Market Overview

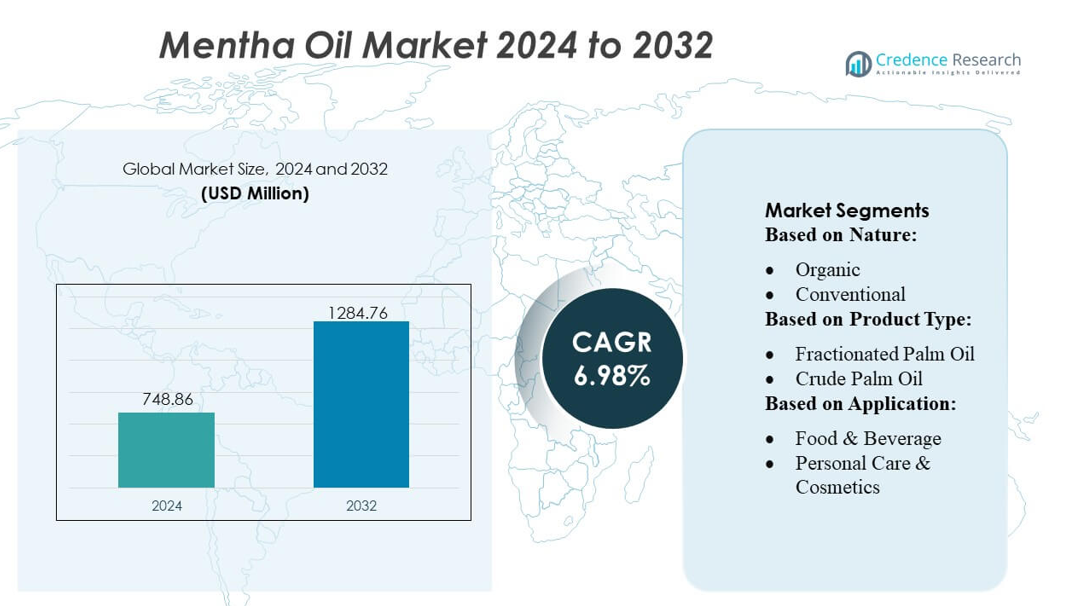

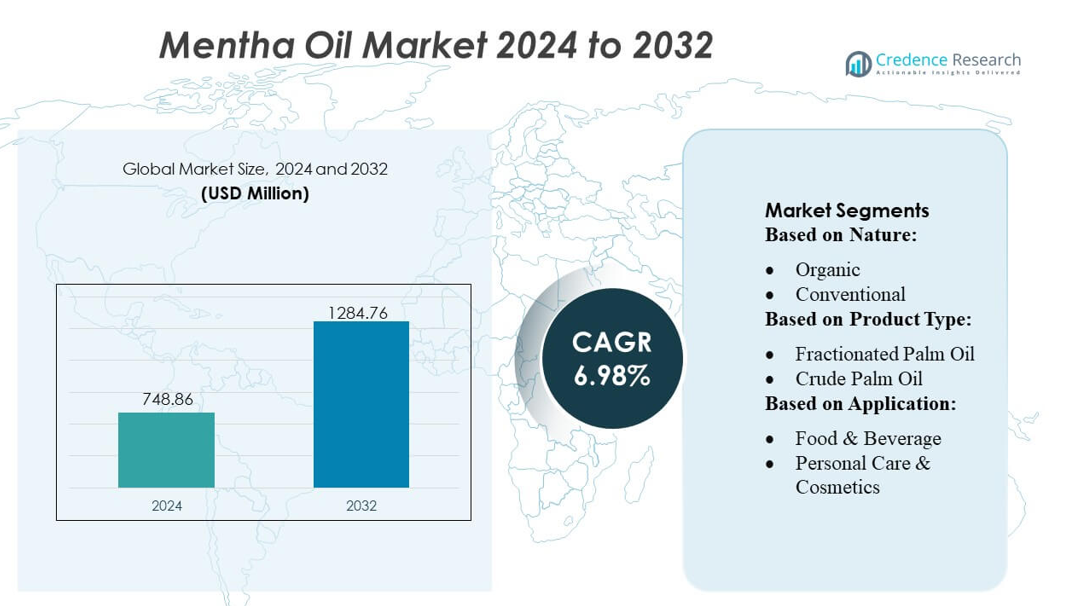

Mentha Oil Market size was valued USD 748.86 million in 2024 and is anticipated to reach USD 1284.76 million by 2032, at a CAGR of 6.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mentha Oil Market Size 2024 |

USD 748.86 million |

| Mentha Oil Market, CAGR |

6.98% |

| Mentha Oil Market Size 2032 |

USD 1284.76 million |

The Mentha Oil Market is shaped by a mix of large distillation units, specialized processors, and export-oriented suppliers that compete through high-purity production, advanced fractionation capabilities, and consistent aroma-profile standardization. Companies strengthen their market positions by adopting traceability systems, improving residue-control processes, and securing long-term procurement partnerships with global F&B, oral-care, and pharmaceutical manufacturers. Asia-Pacific stands as the leading region with an exact 38–40% market share, driven by extensive cultivation, strong distillation infrastructure, and high export volumes that support both domestic and international demand.

Market Insights

- The Mentha Oil Market stands at USD 748.86 million in 2024 and is projected to reach USD 1284.76 million by 2032, advancing at a 6.98% CAGR.

- Asia-Pacific leads the industry with an exact 38–40% share, supported by large-scale cultivation and strong export volumes, while the Food & Beverage segment accounts for an estimated 38–40% share due to high demand for natural cooling agents in confectionery, beverages, and gums.

- Market growth is driven by rising adoption of mentha oil in oral-care, pharmaceutical, and aromatherapy applications, where clean-label and botanical ingredients gain prominence.

- Competition intensifies as producers invest in high-purity distillation, fractionation technologies, and digital traceability systems to strengthen global supply reliability and meet stringent quality standards.

- Key restraints include supply volatility linked to seasonal cultivation, fluctuating raw-material prices, and growing competition from synthetic menthol, though export expansion and value-added menthol derivatives continue to offer new regional opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Nature

The Mentha Oil Market shows clear dominance of the Conventional segment, holding an estimated 82–85% share, supported by large-scale cultivation, steady raw-material availability, and lower production costs across major farming belts. Conventional mentha crops ensure predictable yields and strong supply consistency, making them preferred among flavoring, FMCG, and pharmaceutical manufacturers. The Organic segment, although smaller, expands steadily as premium food, aromatherapy, and natural personal-care brands increase adoption. Rising clean-label preferences, product traceability systems, and certification-driven export demand strengthen its long-term growth potential.

- For instance, Univanich Palm Oil Public Company Ltd. operates advanced extraction and processing infrastructure equipped with continuous-sterilizer systems capable of handling 45 metric tons of fresh fruit bunches per hour, demonstrating the scale efficiencies achieved when optimizing high-throughput agricultural processing lines.

By Product Type

Within product type, Crude Mentha Oil remains the dominant sub-segment with an estimated 72–75% share, driven by its broad use in flavoring formulations, confectionery, oral-care bases, analgesic balms, and pharmaceutical intermediates. Its versatility, strong global trade demand, and well-established distillation network reinforce sustained consumption. Fractionated Mentha Oil grows gradually as end users pursue consistent aroma profiles, higher purity fractions, and application-specific blending advantages. Palm Kernel-derived mentha blends serve niche applications requiring stable oxidation resistance and cost-efficient formulation compatibility, particularly in mass-market personal-care products.

- For instance, Asian Agri the company manages 30 oil-palm plantations spread across North Sumatra, Riau, and Jambi, covering 100,000 hectares of estate land under direct management.

By Application

The Food & Beverage segment leads the Mentha Oil Market with an estimated 38–40% share, supported by strong demand for natural flavorings across confectionery, beverages, bakery products, and chewing gums. Its dominance stems from menthol’s stable sensory profile, clean-label preference, and broad regulatory acceptance. Personal Care & Cosmetics follows closely as brands integrate mentha derivatives into skincare, oral-care, and aromatherapy products. Pharmaceutical applications maintain steady traction due to rising use in cough syrups, topical analgesics, and inhalation therapies. The Others category including tobacco and wellness formulations continues to expand with premium aromatics and customized blends.

Key Growth Drivers

Rising Demand Across F&B, Oral Care, and Pharmaceutical Formulations

The Mentha Oil Market grows rapidly as demand strengthens across food and beverage categories, particularly confectionery, gums, and ready-to-drink beverages that rely on natural cooling agents. Oral-care brands continue to increase menthol usage in toothpastes, mouthwashes, and medicated gels due to its strong sensory impact and antimicrobial attributes. Pharmaceutical adoption expands with higher consumption of cough syrups, inhalation therapies, topical analgesics, and medicated balms. These diversified applications ensure stable volume demand and reinforce mentha oil’s position as a critical natural ingredient in regulated and mass-market formulations.

- For instance, PT. Bakrie Sumatera Plantations Tbk operates a fully integrated plantation-to-processing network with 58,721 hectares of total planted area and five palm oil mills, each equipped with standardized processing capacities (typically ranging from 20 to 60 metric tons of fresh fruit bunches per hour), as documented in the company’s operational disclosures.

Expansion of Aromatherapy, Personal Care, and Wellness Products

Growing global interest in aromatherapy, holistic wellness, and natural skincare elevates the role of mentha oil as a key botanical extract. Personal-care companies incorporate it into cooling creams, serums, foot-care lines, and scalp-care treatments to enhance sensory appeal and functional differentiation. Wellness brands use mentha oil in relaxation blends, massage oils, and diffuser products due to its therapeutic properties. Rising consumer preference for herbal, plant-based formulations accelerates the demand shift toward natural aroma compounds, strengthening the commercial pipeline for mentha-based cosmetic and wellness products.

- For instance, IOI announced commissioning of a new 3.2 MW cogeneration plant, aimed at reducing greenhouse-gas emissions (with a stated potential GHG reduction of 9,000 metric tons CO₂ per annum).

Expansion of Cultivation, Processing Capacity, and Export Opportunities

The market benefits from improved cultivation practices, large-scale distillation infrastructure, and expanded procurement networks across major producing regions. Higher global export demand from flavoring, FMCG, and pharmaceutical companies encourages farmers to adopt better crop management, mechanized harvesting, and quality-focused distillation methods. Strengthening contract farming models and digital procurement platforms increases supply chain efficiency. Export-focused growth, supported by rising demand in Europe, North America, and East Asia, further boosts revenue opportunities and enhances the long-term commercial viability of mentha oil producers.

Key Trends & Opportunities

Shift Toward Natural, Clean-Label, and Traceable Ingredients

Manufacturers capitalize on a strong global movement toward clean-label ingredients, where mentha oil serves as a natural alternative to synthetic cooling agents and artificial aromas. Brands highlight its botanical origin, traceability, and minimal processing to align with consumer expectations for purity and authenticity. Digital supply-chain tools create opportunities for QR-code–based transparency, batch-wise sourcing insights, and quality verification. This trend strengthens mentha oil’s relevance in premium F&B, herbal cosmetics, and therapeutic products, enabling producers to secure higher-value opportunities in regulated and certification-driven markets.

- For instance, UP has been systematically renewing its plantations over the last decade, the company has replanted 15,600 hectares of oil palm, to refresh plantation age profile and boost long-term yield and efficiency.

Product Diversification Through High-Purity Fractions and Value-Added Menthol

Processing innovations create new growth avenues as manufacturers develop high-purity menthol crystals, tailored terpene fractions, and specialty blends for application-specific requirements. Fractionated mentha oils with consistent sensory profiles enable precision use in beverages, confectionery, and pharmaceuticals. Value-added offerings—including deodorized grades, allergen-reduced extracts, and enhanced aromatic fractions—open opportunities in premium formulations. These advancements support portfolio diversification and help producers differentiate in competitive markets by supplying high-performance flavoring and functional ingredients.

- For instance, Kuala Lumpur Kepong (KLK) the group manages approximately 300,000 hectares of oil-palm plantations across Malaysia, Indonesia, and Liberia, feeding 34 palm-oil mills that process fresh fruit bunches at scale.

Rising Adoption in Functional Foods and Herbal Therapeutics

Mentha oil’s natural therapeutic profile drives its use in functional F&B products, herbal supplements, and digestive health formulations. Brands integrate mentha extracts into teas, lozenges, nutraceutical blends, and gut-health products to meet consumer demand for natural relief solutions. Growth in herbal cough remedies, topical pain relievers, and vaporizing blends enhances opportunities for formulators seeking evidence-backed botanical actives. This broadening application landscape increases value creation and supports long-term inclusion in wellness-oriented product categories.

Key Challenges

Price Volatility and Supply-Chain Dependence on Seasonal Cultivation

The Mentha Oil Market faces persistent price fluctuations due to its dependence on seasonal crop cycles, variable climatic conditions, and fragmented farm-level production. Unpredictable rainfall, pest issues, and shifting cultivation patterns significantly affect yield and oil content, creating uncertainty in supply and procurement costs. Limited storage infrastructure and speculative trading activities add further volatility. These challenges pressure downstream manufacturers, forcing them to manage dynamic pricing, hedge risks, and diversify sourcing strategies to maintain production stability.

Rising Competition from Synthetic and Alternative Aroma Compounds

Increasing availability of synthetic menthol and cost-efficient cooling agents challenges natural mentha oil adoption in several mass-market applications. Synthetic alternatives offer consistent quality, predictable supply, and lower formulation costs, making them attractive in high-volume FMCG segments. Regulatory scrutiny related to pesticide residues and batch variability in natural oils adds complexity for manufacturers. To remain competitive, natural mentha producers must focus on purity improvements, traceability, and application-specific innovations that highlight the performance and premium value of naturally derived menthol.

Regional Analysis

North America

North America holds an estimated 24–26% share of the Mentha Oil Market, supported by strong demand from the food, confectionery, oral-care, and pharmaceutical industries. The region benefits from well-established supply partnerships with Asian producers and consistent adoption of natural flavoring agents in premium F&B products. Rising consumption of herbal therapeutics, menthol-based cold remedies, and aromatherapy products strengthens market traction. Regulatory emphasis on clean-label ingredients boosts natural mentha oil usage across personal-care formulations, while steady growth in functional beverages and wellness categories expands long-term demand.

Europe

Europe accounts for roughly 22–24% share, driven by stringent regulatory standards that encourage the use of natural, traceable, and high-purity mentha derivatives. The region’s mature food processing, confectionery, and oral-care industries integrate mentha oil into flavoring systems, sugar-free gums, and medicated lozenges. Demand increases further with the expansion of aromatherapy, herbal cosmetics, and therapeutic wellness blends. Strong consumer inclination toward botanical ingredients and sustainable sourcing pushes manufacturers to secure certified and fractionated mentha oils, supporting steady market growth across Western and Central European economies.

Asia-Pacific

Asia-Pacific leads the Mentha Oil Market with an estimated 38–40% share, driven by extensive cultivation, large-scale distillation networks, and strong domestic consumption across FMCG, Ayurveda, pharmaceuticals, and food processing. India remains the global production hub, supplying mentha oil and menthol crystals to major international buyers. Growing demand for natural cooling agents in beverages, traditional medicines, and personal-care products reinforces regional dominance. Rising export opportunities, expanding aromatherapy markets, and increasing adoption of herbal therapeutics contribute to sustained growth, positioning Asia-Pacific as the primary engine of global mentha oil supply and demand.

Latin America

Latin America holds approximately 8–10% share, supported by rising usage of mentha oil in confectionery, herbal medicines, and wellness-oriented personal-care products. Brazil and Mexico lead consumption due to expanding beverage categories, natural flavor adoption, and growing OTC pharmaceutical demand. Regional manufacturers increasingly prefer botanical cooling agents for premium formulations, while aromatherapy and spa products gain popularity in urban markets. Strengthening import flows from Asia and increasing alignment with clean-label trends enhance market opportunities, though growth remains moderate due to limited local cultivation and reliance on external supply.

Middle East & Africa (MEA)

The Middle East & Africa region captures an estimated 6–8% share, driven by expanding demand for menthol-based pharmaceuticals, oral-care products, and personal-care formulations. Gulf countries exhibit strong consumption due to rising purchases of medicated balms, inhalation remedies, and flavored confectionery. In North Africa, growing interest in herbal wellness and aromatherapy supports gradual market expansion. The region remains import-dependent, sourcing primarily from Asia-Pacific producers. Increasing urbanization, premium cosmetic adoption, and broader retail access to natural therapeutic products continue to create incremental opportunities across MEA markets.

Market Segmentations:

By Nature:

By Product Type:

- Fractionated Palm Oil

- Crude Palm Oil

By Application:

- Food & Beverage

- Personal Care & Cosmetics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mentha Oil Market features such as Univanich Palm Oil Public Company Ltd., ADM, Asian Agri, PT. Bakrie Sumatera Plantations Tbk, Kulim (Malaysia) Berhad, IOI Corporation Berhad, PT Sampoerna Agro Tbk, United Plantations Berhad, Wilmar International Ltd., and Kuala Lumpur Kepong Berhad. The Mentha Oil Market is defined by a mix of large distillation units, specialized processors, and export-driven suppliers that prioritize high-purity production, consistent aromatic profiles, and strong global distribution capabilities. Companies focus on optimizing cultivation networks, improving oil recovery rates, and deploying advanced fractionation technologies to meet stringent quality benchmarks in food, oral care, and pharmaceutical applications. Increasing emphasis on clean-label compliance and batch traceability pushes producers to adopt digital monitoring, residue-control systems, and standardized distillation processes. Market participants strengthen competitiveness through long-term procurement partnerships, customized menthol formulations, and expanded export portfolios targeting Europe, North America, and Asia-Pacific. Sustainability initiatives and supply-chain reliability continue to shape strategic positioning across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Univanich Palm Oil Public Company Ltd.

- ADM

- Asian Agri

- Bakrie Sumatera Plantations Tbk

- Kulim (Malaysia) Berhad

- IOI Corporation Berhad

- PT Sampoerna Agro, Tbk

- United Plantations Berhad

- Wilmar International Ltd.

- Kuala Lumpur Kepong Berhad

Recent Developments

- In January 2025, Baker Hughes has secured an order from Tecnicas Reunidas to deliver six propane compressors and six gas compression trains for 3rd phase development of Aramco’s Jafurah gas field located in Saudi Arabia. Strengthening its expertise in natural gas value chain, the company will also supply electric motor driven by compression solutions.

- In January 2025, BP started gas flow at the Greater Tortue Ahmeyim (GTA) Phase 1 project, sending it to the FPSO for commissioning, with full operation expected to yield around of LNG annually, a major step for West Africa’s energy future, notes bp.com, Energy Connects, LNG Journal, and NS Energy.

- In September 2024, Exxon Mobil Corporation and Mitsubishi Corporation entered a project framework agreement for Mitsubishi’s participation in Exxon Mobil’s advanced facility in Baytown, Texas. The project will produce low carbon hydrogen with an impressive 98% carbon capture efficiency in line with low carbon ammonia.

- In August 2024, Chevron announced to establish the Engineering and Innovation Excellence Center in Bangaluru. This R&D center marked the company’s first large-scale engineering and innovation facility in India. This center will focus on attracting specialized expertise in digital and engineering services

Report Coverage

The research report offers an in-depth analysis based on Nature, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth as food, confectionery, and oral-care manufacturers increase adoption of natural cooling agents.

- Pharmaceutical applications will expand with rising use of menthol in cough remedies, inhalation products, and topical analgesics.

- Clean-label and botanical ingredient preferences will strengthen mentha oil’s position in premium F&B and personal-care formulations.

- Growth in aromatherapy, wellness products, and natural therapeutics will broaden application opportunities.

- Producers will invest in advanced fractionation technologies to deliver high-purity menthol and customized aromatic profiles.

- Supply chains will become more traceable as digital platforms support batch tracking and certification transparency.

- Export demand will rise as global brands prioritize natural flavoring compounds over synthetic substitutes.

- Cultivation improvements and better distillation efficiency will enhance production stability and quality consistency.

- Sustainability programs will gain importance as buyers emphasize responsible sourcing and reduced environmental impact.

- Competition will intensify as manufacturers develop value-added mentha derivatives to serve specialized premium markets.