopt it for mineral supplements that address cardiovascular and bone health, while food and feed industries integrate it as a firming agent and mineral additive. It sustains demand across these applications by delivering efficiency, safety, and cost-effectiveness in both industrial and consumer markets.

- For instance, Nikomag OJSC produced 220 million kilograms of magnesium chloride in 2023, allocating 75 million kilograms for chemical synthesis and flame-retardant production.

Segments:

Based on Product:

Based on Application:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America secures about 25% of the Magnesium Chloride Market, with the United States and Canada representing major demand centers. The region relies heavily on magnesium chloride for de-icing roads during long and severe winters, particularly in northern states and provinces. Transportation agencies and municipalities favor it for efficiency at lower temperatures and reduced corrosive effects compared to traditional salts. The market also gains support from construction and pharmaceutical applications, where it serves as a concrete additive and a key mineral supplement. Companies such as Compass Minerals maintain strong production and supply capacity, reinforcing regional stability. It benefits from advanced infrastructure, reliable distribution networks, and regulatory frameworks that encourage safer, environmentally responsible materials.

Europe

Europe accounts for roughly 20% of the global Magnesium Chloride Market, shaped by both climate and regulatory factors. Cold-weather countries adopt it extensively for road de-icing, while southern nations focus more on construction and industrial uses. European regulations encourage adoption of less corrosive and environmentally safer road maintenance products, which favors magnesium chloride over traditional alternatives. Industrial sectors, including chemicals and textiles, also integrate it for specialized processes. Producers across Germany, France, and Eastern Europe maintain a strong supply presence, balancing domestic use with exports. It secures its role by aligning with regional priorities in sustainability and compliance. The market in Europe benefits from consistent demand but operates under tighter environmental oversight compared to other regions.

Asia Pacific

Asia Pacific leads the Magnesium Chloride Market with approximately 40% share, supported by China, India, and other emerging economies. The region benefits from abundant raw material availability and large-scale industrial activity. Demand from construction, textiles, chemicals, and agriculture strengthens its leadership position. China alone accounts for more than 30 % of global magnesium chloride production, ensuring strong export capacity. Rapid urbanization, infrastructure growth, and industrial expansion in Asia sustain its momentum. It also reflects rising use in agriculture for soil conditioning and in health supplements for preventive healthcare. The region’s cost-effective manufacturing base reinforces its global dominance.

Latin America

Latin America contributes around 8% of the Magnesium Chloride Market, with Brazil and Mexico driving regional demand. The compound finds use in construction, road stabilization, and dust suppression, particularly in mining areas. Moderate adoption in food and pharmaceutical applications further diversifies the market scope. Economic challenges and uneven industrial growth slow its pace, but infrastructure development projects create steady opportunities. Agricultural applications show promise, as farmers integrate magnesium chloride into soil enrichment practices. It benefits from a rising focus on industrial modernization and rural infrastructure improvements. The region remains an emerging but strategically important growth area.

Middle East & Africa

The Middle East & Africa holds close to 7% of the global Magnesium Chloride Market, with applications concentrated in industrial and construction sectors. Oil-producing nations employ it in drilling fluids, brine treatment, and water conditioning systems. Urbanization and infrastructure development across Gulf states increase its use in building materials and road stabilization. African economies adopt it primarily for dust suppression in mining and rural road projects. Regulatory differences and limited industrial bases constrain faster growth, yet demand remains steady in key industries. It demonstrates potential as industrial diversification and infrastructure investments expand across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Magnesium Chloride Market features includes Compass Minerals International, Inc., K+S Aktiengesellschaft, Israel Chemicals Ltd., Shandong Haihua Group Co., Ltd., Huitai Investment Group Co., Ltd., Interpid Potash, Inc., Tianjin Changlu Haiging Group Co., Ltd., DEUSA International GmbH, Nedmag B.V., and Nikomag OJSC. The Magnesium Chloride Market demonstrates a competitive environment defined by capacity expansion, cost efficiency, and diversification of applications. Companies strengthen their positions by focusing on reliable raw material sourcing, advanced processing technologies, and broad distribution networks. Competition centers on meeting demand for de-icing, dust suppression, construction additives, pharmaceuticals, and agricultural uses, where product quality and performance standards remain critical. Global suppliers emphasize environmentally responsible solutions to align with regulatory expectations, particularly in North America and Europe, while producers in Asia leverage cost advantages and abundant resource availability. Strategic partnerships, continuous product development, and regional expansion remain central to sustaining competitiveness in this evolving market.

Recent Developments

- In May 2024, as a technology that has 60% lower CO2 emissions than conventional manufacturing processes, this process recycles magnesium oxide (MgO) from brown coal fly ash, which is a waste material. Apart from reducing the effect on the environment, the process converts almost all the waste into useful products such as agricultural lime and other cementitious materials.

- In 2024, There is an ongoing boom in the construction sector that is a result of increased demand for residential, as well as, commercial infrastructure. Also, urbanization is likely to play a major role in helping the segment grow.

- In December 2023, the European market experiences a notable downturn, deviating from its prior upward trend. This shift reflects a saturation in customer demand, prompting cautious procurement strategies and strategic short positions by buyers. Substantial end-user inventories, softened energy prices, and reduced overseas demand during the holiday season contribute to declining prices.

- In November 2023, the company’s Ogden operation currently produces three essential mineral salts sulfate of potash, sodium chloride and magnesium chloride.

Market Concentration & Characteristics

The Magnesium Chloride Market reflects a moderately concentrated structure, with a mix of global leaders and regional producers competing across diversified applications. It is characterized by high demand in de-icing, dust suppression, construction, pharmaceuticals, and agriculture, which ensures steady consumption across developed and emerging economies. Large-scale manufacturers dominate through vertical integration, strong raw material access, and established supply networks, while regional firms focus on cost competitiveness and localized distribution. It benefits from the availability of natural brine and mineral deposits, particularly in Asia Pacific, which supports bulk production and export capacity. The market demonstrates price sensitivity due to raw material volatility and energy-intensive production processes, compelling companies to invest in operational efficiency and technological improvements. It also emphasizes compliance with environmental regulations, especially in North America and Europe, where sustainability influences adoption in infrastructure and industrial projects. The balance between global supply capabilities and regional specialization defines its competitive characteristics.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase in cold regions where de-icing efficiency and environmental compliance drive adoption.

- Agriculture will expand usage as farmers seek soil enrichment and higher crop yields.

- Pharmaceutical and nutraceutical sectors will strengthen demand for mineral supplements.

- Construction industries will adopt it further to improve concrete durability and road stabilization.

- Industrial applications will widen with chemical, textile, and pulp processing sectors integrating it.

- Asia Pacific will maintain leadership supported by large-scale production and export capacity.

- North America and Europe will focus on sustainable and eco-friendly formulations.

- Supply chain optimization and energy-efficient production will remain priorities for manufacturers.

- Regulatory pressures will encourage development of less corrosive and environmentally safer grades.

- Emerging economies in Latin America and Africa will create growth opportunities through infrastructure and industrial expansion.