Market Overview

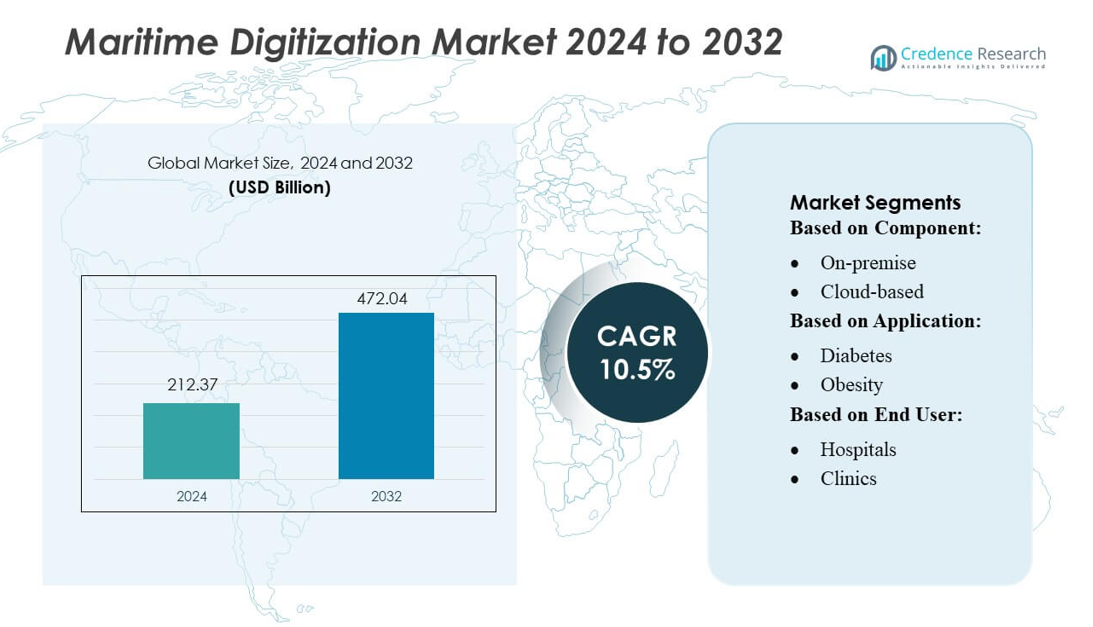

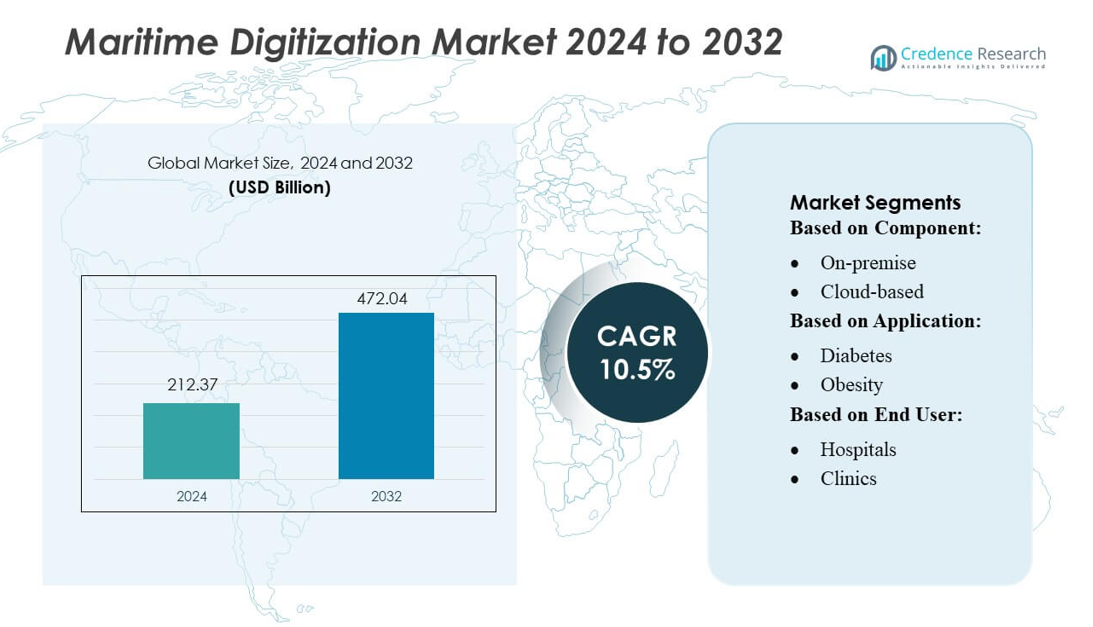

Maritime Digitization Market size was valued USD 212.37 billion in 2024 and is anticipated to reach USD 472.04 billion by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maritime Digitization Market Size 2024 |

USD 212.37 billion |

| Maritime Digitization Market, CAGR |

10.5% |

| Maritime Digitization Market Size 2032 |

USD 472.04 billion |

The Maritime Digitization Market is driven by a competitive mix of technology innovators, maritime solution specialists, and global IT service providers that collectively accelerate digital transformation across ports, fleets, and logistics operations. These top players focus on delivering integrated platforms powered by AI, IoT, cloud computing, and cybersecurity to enhance real-time decision-making, cargo visibility, and operational efficiency. Their strategic partnerships with port authorities and shipping companies further strengthen market penetration and solution scalability. North America leads the global market with a 34% share, supported by advanced digital infrastructure, strong investment in smart port modernization, and rapid adoption of data-driven maritime technologies.

Market Insights

- The Maritime Digitization Market reached USD 212.37 billion in 2024 and is projected to hit USD 472.04 billion by 2032, driven by a strong CAGR of 10.5%, reflecting rapid adoption of digital technologies across global maritime operations.

- Market growth is driven by increasing deployment of AI, IoT, cloud platforms, and cybersecurity solutions that enhance fleet efficiency, automate port operations, and improve cargo visibility across the logistics chain.

- Emerging trends include rising investments in digital twins, autonomous vessel technologies, predictive maintenance systems, and blockchain-enabled documentation to streamline maritime workflows and strengthen data accuracy.

- Competitive intensity increases as technology providers expand partnerships with port authorities and shipping operators, while market restraints include high implementation costs, legacy infrastructure limitations, and uneven digital readiness across developing regions.

- North America leads with a 34% share, Europe follows with strong regulatory-driven adoption, and Asia-Pacific grows rapidly with large port digitalization projects; fleet management solutions hold a dominant segment share due to high demand for optimization tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Software leads the maritime digitization market with over 45% share, driven by rapid adoption of cloud-based fleet management, predictive maintenance, and navigation optimization platforms. Cloud-based solutions dominate within software due to their scalability and lower deployment costs, enabling real-time vessel tracking, voyage analytics, and automated reporting. Hardware, including sensors and monitoring devices, continues to grow as ships integrate IoT-enabled equipment for engine performance, emissions tracking, and safety compliance. Services such as consulting and integration support complex system rollouts, but software remains the key value generator due to recurring subscription revenue.

- For instance, Happiest Minds supports more than 30 IoT customers through its platform, having deployed over 100 secure IoT devices in a global water-treatment client while integrating real-time telemetry and analytics.

By Application

Cardiovascular-related digital solutions hold the largest share at approximately 30%, propelled by rising demand for remote health monitoring of seafarers exposed to high-stress, long-duration voyages. Wearable health systems and AI-enabled diagnostics enable early detection of cardiac irregularities, reducing medical evacuations and operational downtime. Mental and behavioral health applications are expanding quickly as shipping companies prioritize crew well-being using digital therapy platforms and fatigue-monitoring tools. Solutions addressing diabetes, hypertension, and insomnia also gain traction, but cardiovascular monitoring remains dominant due to its strong influence on occupational safety standards and regulatory health compliance in maritime operations.

- For instance, Cisco’s HealthPresence solution has enabled physicians in Bangalore to identify heart lesions using its digital stethoscope, and its deployment increased the average number of patients seen per session by 90 patients compared to prior on-site care.

By End User

Healthcare providers account for the largest end-user share at around 40%, as maritime operators rely on specialized telemedicine partners and clinical networks for remote diagnostics, digital triage, and continuous crew health management. Hospitals and clinics play a crucial role by integrating shipboard data into electronic health systems for emergency response and medical decision support. Telehealth platforms are rapidly increasing adoption due to satellite-enabled connectivity improvements. Payers and patients contribute to demand for cost-efficient digital health services, but providers remain dominant because they manage the majority of clinical workflows, compliance requirements, and intervention protocols across fleets.

Key Growth Drivers

Rising Demand for Real-Time Vessel Monitoring

The maritime digitization market grows as operators increasingly adopt real-time vessel monitoring systems that enhance operational visibility, reduce fuel consumption, and support compliance with global emission standards. Advanced sensor networks, AIS-enabled tracking, and predictive analytics enable fleet managers to optimize routes and avoid unplanned downtime. The push for higher efficiency in deep-sea and coastal operations further accelerates investments in digital twins and automated reporting tools, making real-time monitoring a central driver of digital transformation across commercial and naval fleets.

- For instance, Google Cloud supports over 200,000 vessels in its Global Fishing Watch initiative, ingesting around 22 million AIS position messages daily, processing them with BigQuery so that researchers query five-year datasets in about 60 seconds.

Increasing Adoption of IoT and Automation Technologies

IoT-enabled platforms and automation solutions fuel market growth by streamlining maintenance, navigation, and cargo-handling processes. Maritime operators leverage smart sensors, machine-to-machine communication, and autonomous decision-making systems to achieve predictive maintenance, reduce manual inspection needs, and lower operational risks. Ports and shipping companies also integrate automated berth allocation, crane operations, and asset tracking to enhance throughput efficiency. The rising shift toward intelligent port ecosystems and partially autonomous vessels reinforces the demand for integrated modernization solutions, positioning IoT as a critical enabler of digital maritime operations.

- For instance, Broadcom recently introduced a third-generation co-packaged optics (CPO) technology capable of 200 G per lane, demonstrating advanced integration of optical I/O closer to network switches.

Strengthening Global Regulatory Push for Safety and Sustainability

Stringent international regulations from IMO, EU MRV, and environmental frameworks accelerate adoption of digital tools designed for emission monitoring, fuel optimization, and safety compliance. Maritime operators increasingly use digital dashboards, e-logbooks, and automated compliance platforms to track carbon intensity, verify reporting accuracy, and meet evolving sustainability mandates. The need for transparent documentation and data-driven governance strengthens investments in digitized crew management, cyber-secure communication systems, and safety automation. As regulatory requirements intensify across regions, compliance-driven modernization becomes a major driver of maritime digitization.

Key Trends & Opportunities

Expansion of AI-Driven Predictive Maintenance and Digital Twins

AI-powered predictive maintenance emerges as a major trend, offering operators the ability to reduce equipment failures and extend asset lifespan. Digital twin adoption accelerates as shipbuilders and fleet owners simulate vessel performance under varying sea conditions, enabling proactive maintenance scheduling and optimized fuel use. This trend presents opportunities for solution providers to integrate high-fidelity modeling, real-time sensor mapping, and advanced analytics into fleet operations. Growing acceptance of AI in decision support and risk forecasting positions digital twins as a transformative innovation across the maritime value chain.

- For instance, Adobe MAX 2025, Adobe showcased sessions on innovations in creative workflows, including how brands leverage 3D digital twins created with Substance 3D software.

Growth of Smart Ports and Autonomous Shipping Ecosystems

Smart port development creates new opportunities as terminals deploy automated cranes, intelligent traffic control, optical character recognition systems, and blockchain-enabled documentation tools. These technologies improve cargo throughput, reduce human error, and streamline vessel turnaround times. Autonomous ship trials—ranging from remote-controlled tugboats to AI-assisted navigation systems—further signal a shift toward hyper-connected maritime logistics. Companies investing in automation, robotics, and smart infrastructure stand to benefit from rising demand for resilience, transparency, and efficiency in global maritime trade.

- For instance, Dell Technologies powers PSA Singapore’s Tuas Port, where its multi-cloud foundation—built using VxRail hyperconverged nodes, Unity XT, and PowerScale storage—supports AI applications that predict vessel movements and detect congestion, enabling the port to scale handling capacity to 65 million TEUs by full build-out.

Increasing Use of Cybersecure Cloud Platforms and Data Integration

Maritime companies rapidly adopt cloud-based platforms to unify navigation data, crew information, cargo documentation, and engine performance analytics. Integrated data ecosystems improve decision-making, reduce communication delays, and enhance collaboration between ships and shore offices. With rising cyber threats targeting vessel control systems and port infrastructure, secure cloud environments and encryption-driven communication become priority investments. This trend creates strong opportunities for cybersecurity vendors, cloud platform providers, and maritime IT integrators offering resilient, scalable, and regulatory-compliant digital solutions.

Key Challenges

High Costs of Digital Transformation and Legacy Integration

The maritime sector faces substantial financial and operational challenges due to the high cost of digitizing older vessels and integrating new technologies with legacy control systems. Retrofitting ships with IoT sensors, AI modules, and cybersecure networks requires significant investment, often exceeding budget capacities for smaller operators. The lack of standardized architectures complicates system interoperability, leading to project delays and elevated maintenance costs. These barriers slow digital adoption across segments, especially in aging fleets with outdated navigation and propulsion systems.

Growing Cybersecurity Threats Across Maritime Operations

Cyberattacks targeting vessel navigation systems, port logistics platforms, and communication networks pose a major challenge for maritime digitization. Increased connectivity through IoT devices, cloud platforms, and satellite communication expands the threat surface, leaving critical systems vulnerable to malware, GPS spoofing, and ransomware attacks. Operators must invest heavily in continuous monitoring, encryption protocols, and security audits to protect operational integrity. However, uneven cybersecurity readiness across fleets and ports creates systemic risks, delaying the sector’s ability to achieve fully digital and autonomous maritime operations.

Regional Analysis

North America

North America holds the largest share of the Maritime Digitization Market at approximately 34%, driven by strong digital infrastructure, rapid adoption of AI-based fleet management systems, and strict regulatory requirements for maritime safety and emissions. The U.S. leads advancements in autonomous vessel technologies, cybersecurity solutions, and predictive maintenance platforms, supported by major port modernization programs across the East and West Coasts. Growing investments in smart port ecosystems and real-time cargo visibility tools enhance operational efficiency. Canada’s increasing focus on Arctic route optimization further accelerates adoption, solidifying the region’s leadership in digital maritime transformation.

Europe

Europe captures around 29% of the global market, supported by early digitalization initiatives led by Northern European ports and strong compliance with IMO environmental standards. Countries such as Norway, Denmark, and Germany accelerate deployment of automated port operations, digital twins, and advanced navigation analytics. The region’s decarbonization agenda stimulates investments in emissions-monitoring software and energy-efficient voyage planning systems. Collaborative R&D initiatives under the EU’s maritime innovation programs further drive integration of blockchain-based documentation and smart cargo routing tools. Europe’s strategic focus on enhancing port resilience and reducing logistics bottlenecks strengthens its competitive position in maritime digitization.

Asia-Pacific

Asia-Pacific accounts for approximately 27% of the market, expanding rapidly due to the dominance of China, Japan, Singapore, and South Korea in global shipping and shipbuilding activities. High-volume port operations fuel demand for automated cranes, IoT-enabled tracking systems, and 5G-powered logistics networks. China’s strong investment in smart port infrastructure and South Korea’s leadership in digital shipbuilding technologies accelerate adoption across the region. Meanwhile, Singapore positions itself as a hub for maritime AI innovation and vessel traffic management solutions. Growing e-commerce trade flows, rising port congestion, and government-backed digital maritime initiatives continue to strengthen Asia-Pacific’s upward momentum.

Latin America

Latin America holds about 4% of the market, with digitalization progressing steadily across major ports in Brazil, Mexico, and Chile. Regional stakeholders increasingly integrate vessel monitoring systems, electronic documentation, and terminal automation tools to reduce operational delays and improve cargo visibility. Government-led port modernization programs and private-sector investments support enhanced digital workflows, particularly in containerized shipping. However, infrastructure gaps and limited technology standardization slow broader adoption. Despite challenges, rising trade volumes, expanding intermodal logistics networks, and growing interest in predictive maintenance and cybersecurity solutions position Latin America for gradual but consistent digital transformation.

Middle East & Africa

The Middle East & Africa region contributes around 6% of the global share, supported by growing smart port investments in the UAE, Saudi Arabia, and South Africa. Major ports—including Jebel Ali and King Abdulaziz Port—actively deploy digital cargo-handling systems, automated gate solutions, and integrated terminal operating platforms to increase throughput. Regional governments prioritize maritime digitalization to strengthen trade competitiveness and diversify economic activity beyond oil. Africa’s adoption remains gradual but gains traction through modernization initiatives in key ports such as Durban and Lagos. Expansion of maritime corridor projects and supply-chain digital platforms further enhances the region’s growth.

Market Segmentations:

By Component:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Maritime Digitization Market remains highly competitive, with Happiest Minds, Cisco Systems, Inc., Accenture plc, Dempton Consulting Group, Google Inc., Broadcom, Inc., Adobe Systems Inc., Dell EMC, Hewlett Packard Enterprise Co., and IBM. The Maritime Digitization Market continues to expand rapidly as stakeholders prioritize automation, data intelligence, and integrated operational systems to enhance efficiency and competitiveness. Companies across the value chain increasingly invest in cloud-based fleet management platforms, advanced analytics, IoT-enabled monitoring, and AI-driven route optimization tools to reduce operational costs and improve decision-making. Ports worldwide accelerate adoption of smart infrastructure, including automated terminals, digital documentation systems, and real-time cargo visibility platforms, to streamline workflows and reduce delays. Growing regulatory focus on emissions transparency and safety compliance further drives demand for digital reporting and predictive maintenance solutions. As digital maturity rises, maritime operators seek scalable, interoperable technologies that modernize legacy systems and strengthen end-to-end supply chain performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, MWC Barcelona 2025, Zambia’s Ministry of Technology and Science partnered with Huawei to unveil the global exhibit of Zambia’s smart village during the government industry forum named Secured, Sovereign & Synergized Network-Cloud Strategy Accelerating National Digitalization.

- In April 2024, Happiest Minds acquired PureSoftware Technologies Private Limited, enhancing its expertise in the Banking, Financial Services, and Insurance (BFSI) sector, as well as Healthcare and Life Sciences.

- In January 2024, Google LLC partnered with Worldline in order to boost its digital transformation initiatives and streamline its operations. Worldline will use Google’s cloud-based technologies to enhance its digital payment for customers across Europe.

- In January 2024, Microsoft signed a 10-year partnership agreement with Vodafone to enhance their customer experience services using generative AI technologies from Microsoft. The companies will develop financial and digital services for SMEs across Africa and Europe

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate adoption of AI-driven fleet optimization and automated navigation systems.

- Ports will expand smart infrastructure investments to improve cargo visibility and operational throughput.

- Real-time data platforms will strengthen collaboration across shipping, logistics, and port stakeholders.

- Predictive maintenance technologies will gain broader use to reduce downtime and enhance vessel reliability.

- Digital twins will become a standard tool for port planning, asset monitoring, and operational simulation.

- Cybersecurity solutions will grow in importance as digital connectivity increases across maritime networks.

- Cloud-based vessel and cargo management systems will support scalable, integrated digital operations.

- Compliance-driven digital reporting tools will expand as environmental and safety regulations tighten.

- Autonomous and remotely operated vessels will progress toward commercial deployment.

- Blockchain-enabled documentation systems will reduce paperwork, shorten turnaround times, and enhance transparency.