| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Cardiovascular Devices Market Size 2024 |

USD 1,841.93 Million |

| Mexico Cardiovascular Devices Market, CAGR |

5.7% |

| Mexico Cardiovascular Devices Market Size 2032 |

USD 3,027.91 Million |

Market Overview

The Mexico Cardiovascular Devices Market is projected to grow from USD 1,841.93 million in 2024 to an estimated USD 3,027.91 million based on 2032, with a compound annual growth rate (CAGR) 5.7% from 2025 to 2032. This growth trajectory reflects the country’s increasing burden of cardiovascular diseases, a rising elderly population, and greater accessibility to advanced medical technologies.

Key drivers shaping the market include a growing prevalence of hypertension, obesity, and diabetes, which are primary risk factors for heart disease. Advancements in device technology—such as next-generation pacemakers, defibrillators, and drug-eluting stents—are improving patient outcomes and encouraging clinical adoption. Additionally, trends such as telecardiology, increased health awareness, and integration of AI in diagnostic systems are transforming cardiovascular care delivery and fostering demand for efficient, real-time monitoring solutions.

Geographically, major urban centers such as Mexico City, Guadalajara, and Monterrey serve as hubs for advanced cardiovascular care, with high concentration of hospitals and specialty clinics. These regions attract investments from both domestic and international medical device manufacturers. Prominent players operating in the Mexico market include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, GE HealthCare, and Siemens Healthineers, all of which are actively expanding their product offerings and regional footprint through partnerships, innovation, and regulatory approvals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico Cardiovascular Devices Market is projected to grow from USD1,841.93 million in 2024 to USD3,027.91 million by 2032, registering a CAGR of 5.7% from 2025 to 2032.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- Increasing prevalence of cardiovascular diseases, fueled by aging demographics, hypertension, diabetes, and obesity, is driving the demand for advanced diagnostic and therapeutic devices.

- Innovations such as AI-enabled diagnostics, minimally invasive surgical tools, and next-generation implantable devices are enhancing clinical outcomes and supporting market growth.

- Public health initiatives and expanding private healthcare infrastructure are improving access to cardiovascular care, particularly in urban regions.

- A key restraint is the disparity in healthcare access between urban and rural areas, where limited infrastructure and specialist availability hinder widespread adoption of advanced devices.

- Mexico City, Monterrey, and Guadalajara account for the largest share of the market due to their robust medical infrastructure and concentration of specialty cardiac centers.

- Leading players like Medtronic, Abbott, Boston Scientific, GE HealthCare, and Siemens Healthineers are actively investing in product innovation, partnerships, and local market expansion.

Report Scope

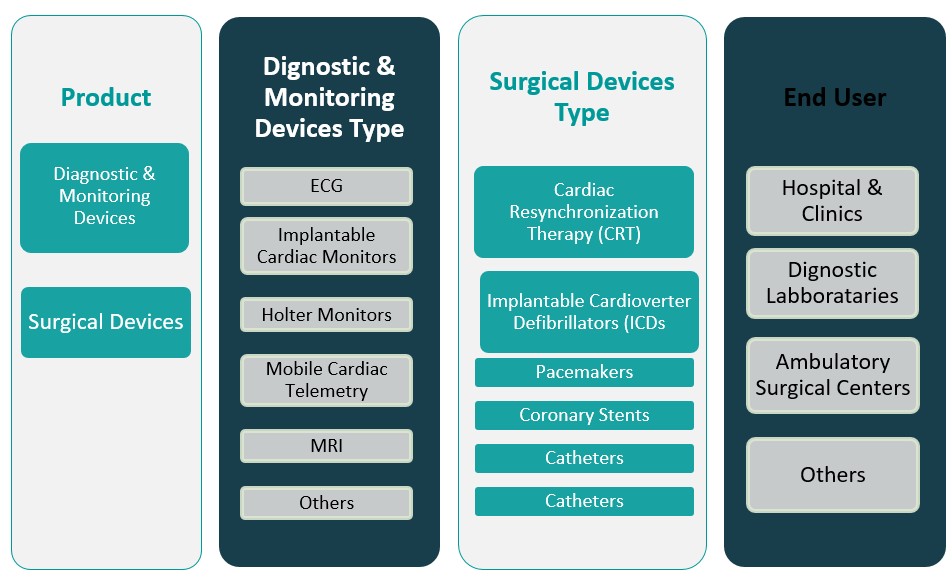

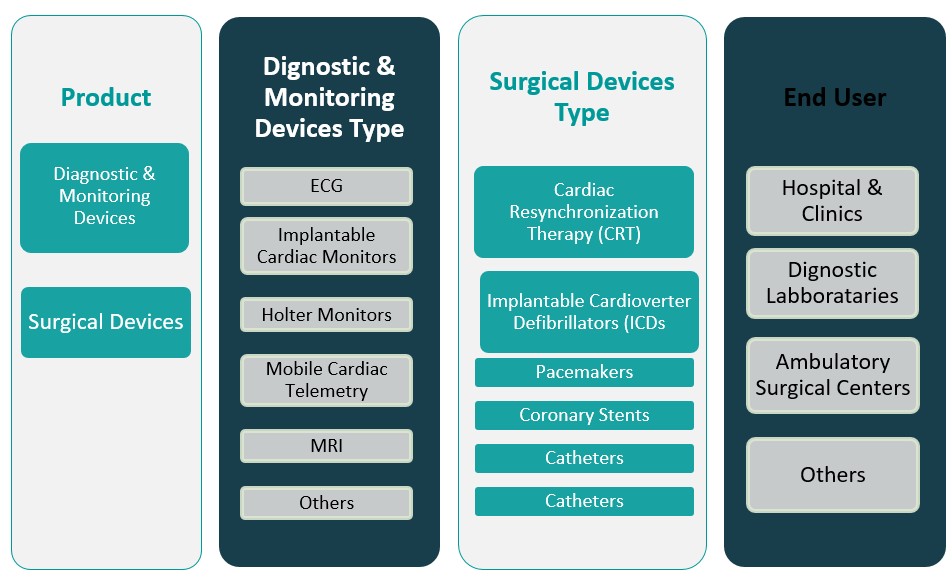

This report segments the Mexico Cardiovascular Devices Market as follows:

Market Drivers

Rising Prevalence of Cardiovascular Diseases and Related Risk Factors

One of the primary drivers of the Mexico Cardiovascular Devices Market is the increasing incidence of cardiovascular diseases (CVDs) across the population. Conditions such as coronary artery disease, heart failure, arrhythmias, and stroke have emerged as leading causes of mortality in the country. The growing burden of lifestyle-related risk factors, including obesity, physical inactivity, smoking, unhealthy diets, and high cholesterol levels, has significantly contributed to the surge in cardiovascular cases. According to the World Heart Observatory, for instance, cardiovascular disease accounted for 167,535 deaths in Mexico. Hypertension and diabetes, both of which are closely linked to CVDs, have shown rising prevalence rates, further aggravating the situation. This rising disease burden has created an urgent demand for effective diagnostic, monitoring, and therapeutic cardiovascular solutions. The need for early intervention, timely diagnosis, and continuous patient monitoring is pushing healthcare providers to adopt advanced cardiovascular devices such as electrocardiographs, echocardiography systems, stents, pacemakers, and defibrillators. Hospitals, clinics, and cardiac care centers are increasingly relying on these technologies to improve outcomes, reduce readmission rates, and enhance patient survival. As the population continues to age and chronic diseases become more widespread, the demand for high-performance cardiovascular devices is expected to escalate further over the forecast period.

Expanding Healthcare Infrastructure and Access to Advanced Medical Technologies

Mexico’s ongoing investment in healthcare infrastructure is another key driver fueling the growth of its cardiovascular devices market. The Mexican government, along with private healthcare institutions, is working to modernize facilities, upgrade diagnostic capabilities, and integrate technologically advanced solutions into clinical workflows. Public and private healthcare spending has increased in recent years, resulting in improved access to specialized cardiology services, particularly in urban and semi-urban regions. Expansion of hospitals, surgical centers, and private cardiac clinics has helped bridge gaps in cardiovascular care and enabled wider adoption of sophisticated cardiovascular technologies. Additionally, global medical device manufacturers are recognizing Mexico as a high-potential market and are expanding their operations, distribution networks, and partnerships in the region. For instance, Leading companies are introducing next-generation devices, including drug-eluting stents, catheter-based interventions, portable diagnostic equipment, and remote cardiac monitoring systems. Technological innovations, coupled with greater accessibility, are allowing healthcare providers to offer minimally invasive procedures with shorter recovery times and lower risks.

Growth in Health Awareness and Preventive Cardiology Initiatives

Increasing health awareness among the general population and a growing focus on preventive healthcare are significantly contributing to the growth of the cardiovascular devices market in Mexico. National campaigns, public-private health programs, and educational initiatives are actively promoting heart health and encouraging early screening for cardiovascular risk factors. As awareness levels improve, more individuals are opting for routine check-ups, cardiac risk assessments, and lifestyle modifications, thereby increasing the demand for cardiovascular diagnostic and monitoring tools. Moreover, the integration of preventive cardiology into primary care is accelerating the use of devices such as blood pressure monitors, cholesterol testing kits, and wearable ECG sensors. These tools support early detection and management of cardiovascular abnormalities before they progress into critical conditions. The adoption of wearable health tech and home-use monitoring devices is also growing, driven by consumer demand for convenient, non-invasive solutions. This trend aligns with the broader shift toward personalized and preventive healthcare, further boosting market demand for cardiovascular technologies that empower patients and clinicians alike.

Favorable Regulatory Framework and Market Entry Support for Medical Device Manufacturers

Mexico’s relatively favorable regulatory environment is another catalyst for the cardiovascular devices market. The country’s medical device industry is regulated by the Federal Commission for the Protection against Sanitary Risk (COFEPRIS), which oversees the approval, importation, and commercialization of medical technologies. In recent years, COFEPRIS has undertaken several reforms to streamline regulatory processes, reduce approval timelines, and align national standards with international benchmarks. These improvements have facilitated quicker market entry for innovative cardiovascular devices and enhanced the competitiveness of the local healthcare ecosystem. Furthermore, Mexico’s participation in global trade agreements—such as the United States-Mexico-Canada Agreement (USMCA)—has strengthened its position as a key player in the North American medical device supply chain. The country offers attractive manufacturing and distribution advantages, including cost-effective labor, geographic proximity to the U.S. market, and well-developed logistics infrastructure. These factors are encouraging both domestic and international players to invest in cardiovascular device development, testing, and commercialization within Mexico. As regulatory frameworks continue to evolve and market entry barriers decline, the availability and adoption of cutting-edge cardiovascular technologies are set to increase, driving sustained growth in the industry.

Market Trends

Rise in Minimally Invasive and Catheter-Based Procedures

The Mexico Cardiovascular Devices Market is witnessing a significant shift toward minimally invasive and catheter-based interventions. These procedures are gaining popularity due to their reduced post-operative risks, shorter hospital stays, and faster patient recovery times. Transcatheter aortic valve replacement (TAVR), angioplasty, and catheter-based ablation therapies are increasingly being adopted in both public and private healthcare institutions. Cardiologists and cardiac surgeons are favoring these techniques over traditional open-heart surgeries, especially for high-risk and elderly patients who may not be suitable candidates for invasive procedures. The trend is further supported by the availability of advanced medical devices and imaging technologies, such as fluoroscopy-guided navigation systems, intravascular ultrasound (IVUS), and drug-eluting stents. These tools enhance the precision and safety of procedures, allowing for better patient outcomes. For instance, hospitals in Mexico City and Monterrey have integrated hybrid operating rooms that combine real-time imaging with interventional cardiology, improving procedural accuracy and efficiency. Additionally, the adoption of minimally invasive cardiovascular procedures is reinforced by advancements in catheter technology. For instance, newer catheter designs allow for better navigation through complex anatomies, reducing procedural complications and improving success rates. As technology advances and clinical outcomes improve, the widespread use of these techniques is expected to strengthen Mexico’s position in patient-centric cardiac care.

Integration of Digital Health and Remote Monitoring Solutions

Digital transformation is reshaping the cardiovascular devices landscape in Mexico, with a marked increase in the integration of remote monitoring systems and digital health tools. The growing demand for real-time, data-driven insights into patient health is driving the adoption of wearable devices, smartphone-based electrocardiograms (ECGs), and cloud-connected cardiac monitors. These technologies support the early detection of arrhythmias, heart failure, and other cardiovascular anomalies, enabling timely medical intervention and reducing hospital readmissions. For instance, AI-powered ECG analysis tools are now being deployed in Mexican hospitals to enhance diagnostic accuracy and streamline patient management. Healthcare providers are increasingly deploying telecardiology solutions that allow specialists to remotely monitor patients’ heart health and adjust treatment plans as needed. This is particularly beneficial in Mexico’s rural and underserved regions, where access to specialized cardiology care is limited. For instance, government-backed telemedicine initiatives are expanding digital health infrastructure to improve accessibility. Patients benefit from greater autonomy in managing chronic heart conditions while remaining connected to healthcare professionals. The COVID-19 pandemic accelerated the shift toward remote care, and this momentum continues to drive innovation in connected cardiovascular devices. As health systems strive for efficiency, the adoption of integrated, interoperable cardiovascular devices that enable proactive care is poised to strengthen significantly in the coming years.

Increasing Focus on Personalized and Precision Cardiology

The market is experiencing a notable shift toward personalized and precision cardiology, with a growing emphasis on individualized treatment plans based on genetic, biometric, and lifestyle data. Cardiologists in Mexico are adopting advanced diagnostic tools and software that enable tailored interventions for conditions such as heart failure, atrial fibrillation, and coronary artery disease. This trend is driven by the recognition that one-size-fits-all approaches are often inadequate in managing complex cardiovascular cases. Genetic testing and biomarker-based diagnostics are becoming more prevalent, particularly in private healthcare settings, where patients seek comprehensive evaluations before undergoing procedures. Device manufacturers are responding by developing modular and adaptive cardiovascular devices—such as adjustable pacemakers and smart stents—that align with specific patient profiles. These innovations enable clinicians to optimize therapy efficacy while minimizing adverse effects and complications. Artificial intelligence (AI) and machine learning are also playing a role in this trend, with algorithms analyzing large datasets to predict cardiovascular risks and recommend treatment paths. As data integration improves and electronic health records become more robust, the application of precision cardiology is set to expand. This trend not only improves patient outcomes but also supports more efficient resource allocation across the healthcare system.

Expansion of Public-Private Partnerships in Cardiovascular Care

Public-private partnerships (PPPs) are emerging as a vital mechanism to enhance cardiovascular care in Mexico. With public healthcare systems often constrained by budget limitations and infrastructure gaps, collaboration with private sector stakeholders is helping bridge the access and quality divide. These partnerships focus on improving diagnostic capabilities, expanding interventional cardiology units, and equipping hospitals with modern cardiovascular devices. The federal and state governments are working with private companies to develop cardiovascular centers of excellence and facilitate medical device procurement under shared funding models. For instance, certain public hospitals have entered agreements with multinational device manufacturers to deploy advanced imaging and intervention equipment while offering training to local medical staff. This collaborative approach not only improves clinical capabilities but also fosters technology transfer and knowledge exchange. Moreover, PPPs play a crucial role in expanding healthcare access in underserved regions. Mobile clinics and outreach programs co-developed by government agencies and private entities provide cardiovascular screenings and early diagnostics in remote areas. As healthcare demand continues to rise, PPPs are expected to remain a strategic tool for scaling high-quality cardiovascular care across the country. Their success will depend on long-term policy support, aligned incentives, and robust evaluation mechanisms.

Market Challenges

Limited Access to Advanced Cardiovascular Care in Rural and Underserved Regions

One of the most pressing challenges in the Mexico Cardiovascular Devices Market is the unequal access to advanced cardiovascular care across the country, particularly in rural and remote regions. While urban centers such as Mexico City, Monterrey, and Guadalajara are equipped with well-established hospitals, trained cardiologists, and high-end cardiovascular technologies, rural areas often lack even basic diagnostic infrastructure. This disparity severely limits early detection, timely intervention, and continuous monitoring for patients suffering from cardiovascular conditions in these regions. Public healthcare facilities in underserved areas are often constrained by inadequate funding, insufficient staffing, and limited availability of advanced medical devices. The shortage of interventional cardiologists and specialized technicians further compounds the issue, forcing patients to travel long distances for consultations or procedures, which leads to delays in treatment and worsened outcomes. Moreover, many rural health centers do not have the purchasing power or procurement flexibility to adopt newer-generation cardiovascular devices. For instance, hospitals in Mexico have increasingly adopted wearable ECG monitors and implantable cardiac devices to improve remote patient monitoring, but rural facilities struggle with implementation due to infrastructure limitations. These limitations contribute to the underutilization of life-saving technologies and hinder the overall market growth. In 2024, Mexico-based MedTech Innovators introduced a portable echocardiography system designed for use in remote clinics, aiming to enhance early detection of cardiovascular diseases in underserved regions. Although telemedicine and mobile health units offer promising alternatives, their implementation remains inconsistent due to infrastructure deficits, such as unreliable internet connectivity and lack of training. Addressing this access gap requires strategic investments, capacity-building programs, and strengthened public-private collaboration to ensure equitable distribution of cardiovascular care and technologies across all regions of Mexico.

High Cost of Advanced Devices and Budget Constraints in Public Healthcare

The high cost associated with advanced cardiovascular devices represents a significant barrier to widespread adoption, particularly within Mexico’s publicly funded healthcare system. Technologies such as implantable cardioverter defibrillators (ICDs), drug-eluting stents, 3D imaging systems, and robotic-assisted surgical tools involve substantial capital investment and recurring maintenance expenses. These costs are often prohibitive for public hospitals operating under budget constraints, limiting their ability to upgrade equipment or introduce innovative treatment options. Although the private healthcare sector in Mexico offers access to state-of-the-art cardiovascular devices, these services remain unaffordable for a large segment of the population. As a result, many patients receiving treatment through public insurance programs must rely on older or less effective devices, potentially impacting clinical outcomes. Reimbursement challenges and long procurement cycles further hinder the adoption of high-end cardiovascular technologies in the public domain. Additionally, the financial burden extends beyond initial device acquisition. The implementation of new technologies often requires training programs, updated clinical protocols, and infrastructure upgrades, which public institutions may struggle to finance. Limited funding also affects research and development, local manufacturing capabilities, and the availability of technical support, contributing to long-term sustainability concerns. To overcome these challenges, stakeholders must focus on cost-containment strategies, such as localized manufacturing, value-based procurement, and public-private partnerships. These efforts could help make advanced cardiovascular devices more accessible, reduce the total cost of ownership, and enhance the quality of care across both public and private healthcare systems in Mexico.

Market Opportunities

Growing Demand for Preventive Cardiology and Early Diagnostic Technologies

A significant market opportunity lies in the rising demand for preventive cardiology solutions and early-stage diagnostic technologies across Mexico. As cardiovascular diseases continue to be the leading cause of mortality, both healthcare providers and policymakers are shifting focus toward proactive health management and early detection strategies. This shift is creating substantial growth potential for manufacturers of non-invasive diagnostic devices such as portable ECG monitors, wearable cardiac sensors, and ambulatory blood pressure monitors. The increasing penetration of digital health platforms and mobile diagnostics further strengthens this opportunity by extending access to underserved populations. Companies that invest in affordable, user-friendly diagnostic solutions and partner with healthcare institutions to expand preventive screening programs stand to capture a sizable share of the market while contributing to improved public health outcomes.

Expansion of Local Manufacturing and Strategic Collaborations

The development of local manufacturing capabilities and strategic collaborations presents another lucrative opportunity in the Mexico Cardiovascular Devices Market. Given the high import dependency and cost pressures associated with advanced medical equipment, local production of cardiovascular devices—especially low-to-mid-range diagnostic and therapeutic tools—could significantly improve market accessibility. Government incentives under Mexico’s industrial development programs and trade agreements such as USMCA support technology transfer and foreign investment in the medical device sector. Collaborations between multinational companies and domestic players can accelerate innovation, reduce production costs, and enhance supply chain efficiency. Market participants that leverage these partnerships and focus on cost-effective, locally adapted solutions are well-positioned to expand their footprint in Mexico’s evolving healthcare landscape.

Market Segmentation Analysis

By Product

The Mexico Cardiovascular Devices Market is segmented into diagnostic & monitoring devices and surgical devices. Diagnostic and monitoring devices include ECG systems, Holter monitors, event monitors, and cardiac imaging systems, which are critical for early detection and ongoing assessment of cardiovascular conditions. This segment continues to witness steady demand owing to the increasing prevalence of cardiovascular diseases, routine health screening initiatives, and the growing emphasis on preventive healthcare. On the other hand, surgical devices such as stents, pacemakers, defibrillators, and heart valves are vital for interventional procedures and long-term cardiac management. The surgical devices segment is expected to expand steadily, driven by the rise in minimally invasive surgeries and technological advancements that enhance procedural precision and patient recovery. Overall, innovation in device technology and increased clinical adoption are fueling growth across both product categories.

By End User

By end user, the market is divided into hospitals & clinics, diagnostic laboratories, ambulatory surgical centers, and others. Hospitals and clinics represent the largest segment, as they serve as primary centers for cardiovascular diagnosis, intervention, and post-operative care. Their dominance is supported by infrastructure improvements, availability of skilled specialists, and increasing patient admissions for cardiovascular conditions. Diagnostic laboratories are also gaining traction due to the rising demand for early and routine testing services. Ambulatory surgical centers, known for offering cost-effective and minimally invasive procedures, are witnessing gradual adoption in urban regions. The “others” category includes research institutes and specialty cardiac centers, which contribute to niche areas such as device trials and specialized care. Each end-user segment plays a critical role in the overall cardiovascular care continuum, contributing to sustained device demand.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Based on Region

- Mexico City

- Nuevo León

- Jalisco

- State of Mexico

Regional Analysis

Central region (38%)

The central region, which includes Mexico City and the State of Mexico, accounts for the largest market share, contributing approximately 38% of the total market revenue in 2024. This dominance is attributed to the presence of leading hospitals, specialized cardiac centers, and a high patient population. The region benefits from advanced healthcare infrastructure, a dense network of private and public medical institutions, and access to cutting-edge cardiovascular technologies. Mexico City, in particular, serves as the country’s medical innovation hub, attracting both domestic and international manufacturers of cardiovascular devices.

Northern region (26%)

The northern region, comprising states such as Nuevo León, Coahuila, and Chihuahua, holds the second-largest market share at 26%. This region is home to industrially advanced cities like Monterrey, which feature a well-established private healthcare sector and growing demand for high-end cardiovascular procedures. Cross-border medical tourism, especially in states adjacent to the United States, further boosts the demand for quality cardiac devices and interventions.

Key players

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- L. Gore & Associates, Inc.

- Siemens Healthcare GmbH

- BIOTRONIK SE & Co. KG

- Canon Medical Systems Asia Pte. Ltd.

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- Flexicare

- Biosyn

- Laboratorio Médico Polanco

- Vascular Solutions de México

Competitive Analysis

The Mexico Cardiovascular Devices Market features a competitive landscape dominated by multinational corporations with diverse product portfolios and strong distribution networks. Companies like Abbott, Medtronic, and Boston Scientific lead in innovation, offering advanced devices for both diagnostic and surgical applications. GE HealthCare and Siemens Healthcare GmbH hold significant shares in the imaging and monitoring segment, while Edwards Lifesciences and W. L. Gore specialize in structural heart and vascular solutions. Local and regional players such as Laboratorio Médico Polanco and Vascular Solutions de México enhance market penetration by catering to cost-sensitive segments and supporting localized supply chains. Strategic partnerships, product launches, and expansion of after-sales services remain core to competitive positioning. The presence of both global and domestic firms fosters innovation and improves device accessibility, ultimately enhancing the standard of cardiovascular care across Mexico.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The Mexico Cardiovascular Devices Market exhibits a moderately high level of market concentration, with a few global players such as Abbott, Medtronic, and Boston Scientific Corporation holding significant market shares due to their extensive product portfolios, strong brand recognition, and widespread distribution networks. The market is characterized by steady demand for both diagnostic and surgical cardiovascular solutions, driven by a growing disease burden, rising healthcare awareness, and increasing adoption of minimally invasive procedures. While urban areas dominate device utilization due to better infrastructure and specialist availability, opportunities are emerging in rural regions through telehealth and mobile care initiatives. The market also reflects a hybrid structure, combining public sector demand for cost-effective solutions with private sector preference for high-performance, technologically advanced devices. Innovation, regulatory compliance, and strategic partnerships are key competitive characteristics shaping the market’s evolution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Mexico Cardiovascular Devices Market is projected to maintain a steady growth trajectory, driven by rising cardiovascular disease prevalence and continued healthcare infrastructure development. Demand for both diagnostic and interventional devices is expected to expand across public and private sectors.

- Government-led health reforms and increased budget allocations toward cardiovascular care will enhance access to life-saving technologies. These initiatives aim to reduce regional disparities and promote early diagnosis and timely treatment.

- The adoption of minimally invasive and catheter-based procedures will accelerate due to patient preference for reduced recovery times. Advancements in surgical tools and imaging guidance systems will further improve procedural outcomes.

- Telecardiology and remote monitoring solutions will gain momentum, especially in rural and underserved regions. Wearable devices and cloud-based monitoring platforms will support early detection and personalized care.

- Strategic public-private partnerships will continue to bridge infrastructure gaps and improve access to advanced cardiac care. These collaborations will facilitate technology transfer, training programs, and device deployment in emerging areas.

- Local manufacturing and regional assembly of cardiovascular devices are expected to rise, reducing import dependency and lowering device costs. Favorable trade policies and industrial incentives will encourage domestic and foreign investments in production facilities.

- Artificial intelligence and machine learning will enhance diagnostics, predictive analytics, and clinical decision-making in cardiology. AI-integrated devices will help providers identify high-risk patients and streamline treatment protocols.

- Regulatory improvements by COFEPRIS will streamline the approval process for innovative cardiovascular technologies. Faster market entry will benefit both multinational firms and local manufacturers aiming to scale operations.

- Patient awareness campaigns and preventive cardiology programs will increase demand for routine cardiac screenings. Educational initiatives will drive early testing and improve long-term health outcomes across all age groups.

- The cardiovascular devices market will see diversification in product offerings, with emphasis on affordability, portability, and real-time monitoring. Customized solutions targeting specific population segments will help drive inclusive market growth across Mexico.