| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Malaysia Chronic Pain Market Size 2024 |

USD 143.77 million |

| Malaysia Chronic Pain Market, CAGR |

5.37% |

| Malaysia Chronic Pain Market Size 2032 |

USD 218.48 Million |

Market Overview

The Chronic Pain Market In Malaysia is expected to grow from USD 143.77 million in 2024 to USD 218.48 million by 2032, with a compound annual growth rate (CAGR) of 5.37%.

The chronic pain market in Malaysia is driven by several factors, including the rising prevalence of chronic conditions such as arthritis, neuropathic pain, and musculoskeletal disorders, coupled with an aging population. Increasing awareness of pain management options and advancements in treatment technologies, including the growth of non-invasive therapies, are also contributing to market expansion. Moreover, improvements in healthcare infrastructure and better access to pain relief treatments are driving demand for chronic pain management solutions. In addition, the adoption of telemedicine and digital health platforms for pain management is gaining traction, offering greater convenience and reach to patients. Trends such as the growing preference for personalized medicine, incorporating genetic factors in pain treatment, and the increasing use of opioids, though regulated, continue to shape the market. Together, these drivers and trends are positioning Malaysia’s chronic pain market for substantial growth over the coming years.

The geographical distribution of the chronic pain market in Malaysia shows significant variation across regions. The Central region, including Kuala Lumpur, is the most developed, with a higher concentration of healthcare facilities, specialized pain management centers, and access to advanced treatments. The Northern Peninsula and Southern Peninsula are also key regions, benefiting from growing urbanization and healthcare access. However, East Malaysia faces challenges due to its relatively underdeveloped healthcare infrastructure and limited access to specialized care in rural areas. Key players driving the market include Abbott Laboratories, Pfizer Inc., Eli Lilly & Company, Cara Therapeutics, Chattem (Sanofi), Endo International plc, Merck & Co. Inc., F. Hoffmann-La Roche AG, and Daiichi Sankyo Company, Limited. These companies are expanding their presence across the country, especially in urban areas, with a focus on enhancing the availability of both pharmacological and non-pharmacological treatment options for chronic pain management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Malaysia chronic pain market is valued at USD 136.62 million in 2023 and is projected to reach USD 228.31 million by 2032, growing at a CAGR of 5.66%.

- The rising aging population in Malaysia contributes to the increasing prevalence of chronic pain, such as arthritis and neuropathic pain.

- Sedentary lifestyles, particularly in urban areas, are leading to a rise in musculoskeletal pain and other chronic conditions.

- The healthcare system is evolving, with government initiatives improving access to pain management services and treatments.

- Limited awareness and the stigma surrounding chronic pain continue to hinder market growth.

- Rural regions face challenges due to insufficient healthcare infrastructure and a shortage of specialized pain clinics.

- Central and Northern Peninsula regions are driving the majority of market growth, with the Central region holding the largest market share.

Report Scope

This report segments the Malaysia Chronic Pain Market as follow

Market Drivers

Aging Population

The aging population in Malaysia is a significant driver for the chronic pain market. As the population continues to age, the prevalence of chronic conditions such as arthritis, neuropathic pain, and osteoarthritis increases. These conditions are commonly associated with the aging process, leading to a higher demand for effective pain management solutions. For instance, the prevalence of chronic pain increases with advancing age, particularly among those aged 60 and above. The growing number of elderly individuals is expected to continue driving the need for chronic pain treatments in the coming years.

Sedentary Lifestyle

The rise in sedentary lifestyles, particularly among urban populations, has led to an increase in musculoskeletal pain, obesity, and related chronic conditions. Prolonged sitting, lack of physical activity, and poor posture contribute to conditions like chronic back pain and joint issues. For instance, 40% of Malaysians are physically inactive, which contributes to the rise in chronic pain conditions. As more people engage in desk-based jobs or sedentary activities, the demand for chronic pain solutions is expected to rise.

Occupational Hazards

Certain occupations in Malaysia, especially those involving physical labor or repetitive tasks, are contributing to work-related musculoskeletal disorders (WMSDs). These conditions, such as low back pain and repetitive strain injuries, are becoming increasingly prevalent, further fueling the demand for chronic pain treatments. For instance, work-related musculoskeletal disorders are common among healthcare workers and plantation workers. Occupational health and safety initiatives aimed at reducing these risks are also helping shape the market’s growth.

Technological Advancements

Technological innovations in pain management, such as minimally invasive procedures and advanced drug delivery systems, are transforming the chronic pain treatment landscape. These advancements improve patient outcomes, reduce recovery times, and expand treatment options, driving the continued growth of the chronic pain market in Malaysia.

Market Trends

Rising Prevalence of Chronic Pain and Increasing Healthcare Awareness

The chronic pain market in Malaysia is experiencing significant growth due to the rising prevalence of chronic pain conditions. As the population ages, conditions like arthritis, neuropathic pain, and osteoarthritis are becoming more widespread, leading to a higher demand for effective pain management solutions. In parallel, the growing number of individuals with sedentary lifestyles is contributing to musculoskeletal pain and related chronic disorders. Urban populations, in particular, are facing increased health risks associated with a lack of physical activity. For instance, the Malaysian Association for the Study of Pain (MASP) has been actively raising awareness about chronic pain and its management. Additionally, occupational hazards in certain industries, especially those involving physical labor or repetitive tasks, are fueling the prevalence of chronic pain, particularly low back pain and repetitive strain injuries. As these trends continue, the demand for chronic pain treatments is expected to rise substantially. Moreover, healthcare awareness is on the rise in Malaysia. More people are becoming cognizant of the debilitating effects of chronic pain, driving the demand for pain management solutions. Patients are taking a more proactive approach to seeking treatment, understanding the impact pain has on their quality of life. This shift is prompting a broader acceptance of various pain management strategies, including both pharmacological and non-pharmacological treatments. As a result, healthcare providers are seeing an increase in consultations and interventions aimed at alleviating chronic pain.

Technological Advancements and Market Opportunities

Technological advancements in pain management are another driving force behind the market’s expansion. Innovations such as minimally invasive procedures, advanced drug delivery systems, and digital health solutions are transforming the landscape of chronic pain treatment. These advancements offer more targeted and effective pain relief, enabling healthcare providers to deliver better outcomes for patients. Digital health solutions, including mobile apps and telemedicine, are enabling remote monitoring and personalized treatment plans, making pain management more accessible and efficient. Additionally, there is a growing trend toward non-pharmacological treatments. As concerns over the side effects of long-term opioid use continue to rise, patients and healthcare professionals are increasingly opting for alternative therapies, such as physical therapy, acupuncture, and mindfulness-based interventions. The shift towards non-pharmacological options is creating new market opportunities for providers of these services.

Market Challenges Analysis

Lack of Awareness, Stigma, and Cultural Challenges

One of the major challenges in Malaysia’s chronic pain market is the lack of public awareness and the stigma surrounding chronic pain. Many individuals still do not fully understand chronic pain, often dismissing it as a normal part of aging or attributing it to psychological issues rather than a legitimate medical condition. This lack of awareness can delay diagnosis and treatment, contributing to a prolonged suffering. Additionally, there is a social stigma associated with chronic pain, where sufferers are often perceived as weak or as exaggerating their symptoms. This stigma can lead to feelings of isolation, causing patients to hesitate in seeking help or discussing their condition openly. Further complicating the situation are cultural and religious beliefs that shape attitudes toward pain and its management. Cultural norms may discourage seeking medical intervention, and certain religious beliefs may limit the acceptance of specific treatments, particularly medications, thus impeding access to comprehensive care for many individuals.

Insufficient Access to Specialized Care and Overreliance on Medication

Another significant challenge facing the chronic pain market in Malaysia is the insufficient access to specialized care. There is a notable shortage of dedicated pain clinics, particularly in rural and underserved areas. This limitation means that many patients have to travel long distances or wait for extended periods to receive treatment, with long wait times for appointments with pain specialists. Additionally, many patients and healthcare providers continue to rely heavily on medication, especially opioids, despite the growing concerns over misuse and addiction. For instance, non-pharmacological interventions are being recognized as essential solutions for better living and disease prevention. Opioid misuse and the risks of overdose remain significant issues, and strict regulations on opioid prescriptions can restrict access to effective pain relief for some patients, especially those with chronic pain who require consistent management. At the same time, non-pharmacological treatments, such as physical therapy, acupuncture, and mindfulness interventions, are often underutilized due to a preference for medication and limited insurance coverage. The lack of reimbursement for these alternative therapies further hinders their widespread adoption, leaving many patients without access to potentially effective pain management options.

Market Opportunities

The chronic pain market in Malaysia presents several key opportunities for growth and innovation. One of the most significant opportunities lies in the development of non-pharmacological pain management solutions. As concerns over opioid misuse continue to rise, patients and healthcare providers are increasingly turning to alternatives like physical therapy, acupuncture, mindfulness-based interventions, and other holistic approaches. These non-pharmacological treatments offer a safer, more sustainable approach to managing chronic pain. The growing demand for these therapies presents a lucrative opportunity for companies and healthcare providers to invest in specialized clinics, mobile health apps, and personalized treatment plans that integrate these alternative methods. Furthermore, expanding insurance coverage for non-pharmacological treatments could further drive market growth, offering greater access to these effective solutions.

Another notable market opportunity stems from technological advancements in pain management. The rise of digital health solutions, such as telemedicine platforms and mobile health apps, is transforming the way chronic pain is managed. These technologies enable remote monitoring, virtual consultations, and personalized care, making it easier for patients to access pain management services from the comfort of their homes. Moreover, innovations in medical devices, including neurostimulators, infusion pumps, and minimally invasive procedures, present significant potential for improved patient outcomes and reduced healthcare costs. Companies developing cutting-edge technologies and treatments can position themselves to capture a share of Malaysia’s rapidly growing chronic pain market by offering more targeted and effective solutions that cater to the evolving needs of patients and healthcare providers.

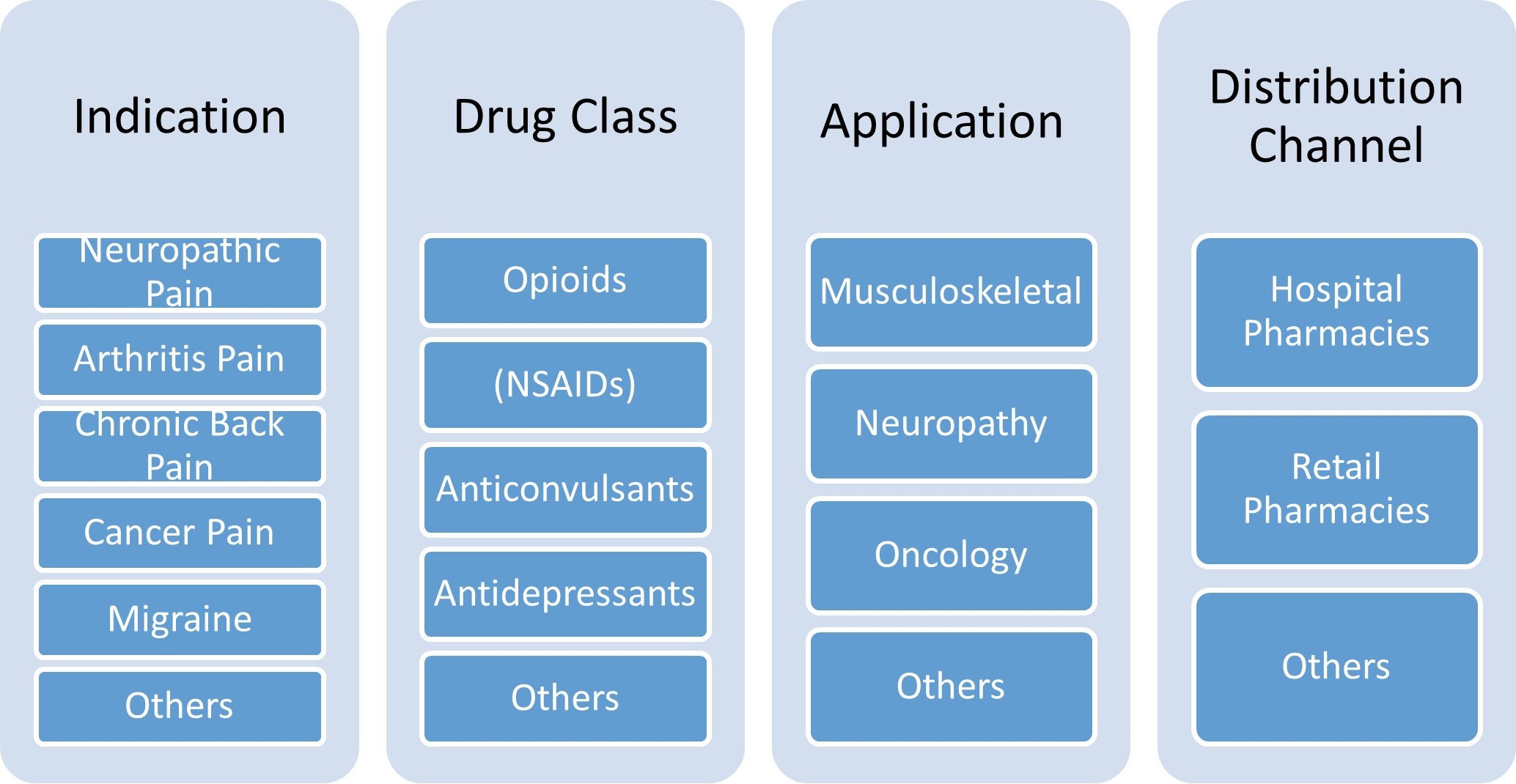

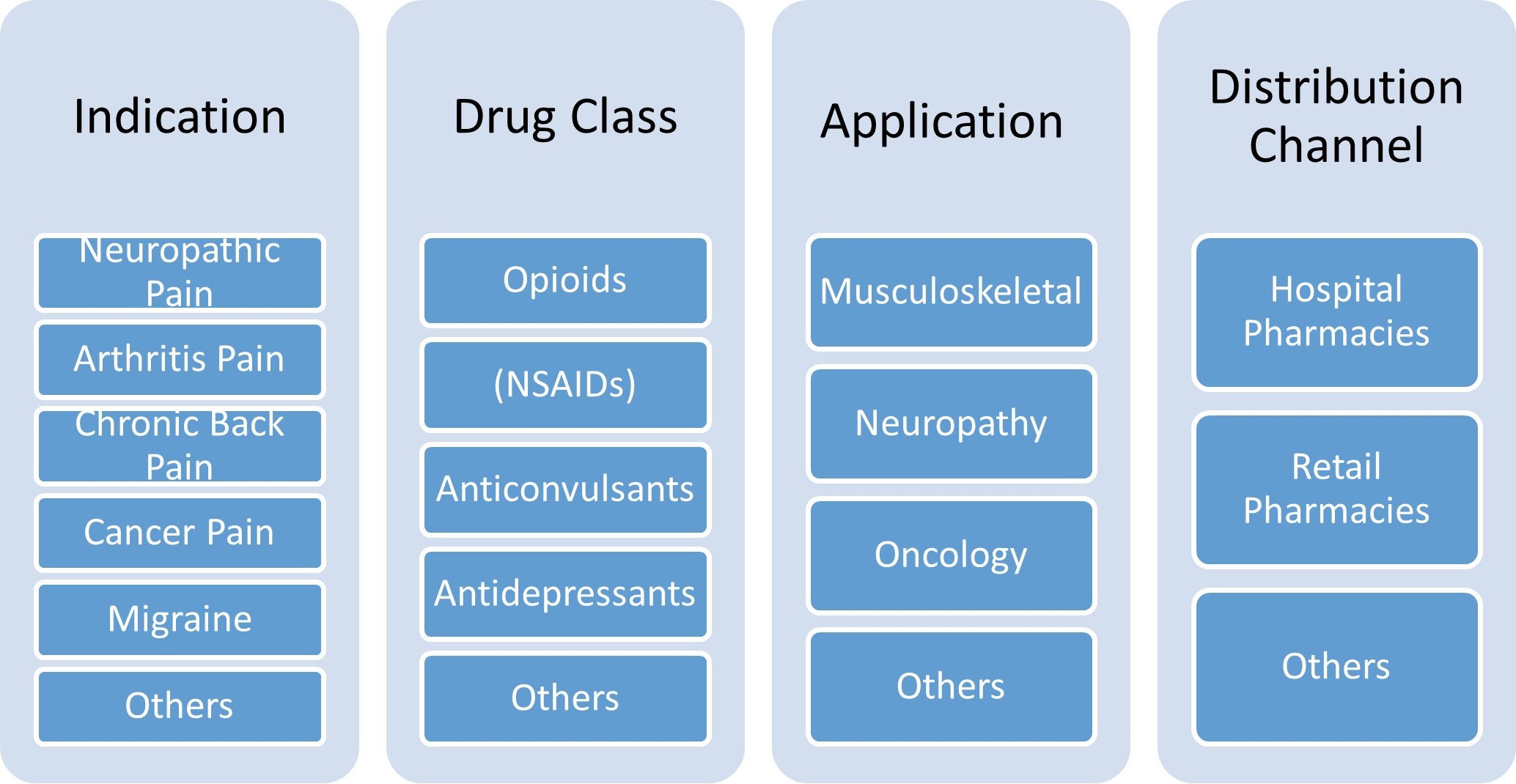

Market Segmentation Analysis:

By Indication:

The chronic pain market in Malaysia is primarily segmented by the type of pain, with the most common being neuropathic pain, arthritis pain, chronic back pain, cancer pain, and migraines. Neuropathic pain, often associated with diabetes, shingles, and multiple sclerosis, is a significant segment due to its rising prevalence in the aging population. Arthritis pain, particularly osteoarthritis, is another major segment, driven by Malaysia’s aging demographic. Chronic back pain, commonly linked to sedentary lifestyles and occupational hazards, contributes to a significant portion of the market. Cancer pain, a critical area for pain management, is growing in importance as cancer rates rise, while migraines also represent a major challenge, affecting a significant proportion of the working-age population. The demand for pain management solutions in these segments is increasing, driven by the need for effective treatment options to manage the long-term and debilitating effects of these conditions.

By Drug Class:

In terms of drug class, opioids, non-steroidal anti-inflammatory drugs (NSAIDs), anticonvulsants, antidepressants, and other emerging therapies are the primary treatments for chronic pain in Malaysia. Opioids remain a dominant treatment option, especially for severe pain, though concerns over misuse and addiction are leading to stricter regulations. NSAIDs are commonly prescribed for arthritis pain and chronic back pain due to their effectiveness in reducing inflammation. Anticonvulsants, particularly gabapentin, are increasingly used for neuropathic pain, offering an alternative to opioids. Antidepressants, such as selective serotonin and norepinephrine reuptake inhibitors (SNRIs), are being utilized for both neuropathic pain and fibromyalgia, expanding the range of non-opioid options. Emerging drug classes also show promise, and the market is seeing a rise in treatments with fewer side effects and better efficacy, responding to the growing demand for safer, long-term pain management solutions.

Segments:

Based on Indication:

- Neuropathic Pain

- Arthritis Pain

- Chronic Back Pain

- Cancer Pain

- Migraine

Based on Drug Class:

- Opioids

- Non-Steroidal

- Anticonvulsants

- Antidepressants

- Drug Class 5

Based on Application:

- Musculoskeletal

- Neuropathy

- Oncology

- Others

Based on Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Others

Based on the Geography:

- Northern Peninsula

- Southern Peninsula

- Central

- East Coast

- East Malaysia

Regional Analysis

Northern Peninsula

The Northern Peninsula, which includes key states like Penang, Kedah, and Perlis, holds a substantial share of the chronic pain market, particularly due to its aging population and rising incidence of chronic pain conditions such as arthritis and neuropathic pain. This region’s market share is approximately 28%, driven by the high prevalence of musculoskeletal and neuropathic pain among the elderly population. Additionally, lifestyle factors, including sedentary behaviors and occupational hazards prevalent in urban areas like George Town, contribute to the demand for chronic pain management solutions. The healthcare infrastructure in this region is also relatively advanced, supporting a steady growth in demand for both pharmacological and non-pharmacological treatments. The increasing awareness of chronic pain and the rising availability of pain management services further bolster market expansion in the Northern Peninsula.

Southern Peninsula

In contrast, the Southern Peninsula, encompassing states like Johor and Melaka, holds an approximate market share of 25% in the chronic pain sector. This region benefits from a growing healthcare infrastructure, especially in urbanized areas like Johor Bahru, which drives the demand for effective pain management solutions. A significant factor influencing chronic pain prevalence in the Southern Peninsula is the high number of individuals involved in physical labor, contributing to a higher incidence of musculoskeletal disorders and chronic back pain. The increasing awareness of pain management and the expansion of medical facilities have led to greater adoption of non-pharmacological treatments such as physical therapy and acupuncture. Furthermore, the Southern Peninsula’s proximity to Singapore has spurred advancements in healthcare services, leading to greater availability of specialized pain clinics and pain management technologies. As a result, the Southern Peninsula is poised for steady market growth, driven by both increasing demand for chronic pain treatments and ongoing healthcare advancements.

Key Player Analysis

- Abbott Laboratories

- Pfizer Inc.

- Eli Lilly & Company

- Cara Therapeutics

- Chattem (Sanofi)

- Endo International plc

- Merck & Co. Inc.

- Hoffmann-La Roche AG

- Daiichi Sankyo Company, Limited

- Company 11

- Company 12

- Company 13

- Company 14

Competitive Analysis

The competitive landscape of the Malaysia chronic pain market is shaped by several key players, including Abbott Laboratories, Pfizer Inc., Eli Lilly & Company, Cara Therapeutics, Chattem (Sanofi), Endo International plc, Merck & Co. Inc., F. Hoffmann-La Roche AG, and Daiichi Sankyo Company, Limited. The competition is driven by the increasing demand for both pharmacological and non-pharmacological pain management solutions. Companies are focusing on developing advanced drug delivery systems, minimally invasive procedures, and novel drug classes to address a wide range of chronic pain conditions such as neuropathic pain, arthritis, and cancer pain. Additionally, there is a growing trend towards opioid-sparing therapies to mitigate the risks associated with long-term opioid use. Players in the market are also investing in digital health solutions, such as mobile applications and telemedicine platforms, to enhance patient outcomes and improve access to care. The market is characterized by a mix of established global players and local companies, all striving to improve the effectiveness of pain relief treatments while addressing regional healthcare challenges, such as access to specialized care in rural areas.

Recent Developments

- In July 2024, Boston Scientific Corporation announced positive five-year results for the Intracept Intraosseous Nerve Ablation System, presented at the American Society of Pain & Neuroscience (ASPN) conference in Miami Beach, Florida. The data, pooled from three clinical trials, highlight the effectiveness of the Intracept system in treating vertebrogenic low back pain, a condition caused by damage to vertebral endplates.

- In April 2024, Vertex Pharmaceuticals announced significant progress in its suzetrigine pain program, an oral selective NaV1.8 pain signal inhibitor that is poised to become the first new class of medicine for acute and neuropathic pain in over two decades. Following positive Phase 3 results in January 2024, the FDA granted New Drug Application (NDA) submission for suzetrigine in moderate-to-severe acute pain.

- In February 2024, CinCor Pharma, Inc. was acquired by AstraZeneca. Cincor is a clinical stage biopharmaceutical company based out of USA that is focused on developing novel treatments for severe hypertension and chronic kidney disease.

- In January 2024, Bayer AG disclosed its plan to strengthen its pharmaceutical and consumer health businesses. This move will bolster the company’s American market presence.

- In January 2024, Sanofi announced its acquisition of Inhibrx, Inc., aiming to incorporate a potential best-in-class rare disease asset for Alpha-1 Antitrypsin Deficiency into its pipeline.

- In December 2023, Forever Cheer, a pharmaceutical company holding more than 10 global patents, selected Hong Kong as the launchpad for its innovative pain management drugs, aiming to expand its global footprint and significantly impact the healthcare industry

- In August 2023, MOBE and Override, digital health innovators, partnered to introduce a shared savings program for chronic pain management. This initiative focuses on providing personalized pain treatment through data analytics and behavioral health coaching, with the goal of reducing healthcare costs.

Market Concentration & Characteristics

The market concentration of Malaysia’s chronic pain sector is relatively moderate, with a mix of global pharmaceutical giants and local players competing for market share. While a few large multinational companies dominate the pharmaceutical side, offering a wide range of pain management drugs, the market also sees increasing participation from regional players and smaller companies focusing on specific pain relief therapies. The market is characterized by a growing focus on both pharmacological and non-pharmacological treatments, as patients and healthcare providers increasingly seek alternatives to traditional medication, especially opioids. This trend has led to a surge in demand for non-invasive therapies, including physical therapy, acupuncture, and digital health solutions. Additionally, with Malaysia’s aging population and rising awareness of chronic pain’s impact on quality of life, there is a steady growth in demand for innovative pain management technologies. The market is also shaped by regional variations, with urban areas benefiting from better healthcare infrastructure and access to advanced treatments, while rural regions face challenges due to limited resources. The competitive landscape is evolving, with companies constantly investing in R&D to introduce more effective, personalized treatments, while also focusing on regulatory compliance and improving accessibility for a broader population.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Indication, Drug Class, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Malaysia chronic pain market is expected to grow significantly due to the aging population and increasing prevalence of chronic pain conditions.

- There will be a growing demand for non-opioid pain management solutions as concerns over opioid misuse continue to rise.

- Technological advancements in pain management, such as digital health solutions and minimally invasive treatments, will drive market innovation.

- Non-pharmacological treatments like physical therapy, acupuncture, and mindfulness-based interventions will see increased adoption.

- The focus on personalized pain management will expand, offering more targeted and effective solutions for patients.

- Increasing awareness about chronic pain and its impact on quality of life will result in greater patient engagement and demand for treatments.

- Expansion of healthcare infrastructure in rural areas will improve access to specialized pain management services.

- Government initiatives aimed at improving healthcare access and affordability will support market growth.

- The development of novel pain medications with fewer side effects will be a key focus for pharmaceutical companies.

- Multidisciplinary pain management approaches will become more prevalent, offering comprehensive care for chronic pain sufferers.