Market Overview

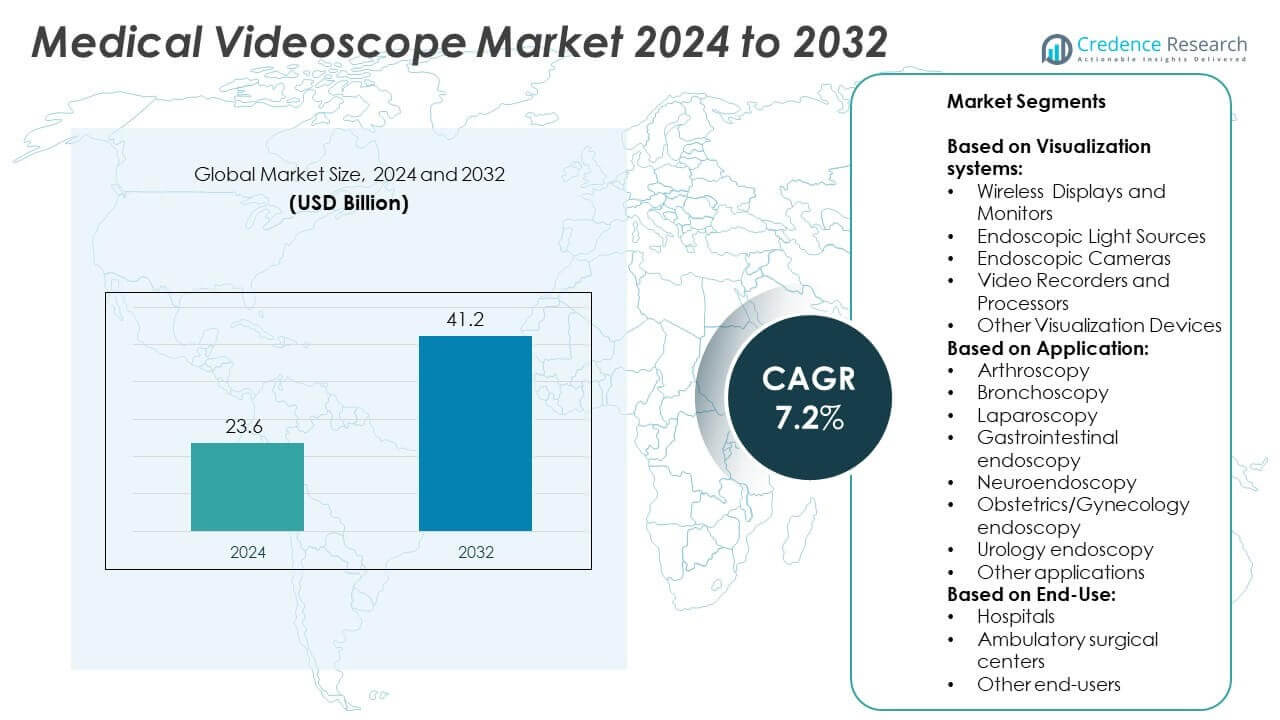

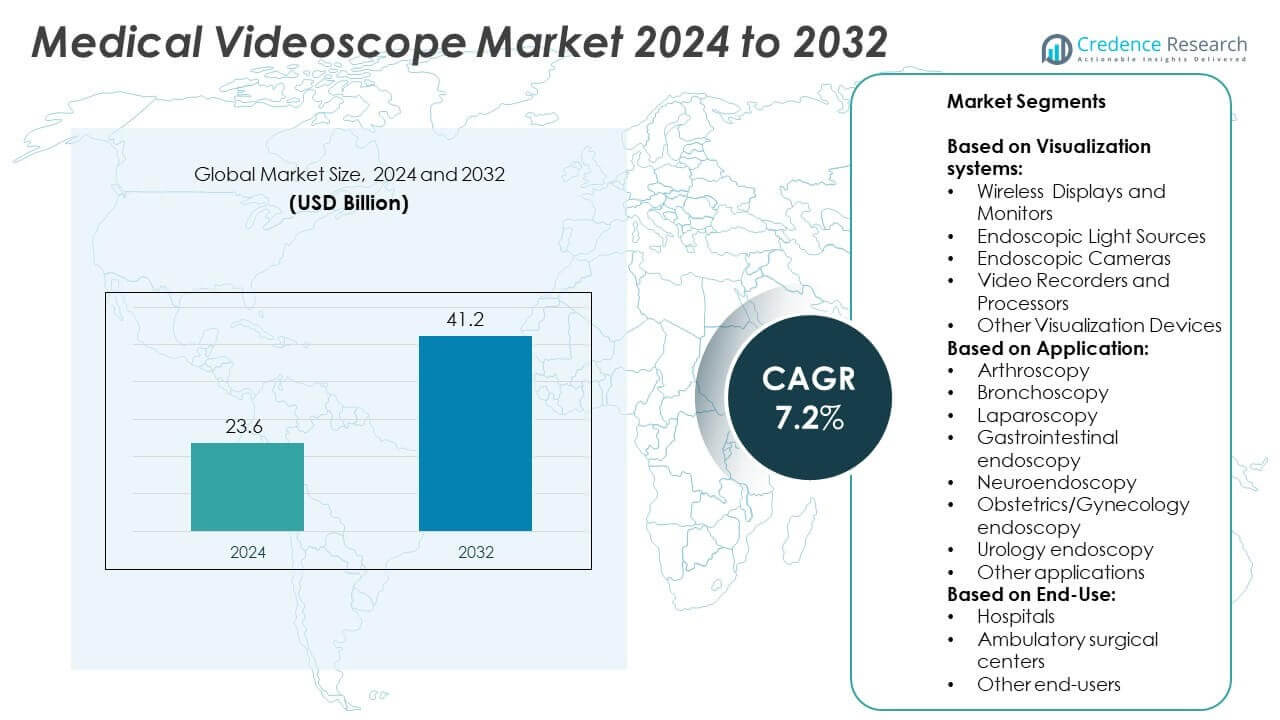

The Medical Videoscope Market size was valued at USD 23.6 billion in 2024 and is projected to reach USD 41.2 billion by 2032. The market is expected to expand at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Videoscope Market Size 2024 |

USD 23.6 Billion |

| Medical Videoscope Market, CAGR |

7.2% |

| Medical Videoscope Market Size 2032 |

USD 41.2 Billion |

The Medical Videoscope market grows with rising demand for minimally invasive procedures, driven by patient preference for reduced recovery times and improved surgical outcomes. Increasing prevalence of chronic diseases such as cancer, gastrointestinal disorders, and respiratory conditions fuels demand for advanced visualization systems. Technological advancements in high-definition imaging, 3D visualization, and AI integration enhance precision and diagnostic accuracy. Expanding healthcare infrastructure in emerging economies and greater adoption in hospitals and ambulatory surgical centers further strengthen market growth across global regions.

North America leads the Medical Videoscope market with advanced healthcare infrastructure and strong adoption of innovative technologies, followed by Europe with significant demand for minimally invasive procedures. Asia-Pacific emerges as the fastest-growing region due to expanding healthcare investments and rising medical tourism. Latin America and the Middle East & Africa show gradual improvements supported by hospital upgrades. Key players influencing market growth include Olympus Corporation, Fujifilm Holdings Corporation, Stryker Corporation, and Medtronic plc, each focusing on innovation and global expansion.

Market Insights

- The Medical Videoscope market was valued at USD 23.6 billion in 2024 and is projected to reach USD 41.2 billion by 2032, expanding at a CAGR of 7.2% during the forecast period.

- Rising demand for minimally invasive procedures drives market growth, supported by patient preference for faster recovery and reduced surgical risks.

- Technological innovations such as high-definition imaging, 3D visualization, and AI-assisted diagnostics strengthen precision and improve clinical outcomes.

- Competitive dynamics are shaped by leading players investing in research, product launches, and collaborations to expand global presence.

- High costs of advanced devices, strict regulatory approvals, and infection control challenges act as restraints to adoption.

- North America leads the market with strong infrastructure and innovation adoption, Europe follows with rising chronic disease burden, Asia-Pacific records the fastest growth through healthcare expansion, while Latin America and the Middle East & Africa show gradual progress.

- Growing focus on reusable and eco-friendly designs, along with demand from emerging economies and medical tourism, presents significant opportunities for long-term market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Minimally Invasive Procedures

The Medical Videoscope market grows significantly due to the rising preference for minimally invasive surgeries. Patients choose procedures that reduce recovery time, hospital stay, and surgical trauma. Healthcare providers adopt advanced videoscopes to enhance diagnostic accuracy and treatment outcomes. It helps surgeons access hard-to-reach areas with precision and safety. Growing awareness of patient comfort further strengthens the adoption of videoscopes in surgical practices. Increasing technological innovations in visualization tools improve efficiency, supporting market expansion.

- For instance, FUJIFILM Holdings has launched the ELUXEO 7000 endoscopy system, featuring innovative 4-LED multi-light technology. This system, which includes modes like Blue Light Imaging (BLI) and Linked Color Imaging (LCI), is used to support gastrointestinal cancer screening and enhance the detection and characterization of lesions.

Rising Prevalence of Chronic and Gastrointestinal Diseases

The Medical Videoscope market benefits from the rising incidence of gastrointestinal, pulmonary, and chronic disorders worldwide. Early detection of cancer and other critical diseases requires effective endoscopic and videoscopic tools. It enables doctors to identify abnormalities with high-definition imaging and advanced optics. Growing cases of colorectal cancer and gastrointestinal infections create steady demand for advanced diagnostic solutions. Increasing adoption of screening programs in hospitals and clinics drives growth. Rising burden of chronic conditions continues to push healthcare systems toward adopting advanced visualization technologies.

- For instance, Boston Scientific’s SpyGlass™ digital endoscopy systems are used globally for biliary and pancreatic diagnostics, enabling direct visualization and therapeutic interventions. According to a Boston Scientific document referenced by ESGENA, the SpyGlass DS system had “impacted more than 110,000 patient lives in more than 65 countries” as of October 2020.

Technological Advancements in Imaging and Visualization

The Medical Videoscope market advances through rapid innovation in imaging technologies, including 3D visualization and ultra-high-definition cameras. It enhances surgical precision by providing clear, magnified, and real-time views. Integration of AI-based image analysis improves diagnostic accuracy and speeds up procedures. Growing use of flexible and wireless designs increases convenience for healthcare professionals. Rising investment in R&D by manufacturers strengthens product quality and functionality. Surgeons increasingly prefer advanced systems that deliver enhanced visualization and reduced complication rates.

Expanding Healthcare Infrastructure and Investments

The Medical Videoscope market benefits from expanding healthcare infrastructure in both developed and emerging economies. Governments and private investors fund hospital upgrades and technology adoption to improve patient care. It drives higher installation rates of advanced endoscopic and videoscopic systems in medical facilities. Growing medical tourism in regions like Asia-Pacific boosts demand for advanced diagnostic procedures. Rising healthcare budgets strengthen procurement of innovative medical devices across hospitals and specialty centers. Increasing training initiatives for healthcare professionals support faster adoption of videoscope technologies worldwide.

Market Trends

Adoption of High-Definition and 3D Visualization Technologies

The Medical Videoscope market is experiencing a strong shift toward high-definition and 3D visualization systems. Hospitals and surgical centers adopt advanced devices to improve accuracy in diagnosis and treatment. It enables physicians to detect small lesions and complex abnormalities with greater clarity. Integration of 3D imaging improves depth perception and precision during complex surgeries. Growing demand for real-time, high-quality imaging supports wider acceptance of these technologies. Manufacturers focus on developing compact systems that enhance image resolution while maintaining ease of use.

- For instance, Stryker manufactures the 1688 AIM 4K platform, a surgical visualization system that supports a wide range of minimally invasive procedures. The platform provides brilliant 4K resolution, advanced imaging modalities including fluorescence, and is used across multiple surgical specialties

Integration of Artificial Intelligence and Robotics

The Medical Videoscope market is shaped by the integration of AI-driven image analysis and robotic-assisted procedures. AI tools assist in detecting anomalies more quickly and accurately during endoscopic examinations. It reduces human error and enhances workflow efficiency in clinical environments. Robotics combined with videoscopes supports greater maneuverability and control during minimally invasive surgeries. Growing partnerships between medtech firms and AI developers accelerate innovation in this field. Rising adoption of automation in operating rooms highlights the trend toward smarter surgical solutions.

- For instance, Intuitive Surgical had 7,544 da Vinci robotic systems installed globally as of December 31, 2022. With its integrated endoscopic visualization, these systems enabled approximately 2million procedures to be performed worldwide in 2022, which Intuitive also referred to as “nearly two million” procedures

Shift Toward Flexible and Portable Videoscope Devices

The Medical Videoscope market demonstrates rising demand for flexible and portable devices across various applications. Surgeons prefer lightweight, user-friendly designs that offer improved access and comfort during procedures. It supports better handling in outpatient settings and smaller medical facilities. Portable videoscopes allow faster deployment in emergency and field-care scenarios. Growing focus on patient-centric care drives preference for adaptable devices that can serve multiple specialties. Manufacturers emphasize flexibility to cater to hospitals, clinics, and ambulatory surgical centers.

Sustainability and Reusable Device Preference

The Medical Videoscope market reflects an increasing trend toward sustainable practices and reusable devices. Hospitals adopt eco-friendly solutions to reduce medical waste and operational costs. It encourages development of sterilizable, long-lasting instruments with advanced cleaning systems. Rising regulatory focus on reducing single-use plastics in healthcare drives demand for reusable models. Growing emphasis on cost efficiency without compromising patient safety further supports this trend. Manufacturers expand offerings in reusable videoscopes while maintaining strong infection control standards.

Market Challenges Analysis

High Cost of Advanced Devices and Maintenance

The Medical Videoscope market faces challenges due to the high cost of advanced devices and maintenance requirements. Hospitals and clinics often struggle to allocate budgets for purchasing high-definition and AI-integrated systems. It also demands recurring expenses for repair, upgrades, and sterilization procedures. Smaller healthcare facilities in developing regions hesitate to invest in these solutions due to limited financial resources. Price sensitivity among buyers restricts adoption in cost-constrained markets. The gap between demand for advanced technology and affordability continues to hinder growth.

Stringent Regulatory Approvals and Infection Control Issues

The Medical Videoscope market is restricted by strict regulatory frameworks and safety compliance standards. Manufacturers face long approval timelines, which delay product launches and global expansion. It also faces concerns related to infection control, as inadequate sterilization can lead to cross-contamination risks. Hospitals require strict adherence to cleaning protocols, increasing operational burdens. Reusable devices demand advanced sterilization infrastructure that not all facilities can manage. Regulatory complexity, combined with infection risks, poses significant challenges to widespread adoption.

Market Opportunities

Expansion Across Emerging Healthcare Markets

The Medical Videoscope market holds strong opportunities in emerging economies with rapidly growing healthcare infrastructure. Rising investments in hospitals and specialty clinics across Asia-Pacific, Latin America, and the Middle East create new demand. It benefits from increasing government focus on improving diagnostic capabilities and surgical outcomes. Growing medical tourism in countries such as India, Thailand, and Mexico supports higher adoption rates. Rising disposable incomes and health awareness drive patients to seek advanced treatment options. Expanding healthcare access in rural and semi-urban regions further strengthens potential for growth.

Innovation in Product Design and Integration of Digital Technologies

The Medical Videoscope market gains opportunities from innovations in design and integration of digital tools. Compact, wireless, and AI-enhanced systems create greater efficiency for healthcare providers. It supports easier maneuverability, faster diagnosis, and improved workflow in busy hospital environments. Growing integration with cloud platforms enables real-time data sharing and remote consultations. Advancements in disposable and hybrid models reduce infection risks while balancing cost efficiency. Expanding research and development investments position manufacturers to deliver next-generation videoscopes for multiple clinical applications.

Market Segmentation Analysis:

By Visualization systems:

Wireless displays and monitors gain strong traction due to their flexibility and ease of integration into surgical environments. Endoscopic light sources hold a critical role in enhancing visibility and ensuring precise procedures. Endoscopic cameras represent one of the fastest-growing categories, supported by rising demand for high-definition and 3D imaging. Video recorders and processors support accurate documentation and advanced image management for training and diagnostic review. Other visualization devices, such as adapters and image-enhancement tools, contribute to procedural efficiency in various specialties.

- For instance, Karl Storz manufactures the IMAGE1 S™ modular camera system, a medical device used for endoscopy that supports high-definition (HD), 4K, and 3D visualization.

By Application:

Laparoscopy dominates with widespread use in abdominal and gynecological surgeries. The Medical Videoscope market also sees significant growth in gastrointestinal endoscopy, driven by rising cases of digestive disorders and cancers. Arthroscopy is gaining demand due to increasing sports-related injuries and orthopedic conditions requiring minimally invasive solutions. Bronchoscopy applications expand with higher incidence of respiratory diseases and growing demand for early lung cancer diagnosis. Neuroendoscopy advances with the need for precise brain and spinal procedures, supported by innovations in navigation systems. Obstetrics and gynecology endoscopy finds increasing relevance in fertility treatments and diagnostic interventions. Urology endoscopy continues to expand with rising kidney stone prevalence and demand for minimally invasive urological care

- For instance, Ambu A/S is a major supplier of single-use endoscopes for applications including bronchoscopy, urology, and gastrointestinal procedures. In 2022, the company’s single-use endoscope sales reached 1,705,000 units, a 12% increase over the previous year. By the end of 2022, more than 1.7 million of Ambu’s single-use endoscopes were used in over 6,500 hospitals.

By End-Use:

Hospitals represent the largest segment, supported by advanced infrastructure and higher adoption of cutting-edge technologies. It benefits from the availability of specialized professionals and wider patient access. Ambulatory surgical centers record strong growth, driven by patient preference for faster recovery and cost-effective procedures. Other end-users, including diagnostic centers and research facilities, adopt videoscope technologies to improve clinical accuracy and expand research potential. Together, these segments demonstrate broad adoption across healthcare, driving innovation and global expansion opportunities for manufacturers.

Segments:

Based on Visualization systems:

- Wireless Displays and Monitors

- Endoscopic Light Sources

- Endoscopic Cameras

- Video Recorders and Processors

- Other Visualization Devices

Based on Application:

- Arthroscopy

- Bronchoscopy

- Laparoscopy

- Gastrointestinal endoscopy

- Neuroendoscopy

- Obstetrics/Gynecology endoscopy

- Urology endoscopy

- Other applications

Based on End-Use:

- Hospitals

- Ambulatory surgical centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 37% share of the Medical Videoscope market in 2024, making it the leading regional contributor. Strong healthcare infrastructure, high adoption of minimally invasive procedures, and advanced diagnostic technologies drive the region’s growth. The presence of major medical device companies ensures continuous innovation and availability of advanced products. It benefits from favorable reimbursement policies that support the adoption of advanced endoscopic and videoscopic procedures in hospitals and clinics. Rising cases of gastrointestinal disorders, cancer, and orthopedic conditions further strengthen demand. Skilled healthcare professionals and widespread training initiatives promote faster integration of new technologies into clinical practices. The region continues to remain attractive for new product launches and clinical research partnerships.

Europe

Europe held 28% share of the Medical Videoscope market in 2024, supported by strong adoption across developed healthcare systems. Demand is driven by an aging population and rising cases of chronic and digestive disorders requiring early diagnosis. It gains momentum through government initiatives to strengthen minimally invasive procedures across public hospitals. Strong research networks and collaborations with medical universities encourage innovation in videoscope applications. The presence of established medtech companies supports steady supply and distribution across key markets such as Germany, the UK, and France. Growing emphasis on eco-friendly and reusable devices further influences procurement decisions in European healthcare systems. Increasing adoption in Eastern Europe is expected to further support regional expansion.

Asia-Pacific

Asia-Pacific captured 23% share of the Medical Videoscope market in 2024, making it the fastest-growing region. Rising healthcare investments in countries such as China, India, and Japan create new growth avenues. It benefits from a growing middle-class population with higher disposable income and increasing awareness of advanced medical procedures. Medical tourism in Thailand, Singapore, and India fuels demand for high-quality surgical and diagnostic equipment. Governments prioritize expanding access to healthcare in rural and semi-urban areas, improving adoption rates of endoscopy and videoscopic procedures. The presence of regional manufacturers offering cost-effective solutions strengthens the competitive landscape. Rising prevalence of gastrointestinal diseases, cancer, and respiratory disorders further accelerates growth prospects.

Latin America

Latin America represented 7% share of the Medical Videoscope market in 2024, with gradual but steady adoption. Growth is supported by expanding private healthcare infrastructure and improvements in hospital facilities across countries like Brazil and Mexico. It benefits from increasing cases of gastrointestinal and urological conditions requiring advanced diagnostic tools. Market players are investing in training programs to equip healthcare professionals with endoscopic and videoscopic expertise. Rising collaborations between local hospitals and international device manufacturers are improving product availability. Medical tourism in Brazil and Mexico provides opportunities for advanced procedural adoption. Despite financial constraints in some countries, the region demonstrates strong growth potential.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the Medical Videoscope market in 2024, making it the smallest regional contributor. Growth is supported by rising government investments in healthcare modernization and improved hospital infrastructure. It gains traction from increasing demand for advanced diagnostics in Gulf Cooperation Council countries, particularly Saudi Arabia and the UAE. Rising burden of gastrointestinal and respiratory diseases supports wider adoption of videoscopic procedures. International companies expand their presence in the region by partnering with local distributors and healthcare providers. Africa demonstrates slower adoption due to limited budgets and lack of advanced facilities, though urban centers show improving uptake. Training initiatives and government-driven healthcare reforms are expected to gradually improve penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- Richard Wolf GMBH

- MicroPort Scientific Corporation

- Braun Melsungen AG

- Fujifilm Holdings Corporation

- Stryker Corporation

- Smith & Nephew plc

- HOYA Corporation

- Medtronic plc

- Cook Medical

- CONMED Corporation

Competitive Analysis

The leading players in the Medical Videoscope market include Olympus Corporation, Richard Wolf GMBH, MicroPort Scientific Corporation, B. Braun Melsungen AG, Fujifilm Holdings Corporation, Stryker Corporation, Smith & Nephew plc, HOYA Corporation, Medtronic plc, Cook Medical, and CONMED Corporation. These companies focus on product innovation, technological integration, and global expansion to strengthen their market positions. The market demonstrates intense competition driven by advancements in visualization systems, including high-definition cameras, 3D imaging, and AI-based diagnostic tools. Companies prioritize research and development to improve device accuracy, portability, and patient safety while meeting strict regulatory requirements. Strategic mergers, acquisitions, and collaborations are common approaches to expand product portfolios and enhance geographic presence. Manufacturers aim to address diverse clinical needs across applications such as laparoscopy, gastrointestinal endoscopy, urology, and bronchoscopy. Strong distribution networks and partnerships with hospitals and surgical centers ensure widespread adoption of advanced devices. Rising demand for reusable and eco-friendly designs pushes companies to invest in sustainable product development. Competitive advantage often depends on balancing innovation with cost efficiency to meet demands from both advanced and emerging healthcare markets. The industry is expected to remain dynamic, with players focusing on expanding access to next-generation videoscope technologies worldwide.

Recent Developments

- In September 2025, Olympus Corporation launched the VISERA S OTV-S500 imaging platform for ENT and urological applications in the U.S.

- In 2025, Fujifilm Holdings Corporation announced commercialization of the EG-840T and EG-840TP gastroscopes (800 series) at the DDW 2025 conference.

- In 2024, B. Braun reported growth and significant investments in technology, including modern digital surgical microscopes and advancements in laparoscopic camera systems.

Report Coverage

The research report offers an in-depth analysis based on Visualization systems, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medical Videoscope market will expand with rising demand for minimally invasive surgeries.

- Adoption of AI-based image analysis will strengthen diagnostic accuracy and efficiency.

- Growing preference for high-definition and 3D visualization will enhance surgical outcomes.

- Portable and flexible videoscopes will see wider use in emergency and outpatient settings.

- Reusable and eco-friendly designs will gain traction to support sustainability goals.

- Emerging economies will drive growth through healthcare infrastructure upgrades and medical tourism.

- Integration with robotics will improve precision and control in complex procedures.

- Cloud-based data sharing will support real-time collaboration and remote consultations.

- Increasing training programs for surgeons will accelerate adoption of advanced systems.

- Rising prevalence of chronic diseases will sustain long-term demand for videoscope technologies.