Market Overview

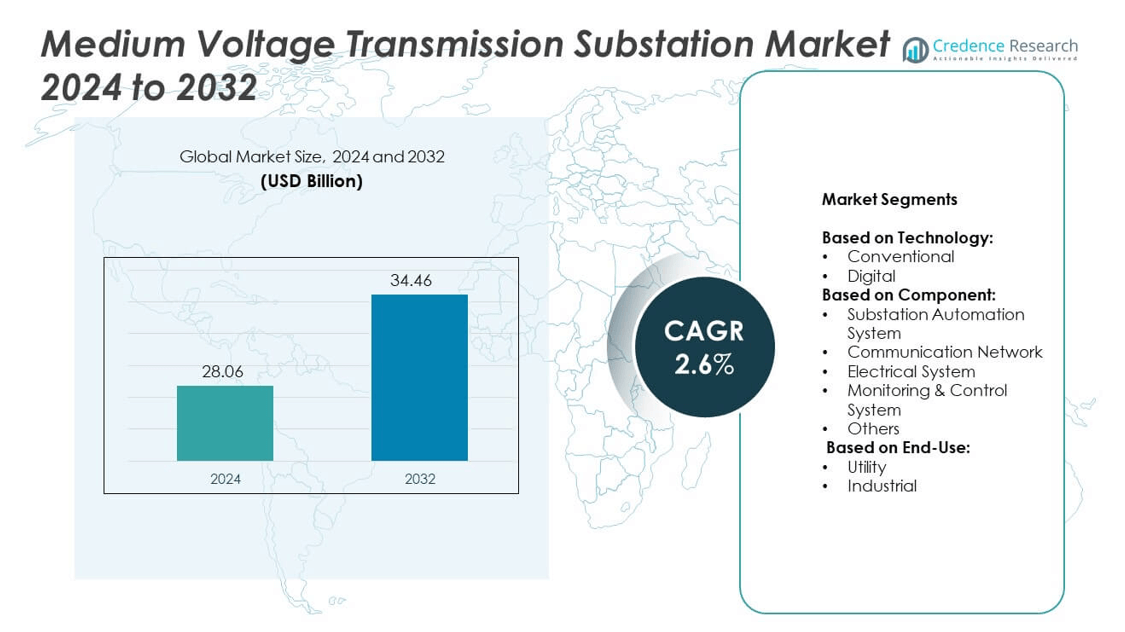

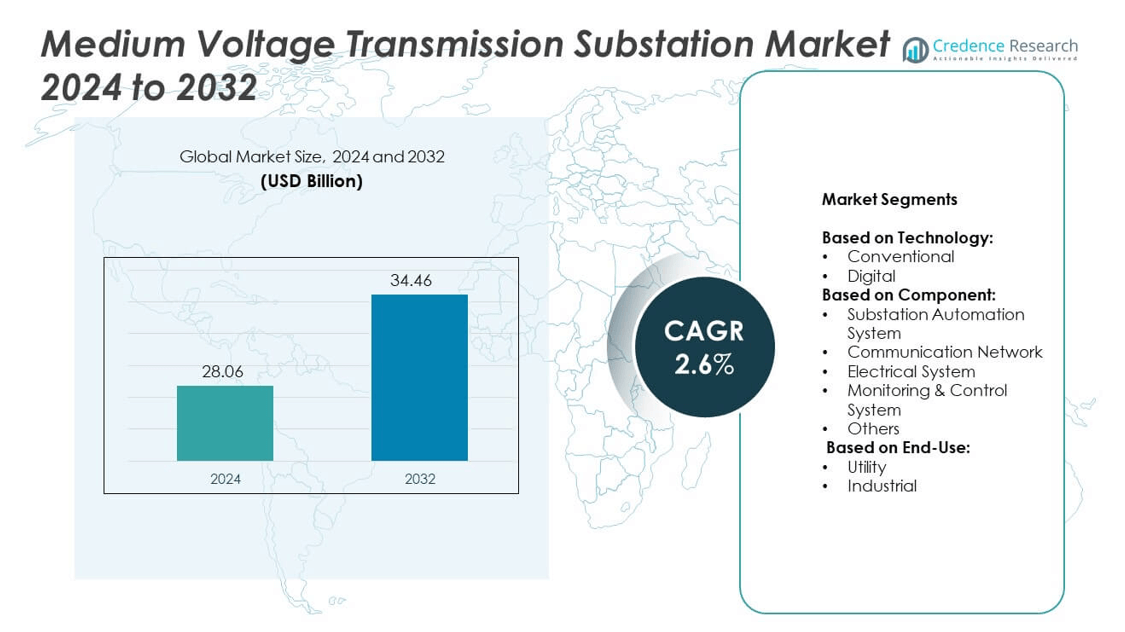

Medium Voltage Transmission Substation Market size was valued at USD 28.06 billion in 2024 and is anticipated to reach USD 34.46 billion by 2032, at a CAGR of 2.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Transmission Substation Market Size 2024 |

USD 28.06 billion |

| Medium Voltage Transmission Substation Market, CAGR |

2.6% |

| Medium Voltage Transmission Substation Market Size 2032 |

USD 34.46 billion |

The Medium Voltage Transmission Substation market grows with rising demand for grid modernization, renewable energy integration, and urban electrification. Utilities invest in automation systems, digital controls, and compact modular designs to enhance reliability and efficiency. Governments support rural electrification and emission reduction targets, driving adoption of eco-efficient and smart substations. The market also benefits from increasing industrial load, aging infrastructure replacement, and growing focus on cybersecurity. Technology upgrades and regulatory alignment continue to shape future deployment strategies across regions.

Asia-Pacific leads the Medium Voltage Transmission Substation market due to rapid urbanization, industrial expansion, and large-scale electrification programs. North America follows with strong investments in smart grid upgrades and substation automation. Europe focuses on sustainability and SF₆-free switchgear adoption, while Latin America and the Middle East & Africa show steady infrastructure development. Major players shaping the market include ABB, Siemens, General Electric, and Schneider Electric, each offering advanced substation solutions tailored to evolving utility and industrial requirements.

Market Insights

- The Medium Voltage Transmission Substation market was valued at USD 28.06 billion in 2024 and is expected to reach USD 34.46 billion by 2032, growing at a CAGR of 2.6%.

- Rising investments in grid modernization, renewable integration, and smart infrastructure drive consistent market demand.

- Compact, modular, and SF₆-free substation technologies are gaining traction across utility and industrial projects.

- Leading players such as ABB, Siemens, Schneider Electric, and General Electric focus on automation, sustainability, and digital controls.

- High capital costs, skilled workforce shortages, and complex integration with legacy systems restrain faster adoption.

- Asia-Pacific leads the market due to electrification programs, industrial expansion, and urban infrastructure development.

- North America and Europe prioritize digital upgrades, environmental compliance, and enhanced cybersecurity for modern substations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Grid Modernization Projects Across Developed and Developing Economies

Grid modernization remains a primary growth driver in the Medium Voltage Transmission Substation market. Governments invest in advanced substations to improve grid stability and support renewable energy. Ageing infrastructure replacement fuels demand for compact, modular substation units. Utilities adopt digital technologies to enhance grid automation and minimize downtime. The market grows with national targets to improve energy efficiency and transmission performance. It supports the integration of smart grid components and data-driven control systems. Countries such as the U.S., Germany, and China lead large-scale grid upgrade initiatives.

- For instance, ABB offers compact and eco-efficient Gas-Insulated Switchgear (GIS) platforms, including models for 72.5 kV environments.

Accelerated Deployment of Renewable Energy Infrastructure

The global shift toward renewable energy boosts demand for medium voltage substations. Wind, solar, and hydro power projects require reliable transmission infrastructure close to generation sites. Substations enable smooth power evacuation and grid balancing across decentralized energy systems. The Medium Voltage Transmission Substation market supports renewable energy parks with modular and scalable solutions. Governments implement policies to connect off-grid and hybrid energy systems to national networks. It increases substation installation in rural and remote locations. OEMs focus on compact design and easy transportability for renewable energy projects.

- For instance, Siemens Energy offers prefabricated substations — including micro‑substations and E‑Houses — that can substantially reduce construction time. One deployment path delivers time savings of up to 30 % in substation construction compared to traditional site-assembled builds.

Expanding Industrial and Commercial Energy Demand

Rapid industrialization and commercial expansion increase electricity consumption, driving the need for efficient transmission infrastructure. Sectors like manufacturing, data centers, mining, and healthcare require stable and uninterrupted power supply. Substations support medium voltage transmission from generation sources to high-demand zones. The Medium Voltage Transmission Substation market meets rising industrial load requirements with intelligent monitoring and fault isolation systems. Companies invest in customized substations to reduce energy losses and meet local power quality norms. It creates long-term growth prospects across urban and industrial regions.

Government Regulations and Electrification Policies

Policies promoting electrification of transport, rural areas, and utilities create strong demand for substations. Governments introduce funding schemes and incentives to expand grid access and upgrade infrastructure. Regulatory mandates focus on reducing transmission losses and improving system reliability. The Medium Voltage Transmission Substation market benefits from public-private partnerships for substation deployment in underserved regions. Standardization of components and grid codes ensures interoperability and speeds up project execution. It drives adoption of pre-engineered substations and containerized systems to shorten installation timeframes.

Market Trends

Integration of Digital Substation Technologies

Utilities adopt digital substations to enhance operational visibility and control. These systems use intelligent electronic devices, fiber-optic communication, and advanced sensors. The shift reduces physical wiring and simplifies maintenance, improving long-term reliability. Companies implement digital substations to support remote diagnostics and predictive maintenance. The Medium Voltage Transmission Substation market grows with demand for data-driven performance optimization. It enables fast fault detection, real-time asset monitoring, and seamless coordination with central SCADA systems. Digital retrofitting also supports older infrastructure in mature markets.

- For instance, Siemens Energy designed a fully digital substation for Netze BW in Burladingen, Germany. It includes two 40 MVA Sensformer® transformers and switchgear converted into digital Sensgear®, using LPITs and merging units.

Rising Preference for Compact and Modular Substations

Urbanization and space constraints drive the adoption of compact substation designs. Modular solutions allow faster deployment in congested or space-limited areas. These units offer plug-and-play flexibility, reducing site work and civil construction time. Prefabricated substations meet the growing need for speed and standardization in grid development. The Medium Voltage Transmission Substation market aligns with this trend by offering scalable units for urban, rural, and renewable applications. It also helps streamline logistics and improve project delivery timelines. OEMs focus on lightweight structures for simplified installation.

- For instance, TGOOD offers modular substations that can utilize as little as 420 m² of land. This reflects the industry-wide benefit of prefabricated solutions, which are designed to save both space and time in substation construction

Increased Focus on Cybersecurity and Substation Protection

Cybersecurity becomes a top priority due to increasing digitalization of substation systems. Governments and utilities implement protocols to protect critical grid infrastructure from external threats. Substation automation platforms now feature built-in security layers and access control mechanisms. The Medium Voltage Transmission Substation market responds with hardened communication networks and secure device configurations. It ensures data integrity, operational continuity, and compliance with cybersecurity norms. Manufacturers invest in intrusion detection systems and firmware-level protections to enhance system resilience.

Adoption of Environmentally Friendly Switchgear and Components

Sustainability goals influence the shift to eco-efficient equipment in substations. Utilities replace SF₆-insulated switchgear with alternatives that reduce greenhouse gas emissions. Dry-type transformers and biodegradable insulating fluids gain traction for environmental compliance. The Medium Voltage Transmission Substation market supports this transition through product innovation and regulatory alignment. It helps reduce carbon footprint while ensuring high performance in harsh conditions. Buyers now prioritize solutions with minimal environmental impact over traditional designs.

Market Challenges Analysis

High Capital Costs and Long Project Cycles

The deployment of medium voltage substations requires significant upfront capital investment. Equipment costs, site preparation, and compliance requirements increase the overall project budget. Long approval cycles and land acquisition issues often delay execution timelines. Utilities in developing regions face budget constraints that hinder new substation projects. The Medium Voltage Transmission Substation market struggles with inconsistent funding and project-level financial risks. It affects private sector participation and slows infrastructure modernization. Coordinating between multiple regulatory and engineering entities adds to delays.

Complex Technical Integration and Skilled Workforce Gaps

The shift toward digital and modular substations demands advanced technical expertise. Integrating new systems with legacy grid infrastructure poses compatibility issues. Utilities must upgrade control systems, train staff, and manage cybersecurity protocols. Shortage of skilled professionals in protection engineering and grid automation slows adoption. The Medium Voltage Transmission Substation market faces delays in commissioning due to lack of trained operators. It also increases reliance on external system integrators and global suppliers. Technical faults during setup can escalate maintenance costs and system downtime.

Market Opportunities

Growing Electrification in Emerging Economies and Rural Regions

Emerging economies increase investment in rural electrification to expand grid access. Governments in Asia-Pacific and Africa implement large-scale power infrastructure programs to meet population demands. Medium voltage substations play a key role in connecting isolated regions to national grids. The Medium Voltage Transmission Substation market gains from public-private partnerships and international funding agencies. It supports low-cost, modular substations that reduce deployment complexity in remote locations. OEMs introduce off-grid compatible designs to support decentralized energy models. Rural electrification targets create a stable, long-term demand pipeline.

Expansion of E-Mobility Infrastructure and Smart Cities

Electric vehicle (EV) infrastructure development creates new growth avenues for substations. EV charging networks depend on reliable medium voltage distribution close to urban centers. Governments implement smart city plans that integrate energy, transport, and communication systems. The Medium Voltage Transmission Substation market addresses this need through compact, digitally enabled units with remote control features. It enables faster response to load variation and real-time energy distribution. Urban planners prioritize smart substations to manage rising power demand from EVs, street lighting, and connected infrastructure. This trend opens opportunities for technology providers offering turnkey substation solutions.

Market Segmentation Analysis:

By Technology:

It continues to lead due to widespread use in legacy grid systems. Utilities prefer conventional substations for their familiarity, ease of maintenance, and lower upfront costs. These systems remain dominant in regions with limited digitization and stable grid demands. However, the digital substation segment shows strong growth momentum. It supports smart grid integration, remote diagnostics, and real-time monitoring. The Medium Voltage Transmission Substation market gains from rising investment in automation and digital infrastructure. It reflects growing demand for safer, more efficient, and flexible grid operations.

- For instance, GE Grid Solutions completed a fully digital high-voltage substation project in Senegal that achieved a footprint reduction of nearly 50% compared to conventional designs, thanks to its digital architecture that minimizes physical wiring and equipment footprint

By Component:

The electrical system segment holds a major share due to the essential nature of switchgear, transformers, and busbars in all installations. These elements form the core of transmission substations and remain critical regardless of technology upgrades. The substation automation system segment grows with utilities adopting SCADA-based control and protection schemes. Demand rises for intelligent devices that allow remote configuration and monitoring. The communication network segment expands through adoption of fiber optics and digital protocols, enabling real-time data transfer. The monitoring and control system segment gains traction due to rising need for predictive maintenance and fault detection. The others category includes structural supports, auxiliary systems, and protective enclosures that complement core components.

- For instance, Schneider Electric offers its Model III packaged unit substations that integrate switchgear, transformer, and HV/LV assembly in one compact module. These units support primary voltages from 2.4 kV to 13.8 kV and transformer ratings from 75 kVA to 1,000 kVA, making them ideal for space-constrained or rapid-deployment environments

By End-Use:

The utility segment dominates the Medium Voltage Transmission Substation market due to large-scale grid expansion and maintenance needs. National and regional utilities invest in modernizing transmission networks to meet rising energy consumption. The industrial segment shows steady demand across sectors such as mining, manufacturing, oil and gas, and data centers. Industries deploy substations for consistent power delivery and protection of sensitive equipment. It supports decentralization of power infrastructure in energy-intensive environments. Industrial players prioritize reliability and quick recovery in case of grid failures.

Segments:

Based on Technology:

Based on Component:

- Substation Automation System

- Communication Network

- Electrical System

- Monitoring & Control System

- Others

Based on End-Use:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 29.4% of the global Medium Voltage Transmission Substation market share in 2024. The region benefits from strong grid infrastructure, rising investments in digital substations, and smart grid integration. The U.S. leads with widespread modernization programs across utility and industrial sectors. Federal energy policies promote grid resilience and support the deployment of modular, prefabricated substations. Canada shows growing demand for compact substation solutions in remote and northern regions. Utilities prioritize automation, cybersecurity, and renewable energy integration. The market expands with emphasis on digital upgrades, substation retrofitting, and enhanced control systems.

Europe

Europe held a 24.1% share of the Medium Voltage Transmission Substation market in 2024. The region shows high adoption of environment-friendly switchgear and SF₆-free technologies. Countries such as Germany, France, and the UK lead investments in digital substations and renewable integration. The European Union supports grid standardization, cross-border interconnection, and emission reduction goals. Market growth aligns with offshore wind and solar power projects that require medium voltage infrastructure. Utilities focus on substation automation and predictive monitoring to improve grid performance. Eastern European nations invest in upgrading ageing substations with new communication and control systems.

Asia-Pacific

Asia-Pacific represented 33.7% of the Medium Voltage Transmission Substation market share in 2024, making it the largest regional segment. Rapid urbanization, industrial growth, and government-backed electrification programs drive demand. China dominates substation deployment due to its extensive grid expansion plans and smart city projects. India increases investment in rural electrification and industrial corridors that require scalable transmission infrastructure. Southeast Asian countries adopt modular substations for renewable energy parks and export-oriented industrial zones. Regional utilities prioritize grid reliability and cost-effective transmission across large geographic areas. The market benefits from local manufacturing and growing public-private partnerships.

Latin America

Latin America contributed 7.8% to the global Medium Voltage Transmission Substation market in 2024. The region shows steady demand driven by power sector reform, renewable energy development, and grid expansion in rural zones. Brazil and Mexico lead with investment in new transmission projects and industrial infrastructure. Governments promote energy access and upgrade programs through public funding and international support. Substations support medium voltage links between generation plants and growing urban centers. Utilities focus on cost optimization and faster deployment timelines through compact substation designs. Market growth remains modest but consistent across key countries.

Middle East & Africa

Middle East & Africa accounted for 5.0% of the Medium Voltage Transmission Substation market in 2024. Countries in the Gulf region invest in infrastructure to support industrial zones and clean energy targets. Saudi Arabia and the UAE deploy smart substations as part of Vision 2030 and renewable diversification efforts. Sub-Saharan Africa focuses on rural electrification, mini-grid connectivity, and grid extension. Project funding from international agencies helps improve access to modern transmission systems. The market advances slowly due to regulatory gaps and financial constraints, but long-term prospects remain strong with planned national grid upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the Medium Voltage Transmission Substation market include ABB, Siemens, Schneider Electric, General Electric, Eaton, Hitachi Energy Ltd., Rockwell Automation, Inc., Texas Instruments Incorporated, Open System International, Inc., Tesco Automation Inc., L&T Electrical and Automation, Locamation, Efacec, and CG Power & Industrial Solutions Ltd. These companies compete through advanced product portfolios, strong project execution capabilities, and global supply chains. They focus on offering digital substations, modular systems, and automation platforms that meet evolving grid requirements. Innovation in compact switchgear, monitoring solutions, and eco-efficient technologies strengthens their market presence. Players invest in R&D and partnerships to expand into renewable, industrial, and urban infrastructure projects. Several companies collaborate with utilities and governments to support national electrification goals. The shift toward SF₆-free switchgear and remote diagnostics drives new product development. Market leaders prioritize cybersecurity, interoperability, and scalable designs to address complex technical challenges. Strong service networks and local manufacturing facilities support aftersales and regional project delivery. Players gain a competitive edge by customizing solutions for different applications, including renewable energy parks, data centers, and industrial clusters. The competitive landscape remains dynamic, driven by technology integration, regional policy alignment, and the race toward digital grid transformation.

Recent Developments

- In June 2025, ABB won a contract to design and build electrical equipment, substation automation systems, and eHouses for two Petrobras FPSO units, employing ABB Ability™ System 800xA® with IEC 61850 standard for enhanced interoperability and reliability

- In August 2024, GE Vernova announced plans to deliver the world’s first 245 kV SF₆‑free gas‑insulated substation (GIS) using a g³ gas mixture, marking a milestone in high-voltage, SF₆‑free transmissions

- In November 2022, Hitachi Energy and Equinor entered into a partnership to advance electrification, renewable power generation, and low-carbon initiatives.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with continued grid modernization across industrial and utility sectors.

- Digital substations will see rising demand due to smart grid integration and automation needs.

- Compact and modular designs will gain traction in space-constrained urban and remote areas.

- Substation automation systems will expand with increasing focus on real-time control and monitoring.

- Renewable energy projects will drive deployment of medium voltage infrastructure for power evacuation.

- Governments will support rural electrification through funding for medium voltage substation projects.

- Cybersecurity solutions will become critical with the growing use of digital communication networks.

- Manufacturers will invest in SF₆-free and eco-efficient technologies to meet environmental regulations.

- Demand will increase for skilled technicians to manage digital substations and automation platforms.

- Emerging markets will adopt pre-engineered solutions to accelerate project execution and grid access.