Market Overview

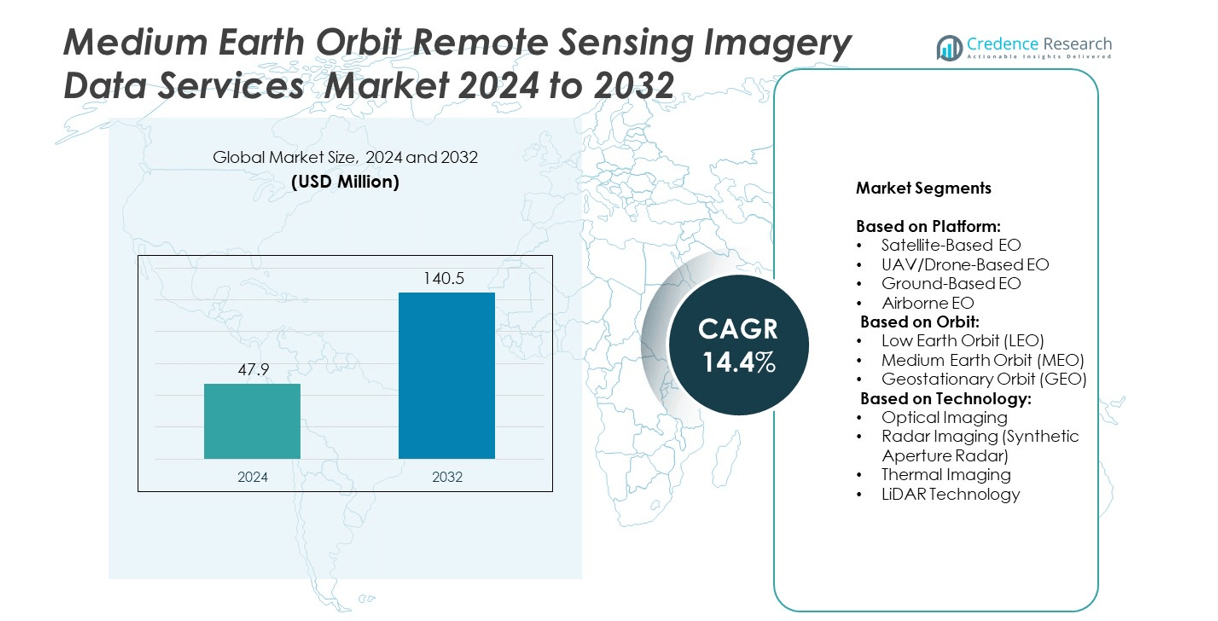

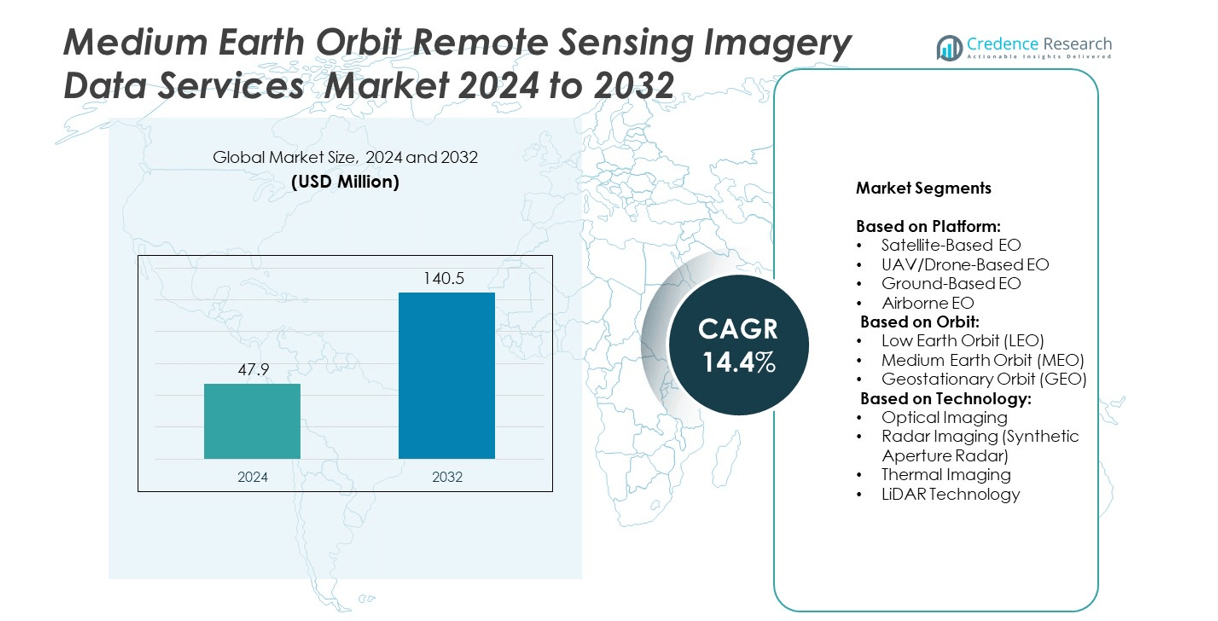

Medium Earth Orbit Remote Sensing Imagery Data Services Market size was valued at USD 47.9 million in 2024 and is anticipated to reach USD 140.5 million by 2032, at a CAGR of 14.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Earth Orbit Remote Sensing Imagery Data Services Market Size 2024 |

USD 47.9 million |

| Medium Earth Orbit Remote Sensing Imagery Data Services Market, CAGR |

14.4% |

| Medium Earth Orbit Remote Sensing Imagery Data Services Market Size 2032 |

USD 140.5 million |

The Medium Earth Orbit Remote Sensing Imagery Data Services market grows due to rising demand for high-resolution satellite imagery across defense, agriculture, environmental monitoring, and logistics sectors. It benefits from technological advancements in AI, machine learning, and cloud-based analytics that enhance data accuracy and enable real-time insights. Increasing government investments in space programs and collaborations with private enterprises drive innovation and satellite deployment. It also witnesses a shift toward integrating radar, LiDAR, and thermal imaging technologies, expanding applications in commercial and strategic domains.

The Medium Earth Orbit Remote Sensing Imagery Data Services market shows strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with advanced satellite infrastructure and high adoption in defense and environmental monitoring. Europe focuses on climate research and space collaborations, while Asia Pacific experiences rapid growth driven by rising satellite launches. Key players shaping the market include Airbus, Maxar Technologies, Planet Labs PBC., and Lockheed Martin Corporation.

Market Insights

- The Medium Earth Orbit Remote Sensing Imagery Data Services market was valued at USD 47.9 million in 2024 and is projected to reach USD 140.5 million by 2032, growing at a CAGR of 14.4% from 2025 to 2032.

- Rising demand for high-resolution satellite imagery across defense, agriculture, logistics, and environmental monitoring sectors is driving market growth.

- Increasing integration of AI, machine learning, and cloud-based analytics enhances image processing and enables real-time data delivery for multiple applications.

- Leading players focus on innovation, partnerships, and expanding satellite constellations to strengthen their competitive position and meet evolving customer demands.

- High deployment and maintenance costs, along with data privacy concerns and regulatory constraints, remain major challenges for wider adoption in the market.

- North America leads with 36% market share, followed by Europe at 28% and Asia Pacific at 22%, with the latter showing the fastest growth due to rising investments and satellite launches.

- Growing collaborations between governments and private enterprises, combined with advancements in LiDAR, radar imaging, and thermal imaging technologies, are expanding opportunities across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Resolution Satellite Imagery

The Medium Earth Orbit Remote Sensing Imagery Data Services market benefits from the growing need for high-resolution imagery across multiple industries. It supports critical applications such as environmental monitoring, disaster management, urban planning, and defense operations. Organizations increasingly require accurate and timely data for decision-making, driving investments in advanced MEO satellite systems. The capability to capture broader coverage with fewer satellites strengthens its adoption in commercial and government sectors. It offers higher image quality and improved data accuracy, enhancing operational efficiency. This demand creates opportunities for service providers to expand capabilities and develop customized solutions.

- For instance, DigitalGlobe’s WorldView‑3 satellite captures panchromatic imagery at a resolution of 0.31 meters, multispectral at 1.24 meters, and shortwave infrared at 3.7 meters, offering detail sharp enough to discern individual trees and measure crown dimensions

Technological Advancements in Satellite Imaging Systems

Continuous innovation drives the Medium Earth Orbit Remote Sensing Imagery Data Services market toward improved efficiency and precision. It leverages enhanced sensors, better imaging algorithms, and data processing technologies to deliver detailed geospatial insights. The integration of artificial intelligence and machine learning improves data analysis, enabling faster and more accurate image interpretation. Growing partnerships between satellite operators and technology firms accelerate product enhancements. It also benefits from advancements in onboard computing, increasing system performance and reducing turnaround times. These developments enable industries to access real-time, actionable information.

- For instance, WorldView‑3 achieves revisit intervals of less than one day at nadir using multispectral imagery with 1.24‑meter spatial resolution, demonstrating swift, high-quality data delivery

Rising Adoption Across Defense and Security Applications

The Medium Earth Orbit Remote Sensing Imagery Data Services market gains significant traction in defense, intelligence, and security sectors. It enables effective surveillance, threat detection, and strategic planning through high-precision imagery. Governments invest in MEO satellite programs to enhance national security and maintain situational awareness. The ability to track large areas with fewer satellites provides operational efficiency for military applications. It also supports maritime monitoring, border control, and infrastructure protection. Growing geopolitical tensions increase the demand for reliable and secure imaging services globally.

Expanding Commercial Applications and Business Opportunities

The Medium Earth Orbit Remote Sensing Imagery Data Services market experiences growth due to rising commercial usage in industries such as agriculture, energy, mining, and logistics. It provides accurate mapping and monitoring capabilities that improve productivity and resource management. Businesses adopt satellite-based solutions for predictive analytics and real-time decision-making. The increasing availability of cost-effective MEO satellite services accelerates adoption among private players. It also supports climate research and natural resource assessments, attracting investments from environmental organizations. This broader application base creates a competitive landscape for service providers.

Market Trends

Growing Integration of Artificial Intelligence and Machine Learning

The Medium Earth Orbit Remote Sensing Imagery Data Services market witnesses a strong trend toward incorporating AI and ML technologies for enhanced data processing and analysis. It enables faster image classification, pattern recognition, and predictive modeling across industries. These technologies support advanced applications such as environmental forecasting, defense intelligence, and disaster risk assessment. AI-driven solutions improve automation, reducing manual intervention and processing time. It helps stakeholders extract deeper insights from vast datasets with higher accuracy. This integration accelerates the demand for intelligent and scalable imagery solutions.

- For instance, MEO orbits span altitudes from 2,000 km to approximately 35,786 km, such as for navigation constellations like GPS at about 20,200 km altitude .

Increasing Demand for Real-Time Data and Analytics

The Medium Earth Orbit Remote Sensing Imagery Data Services market experiences rising demand for real-time satellite data and rapid analytics. It supports critical decision-making in sectors such as agriculture, energy, logistics, and national security. Organizations seek instant access to actionable geospatial intelligence to manage dynamic environments effectively. The capability to provide near real-time updates enhances operational planning and resource allocation. It also enables faster responses to natural disasters, maritime tracking, and climate monitoring. This growing demand drives innovation in data transmission and satellite network architectures.

- For instance, the GeoEye‑2 (later designated WorldView‑4) satellite—designed by Lockheed Martin with an ITT Corporation camera payload—can provide panchromatic images at 0.31 meters resolution and multispectral images at 1.24 meters resolution

Expansion of Government and Private Sector Collaborations

The Medium Earth Orbit Remote Sensing Imagery Data Services market evolves with increasing partnerships between government agencies and private enterprises. It fosters joint investments in satellite launches, infrastructure development, and advanced imaging technologies. Governments rely on commercial providers for cost-efficient access to high-resolution imagery and analytical tools. These collaborations improve space-based surveillance, environmental monitoring, and infrastructure management. It strengthens the satellite ecosystem by enabling shared resources and technological capabilities. This trend creates sustainable growth opportunities across both defense and commercial domains.

Rising Focus on Cost-Efficient Satellite Deployment Strategies

The Medium Earth Orbit Remote Sensing Imagery Data Services market shows a growing emphasis on affordable satellite design and deployment. It leverages miniaturization, reusable launch vehicles, and shared satellite constellations to reduce overall costs. Service providers adopt innovative business models to improve accessibility for small and medium enterprises. The demand for flexible pricing strategies expands the reach of MEO-based solutions globally. It enables wider participation in imagery-based services, increasing competitiveness within the industry. This cost optimization trend drives technological innovation and market penetration.

Market Challenges Analysis

High Costs of Deployment and Maintenance

The Medium Earth Orbit Remote Sensing Imagery Data Services market faces challenges due to the significant costs associated with satellite development, deployment, and maintenance. It requires substantial investments in advanced imaging technologies, launch operations, and ground-based infrastructure. Smaller companies often struggle to compete with established players due to limited financial resources. The complexity of designing satellites with high-resolution imaging capabilities further increases expenses. It also faces pressure from growing demand for faster innovation, forcing providers to balance affordability with quality. These financial barriers slow down adoption, particularly for startups and developing markets.

Data Privacy, Security Concerns, and Regulatory Constraints

The Medium Earth Orbit Remote Sensing Imagery Data Services market encounters operational challenges related to data privacy, cybersecurity risks, and regulatory compliance. It deals with sensitive information used by defense agencies, government authorities, and private sectors, making security a top priority. Rising concerns about unauthorized access and data misuse require service providers to implement advanced encryption and monitoring systems. International regulations governing satellite launches and imagery distribution add complexity to cross-border operations. It also struggles with evolving legal frameworks that vary across regions, creating delays in approvals and licensing. These challenges require consistent investment in secure technologies and regulatory alignment.

Market Opportunities

Expanding Commercial Applications Across Diverse Industries

The Medium Earth Orbit Remote Sensing Imagery Data Services market presents significant opportunities driven by growing adoption across sectors such as agriculture, energy, logistics, and infrastructure. It supports precision farming by providing real-time monitoring, crop health analysis, and yield optimization. Energy and mining industries benefit from detailed mapping for resource exploration and project planning. Logistics companies use satellite-based insights for route optimization and supply chain efficiency. It enables businesses to make data-driven decisions, enhancing operational performance and cost-effectiveness. The increasing demand for customized imagery solutions creates new revenue streams for service providers globally.

Advancements in Technology and Government Support

The Medium Earth Orbit Remote Sensing Imagery Data Services market benefits from rapid technological advancements and favorable government initiatives. It leverages innovations in satellite miniaturization, reusable launch vehicles, and cloud-based analytics to enhance accessibility and scalability. Governments across various regions invest in space infrastructure and collaborate with private players to expand imaging capabilities. It also gains momentum from the integration of AI and machine learning, which deliver more accurate and faster geospatial insights. Supportive policies and funding for space-based solutions further accelerate market growth. These developments open opportunities for innovation, strategic partnerships, and global market expansion.

Market Segmentation Analysis:

By Platform:

The Medium Earth Orbit Remote Sensing Imagery Data Services market is segmented by platform into satellite-based EO, UAV/drone-based EO, ground-based EO, and airborne EO systems. Satellite-based EO holds a significant share due to its capability to provide extensive coverage and high-resolution imagery for environmental monitoring, defense operations, and urban planning. It supports long-duration missions with advanced imaging capabilities and reliable data delivery. UAV and drone-based EO grow steadily, offering flexible, cost-effective, and on-demand data collection for agriculture, construction, and disaster management. Ground-based EO contributes to applications requiring localized, high-accuracy monitoring, while airborne EO caters to real-time surveillance and defense requirements. The rising integration of multiple platforms improves operational efficiency and expands use cases across industries.

- For instance, WorldView‑3 transmits imagery data at rates up to 1.2 gigabytes per second, supporting rapid downlink of high-resolution capture—vital for intelligence applications

By Orbit:

The market is classified into low earth orbit (LEO), medium earth orbit (MEO), and geostationary orbit (GEO) segments. MEO dominates due to its ability to balance image resolution and broader coverage with fewer satellites, making it suitable for commercial and governmental applications. It enables continuous monitoring and delivers enhanced data accuracy for maritime tracking, weather observation, and defense operations. LEO satellites support rapid data acquisition for industries requiring high revisit rates and real-time insights. GEO satellites provide consistent imaging over fixed locations, making them ideal for meteorological forecasting and telecommunications support. Each orbit segment addresses unique operational requirements, enabling diverse applications and expanding market opportunities.

- For instance, Maxar’s upcoming WorldView Legion constellation is designed to collect up to 5 million square kilometers of imagery per day and supports up to 15 revisit passes per day with roughly 30 cm-class resolution

By Technology:

The Medium Earth Orbit Remote Sensing Imagery Data Services market leverages advanced technologies, including optical imaging, radar imaging, thermal imaging, and LiDAR. Optical imaging dominates due to its ability to deliver high-resolution visuals used in agriculture, forestry, and land-use mapping. It enhances visual analytics and supports detailed surface observations. Radar imaging, particularly synthetic aperture radar, enables accurate monitoring in low-light and all-weather conditions, strengthening defense and disaster management operations. Thermal imaging drives demand across energy, environmental monitoring, and industrial inspection applications by detecting temperature variations. LiDAR technology offers precise 3D mapping and elevation data, improving infrastructure planning and resource exploration. These innovations improve data quality and broaden the adoption of EO solutions globally.

Segments:

Based on Platform:

- Satellite-Based EO

- UAV/Drone-Based EO

- Ground-Based EO

- Airborne EO

Based on Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

Based on Technology:

- Optical Imaging

- Radar Imaging (Synthetic Aperture Radar)

- Thermal Imaging

- LiDAR Technology

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Medium Earth Orbit Remote Sensing Imagery Data Services market, contributing 36% of the global revenue in 2024. The region benefits from advanced space infrastructure, high investments in satellite technology, and strong demand from defense, security, and environmental monitoring sectors. It supports extensive applications in agriculture, climate research, and resource management through cutting-edge imagery solutions. The presence of key players and government-funded space programs further strengthens the regional ecosystem. It also experiences growth due to rising collaborations between private companies and federal agencies to expand data analytics capabilities. Continuous innovation in AI-driven image processing accelerates the region’s leadership position in this sector.

Europe

Europe accounts for 28% of the Medium Earth Orbit Remote Sensing Imagery Data Services market share, driven by strong adoption across environmental monitoring, defense intelligence, and infrastructure planning. It benefits from significant investments by the European Space Agency and collaborations between research institutions and private firms. The demand for advanced geospatial intelligence supports applications in agriculture, energy, and urban development. It also demonstrates strong growth potential due to initiatives focused on climate change mitigation and sustainable development. European nations leverage MEO satellite solutions to enhance security and surveillance operations across borders. The integration of AI and machine learning technologies further improves operational efficiency, enhancing data delivery for both governmental and commercial users.

Asia Pacific

Asia Pacific captures 22% of the Medium Earth Orbit Remote Sensing Imagery Data Services market share and represents the fastest-growing region. The expansion is driven by increasing satellite launches, government-backed space programs, and rising demand for accurate geospatial intelligence. It finds applications across agriculture, defense, disaster management, and natural resource monitoring, supported by investments from countries like China, India, and Japan. The development of indigenous satellite networks and partnerships with private enterprises fuel the adoption of MEO-based solutions. It also benefits from growing commercial applications in logistics, urban planning, and energy infrastructure. The rising need for cost-effective data analytics and cloud-based services further accelerates regional growth.

Latin America

Latin America holds 8% of the Medium Earth Orbit Remote Sensing Imagery Data Services market share, with expanding adoption in environmental monitoring, agriculture, and natural resource management. Governments in the region increasingly invest in satellite-based technologies to enhance disaster preparedness and climate studies. It supports improved urban development planning and forest conservation initiatives, particularly in Brazil and Argentina. The presence of regional collaborations promotes advancements in imagery solutions for precision farming and sustainable practices. It also experiences steady growth from private players entering the market to address rising commercial demands. Increasing investments in research and development create opportunities for further expansion across industries.

Middle East and Africa

The Middle East and Africa collectively represent 6% of the Medium Earth Orbit Remote Sensing Imagery Data Services market share, driven by applications in infrastructure monitoring, energy exploration, and defense operations. It supports enhanced resource mapping, particularly in oil and gas sectors, contributing to sustainable industrial development. Regional governments invest in satellite imaging technologies to strengthen disaster management and security measures. The adoption of MEO-based imagery solutions also supports agriculture and water resource management in arid regions. It demonstrates growth potential through partnerships with global satellite providers to improve access to advanced data services. Rising private investments in geospatial analytics enhance market opportunities across both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SARsat Arabia

- Lockheed Martin Corporation

- Thales

- ICEYE

- L3Harris Technologies, Inc.

- ImageSat International NV

- Maxar Technologies

- Planet Labs PBC.

- Northrop Grumman

- AIRBUS

Competitive Analysis

Key players in the Medium Earth Orbit Remote Sensing Imagery Data Services market include Airbus, Maxar Technologies, Planet Labs PBC, Lockheed Martin Corporation, L3Harris Technologies, Inc., Northrop Grumman, ICEYE, Thales, SARsat Arabia, and ImageSat International NV. A company with a large constellation of low-cost satellites focuses on scalable data services and frequent Earth coverage, attracting customers with competitive pricing. Another major provider integrates satellite systems with defense-grade encryption and real-time feed reliability, meeting stringent national security requirements. Compact satellite systems with agile deployment and tailored data-intensive services define the approach of another firm serving both government and commercial operations. Some companies lead through resilient satellite architectures, embedding next-generation sensors and robust cybersecurity for mission-critical missions. Others specialize in synthetic aperture radar (SAR) imaging, ensuring all-weather, day-and-night capabilities that benefit maritime surveillance, disaster response, and insurance assessments. Advanced hyperspectral and multi-modal imaging solutions further add depth, enriching environmental and industrial monitoring. Regional players contribute by offering localized expertise, secure data access, and customized services that cater to governmental and private clients in their markets. Overall, this landscape reflects a balance between global infrastructure investments, technological innovation, and regional specialization, with each participant targeting unique segments through strengths in coverage, modality, security, or pricing.

Recent Developments

- In 2025, Airbus completed development and shipped four CO3D (Constellation Optique 3D) satellites to the launch pad in French Guiana; they were scheduled for liftoff

- In 4 February 2025, SpaceX successfully launched Maxar’s fifth and sixth WorldView Legion satellites into Medium Earth Orbit (MEO), boosting the constellation’s capacity

- In October 2023, the MEO-Irrigation demonstrator of the Space4IRRIG project established a foundation for advanced rRemote sensing tools aimed at farmers and water managers. Amid increasing water resource pressures, this initiative enhances knowledge of irrigated plots and water usage. Complementing this, the EO4AgriWater project collaborates with INSIGHT to apply rRemote sensing data for drought management in New Caledonia.

Market Concentration & Characteristics

The Medium Earth Orbit Remote Sensing Imagery Data Services market demonstrates a moderately concentrated structure, dominated by a few global players alongside several emerging regional participants. It features strong competition driven by technological innovation, satellite deployment strategies, and advanced data analytics capabilities. Leading companies focus on expanding high-resolution imaging solutions, integrating AI-driven analytics, and improving near real-time data delivery to meet diverse industry needs. It benefits from growing investments in defense, environmental monitoring, and commercial applications, which accelerate demand for reliable and precise geospatial intelligence. Strategic partnerships between government agencies and private enterprises strengthen market positioning while creating opportunities for cost-efficient satellite launches and collaborative research. It also exhibits rapid technological evolution with advancements in optical, radar, thermal, and LiDAR imaging, enabling wider application across sectors such as agriculture, energy, logistics, and disaster management. The market’s growth is shaped by continuous innovation, rising private investments, and increasing cross-border collaborations, driving competitiveness and expanding service capabilities.

Report Coverage

The research report offers an in-depth analysis based on Platform, Orbit, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medium Earth Orbit Remote Sensing Imagery Data Services market will experience steady growth driven by rising demand for high-resolution imagery across industries.

- Technological advancements in AI, machine learning, and cloud-based analytics will enhance data processing and delivery efficiency.

- Governments and private enterprises will continue investing in satellite infrastructure and collaborative space programs.

- Real-time geospatial intelligence will gain importance in defense, disaster management, and environmental monitoring.

- The integration of synthetic aperture radar, LiDAR, and thermal imaging will expand application potential in diverse sectors.

- Growing commercial adoption in agriculture, logistics, and energy will create new business opportunities for service providers.

- Regional collaborations and international partnerships will strengthen global data accessibility and operational efficiency.

- Miniaturization of satellites and reusable launch technologies will reduce costs and improve market penetration.

- Emerging economies will increasingly adopt MEO-based solutions for urban planning, infrastructure development, and resource management.

- The market will evolve toward customized, on-demand imagery solutions tailored to industry-specific requirements.