Market Overview

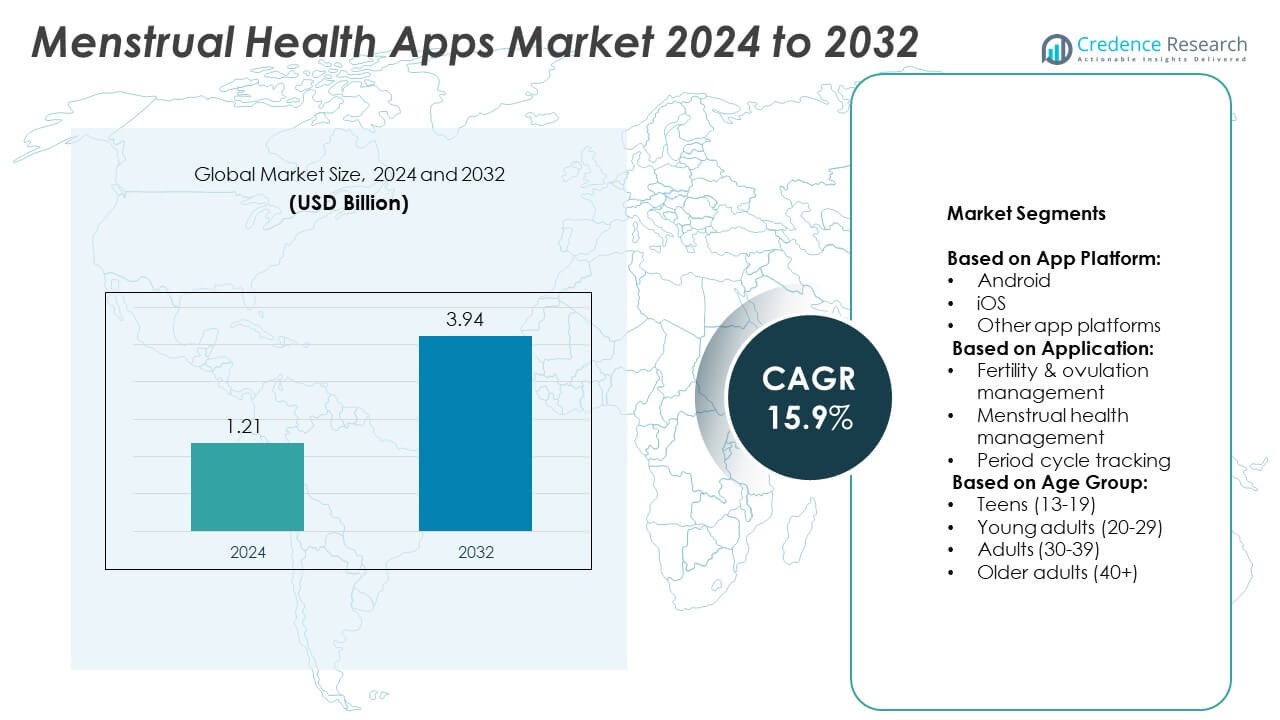

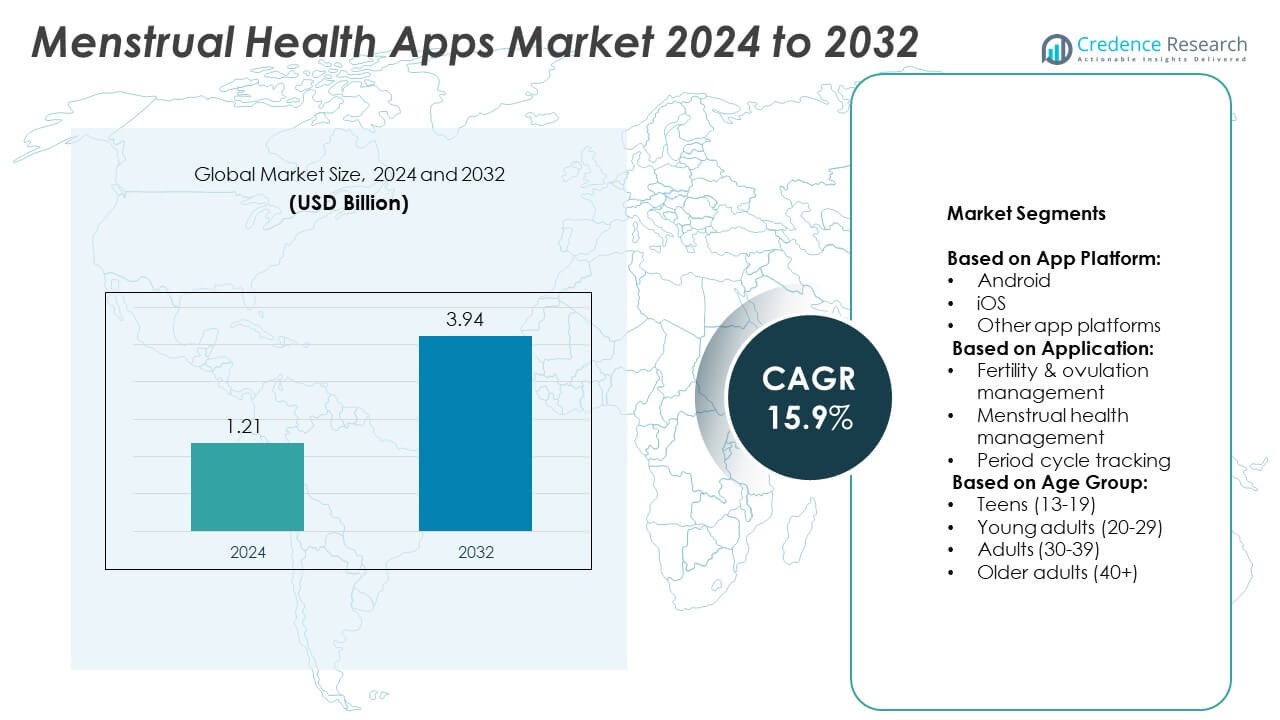

Menstrual Health Apps Market size was valued at USD 1.21 billion in 2024 and is anticipated to reach USD 3.94 billion by 2032, at a CAGR of 15.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Menstrual Health Apps Market Size 2024 |

USD 1.21 Billion |

| Menstrual Health Apps Market, CAGR |

15.9% |

| Menstrual Health Apps Market Size 2032 |

USD 3.94 Billion |

The Menstrual Health Apps market grows through rising awareness of women’s health, mobile penetration, and digital wellness adoption. Users seek personalized tracking, fertility insights, and symptom management, driving consistent engagement. Developers integrate AI, analytics, and wearable compatibility to enhance user experience and app value. Strong support from healthcare providers and insurers boosts institutional adoption. Data privacy regulations and regional health initiatives further shape market growth. These trends position menstrual apps as essential tools in preventive and reproductive health management.

North America leads the Menstrual Health Apps market due to strong digital infrastructure and high user engagement. Europe follows with growing adoption driven by health policies and femtech innovation. Asia-Pacific shows rapid growth supported by rising smartphone use and reproductive health awareness. Latin America and the Middle East & Africa show steady expansion through localized apps and NGO-led outreach. Key players include Flo Health Inc., Natural Cycles USA Corp, Fitbit, Inc., and Glow Inc., who continue to invest in innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Menstrual Health Apps market was valued at USD 1.21 billion in 2024 and is projected to reach USD 3.94 billion by 2032, growing at a CAGR of 15.9%.

- Rising awareness of menstrual wellness, fertility planning, and digital health literacy drives strong market demand.

- Trends include integration of AI, wearables, and mental health features to offer personalized and holistic care.

- Leading players focus on clinical validation, privacy compliance, and partnerships with healthcare providers to strengthen credibility.

- Challenges include lack of medical oversight in many apps, limited integration into formal healthcare, and privacy concerns.

- North America leads the market due to advanced digital infrastructure and strong user adoption, while Asia-Pacific shows fastest growth.

- Competitive firms such as Flo Health Inc., Fitbit, Glow Inc., and Natural Cycles USA Corp drive innovation across platforms and regions.

Market Drivers

Rising Awareness of Women’s Health and Digital Health Literacy Boosting App Adoption

Growing awareness about reproductive health and menstrual hygiene supports stronger interest in period tracking tools. Women across all age groups seek personalized insights, fertility monitoring, and symptom management. Schools, workplaces, and public campaigns increasingly promote menstrual education. This has led to higher demand for apps that simplify health tracking. The Menstrual Health Apps market benefits from this shift in public mindset and digital health awareness. It supports the uptake of self-monitoring solutions and builds confidence in health technology. Rising literacy in digital platforms further encourages usage among younger and tech-savvy users.

- For instance, the Flo app recorded about 70 million monthly active users as of mid‑2024, highlighting widespread adoption driven by increasing digital health awareness

Expansion of Smartphone Penetration and Affordable Internet Services Encouraging Usage

Smartphone access and low-cost mobile data plans have expanded significantly in emerging and developed regions. These trends allow more users to access health apps regardless of geography or income. Developers optimize apps to function offline or in low-connectivity settings, making them usable in rural areas. The Menstrual Health Apps market gains from this broader tech accessibility and improved connectivity infrastructure. It supports daily usage, symptom logging, and medication reminders without disruption. Affordable smartphones also drive first-time downloads and frequent app interactions. This growth expands the user base across age and income segments.

- For instance, Clue continued to experience growth beyond the 10 million user mark. As of May 2025, Clue announced it had reached 1 million paid subscribers, leveraging its large user base of over 10 million active users. In December 2023, the University of Exeter news team confirmed that Clue was used by “more than 10 million women and people with cycles

Integration of AI, Analytics, and Custom Features Enhancing User Experience

App developers invest in advanced features including predictive analytics, AI-based recommendations, and telehealth integration. These tools provide better period predictions, fertility window alerts, and real-time consultations. Users value custom tracking features for mood, pain, flow, and sleep. The Menstrual Health Apps market benefits from innovations that personalize and improve user engagement. It fosters repeat usage and long-term app loyalty among diverse users. These technologies increase perceived app value and expand monetization options. Enhanced app quality supports market growth by meeting individual health needs.

Support from Healthcare Providers, Insurers, and Government Policies Strengthening Adoption

Healthcare providers now recommend menstrual tracking apps to support diagnosis, treatment planning, and virtual consultations. Some insurers include such apps in wellness programs or reimburse usage costs. Government support for women’s health policies and digital health frameworks creates a favorable environment. The Menstrual Health Apps market is strengthened by these institutional partnerships and healthcare incentives. It allows broader integration into formal health systems and patient support strategies. Hospitals and clinics encourage app use for chronic condition tracking and reproductive planning. Policy support ensures that menstrual health tools reach underserved populations.

Market Trends

Shift Toward Comprehensive Reproductive and Wellness Tracking Platforms

Menstrual health apps are evolving beyond basic period tracking to include full-cycle wellness management. Users expect features covering ovulation, PMS symptoms, sexual health, mood, sleep, and nutrition. Many platforms offer guided content, reminders, and wellness tips aligned with each cycle phase. The Menstrual Health Apps market reflects this trend through multi-functional apps tailored to broader lifestyle needs. Developers respond with deeper insights, making apps more personalized and engaging. This shift supports daily app engagement and long-term user retention. Comprehensive tracking positions these platforms as holistic health companions.

- For instance, Flo launched its Anonymous Mode in 2022, beginning with iOS users on June 30, 2022, and expanding to Android users in October 2022, making the feature available to its entire user base. Around the time of the launch, Flo reported 48 million monthly active users and over 240 million downloads, highlighting its widespread adoption.

Growing Focus on Data Privacy, Security, and Regulatory Compliance

Concerns about personal data privacy drive stronger user expectations and regulatory scrutiny. Developers must comply with GDPR, HIPAA, and region-specific laws to protect sensitive health data. Many apps now feature end-to-end encryption, anonymous tracking, and user consent controls. The Menstrual Health Apps market adapts to this shift by promoting transparency and data ownership. Users show growing preference for platforms that clearly disclose data policies. App providers build trust through secure architecture and ethical practices. This trend is shaping brand loyalty and product credibility.

- For instance, Clue allows users to monitor over 30 health categories, including mood, sleep, energy, and pain—integrated into its core tracking features across global user base

Increased Collaboration with Femtech Startups and Healthcare Stakeholders

App developers partner with femtech startups, fertility clinics, and women’s health organizations to expand service offerings. These collaborations bring clinical validation, expert content, and integration with diagnostics or wearable devices. The Menstrual Health Apps market reflects growing synergy between consumer apps and clinical care. It improves care continuity, supports chronic condition tracking, and aligns with personalized health plans. Health professionals increasingly use data insights from apps to guide treatment decisions. Strategic alliances support research, clinical trials, and product innovation.

Integration with Smart Devices and Wearables for Real-Time Health Insights

Wearables like fitness bands and smartwatches now sync with menstrual health apps to enable real-time tracking. Metrics such as heart rate, temperature, and sleep patterns support better cycle predictions and symptom analysis. The Menstrual Health Apps market incorporates this hardware-software integration to improve accuracy. It enables passive data collection and strengthens health monitoring capabilities. Users benefit from seamless app-device interactions that reduce manual entry. This trend supports smarter, data-driven reproductive health solutions.

Market Challenges Analysis

Lack of Standardized Clinical Validation and Medical Integration Slows Trust Building

Many menstrual health apps lack medical oversight or clinically validated algorithms. This limits their credibility among healthcare professionals and policy stakeholders. Users often face inconsistent insights or generic recommendations that fail to align with actual symptoms. The Menstrual Health Apps market struggles to build trust without standardized validation frameworks. Integration with healthcare systems remains limited, making app data underutilized in formal diagnosis or care plans. Some apps also rely heavily on self-reported data, which affects accuracy. Without clinical partnerships, many apps remain perceived as wellness tools rather than reliable health solutions.

Data Privacy Concerns and Uneven Global Regulatory Frameworks Impact Growth

Privacy remains a major concern, especially when apps collect intimate health data without clear usage policies. Many users lack awareness of how their data is stored, shared, or monetized. This creates barriers to adoption in regions with limited legal protections. The Menstrual Health Apps market faces challenges in aligning with fragmented global privacy laws. It must adapt to varying rules across regions while keeping trust intact. In low-income or rural areas, lack of digital literacy and mistrust of digital platforms further limit market expansion. These concerns reduce user confidence and stall long-term engagement.

Market Opportunities

Expansion into Underserved Regions with Localized Content and Language Support

Emerging markets in Asia-Pacific, Latin America, and Africa offer strong growth potential due to rising mobile usage and increased health awareness. Many women in these regions still lack access to personalized menstrual health tools. Developers have an opportunity to introduce low-bandwidth apps with regional language support and culturally sensitive content. The Menstrual Health Apps market can grow by tailoring features to local health needs, privacy expectations, and literacy levels. Governments and NGOs increasingly support digital health outreach, creating channels for app promotion and adoption. Localization strengthens relevance, builds user trust, and encourages daily engagement. This expansion addresses gaps in reproductive care access across developing regions.

Development of Paid Wellness Plans, Premium Features, and B2B Partnerships

Freemium business models create opportunities to offer advanced features like hormone tracking, fertility analysis, and telehealth access. Employers, insurers, and healthcare providers seek to integrate such apps into wellness programs and patient support initiatives. The Menstrual Health Apps market can monetize through B2B partnerships and in-app purchases without relying on ads. Subscription models attract users willing to pay for personalized insights and medical-grade features. Clinical content, mental health modules, and lifestyle coaching open new revenue streams. Companies that invest in premium user experiences and trusted partnerships can scale quickly across user segments.

Market Segmentation Analysis:

By App Platform:

Android dominates the global user base due to its affordability and wide adoption, especially in emerging regions. App developers prioritize Android compatibility to ensure reach in cost-sensitive markets. iOS holds a strong share in North America and Western Europe, where Apple devices are more common. It supports users seeking premium features and seamless integration with wearables. Other platforms, including web-based and hybrid apps, serve niche segments but face limited growth. The Menstrual Health Apps market gains from multi-platform strategies that enhance accessibility and user experience across devices.

- For instance, Bellabeat sold 20,000 preorders of its Ivy smart wellness tracker within the first hour of its announcement on December 16, 2020. The company reached over 50,000 preorders by January 2021. This strong initial demand indicates market interest in integrated reproductive and wellness tracking tools

By Application:

Fertility and ovulation management leads the application segment due to rising interest in family planning and conception tracking. Many users seek accurate predictions, hormonal data, and cycle-based reminders to support pregnancy goals. Menstrual health management apps help users address irregular cycles, PMS symptoms, and chronic conditions like PCOS. This sub-segment appeals to women managing reproductive health alongside general wellness. Period cycle tracking remains widely used among teens and young women for daily logging, basic predictions, and calendar tracking. The market sees steady demand across all application areas, driven by personalization and content integration.

- For instance, Natural Cycles has analyzed over 13 million menstrual cycles through its app as of mid-2024, demonstrating robust user engagement and data collection across its registered user base

By Age Group:

Young adults aged 20–29 represent the largest and most active user group, driven by high digital engagement and fertility planning needs. This group values advanced features, health content, and wellness tools integrated into daily routines. Adults aged 30–39 use apps to manage symptoms, pregnancy planning, and long-term reproductive health. Teens aged 13–19 often start with basic period trackers introduced through school or family awareness programs. The Menstrual Health Apps market sees strong adoption in this age band due to early digital exposure. Older adults aged 40+ show growing interest in tracking perimenopause symptoms, although uptake remains moderate. Each age group shows distinct usage behavior, requiring age-specific app features and guidance.

Segments:

Based on App Platform:

- Android

- iOS

- Other app platforms

Based on Application:

- Fertility & ovulation management

- Menstrual health management

- Period cycle tracking

Based on Age Group:

- Teens (13-19)

- Young adults (20-29)

- Adults (30-39)

- Older adults (40+)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Menstrual Health Apps market at 34.2%. High digital health awareness, early adoption of femtech platforms, and strong privacy regulations support this dominance. A large population of tech-savvy users drives strong engagement with menstrual tracking, fertility planning, and wellness apps. Healthcare providers across the United States and Canada increasingly recommend digital tools to support cycle-related consultations and treatment decisions. Widespread use of wearables and smart devices enables seamless app integration and continuous health monitoring. Partnerships with insurance providers and inclusion in wellness benefit programs further increase user adoption. Startups and leading tech firms in the region continue to enhance app design, data security, and AI-based personalization, keeping North America at the forefront of the market.

Europe

Europe accounts for 28.6% of the global Menstrual Health Apps market. Strong focus on digital health, public awareness campaigns, and well-defined regulatory frameworks drive regional adoption. Users in countries such as Germany, the UK, France, and Sweden show consistent use of apps that offer multi-language support and clinical integration. Government policies encourage the use of digital tools for preventive health, including reproductive care. European startups and femtech firms focus on creating apps aligned with data privacy laws such as GDPR, which increases trust among users. Increasing demand for fertility monitoring, especially among women in their 30s and 40s, adds to app engagement. Collaborations with healthcare institutions, universities, and NGOs support widespread education and user retention.

Asia-Pacific

Asia-Pacific holds a 21.3% share of the Menstrual Health Apps market and shows the fastest growth rate. Rising smartphone penetration, affordable internet, and growing awareness of reproductive health drive strong adoption across India, China, Japan, and Southeast Asia. Younger populations with high digital exposure make this region a key target for femtech expansion. Localized app content, multilingual support, and simplified interfaces encourage usage across diverse populations. Governments support digital health initiatives, particularly in rural and semi-urban areas, where traditional healthcare access remains limited. Companies invest in educational campaigns to promote menstrual literacy and reduce social stigma. The integration of menstrual apps into school health programs and public health campaigns strengthens long-term user engagement.

Latin America

Latin America captures 9.7% of the Menstrual Health Apps market. Countries like Brazil, Mexico, Argentina, and Colombia show increasing smartphone adoption and rising interest in women’s wellness tools. Regional users often seek basic period trackers and fertility tools available through free apps or freemium models. Cultural openness to health discussions and improved digital literacy help drive user growth. However, challenges remain in infrastructure and access to advanced digital healthcare solutions. Developers focus on affordability, offline capability, and community-based features to increase engagement. Partnerships with NGOs and women’s health organizations support awareness and encourage app usage in underserved communities.

Middle East & Africa

Middle East & Africa hold the smallest share of 6.2% in the Menstrual Health Apps market. Limited access to digital health tools, cultural barriers, and low awareness levels restrict market expansion in many areas. However, rising mobile penetration and urbanization improve future growth prospects. Countries such as South Africa, the UAE, Nigeria, and Kenya show early signs of adoption, especially among urban youth and women with access to health education. Local developers and global brands create culturally sensitive and privacy-focused apps tailored to the needs of users in this region. Growth depends on targeted outreach, school-based education programs, and partnerships with health ministries. With proper investment and support, the region has potential to unlock stronger market share over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ovia Health

- Fitbit, Inc.

- Flo Health Inc.

- Natural Cycles USA Corp

- MagicGirl

- Planned Parenthood

- Joii Limited

- Glow Inc.

- Biowink GmbH

- Easy@Home Fertility

- Simple Design.Ltd

- Procter & Gamble

- Perigee

Competitive Analysis

Key players in the Menstrual Health Apps market include Flo Health Inc., Fitbit, Inc., Glow Inc., Natural Cycles USA Corp, Ovia Health, Biowink GmbH, Easy@Home Fertility, Procter & Gamble, Planned Parenthood, Joii Limited, Perigee, MagicGirl, and Simple Design Ltd. These companies compete by offering personalized features such as fertility tracking, ovulation prediction, symptom logging, and AI-driven health insights. Many apps prioritize user-friendly interfaces, data security, and integrations with wearable devices. Leading players invest in clinical validation and align with privacy regulations to strengthen user trust. Strategic partnerships with healthcare providers and wellness programs expand their reach into formal health systems. Some companies diversify their offerings by integrating mental health support, lifestyle content, and telehealth access. Freemium models allow broad access, while premium tiers deliver advanced analytics and personalized coaching. Localization, multilingual support, and region-specific features help expand their global footprint. Startups focus on niche areas like perimenopause tracking or adolescent health, while established brands leverage scale, marketing, and brand loyalty to maintain dominance. Continuous innovation, compliance with evolving data laws, and user-centric design remain critical for sustaining leadership in this competitive space.

Recent Developments

- In June 2025, Databricks announced that Flo Health was utilizing its Data Intelligence Platform to power its AI and analytics initiatives.

- In June 2025, Flo Health adds robust AI-driven tracking and predictive analytics, linked to partnerships and privacy-enhancing collaborations

- In 2024, Biowink GmbH (maker of the Clue app) expanded its features beyond cycle tracking, including a new menopause tracking option released in 2023 to cater to users aged 40 and above.

Report Coverage

The research report offers an in-depth analysis based on App Platform, Application, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global focus on women’s health and digital wellness.

- AI and predictive analytics will improve cycle accuracy and personalized recommendations.

- Integration with wearables will support passive tracking and seamless health monitoring.

- Regulatory support will grow to ensure data privacy, clinical safety, and ethical standards.

- New markets will open in low-income and rural regions through localized, low-data apps.

- Partnerships with healthcare providers will enable app-based support in clinical care.

- Mental health and lifestyle tracking will become core features in app ecosystems.

- Freemium and subscription models will drive revenue through added premium features.

- Schools and public health programs will adopt apps for menstrual health education.

- Femtech startups will lead innovation with niche offerings and evidence-backed tools.