| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Protein Based Sports Supplements Market Size 2024 |

USD 185.91 Million |

| Mexico Protein Based Sports Supplements Market, CAGR |

6.06% |

| Mexico Protein Based Sports Supplements Market Size 2032 |

USD 297.59 Million |

Market Overview

Mexico Protein Based Sports Supplements Market size was valued at USD 185.91 million in 2024 and is anticipated to reach USD 297.59 million by 2032, at a CAGR of 6.06% during the forecast period (2024-2032).

The Mexico protein-based sports supplements market is witnessing steady growth, driven by increasing health consciousness, a rising number of fitness enthusiasts, and growing participation in sports and gym activities. Consumers are becoming more aware of the benefits of protein supplementation for muscle recovery, weight management, and overall wellness, which is fueling demand across various age groups. Additionally, the rising influence of social media fitness trends and endorsements by professional athletes are positively impacting consumer preferences. The market is also benefiting from expanding retail availability, including e-commerce platforms, which offer greater accessibility and product variety. Moreover, innovation in product formulations such as plant-based and clean-label protein supplements caters to evolving dietary preferences and lifestyle choices. These factors, combined with government initiatives promoting healthy living and increasing disposable incomes, are expected to sustain the market’s upward trajectory in the coming years.

The geographical landscape of the Mexico protein-based sports supplements market is shaped by the growing demand across key urban centers such as Mexico City, Monterrey, Guadalajara, and Tijuana. These regions demonstrate a strong inclination toward health and fitness, driven by rising disposable incomes, urbanization, and increased awareness of nutritional wellness. The presence of gyms, sports clubs, and wellness retailers further supports regional market growth. Key players actively contributing to market expansion include Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, Dymatize Enterprises, LLC, Iovate Health Sciences International Inc. (MuscleTech), CytoSport, Inc. (Muscle Milk), Garden of Life, LLC, Quest Nutrition LLC, and Amazing Grass. These companies are leveraging both online and offline channels, offering a diverse range of protein-based products such as powders, bars, and beverages. Strategic initiatives such as product innovation, branding, and partnerships with fitness influencers continue to enhance their presence and drive consumer engagement across the Mexican market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico protein-based sports supplements market was valued at USD 185.91 million in 2024 and is expected to reach USD 297.59 million by 2032, growing at a CAGR of 6.06%.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Increasing health awareness and fitness consciousness among consumers is driving consistent demand for protein supplements.

- A noticeable trend is the growing preference for plant-based and clean-label protein products across major cities.

- Key companies like Glanbia PLC, Abbott Laboratories, and MusclePharm Corporation are focusing on product innovation and strategic distribution.

- Price sensitivity among lower-income groups and limited awareness in rural regions are key restraints to broader market penetration.

- Urban centers such as Mexico City, Monterrey, Guadalajara, and Tijuana are witnessing higher product adoption due to better fitness infrastructure.

- Online platforms and e-commerce channels are playing a crucial role in improving product accessibility and expanding consumer reach.

Report Scope

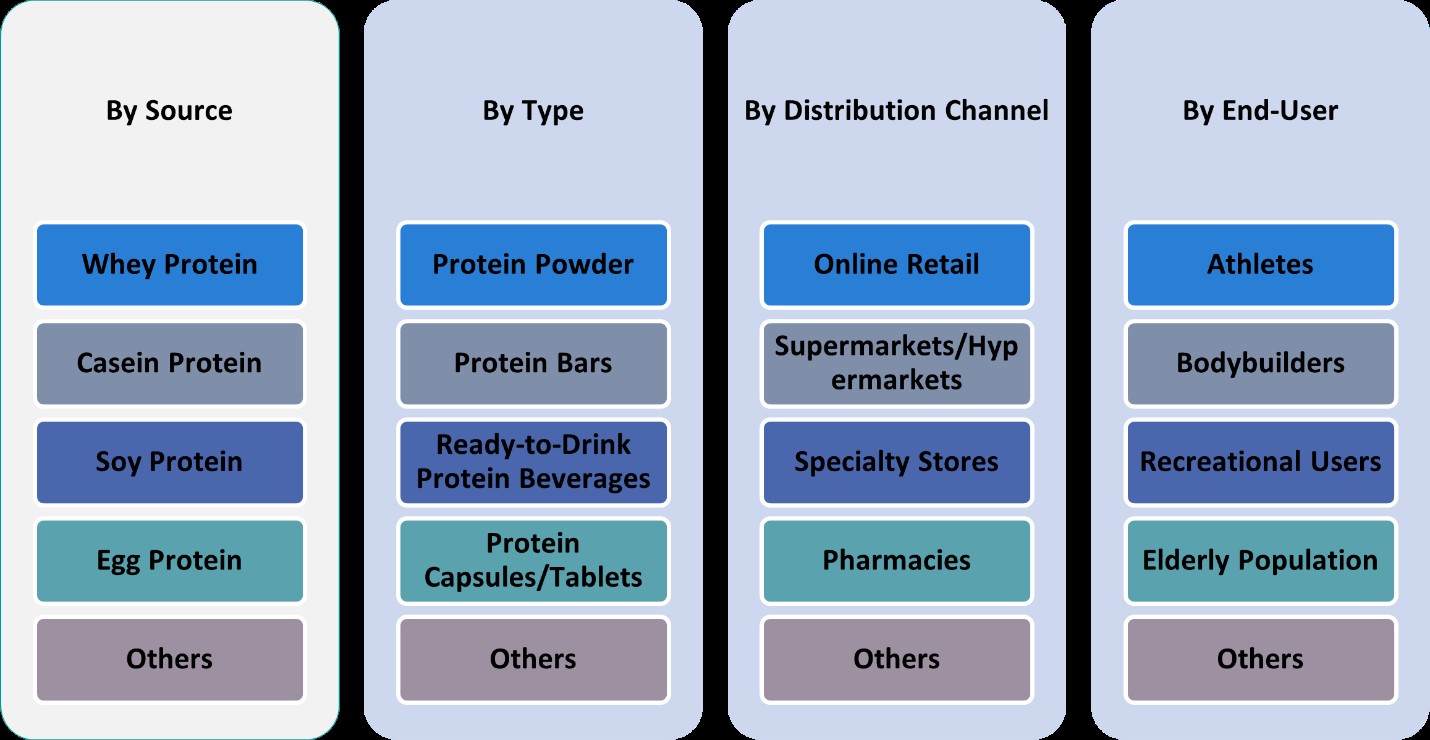

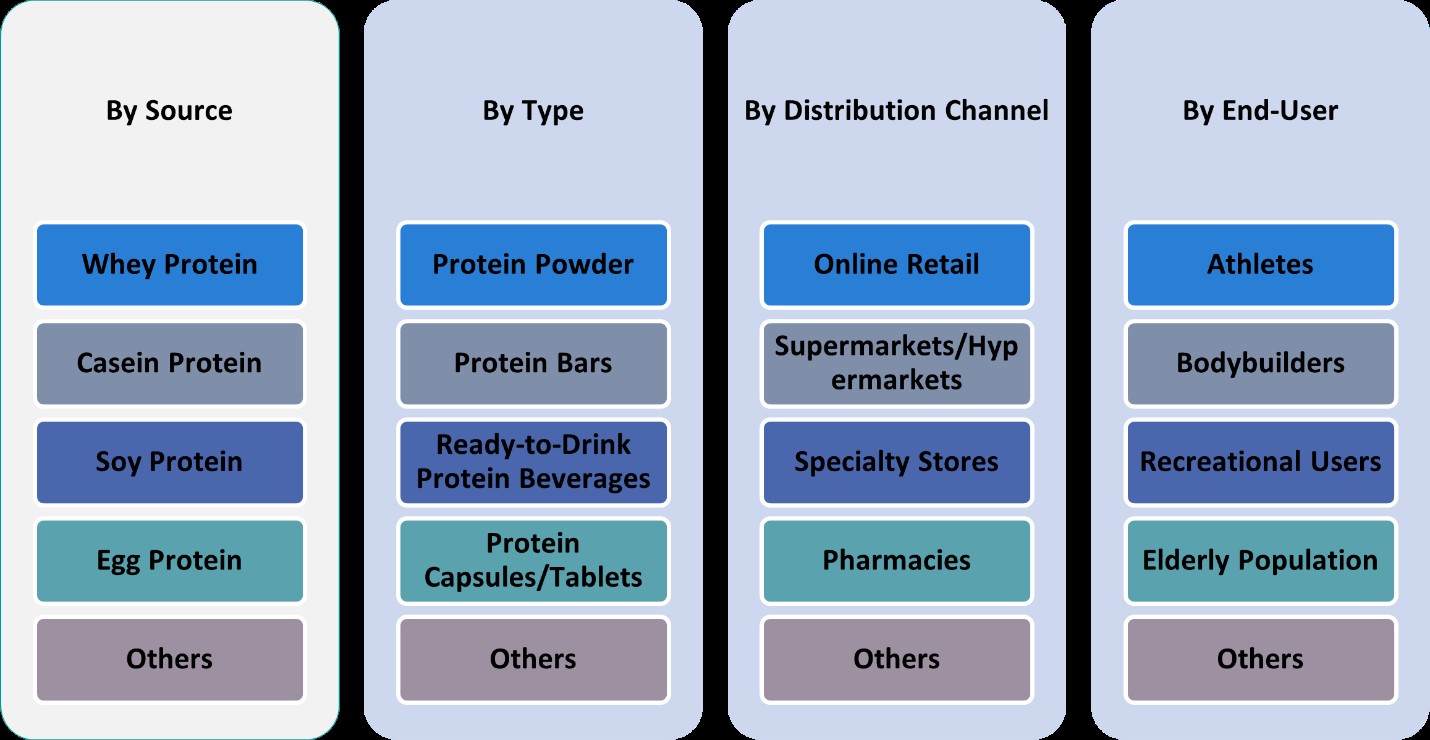

This report segments the Mexico Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Awareness and Fitness Culture

A significant driver propelling the growth of the Mexico protein-based sports supplements market is the increasing health awareness among consumers. For instance, a report by the World Health Organization highlighted that urbanization and exposure to global wellness trends have encouraged Mexican consumers to adopt healthier lifestyles, prioritizing physical fitness and balanced nutrition. This shift has directly increased the demand for dietary supplements, particularly protein-based products, which are essential for muscle development, weight management, and improved athletic performance. Furthermore, the growing trend of personalized wellness and preventive healthcare has positioned protein supplements as a daily health necessity rather than a niche sports product.

Expanding Gym and Fitness Center Memberships

The expansion of gym chains, fitness centers, and wellness clubs across Mexico has significantly contributed to the market’s momentum. For instance, a report by the International Health, Racquet & Sportsclub Association (IHRSA) noted a rise in gym memberships in urban areas such as Mexico City, Guadalajara, and Monterrey, reflecting a cultural shift toward active living. Fitness enthusiasts and amateur athletes increasingly incorporate protein supplements into their daily routines to enhance endurance, speed up post-workout recovery, and support lean muscle development. This institutionalized focus on fitness has also given rise to certified fitness trainers and nutrition consultants who often recommend protein-based supplements to clients. Their influence, along with targeted promotions by fitness centers, has further solidified consumer trust in the efficacy and benefits of these products.

Influence of Social Media and Celebrity Endorsements

Digital platforms and social media have become powerful tools in shaping consumer preferences, particularly among younger demographics. In Mexico, fitness influencers, athletes, and lifestyle bloggers play a key role in promoting protein-based supplements by sharing personal testimonials, workout regimes, and dietary practices. This digital engagement has helped destigmatize the use of sports nutrition products and made them more relatable to the average consumer. Moreover, endorsements by professional athletes and collaborations between supplement brands and social media figures have amplified product visibility and credibility. As consumers increasingly look to online sources for health and fitness inspiration, this trend is expected to continue driving product adoption across a broader audience.

Growing Availability and Product Innovation

Another vital factor supporting market growth is the expanding retail and e-commerce infrastructure in Mexico. Consumers now have easier access to a diverse range of protein supplements through supermarkets, specialty stores, pharmacies, and online platforms. This accessibility, combined with increased product knowledge, encourages frequent and informed purchases. Furthermore, manufacturers are innovating with new product formats, such as ready-to-drink protein shakes, vegan protein powders, and fortified protein bars, catering to specific dietary preferences including lactose intolerance, gluten-free, and plant-based diets. Clean-label formulations, organic certifications, and locally sourced ingredients are gaining popularity among health-conscious buyers, contributing to higher product penetration. These advancements in formulation and distribution significantly enhance the market’s appeal and growth potential.

Market Trends

Growing Preference for Plant-Based and Clean-Label Supplements

A prominent trend in the Mexico protein-based sports supplements market is the rising consumer preference for plant-based and clean-label protein options. For instance, a report by the Mexican Association of Vegan and Vegetarian Nutrition highlighted the increasing adoption of plant-derived protein sources such as soy, pea, rice, and hemp among younger demographics and urban dwellers. Clean-label products, which emphasize transparency, minimal ingredients, and the absence of artificial additives, are gaining traction as consumers seek healthier and more natural alternatives. Moreover, concerns about allergens, environmental impact, and overall wellness are prompting brands to innovate and reformulate their offerings with plant-based and organic ingredients. This trend not only supports environmental sustainability but also expands the consumer base beyond traditional fitness enthusiasts to include wellness-focused individuals and casual users.

Rapid Expansion of E-Commerce and Digital Retail Channels

The growth of e-commerce in Mexico has significantly reshaped how consumers access protein-based sports supplements. Online platforms offer broader product variety, ease of comparison, and convenience—factors that resonate strongly with time-conscious consumers. The COVID-19 pandemic further accelerated this shift, with many consumers turning to digital channels for health and wellness products. As a result, brands have increasingly invested in digital marketing, influencer collaborations, and direct-to-consumer (DTC) strategies. Subscription-based models, online fitness coaching integrations, and bundling of supplements with fitness plans are gaining popularity among tech-savvy consumers. Additionally, e-commerce enables regional and international brands to penetrate the Mexican market with minimal infrastructure, increasing competitive dynamics and offering consumers greater choice. The ease of access and doorstep delivery are not only expanding market reach but also enhancing product visibility and consumer engagement.

Integration of Traditional Ingredients and Localized Formulations

Another noteworthy trend is the incorporation of traditional Mexican ingredients into protein supplement formulations. For instance, a report by the National Institute of Nutrition and Health in Mexico highlighted the growing use of native superfoods such as chia seeds, amaranth, cacao, and nopal (cactus) in protein supplements. This trend reflects a growing desire among consumers to connect with heritage while maintaining a modern, health-conscious lifestyle. Localized product development helps brands build trust and familiarity, especially in regional markets. It also opens up opportunities to cater to niche dietary needs and flavor preferences, creating a sense of authenticity and uniqueness in a competitive market. As Mexican consumers become more discerning, products that balance innovation with cultural identity are more likely to succeed in capturing consumer loyalty and market share.

Personalized Nutrition and Technological Integration

Personalization is becoming a key differentiator in the protein-based sports supplements market. Increasingly, consumers seek products tailored to their individual fitness goals, body types, and nutritional needs. This trend is supported by the growth of wearable fitness technology, mobile health apps, and AI-driven nutrition platforms that provide personalized supplement recommendations. In Mexico, tech-savvy consumers are embracing solutions that integrate data from fitness trackers and apps to create custom protein intake plans. This shift from one-size-fits-all to data-driven personalization enhances user satisfaction and product effectiveness. Brands that invest in tech-enabled personalization—whether through online quizzes, mobile platforms, or subscription services—are positioning themselves at the forefront of innovation. This trend not only boosts product relevance but also strengthens long-term customer engagement and loyalty.

Market Challenges Analysis

Limited Consumer Awareness and Misinformation

One of the primary challenges in the Mexico protein-based sports supplements market is the limited awareness and widespread misinformation among consumers, particularly in semi-urban and rural areas. While urban populations are increasingly adopting sports nutrition products, a large segment of potential consumers still lacks adequate knowledge regarding the benefits, usage, and safety of protein supplements. Misconceptions, such as associating supplements with steroids or viewing them as unnecessary for general fitness, hinder market penetration. Additionally, inadequate nutritional education and limited access to certified fitness professionals contribute to skepticism about supplement consumption. This knowledge gap restricts product adoption beyond the fitness-savvy demographic and slows down the potential expansion of the market into broader consumer groups. Bridging this awareness gap through targeted education campaigns and transparent product labeling remains essential for driving sustainable growth in the sector.

Regulatory Challenges and Product Authenticity Concerns

Regulatory compliance and product authenticity pose ongoing challenges for manufacturers and distributors in the Mexico protein-based sports supplements market. For instance, a report by COFEPRIS (Federal Commission for the Protection Against Sanitary Risks) emphasized the lack of a uniform regulatory framework governing dietary supplements, which creates ambiguity and can lead to inconsistent product quality and safety standards. As a result, counterfeit or substandard products sometimes enter the market, eroding consumer trust and damaging brand reputations. Inadequate enforcement of labeling regulations and limited oversight of online marketplaces further exacerbate these issues. Additionally, navigating import regulations for international supplement brands can be complex and time-consuming, hindering market entry and expansion. These regulatory and authenticity concerns not only impact consumer confidence but also increase operational costs for legitimate companies striving to meet quality and safety benchmarks. Addressing these challenges will require collaborative efforts between industry stakeholders and regulatory authorities to establish clear guidelines and ensure product integrity across all distribution channels.

Market Opportunities

The Mexico protein-based sports supplements market presents substantial growth opportunities, primarily fueled by the expanding health and fitness culture among millennials and Gen Z. As more individuals adopt active lifestyles and prioritize physical well-being, the demand for nutritional support through protein supplements continues to grow. Rising disposable incomes and increasing urbanization have contributed to higher spending on fitness-related products, particularly in metropolitan areas. Furthermore, the growing number of gyms, fitness studios, and wellness centers has created a fertile environment for supplement brands to promote their products. There is also an untapped opportunity to target women and older adults by introducing specialized protein formulations that cater to their unique nutritional needs. Offering personalized products that address muscle maintenance, weight management, or bone health can help brands diversify their consumer base and drive additional revenue.

In addition, the expanding digital ecosystem and increased smartphone penetration have made it easier for supplement companies to reach consumers directly through e-commerce, social media, and fitness apps. This shift towards digital platforms enables both domestic and international brands to market their products effectively, educate consumers, and build brand loyalty. Innovative marketing strategies, influencer partnerships, and targeted advertising campaigns can further amplify brand visibility and boost sales. Moreover, the trend towards clean-label, plant-based, and organic supplements offers brands a strategic advantage if they focus on transparent ingredient sourcing and sustainability. Collaborations with local farms for indigenous ingredients, combined with culturally resonant branding, can strengthen market presence. Companies that invest in nutritional education and collaborate with healthcare professionals or fitness trainers can also build trust and encourage trial among hesitant or new users. Overall, the market offers ample opportunities for innovation, segmentation, and expansion through digital engagement and product differentiation.

Market Segmentation Analysis:

By Type:

The Mexico protein-based sports supplements market is segmented into protein powder, protein bars, ready-to-drink protein beverages, protein capsules/tablets, and others. Among these, protein powders continue to dominate due to their widespread availability, cost-effectiveness, and strong consumer trust, particularly among bodybuilders and athletes. The growing culture of home workouts and fitness training further supports the sustained demand for powders, which can be easily incorporated into daily routines. However, protein bars and ready-to-drink (RTD) beverages are rapidly gaining traction among busy professionals and on-the-go consumers who prefer convenient formats without compromising nutritional value. Protein capsules and tablets occupy a smaller market share but are gradually attracting attention due to their portability and precise dosage. The “others” category, which includes protein-infused snacks and meal replacements, is expanding as brands innovate to offer diverse consumption formats. This evolving product landscape reflects consumers’ desire for flexible, lifestyle-friendly nutrition options, making it crucial for manufacturers to diversify offerings in line with consumer preferences and usage occasions.

By Source:

Based on source, the market is segmented into whey protein, casein protein, soy protein, egg protein, and others. Whey protein remains the most popular and widely consumed source due to its fast absorption rate, high bioavailability, and proven effectiveness in muscle recovery and growth. It is especially favored by gym-goers and sports professionals. Casein protein, which digests more slowly, is preferred for sustained amino acid release, making it ideal for nighttime use. Plant-based alternatives such as soy protein are witnessing growing demand, particularly among lactose-intolerant individuals, vegans, and environmentally conscious consumers. Egg protein, valued for its complete amino acid profile and digestibility, appeals to a niche segment looking for non-dairy, high-quality animal protein. The “others” category includes emerging sources like pea, rice, and hemp protein, which are gaining momentum as clean-label and hypoallergenic options. This diversified sourcing landscape provides manufacturers with an opportunity to cater to various dietary needs and lifestyle choices, fostering innovation and broadening the market appeal across consumer segments.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Regional Analysis

Mexico City

Mexico City commands approximately 32% of the protein-based sports supplements market in Mexico, making it the largest regional contributor. The city’s vast population, rising middle class, and increasing awareness of health and wellness trends drive substantial demand. Mexico City hosts a dense network of gyms, wellness centers, and specialty nutrition stores that promote sports supplements as part of regular fitness regimens. The urban youth, particularly millennials and Gen Z, are embracing protein powders, bars, and ready-to-drink beverages to meet dietary goals and support their active lifestyles. Additionally, the presence of multinational supplement brands and domestic distributors has made product accessibility easier, reinforcing the city’s leadership position in the national market.

Monterrey

Monterrey holds an estimated 27% share of the Mexico protein-based sports supplements market, underpinned by a high concentration of fitness-focused consumers and a strong economic base. The region, especially Nuevo León, has a well-established sports culture and a rising number of professional and amateur athletes. The population here shows a preference for whey protein products due to their effectiveness and accessibility. High per capita income also enables broader consumption of premium nutritional supplements, including plant-based alternatives. Several local and international companies have set up distribution hubs in Monterrey, recognizing its potential as a strategic market for growth and product testing.

Guadalajara

Guadalajara contributes around 21% to the national protein-based sports supplements market, emerging as a vibrant hub for sports nutrition in western Mexico. The city’s growing middle-income population and improved lifestyle choices have significantly boosted interest in health supplements. The adoption of protein bars and ready-to-drink beverages is particularly notable among working professionals and college students who seek convenience and balanced nutrition. Guadalajara also benefits from strong local branding efforts and increasing promotional campaigns from both domestic and global supplement brands. The city’s expanding fitness infrastructure supports further penetration of specialized supplement products targeting different age groups and fitness levels.

Tijuana

Tijuana accounts for approximately 14% of the market share, driven largely by its cross-border influence and evolving urban demographics. The city’s proximity to the United States plays a significant role in shaping consumer preferences and access to international supplement brands. Fitness awareness is on the rise, supported by a growing number of health clubs and wellness influencers who actively promote protein-based supplements. While the market is still developing compared to larger cities, Tijuana shows strong potential due to increasing disposable income, youthful demographics, and the popularity of U.S. fitness trends. Continued investments in retail expansion and e-commerce are likely to accelerate the market’s growth in this region.

Key Player Analysis

- Glanbia PLC

- Abbott Laboratories

- MusclePharm Corporation

- NOW Foods

- Dymatize Enterprises, LLC

- Iovate Health Sciences International Inc. (MuscleTech)

- CytoSport, Inc. (Muscle Milk)

- Garden of Life, LLC

- Quest Nutrition LLC

- Amazing Grass

Competitive Analysis

The competitive landscape of the Mexico protein-based sports supplements market is characterized by the presence of several prominent global and regional players striving to strengthen their market position through innovation, branding, and strategic distribution. Leading companies such as Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, Dymatize Enterprises, LLC, Iovate Health Sciences International Inc. (MuscleTech), CytoSport, Inc. (Muscle Milk), Garden of Life, LLC, Quest Nutrition LLC, and Amazing Grass actively compete by offering a wide range of protein supplements tailored to different consumer needs. These players focus on expanding their product portfolios with clean-label, plant-based, and specialized protein formulations to attract a broader audience, including athletes, fitness enthusiasts, and health-conscious consumers. Moreover, partnerships with gyms, nutritionists, and e-commerce platforms have become key strategies to enhance brand visibility and consumer reach. Innovation in packaging, taste, and convenience also plays a vital role in product differentiation. The competitive intensity remains high, encouraging continuous investment in R&D and marketing to retain consumer loyalty and capture new market segments in a dynamic, growing industry.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The Mexico protein-based sports supplements market exhibits a moderately concentrated structure, with a few key players dominating a significant share while several emerging brands compete in niche segments. Leading multinational companies leverage their global presence, advanced R&D capabilities, and extensive distribution networks to maintain their competitive edge. These players cater to a wide consumer base by offering diverse protein formats, including powders, bars, ready-to-drink beverages, and capsules. The market is characterized by strong brand loyalty, especially among fitness enthusiasts, and a growing emphasis on clean-label and plant-based products. Consumer preferences continue to shift toward convenience, transparency in ingredients, and personalized nutrition solutions. Additionally, the market demonstrates rapid digitalization, with online sales channels gaining momentum across urban areas. Although the industry is dynamic and innovation-driven, entry barriers such as regulatory compliance, high marketing costs, and brand recognition challenges pose difficulties for new entrants, contributing to the current structure of market concentration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for protein-based sports supplements in Mexico is expected to grow steadily due to increasing health awareness among consumers.

- Rising participation in fitness activities and sports will continue to drive market expansion.

- The influence of social media and fitness influencers is projected to boost consumer interest in protein supplements.

- E-commerce platforms are likely to play a significant role in improving product accessibility and sales.

- Local manufacturers are anticipated to invest in product innovation to cater to evolving consumer preferences.

- Plant-based and organic protein supplements are expected to gain popularity among health-conscious users.

- Strategic partnerships and collaborations may help brands expand their market presence and distribution networks.

- Increasing urbanization and disposable income levels are set to fuel consumer spending on sports nutrition products.

- Regulatory support for safe and high-quality supplement production will enhance consumer trust in the market.

- Continued marketing efforts by global and regional players are likely to increase brand visibility and consumer adoption.