Market Overview

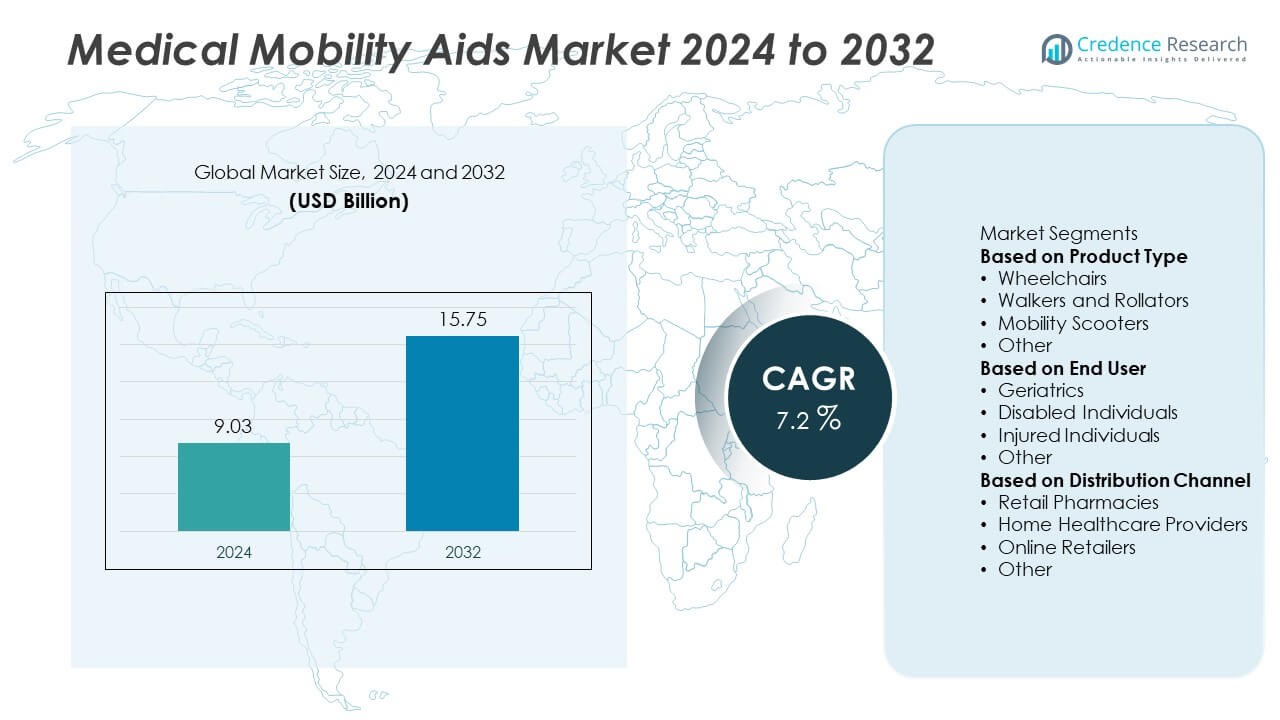

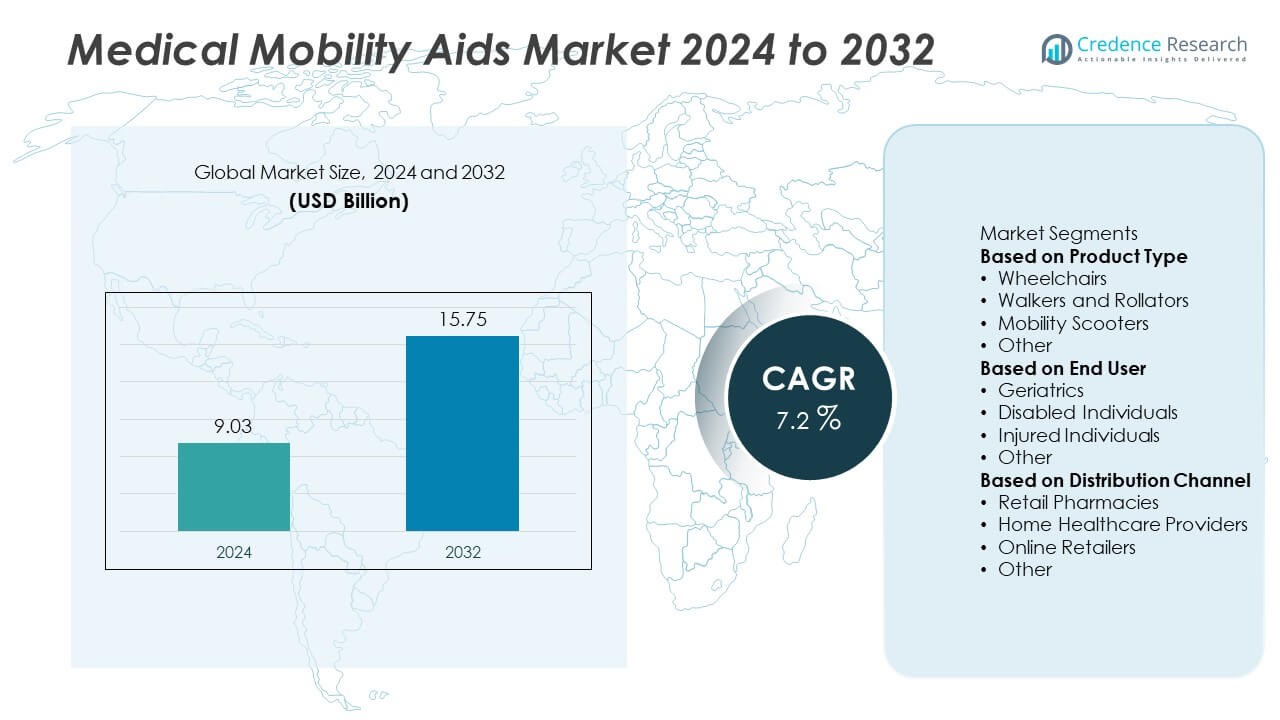

The Medical Mobility Aids Market was valued at USD 9.03 billion in 2024 and is projected to reach USD 15.75 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Mobility Aids Market Size 2024 |

USD 9.03 Billion |

| Medical Mobility Aids Market, CAGR |

7.2% |

| Medical Mobility Aids Market Size 2032 |

USD 15.75 Billion |

The Medical Mobility Aids Market grows with rising geriatric population, higher incidence of mobility disorders, and increasing post-surgical rehabilitation needs. Demand strengthens as hospitals, rehabilitation centers, and homecare providers adopt advanced wheelchairs, walkers, and scooters to improve patient independence.

Asia-Pacific leads the Medical Mobility Aids Market due to its large aging population, rising awareness of rehabilitation care, and government initiatives supporting affordable assistive devices. China, India, and Japan show strong adoption of wheelchairs, walkers, and scooters in hospitals and homecare settings. North America follows with high demand driven by advanced healthcare infrastructure, strong insurance coverage, and early adoption of power-assisted wheelchairs and mobility scooters. Europe shows steady growth supported by disability inclusion programs and preference for ergonomic and lightweight mobility aids. Latin America and Middle East & Africa are emerging markets with improving distribution networks and growing public health investments. Key players driving the market include Quantum Rehab, Ottobock, Drive DeVilbiss Healthcare, and Sunrise Medical, which focus on product innovation, expanding manufacturing capacity, and strategic partnerships with healthcare providers to strengthen their presence across both developed and developing markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Mobility Aids Market was valued at USD 9.03 billion in 2024 and is projected to reach USD 15.75 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

- Growth is driven by rising geriatric population, increasing prevalence of chronic diseases, and higher demand for assistive devices that improve independence and mobility.

- Trends highlight adoption of electric wheelchairs, mobility scooters, and foldable lightweight devices with ergonomic designs to improve patient comfort and usability.

- Competitive landscape includes key players such as Quantum Rehab, Ottobock, Drive DeVilbiss Healthcare, Sunrise Medical, and Permobil, focusing on innovation, R&D investment, and global distribution expansion.

- Market restraints include high cost of advanced mobility solutions, limited affordability in developing regions, and infrastructure gaps such as lack of ramps and barrier-free facilities.

- Asia-Pacific leads growth with rising healthcare access and government-backed disability programs, while North America and Europe remain strong markets due to advanced infrastructure and insurance coverage.

- Latin America and Middle East & Africa are emerging regions showing potential with expanding distribution networks, public health initiatives, and growing awareness of rehabilitation and mobility support solutions.

Market Drivers

Rising Geriatric Population and Age-Related Mobility Challenges

The Medical Mobility Aids Market grows with a rapidly expanding elderly population worldwide. Aging individuals face higher risks of arthritis, osteoporosis, and post-surgical immobility, creating consistent demand for walking aids, wheelchairs, and scooters. It supports independence and reduces caregiver burden, making mobility solutions essential for daily living. Longer life expectancy increases the number of patients requiring assistive devices for extended periods. Healthcare systems promote early adoption to improve quality of life and prevent fall-related injuries. It positions mobility aids as a crucial part of geriatric care strategies.

- For instance, Pride Mobility launched the Go Go Super Portable scooter weighing 41.6 lbs without battery and supporting 300 lbs capacity, designed for seniors needing easy transport solutions.

Increasing Incidence of Disability and Chronic Conditions

Chronic conditions such as stroke, spinal cord injuries, and multiple sclerosis drive steady demand for mobility support. The Medical Mobility Aids Market benefits from higher diagnosis rates and improved access to rehabilitation services. It plays a vital role in patient recovery and long-term care management. Growing awareness of assistive technologies encourages families and caregivers to invest in advanced solutions. Rising accident-related injuries further fuel demand for wheelchairs, crutches, and walkers. It ensures patients regain mobility faster and maintain functional independence.

- For instance, Ottobock launched the Taleo Adapt hydraulic ankle foot prosthetic in late 2024. The device, which supports rehabilitation for amputees, features a hydraulic ankle joint with customizable resistance levels to help users adapt to uneven terrains.

Technological Advancements and Product Innovation

Manufacturers focus on lightweight materials, foldable frames, and smart mobility features to improve user comfort. The Medical Mobility Aids Market sees adoption of power-assisted wheelchairs, stair lifts, and connected devices with tracking features. It enables patients to move independently while reducing physical strain. Integration of IoT and ergonomic design enhances usability and safety. Hospitals and home care providers prefer devices with better durability and lower maintenance requirements. It drives competition among players to launch innovative, patient-friendly solutions.

Government Initiatives and Supportive Healthcare Policies

Public programs offer subsidies and insurance coverage for mobility devices, encouraging adoption. The Medical Mobility Aids Market gains from disability benefits and tax incentives that make devices affordable. It benefits from regulations mandating accessibility in public infrastructure and healthcare facilities. Awareness campaigns promote early mobility aid use to prevent secondary health complications. Non-profit organizations distribute low-cost aids in underserved regions, expanding reach. It strengthens market penetration and supports long-term industry growth.

Market Trends

Growing Demand for Electric and Smart Mobility Solutions

The Medical Mobility Aids Market witnesses rising adoption of electric wheelchairs, scooters, and automated lifts. Users prefer power-driven devices for ease of movement and minimal physical effort. It supports greater independence for elderly and disabled patients in home and community settings. Integration of battery technology and compact motors enhances product performance and range. Smart mobility aids with joystick controls and remote operation are gaining popularity. It expands opportunities for manufacturers to target tech-savvy and urban customers.

- For instance, Quantum Rehab’s Edge 3 Stretto power chair includes iLevel® technology allowing seat elevation up to 12 inches, which can be operated at a reduced speed of up to 3.5 mph. This feature enhances user independence in daily tasks by enabling tasks such as reaching and interacting at eye level.

Shift Toward Lightweight and Ergonomic Designs

Manufacturers invest in lightweight materials such as aluminum and carbon fiber to improve usability. The Medical Mobility Aids Market benefits from foldable and portable devices that suit small living spaces and travel needs. It enables patients to handle devices independently without assistance. Ergonomic design reduces strain and prevents long-term discomfort for users. Adjustable height features and customizable seating add value for patients with specific medical needs. It aligns with consumer preference for comfort and convenience.

- For instance, Sunrise Medical introduced the QUICKIE Nitrum wheelchair, weighing as little as 7.5 kg, with an aerospace-grade aluminum frame and an adjustable backrest, enabling efficient propulsion and independent handling.

Rising Home Healthcare Adoption

Growing preference for home-based rehabilitation drives demand for mobility aids designed for personal use. The Medical Mobility Aids Market benefits from products that support recovery outside hospital environments. It encourages patients to continue physiotherapy routines and maintain mobility. Manufacturers offer compact walkers, wheelchairs, and stair lifts suitable for residential spaces. Increasing healthcare costs motivate patients to shift toward home care solutions. It creates a steady market for affordable and easy-to-use devices.

Integration of Digital Monitoring and Telehealth Support

Digital connectivity is becoming a key feature in advanced mobility aids. The Medical Mobility Aids Market sees integration of sensors to track usage, posture, and patient activity. It allows healthcare professionals to monitor patient progress remotely. Data-driven insights improve therapy plans and device adjustments. Telehealth platforms link patients to caregivers for real-time support. It strengthens the value proposition of high-tech mobility solutions and supports better clinical outcomes.

Market Challenges Analysis

High Cost and Limited Affordability in Developing Regions

The Medical Mobility Aids Market faces challenges due to the high cost of advanced devices such as powered wheelchairs and mobility scooters. Many patients in low- and middle-income countries cannot afford these solutions, limiting adoption. It struggles to penetrate price-sensitive markets where healthcare reimbursement is weak or absent. Import duties and high logistics costs further increase retail prices, making mobility aids inaccessible to a large population. Limited availability of low-cost alternatives slows overall market expansion. It requires strategic pricing models and local manufacturing to improve affordability and reach.

Infrastructure Gaps and Low Awareness Levels

Lack of accessible infrastructure such as ramps, elevators, and barrier-free public spaces limits effective use of mobility aids. The Medical Mobility Aids Market is impacted by insufficient awareness about available solutions among patients and caregivers. It leads to underutilization of devices that could improve quality of life. In rural regions, distribution networks remain underdeveloped, causing delays in product availability. Healthcare professionals may also have limited training on prescribing or fitting mobility aids. It calls for educational initiatives, better infrastructure planning, and stronger supply chains to maximize market potential.

Market Opportunities

Rising Demand in Emerging Economies and Home Healthcare

The Medical Mobility Aids Market holds strong opportunities in emerging economies where aging populations and healthcare access are improving. Growing middle-class income levels create demand for affordable wheelchairs, walkers, and scooters. It benefits from government programs that support disability care and public health initiatives. Expansion of home healthcare services boosts sales of compact and easy-to-use devices. Manufacturers introducing low-cost, durable solutions can capture significant share in these price-sensitive regions. It helps bridge the gap between demand and accessibility for underserved populations.

Innovation in Smart and Connected Mobility Devices

Technological innovation offers opportunities for premium product development and differentiation. The Medical Mobility Aids Market can leverage IoT integration, telehealth connectivity, and AI-driven assistance to attract advanced healthcare providers. It enables remote monitoring and personalized care plans for patients. Companies investing in lightweight materials and customizable solutions will appeal to users seeking comfort and independence. Growing adoption of digital health ecosystems supports demand for data-enabled mobility aids. It positions manufacturers to serve both clinical and consumer segments with high-value offerings.

Market Segmentation Analysis:

By Product Type

The Medical Mobility Aids Market is segmented into wheelchairs, mobility scooters, walkers and rollators, canes and crutches, and stair lifts. Wheelchairs dominate demand due to their use in hospitals, rehabilitation centers, and homecare settings for patients with temporary or permanent disabilities. It includes both manual and powered variants, with powered wheelchairs showing faster growth driven by preference for independent movement. Mobility scooters appeal to elderly users seeking outdoor mobility and ease of use. Walkers and rollators are popular among post-surgical patients and individuals with partial mobility challenges. Canes and crutches remain cost-effective solutions for short-term rehabilitation needs, while stair lifts are increasingly adopted in residential settings for enhanced safety.

- For instance, Pride Mobility’s Baja Raptor 2 scooter, released in 2023, is one of its faster models, with the 3-wheel version reaching a top speed of up to 22.5 km/h (14 mph). Its maximum travel range is dependent on the model and rider weight, with the 3-wheel model achieving up to 49.5 km (31 miles) under ideal conditions, such as a 100 kg (220 lbs) rider, while the range is shorter for heavier users or higher speeds. This enhances outdoor mobility for seniors.

By End User

End users of medical mobility aids include hospitals, rehabilitation centers, homecare settings, and elderly care facilities. The Medical Mobility Aids Market sees highest demand from hospitals, which require large inventories of wheelchairs and walkers for patient transport and recovery support. Rehabilitation centers focus on customized devices that enhance physical therapy outcomes and accelerate recovery. It records steady growth in homecare settings, where patients prefer personal devices that promote independence. Elderly care facilities adopt advanced mobility solutions such as power scooters and lift chairs to improve resident quality of life. Rising geriatric population drives steady expansion across all end-user categories.

- For instance, Drive DeVilbiss Healthcare expanded its homecare range with the Titan AXS mid-wheel drive powerchair, which offers a 136 kg (300 lbs) weight capacity and an advertised range of up to 19 miles (approximately 30 km) per charge.

By Distribution Channel

Distribution of medical mobility aids is segmented into offline retail, hospital supply stores, and online platforms. The Medical Mobility Aids Market benefits from strong offline presence, allowing patients and caregivers to physically test and select devices. It experiences growing traction in online channels, where buyers compare features, prices, and access home delivery services. Hospital supply chains remain critical for bulk procurement and institutional demand fulfillment. Specialty medical equipment stores offer expert fitting and after-sales service, building trust among customers. Rising e-commerce adoption enables manufacturers to reach wider audiences, including patients in remote and underserved locations.

Segments:

Based on Product Type

- Wheelchairs

- Walkers and Rollators

- Mobility Scooters

- Other

Based on End User

- Geriatrics

- Disabled Individuals

- Injured Individuals

- Other

Based on Distribution Channel

- Retail Pharmacies

- Home Healthcare Providers

- Online Retailers

- Other

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 38% market share in the Medical Mobility Aids Market, driven by advanced healthcare infrastructure and high adoption of assistive devices. The U.S. leads demand, supported by a large geriatric population and strong insurance coverage for mobility products. It benefits from a well-established network of rehabilitation centers and homecare services that promote use of wheelchairs, walkers, and scooters. Technological innovation from leading manufacturers ensures availability of smart and power-driven devices that enhance patient independence. Growing prevalence of obesity and chronic diseases also fuels need for mobility aids across hospitals and long-term care facilities. It continues to dominate global sales due to high awareness, favorable reimbursement policies, and a strong focus on patient-centric care.

Europe

Europe accounts for 27% market share and shows steady growth fueled by government-backed disability programs and aging demographics. Countries such as Germany, the U.K., and France lead adoption of powered wheelchairs and rollators for both home and institutional use. The Medical Mobility Aids Market benefits from EU initiatives promoting accessibility and equal mobility rights for disabled individuals. It records rising demand for ergonomic and lightweight devices suited for urban environments. Healthcare providers invest in rehabilitation infrastructure and assistive technology training, boosting market penetration. Rising popularity of homecare services and outpatient rehabilitation continues to strengthen demand across the region.

Asia-Pacific

Asia-Pacific holds 22% market share and is the fastest-growing regional market, supported by a large aging population and expanding healthcare access. China, Japan, and India drive significant demand for wheelchairs, canes, and crutches used in hospitals and homecare settings. The Medical Mobility Aids Market gains from increasing awareness of rehabilitation and post-operative care in urban areas. It benefits from government schemes offering subsidies for disability support products and local manufacturing initiatives that reduce costs. Adoption of affordable, durable devices supports penetration in rural regions. Rapid urbanization and rising middle-class income levels are expected to accelerate demand further in the coming years.

Latin America

Latin America represents 8% market share, with Brazil and Mexico leading consumption. The Medical Mobility Aids Market grows as public health systems expand disability support services and provide low-cost devices to patients. It records rising demand in private healthcare facilities where patients seek high-quality and customized mobility solutions. Distribution networks are improving, making wheelchairs and walkers more accessible in secondary cities. Increasing awareness campaigns promote early adoption to prevent fall-related injuries among elderly populations. Economic development and expanding medical insurance coverage support steady regional growth.

Middle East & Africa

Middle East & Africa hold 5% market share, with demand concentrated in Gulf countries and South Africa. The Medical Mobility Aids Market benefits from government investment in healthcare infrastructure and disability inclusion programs. It faces challenges of limited accessibility in remote areas but shows growth potential with rising urbanization. Importers and distributors collaborate with global manufacturers to provide affordable options for patients. Awareness campaigns and NGO-led initiatives help supply mobility aids to underserved populations. Rising healthcare spending and focus on rehabilitation services are expected to create new opportunities for market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Medical Mobility Aids Market features leading players such as Quantum Rehab, Ottobock, Drive DeVilbiss Healthcare, Sunrise Medical, Merits Health Products, Invacare, Karma Medical Products, Permobil, Pride Mobility, and Stryker. These companies focus on developing advanced mobility solutions including powered wheelchairs, mobility scooters, and ergonomic walkers that enhance patient independence and comfort. They invest heavily in research and development to introduce lightweight materials, smart controls, and connected devices that integrate with telehealth platforms. Strategic partnerships with hospitals, rehabilitation centers, and distributors strengthen market reach and ensure reliable supply. Many players expand their manufacturing facilities and product portfolios to meet rising global demand, especially in aging populations. Marketing efforts highlight improved usability, safety, and long-term cost efficiency to attract healthcare providers and end users. Continuous innovation, combined with mergers and acquisitions, allows these companies to maintain competitive advantage and address diverse patient needs across regions.

Recent Developments

- In August 2025, Permobil / Max Mobility issued an expanded recall of the SpeedControl Dial used in its SmartDrive MX2+ power assist device. The recall covers units manufactured between April 25, 2022 and July 8, 2025.

- In June 2025, Drive DeVilbiss Healthcare acquired De Oro Devices, maker of the NexStride® gait-cueing device. The device attaches to walking tools and delivers both visual and auditory cues to help reduce fall risk in people with Parkinson’s disease and related disorders.

- In May 2024, Pride Mobility launched the Go Go Super Portable scooter and the Jazzy Ultra Light power wheelchair. The Go Go Super Portable weighs 41.6 lbs without its lithium battery, folds to 12 inches high, and is rated for a 300-lb capacity / 10-mile range. The Jazzy Ultra Light weighs 33 lbs without battery.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mobility aids will grow with the aging global population and rising disability cases.

- Electric wheelchairs and mobility scooters will see higher adoption for independent living.

- Lightweight and foldable designs will gain popularity for homecare and travel use.

- Integration of IoT and smart monitoring features will become standard in advanced devices.

- Home healthcare expansion will create strong opportunities for compact and easy-to-use products.

- Manufacturers will invest in local production to reduce costs and improve accessibility in emerging markets.

- Strategic collaborations with hospitals and rehab centers will strengthen product penetration.

- Insurance coverage and government programs will boost adoption in price-sensitive regions.

- R&D efforts will focus on ergonomic designs and energy-efficient power systems.

- Digital health platforms will support remote monitoring and improve patient engagement with mobility solutions.