Market Overview

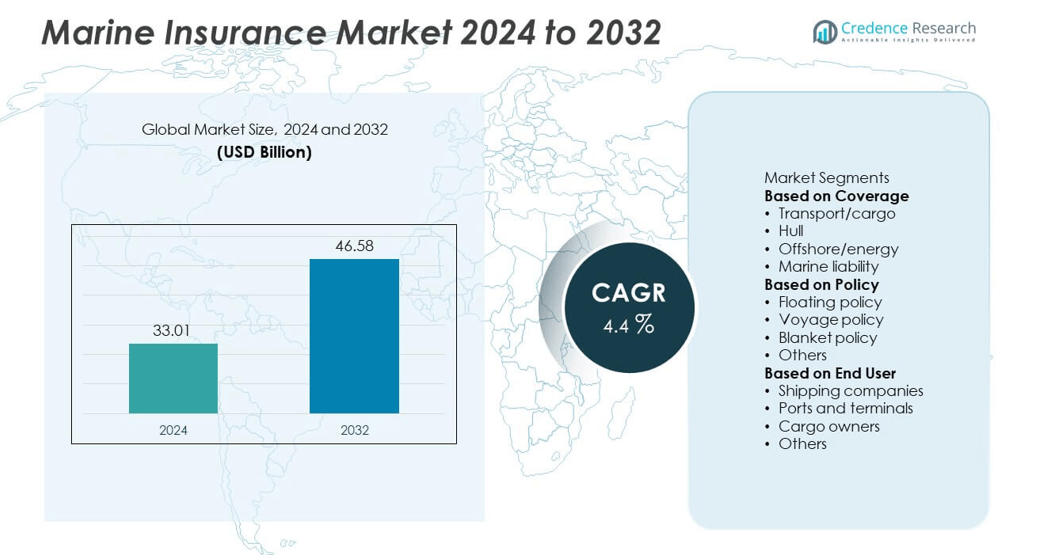

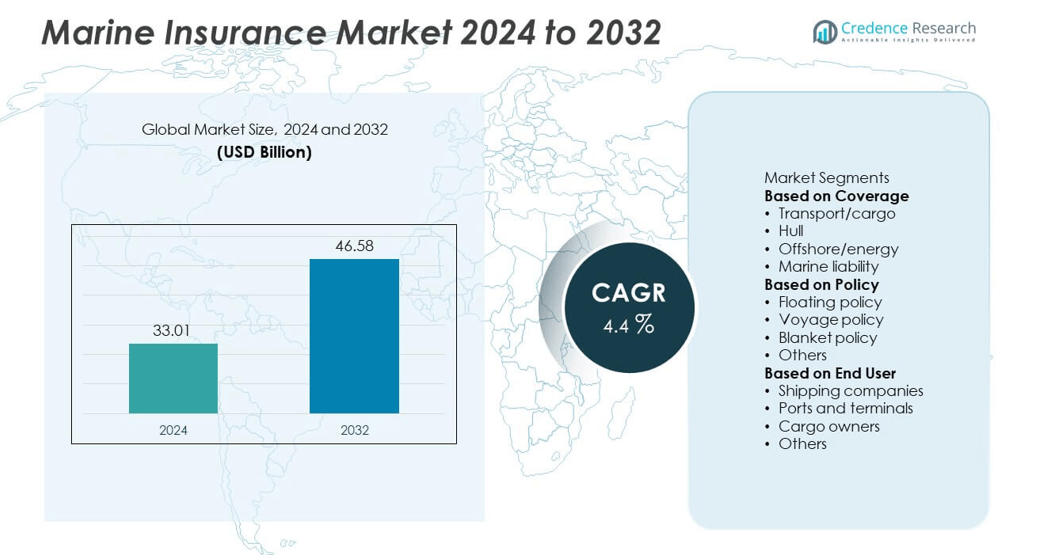

Marine Insurance Market was valued at USD 33.01 billion in 2024 and is expected to reach USD 46.58 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Insurance Market Size 2024 |

USD 33.01 billion |

| Marine Insurance Market, CAGR |

4.4% |

| Marine Insurance Market Size 2032 |

USD 46.58 billion |

The Marine Insurance Market grows with rising global trade volumes, stricter regulatory frameworks, and increasing exposure to climate-related risks. Shipowners and cargo operators adopt comprehensive policies to protect against accidents, piracy, and natural disasters. It also benefits from the expansion of offshore energy projects that require specialized coverage.

The Marine Insurance Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America demonstrates steady adoption supported by advanced port infrastructure, offshore energy projects, and strict compliance requirements. Europe remains a major hub for underwriting, with London serving as a global center for marine insurance supported by strong regulatory oversight and sustainability-driven policies. Asia-Pacific records the fastest expansion with high cargo volumes, busy shipping lanes, and growing offshore renewable projects. Latin America and the Middle East & Africa show gradual growth, driven by increasing exports, energy exploration, and infrastructure investments. Key players influencing the market include Allianz SE, recognized for comprehensive risk solutions, Lloyd’s of London, serving as a global underwriting hub, Tokio Marine Holdings, Inc., expanding across Asia-Pacific with tailored coverage, and Zurich Insurance Group, offering strong global marine insurance portfolios with emphasis on sustainability and digital solutions.

Market Insights

- The Marine Insurance Market was valued at USD 33.01 billion in 2024 and is expected to reach USD 46.58 billion by 2032, growing at a CAGR of 4.4%.

- Rising global trade volumes, shipping activity, and offshore energy projects drive steady demand for marine insurance policies.

- Market trends focus on digital platforms, predictive analytics, and InsurTech solutions that enhance claims management, transparency, and risk evaluation.

- Leading players such as Allianz SE, Lloyd’s of London, Zurich Insurance Group, Tokio Marine Holdings, Inc., and Swiss Re shape the competitive landscape with diversified marine portfolios and tailored risk solutions.

- High claims costs, climate-related uncertainties, and evolving international regulations act as restraints, making profitability and compliance key challenges for insurers.

- North America shows strong adoption with offshore projects and regulated shipping, Europe remains a global hub with London’s underwriting dominance, and Asia-Pacific records the fastest growth with high cargo volumes and busy shipping routes.

- The overall market outlook is positive as insurers align with sustainability goals, expand cyber risk coverage, and deliver flexible policies to meet the evolving needs of global maritime stakeholders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and Shipping Activities

The Marine Insurance Market grows with the steady rise in international trade and shipping volumes. Expanding seaborne commerce requires coverage for cargo, vessels, and logistics operations. It protects businesses against losses caused by accidents, piracy, and natural hazards during transit. Increased containerization and growth in bulk shipping reinforce the demand for reliable policies. Major shipping routes across Asia-Pacific and Europe highlight the importance of risk mitigation. The continuous expansion of maritime trade strengthens adoption across global markets.

- For instance, Allianz Commercial’s Safety and Shipping Review 2025 reported a record low of 27 large vessel losses globally in 2024, a significant decrease from over 200 annual losses in the 1990s. Of the 2024 losses, six were cargo vessels and 10 were fishing vessels.

Stringent Regulatory Frameworks and Compliance Needs

Government authorities and international bodies enforce strict maritime regulations to ensure safety and accountability. The Marine Insurance Market benefits from mandatory requirements that compel shipowners and cargo operators to secure adequate coverage. It ensures compliance with conventions such as SOLAS and MARPOL. Insurance providers adapt products to meet these evolving legal obligations. Shipping companies invest in comprehensive coverage to avoid penalties and disruptions. Strong regulatory frameworks encourage sustainable growth in the sector.

- For instance, AXA XL was included in the Poseidon Principles for Marine Insurance third annual disclosure report, published in February 2025, which covered 5.8% of the global Hull & Machinery portfolio across all signatories.

Growing Exposure to Natural Disasters and Climate Risks

Rising climate-related risks create greater reliance on marine insurance policies. The Marine Insurance Market addresses vulnerabilities linked to storms, floods, and unpredictable sea conditions. It provides financial protection against damage to vessels, ports, and cargoes. Increasing severity of weather patterns forces operators to adopt robust insurance solutions. Insurers develop products that account for environmental uncertainties and long-term climate impacts. This demand for climate risk management drives consistent policy uptake.

Expansion of Offshore Energy and Marine Infrastructure

The global rise in offshore oil, gas, and renewable energy projects drives insurance demand. The Marine Insurance Market supports coverage for offshore rigs, wind farms, and undersea infrastructure. It enables companies to safeguard high-value assets exposed to maritime risks. Growing investments in offshore exploration require specialized insurance offerings. Insurers tailor products to cover complex risks in construction and operations. The expansion of marine infrastructure underpins long-term market opportunities.

Market Trends

Adoption of Digital Platforms and InsurTech Solutions

The Marine Insurance Market is witnessing strong adoption of digital platforms and InsurTech innovations. Insurers deploy blockchain, AI, and data analytics to streamline claims management and risk assessment. It reduces paperwork, improves transparency, and accelerates policy issuance. Automated tools allow faster premium calculations and customized coverage options. Real-time monitoring of shipping operations enhances risk evaluation. This digital shift strengthens efficiency and customer experience across the sector.

- For instance, Tokio Marine piloted a blockchain-based marine cargo insurance certificate system that reduced certification issuance time by 85%, speeding up documentation processes for shippers.

Integration of Advanced Risk Modeling and Predictive Analytics

Growing complexity in global shipping requires advanced risk evaluation techniques. The Marine Insurance Market benefits from predictive analytics and simulation models that assess vessel performance and cargo exposure. It enables insurers to design policies tailored to specific shipping routes and cargo types. Satellite tracking and IoT data improve visibility into vessel operations. Insurers utilize these insights to optimize pricing and reduce claims disputes. The trend reflects a shift toward proactive risk management.

- For instance, marine insurers partnering with EY and Guardtime have deployed blockchain platforms, working with Microsoft’s Azure Blockchain team, to digitize contract data and reduce risk-related ambiguity during transit. This automated approach enhances accuracy and lowers exposure in underwriting.

Expansion of Specialized Coverage for Offshore Projects

Rising offshore energy and infrastructure activities create demand for niche insurance solutions. The Marine Insurance Market expands with policies covering offshore wind farms, oil rigs, and subsea assets. It supports investors by reducing financial risks linked to construction and operational hazards. Specialized underwriting teams develop products addressing complex marine environments. Growing renewable energy projects accelerate demand for tailored offshore coverage. This trend reinforces the market’s role in supporting global energy expansion.

Focus on Sustainability and Green Shipping Practices

Sustainability initiatives influence product design in marine insurance. The Marine Insurance Market aligns with the shipping industry’s decarbonization goals and green vessel investments. It encourages adoption of cleaner technologies by offering favorable policy terms for eco-friendly fleets. Insurers assess compliance with IMO 2030 and IMO 2050 emission targets. Coverage models reward operators investing in energy-efficient vessels. The trend highlights the alignment of insurance offerings with environmental responsibility.

Market Challenges Analysis

High Claims Costs and Complex Risk Assessment

The Marine Insurance Market faces challenges from rising claims costs linked to accidents, piracy, and cargo losses. Insurers struggle with complex risk assessment due to unpredictable weather conditions and geopolitical disruptions along major trade routes. It creates pressure on underwriting practices and premium pricing. High-value cargo and specialized vessels increase financial exposure for insurers. Disputes in claims settlements often delay compensation and reduce client satisfaction. Managing these risks demands advanced tools and strong industry collaboration.

Regulatory Uncertainty and Limited Profit Margins

Evolving international regulations and regional compliance standards complicate operations for insurers. The Marine Insurance Market requires continuous adaptation to frameworks such as IMO conventions and local maritime laws. It increases administrative costs and challenges profitability in competitive markets. Low premium rates and strong competition among providers further strain margins. Emerging risks such as cyberattacks on shipping systems add new layers of complexity. Maintaining compliance while delivering sustainable profitability remains a critical market challenge.

Market Opportunities

Growth Potential in Emerging Trade Routes and Developing Economies

The Marine Insurance Market presents significant opportunities with the rise of new trade corridors and expanding maritime activity in developing regions. Emerging economies in Asia-Pacific, Africa, and Latin America increase demand for cargo and hull coverage as shipping volumes rise. It supports businesses involved in bulk commodities, containerized goods, and energy transport. Expanding port infrastructure and foreign investments strengthen the need for comprehensive marine policies. Insurers offering flexible, region-specific products can capture growing market share. Developing economies provide a strong platform for long-term insurance growth.

Expansion of Digital Solutions and Cyber Risk Coverage

Rapid digitalization of shipping operations opens opportunities for insurers to introduce technology-driven products. The Marine Insurance Market benefits from demand for policies covering cyber threats, automated vessels, and IoT-enabled fleets. It enables operators to manage modern risks while ensuring compliance with global security standards. Blockchain and predictive analytics enhance claims processing and risk evaluation. Insurers offering integrated digital platforms improve transparency and customer trust. The expansion of digital services and specialized coverage strengthens the market’s future outlook.

Market Segmentation Analysis:

By Coverage

The Marine Insurance Market is segmented into cargo insurance, hull and machinery insurance, liability insurance, and offshore/energy insurance. Cargo insurance dominates due to the rising volume of global trade and the need to safeguard goods in transit. It protects shipments against risks such as theft, fire, collision, and natural hazards. Hull and machinery insurance supports shipowners by covering damage to vessels and onboard equipment. Liability insurance is gaining importance with increasing compliance requirements and risks of pollution, collisions, and crew-related liabilities. Offshore and energy insurance emerges as a vital segment, offering coverage for rigs, wind farms, and subsea operations. Each coverage type addresses distinct risks within maritime activities, making insurance solutions highly diversified.

- For instance, Allianz’s Safety and Shipping Review 2025 reported only 27 ship losses globally in 2024—of these, just 6 were cargo vessels and 10 were fishing vessels—highlighting insurers’ need to continuously tailor cargo and liability coverage based on vessel type and risk scenario.

By Policy

The Marine Insurance Market includes open cover policies, time policies, and voyage policies. Open cover policies are widely used by companies engaged in frequent shipping, offering continuous coverage for multiple consignments. It simplifies processes for exporters and logistics providers by reducing the need for repeated documentation. Time policies remain popular for shipowners, providing protection for vessels over a fixed period. Voyage policies serve cargo owners and operators seeking coverage for specific journeys, offering flexibility for irregular trade routes. Insurers balance these policies to meet varying customer needs across global shipping networks.

- For instance, Lloyd’s postponed its full digital transformation under Blueprint Two to 2028, extending the use of legacy systems in policy placement and claims processing through that year—highlighting how operational continuity shapes policy evolution.

By End User

The Marine Insurance Market serves end users including shipowners, cargo owners, and offshore energy companies. Shipowners rely on policies to protect vessels and manage operational risks. Cargo owners seek coverage to safeguard goods transported across volatile routes. Offshore energy companies demand specialized policies for rigs, pipelines, and renewable energy structures operating in harsh marine environments. It enables businesses to mitigate financial exposure and ensure operational continuity. Diverse end-user requirements push insurers to design tailored solutions that address unique risks in global maritime activities.

Segments:

Based on Coverage

- Transport/cargo

- Hull

- Offshore/energy

- Marine liability

Based on Policy

- Floating policy

- Voyage policy

- Blanket policy

- Others

Based on End User

- Shipping companies

- Ports and terminals

- Cargo owners

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% of the Marine Insurance Market in 2024, making it one of the leading regions. The region benefits from strong shipping activity along the U.S. East Coast, Gulf of Mexico, and Canadian trade routes. The presence of established insurers and underwriters ensures comprehensive coverage for both cargo and vessel operators. It gains further strength from high demand for offshore energy insurance, particularly in oil and gas exploration zones. Strict compliance with international maritime safety standards fuels the need for liability and pollution coverage. Growth is reinforced by digital adoption, where insurers introduce platforms that streamline claims and improve transparency.

Europe

Europe holds 30% of the Marine Insurance Market in 2024, supported by major maritime hubs such as the UK, Germany, Norway, and the Netherlands. London remains a global center for marine underwriting, attracting both domestic and international clients. The region benefits from strong port infrastructure and trade connectivity across the North Sea, Baltic Sea, and Mediterranean. It shows consistent demand for hull, cargo, and liability insurance due to dense shipping lanes and offshore energy projects. It also leads in sustainability initiatives, with insurers introducing green policies aligned with European Union decarbonization goals. Europe’s regulatory environment ensures robust oversight, strengthening trust in insurance solutions.

Asia-Pacific

Asia-Pacific represents 25% of the Marine Insurance Market in 2024, recording the fastest growth. China, Japan, South Korea, and India are key contributors, driven by massive cargo volumes and expanding port infrastructure. The region is home to some of the world’s busiest shipping routes, such as the Strait of Malacca and South China Sea, creating high demand for comprehensive coverage. It benefits from rising trade flows in manufactured goods, commodities, and energy resources. Governments across Asia-Pacific invest heavily in port modernization, fueling growth in cargo and liability insurance. Increasing offshore renewable projects, including wind farms in China and Japan, further support demand. The region’s strong role in global shipping ensures sustained insurance growth.

Latin America

Latin America accounts for 7% of the Marine Insurance Market in 2024, with Brazil, Mexico, and Chile driving adoption. The region depends heavily on shipping for agricultural exports, mining products, and oil shipments. It creates steady demand for cargo and hull insurance across Atlantic and Pacific trade routes. Offshore exploration projects, particularly in Brazil’s pre-salt oil fields, increase the requirement for specialized insurance. It also benefits from growing port investments and regional trade agreements that encourage shipping expansion. Limited local underwriting capacity often pushes international insurers to strengthen their presence in Latin America.

Middle East & Africa

The Middle East & Africa region captures 6% of the Marine Insurance Market in 2024, with the UAE, Saudi Arabia, and South Africa leading activity. Strategic shipping lanes, including the Suez Canal and Strait of Hormuz, elevate the importance of marine coverage. It shows demand for cargo insurance linked to oil and gas exports, as well as rising interest in liability policies. Offshore projects in the Gulf drive specialized insurance for rigs and energy infrastructure. Africa’s reliance on maritime trade for agricultural and mineral exports supports further adoption. Gradual port modernization and trade initiatives ensure long-term market opportunities in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tokio Marine Holdings, Inc.

- Zurich Insurance Group

- AXA XL

- Swiss Re

- Munich Re

- Allianz SE

- The Travelers Companies, Inc.

- Lloyd’s of London

- Chubb Limited

- American International Group, Inc. (AIG)

Competitive Analysis

The competitive landscape of the Marine Insurance Market is defined by leading players such as Allianz SE, American International Group, Inc. (AIG), AXA XL, Chubb Limited, Lloyd’s of London, Munich Re, Swiss Re, The Travelers Companies, Inc., Tokio Marine Holdings, Inc., and Zurich Insurance Group. These companies play a central role in shaping the global marine insurance sector by offering comprehensive coverage across cargo, hull, liability, and offshore energy risks. They focus on integrating digital platforms, predictive analytics, and blockchain technologies to enhance claims processing and improve transparency. Strategic investments in specialized products, including cyber risk coverage and green shipping initiatives, demonstrate their adaptability to evolving maritime needs. Many players expand global presence through partnerships with shipping companies, reinsurers, and port authorities, reinforcing customer trust. Competitive intensity remains strong as insurers balance regulatory compliance, profitability, and sustainability-driven offerings. Continuous innovation and diversified marine portfolios enable these companies to maintain leadership in a dynamic global market.

Recent Developments

- In June 2025, PRA, FCA, and Lloyd’s—agreed to streamline the managing agent authorization process, accelerating onboarding while maintaining standards—a key move impacting marine underwriting capabilities

- In March 2025, AIG’s Head of Marine Facultative Reinsurance, Francisco Campos, outlined evolving trends in facultative marine coverage. AIG offers cargo insurance covering Stock Throughput and Project Cargo including Delay in Start-Up, backed by a vast Latin American network across 36 territories.

- In 2025, Allianz Commercial released its Safety and Shipping Review 2025, highlighting that the number of vessels lost in 2024 reached a record low of 27 ships, down from 35 in the previous year and over 200 in the 1990s.

- In August 2024, AXA XL signed an underwriting agreement with U.S. Marine Insurance Group (US MIG) to expand its inland marine insurance offerings in logistics and supply chain sectors. The collaboration aims to provide flexible and tailored coverage for goods in transit and storage, addressing gaps left by standard policie

Report Coverage

The research report offers an in-depth analysis based on Coverage, Policy, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global shipping volumes and growing offshore energy projects.

- Digital platforms and InsurTech solutions will transform underwriting and claims management.

- Predictive analytics and AI will enhance risk modeling and pricing accuracy.

- Cyber risk coverage will become a core component of marine insurance offerings.

- Sustainability-focused policies will support green shipping and decarbonization initiatives.

- Emerging economies will drive growth with expanding port infrastructure and trade routes.

- Regulatory changes will push insurers to adapt quickly and offer compliant solutions.

- Reinsurers will play a larger role in managing large-scale climate-related risks.

- Partnerships with shipping firms and logistics companies will strengthen market penetration.

- Continuous product innovation will position marine insurance as a critical safeguard for global trade.