Market Overview:

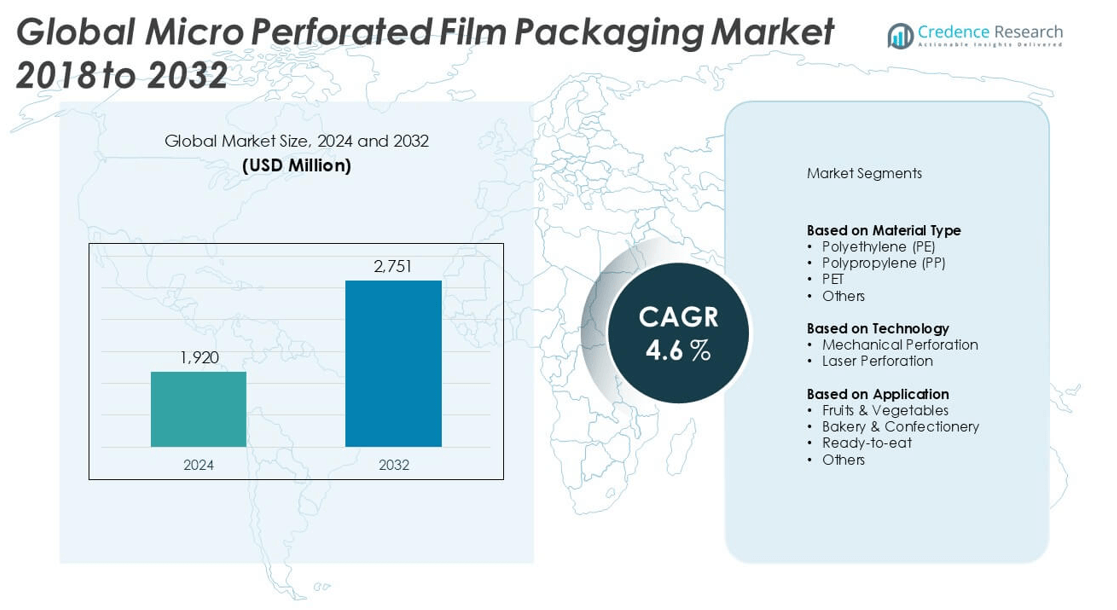

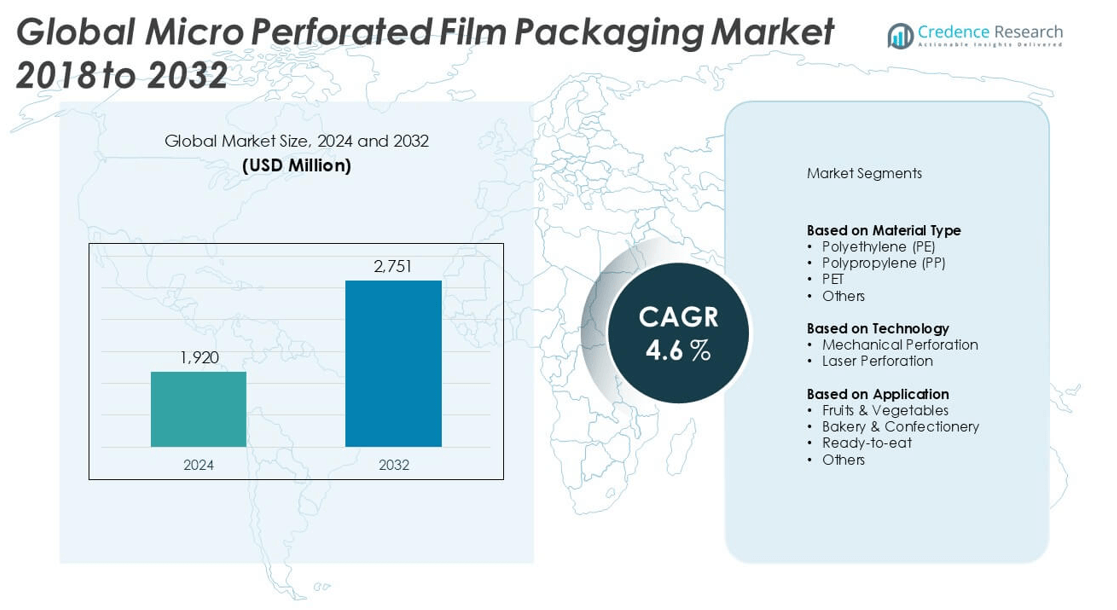

The Micro Perforated Film Packaging market size was valued at USD 1,920 million in 2024 and is anticipated to reach USD 2,751 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro Perforated Film Packaging Market Size 2024 |

USD 1,920 million |

| Micro Perforated Film Packaging Market, CAGR |

4.6% |

| Micro Perforated Film Packaging Market Size 2032 |

USD 2,751 million |

The Micro Perforated Film Packaging market is led by key players such as Amcor Limited, Sealed Air Corporation, Mondi Group, Coveris Holdings S.A., and Uflex Ltd., all of which hold strong positions due to their global presence, advanced technological capabilities, and broad product offerings. These companies prioritize innovation in sustainable materials and precision perforation techniques to meet the rising demand for extended shelf-life and eco-friendly packaging. Asia-Pacific dominates the global market, accounting for approximately 32% of total market share in 2024, driven by expanding retail infrastructure, increasing consumption of fresh and ready-to-eat foods, and growing investments in food packaging technologies.

Market Insights

- The Micro Perforated Film Packaging market was valued at USD 1,920 million in 2024 and is projected to reach USD 2,751 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- Rising demand for fresh produce and minimally processed foods is driving adoption of breathable packaging that extends shelf life while maintaining product quality.

- Technological advancements in laser and mechanical perforation, along with the growing preference for recyclable and biodegradable materials, are key market trends influencing product development.

- The market is moderately fragmented, with leading players including Amcor Limited, Sealed Air Corporation, Mondi Group, and Uflex Ltd. competing through innovation, strategic partnerships, and regional expansions.

- Asia-Pacific leads the market with a 32% share, followed by North America at 28% and Europe at 26%; by application, the Fruits & Vegetables segment holds the largest share due to high demand for extended shelf-life packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Polyethylene (PE) dominated the Micro Perforated Film Packaging market in 2024, accounting for the largest market share among material types. Its widespread use is attributed to its cost-effectiveness, flexibility, and excellent moisture barrier properties, which make it ideal for perishable food packaging. PE is particularly favored in fresh produce packaging where extended shelf life and breathability are essential. Additionally, the growing demand for lightweight and recyclable packaging materials further supports the dominance of PE. While Polypropylene (PP) and PET are also gaining traction due to their clarity and strength, PE remains the material of choice for most manufacturers.

- For instance, Amcor Limited developed its PE-based AmLite Ultra Recyclable film, which offers oxygen transmission rates below 0.2 cc/m²/day, significantly enhancing produce shelf life while meeting recyclability standards.

By Technology

Mechanical perforation held the leading market share in 2024, outperforming laser perforation in terms of volume and affordability. This method is widely adopted due to its ease of integration into existing production lines and its cost-effectiveness for high-volume packaging applications. Mechanical perforation is especially popular among manufacturers of fruit and vegetable packaging, where consistent airflow and rapid processing are required. However, laser perforation is gaining attention in premium and ready-to-eat food segments for its precision and ability to create micro holes without compromising film integrity. Still, the mechanical perforation segment continues to lead due to its economic viability and scalability.

- For instance, Mondi Group’s mechanical perforation systems can process film rolls at speeds of over 600 meters per minute, allowing for large-scale packaging operations without compromising hole consistency.

By Application

Fruits & Vegetables emerged as the dominant application segment in the Micro Perforated Film Packaging market, capturing the highest market share in 2024. This dominance is driven by the increasing global demand for fresh produce and the need for packaging that maintains freshness by regulating gas exchange and moisture levels. Micro perforated films help reduce spoilage and extend shelf life, making them essential for retail and export packaging of fruits and vegetables. The bakery & confectionery and ready-to-eat segments are also growing steadily, driven by changing lifestyles and the rising popularity of convenience foods, but remain secondary to the fresh produce segment.

Market Overview

Rising Demand for Fresh and Minimally Processed Foods

The increasing consumer preference for fresh, minimally processed food is a key driver for the micro perforated film packaging market. These films enhance product shelf life by enabling controlled respiration in perishable items such as fruits, vegetables, and bakery goods. As global consumption of fresh produce rises—especially in urban areas—retailers and food manufacturers are adopting breathable packaging solutions to reduce spoilage and maintain quality. This shift in dietary trends continues to create consistent demand for advanced packaging technologies that preserve freshness without relying heavily on preservatives.

- For instance, Sealed Air Corporation’s Cryovac Freshness Plus range demonstrated a reduction in mold growth by up to 34 days in trials with fresh berries, supporting longer retail shelf life with minimal processing.

Expansion of Organized Retail and E-commerce

The rapid growth of organized retail chains and e-commerce platforms is significantly contributing to market expansion. These channels require reliable packaging solutions that ensure product integrity during storage and transit. Micro perforated films meet this requirement by offering durability and extended freshness, particularly for temperature-sensitive items. Additionally, the proliferation of online grocery and meal delivery services is increasing the need for effective packaging that balances shelf life with visual appeal. This trend is especially strong in emerging economies where modern retail infrastructure is expanding rapidly.

- For instance, Uflex Ltd. supplies perforated films for BigBasket in India, supporting fulfillment of over 60,000 daily fresh food deliveries with consistent thermal and respiratory performance.

Sustainability and Regulatory Push for Eco-friendly Packaging

Sustainability concerns and evolving regulatory standards are driving the shift toward recyclable and environmentally friendly packaging materials. Micro perforated films, especially those made from biodegradable or recyclable polymers, are gaining traction as brands strive to reduce plastic waste and carbon footprints. Government policies promoting sustainable packaging practices and consumer demand for green alternatives are compelling manufacturers to invest in innovative materials and perforation technologies. These factors are accelerating adoption across multiple industries, particularly in food packaging, where both performance and environmental compliance are critical.

Key Trends & Opportunities

Technological Advancements in Perforation Techniques

Advancements in laser and mechanical perforation technologies are enabling precise control over hole size, density, and distribution in micro perforated films. These innovations improve packaging performance by optimizing airflow and moisture control, thereby extending product shelf life. The growing availability of high-speed and automated perforation systems is also improving manufacturing efficiency and scalability. This trend opens opportunities for companies to offer customized packaging solutions tailored to specific food types and storage conditions, giving them a competitive edge in a highly fragmented market.

- For instance, Bolloré Group’s laser perforation units achieve micro-hole diameters as small as 50 microns with positioning accuracy of ±5 microns, allowing tailored solutions for respiration-sensitive food categories.

Increasing Adoption in Emerging Economies

Emerging markets in Asia-Pacific and Latin America are witnessing increased adoption of micro perforated film packaging, driven by growing middle-class populations, urbanization, and shifts in food consumption patterns. Rising demand for packaged and ready-to-eat foods, combined with the expansion of cold chain logistics and retail infrastructure, is creating new growth avenues. Local manufacturers are increasingly investing in advanced packaging solutions to meet the rising standards of food safety and freshness. This trend presents a strategic opportunity for global players to expand their presence and form partnerships in these high-potential regions.

- For instance, Avery Dennison’s Performance Tapes division supported over 100 packaging lines in Brazil and India in 2023 by installing localized micro perforation units with throughput capacities of 4 million meters of film per month.

Key Challenges

High Cost of Advanced Materials and Perforation Equipment

One of the primary challenges facing the market is the high cost associated with premium materials and advanced perforation equipment, particularly laser systems. Small and medium-sized manufacturers may find it difficult to invest in such capital-intensive technologies, limiting their competitiveness. Additionally, the use of biodegradable or specialty films further increases production costs, potentially affecting product pricing. This financial barrier can restrict market penetration in cost-sensitive regions, despite the rising demand for high-performance and sustainable packaging.

Complexity in Achieving Optimal Breathability

Achieving the right balance between breathability and barrier protection is technically challenging in micro perforated film packaging. Different food products require customized oxygen and moisture transmission rates, and failure to optimize these parameters can lead to reduced shelf life or product spoilage. This complexity demands in-depth knowledge of food science, product-specific respiration rates, and environmental factors, which not all manufacturers possess. As a result, improper application or design flaws can lead to compromised product quality and customer dissatisfaction.

Regulatory Compliance and Recycling Limitations

While demand for sustainable packaging is growing, regulatory compliance remains a major challenge, especially in regions with strict packaging and environmental laws. Many micro perforated films, particularly multilayered or composite ones, pose difficulties in recycling due to their mixed-material composition. This limits their suitability for circular economy initiatives and increases scrutiny from environmental agencies. Manufacturers must continuously adapt to evolving regulations, which can involve additional R&D investment and reformulation of existing product lines to remain compliant and competitive.

Regional Analysis

North America

North America held a significant share of the micro perforated film packaging market in 2024, accounting for approximately 28% of global revenue. The region’s dominance stems from strong demand for packaged fresh produce, baked goods, and convenience foods. The presence of established retail chains and e-commerce platforms further drives the need for effective, shelf-life-extending packaging solutions. Additionally, stringent food safety regulations encourage the adoption of high-performance materials and advanced perforation technologies. The United States remains the primary contributor due to its advanced packaging infrastructure and growing emphasis on sustainable packaging alternatives.

Europe

Europe accounted for nearly 26% of the global micro perforated film packaging market in 2024, supported by its mature food packaging sector and heightened environmental regulations. Countries such as Germany, France, and the U.K. are driving demand, particularly for sustainable and recyclable films used in fresh produce and bakery packaging. The European Union’s push for circular economy practices has spurred investment in biodegradable materials and eco-friendly perforation technologies. Moreover, increasing health awareness and preference for fresh food products are boosting market growth across both Western and Eastern Europe, reinforcing the region’s position as a major consumer of breathable packaging solutions.

Asia-Pacific

Asia-Pacific led the micro perforated film packaging market with the largest share of approximately 32% in 2024, driven by rising demand for packaged fruits, vegetables, and ready-to-eat meals across emerging economies. Rapid urbanization, population growth, and expanding retail and cold chain infrastructure have fueled adoption in countries like China, India, and Indonesia. Local manufacturers are increasingly investing in affordable and scalable packaging technologies to meet domestic consumption and export demands. Moreover, government initiatives promoting food safety and hygiene continue to support the adoption of high-performance packaging, establishing the region as a key growth engine for the global market.

Latin America

Latin America captured around 8% of the global micro perforated film packaging market in 2024, with Brazil and Mexico being the dominant contributors. The market is primarily driven by the growing consumption of fresh produce and bakery items, along with expanding food processing industries. Improvements in retail infrastructure and increased exports of fruits and vegetables are encouraging local manufacturers to adopt breathable packaging solutions. However, market penetration remains moderate due to limited access to advanced perforation technologies and cost constraints, presenting opportunities for foreign investments and technological collaborations to address existing gaps.

Middle East & Africa (MEA)

The Middle East & Africa accounted for nearly 6% of the global micro perforated film packaging market in 2024. Although relatively smaller in size, the region is experiencing steady growth driven by rising demand for packaged food, growing retail expansion, and increasing import of fresh produce. Countries like the UAE and South Africa are witnessing a shift toward quality packaging solutions to meet international food safety standards. However, limited manufacturing capabilities and high dependency on imports restrict large-scale adoption. Nevertheless, the growing middle-class population and rising health consciousness provide long-term growth potential in the region.

Market Segmentations:

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- PET

- Others

By Technology

- Mechanical Perforation

- Laser Perforation

By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Ready-to-eat

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Micro Perforated Film Packaging market is characterized by the presence of both global packaging giants and specialized regional players. Companies such as Amcor Limited, Sealed Air Corporation, Mondi Group, and Coveris Holdings S.A. lead the market with extensive product portfolios, strong R&D capabilities, and global distribution networks. These firms focus on innovation in film materials and perforation technologies to meet evolving consumer and regulatory demands, particularly for sustainable and high-performance packaging. Meanwhile, regional players like Uflex Ltd., TCL Packaging Ltd., and Now Plastics Inc. cater to niche segments and offer customized solutions at competitive prices. Strategic initiatives including mergers, acquisitions, capacity expansions, and collaborations are commonly employed to enhance market share and technological capabilities. Additionally, growing investments in biodegradable films and precision laser perforation techniques highlight the industry’s shift toward sustainability and efficiency. The competitive environment remains dynamic, driven by continuous innovation and evolving customer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Limited

- Sealed Air Corporation

- Mondi Group

- Coveris Holdings S.A.

- Uflex Ltd.

- Bolloré Group

- TCL Packaging Ltd.

- Avery Dennison Corporation

- Amerplast

- Now Plastics Inc.

Recent Developments

- In May 2025, Sealed Air Corporation reported strong Q1 2025 financial results, highlighting steady volume growth in its food packaging segment. The company also achieved improved margins through strategic cost control measures, reflecting progress in its ongoing business transformation and operational efficiency initiatives.

- In April 2025, Amcor finalized its acquisition of Berry Global, forming one of the largest packaging conglomerates worldwide. The merger significantly enhances Amcor’s R&D capabilities and broadens its geographic footprint. This consolidation is expected to streamline operations and accelerate innovation in micro-perforated film technologies, particularly for applications in fresh produce and breathable packaging solutions.

- In August 2024, Specialty Polyfilms announced that they would participate in the Global Produce and Floral Show held in Atlanta, GA. Specialty Polyfilms is a team member of the International Fresh Produce Association, and it welcomes all Fresh Produce and Foodservice industry stakeholders to visit its booth C1501 in the business solution sections. Team members will demonstrate the distinguished attributes of Forvara Foodservice Films, Forvara Cheese Wrapping Films, Forvara Mushroom Films, and Forvara Fresh Produce Films from October 17-19, 2024. Forvara Mushroom Films is available in boreholes and micro-perforated options and helps to improve the shelf life of mushrooms.

- In August 2024, a global partnership for the supply of sustainable packaging materials from recycled plastics was announced with the signing of an MOU (Memorandum of Understanding) by Winpak Ltd. and SK Geo Centric (SKGC).

- In August 2023, at Labelexpo Europe 2023, two new decorative linerless solutions, pressure-sensitive labels, and developments in connected packaging, which is a micro-perforated technology launched by Avery Dennison. It is helpful for traceability and reduced environmental impact.

- In December, 2022, Laser micro-perforated bags were developed by Perfo Tec to increase the shelf life of products. Fresh products that are packaged have better quality and longer shelf lives thanks to this laser micro-perforation technique. According to PerfoTec study, utilizing this technique increases the shelf life of certain foods, including spinach, from seven to 21 days.

Market Concentration & Characteristics

The Micro Perforated Film Packaging Market shows moderate market concentration, with a mix of global leaders and regional manufacturers shaping its competitive dynamics. Large multinational companies, including Amcor Limited, Sealed Air Corporation, and Mondi Group, dominate due to their extensive distribution networks, advanced technology, and strong customer relationships. These players invest in R&D and focus on sustainability, targeting growing consumer demand for eco-friendly packaging. Regional players compete on cost efficiency and customized solutions, particularly in emerging markets. It demonstrates steady growth due to its essential role in preserving the freshness of perishable products across food segments. The market exhibits high demand elasticity, closely linked to consumer trends in fresh and ready-to-eat food products. Standardization and product differentiation are key characteristics, influenced by regulatory requirements and end-use application needs. It remains innovation-driven, with players introducing advanced perforation techniques and recyclable materials to strengthen market position. The presence of both established and emerging players ensures continuous competition and innovation.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to increasing demand for fresh and minimally processed food.

- Advancements in laser and mechanical perforation will improve packaging precision and performance.

- Sustainability initiatives will push manufacturers to adopt recyclable and biodegradable materials.

- Demand from e-commerce and organized retail sectors will expand usage in perishable goods packaging.

- Asia-Pacific will maintain its lead due to rising consumption and expanding food supply chains.

- Fruits and vegetables will remain the dominant application segment throughout the forecast period.

- Food safety regulations will drive innovation in breathable and hygienic packaging solutions.

- Global players will increase investment in emerging markets to strengthen regional presence.

- Product customization will grow as brands seek differentiation in competitive retail environments.

- Rising energy and raw material costs may pressure profit margins, especially for smaller manufacturers.