Market Overview

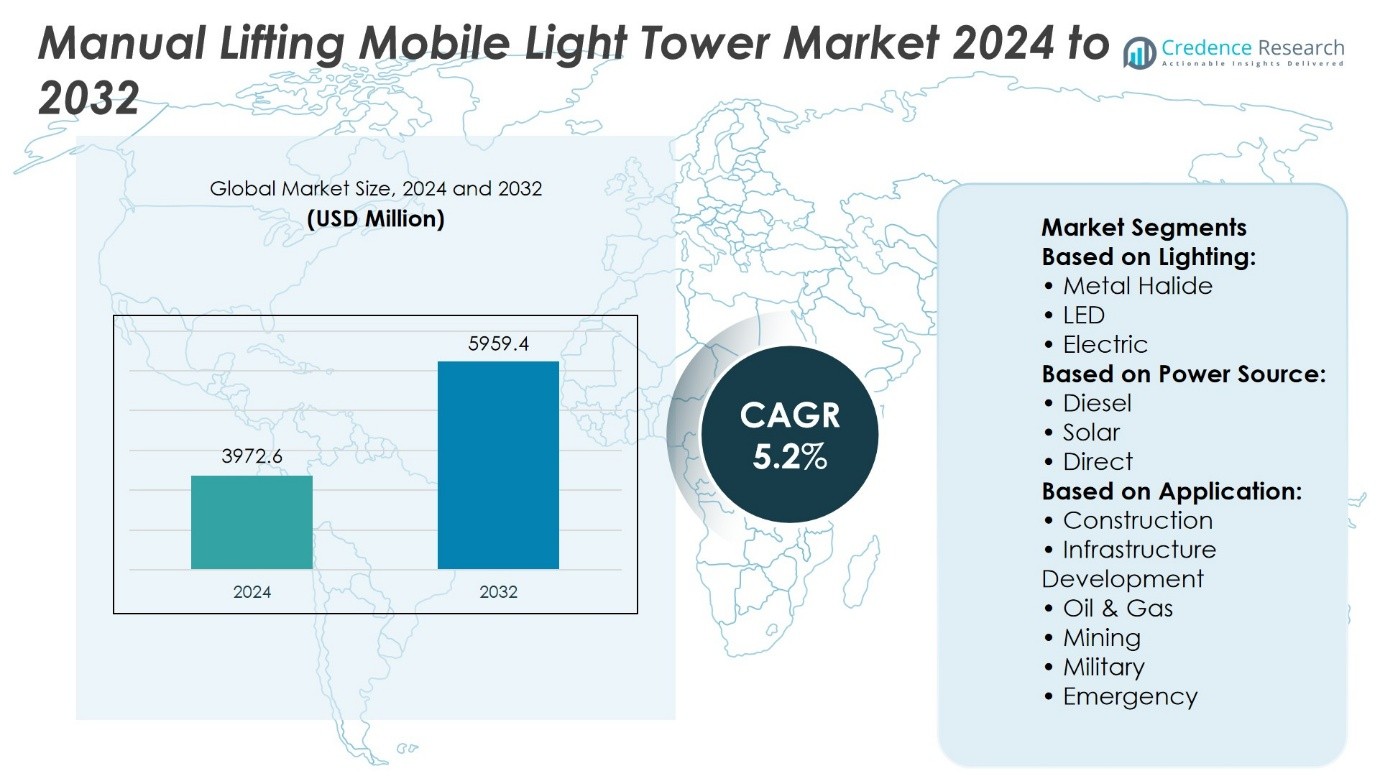

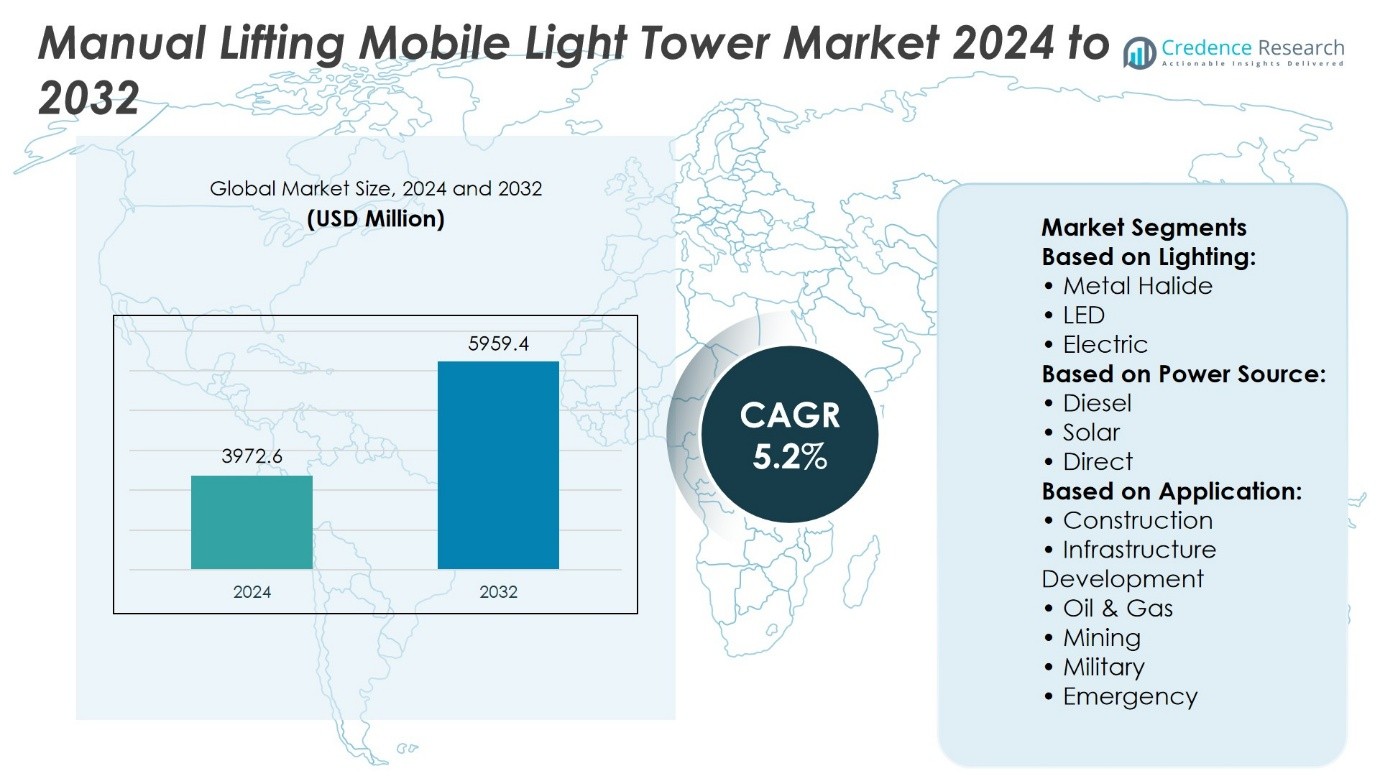

Manual Lifting Mobile Light Tower Market size was valued at USD 3972.6 million in 2024 and is anticipated to reach USD 5959.4 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manual Lifting Mobile Light Tower Market Size 2024 |

USD 3972.6 Million |

| Manual Lifting Mobile Light Tower Market, CAGR |

5.2% |

| Manual Lifting Mobile Light Tower Market Size 2032 |

USD 5959.4 Million |

The Manual Lifting Mobile Light Tower Market grows on the back of expanding construction, infrastructure, and mining activities that require portable, reliable lighting in diverse environments. It benefits from rising adoption of LED technology, hybrid and solar-powered systems, and designs that enhance fuel efficiency and reduce maintenance. Demand strengthens with the expansion of rental services, enabling cost-effective access for short-term projects. Trends show increasing use in emergency response, outdoor events, and military operations, alongside integration of smart monitoring features. Sustainability initiatives and stricter emission regulations further drive the shift toward eco-friendly and energy-efficient lighting solutions in both developed and emerging markets.

The Manual Lifting Mobile Light Tower Market shows strong demand across North America, Europe, and Asia-Pacific, with notable growth in Latin America and the Middle East & Africa due to infrastructure expansion and industrial projects. North America leads with large-scale construction and energy sector applications, while Asia-Pacific benefits from rapid urbanization. Key players include Multiquip, United Rentals, OLIKARA LIGHTING TOWERS, Wacker Neuson, Trime, Light Boy, Progress Solar Solutions, LTA Projects, The Will Burt Company, and LARSON Electronics, all competing through innovation and expanded service networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Manual Lifting Mobile Light Tower Market was valued at USD 3972.6 million in 2024 and is projected to reach USD 5959.4 million by 2032, at a CAGR of 5.2%.

- Expansion in construction, infrastructure, and mining sectors fuels demand for portable and reliable lighting solutions.

- Rising adoption of LED, hybrid, and solar-powered systems enhances energy efficiency and reduces maintenance needs.

- Market competition intensifies with innovation, product diversification, and expanded rental service networks.

- Dependence on fuel-based units in certain regions and operational challenges in extreme weather act as restraints.

- North America leads in market share, followed by Europe and Asia-Pacific, with growth in Latin America and the Middle East & Africa.

- Key players focus on sustainable designs, smart monitoring integration, and broader application in events, emergency response, and military operations.

Market Drivers

Rising Demand from Construction and Infrastructure Development Projects

The Manual Lifting Mobile Light Tower Market benefits from consistent demand from large-scale construction and infrastructure projects. These operations require reliable, portable lighting solutions to maintain productivity and safety during low-light hours. It supports worksites in road building, bridge construction, mining, and utility maintenance where stationary lighting is impractical. The compact design and mobility of manual lifting units make them suitable for rapid deployment in varying terrains. They allow workers to adjust mast height and light positioning without specialized equipment. Strong adoption in both urban and remote project sites sustains market growth. Governments and private developers continue to invest in projects that require extended operational hours, fueling product usage.

- For instance, Olikara’s DAZZLER tower delivers 320,000 lumens of light coverage over nearly 10 acres, with a fuel burn rate of 2 liters per hour, ensuring uninterrupted illumination on expansive job sites.

Advancements in Energy-Efficient Lighting Technologies

Manufacturers in the Manual Lifting Mobile Light Tower Market integrate LED lighting and hybrid power systems to improve performance and reduce operational costs. It offers higher lumen output with lower power consumption compared to traditional metal halide systems. These upgrades extend fuel runtime and minimize generator maintenance, enhancing uptime in demanding environments. Reduced energy use also aligns with stricter emissions regulations in many regions. Innovations such as adjustable beam angles and multi-directional lighting enhance site coverage. These features improve worker visibility and reduce accident risks. Technological improvements strengthen market acceptance in industries with high safety and operational efficiency standards.

- For instance, the LumiTrek-500 light tower offers adjustable beam angles with a fully rotatable head and delivers 65,000 lumens on AC power.

Expansion of Rental Equipment Services Supporting Accessibility

The Manual Lifting Mobile Light Tower Market gains momentum from the growth of rental equipment businesses. It allows contractors and event organizers to access high-performance lighting without significant upfront investment. Rental companies maintain and upgrade fleets regularly, ensuring clients receive dependable units. This business model suits seasonal work, emergency response, and short-term projects. Rental providers often offer transport, setup, and operational guidance to maximize efficiency. Expanding rental networks increase product penetration in emerging markets. Competitive pricing and flexible lease terms encourage broader adoption across industries.

Increased Application in Emergency and Disaster Response Operations

The Manual Lifting Mobile Light Tower Market experiences rising deployment in emergency and disaster recovery operations. It plays a vital role in restoring visibility during rescue, repair, and relief efforts after natural disasters. Quick setup capability and portability make these towers suitable for unstable or inaccessible areas. Emergency services value units with fuel-efficient generators and long run times for extended missions. Integration with renewable energy sources further supports off-grid operation in remote disaster zones. Strong reliability under challenging conditions reinforces their importance in emergency preparedness strategies. Government agencies and NGOs continue to invest in these solutions for rapid-response capability.

Market Trends

Integration of Hybrid and Solar-Powered Configurations

The Manual Lifting Mobile Light Tower Market shows a growing shift toward hybrid and solar-powered designs. It reduces fuel dependency and supports compliance with stricter emission regulations. Manufacturers incorporate photovoltaic panels and battery storage to operate in remote or off-grid locations. These systems lower operational costs and extend runtime without constant refueling. Hybrid configurations offer flexibility by combining renewable and conventional power sources. The adoption of sustainable energy solutions aligns with environmental policies and corporate sustainability goals. This trend attracts industries seeking to improve energy efficiency while maintaining lighting reliability.

- For instance, Progress Solar Solutions’ HELIOS‑HYB light tower includes two 2,250-watt solar power arrays, paired with 800 amp-hours of AGM battery storage, enabling extended autonomous operation even in challenging environments.

Adoption of Advanced LED Illumination Systems

The Manual Lifting Mobile Light Tower Market increasingly features LED technology for its superior performance and energy savings. It delivers higher brightness with reduced wattage compared to traditional metal halide lamps. LEDs offer longer service life, minimizing replacement frequency and maintenance costs. Enhanced durability allows operation in harsh weather and demanding work conditions. Adjustable beam patterns and directional lighting improve coverage efficiency on work sites. Reduced heat emission ensures safer operation in confined or crowded environments. The industry continues to invest in LED upgrades to meet evolving efficiency standards.

- For instance, Allmand’s Night‑Lite Pro II LD‑Series tower delivers up to 542,000 total lumens, showcasing its capability to illuminate expansive sites with impactful brightness.

Growing Demand from Non-Construction Applications

The Manual Lifting Mobile Light Tower Market expands its scope beyond construction and infrastructure sectors. It gains traction in outdoor events, sports venues, and emergency relief operations. Event organizers value its portability and rapid setup for temporary lighting needs. Emergency agencies deploy units for disaster response, night-time rescue, and infrastructure repair. Agricultural operations use mobile towers for night harvesting and equipment maintenance. Flexible design and low transport requirements enable broad application diversity. This diversification supports steady demand even during construction market fluctuations.

Expansion of Smart Control and Monitoring Features

The Manual Lifting Mobile Light Tower Market adopts smart control systems to enhance operational efficiency. It includes features such as remote start, fuel monitoring, and automated mast adjustments. Integration with IoT platforms allows fleet managers to track performance and schedule maintenance. Real-time alerts help prevent breakdowns and optimize fuel use. Smart monitoring improves resource allocation for rental companies and large-scale projects. The ability to control lighting remotely reduces labor costs and improves response time. This digital transformation strengthens product value and competitiveness in the market.

Market Challenges Analysis

Operational Limitations in Extreme Weather and Harsh Environments

The Manual Lifting Mobile Light Tower Market faces performance challenges in extreme weather conditions. It can experience reduced stability and lighting efficiency during high winds, heavy rain, or snow. Manual mast operation becomes difficult in sub-zero temperatures or dusty environments, affecting deployment speed. Exposure to moisture and abrasive particles can accelerate wear on mechanical parts. Units operating in coastal or mining regions require more frequent maintenance to prevent corrosion and mechanical failure. These environmental constraints limit usage in certain high-risk areas. Manufacturers continue to explore improved materials and weather-resistant designs to address these operational issues.

High Maintenance Requirements and Limited Technological Integration

The Manual Lifting Mobile Light Tower Market contends with maintenance demands that can increase operational costs. It relies on regular inspections to ensure safe mast operation, fuel system performance, and lighting quality. Manual systems lack the automated adjustments and advanced diagnostics available in hydraulic or smart-controlled models. This limitation can slow setup times and reduce efficiency for large-scale operations. Rental companies face higher service intervals to maintain unit reliability for repeated deployments. The absence of integrated monitoring systems reduces the ability to track performance remotely. Technological upgrades remain essential to minimize downtime and improve cost-effectiveness for end users.

Market Opportunities

Rising Demand for Sustainable and Energy-Efficient Lighting Solutions

The Manual Lifting Mobile Light Tower Market has significant potential in the shift toward sustainable lighting technologies. It can benefit from the integration of solar panels, hybrid power systems, and advanced LED fixtures. These solutions reduce fuel consumption and align with regulatory efforts to lower emissions. Industries in remote areas seek energy-efficient equipment to minimize logistical challenges related to fuel supply. Portable units with renewable energy capability appeal to sectors such as mining, infrastructure, and outdoor events. Manufacturers offering eco-friendly models position themselves to capture demand from environmentally conscious buyers. The transition to sustainable solutions creates opportunities for long-term market expansion.

Growing Adoption in Emerging Economies and Expanding Rental Networks

The Manual Lifting Mobile Light Tower Market can leverage increasing infrastructure investments in emerging economies. It supports construction, road development, and industrial expansion in regions with limited fixed lighting infrastructure. Rental companies in these markets expand their fleets to cater to seasonal and short-term projects. This approach enables small and mid-sized contractors to access high-performance lighting without heavy capital investment. Portable and easy-to-maintain designs appeal to businesses seeking flexibility and reduced operational complexity. Expansion of rental services in underserved regions enhances product reach and market penetration. Targeting these growing markets provides a strategic advantage for manufacturers and service providers.

Market Segmentation Analysis:

By Lighting

The Manual Lifting Mobile Light Tower Market segments into metal halide, LED, electric, and other lighting technologies. LED holds a growing share due to its superior energy efficiency, extended service life, and lower maintenance requirements. It delivers high lumen output with reduced power consumption, making it suitable for long-duration projects. Metal halide continues to serve in applications requiring intense, broad-area illumination but faces gradual replacement in favor of LEDs. Electric lighting options appeal to projects with access to grid power, offering low-noise operation ideal for urban or event environments. Other technologies, including plasma and hybrid systems, serve niche demands where specialized performance is required.

- For instance, Allmand’s Night‑Lite Pro II V-Series LED configuration delivers 57,140 lumens per lamp, underscoring the high brightness capability of LED systems in field applications.

By Power Source

The market divides into diesel, solar, direct, and other power sources. Diesel remains dominant for remote and heavy-duty applications, offering high output and long runtime without reliance on external power. It supports continuous operation in construction, mining, and large-scale infrastructure projects. Solar-powered units are gaining adoption due to their ability to reduce fuel usage and emissions, particularly in environmentally regulated zones. Direct-powered towers suit sites with reliable electrical infrastructure, providing uninterrupted lighting without refueling needs. Other sources, such as hybrid configurations, combine diesel and renewable inputs to maximize flexibility and operational efficiency.

- For instance, Atlas Copco’s HiLight V5+ LED light tower features four 350‑W LED lamps delivering lighting coverage across up to 5,000 m², paired with a spillage‑free frame specifically engineered for rugged conditions.

By Application

The market serves multiple sectors, with construction representing the largest application segment. It provides essential lighting for building sites, road projects, and night operations. Infrastructure development projects depend on mobile towers to maintain schedules in low-light or extended work conditions. Oil and gas operations use these towers for rig sites and refinery maintenance, where portability and reliability are critical. Mining activities require rugged units capable of withstanding dust, vibration, and harsh terrain. Military and defense applications rely on mobile towers for base security, field operations, and training exercises. Emergency and disaster relief operations value the quick deployment and off-grid capability of these units to restore visibility in crisis zones.

Segments:

Based on Lighting:

- Metal Halide

- LED

- Electric

Based on Power Source:

Based on Application:

- Construction

- Infrastructure Development

- Oil & Gas

- Mining

- Military

- Emergency

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 34% of the Manual Lifting Mobile Light Tower Market, driven by sustained demand from construction, oil and gas, and infrastructure maintenance sectors. The United States leads the regional market with extensive usage in highway construction, pipeline development, and mining operations. It benefits from established rental equipment networks that allow contractors to access advanced lighting units for short-term and seasonal projects. The presence of leading manufacturers and distributors ensures a steady supply of high-performance towers with advanced features such as LED illumination and hybrid power systems. Regulatory emphasis on workplace safety drives the adoption of mobile lighting in nighttime and low-visibility work. Canada contributes significantly through mining and energy exploration projects in remote areas, where mobile units with diesel or hybrid power sources are preferred for their reliability and runtime efficiency.

Europe

Europe accounts for 28% of the Manual Lifting Mobile Light Tower Market, with demand supported by infrastructure modernization, renewable energy installations, and public works projects. Countries such as Germany, the United Kingdom, and France lead adoption, driven by strict safety standards and environmental regulations. It witnesses strong interest in LED and solar-powered variants as contractors seek compliance with low-emission requirements. The event management sector in Europe also contributes to demand, as mobile towers are used in festivals, sporting events, and temporary public spaces. Availability of hybrid units helps meet regional sustainability goals while ensuring operational reliability. Eastern European countries are gradually increasing adoption through infrastructure development and cross-border construction initiatives, creating opportunities for rental service providers and manufacturers offering cost-efficient models.

Asia-Pacific

Asia-Pacific holds 24% of the Manual Lifting Mobile Light Tower Market, fueled by rapid urbanization, industrial expansion, and large-scale infrastructure projects. China, India, and Australia dominate regional demand, with applications in road construction, mining, and oil exploration. It benefits from government-led infrastructure programs, including expressway expansions, airport development, and rail network upgrades. The mining industries of Australia and Indonesia rely heavily on mobile towers capable of enduring harsh environments while delivering consistent illumination. Competitive pricing from regional manufacturers increases accessibility for small and mid-sized contractors. LED and solar-powered units are gaining popularity in emerging economies due to their reduced operating costs and suitability for off-grid locations.

Latin America

Latin America captures 8% of the Manual Lifting Mobile Light Tower Market, driven by energy, mining, and infrastructure sectors. Brazil, Mexico, and Chile represent the largest markets, with investments in highway upgrades, mining sites, and oilfield operations. It faces growing adoption of LED-based units for reduced maintenance and better energy efficiency in remote sites. Rental companies in the region play a vital role in expanding access to high-quality towers without high capital investment. Seasonal events and emergency response operations also contribute to market demand. Economic growth and infrastructure development initiatives are expected to gradually boost the market share in the coming years.

Middle East & Africa

The Middle East & Africa region holds 6% of the Manual Lifting Mobile Light Tower Market, supported by oil and gas exploration, mining activities, and military applications. The Gulf countries, including Saudi Arabia and the UAE, deploy mobile light towers extensively for pipeline construction, refinery maintenance, and large-scale building projects. It benefits from the adoption of diesel-powered units that can withstand high temperatures and prolonged operational hours. African mining hubs such as South Africa and Botswana use mobile towers in open-pit operations, while infrastructure projects across East Africa add to regional demand. The expansion of emergency and disaster relief capabilities in the region further strengthens usage of portable lighting solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Multiquip

- United Rentals

- OLIKARA LIGHTING TOWERS

- Wacker Neuson

- Trime

- Light Boy

- Progress Solar Solutions

- LTA Projects

- The Will Burt Company

- LARSON Electronics

Competitive Analysis

The Manual Lifting Mobile Light Tower Market features a competitive landscape led by Multiquip, United Rentals, OLIKARA LIGHTING TOWERS, Wacker Neuson, Trime, Light Boy, Progress Solar Solutions, LTA Projects, The Will Burt Company, and LARSON Electronics. The Manual Lifting Mobile Light Tower Market is characterized by intense competition, with companies focusing on product innovation, operational efficiency, and compliance with evolving safety and environmental standards. Manufacturers are investing in LED-based systems, hybrid and solar-powered configurations, and advanced mast mechanisms to improve performance and reduce lifecycle costs. The market rewards players that offer versatile designs adaptable to diverse applications such as construction, infrastructure development, mining, military operations, and emergency response. Expanding rental networks enhance accessibility, allowing customers to deploy high-quality lighting solutions without significant capital expenditure. Differentiation often comes from durability in harsh environments, energy efficiency, and ease of transport and setup. The most competitive brands emphasize both technological advancements and comprehensive after-sales support to maintain customer loyalty and secure repeat business.

Recent Developments

- In January 2025, Royal Philips announced the sale of its Emergency Care business, including defibrillators, to Bridgefield Capital. This deal is part of Philips’ strategy to focus on areas with greater scale and financial impact. The Emergency Care business, previously part of Philips’ Connected Care segment, includes products like automated external defibrillators (AEDs) and other emergency care devices.

- In January 2024, Generac Mobile introduced the GLT Series, a new line of mobile lighting towers designed for improved performance and sustainability. These towers feature compact designs, enhanced fuel efficiency, and low noise emissions, making them suitable for urban and sensitive environments.

- In March 2024, Larson Electronics launched the SPLT-.53K-LM30-2XN3B-4X250AH-PW-TLR7, a 30-foot portable solar LED light tower designed for camera and security device deployment.

- In December 2023, Atlas Copco launched its first hybrid light tower, the HiLight HVT 500, combining battery and diesel technologies.

Market Concentration & Characteristics

The Manual Lifting Mobile Light Tower Market displays a moderately concentrated structure, with a mix of global manufacturers and regional suppliers competing on product quality, technological integration, and cost efficiency. It serves diverse industries including construction, infrastructure development, mining, oil and gas, military, and emergency response, where mobility and reliable illumination are critical. Leading producers focus on LED technology, hybrid and solar-powered options, and enhanced mast stability to meet operational and environmental standards. The market values products that combine durability, ease of transport, and quick setup for both urban and remote applications. Rental service providers play a significant role in market penetration by offering flexible access to advanced units without high upfront investment. Competitive dynamics are shaped by the ability to deliver consistent performance in harsh conditions while reducing fuel consumption and maintenance requirements. The demand profile remains stable, supported by infrastructure growth, safety regulations, and the need for energy-efficient off-grid lighting solutions worldwide.

Report Coverage

The research report offers an in-depth analysis based on Lighting, Power Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with expansion of global infrastructure and construction projects.

- Adoption of LED technology will increase for energy efficiency and longer service life.

- Hybrid and solar-powered models will gain popularity in regions with strict emission norms.

- Rental service networks will expand to meet short-term and seasonal project needs.

- Product designs will focus on improved mast stability and faster manual operation.

- Use in emergency and disaster relief operations will increase due to portability.

- Mining and oil sector projects will sustain demand in remote and off-grid locations.

- Smart monitoring features will see gradual integration for performance tracking.

- Manufacturers will invest in lightweight and durable materials to enhance mobility.

- Emerging markets will offer strong growth opportunities through infrastructure investment.