Market Overview

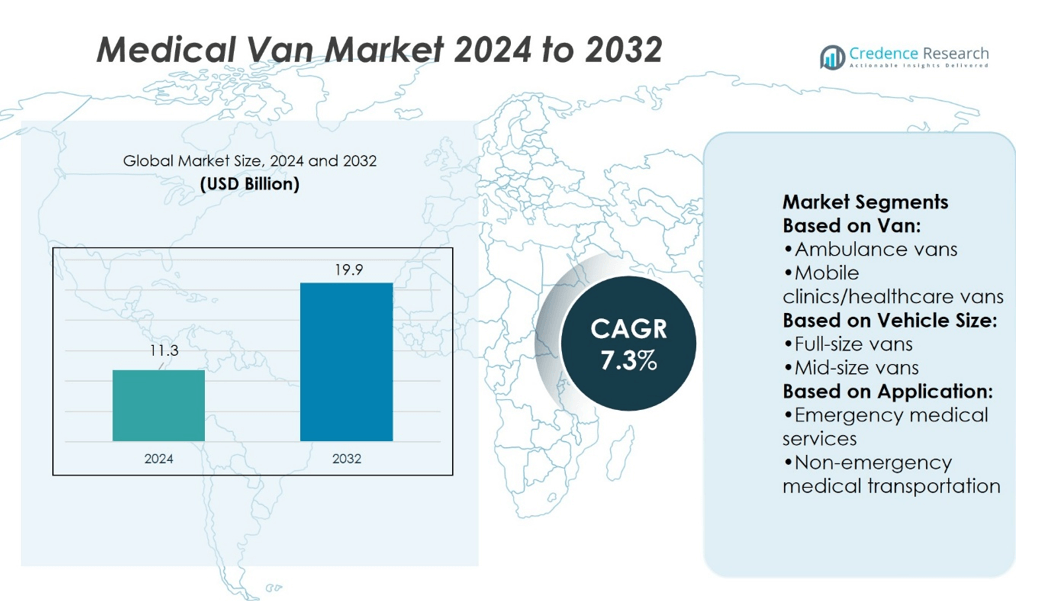

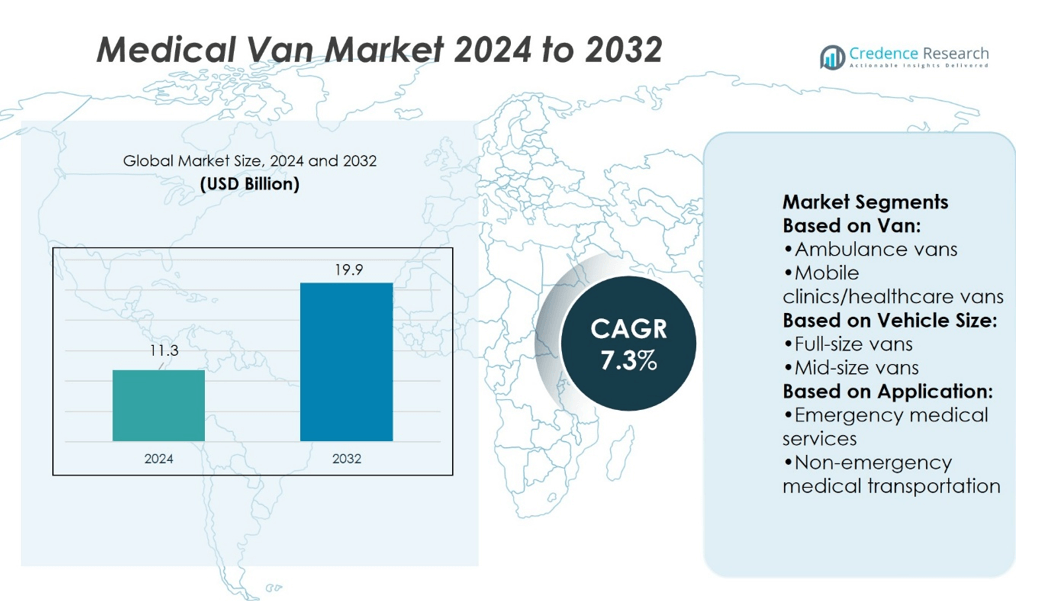

Medical Van Market size was valued at USD 11.3 billion in 2024 and is anticipated to reach USD 19.9 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Van Market Size 2024 |

USD 11.3 billion |

| Medical Van Market, CAGR |

7.3% |

| Medical Van Market Size 2032 |

USD 19.9 billion |

The Medical Van Market grows with rising demand for accessible healthcare in underserved regions and the increasing need for mobile emergency response solutions. Governments and healthcare providers deploy vans to expand preventive programs, vaccination drives, and chronic disease management. Integration of telemedicine, digital diagnostics, and portable medical equipment strengthens service efficiency and patient outcomes. Sustainability also influences market growth, with electric and hybrid vans gaining adoption to reduce operational costs and meet environmental goals. Strong support from public health initiatives and private investments ensures continuous expansion, positioning medical vans as a critical component of modern healthcare delivery systems.

North America holds the largest share of the Medical Van Market, driven by advanced healthcare infrastructure and strong adoption of mobile emergency services. Europe follows with significant demand for preventive care and specialized medical vans, while Asia-Pacific emerges as the fastest-growing region due to expanding healthcare access programs. Latin America and the Middle East & Africa show steady but smaller contributions. Key players focus on technology integration, sustainability, and modular designs to strengthen their competitive position and meet evolving healthcare needs.

Market Insights

- Medical Van Market size was valued at USD 11.3 billion in 2024 and is projected to reach USD 19.9 billion by 2032, growing at a CAGR of 7.3%.

- Rising demand for mobile healthcare access in underserved and rural regions drives consistent growth.

- Integration of telemedicine, digital diagnostics, and portable equipment defines key market trends.

- Competition focuses on innovation, modular van designs, and adoption of sustainable technologies.

- High operational costs, infrastructure gaps, and workforce shortages act as major restraints.

- North America leads the market, followed by Europe with strong preventive care demand.

- Asia-Pacific grows fastest, while Latin America and Middle East & Africa contribute smaller but expanding shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Mobile Healthcare Access

The Medical Van Market expands with the growing need for accessible healthcare in underserved areas. It addresses rural and semi-urban populations where hospital infrastructure remains limited. Governments and private providers adopt vans to bridge treatment gaps and deliver preventive services. Mobile clinics help manage chronic diseases, vaccinations, and maternal care. The increasing global focus on universal healthcare drives adoption. It ensures critical health services reach populations otherwise excluded from conventional systems. This shift strengthens demand across both developed and emerging economies.

- For instance, Malley Industries’ RAM ProMaster-based Crossover ambulances offer 72 inches of headroom, 43-inch aisle width, and 63-inch cabinet-to-wall span. Confirmed by Malley’s distributor, Southeastern Specialty Vehicles.

Increasing Focus on Emergency and Disaster Response

Medical vans play a critical role in emergency response and disaster relief. They provide immediate access to treatment where hospitals are damaged or unreachable. Rising climate-related disasters and humanitarian crises heighten the need for mobile medical units. The Medical Van Market benefits from government investments in disaster preparedness programs. It enhances healthcare resilience by supporting rapid deployment during emergencies. Non-governmental organizations and aid agencies also rely heavily on mobile vans. This dependency boosts consistent demand from humanitarian and relief sectors.

- For instance, Leader Emergency Vehicles produced a Ford E-Series E-450 Type III critical care ambulance featuring a 6.8 L V10 engine rated at 305 hp, 14,500 lb GVWR, a 158-inch wheelbase, a 55-gallon fuel tank, and a 225-amp alternator.

Technological Integration Driving Service Efficiency

Integration of advanced technologies significantly boosts the capabilities of medical vans. Digital diagnostics, telemedicine, and portable imaging systems expand treatment capacity. Healthcare providers deploy these units to deliver specialized care such as cardiology or radiology. The Medical Van Market grows as digital platforms improve patient data handling and continuity of care. It improves patient outcomes by linking remote consultations with urban specialists. Adoption of renewable energy systems and mobile connectivity strengthens sustainability and reliability. These improvements align with global digital health initiatives.

Government Support and Public Health Programs

National health policies increasingly promote mobile healthcare to widen service coverage. Subsidies, grants, and partnerships stimulate investments in modern fleets. The Medical Van Market benefits from large-scale public health campaigns such as vaccination drives. It plays a crucial role in tuberculosis, HIV, and COVID-19 outreach programs. Governments in Asia, Africa, and Latin America prioritize mobile units for rural care delivery. Public-private collaborations further accelerate market penetration. Growing policy support ensures stable long-term growth for mobile healthcare solutions.

Market Trends

Expansion of Telemedicine and Digital Health in Mobile Units

The Medical Van Market advances with integration of telemedicine platforms into mobile healthcare units. It enables remote consultations, real-time diagnostics, and efficient follow-up care. Patients in rural and underserved regions benefit from access to specialists without long travel. Healthcare providers adopt digital health records to streamline treatment and improve accuracy. Growing reliance on wireless connectivity and cloud systems enhances patient management. This trend strengthens mobile care delivery, making medical vans critical for digital health expansion.

- For instance, the Mercedes-Benz Sprinter used in mobile clinics offers a factory-installed MBUX multimedia system with a 10.25-inch touchscreen that supports smartphone integration via Apple CarPlay or Android Auto, enabling telehealth app access and video consultations directly on-screen.

Rising Adoption of Specialized Mobile Clinics

Mobile healthcare is shifting from general-purpose services toward specialized medical vans. The Medical Van Market reflects this trend with units designed for oncology, dental, ophthalmology, and dialysis care. It creates opportunities for targeted treatments in areas lacking specialty clinics. Demand for mobile diagnostic labs and imaging vans also rises steadily. Healthcare providers value specialized vans for outreach and screening campaigns. This diversification expands the market beyond primary care and boosts clinical efficiency.

- For instance, REV Fire Group introduced the Vector™, a fully electric fire truck featuring 316 kWh of automotive-grade batteries—this innovation reflects REV’s ability to scale high-capacity mobile systems with electrical energy storage suited for specialized mobile clinics.

Integration of Sustainable and Energy-Efficient Technologies

Sustainability drives innovation in medical vans, with manufacturers focusing on energy-efficient designs. The Medical Van Market benefits from integration of solar panels, electric drivetrains, and lightweight materials. It reduces operating costs while meeting environmental regulations. Health organizations adopt greener fleets to align with carbon-reduction targets. This trend also attracts government funding and corporate social responsibility investments. Growing focus on sustainability shapes long-term development of mobile healthcare solutions worldwide.

Increasing Role in Public Health and Preventive Care

Medical vans play a larger role in preventive healthcare programs. The Medical Van Market grows with expansion of vaccination drives, health screenings, and maternal care services. It supports national strategies aimed at reducing disease burden and improving early detection. Mobile units provide effective outreach in hard-to-reach communities. Healthcare systems prioritize preventive programs to lower long-term treatment costs. This trend positions medical vans as essential tools for sustainable population health management.

Market Challenges Analysis

High Operational Costs and Infrastructure Limitations

The Medical Van Market faces challenges linked to high operational expenses and infrastructure gaps. It requires significant investment in fuel, maintenance, and medical equipment. Rural areas often lack proper road networks, which delays service delivery and reduces efficiency. Healthcare providers struggle to maintain consistent supply chains for essential medicines in remote regions. Limited access to reliable electricity and clean water further complicates daily operations. These hurdles restrict the scalability of mobile healthcare services. Managing operational costs while maintaining quality remains a critical barrier for long-term growth.

Workforce Shortages and Regulatory Complexities

A shortage of skilled healthcare professionals presents another major challenge for the Medical Van Market. It depends on trained doctors, nurses, and technicians willing to serve in mobile environments. Retaining staff in demanding conditions often proves difficult for providers. Regulatory barriers also complicate deployment, with differing safety, licensing, and compliance requirements across regions. Mobile healthcare units must meet strict standards for medical waste management and patient safety. Complex rules often delay approval processes and slow adoption. Workforce limitations combined with regulatory complexity hinder the broader expansion of mobile medical services.

Market Opportunities

Growing Demand for Rural Healthcare and Preventive Services

The Medical Van Market presents strong opportunities through expansion in rural and underserved regions. It helps bridge critical gaps where hospitals and clinics remain scarce. Governments and NGOs increasingly invest in mobile solutions to extend vaccination, maternal care, and chronic disease management. Rising awareness of preventive healthcare creates demand for screening and early diagnostic programs. Medical vans serve as effective platforms for outreach campaigns and public health initiatives. Partnerships with local health systems can further improve reach and impact. This rising demand opens new pathways for sustainable market growth.

Advancements in Technology and Public-Private Collaborations

Technological innovation creates significant opportunities for the Medical Van Market. It incorporates portable imaging systems, telemedicine platforms, and AI-based diagnostics to improve efficiency. Healthcare providers benefit from real-time data collection and integration with electronic health records. Governments and private players collaborate to deploy fleets for both urban outreach and disaster response. Corporate social responsibility initiatives also drive funding support for mobile healthcare units. Expansion into specialized services such as oncology, dialysis, and dental care enhances market potential. These combined developments provide strong momentum for future adoption of medical vans worldwide.

Market Segmentation Analysis:

By Van

The Medical Van Market divides into ambulance vans, mobile clinics or healthcare vans, blood donation vans, and medical transport vans. Ambulance vans dominate due to their critical role in emergency medical response and immediate patient transfer. It provides advanced life support features and ensures rapid connectivity with hospitals. Mobile clinics gain traction by offering preventive care, diagnostics, and primary treatment in remote areas. Blood donation vans support large-scale health campaigns and contribute to national blood banks. Medical transport vans assist in safe transfer of patients requiring non-emergency care, rehabilitation, or specialized treatments. This diversification strengthens the adaptability of mobile healthcare services.

- For instance, AEV Type III ambulances are offered in lengths from 148″ to 172″, and in five chassis options, including Ford, GM, and Sprinter—providing upfitting versatility across major platforms.

By Vehicle Size

Segmentation by vehicle size includes full-size vans, mid-size vans, and compact vans. Full-size vans lead the segment due to greater capacity for medical equipment, staff, and patients. It supports integration of advanced diagnostic tools and telemedicine platforms. Mid-size vans hold demand from urban healthcare programs, balancing maneuverability with service capacity. Compact vans remain useful for highly localized care, vaccination drives, and outreach in congested areas. Healthcare providers choose vehicle size based on population density, service scope, and geographic challenges. This flexibility ensures effective deployment in diverse healthcare environments.

- For instance, the Crestline CCL 150 Type I offers a module measuring 150″ long by 96″ wide with 72″ interior headroom, built using all-aluminum extruded body and cabinetry, plus a Lifetime Structural and Paint Warranty.

By Application

The Medical Van Market further segments by emergency medical services, non-emergency medical transportation, mobile healthcare services, and blood or organ transportation. Emergency medical services remain the largest application, supported by growing investments in ambulance fleets. It ensures timely access to treatment in critical situations, reducing mortality rates. Non-emergency transportation plays a growing role in managing elderly care and rehabilitation support. Mobile healthcare services gain importance in preventive programs and chronic disease management. Blood and organ transportation creates demand for specialized vans with temperature control and safety systems. Each application segment strengthens the market by fulfilling distinct healthcare needs.

Segments:

Based on Van:

- Ambulance vans

- Mobile clinics/healthcare vans

Based on Vehicle Size:

- Full-size vans

- Mid-size vans

Based on Application:

- Emergency medical services

- Non-emergency medical transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Medical Van Market with a dominant share of 38% in 2023. The region benefits from advanced healthcare infrastructure, strong public health investments, and widespread adoption of telemedicine platforms integrated into mobile units. Ambulance vans remain highly demanded due to their critical role in emergency medical services, supported by extensive government funding for emergency preparedness. Mobile clinics also gain importance in serving underserved communities, particularly in rural parts of the United States and Canada, where access to fixed hospitals is limited. Manufacturers focus on designing technologically advanced vans equipped with portable imaging devices, AI-based diagnostic systems, and electronic health record integration. This trend ensures improved patient outcomes and faster decision-making during emergency and non-emergency care. The presence of established market players, favorable reimbursement policies, and steady investment in fleet modernization reinforce the leadership of North America. With continuous innovation and a focus on expanding coverage, the region is expected to maintain its dominance over the forecast period.

Europe

Europe accounts for 26% of the Medical Van Market in 2023, making it the second-largest regional contributor. The region’s growth is supported by strong national healthcare systems that increasingly rely on mobile solutions for rural outreach, preventive health campaigns, and elderly patient care. Mobile clinics and blood donation vans are widely adopted across Western and Central Europe to extend coverage in areas where permanent healthcare infrastructure is either overburdened or difficult to access. Governments and healthcare providers invest in diagnostic vans with portable laboratory and imaging equipment, supporting cancer screening, cardiovascular monitoring, and infectious disease control. The regulatory environment across the European Union ensures high standards of safety, hygiene, and compliance, shaping van design and service quality. Sustainability also plays a role, with many countries encouraging electric or hybrid vans to align with carbon-reduction targets. The combination of regulatory oversight, advanced technology integration, and public investment positions Europe as a region with strong demand for both general-purpose and specialized medical vans.

Asia-Pacific

Asia-Pacific represents 23% of the Medical Van Market and is the fastest-growing regional segment. Governments across China, India, Japan, and Southeast Asian nations increasingly prioritize mobile healthcare programs to extend access to underserved populations. Expanding urbanization, rising prevalence of chronic diseases, and heightened demand for preventive services drive strong adoption of both mid-size and compact vans. Public health programs utilize mobile units to conduct vaccination campaigns, maternal and child health initiatives, and early disease detection, particularly in remote and hard-to-reach areas. The integration of telemedicine and digital health platforms within vans enhances efficiency by connecting rural patients with urban specialists. Infrastructure development and investments in rural healthcare strengthen the capacity of mobile services. The region also benefits from growing participation of private players and NGOs that collaborate with governments to widen access. With supportive policies and increasing awareness of preventive care, Asia-Pacific shows significant long-term growth potential and is likely to capture a larger share in the coming years.

Latin America

Latin America contributes 8% to the Medical Van Market in 2023, reflecting modest but growing importance. Many countries in the region face gaps in permanent healthcare infrastructure, especially in rural provinces, which increases reliance on mobile healthcare units. Mobile clinics are commonly deployed for vaccination drives, maternal care, and basic diagnostics, ensuring services reach communities that lack hospital facilities. Emergency response vans also play a critical role, particularly in regions prone to natural disasters where quick medical intervention is essential. Despite rising demand, economic constraints and uneven distribution of resources limit the speed of adoption. Governments collaborate with non-governmental organizations and private companies to procure vans and manage mobile healthcare programs effectively. Partnerships often target large-scale public health campaigns, aiming to reduce the disease burden and improve preventive care. While overall growth remains gradual, increasing investments and focus on expanding reach give Latin America steady momentum in the global market.

Middle East & Africa

The Middle East & Africa together hold 5% of the Medical Van Market in 2023, marking them as the smallest contributors but with emerging opportunities. Many African countries face healthcare access challenges due to limited infrastructure, poor road networks, and resource shortages, making mobile healthcare vans essential for primary and preventive care delivery. Blood donation vans, vaccination vans, and maternal health vans are frequently used in rural communities to close healthcare gaps. Gulf countries in the Middle East, such as Saudi Arabia and the United Arab Emirates, invest in advanced ambulance vans and mobile clinics to strengthen urban healthcare systems and disaster preparedness. International aid organizations and donor-funded projects also contribute by deploying mobile units for immunization campaigns and disease control programs in low-income nations. Infrastructure gaps, regulatory complexities, and high operating costs remain barriers to wider adoption, yet the need for mobile healthcare keeps driving deployment. With rising donor funding, CSR-backed programs, and government healthcare reforms, the Middle East & Africa region holds significant potential for future expansion, despite starting from a smaller base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Excellance, Inc.

- Malley Industries

- Leader Emergency Vehicles

- Mercedes-Benz Vans

- REV Group

- Frazer Ltd.

- AEV Ambulance

- Demers Braun Crestline

- Mobile Healthcare Facilities LLC

- First Priority Emergency Vehicles, Inc.

Competitive Analysis

The Medical Van Market players such as Excellance, Inc., Malley Industries, Leader Emergency Vehicles, Mercedes-Benz Vans, REV Group, Frazer Ltd., AEV Ambulance, Demers Braun Crestline, Mobile Healthcare Facilities LLC, and First Priority Emergency Vehicles, Inc. The Medical Van Market demonstrates a competitive environment shaped by constant innovation, customization, and service integration. Companies focus on developing vans that support both emergency response and preventive healthcare delivery. Rising demand for telemedicine-enabled units, portable diagnostics, and sustainable vehicle designs pushes manufacturers to modernize fleets. Competition also centers on providing flexible solutions that can adapt to diverse applications, from emergency services to mobile clinics and organ transport. Firms invest in research and development to introduce energy-efficient drivetrains, advanced safety systems, and modular interiors. Strategic partnerships with governments, NGOs, and healthcare providers further strengthen market positioning. This dynamic competition ensures continuous improvement in performance, accessibility, and patient care outcomes.

Recent Developments

- In Dec 2024, Electrocore, which is headquartered in New Jersey, announced that it has acquired NeuroMetrix and its platform called neuromodulation. Quell is a solution presented to treat fibromyalgia and lower extremity chronic pain.

- In November 2024, Beurer India Pvt. Ltd. introduced the GL 22 Blood Glucose Monitor. This innovative and user-friendly glucose monitoring solution manufactured under Beurer’s “Make in India” initiative.

- In August 2024, Renata Medical launched a U.S. FDA-approved Minima stent system. This medical device is specially designed for young patients suffering from severe artery narrowing.

- In February 2024, RP collaborated with Sonoma County Fire District (SCFD) and Medic Ambulance Service to deliver emergency medical response and ground ambulance transport services in central Sonoma County. This joint endeavor, known as SCFD-EMS, entails SCFD acting as the exclusive provider of emergency ambulance transport services in Santa Rosa, Rohnert Park, Sebastopol, Cotati, Kenwood, Oakmont, Graton, Occidental, Larkfield, and Mark West Springs, secured through a competitively bid five-year contract with the County of Sonoma.

Report Coverage

The research report offers an in-depth analysis based on Van, Vehicle Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medical Van Market will expand with rising demand for mobile healthcare in rural areas.

- Governments will invest more in mobile fleets to strengthen emergency and preventive services.

- Telemedicine integration will increase adoption of advanced digital health features in vans.

- Sustainable designs with electric and hybrid drivetrains will gain wider preference.

- Mobile diagnostic and specialty vans will see higher demand in cancer and dialysis care.

- Public-private partnerships will drive greater deployment of healthcare vans across regions.

- Aging populations will boost demand for non-emergency medical transportation services.

- Disaster response and humanitarian missions will continue to rely on mobile medical units.

- Compact and mid-size vans will grow in use for community outreach and vaccination programs.

- Continuous innovation in modular designs will enhance flexibility for diverse medical applications.