Market Overview:

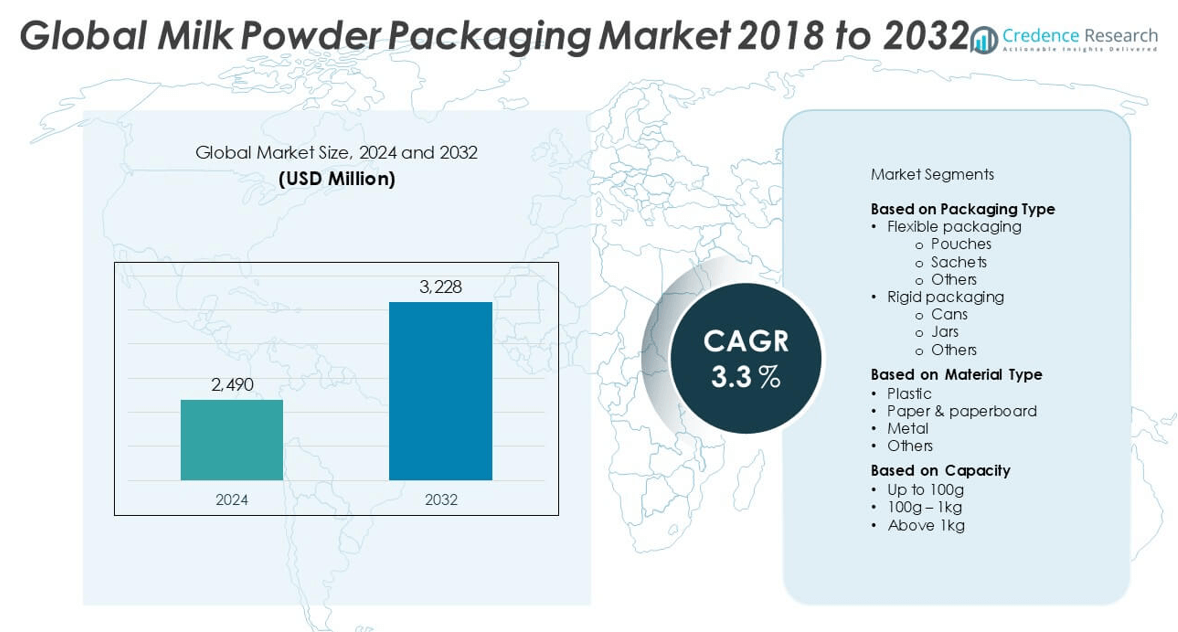

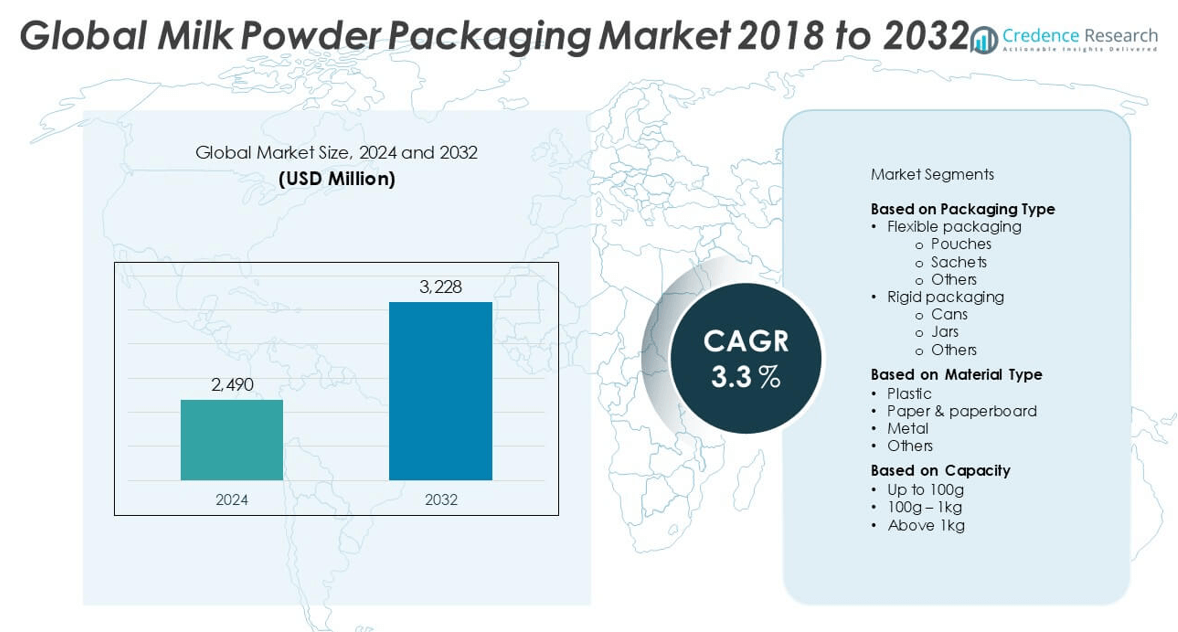

The Milk Powder Packaging market size was valued at USD 2,490 million in 2024 and is anticipated to reach USD 3,228 million by 2032, growing at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Milk Powder Packaging Market Size 2024 |

USD 2,490 million |

| Milk Powder Packaging Market, CAGR |

3.3% |

| Milk Powder Packaging Market Size 2032 |

USD 3,228 million |

The milk powder packaging market is dominated by leading players such as CarePac, Coveris, Huhtamaki, Mondi, Sonoco Product Company, Advanced Industries Packaging, and BOWE PACK, who collectively hold a significant share of the global market. These companies leverage advanced packaging technologies, sustainable material innovations, and strategic geographic expansions to maintain competitive advantage. Asia Pacific emerged as the leading region in 2024, accounting for approximately 35% of the global market share, driven by rising population, increasing infant nutrition demand, and growing adoption of flexible packaging formats. North America and Europe follow, supported by high-quality standards and sustainability regulations.

Market Insights

- The milk powder packaging market was valued at USD 2,490 million in 2024 and is expected to reach USD 3,228 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- Rising demand for long-shelf-life dairy products, growing infant nutrition needs, and the expansion of e-commerce are key factors driving market growth globally.

- Flexible packaging, particularly pouches, holds the largest segment share due to affordability, convenience, and reduced material usage; plastic remains the dominant material type.

- Asia Pacific leads the market with around 35% share, followed by North America at 25% and Europe at 22%, driven by population growth, health awareness, and retail expansion.

- Environmental regulations, raw material price volatility, and limited recycling infrastructure in emerging markets act as key restraints, although companies are increasingly investing in sustainable and high-barrier packaging solutions to gain a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

The milk powder packaging market is primarily segmented into flexible and rigid packaging, with flexible packaging emerging as the dominant category. Within flexible packaging, pouches held the largest market share in 2024 due to their lightweight nature, cost-effectiveness, and ease of transportation. The growing demand for convenience-oriented packaging solutions, particularly in developing economies, continues to drive the adoption of pouches. In contrast, rigid packaging such as cans and jars are preferred in premium or bulk product segments, but their higher material and transportation costs limit widespread adoption compared to flexible formats.

- For instance, Huhtamaki produces over 3 billion flexible pouch units annually across its global network, emphasizing lightweight, high-barrier materials for powdered food applications.

By Material Type:

Plastic was the leading material type in the milk powder packaging market in 2024, capturing the largest share due to its versatility, durability, and excellent barrier properties against moisture and contamination. It supports extended shelf life, which is a critical factor for powdered milk products. Despite environmental concerns, plastic remains widely used because of its cost-efficiency and performance. However, increasing regulatory pressures and consumer preference for eco-friendly alternatives are gradually boosting the demand for paper & paperboard and metal materials, particularly in markets with strong sustainability mandates.

- For instance, Mondi Group developed its BarrierPack Recyclable film, certified recyclable by Institut cyclos-HTP, and deployed it across over 25 commercial packaging formats, including dairy powder lines.

By Capacity:

In terms of packaging capacity, the 100g – 1kg segment dominated the market in 2024. This range is favored by both household consumers and small-scale institutional buyers due to its balance of affordability, convenience, and storage efficiency. The increasing popularity of infant formula and nutritional supplements in moderate quantities has fueled demand in this segment. While up to 100g packs are gaining traction in single-use or travel-friendly formats, above 1kg packages serve large families and commercial buyers but are less dominant due to higher price points and storage constraints.

Market Overview

Rising Demand for Convenience and Shelf-Stable Products

Consumers increasingly prefer packaged products that offer convenience, long shelf life, and easy storage, which has significantly fueled the growth of the milk powder packaging market. Milk powder serves as an ideal substitute for liquid milk in regions with limited refrigeration infrastructure. Packaging solutions that maintain product freshness and prevent contamination are in high demand. This has led to a surge in flexible packaging options like pouches and sachets, as they offer portability and resealability, aligning with the busy lifestyles and changing consumption patterns of modern consumers.

- For instance, Sonoco Products Company launched InvisiShield™, an oxygen scavenger technology integrated into pouches that extends the shelf life of powdered dairy products by up to 12 months without altering the package design.

Expansion of Infant and Nutritional Products Market

The growing demand for infant formula and adult nutritional supplements has been a critical growth driver for milk powder packaging. These products require high-barrier, contamination-resistant packaging materials to preserve product quality and meet stringent regulatory standards. As birth rates remain steady in emerging markets and health-conscious consumer segments grow globally, manufacturers are investing in specialized packaging formats like vacuum-sealed pouches and metal tins that ensure hygiene and freshness. This trend has bolstered demand for both flexible and rigid packaging solutions tailored to the needs of the nutritional product segment.

- For instance, Coveris provides customized high-barrier laminates for powdered infant formula across 15 production lines in Europe, supporting leading nutrition brands with contamination-resistant, foil-based packaging.

Growth of E-commerce and Modern Retail Channels

The expansion of e-commerce platforms and organized retail has provided significant growth opportunities for milk powder packaging. These channels demand robust and tamper-proof packaging to ensure safe delivery and shelf appeal. Products sold online often require consumer-friendly and durable packaging that prevents leaks or spoilage during transit. Additionally, attractive packaging boosts brand visibility and consumer trust. As more consumers shift to online grocery shopping, especially post-pandemic, the demand for standardized, lightweight, and protective packaging formats continues to rise, reinforcing growth in this market segment.

Key Trends & Opportunities

Sustainability-Driven Packaging Innovations

Sustainability is emerging as a central trend in the milk powder packaging market. Consumers and regulators are pushing for eco-friendly materials, prompting manufacturers to adopt recyclable plastics, biodegradable films, and paper-based packaging solutions. Brands that invest in reducing carbon footprints and promoting circular economy principles are gaining competitive advantage. Innovations in compostable pouches and reduced plastic use not only address environmental concerns but also appeal to eco-conscious consumers. This trend presents opportunities for material innovation and strategic brand positioning in response to shifting consumer values.

- For instance, Huhtamaki reported replacing over 81,000 tonnes of virgin plastic with renewable and recycled materials in 2023, including applications in dry dairy and powdered beverage packaging.

Technological Advancements in Barrier Packaging

Recent advancements in packaging technology have enabled manufacturers to enhance the barrier properties of materials without compromising flexibility or cost-efficiency. High-barrier laminates, multilayer films, and modified atmosphere packaging (MAP) are increasingly used to improve product shelf life and prevent moisture infiltration. These innovations are particularly important for milk powder, which is highly sensitive to humidity and contamination. As technology continues to evolve, companies have the opportunity to differentiate their offerings by providing high-performance packaging that ensures quality retention and regulatory compliance.

Key Challenges

Environmental Concerns and Plastic Regulations

The widespread use of plastic in milk powder packaging poses a significant challenge due to growing environmental concerns and tightening regulations. Many countries are implementing restrictions or bans on single-use plastics, pressuring manufacturers to shift to sustainable alternatives. However, replacing plastic without compromising product protection or cost-efficiency remains a complex task. The transition also involves substantial investment in research, development, and supply chain adjustments, which may be difficult for smaller players in the market to manage effectively.

- For instance, Mondi invested €65 million in its EcoSolutions program between 2021 and 2023 to redesign plastic-heavy dairy packaging formats into mono-material structures with reduced environmental impact.

Volatile Raw Material Prices

Fluctuations in the prices of key raw materials such as plastics, metals, and paper significantly impact production costs in the milk powder packaging market. These price variations are often influenced by global economic conditions, oil prices, and supply chain disruptions. Unpredictable input costs can strain profit margins and limit the ability of manufacturers to offer competitive pricing. Companies must continuously adapt to changing market conditions and consider strategies such as long-term supplier contracts or alternative materials to mitigate cost volatility.

Stringent Regulatory Compliance Requirements

The milk powder industry is highly regulated due to its association with health and nutrition, especially in infant and clinical nutrition segments. Packaging must comply with strict food safety and labeling standards, which vary across regions. Adhering to these standards requires investment in specialized equipment, quality assurance processes, and frequent product testing. Failure to comply can result in product recalls, legal penalties, and reputational damage. Navigating complex regulatory landscapes remains a major challenge, particularly for companies operating across multiple international markets.

Regional Analysis

North America:

North America accounted for a significant share of the global milk powder packaging market in 2024, holding approximately 25% of the total revenue. The region benefits from high consumption of dairy-based nutritional products, especially infant formula and protein supplements. Advanced packaging technologies and a strong focus on product safety and convenience drive demand for rigid containers such as cans and jars. Additionally, widespread retail and e-commerce penetration supports demand for durable and tamper-evident packaging. Environmental regulations are encouraging the shift toward recyclable and sustainable packaging formats, prompting innovation among manufacturers operating across the United States and Canada.

- For instance, Sonoco operates over 40 packaging facilities in North America, supplying rigid paperboard cans with recyclable liners for dairy powder clients such as Abbott Nutrition and Nestlé Health Science.

Europe:

Europe held around 22% of the global milk powder packaging market in 2024, driven by growing demand for organic and sustainably packaged dairy products. The region’s strong emphasis on environmental protection has accelerated the adoption of paper-based and recyclable packaging materials. Countries like Germany, France, and the Netherlands lead in innovation and compliance with EU packaging directives. Flexible packaging formats, particularly resealable pouches, are gaining traction due to their convenience and reduced material use. Additionally, rising demand for specialized products such as lactose-free and infant milk powder contributes to the development of high-barrier, contamination-resistant packaging solutions.

- For instance, Coveris Group produces over 6,000 tonnes of recyclable polyethylene-based dairy packaging annually from its Austrian and Polish facilities, compliant with EU Circular Plastics Alliance goals

Asia Pacific:

Asia Pacific dominated the milk powder packaging market in 2024 with an estimated 35% market share, fueled by high population growth, expanding middle class, and rising infant nutrition demand. China, India, and Southeast Asian countries represent key growth hubs due to increasing consumption of packaged food and dairy products. Flexible packaging, especially pouches and sachets, is the preferred choice due to affordability and ease of use. Government initiatives supporting nutrition and growing online retail platforms also boost packaging innovations. However, sustainability remains a developing aspect, with gradual adoption of eco-friendly packaging options across major manufacturing countries.

Latin America:

Latin America contributed approximately 10% to the global milk powder packaging market in 2024, with Brazil, Mexico, and Argentina serving as the primary contributors. The region’s growing urban population and rising awareness of infant nutrition and dietary supplements are driving the demand for milk powder and corresponding packaging solutions. Flexible packaging dominates due to lower production costs and accessibility for mass-market distribution. However, economic volatility and limited recycling infrastructure challenge the adoption of sustainable materials. Manufacturers are increasingly focusing on affordable yet efficient packaging formats that cater to evolving consumer needs and regulatory expectations in the region.

Middle East & Africa:

The Middle East & Africa held nearly 8% of the global milk powder packaging market share in 2024. Increasing reliance on imported milk powder products, along with rising demand for long-shelf-life dairy solutions, fuels the need for high-barrier packaging. Countries such as Saudi Arabia, South Africa, and the UAE are witnessing growing consumption of infant and nutritional milk powder, driving packaging innovation. Flexible packaging remains dominant due to cost and logistic efficiency, although rigid containers are also used in premium segments. However, limited manufacturing infrastructure and sustainability awareness may slow the pace of adoption for advanced or eco-friendly packaging formats.

Market Segmentations:

By Packaging Type

- Flexible packaging

- Rigid packaging

By Material Type

- Plastic

- Paper & paperboard

- Metal

- Others

By Capacity

- Up to 100g

- 100g – 1kg

- Above 1kg

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the milk powder packaging market is characterized by the presence of both global and regional players focusing on innovation, sustainability, and efficiency. Key companies such as CarePac, Coveris, Huhtamaki, Mondi, and Sonoco Product Company lead the market through advanced packaging technologies, strong distribution networks, and diversified product portfolios. These companies invest in research and development to introduce sustainable materials and high-barrier packaging formats that extend shelf life and meet regulatory standards. Strategic partnerships, mergers, and capacity expansions are common as companies aim to strengthen their market presence and cater to the growing demand in emerging economies. Sustainability remains a key differentiator, with many manufacturers shifting toward recyclable and biodegradable materials to align with environmental regulations and consumer preferences.

- For instance, CarePac doubled its flexible food packaging output to over 15 million units annually by 2023, investing in digital print-to-packaging systems tailored for small and mid-scale dairy powder producers in the U.S. and Latin America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CarePac

- Coveris

- Huhtamaki

- Mondi

- Sonoco Product Company

- Advanced Industries Packaging

- BOWE PACK

Recent Developments

- In July 2024, Berry Global joined forces with Abel & Cole, a player in sustainable food delivery, to provide bottles for the Club Zero Refillable Milk service. These innovative polypropylene (PP) bottles can be refilled up to 16 times before they need recycling. Crafted from widely recyclable PP, these bottles emit fewer greenhouse gases (GHG) during transport and processing than traditional heavier glass bottles, challenging the long-standing norm of using glass for home milk deliveries.

- In May 2024, Fonterra announced sustainable packaging, particularly for its milk powder sachets, by transitioning to recycle-ready ‘mono-material’ structures. This move aims to reduce plastic waste in the Asia Pacific region, where flexible packaging contributes heavily to mismanaged waste. By aligning packaging with evolving recycling infrastructure, Fonterra aims for a fully recycle-ready global packaging portfolio by 2025.

- In May 2024, Ball Corporation, a global player in sustainable packaging, announced that it had teamed up with CavinKare, a significant player in the dairy industry. Their collaboration aims to transform dairy packaging, debuting retort two-piece aluminum cans specifically for CavinKare’s milkshakes.

- In January 2023, Overherd introduced the UK’s first oat milk powder, packaged in flexible, recyclable pouches instead of traditional cartons. This innovative packaging reduces waste and enhances sustainability. Oat milk, the UK’s top plant-based milk, saw spending hit in 2020, highlighting increasing demand for eco-friendly dairy alternatives.

Market Concentration & Characteristics

The Milk Powder Packaging Market exhibits moderate to high market concentration, with a few global players holding a dominant share due to their strong distribution networks, technological capabilities, and brand reputation. It remains highly competitive, where regional manufacturers compete on pricing and customization while global firms focus on innovation and sustainability. The market is characterized by a growing preference for flexible packaging formats, driven by cost-efficiency and convenience. Consumer demand for contamination-free and long-shelf-life products continues to influence packaging trends. The market reflects a shift toward recyclable and eco-friendly materials in response to tightening environmental regulations and changing consumer behavior. Manufacturers prioritize barrier protection, shelf stability, and visual appeal to meet the functional and marketing needs of dairy producers. It also shows strong regional variation, with Asia Pacific leading in volume consumption and Europe and North America advancing in material innovation. These characteristics shape a dynamic landscape requiring continuous adaptation by packaging providers.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material Type, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for milk powder packaging will continue to grow steadily, driven by rising consumption of infant formula and nutritional supplements.

- Flexible packaging formats like pouches and sachets will maintain dominance due to their convenience and cost-effectiveness.

- Manufacturers will increasingly adopt recyclable and biodegradable materials to align with global sustainability goals.

- E-commerce growth will create higher demand for tamper-evident and durable packaging solutions.

- Asia Pacific will remain the leading regional market due to population growth and expanding middle-class demand.

- Innovations in barrier technologies will enhance shelf life and product safety in varying climates.

- Premium and value-added packaging will gain traction in developed regions, particularly in Europe and North America.

- Smart packaging solutions with features like QR codes and freshness indicators may see increased adoption.

- Regulatory pressure will push companies to improve labeling, traceability, and environmental compliance.

- Strategic partnerships and mergers will become more common as companies aim to expand regional presence and production capacity.