| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Distributed Acoustic Sensing Market Size 2024 |

USD 16.13 Million |

| Mexico Distributed Acoustic Sensing Market, CAGR |

10.62% |

| Mexico Distributed Acoustic Sensing Market Size 2032 |

USD 36.15 Million |

Market Overview:

The Mexico Distributed Acoustic Sensing Market is projected to grow from USD 16.13 million in 2024 to an estimated USD 36.15 million by 2032, with a compound annual growth rate (CAGR) of 10.62% from 2024 to 2032.

Several factors are propelling the growth of the DAS market in Mexico. The country’s extensive oil and gas pipeline infrastructure necessitates advanced monitoring systems to detect leaks, intrusions, and other anomalies in real-time. DAS technology offers a cost-effective solution by utilizing existing fiber optic cables for continuous monitoring, enhancing safety and operational efficiency. Additionally, the increasing focus on infrastructure development, including transportation and civil engineering projects, is driving the adoption of DAS for structural health monitoring. The technology’s ability to provide precise, real-time data makes it invaluable for ensuring the integrity and safety of critical infrastructure. As industries aim to reduce downtime and prevent costly incidents, DAS is becoming a preferred choice for proactive asset management. Supportive government policies encouraging digital transformation and smart monitoring further reinforce the market’s momentum.

Within Latin America, Mexico stands out as a key market for DAS technology. The country’s strategic initiatives to modernize its energy sector and infrastructure are creating opportunities for the deployment of advanced sensing technologies. Moreover, Mexico’s commitment to enhancing border security and surveillance is contributing to the demand for DAS systems, which can detect and locate disturbances along perimeters with high accuracy. The combination of industrial growth, infrastructure development, and security needs positions Mexico as a significant player in the regional DAS market. Its proximity to the U.S. market also encourages cross-border collaborations and adoption of cutting-edge monitoring technologies. Additionally, investment inflows into smart city and telecommunications projects are expected to further elevate Mexico’s standing in the regional DAS landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Distributed Acoustic Sensing Market is projected to grow from USD 16.13 million in 2024 to an estimated USD 36.15 million by 2032, with a compound annual growth rate (CAGR) of 10.62% from 2024 to 2032.

- The Global Distributed Acoustic Sensing Market is projected to grow from USD 639.45 million in 2024 to an estimated USD 1596.46 million by 2032, with a compound annual growth rate (CAGR) of 12.12% from 2024 to 2032.

- Rising investments in oil and gas infrastructure are driving DAS adoption for pipeline integrity, leak detection, and intrusion monitoring.

- Infrastructure projects in transportation, bridges, and tunnels are creating demand for real-time structural health monitoring using DAS technology.

- Border security and facility surveillance applications are expanding as DAS offers enhanced perimeter monitoring capabilities over vast distances.

- Government-led digitalization initiatives and smart city projects are fostering the integration of DAS into public infrastructure networks.

- Market growth is restrained by high initial deployment costs and a lack of skilled professionals for configuration and data analysis.

- Mexico’s strategic geographic position, regional industrialization, and cross-border collaborations are strengthening its role in Latin America’s DAS landscape.

Market Drivers:

Expansion of Oil and Gas Infrastructure

The rapid development and modernization of Mexico’s oil and gas infrastructure have emerged as a key driver for the distributed acoustic sensing (DAS) market. As the country continues to invest in expanding its upstream and midstream assets, the need for real-time monitoring and maintenance of critical infrastructure has grown substantially. DAS technology enables precise detection of leaks, pipeline intrusions, and other anomalies along extensive networks, ensuring operational efficiency and environmental compliance. For instance, OptaSense implemented DAS systems along a 200-mile oil pipeline in Mexico to detect leaks and third-party intrusions. The system provides real-time acoustic monitoring, enabling rapid identification of anomalies and enhancing pipeline integrity management. This capability is particularly valuable in Mexico, where pipeline theft and unplanned downtimes have long posed serious risks to profitability and safety. Consequently, energy companies are increasingly deploying DAS systems to monitor their assets and reduce operational risks.

Rising Demand for Structural Health Monitoring

Mexico’s focus on large-scale infrastructure development is driving the adoption of DAS technology in civil engineering and transportation sectors. For example, wireless smart sensors integrated with DAS systems are being utilized to monitor bridges and tunnels, providing real-time data on vibrations, strain, and acoustic signatures. As the government prioritizes investment in smart cities, highways, bridges, and tunnels, the need for continuous and accurate structural health monitoring becomes essential. DAS solutions provide real-time data on vibrations, strain, and acoustic signatures, allowing engineers to detect early signs of structural fatigue or failure. This helps extend the life of infrastructure assets and ensures public safety. In an environment marked by frequent seismic activity and urban expansion, DAS offers a proactive monitoring approach that traditional sensors cannot match. The scalability and cost-efficiency of fiber-optic sensing make it particularly suitable for large-scale deployments across public infrastructure.

Growth of Security and Surveillance Applications

The increasing demand for advanced perimeter security and surveillance is significantly contributing to the growth of Mexico’s DAS market. With growing concerns over border security, facility intrusion, and theft prevention, both government and private entities are turning to DAS for its ability to detect movement, vibrations, and acoustic disturbances along fences, pipelines, and perimeters. DAS systems offer superior sensitivity and coverage compared to conventional security solutions, enabling authorities to respond swiftly to potential threats. In regions with long and complex borders, the capability to monitor in real-time and pinpoint incidents over vast distances gives DAS a strategic edge. As a result, national security agencies and critical infrastructure operators are integrating DAS into their broader surveillance frameworks.

Supportive Government Policies and Technological Advancements

Favorable government initiatives promoting digitalization, industrial modernization, and energy reform are encouraging the adoption of DAS technology in Mexico. Public and private partnerships are increasingly investing in smart sensing and IoT-based solutions to enhance operational transparency and efficiency. Furthermore, advancements in DAS algorithms, data analytics, and integration with cloud platforms are improving the technology’s usability and value proposition across various sectors. As these technologies mature, their cost-effectiveness improves, making DAS accessible not only to large corporations but also to medium-sized enterprises seeking scalable monitoring solutions. These combined factors create a conducive environment for sustained DAS market growth in Mexico.

Market Trends:

Integration with Artificial Intelligence and Machine Learning

A prominent trend shaping the Mexico Distributed Acoustic Sensing (DAS) market is the integration of artificial intelligence (AI) and machine learning (ML) into DAS platforms. These technologies are enhancing the capability of DAS systems to distinguish between different types of acoustic signals, reducing false positives and improving response accuracy. As infrastructure and industrial environments become more complex, intelligent signal processing enables more efficient data interpretation and decision-making. AI-driven DAS solutions are increasingly being used in predictive maintenance, where the system learns from past acoustic patterns to forecast future anomalies. This approach is gaining traction in industries such as rail transport and energy, where reliability and uptime are critical.

Adoption in Renewable Energy Sector

The growth of Mexico’s renewable energy sector is driving new applications for DAS technology. As the country expands its wind and solar infrastructure, the need for advanced monitoring solutions is becoming more apparent. For instance, DAS is being explored for monitoring underground cable networks in wind farms and detecting mechanical faults in turbine structures. These sensors provide continuous data on vibrations and strain without requiring frequent manual inspections, contributing to operational efficiency and cost savings. The shift toward clean energy and the implementation of Mexico’s Energy Transition Law are accelerating the demand for real-time sensing technologies that align with sustainability goals and regulatory compliance.

Deployment in Urban Infrastructure and Smart Cities

Urbanization and the development of smart cities are promoting the integration of DAS into municipal infrastructure projects across Mexico. City planners are deploying DAS systems to monitor traffic patterns, detect underground construction activity, and manage utilities. The technology is particularly effective in detecting and localizing disturbances in subterranean pipelines, sewage networks, and water mains. These applications are helping city authorities reduce maintenance costs and respond swiftly to infrastructure issues. As smart city initiatives continue to evolve, DAS is playing a key role in building resilient, data-driven urban systems. The ability to integrate DAS data with centralized management platforms is further enhancing its appeal for large-scale municipal use.

Rising Investment from Telecom and Data Infrastructure Providers

Mexico’s increasing investment in fiber-optic networks for telecommunications and data infrastructure is also influencing the DAS market landscape. Telecom providers are leveraging existing fiber deployments to incorporate DAS functionalities without the need for dedicated sensing lines. This dual-use capability allows for enhanced asset monitoring, intrusion detection, and vibration analysis along network routes. For example, MXT Holdings has integrated DAS with its fiber network to enhance connectivity solutions for 5G infrastructure deployment across urban areas like Mexico City and Monterrey. The trend is particularly noticeable in areas with expanding 5G infrastructure, where ensuring cable security and performance is paramount. As telecom operators seek to maximize their infrastructure investments, the convergence of DAS with communication networks is expected to expand the technology’s footprint across the country.

Market Challenges Analysis:

High Initial Deployment Costs

One of the primary restraints in the Mexico Distributed Acoustic Sensing (DAS) market is the high initial cost associated with system deployment. The installation of DAS requires specialized fiber optic cables, advanced interrogators, and sophisticated signal processing software, which collectively lead to significant upfront investment. While DAS can leverage existing fiber infrastructure in some scenarios, new installations particularly in remote or industrial areas still require substantial capital outlay. For instance, according to industry insights, the cost of deploying active DAS systems with fiber-optic technology can range from $250,000 to $5 million depending on the scale and complexity of the project. For small and medium-sized enterprises, these costs can act as a deterrent, limiting widespread adoption. Budget constraints in public infrastructure projects also contribute to slower technology penetration in sectors such as transportation and utilities.

Limited Technical Expertise and Awareness

The DAS market in Mexico faces challenges related to limited technical expertise and a general lack of awareness among end-users. Although the technology offers numerous advantages, its complex nature demands skilled personnel for configuration, data interpretation, and maintenance. The shortage of trained professionals capable of managing DAS systems hampers the effective implementation of projects, particularly in rural or underdeveloped regions. Additionally, end-users in industries such as civil construction or water management may not fully understand the value proposition of DAS, resulting in a preference for conventional monitoring solutions despite their limitations.

Data Management and Integration Complexity

Another key challenge involves the management and integration of large volumes of data generated by DAS systems. Real-time monitoring across long distances produces continuous acoustic data that must be accurately filtered, stored, and analyzed. Integrating this data into existing IT or operational platforms can be technically demanding, particularly for organizations lacking advanced digital infrastructure. Ensuring data security, scalability, and compatibility with other industrial monitoring systems adds to the complexity. These factors collectively hinder the seamless adoption of DAS technology across various sectors in Mexico, requiring further technological standardization and digital transformation support.

Market Opportunities:

The Mexico Distributed Acoustic Sensing (DAS) market presents substantial opportunities due to the country’s ongoing investments in energy infrastructure, urban development, and digital transformation. With the government prioritizing modernization across oil and gas, transportation, and utilities, DAS technology offers a scalable and efficient solution for real-time monitoring of critical assets. The increasing shift toward automation and intelligent infrastructure enhances the relevance of DAS for predictive maintenance and asset integrity applications. Mexico’s growing focus on renewable energy and the expansion of underground cable networks in wind and solar farms further create demand for advanced sensing solutions. As industries seek to enhance operational reliability while minimizing costs and environmental risks, DAS stands out as a strategic enabler of performance and safety.

In addition to industrial adoption, the broader digitization of municipal services and infrastructure creates new frontiers for DAS integration. Smart city initiatives and investments in fiber-optic connectivity provide a foundation for incorporating distributed sensing into urban systems, including traffic flow monitoring, utility management, and public safety. Furthermore, cross-sector collaborations and public-private partnerships are expected to boost DAS deployment in large-scale projects. With advancements in data analytics, AI, and cloud-based platforms, DAS solutions are becoming more user-friendly and adaptable, opening doors for mid-sized enterprises and public agencies. As awareness increases and technical barriers are reduced, the Mexico DAS market is poised to expand significantly, positioning the technology as a core component of the country’s digital infrastructure evolution.

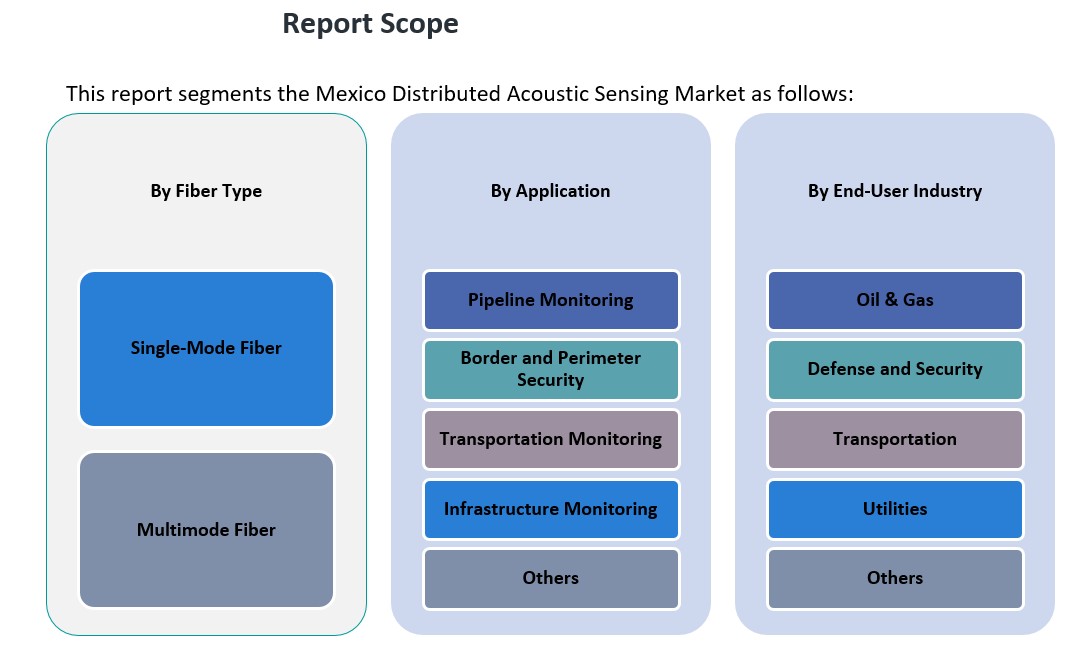

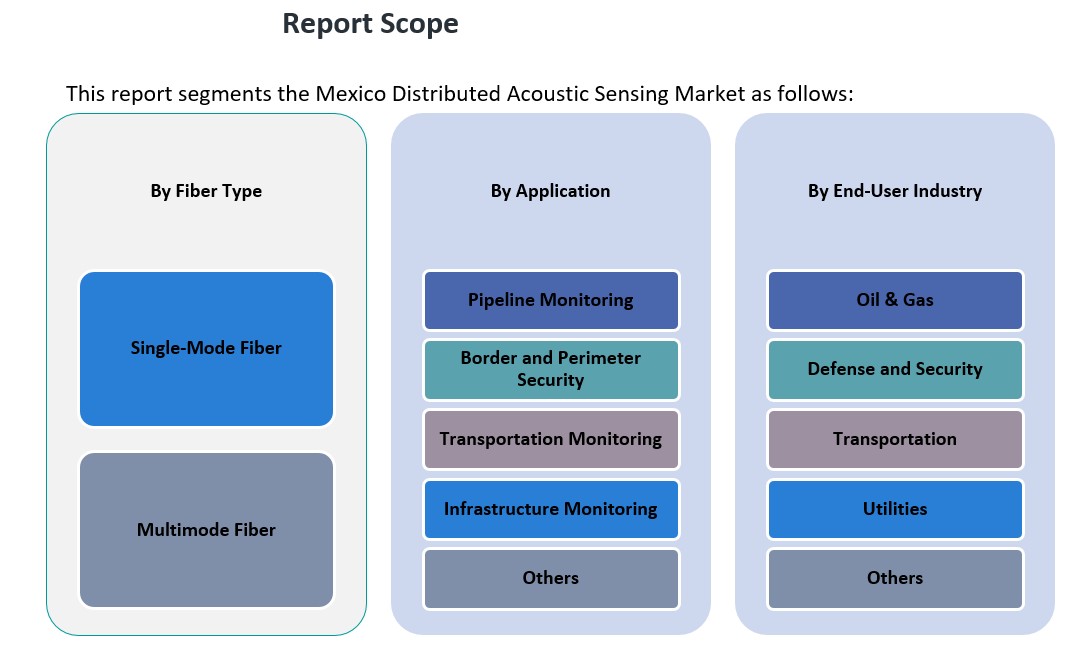

Market Segmentation Analysis:

The Mexico Distributed Acoustic Sensing (DAS) market is segmented by fiber type, application, and end-user industry, each contributing to the overall market expansion.

By fiber type, single-mode fiber dominates the market due to its superior performance over long distances and higher sensitivity. It is widely used in oil and gas pipeline monitoring and border security applications, where accuracy and signal clarity are critical. Multimode fiber, while less prevalent, finds relevance in short-range applications and cost-sensitive deployments where lower bandwidth suffices. The choice between fiber types often depends on the specific operational and geographical requirements of the end-users.

By application, pipeline monitoring holds the largest share, driven by Mexico’s expansive oil and gas infrastructure and the need for leak detection and intrusion prevention. Transportation monitoring is also gaining traction as smart transportation initiatives and railway safety systems adopt DAS for continuous track monitoring. Border and perimeter security remain key applications, especially with increased emphasis on national security and infrastructure protection. Infrastructure monitoring, including tunnels, bridges, and urban utilities, is an emerging segment as municipalities explore smart city technologies.

By end-user industry, the oil and gas sector leads due to its long-standing reliance on fiber optic sensing for asset integrity management. The defense and security segment follows closely, leveraging DAS for strategic surveillance. Transportation and utilities are witnessing steady adoption as awareness of DAS benefits grows. These diverse applications and sectoral investments indicate a robust and evolving demand for DAS solutions in Mexico.

Segmentation:

By Fiber Type:

- Single-Mode Fiber

- Multimode Fiber

By Application:

- Pipeline Monitoring

- Transportation Monitoring

- Border and Perimeter Security

- Infrastructure Monitoring

- Others

By End-User Industry:

- Oil & Gas

- Defense and Security

- Transportation

- Utilities

- Others

Regional Analysis:

The Mexico Distributed Acoustic Sensing (DAS) market exhibits notable regional variations influenced by industrial activity, infrastructure development, and security priorities. While specific regional market share data within Mexico is limited, the country’s diverse geography and economic hubs suggest differentiated adoption rates across regions.

Northern Mexico

Northern Mexico, encompassing states such as Nuevo León, Coahuila, and Chihuahua, is characterized by significant industrial activity and proximity to the United States border. This region’s emphasis on manufacturing and cross-border trade necessitates robust infrastructure and security measures. Consequently, there is a heightened demand for DAS technologies to monitor pipelines, transportation networks, and border perimeters. The integration of DAS in these applications enhances real-time monitoring capabilities, contributing to operational efficiency and security.

Central Mexico

Central Mexico, including Mexico City and surrounding states, serves as the country’s political and economic nucleus. The region’s dense urban infrastructure and critical facilities present opportunities for DAS deployment in infrastructure monitoring and urban security. Implementing DAS in this area can aid in the early detection of structural issues in bridges, tunnels, and buildings, as well as in enhancing surveillance systems. The adoption of DAS in Central Mexico aligns with initiatives aimed at modernizing urban infrastructure and improving public safety.

Southern Mexico

Southern Mexico, comprising states like Oaxaca and Chiapas, is characterized by challenging terrain and developing infrastructure. While industrial activity is less concentrated here, the region’s susceptibility to natural events such as earthquakes and landslides underscores the potential for DAS applications in environmental monitoring and disaster prevention. Deploying DAS in Southern Mexico can facilitate early warning systems and contribute to the resilience of infrastructure in the face of natural hazards.

Key Player Analysis:

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Silixa Ltd.

- Hifi Engineering Inc.

- OFS Fitel LLC

- AP Sensing GmbH

- Future Fibre Technologies

- OZ Optics Ltd.

- GEOSpace Technologies

Competitive Analysis:

The Mexico Distributed Acoustic Sensing (DAS) market is moderately competitive, with both international and regional players actively expanding their presence. Global technology providers such as Halliburton, Schlumberger, and Baker Hughes leverage their established expertise in oilfield services to deliver advanced DAS solutions tailored to Mexico’s energy infrastructure. These companies focus on pipeline monitoring, leveraging real-time data analytics and fiber optic technologies. Additionally, players like Hifi Engineering and Fotech Solutions are enhancing their footprint through collaborations and customized sensing platforms. Local firms and integrators contribute by offering deployment support and post-installation services, often partnering with global vendors. Competitive dynamics are shaped by innovation, cost-effectiveness, and integration capabilities. As the demand for smart infrastructure and real-time monitoring grows, competition is expected to intensify, driving further investment in product development, AI integration, and regional partnerships to meet the specific needs of Mexico’s industrial and urban sectors.

Recent Developments:

- In July 2024, VIAVI Solutions Inc.introduced the NITRO® Fiber Sensing solution, a cutting-edge real-time asset monitoring and analytics system designed for critical infrastructure. This innovative solution integrates Distributed Acoustic Sensing (DAS), Distributed Temperature Sensing (DTS), and Simultaneous Temperature and Strain Sensing (DTSS) technologies. It enables operators to monitor fiber optic cables for temperature, strain, and acoustic vibrations, providing precise alerts to detect and prevent external threats such as human interference or environmental hazards.

- In September 2023, researchers from the University of New Mexicoand Sandia National Laboratories developed a novel method to monitor local sea ice in Alaska using Distributed Acoustic Sensing (DAS) technology. By leveraging a telecommunications fiber optic cable combined with machine learning algorithms, the team analyzed ground vibrations caused by ocean waves to detect sea ice coverage and strength.

- In December 2023, Luna Innovations Inc. acquired Silixa Ltd., a UK-based leader in distributed fiber optic sensing solutions. This strategic acquisition enhanced Luna’s capabilities in distributed acoustic sensing (DAS), distributed temperature sensing (DTS), and distributed strain sensing (DSS), enabling improved performance for applications in energy, natural environments, mining, and defense.

Market Concentration & Characteristics:

The Mexico Distributed Acoustic Sensing (DAS) market is characterized by a moderately concentrated landscape, featuring a mix of global and regional players. Prominent international companies, including Halliburton, Schlumberger, and Baker Hughes, leverage their extensive expertise in oilfield services to offer advanced DAS solutions tailored to Mexico’s energy sector. These industry leaders focus on applications such as pipeline monitoring and infrastructure surveillance, capitalizing on their established reputations and technological capabilities. In addition to these global entities, regional firms and specialized integrators play a crucial role in the market by providing localized deployment support and customized solutions. This collaboration between international technology providers and local partners enhances the overall service quality and ensures that DAS systems are effectively integrated into existing infrastructures. The market’s characteristics are defined by continuous innovation, with companies investing in research and development to improve sensor sensitivity, data analytics, and integration with artificial intelligence. Furthermore, the market is influenced by stringent regulatory standards, particularly in the oil and gas industry, where compliance with safety and environmental regulations is paramount. These factors collectively shape a competitive and dynamic DAS market in Mexico, driving advancements and fostering a focus on delivering comprehensive, real-time monitoring solutions across various sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Fiber Type, Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Mexico’s DAS market is projected to grow steadily, driven by rising demand for real-time infrastructure and asset monitoring.

- Ongoing modernization of oil and gas pipelines will continue to create sustained demand for advanced sensing technologies.

- Adoption of DAS in smart city projects will expand, particularly for traffic, utility, and structural monitoring.

- Integration with AI and machine learning will enhance data accuracy, reducing false alarms and improving operational efficiency.

- Investment in renewable energy infrastructure will generate new opportunities for DAS in cable and equipment monitoring.

- Expansion of fiber-optic networks will support wider DAS deployment across urban and industrial regions.

- Government-led security initiatives will increase implementation of DAS in border and perimeter surveillance.

- Technological advancements will reduce deployment costs, making DAS more accessible to mid-sized enterprises.

- Public-private partnerships will accelerate pilot projects and commercial adoption across diverse sectors.

- Increasing awareness and training programs will help bridge the technical skills gap, facilitating smoother DAS integration.