Market Overview

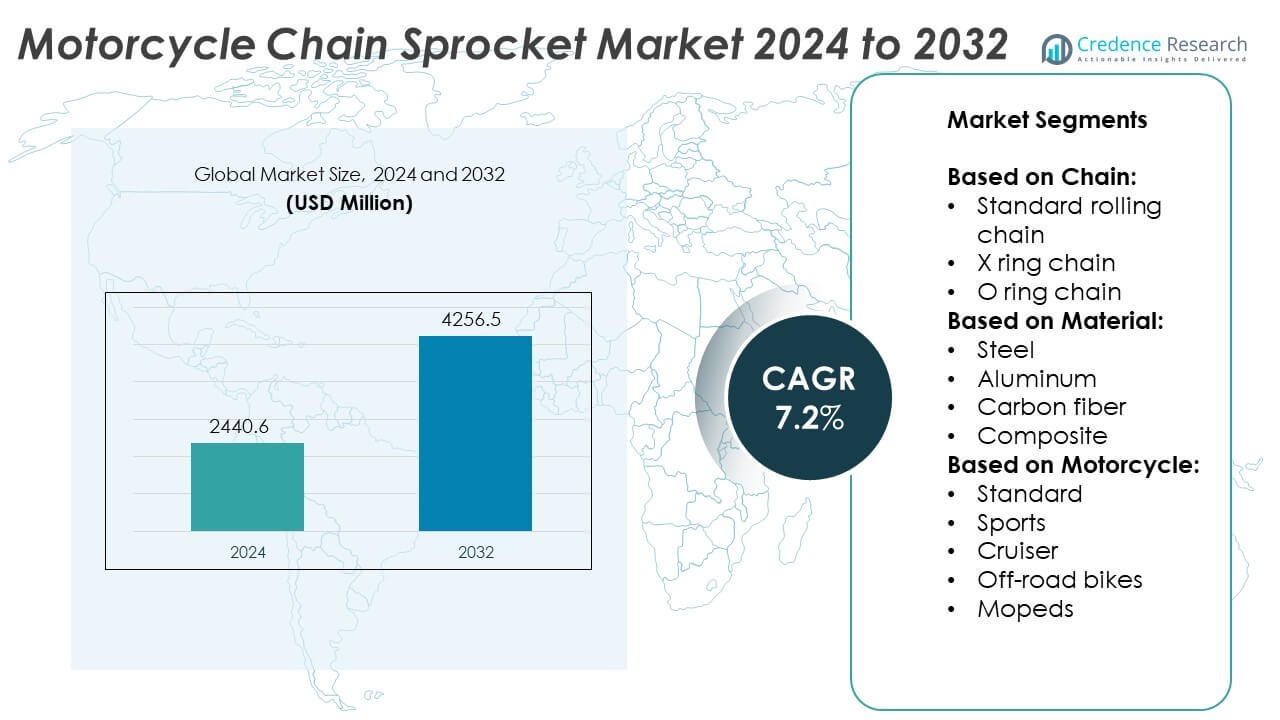

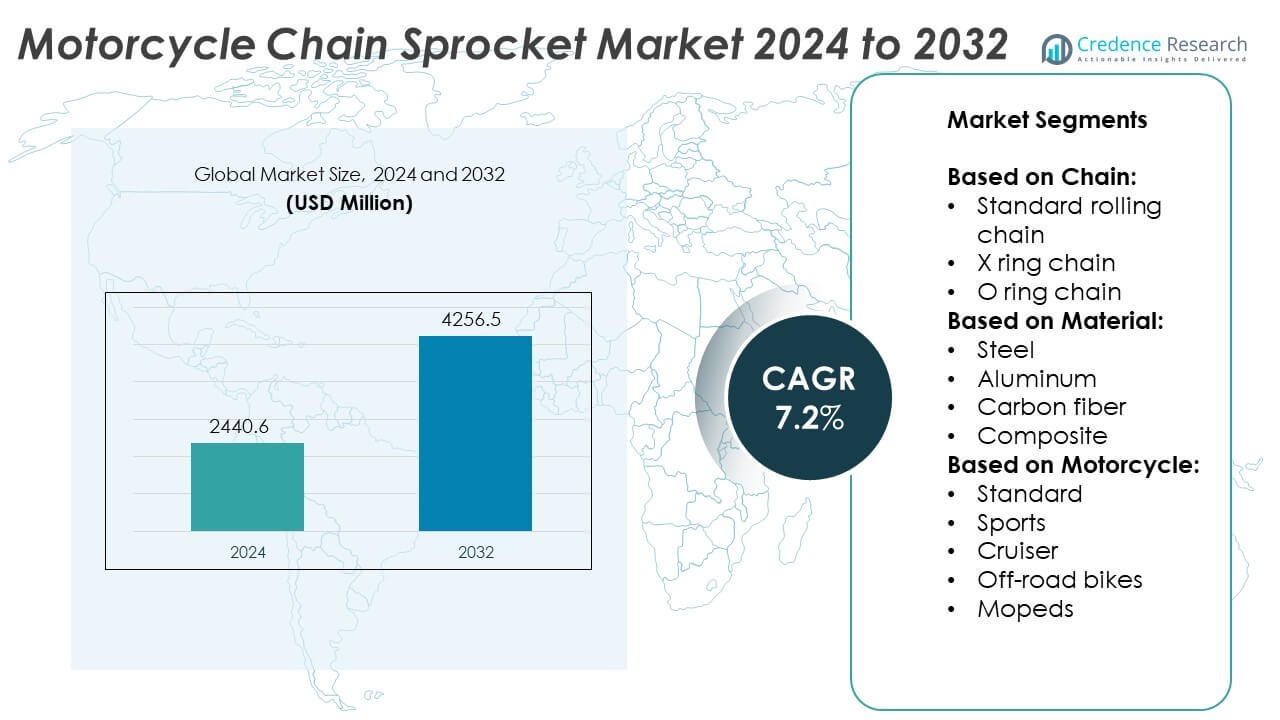

The Motorcycle Chain Sprocket Market size was valued at USD 2440.6 million in 2024 and is anticipated to reach USD 4256.5 million by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorcycle Chain Sprocket Market Size 2024 |

USD 2440.6 Million |

| Motorcycle Chain Sprocket Market, CAGR |

7.2% |

| Motorcycle Chain Sprocket Market Size 2032 |

USD 4256.5 Million |

The Motorcycle Chain Sprocket market experiences growth driven by rising motorcycle production and increasing demand for durable, high-performance components. Advancements in materials and manufacturing techniques enhance sprocket strength, wear resistance, and efficiency, attracting both OEM and aftermarket customers. Growing popularity of customization and performance upgrades among motorcycle enthusiasts further stimulates market expansion. The shift toward electric motorcycles introduces new design requirements, promoting innovation. Urbanization and rising disposable incomes in emerging economies boost motorcycle ownership, fueling replacement part demand.

The Motorcycle Chain Sprocket market shows strong demand across regions including Asia-Pacific, North America, and Europe, driven by growing motorcycle ownership and aftermarket customization trends. Asia-Pacific leads due to rapid urbanization and increasing two-wheeler sales in countries like India and China. North America and Europe emphasize high-performance and premium-quality sprockets, supported by well-established motorcycle cultures. Key players driving the market include Daido Kogyo, Tsubakimoto Chain, Regina Catene Calibrate, and Renthal. These companies focus on innovation, material advancements, and expanding distribution networks to meet diverse regional requirements and enhance their global presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Motorcycle Chain Sprocket market was valued at USD 2440.6 million in 2024 and is expected to reach USD 4256.5 million by 2032, growing at a CAGR of 7.2% during the forecast period.

- Increasing global motorcycle production and rising demand for durable replacement parts drive market growth.

- Advances in materials like aluminum and composites improve sprocket performance and fuel efficiency, influencing market trends.

- Growing popularity of motorcycle customization and performance upgrades boosts aftermarket sales.

- The market faces challenges from raw material price fluctuations and the need to meet diverse motorcycle segment requirements.

- Asia-Pacific leads market growth due to expanding two-wheeler ownership, while North America and Europe focus on premium and high-performance sprockets.

- Key players such as Daido Kogyo, Tsubakimoto Chain, and Renthal emphasize innovation and regional expansion to maintain competitiveness.

Market Drivers

Key Technological Advancements Enhancing Durability and Performance in the Motorcycle Chain Sprocket Market

The Motorcycle Chain Sprocket market benefits from continuous innovation in materials and manufacturing technologies. Manufacturers employ high-strength alloys and advanced heat treatment processes to improve sprocket durability and resistance to wear. Enhanced surface coatings reduce friction and extend product lifespan, supporting higher performance standards demanded by consumers. These technological improvements enable sprockets to withstand harsh operating conditions and maintain efficient power transmission. It drives customer preference for premium quality components, influencing market growth. The integration of lightweight materials also contributes to fuel efficiency and better handling in motorcycles, increasing demand. Ongoing research and development activities sustain the introduction of such innovations.

- For instance, Tsubakimoto Chain reported manufacturing over 5 million motorcycle sprockets annually to meet rising demand from emerging markets like India and Southeast Asia.

Growing Motorcycle Production and Rising Demand for Replacement Parts Worldwide

Increasing production and sales of motorcycles globally fuel the demand for chain sprockets. Emerging economies exhibit expanding motorcycle ownership due to affordability and convenience, creating a broad customer base. Regular maintenance and replacement of chain sprockets remain essential to ensure optimal vehicle performance and safety. It drives steady aftermarket demand, supporting sustained market expansion. Moreover, growing popularity of sports and off-road motorcycles encourages use of high-performance sprockets. Market participants focus on catering to diverse motorcycle segments to capture these opportunities. Rising urbanization and increasing mobility needs further contribute to sales growth.

- For instance, Rental offers sprocket ranging from 14 to 52 teeth, allowing riders to fine-tune gear ratios and improve torque or top speed according to riding preferences.

Rising Popularity of Customization and Performance Upgrades among Motorcycle Enthusiasts

Customization trends in the motorcycle industry significantly impact the Motorcycle Chain Sprocket market. Enthusiasts seek aftermarket sprockets that improve speed, torque, and overall ride quality. It encourages manufacturers to offer sprockets with varied tooth counts, designs, and materials tailored to performance upgrades. Customized sprockets enable riders to optimize gear ratios according to specific riding styles and conditions. This trend drives demand for specialized products beyond standard OEM replacements. Motorcycle clubs and racing events further promote performance modifications, expanding market scope. The increasing focus on personalized motorcycle enhancement remains a key market driver.

Stringent Regulatory Norms Driving Demand for High-Quality and Compliant Components

The Motorcycle Chain Sprocket market faces regulatory pressure to meet safety and environmental standards. Governments and industry bodies impose quality and performance requirements to ensure consumer protection and reduce emissions. It compels manufacturers to adopt advanced manufacturing processes and quality control measures. Compliance with international standards enhances product reliability and market acceptance. This regulatory environment stimulates innovation towards eco-friendly materials and sustainable production. Market players invest in certification and testing to maintain competitiveness. Consequently, regulatory frameworks influence market dynamics and product development strategies.

Market Trends

Increasing Adoption of Lightweight and High-Performance Materials in the Motorcycle Chain Sprocket Market

The Motorcycle Chain Sprocket market demonstrates a growing shift toward lightweight materials such as aluminum alloys and composites. These materials offer improved strength-to-weight ratios, reducing overall motorcycle weight and enhancing fuel efficiency. Manufacturers focus on optimizing sprocket design to balance durability with weight reduction. It drives demand for technologically advanced products that support better acceleration and handling. The trend influences production techniques, encouraging precision manufacturing and innovative surface treatments. Customers increasingly prefer components that deliver superior performance without compromising reliability. This evolution supports the market’s competitiveness and product differentiation.

- For instance, Daido Kogyo expanded its Indian manufacturing plant, boosting annual sprocket production by 2 million units to cater to increased demand in South Asia.

Rising Influence of Electric Motorcycles on Chain Sprocket Design and Demand

Electric motorcycles contribute to evolving trends in the Motorcycle Chain Sprocket market by introducing unique powertrain requirements. Electric drivetrains generate instant torque, necessitating sprockets capable of withstanding higher stress levels. It prompts manufacturers to develop sprockets with enhanced wear resistance and precision engineering. The shift toward electric mobility also affects material selection and sprocket geometry. This trend expands opportunities for aftermarket customization and specialized product lines. Market players invest in research to align with the growing electric motorcycle segment. The ongoing transition to electric vehicles will continue to shape product innovation and demand patterns.

- For instance, JT Sprockets introduced a line of sprockets made from hardened stainless steel alloys designed to withstand the instant torque of electric motorcycles. These sprockets undergo heat treatment processes that improve wear resistance by approximately 25%, while their optimized tooth geometry reduces friction and noise, enhancing overall drivetrain efficiency and durability in electric motorcycle applications.

Growing Popularity of Aftermarket Customization and Performance Enhancements

Customization remains a significant trend influencing the Motorcycle Chain Sprocket market. Motorcycle enthusiasts increasingly seek aftermarket sprockets that offer improved performance, unique aesthetics, and personalized riding experience. It drives suppliers to offer a wider range of sprocket sizes, materials, and finishes tailored to specific rider preferences. Performance-oriented sprockets enable gear ratio adjustments that optimize speed and torque for different applications. The aftermarket’s growth reflects the expanding community of riders focused on modification and racing activities. This trend encourages manufacturers to diversify their product portfolios and engage directly with enthusiast markets.

Expansion of Global Motorcycle Production and Regional Market Dynamics

The Motorcycle Chain Sprocket market experiences growth aligned with increasing motorcycle production in emerging regions such as Asia-Pacific and Latin America. Rising disposable incomes and urbanization support higher motorcycle ownership, fueling demand for both OEM and replacement sprockets. It drives regional manufacturers to scale production capacity and introduce cost-effective solutions. Diverse consumer preferences across regions prompt product customization to meet specific market needs. The trend promotes strategic partnerships and distribution network expansion worldwide. Market participants focus on strengthening presence in high-growth markets to capitalize on expanding opportunities.

Market Challenges Analysis

Complexity in Meeting Diverse Performance and Durability Requirements Across Motorcycle Segments

The Motorcycle Chain Sprocket market faces challenges in developing products that meet the varied performance and durability demands of different motorcycle types. Manufacturers must balance cost, weight, and strength to cater to segments ranging from commuter bikes to high-performance motorcycles. It requires continuous innovation in materials and manufacturing processes to prevent premature wear and failure. Variability in riding conditions and maintenance practices further complicates product standardization. Meeting these diverse requirements without compromising quality poses operational and design challenges. This complexity limits economies of scale and affects pricing strategies. Companies must invest in extensive testing and customization to maintain competitive advantage.

Impact of Raw Material Price Fluctuations and Supply Chain Disruptions on Market Stability

Fluctuating prices of raw materials such as steel and aluminum create uncertainty in production costs within the Motorcycle Chain Sprocket market. It affects manufacturers’ ability to maintain stable pricing and profit margins. Global supply chain disruptions further strain material availability and lead times, causing delays in production and delivery. These challenges increase operational costs and affect inventory management efficiency. Market players face pressure to optimize sourcing strategies and strengthen supplier relationships. Maintaining consistent product quality while managing cost volatility remains a critical challenge. Such instability can hinder market growth and delay new product launches.

Market Opportunities

Expansion of Aftermarket and Customization Segments Creating New Growth Avenues

The Motorcycle Chain Sprocket market benefits from growing interest in aftermarket upgrades and customization among motorcycle enthusiasts. Riders increasingly seek high-performance sprockets that enhance speed, torque, and overall riding experience. It creates opportunities for manufacturers to introduce specialized products with varied materials, designs, and finishes tailored to specific needs. The expanding community of hobbyists and racers supports steady demand for performance-oriented components. Collaborations with motorcycle clubs and event organizers further stimulate product visibility and adoption. This focus on personalization encourages innovation and differentiation within the market. Capitalizing on this trend allows players to strengthen brand loyalty and expand revenue streams.

Increasing Motorcycle Production in Emerging Economies Driving Market Expansion

Rising motorcycle production and ownership in emerging markets present significant opportunities for the Motorcycle Chain Sprocket market. Growing urbanization and improved infrastructure boost demand for affordable and efficient transportation solutions. It encourages both OEMs and aftermarket suppliers to expand their presence in these regions. The increasing need for reliable replacement parts supports sustained aftermarket growth. Market players can leverage regional manufacturing advantages to offer cost-effective products. Strategic investments in distribution and localized product development enhance market penetration. This expanding consumer base underpins long-term growth potential and global market diversification.

Market Segmentation Analysis:

By Chain:

The market includes standard rolling chains, O ring chains, and X ring chains. Standard rolling chains provide fundamental power transmission and cost efficiency, making them popular in entry-level and commuter motorcycles. O ring chains offer improved lubrication retention and durability, extending sprocket and chain life under moderate performance conditions. X ring chains deliver superior sealing and reduced friction, supporting high-performance motorcycles that demand enhanced efficiency and longevity. It drives manufacturers to tailor sprocket designs compatible with each chain type to optimize performance and maintenance intervals.

- For instance, RK Takasago, a division of RK Japan, produces sprockets hardened to 59 HRC specifically designed for O-ring chains.

By Material:

The market into steel, aluminum, carbon fiber, and composite sprockets. Steel remains the dominant material due to its strength, wear resistance, and cost-effectiveness, suitable for a broad range of motorcycles. Aluminum sprockets appeal to riders seeking lightweight solutions without sacrificing durability, particularly in sports and racing segments. Carbon fiber and composite sprockets represent advanced material options, offering significant weight reduction and corrosion resistance while maintaining performance. These materials target premium segments focused on maximizing acceleration and handling. It encourages ongoing innovation in material engineering to meet evolving rider expectations.

- For instance, JT Sprockets produces aluminum sprockets tailored for sports motorcycles, with surface hardness of 55 HRC and weight as low as 135 grams.

By Motorcycle:

It includes standard, sports, cruiser, off-road bikes, and mopeds. Standard motorcycles require reliable and versatile sprockets that balance durability and affordability, appealing to everyday riders. Sports motorcycles demand high-performance sprockets optimized for speed, torque, and weight reduction to enhance competitive riding. Cruiser motorcycles prioritize durability and aesthetic appeal, influencing sprocket design and finishes. Off-road bikes operate in rugged conditions, requiring sprockets with reinforced strength and wear resistance to endure challenging terrains. Mopeds, being lightweight and low-powered, use simpler sprocket designs focused on cost efficiency and maintenance ease. It directs manufacturers to develop specialized products catering to the unique demands of each motorcycle segment.

Segments:

Based on Chain:

- Standard rolling chain

- X ring chain

- O ring chain

Based on Material:

- Steel

- Aluminum

- Carbon fiber

- Composite

Based on Motorcycle:

- Standard

- Sports

- Cruiser

- Off-road bikes

- Mopeds

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant portion of the Motorcycle Chain Sprocket market with a market share of 28%. The region benefits from a strong presence of established motorcycle manufacturers and a well-developed aftermarket for replacement and performance parts. High consumer spending power and a large base of motorcycle enthusiasts drive demand for premium and customized sprockets. It also experiences growing interest in sports and cruiser motorcycles, which require specialized sprocket designs. The steady growth in electric motorcycle adoption in the region influences product innovation, pushing manufacturers to develop sprockets tailored to electric drivetrains. Robust distribution networks and the presence of key industry players further strengthen North America’s market position.

Europe

Europe accounts for approximately 25% of the Motorcycle Chain Sprocket market, supported by mature motorcycle markets in countries such as Germany, Italy, and the United Kingdom. The region’s regulatory environment emphasizes safety and environmental compliance, compelling manufacturers to focus on high-quality, durable sprockets. It has a well-established motorsport culture, which fuels demand for high-performance aftermarket sprockets in sports and off-road segments. European consumers display a preference for advanced materials like aluminum and composites, accelerating innovation in product development. The growth of electric motorcycles and sustainable manufacturing practices also shape the market landscape. Market players invest heavily in R&D to cater to the evolving needs of European riders.

Asia-Pacific

The Asia-Pacific region commands the largest market share at 33% in the Motorcycle Chain Sprocket market. Rapid urbanization, rising disposable incomes, and increasing motorcycle ownership in countries such as China, India, and Indonesia drive demand. The region’s growing middle class favors motorcycles as affordable and efficient transportation, supporting both OEM and aftermarket sprocket sales. It experiences strong growth in the commuter and standard motorcycle segments, but expanding interest in sports and off-road motorcycles contributes to product diversification. Local manufacturers play a vital role in supplying cost-effective sprockets to meet regional demand. Investments in infrastructure and supportive government policies for two-wheelers enhance market growth prospects. Increasing awareness about maintenance and performance upgrades also stimulates aftermarket demand.

Latin America

Latin America holds around 8% of the Motorcycle Chain Sprocket market, driven by increasing motorcycle penetration in countries such as Brazil and Mexico. Economic development and expanding urban centers encourage motorcycle use for daily commuting and logistics. It presents growth opportunities in both OEM and replacement markets due to a rising number of motorcycles on the road. Demand focuses largely on affordable and durable sprockets suitable for standard and off-road motorcycles. The region’s market faces challenges related to supply chain efficiency and cost sensitivity, prompting manufacturers to optimize pricing strategies. Regional partnerships and localized production help improve accessibility and strengthen market presence.

Middle East & Africa

The Middle East & Africa region contributes approximately 6% to the Motorcycle Chain Sprocket market. Growing motorcycle adoption in urban and rural areas supports demand for maintenance parts and aftermarket customization. Harsh climatic conditions in this region emphasize the need for durable and corrosion-resistant sprockets. It witnesses increasing interest in off-road and adventure motorcycles, creating niche opportunities for specialized sprocket products. Infrastructure development and improved distribution channels aid market expansion. Market players focus on enhancing product availability and providing cost-effective solutions to capture the region’s growth potential. Collaborative initiatives with local dealers help improve brand reach and customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Regina Catene Calibrate

- Renthal

- Hengjiu

- Daido Kogyo

- Rockman

- Tsubakimoto Chain

- JT Sprockets

- TIDC India

- L.G.Balakrishnan

- RK Japan

Competitive Analysis

Key players in the Motorcycle Chain Sprocket market include Daido Kogyo, Tsubakimoto Chain, Regina Catene Calibrate, Renthal, Hengjiu, JT Sprockets, L.G. Balakrishnan, RK Japan, Rockman, and TIDC India. These companies maintain competitive advantages through continuous innovation in materials and manufacturing processes, focusing on improving sprocket durability, weight reduction, and performance. They invest heavily in research and development to introduce products that meet evolving consumer demands for enhanced strength and corrosion resistance. Strong distribution networks and global presence enable these players to cater to diverse regional markets efficiently. Strategic collaborations with motorcycle manufacturers and aftermarket suppliers further strengthen their market position. Quality control and adherence to international standards remain a priority, ensuring reliability and customer trust. Leading companies also emphasize customization options to appeal to the growing segment of motorcycle enthusiasts seeking performance upgrades. Competitive pricing strategies and localized production capabilities help address cost sensitivities in emerging markets. Together, these efforts create a dynamic and competitive landscape, driving market growth and encouraging continuous product improvement.

Recent Developments

- In 2025, Hengjiu Group is listed among the important companies driving the motorcycle chain sprocket market. It is included in profiles of key global suppliers working on improved chain transmissions and drivetrain components with a focus on quality and performance.

- In 2025, Daido Kogyo Co., Ltd. (DID Chains) Known for X-ring and O-ring chain technologies enhancing chain lifespan and corrosion resistance. The company focuses on expanding the durability and wear resistance of sprockets and chains in high-stress riding conditions.

- In 2023, L. G. Balakrishnan & Bros Ltd., one of the leading players in the automobile industry, specializes in manufacturing chain sprocket kits, belts, and other accessories under the ROLON brand introduced the first electric bike chain sprocket kit in the market, which the company exclusively supplies to Tork Motors.

Market Concentration & Characteristics

The Motorcycle Chain Sprocket market exhibits a moderately concentrated structure, with a handful of key players holding significant market shares through advanced technology and extensive distribution networks. It features a mix of large multinational manufacturers and regional suppliers catering to varied customer segments. Market leaders leverage strong R&D capabilities to develop innovative sprockets that enhance durability, reduce weight, and improve performance, securing their competitive positions. The market demands high-quality products that comply with stringent industry standards, driving investments in precision manufacturing and quality control. It also faces pressure to balance cost efficiency with technological advancements, especially to serve emerging markets with price-sensitive customers. The coexistence of OEM and aftermarket segments shapes market characteristics, where aftermarket customization and performance upgrades drive product diversification. Market players focus on expanding regional footprints, particularly in Asia-Pacific, North America, and Europe, to capitalize on growing motorcycle ownership and replacement needs. Overall, it remains a dynamic market characterized by continuous innovation, competitive pricing strategies, and evolving consumer preferences, requiring manufacturers to adapt rapidly to maintain relevance and growth.

Report Coverage

The research report offers an in-depth analysis based on Chain, Material, Motorcycle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing global motorcycle production.

- Demand for lightweight and high-performance sprockets will continue to rise.

- Innovation in materials such as composites and carbon fiber will gain prominence.

- Electric motorcycles will create new design and performance requirements.

- Aftermarket customization and performance upgrades will expand market opportunities.

- Emerging economies will contribute significantly to market growth through rising motorcycle ownership.

- Manufacturers will focus on enhancing durability and wear resistance of sprockets.

- Supply chain optimization will become crucial to manage raw material cost fluctuations.

- Regulatory compliance will drive adoption of environmentally friendly manufacturing processes.

- Strategic collaborations and regional expansion will remain key for competitive advantage.