Market Overview

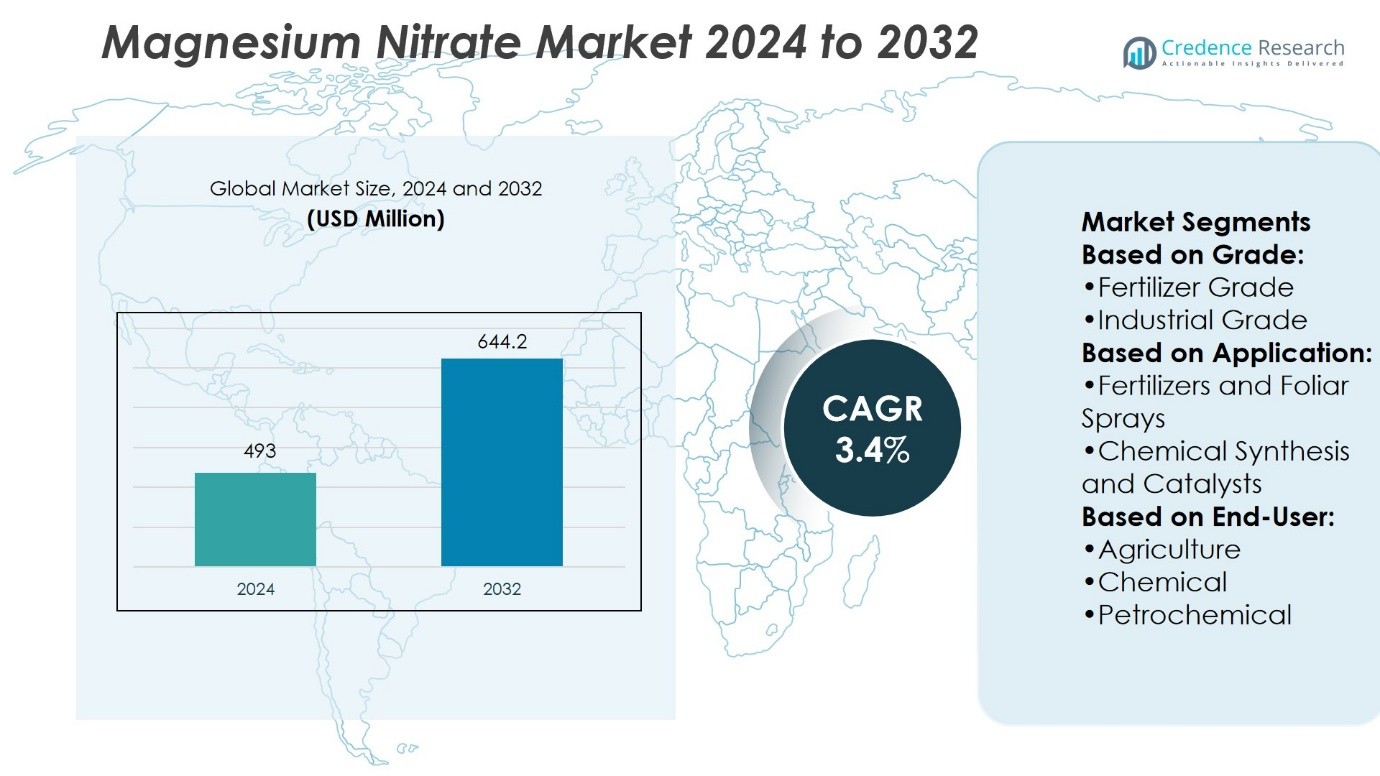

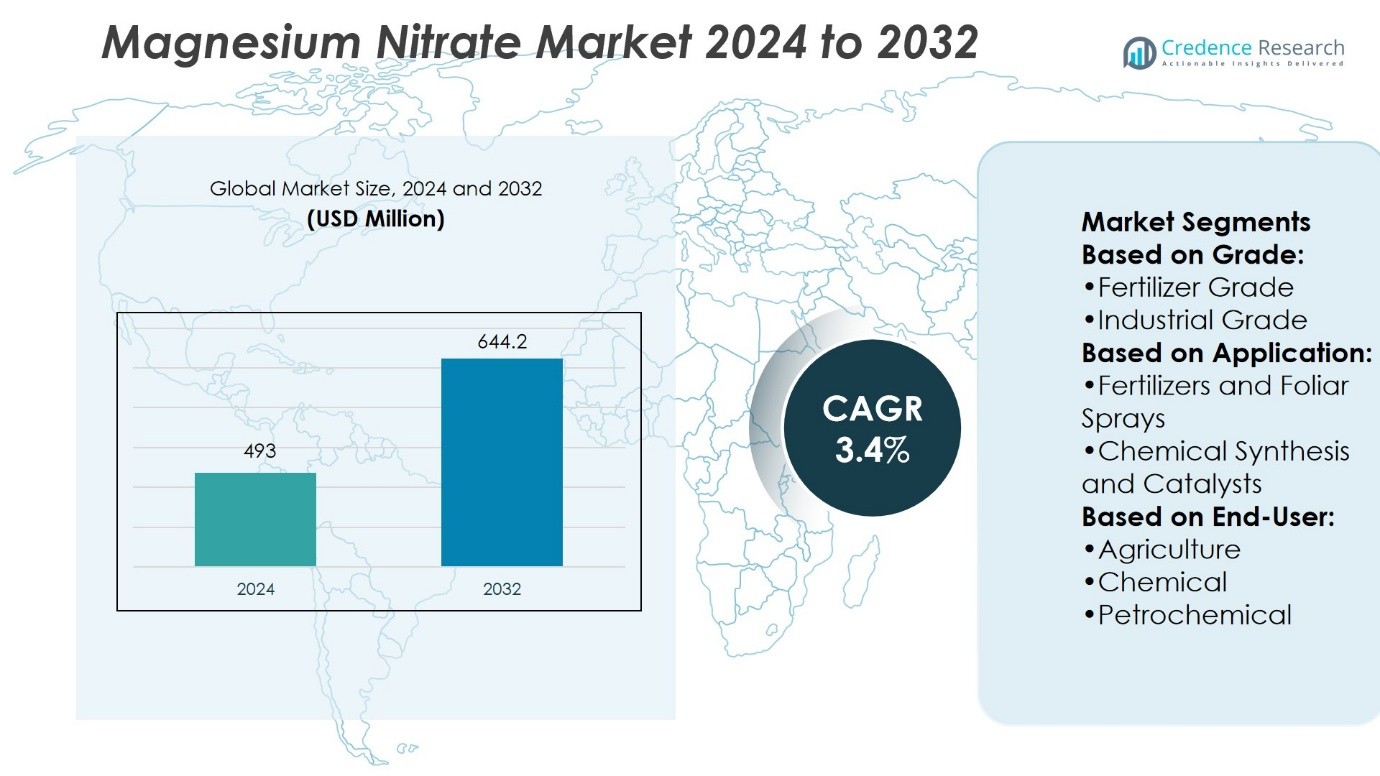

Magnesium Nitrate Market size was valued at USD 493 million in 2024 and is anticipated to reach USD 644.2 million by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnesium Nitrate Market Size 2024 |

USD 493 Million |

| Magnesium Nitrate Market, CAGR |

3.4% |

| Magnesium Nitrate Market Size 2032 |

USD 644.2 Million |

The Magnesium Nitrate Market grows through strong drivers such as rising demand for high-efficiency fertilizers, expanding use in chemical synthesis, and increasing applications in specialty industries. It gains traction from the need for improved agricultural productivity and the role of magnesium as a critical nutrient for soil health. It also benefits from steady adoption in catalyst formulations and laboratory chemicals. Key trends include investments in production technologies, development of high-purity grades, and focus on sustainable, eco-friendly solutions. The market reflects a balanced mix of agricultural demand and industrial innovation, positioning it for stable, long-term growth across diverse sectors.

The Magnesium Nitrate Market shows significant geographical presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to strong agricultural demand and industrial expansion. North America and Europe maintain steady growth through advanced chemical and fertilizer applications, while Latin America and MEA offer emerging opportunities. Key players such as Merck KGaA, Thermo Fisher Scientific, Avantor Performance Materials, Haifa Mexico, Yara International, and American Elements shape competition through global reach, product innovation, and strong distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Magnesium Nitrate Market size was valued at USD 493 million in 2024 and is anticipated to reach USD 644.2 million by 2032, at a CAGR of 3.4% during the forecast period.

- Rising demand for high-efficiency fertilizers and the role of magnesium in improving soil health drive consistent market growth.

- Expanding use in chemical synthesis, catalyst formulations, and laboratory applications strengthens industrial demand.

- Key trends include investments in production technologies, development of high-purity grades, and adoption of eco-friendly solutions.

- Competition remains moderate, with global players focusing on product innovation, regulatory compliance, and supply chain strength.

- Limited raw material availability and fluctuating production costs act as restraints for smaller and regional suppliers.

- Asia-Pacific leads due to strong agricultural demand and industrial expansion, while North America and Europe grow steadily; Latin America and MEA present emerging opportunities supported by rising fertilizer use.

Market Drivers

Rising Demand from Fertilizer Applications and Agricultural Productivity Needs

The Magnesium Nitrate Market advances with growing fertilizer use to enhance crop yield and soil nutrition. It supplies magnesium and nitrogen in a highly soluble form, making it a preferred input for horticulture and specialty crops. Farmers adopt it to address magnesium deficiencies that directly impact photosynthesis and chlorophyll formation. It also supports controlled irrigation systems where solubility is essential. Expanding greenhouse cultivation increases the requirement for efficient nutrient solutions. The agricultural sector strengthens demand by prioritizing balanced fertilizers that improve both yield and crop quality.

- For instance, Haifa Chemicals reported that its magnesium nitrate-based product line supported application in over 1.2 million hectares of specialty crops in 2022, with trials showing a 15% increase in tomato yield per hectare when compared to conventional fertilizers.

Expanding Use in Specialty Chemicals and Industrial Applications

The market gains momentum from industrial applications where magnesium nitrate serves as a raw material and process aid. It finds use in specialty chemicals for catalyst preparation, explosives, and heat storage materials. It supports large-scale production processes that require oxidizing properties. Demand grows in wastewater treatment where it helps in odor control and denitrification. It also contributes to the development of advanced ceramics and coatings. The industrial versatility of magnesium nitrate secures its position in multiple value chains.

- For instance, Shandong Fortune Chemical embarked on an expansion project to increase its annual intermediate magnesium nitrate hexahydrate production to 56.0 million kilograms scaling up from its original capacity thus reinforcing global supply capabilities.

Role in Environmental Management and Sustainable Practices

The Magnesium Nitrate Market benefits from its contribution to environmental applications. It enables efficient biological denitrification in municipal wastewater plants by serving as a nitrogen source for microorganisms. It reduces greenhouse gas emissions by replacing less efficient chemical alternatives. It plays a role in odor management for large-scale livestock operations. Increasing environmental regulations drive wider adoption in public utilities. The shift toward sustainability reinforces its use in eco-friendly treatment solutions.

Advancements in Manufacturing Processes and Global Supply Expansion

The market expands through innovations in production technologies and distribution networks. Manufacturers invest in scaling facilities to meet rising demand across agriculture and industry. It achieves cost efficiency by integrating optimized synthesis methods and automated quality control systems. Strategic investments in logistics improve availability in emerging economies. It also benefits from collaborations that secure raw material access and expand export capacity. Growing emphasis on global trade enhances competitiveness and reliability of supply.

Market Trends

Growing Adoption of Water-Soluble Fertilizers in Precision Agriculture

The Magnesium Nitrate Market reflects a strong trend toward water-soluble fertilizers tailored for precision agriculture. Farmers prefer products that dissolve completely in irrigation systems and deliver balanced nutrition. It supports fertigation methods that enhance nutrient uptake efficiency. Rising focus on high-value crops such as fruits, vegetables, and floriculture increases demand for advanced nutrient blends. Controlled application reduces waste and improves soil health. The trend aligns with global agricultural modernization and growing awareness of crop-specific nutrition.

- For instance, OCP Group’s soluble fertilizer operations supply approximately 8.8 million metric tonnes per year of water-soluble fertilizer—including magnesium nitrate formulations—specifically engineered for high-value, irrigated cropping systems.

Rising Utilization in Wastewater Treatment and Environmental Solutions

The market demonstrates expanding use of magnesium nitrate in wastewater treatment facilities. It acts as a denitrification agent and odor control solution in municipal and industrial plants. It provides a safe and efficient alternative to other nitrogen sources with higher risks. The ability to improve water quality supports its adoption in large-scale environmental projects. Public utilities invest in sustainable methods that meet stricter discharge regulations. The trend reinforces its role in eco-friendly water management practices.

- For instance, the Council for Scientific and Industrial Research (CSIR) in South Africa deployed magnesium nitrate in their fluidized bed reactor system treating acid mine drainage, processing approximately 3.2 million liters per day of wastewater in pilot-scale operations.

Expanding Integration into Specialty Chemical Manufacturing

The Magnesium Nitrate Market shows increasing use in specialty chemical production. It serves as a precursor for catalysts, explosives, and advanced ceramics. Growing demand for high-performance materials enhances its application scope. It supports the development of heat storage solutions used in energy systems. Industrial producers value its oxidizing properties that enable stable chemical processes. The trend highlights diversification of end uses beyond traditional agriculture.

Advancements in Production Technologies and Global Trade Networks

The market experiences steady progress in manufacturing processes and supply chain efficiency. Producers implement automated systems that improve purity levels and consistency. It benefits from investments in scalable production plants across Asia and Europe. Supply chain improvements reduce lead times and strengthen market reliability. Export-driven growth creates opportunities in regions with limited domestic manufacturing. The trend underscores the importance of innovation and international trade in sustaining competitive advantage.

Market Challenges Analysis

Supply Chain Volatility and Dependence on Raw Material Availability

The Magnesium Nitrate Market faces challenges linked to raw material access and global supply chain disruptions. It relies on stable production of nitric acid and magnesium compounds, which are vulnerable to fluctuations in energy costs and regional availability. Producers encounter constraints when geopolitical tensions or trade restrictions disrupt imports of essential inputs. Rising transportation costs further strain margins and impact delivery timelines. Limited domestic manufacturing capacity in several regions heightens dependency on external suppliers. These factors create uncertainty in long-term pricing and hinder consistent supply security.

Safety Regulations and Environmental Compliance Requirements

The market also navigates stringent safety and environmental regulations that influence production and distribution practices. Magnesium nitrate’s oxidizing properties demand strict handling, storage, and transportation protocols. Compliance with hazardous material guidelines increases operational costs for producers and distributors. Environmental policies that limit nitrate use in agriculture and wastewater treatment add regulatory pressure. It forces companies to invest in advanced monitoring systems and safer product formulations. These requirements slow market expansion in regions with tighter chemical management frameworks.

Market Opportunities

Expanding Role in High-Value Agriculture and Specialty Crop Nutrition

The Magnesium Nitrate Market holds opportunities in advanced agricultural practices that prioritize crop quality and resource efficiency. It delivers dual nutrients essential for photosynthesis, making it highly suitable for fruits, vegetables, and floriculture where quality standards are strict. Demand rises from controlled-environment farming systems such as hydroponics and greenhouses. It provides reliable solubility that supports precision fertigation and reduces nutrient loss. Growing investment in high-value crops creates room for tailored fertilizer solutions. The market benefits from rising focus on sustainable farming methods and improved productivity in both developed and emerging regions.

Increasing Adoption in Environmental Management and Industrial Innovation

The market also presents opportunities through its role in environmental and industrial applications. It strengthens wastewater treatment processes where denitrification and odor control are critical. Expansion of municipal infrastructure projects creates demand for cost-effective nitrogen sources. It also supports growth in specialty chemicals and advanced material sectors that rely on magnesium nitrate as a precursor. Development of energy storage and heat-transfer materials further widens its industrial scope. These applications open new growth channels and position the market as a versatile solution provider across multiple industries.

Market Segmentation Analysis:

By Grade

The Magnesium Nitrate Market divides into fertilizer grade, industrial grade, and other specialty forms. Fertilizer grade commands significant demand due to its dual nutrient contribution of magnesium and nitrogen, supporting plant growth and photosynthetic efficiency. It is widely applied in high-value crops where nutrient balance directly impacts yield quality. Industrial grade serves chemical, petrochemical, and specialty applications where oxidizing properties are essential. Producers expand manufacturing capabilities to ensure consistency in purity levels required by diverse industries. The variety of grades secures the compound’s relevance across agriculture and industrial processes.

- For instance, a major Chinese chemical producer expanded its fertilizer-grade magnesium nitrate production capacity to produce 0.56 million metric tonnes per year of the intermediate magnesium nitrate hexahydrate used in water-soluble fertilizer blends.

By Application

Applications extend across fertilizers and foliar sprays, chemical synthesis, catalysts, and other industrial uses. Fertilizers and foliar sprays dominate due to broad adoption in horticulture and field crops. Magnesium nitrate’s water solubility enables efficient fertigation and precision agriculture practices. In chemical synthesis, it functions as a precursor for catalysts and explosives, securing a role in specialized manufacturing. Catalyst applications drive value in environmental technologies and energy processes. The wide application spectrum highlights its adaptability to both agricultural and industrial needs.’

- For instance, Van Iperen’s horticultural-grade magnesium nitrate is used in fertigation solutions prepared at a concentration of 25 kg per 1,000 liters—translating to 1,000 liters of stock solution.

By End-User

End-users include agriculture, chemical, petrochemical, and allied industries. Agriculture remains a leading consumer as demand grows for nutrient-rich fertilizers to improve soil productivity and crop resilience. The chemical sector employs magnesium nitrate in specialty processes, including advanced ceramics and coating formulations. The petrochemical industry values it for heat-transfer and energy storage materials that support innovation in energy systems. Smaller end-user segments explore niche applications in water treatment and odor control. The spread across multiple sectors reinforces the compound’s role in driving operational efficiency and sustainable solutions.

Segments:

Based on Grade:

- Fertilizer Grade

- Industrial Grade

Based on Application:

- Fertilizers and Foliar Sprays

- Chemical Synthesis and Catalysts

Based on End-User:

- Agriculture

- Chemical

- Petrochemical

Based on the Geography:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for a market share of around 27% in the global Magnesium Nitrate Market, supported by advanced agricultural practices and a robust chemical industry. The region demonstrates strong adoption of fertilizer-grade magnesium nitrate, particularly in the United States where high-value crops such as fruits, vegetables, and ornamental plants dominate. Precision farming methods and greenhouse cultivation contribute to steady consumption. The U.S. also leverages magnesium nitrate in wastewater treatment facilities, where denitrification processes play a role in meeting regulatory requirements for clean water standards. Industrial applications add further demand through use in catalysts and specialty chemicals. Canada enhances the regional share by promoting controlled-environment farming systems, which benefit from soluble fertilizers like magnesium nitrate. Consistent investments in sustainable farming and environmental technologies reinforce North America’s position in the market.

Europe

Europe holds an estimated 22% market share, driven by environmental regulations and advanced chemical manufacturing. The region emphasizes sustainable agriculture and precision crop nutrition, which favors water-soluble fertilizers such as magnesium nitrate. Countries like Germany, Spain, and the Netherlands are leaders in greenhouse farming, where magnesium nitrate is widely integrated into fertigation systems. The European chemical sector also utilizes industrial-grade magnesium nitrate in catalyst development and specialty chemical processes. Strong emphasis on wastewater management further boosts demand, as magnesium nitrate is deployed in denitrification and odor control. European Union policies that restrict excessive use of conventional fertilizers open opportunities for nitrate-based solutions with efficient nutrient delivery. The regional focus on sustainability and innovation supports steady growth.

Asia-Pacific

Asia-Pacific commands the largest market share at approximately 34%, supported by large-scale agricultural operations and expanding industrial capacity. China and India lead the region with significant consumption of fertilizer-grade magnesium nitrate in intensive farming systems. The compound is critical in boosting yields of cereals, vegetables, and fruit crops, which dominate regional diets. Southeast Asian nations expand adoption through greenhouse farming and floriculture, benefiting from water-soluble fertilizers. Industrial demand also rises, with China using magnesium nitrate in chemical synthesis, catalysts, and heat storage materials. Japan and South Korea invest in high-tech agricultural practices, increasing the use of soluble fertilizers for premium crops. The combination of agriculture, industry, and rapid urbanization drives the region’s dominant position in the market.

Latin America

Latin America represents about 9% of the global Magnesium Nitrate Market, supported by strong agricultural production and growing demand for specialty fertilizers. Brazil and Mexico are leading contributors, with significant consumption in horticulture, sugarcane, and fruit cultivation. The region’s emphasis on export-oriented crops increases the need for nutrient-rich fertilizers. Adoption of magnesium nitrate in foliar sprays improves crop quality, particularly in fruits like citrus and grapes. Industrial applications remain limited but are gradually expanding, particularly in Mexico’s chemical sector. Government programs encouraging modern agricultural practices and improved soil fertility further strengthen market presence. Latin America’s share continues to grow as sustainable farming techniques gain traction.

Middle East and Africa (MEA)

The Middle East and Africa account for an estimated 8% share of the Magnesium Nitrate Market, driven by rising agricultural modernization and infrastructure development. Countries in the Gulf region adopt magnesium nitrate in greenhouse farming and controlled irrigation systems to enhance crop yield under arid conditions. Africa presents emerging opportunities where magnesium nitrate supports soil enrichment and crop resilience in areas with nutrient deficiencies. South Africa shows stronger adoption in both agriculture and water treatment applications. Industrial demand remains modest but grows steadily with regional investments in chemicals and wastewater infrastructure. The region’s climatic challenges create opportunities for magnesium nitrate as a high-solubility, efficient fertilizer solution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Spectrum Chemical Manufacturing

- Neochim PLC

- Haifa Mexico

- Rongyu Chemical Co. Ltd.

- Thermo Fisher Scientific India Private Limited

- Avantor Performance Materials

- Merck KGaA

- AKO Kasei Co. Ltd.

- GFS Chemicals

- American Elements

Competitive Analysis

The Magnesium Nitrate Market include such as Spectrum Chemical Manufacturing, Neochim PLC, Haifa Mexico, Rongyu Chemical Co. Ltd., Thermo Fisher Scientific India Private Limited, Avantor Performance Materials, Merck KGaA, AKO Kasei Co. Ltd., GFS Chemicals, American Elements. The Magnesium Nitrate Market shows moderate competition, shaped by diversified product portfolios, global distribution strength, and a focus on quality differentiation. Companies operating in this space leverage established networks in laboratory chemicals, agriculture, and industrial applications to secure consistent demand. Competitive strategies emphasize innovation in production processes, compliance with regulatory frameworks, and the ability to tailor solutions for end-use industries. Fertilizer-grade magnesium nitrate remains a core growth area, while industrial and high-purity grades are increasingly important for chemical synthesis and specialized applications. Market participants also pursue capacity expansions and efficiency improvements to strengthen cost competitiveness, particularly in regions with rising agricultural activity. Continuous investment in technology, customer-focused product development, and global supply chain resilience ensures that leading companies maintain strong market positioning despite pricing pressures and fluctuating raw material availability.

Recent Developments

- In August 2025, Calcium ammonium nitrate is a nitrogen-based fertilizer extensively used in agriculture to improve soil fertility and enhance crop productivity. Emerging markets like China and India are driving growth due to expanding agricultural activities.

- In June 2025, a study published in MDPI Nanomaterials highlighted the development of carbon-enhanced magnesium nitrate hexahydrate composites. These composites demonstrated significantly improved thermal conductivity and a notable reduction in supercooling, making them highly suitable for advanced thermal energy storage applications.

- In June 2025, Researchers successfully synthesized magnesium borate/magnesium oxide nanostructures using magnesium nitrate hexahydrate as a precursor. These nanostructures exhibited an exceptional adsorption capacity of 505.05 mg/g, showcasing their potential for efficient water treatment applications.

- In November 2023, Avantor enhanced its cellular science offerings by adding multi-span cell engineering and assay services. These services aim to support advanced research and development in cellular biology, providing enhanced capabilities for cell engineering projects.

Market Concentration & Characteristics

The Magnesium Nitrate Market reflects a moderately concentrated structure, where a mix of global chemical manufacturers and regional suppliers shape competition. It benefits from stable demand across agriculture, industrial synthesis, and specialty applications, creating consistent opportunities for producers with diversified portfolios. It is characterized by high product purity requirements, regulatory compliance, and the need for reliable supply chains that meet both bulk fertilizer demand and precise industrial standards. The market shows stronger presence in regions with intensive agricultural activity, while developed economies emphasize laboratory and specialty-grade applications. It demonstrates steady competition driven by product differentiation, distribution capabilities, and technological efficiency.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fertilizer-grade magnesium nitrate will grow with increasing adoption of high-yield crop practices.

- Industrial-grade applications will expand in chemical synthesis and catalyst production.

- Global suppliers will strengthen supply chains to ensure consistent availability in key markets.

- Product innovation will focus on improving purity and efficiency for specialized applications.

- Regulatory compliance will remain a critical factor influencing competitive positioning.

- Emerging economies will drive growth through rising agricultural consumption.

- Technological advancements in production processes will improve cost efficiency.

- Strategic collaborations will enhance distribution networks and market access.

- Sustainability initiatives will encourage development of eco-friendly formulations.

- Competitive intensity will increase as regional players expand their production capacity.