Market Overview

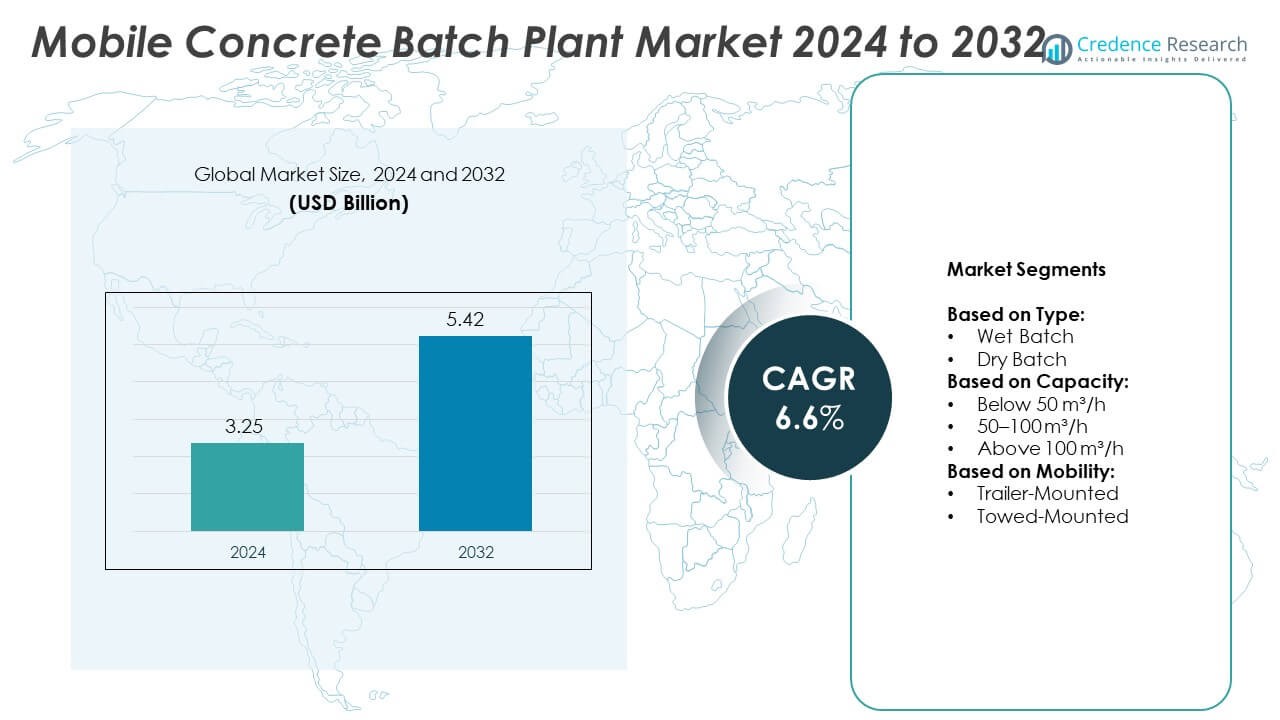

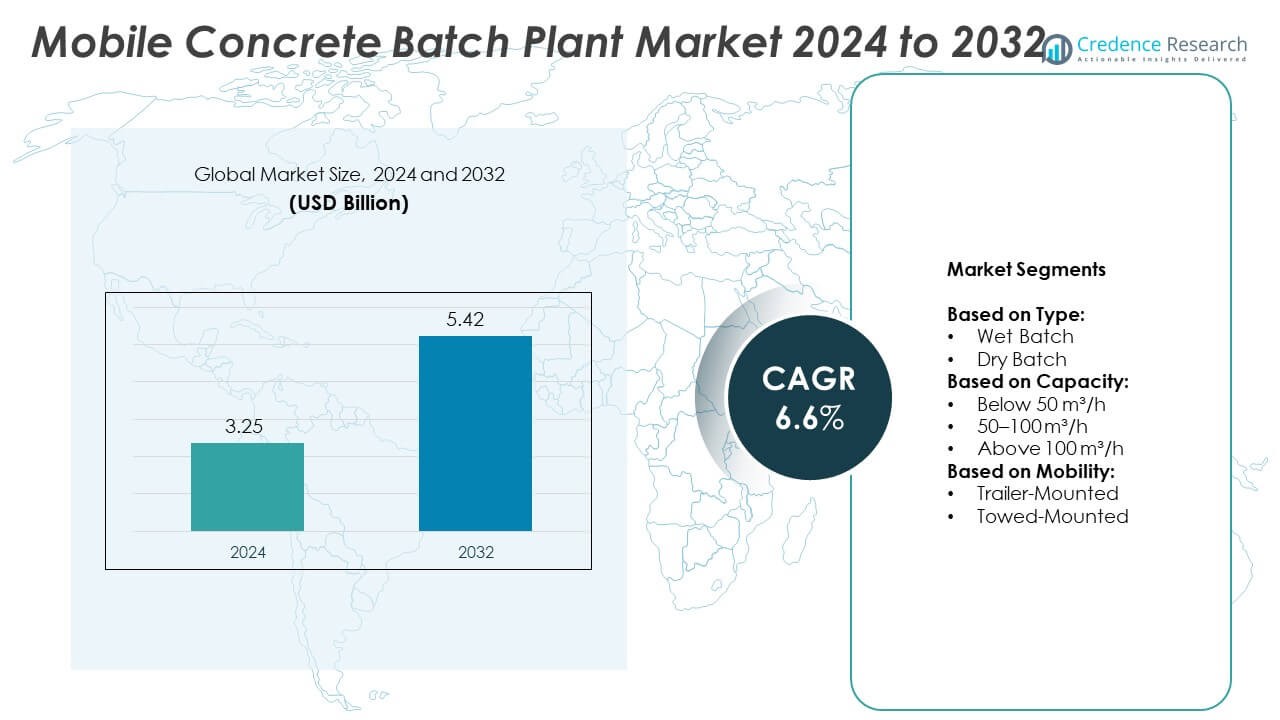

Mobile Concrete Batch Plant Market size was valued at USD 3.25 Billion in 2024 and is anticipated to reach USD 5.42 Billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Concrete Batch Plant Market Size 2024 |

USD 3.25 Billion |

| Mobile Concrete Batch Plant Market, CAGR |

6.6% |

| Mobile Concrete Batch Plant Market Size 2032 |

USD 5.42 Billion |

The Mobile Concrete Batch Plant market grows due to rising infrastructure development, demand for on-site concrete production, and flexibility in remote construction projects. Contractors prefer mobile units for faster setup, reduced transport costs, and improved job site efficiency. Automation, digital monitoring, and energy-efficient systems drive technological upgrades. Trends include compact modular designs, integration of telematics, and adoption in military, mining, and disaster relief sectors. Emerging economies and regulatory focus on emissions further support long-term market expansion.

Asia Pacific leads the Mobile Concrete Batch Plant market, driven by large-scale infrastructure and urban development across China, India, and Southeast Asia. North America follows with steady demand from roadworks and energy projects, while Europe emphasizes sustainability and quality compliance. Latin America and the Middle East & Africa show gradual growth in remote and rural construction. Key players active across these regions include Putzmeister, Aimix Group, Liebherr Group, and Sany Group, all expanding their presence through regional partnerships and tailored product offerings.

Market Insights

- The Mobile Concrete Batch Plant market was valued at USD 3.25 Billion in 2024 and is projected to reach USD 5.42 Billion by 2032, growing at a CAGR of 6.6%.

- Infrastructure development, urban expansion, and rural connectivity projects are key drivers supporting market growth globally.

- Modular design, digital automation, and rising demand for on-site mixing drive emerging trends in product innovation.

- Leading players such as Putzmeister, Sany Group, Semix Global, and Liebherr Group focus on mobile efficiency and smart batching solutions.

- High initial equipment costs and compliance with strict emission and safety regulations limit adoption among small contractors.

- Asia Pacific remains the leading region, supported by rapid urbanization and government spending on smart cities and roads.

- North America and Europe show stable demand with focus on high-quality batching, while Latin America and the Middle East grow steadily through public-private infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Infrastructure Development Across Emerging and Developed Economies

The global surge in infrastructure projects significantly boosts demand for mobile concrete batch plants. Governments invest heavily in roads, bridges, and public infrastructure to support urbanization and economic growth. Rapid construction timelines and remote project locations require on-site concrete production. The Mobile Concrete Batch Plant market benefits from this flexibility, enabling real-time mixing near construction zones. It reduces transportation costs and improves efficiency in large-scale civil works. Developing regions in Asia Pacific and Latin America show strong investment momentum across public infrastructure sectors.

- For instance, In late 2020 and early 2021, Lintec & Linnhoff deployed Eurotec ECO60 concrete batching plants for the Nadzab Airport Redevelopment Project in Lae, Papua New Guinea. For this project, a Japanese contractor also purchased a second Eurotec ECO60. The Eurotec ECO batching plant range features models with outputs from 30 m³/h up to 90 m³/h and can be equipped with either a planetary pan mixer or a twin-shaft mixer. The Eurotec ECO60 model specifically offers a maximum output of 60 m³/h.

Growing Demand for Efficient and Time-Saving Construction Equipment

Contractors increasingly seek portable, modular solutions to meet project deadlines and reduce downtime. Mobile concrete batch plants offer quick setup, ease of relocation, and minimal site preparation. It improves job site productivity by enabling immediate access to fresh concrete. The Mobile Concrete Batch Plant market gains traction in projects where mobility and responsiveness are crucial. Short-term and medium-sized construction ventures prefer mobile plants over stationary ones. Market players integrate advanced automation to further reduce cycle times and operational errors.

- For instance, MEKA manufactures a range of mobile concrete batching plants, including the MB-60M model, which is designed for temporary worksites and has a compacted concrete output of 54–63 m³/h (cubic meters per hour). The MB-60M can be configured with various mixers, including a twin-shaft mixer, and is operated with a fully automatic computerized control system.

Expanding Use in Remote and Difficult Terrain Construction Projects

Geographical challenges such as mountains, deserts, or remote islands drive the need for compact, mobile mixing systems. The Mobile Concrete Batch Plant market supports military, mining, and energy infrastructure that often develops in isolated areas. It allows on-site batching where transporting ready-mix concrete becomes costly or unfeasible. Governments and private developers in such regions rely on mobile units to maintain consistency and quality. It ensures stable concrete supply regardless of logistical constraints. The market thrives on such location-specific advantages.

Technological Advancements Supporting Smart Mixing and Remote Monitoring

Automation, telematics, and sensor integration enhance efficiency, quality control, and remote operability. The Mobile Concrete Batch Plant market adopts digital technologies to support predictive maintenance and real-time monitoring. Operators receive alerts and performance analytics that reduce risk and downtime. It helps maintain batch accuracy and compliance with construction codes. Digital features appeal to large contractors managing multiple remote sites. Manufacturers continue to upgrade systems to meet rising performance expectations.

Market Trends

Compact and Modular Mobile Plants Enable Fast Urban Deployment

Manufacturers focus on compact plant designs that allow faster relocation and setup. The trend supports small- to medium-scale projects that require mobility across multiple job sites. The Mobile Concrete Batch Plant market benefits from modular units with detachable components. It simplifies loading, unloading, and site installation. Compact formats support urban projects with space constraints. Contractors prefer systems that can be deployed without large foundations or fixed infrastructure.

- For instance, Blend Plants manufactures mobile concrete mixing plants, including the E050 model, which is a modular, continuous-mix system for producing certified concrete, mortars, and cold asphalt on-site. The E050 has an output capacity of ≤50 m³/h (or ≤70 m³/h with PTO) and features a 10 m³ aggregate bin and a 3,500 kg cement bin.

Integration of Digital Control Systems for Automation and Process Optimization

Digital transformation is reshaping how concrete is mixed and managed at construction sites. The Mobile Concrete Batch Plant market integrates automated batching systems with PLCs and SCADA platforms. It helps operators maintain batch consistency, record mix data, and troubleshoot faults remotely. Automation reduces operator dependency and human errors. Digital dashboards now provide real-time visibility into plant performance and maintenance alerts. These smart systems support compliance with regulatory mix requirements.

- For instance, ELKON is a leading concrete batching plant manufacturer based in Turkey that produces a wide range of plants, including mobile models for highway projects worldwide. The company has an accredited R&D center and uses advanced design software to ensure high accuracy in its products. ELKON offers various Mobile Master-60 models, including the Pegasus, which features a 1500/1000 l pan mixer and a production capacity of 50 m³/h.

Increased Preference for Environmentally Compliant and Low-Emission Equipment

Contractors and developers are under pressure to reduce environmental impact at construction sites. The Mobile Concrete Batch Plant market responds with energy-efficient motors, enclosed mixing drums, and dust suppression systems. It helps meet emission norms and reduce material wastage. Electric and hybrid-powered batching units are entering the market in response to stricter air quality norms. Sustainability goals drive adoption of such technologies across urban and green-certified projects. Manufacturers highlight compliance with global emission standards.

Growing Demand from Temporary and Emergency Infrastructure Projects

Rapid deployment needs in disaster recovery, military construction, and remote housing accelerate mobile plant use. The Mobile Concrete Batch Plant market supports fast-track setups where speed and availability matter. It enables batch production at point of use, supporting quick foundation work and structural repairs. Governments use mobile plants in flood relief, post-earthquake rebuilding, and emergency road construction. Rental companies also expand their fleets to serve such short-term needs. This trend strengthens year-round market demand.

Market Challenges Analysis

High Initial Investment and Complex Regulatory Compliance Requirements

Mobile batching plants require significant upfront capital for equipment, automation systems, and transport-ready design. Small and mid-sized contractors often face difficulty in justifying such investment for short-duration projects. Regulatory requirements related to emissions, noise levels, and safety standards further increase operational complexity. The Mobile Concrete Batch Plant market faces hurdles from site-specific permitting delays and compliance inspections. It raises entry barriers in markets with strict construction or environmental codes. Operators must also invest in trained personnel to manage these high-spec units efficiently.

Limited Productivity in High-Volume and Continuous Concrete Supply Projects

While mobile plants offer flexibility, they often fall short in large-scale, continuous concrete production needs. Productivity gaps emerge when compared to fixed batching plants that support high-volume commercial infrastructure. It creates challenges in meeting fast-paced urban projects that require steady concrete flow. The Mobile Concrete Batch Plant market experiences reduced demand where mega construction ventures prioritize output over mobility. Capacity limitations restrict usage in airport runways, dams, or long-span bridges. Operators often need to supplement mobile systems with auxiliary equipment, increasing cost and logistical burden.

Market Opportunities

Rising Demand from Emerging Markets Focused on Rural and Semi-Urban Infrastructure

Governments across Asia Pacific, Africa, and Latin America invest in roadways, housing, and utility networks. These regions often lack ready-mix supply chains, making mobile plants a preferred choice. The Mobile Concrete Batch Plant market finds strong opportunity in rural projects that need reliable concrete near construction zones. It reduces haul time, material loss, and equipment downtime. Infrastructure missions like India’s PMGSY and Africa’s transport corridor programs create recurring demand. Manufacturers targeting these areas can benefit from plant leasing models and cost-effective designs.

Increased Adoption Across Military, Mining, and Disaster Relief Applications

Projects in remote, conflict-prone, or disaster-affected areas require fast and self-sufficient batching solutions. The Mobile Concrete Batch Plant market supports emergency infrastructure such as base camps, helipads, and temporary housing. It enables defense agencies and relief organizations to meet urgent construction needs. Mining firms also deploy mobile units near extraction sites to build roads, foundations, and containment systems. Governments and international aid agencies prioritize equipment that can be moved, assembled, and operated with minimal resources. These high-need applications create long-term demand across public and private sectors.

Market Segmentation Analysis:

By Type:

Wet batch plants dominate the market due to higher mix consistency and quality. These systems combine all ingredients with water before discharge, ensuring uniform concrete. The Mobile Concrete Batch Plant market benefits from their growing use in residential and commercial projects requiring precise mixtures. Dry batch plants, while less complex, serve projects focused on speed and lower cost. They deliver components separately and mix at the delivery site. Contractors prefer dry batch types for short-haul or remote applications where full mixing flexibility is needed.

- For instance, CIFA launched the hybrid-electric Energya E10 mixer at Bauma 2025 in March. This new model is part of CIFA’s broader Energya series, which uses BEE (Battery Electric Equipment) technology to achieve zero tailpipe emissions on the construction site. It features a 28.1 kW / 100Ah lithium-ion battery pack and a KERS (Kinetic Energy Recovery System) to recover energy during braking.

By Capacity:

The 50–100 m³/h segment holds the largest share due to its balance between mobility and output. It suits mid-scale infrastructure projects such as road paving, bridge foundations, and industrial buildings. The Mobile Concrete Batch Plant market sees strong uptake in this capacity range from private contractors and municipal agencies. Below 50 m³/h plants cater to small-scale construction, repairs, and remote access work. These units offer compact size and cost efficiency. Above 100 m³/h capacity serves large civil infrastructure projects but faces limited demand due to bulkiness and transport complexity.

- For instance, Rapid International produces a variety of concrete mixers and batching plants, including the R3000 3.0 m³ pan mixer and the Transbatch mobile plant, which is capable of outputs up to 100 m³/hr…

By Mobility:

Trailer-mounted units lead the market because they offer better road transport flexibility and faster relocation. The Mobile Concrete Batch Plant market benefits from their application across multi-site construction operations. It allows contractors to shift plants without dismantling major components. Towed-mounted systems find use in shorter-distance or single-site deployments. These models offer durability and simpler construction but lack the speed and ease of trailer systems. Manufacturers continue to improve chassis designs and axle configurations to meet mobility standards.

Segments:

Based on Type:

Based on Capacity:

- Below 50 m³/h

- 50–100 m³/h

- Above 100 m³/h

Based on Mobility:

- Trailer-Mounted

- Towed-Mounted

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 27.4% of the global Mobile Concrete Batch Plant market. The region sees strong demand from highway expansion, energy infrastructure, and commercial real estate development. The United States drives most of the activity, supported by the Infrastructure Investment and Jobs Act which allocates over USD 1 trillion for long-term projects. Mobile batch plants play a key role in rural roadworks, pipeline installations, and wind farm foundations. It offers flexibility to meet logistical challenges in remote and regulated areas. Canada contributes steadily, with public infrastructure and mining-related activities supporting market expansion. Cold-climate batching requirements drive demand for insulated and winterized mobile units, encouraging innovation among regional equipment providers.

Europe

Europe holds 22.1% of the global market share due to robust construction regulations and a high rate of public sector investment. The region emphasizes eco-friendly construction practices, boosting demand for energy-efficient and low-emission batch plants. Germany, France, and the United Kingdom lead adoption due to urban redevelopment and transportation upgrades. The Mobile Concrete Batch Plant market in Europe benefits from stringent material quality control standards. Wet mix systems dominate due to their higher consistency, aligning with EU norms. Eastern Europe presents rising opportunities with EU funding driving cross-border highway and rail connectivity projects. OEMs in the region also export trailer-mounted and hybrid-powered systems to developing markets.

Asia Pacific

Asia Pacific represents the largest market share at 34.6%, fueled by rapid urbanization and government-led infrastructure development. China, India, and Southeast Asian countries invest heavily in smart cities, expressways, and industrial corridors. The Mobile Concrete Batch Plant market in this region grows due to labor shortages and the push for mechanized construction methods. Portable plants support affordable housing projects, metro rail expansion, and energy facility development. India’s National Infrastructure Pipeline and China’s Belt and Road Initiative create continuous demand across urban and rural landscapes. The rising number of infrastructure PPPs boosts rentals and leasing of mobile units. Local manufacturers deliver cost-effective models suited for tropical climates and high-output needs.

Latin America

Latin America holds 8.3% of the global Mobile Concrete Batch Plant market. Brazil and Mexico lead demand with national road and housing programs in progress. Mobile plants suit the geography and fragmented nature of projects in this region. Government efforts to boost rural access and rebuild post-disaster infrastructure sustain moderate growth. It helps minimize delays due to lack of ready-mix supply chains in hilly or isolated areas. Market growth is gradual but steady, driven by public-private partnerships and multilateral funding support from organizations like the Inter-American Development Bank.

Middle East & Africa

The Middle East & Africa region contributes 7.6% to the global market. Gulf nations focus on mega infrastructure and real estate developments that include smart cities and industrial zones. The Mobile Concrete Batch Plant market benefits from requirements for portable solutions across remote oil fields and mining projects. African countries show growing interest in trailer-mounted batch plants for transcontinental road and energy corridor projects. International contractors use mobile plants to meet strict delivery timelines in desert or high-altitude conditions. Political stability and infrastructure funding reforms will likely improve long-term demand in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Putzmeister

- Semix Global

- Lyroad

- Vince Hagan

- CIFA

- Meka

- Sany Group

- Rapid International

- Aimix Group

- BHS-Sonthofen Group

- Astec Industries

- McCrory Engineering

- Odisa Concrete Equipment

- Stephens Manufacturing

- Liebherr Group

Competitive Analysis

The Mobile Concrete Batch Plant market is highly competitive, with leading players such as Putzmeister, Semix Global, Lyroad, Vince Hagan, CIFA, Meka, Sany Group, Rapid International, Aimix Group, BHS-Sonthofen Group, Astec Industries, McCrory Engineering, Odisa Concrete Equipment, Stephens Manufacturing, and Liebherr Group shaping global dynamics. These companies focus on innovation, automation, and modular mobility to meet evolving construction needs. Players offer a wide range of products, including trailer-mounted and towed-mounted systems across varying capacities to serve both small and large infrastructure projects. Strong emphasis is placed on fuel efficiency, digital controls, and rapid setup features. Leading manufacturers target both rental and sales channels to increase market presence in emerging and developed regions. Strategic expansion into Asia Pacific, Latin America, and the Middle East enables growth beyond core markets. Many firms invest in local assembly and partnerships to cater to region-specific technical and regulatory requirements. Innovation in hybrid-powered units and environmental compliance features helps manufacturers align with green construction practices. Competitive advantage depends on equipment reliability, after-sales support, and fleet adaptability. Established players continue to maintain strong brand recognition and technical trust across civil infrastructure, mining, and emergency construction sectors. The market is expected to see increased product differentiation and technological integration in the coming years.

Recent Developments

- In 2025, Vince Hagan showcased its various innovations and updated product lines, including the HS Series, at events like the World of Concrete in January 2025.

- In 2025, Putzmeister also launched “Precast Automation 4.0” solutions at Bauma, enabling retrofit-capable, highly automated systems for precast concrete handling.

- In 2023, Aimix Group delivered AJY-60 Mobile Concrete Batching Plant for a road construction project in Kazakhstan. Installation was completed and commissioned by the end of August 2023.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Mobility and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising infrastructure investments in developing nations.

- Demand for mobile plants will increase in rural and remote construction projects.

- Automation and digital controls will become standard features in new equipment.

- Manufacturers will focus on lightweight and modular designs for faster mobility.

- Energy-efficient and low-emission models will see higher adoption across regulated regions.

- Rental and leasing services will grow to serve short-term and multi-site contractors.

- Asia Pacific will remain the leading market due to ongoing urbanization and transport development.

- Use of mobile plants in emergency relief and defense projects will continue to rise.

- Partnerships between OEMs and local contractors will support regional customization.

- Hybrid and electric-powered batch plants will gain traction in emission-sensitive markets.