Market Overview

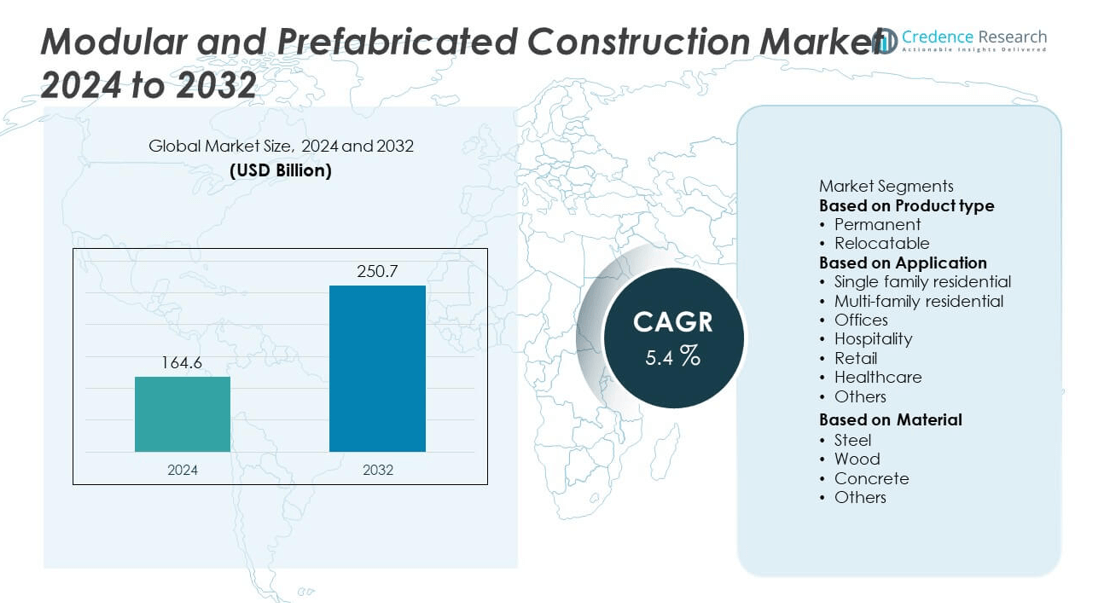

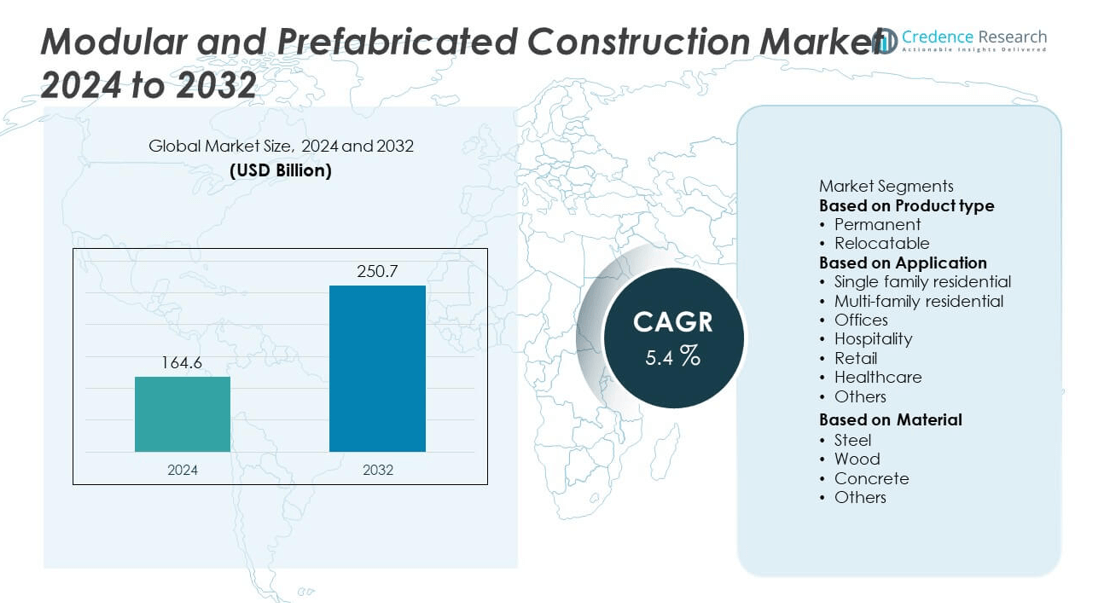

The Modular and Prefabricated Construction Market was valued at USD 164.6 billion in 2024 and is projected to reach USD 250.7 billion by 2032, expanding at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular and Prefabricated Construction Market Size 2024 |

USD 164.6 billion |

| Modular and Prefabricated Construction Market, CAGR |

5.4% |

| Modular and Prefabricated Construction Market Size 2032 |

USD 250.7 billion |

The Modular and Prefabricated Construction Market grows with rising demand for cost-efficient, time-saving, and sustainable building solutions. Increasing urbanization and housing shortages drive governments and developers to adopt prefabricated methods for faster project delivery. It benefits from technological integration such as BIM, robotics, and 3D printing,

The Modular and Prefabricated Construction Market demonstrates strong growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region shaped by unique drivers. North America leads in adoption due to advanced infrastructure, labor shortages, and rising demand for affordable housing. Europe emphasizes sustainability and green building standards, with countries like Germany and the UK advancing large-scale prefabricated housing and commercial projects. Asia Pacific records rapid growth, supported by urbanization, government-led housing programs, and technological innovation in China, India, and Japan. Latin America and the Middle East & Africa gradually expand adoption through infrastructure projects and government-backed initiatives to address housing shortages. Key players shaping the global market include Bouygues Construction, Laing O’Rourke, ACS Group, and Algeco (Modulaire Group), all investing in automation, sustainable materials, and global expansion strategies to strengthen their positions and meet rising construction demands worldwide.

Market Insights

- The Modular and Prefabricated Construction Market was valued at USD 164.6 billion in 2024 and is expected to reach USD 250.7 billion by 2032, expanding at a CAGR of 5.4% during the forecast period.

- Rising demand for cost-efficient, time-saving, and scalable building solutions drives adoption across residential, commercial, and industrial sectors. It addresses housing shortages, urbanization challenges, and the need for faster project delivery worldwide.

- Key trends include the integration of advanced technologies such as Building Information Modeling (BIM), robotics, and 3D printing, which improve accuracy, reduce waste, and enhance efficiency in modular production.

- Competitive dynamics remain strong, with leading companies such as Bouygues Construction, Laing O’Rourke, ACS Group, and Algeco (Modulaire Group) focusing on sustainable materials, automation, and global expansion strategies.

- High initial investment costs, limited awareness in developing economies, and varying building codes across regions act as key restraints for broader adoption, particularly in cost-sensitive markets.

- Regional growth patterns highlight strong adoption in North America through affordable housing and labor-saving solutions, Europe through sustainability and green building standards, and Asia Pacific as the fastest-growing region supported by urbanization and infrastructure investments.

- Emerging opportunities exist in Latin America and the Middle East & Africa, where government-backed housing programs and infrastructure development projects encourage the gradual adoption of modular methods and strengthen the long-term market outlook.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Cost-Efficient and Time-Saving Construction Solutions

The Modular and Prefabricated Construction Market grows strongly due to its ability to reduce project timelines and labor costs. Prefabricated modules allow parallel production and on-site assembly, cutting overall construction time. It supports developers by lowering expenses linked to material waste and workforce management. Builders adopt prefabrication to address housing shortages in urban centers quickly. Governments and private sectors prefer modular designs to meet infrastructure needs within strict deadlines. This driver highlights how efficiency and cost reduction boost the appeal of prefabricated methods globally.

- For instance, For the Atira student tower in Melbourne, Hickory Group’s HBS2 system enabled completion in 24 months, representing a 30-40% reduction in construction time compared to conventional methods. This prefabricated construction approach significantly reduced material waste and environmental disruption.

Growing Adoption of Sustainable and Green Building Practices

The Modular and Prefabricated Construction Market benefits from rising emphasis on sustainability and energy efficiency. Prefabrication minimizes material waste and supports the use of eco-friendly components. It aligns with global carbon reduction goals and environmental regulations. Companies adopt modular solutions to meet green certification standards such as LEED and BREEAM. Prefabricated buildings often include advanced insulation and energy-saving systems, improving long-term efficiency. The trend toward environmentally responsible construction strengthens demand for modular technologies.

- For instance, Laing O’Rourke’s Design for Manufacture and Assembly (DfMA) approach on the Grange University Hospital project delivered 50–55% of its components as prefabricated modules. The project saw significant carbon savings, and Laing O’Rourke also developed a D-Frame system that can save up to 70% of embodied carbon compared to traditional methods. By completing a majority of the work offsite in controlled factory environments, the approach significantly cut onsite emissions, improved quality, and reduced the construction schedule.

Urbanization and Expanding Housing Needs Worldwide

The Modular and Prefabricated Construction Market expands with rapid urbanization and rising demand for affordable housing. Population growth in developing economies creates pressure for faster housing development. It provides scalable solutions that meet residential demand without compromising quality. Governments invest in prefabricated housing projects to address shortages in metropolitan areas. Private real estate developers also adopt modular solutions to meet growing middle-class housing demand. This driver reflects how urban development accelerates adoption of prefabricated methods.

Rising Investments in Infrastructure and Commercial Projects

The Modular and Prefabricated Construction Market benefits from large-scale infrastructure and commercial developments. Modular systems support schools, hospitals, and office buildings that require faster delivery. It allows customization for diverse applications, from healthcare facilities to retail spaces. Growing investments in industrial projects also increase demand for prefabricated structures. Companies seek modular solutions for their flexibility, scalability, and durability. Expanding government and private investments make prefabricated construction an essential part of global infrastructure growth.

Market Trends

Integration of Advanced Technologies in Modular Designs

The Modular and Prefabricated Construction Market shows strong adoption of digital tools and automation. Companies use BIM, robotics, and 3D printing to improve design accuracy and speed. It enables real-time collaboration across architects, engineers, and contractors. Advanced tools also reduce errors and material waste, ensuring greater efficiency. Modular producers integrate automated assembly lines to scale output. This trend highlights how technology drives precision and productivity in modern construction.

- For instance, BIM has been shown to reduce project timelines and minimize costly rework by enhancing digital integration, precision, and productivity in construction. Case studies and industry reports have documented average schedule reductions of 15% to 25%, with rework costs lowered by 40% to 50%. Such efficiencies result in significant overall cost savings for the construction industry.

Expansion of Modular Solutions in Healthcare and Education

The Modular and Prefabricated Construction Market benefits from rising adoption in public infrastructure projects. Hospitals, clinics, and schools increasingly use modular units for faster deployment. It supports governments in meeting urgent demands for healthcare and education facilities. Prefabricated structures allow rapid scaling without sacrificing safety or quality. Institutions adopt modular models to expand facilities cost-effectively. This trend reinforces the importance of modular methods in socially critical sectors.

- For instance, Laing O’Rourke utilized its modular construction techniques, including Design for Manufacture and Assembly (DfMA), during the Royal Sussex County Hospital expansion. This approach involved manufacturing over 3,000 prefabricated components off-site, including entire plant rooms, which allowed for faster on-site assembly.

Growth in Customization and Flexible Design Options

he Modular and Prefabricated Construction Market reflects a shift toward tailored solutions. Developers demand customizable modules that adapt to diverse residential, commercial, and industrial needs. It allows integration of modern aesthetics, smart technologies, and energy-efficient systems. Customers value flexibility in layout and design while maintaining structural reliability. Modular providers respond with versatile offerings to suit varying regional preferences. This trend underscores the growing role of prefabrication in meeting specific client expectations.

Rising Popularity of Hybrid Construction Approaches

The Modular and Prefabricated Construction Market records growth in hybrid models that combine on-site and off-site techniques. Builders integrate prefabricated components with traditional construction methods for enhanced efficiency. It offers flexibility while reducing project timelines and costs. Hybrid models enable use of prefabrication in projects where full modular deployment is impractical. Developers adopt these solutions for high-rise buildings and complex infrastructure. This trend reflects how hybrid approaches expand opportunities for prefabricated construction across multiple sectors.

Market Challenges Analysis

High Initial Costs and Limited Awareness in Developing Regions

The Modular and Prefabricated Construction Market faces barriers from high upfront costs and lack of awareness. Prefabricated systems often require advanced manufacturing facilities, logistics, and skilled labor, which increases initial investment. It makes adoption challenging for small developers and governments in emerging economies. Limited understanding of modular benefits also restricts demand in cost-sensitive markets. Customers still view traditional construction as more reliable, delaying the shift toward prefabrication. These factors create hesitation among stakeholders despite the long-term cost advantages of modular construction.

Regulatory Complexities and Supply Chain Constraints

The Modular and Prefabricated Construction Market encounters challenges from inconsistent regulations and fragmented supply chains. Building codes and compliance requirements vary widely across regions, making standardization difficult. It forces manufacturers to customize modules for different jurisdictions, raising costs and timelines. Supply chain disruptions also affect the timely delivery of prefabricated components. Shortages of specialized materials or transportation delays impact project execution. These challenges highlight the need for coordinated policies and resilient supply networks to support wider modular adoption.

Market Opportunities

Rising Demand for Affordable Housing and Urban Infrastructure

The Modular and Prefabricated Construction Market has strong opportunities from global housing shortages and urban expansion. Rapid urbanization creates the need for cost-efficient and quick construction methods. It enables governments and private developers to address affordable housing gaps with scalable solutions. Prefabricated designs shorten construction cycles, making them ideal for high-density cities. Demand also rises in infrastructure projects, including schools, hospitals, and transport hubs that require faster delivery. Growing emphasis on timely project execution strengthens opportunities for modular adoption worldwide.

Advancement in Sustainable and Smart Construction Practices

The Modular and Prefabricated Construction Market benefits from opportunities in sustainable and technology-driven construction. Green building standards encourage adoption of prefabricated units that reduce waste and improve energy efficiency. It supports developers in meeting carbon reduction and resource conservation goals. Integration of smart technologies, such as IoT-enabled monitoring and energy management systems, enhances building performance. Modular designs also allow integration of renewable energy solutions, making projects more attractive to eco-conscious investors. These advancements expand the role of prefabricated construction in shaping modern, sustainable urban environments.

Market Segmentation Analysis:

By Product Type

The Modular and Prefabricated Construction Market divides into permanent and relocatable structures. Permanent modular construction accounts for significant demand across residential and commercial projects, where durability and long-term value are critical. It offers design flexibility and supports large-scale applications such as offices, schools, and hospitals. Relocatable modular units hold importance in temporary infrastructure, including construction site offices, disaster relief shelters, and military housing. It provides rapid deployment and cost efficiency while meeting short-term needs. Both categories reflect how modular methods adapt to diverse project requirements with speed and scalability.

- For instance, Guerdon, LLC, constructed and delivered 27 modular homes to the Kilohana Group Housing site in Lahaina to rehouse Maui wildfire survivors. Construction for the project began in October 2024, with the first homes arriving on Maui via barge in November 2024. While the timeline for building and delivering these modular homes was rapid, the overall housing recovery effort for wildfire survivors took longer due to extensive site preparation, which involved installing infrastructure and utilities. This project shows the speed and scalability potential of modular construction once a site is ready.

By Application

The Modular and Prefabricated Construction Market shows strong adoption across residential, commercial, and industrial sectors. Residential projects dominate demand, driven by urban housing shortages and the need for affordable living spaces. It supports rapid construction of apartments and housing units without compromising quality. Commercial applications such as retail outlets, healthcare centers, and educational facilities also show strong growth due to their need for timely delivery. Industrial users adopt modular methods to build warehouses, factories, and remote-site facilities that require quick deployment. This wide application base highlights modular construction’s versatility across key end-user industries.

- For instance, Laing O’Rourke delivered 384 hospital beds at Grange University Hospital one year ahead of schedule using modular housing systems, highlighting efficiency in healthcare-linked residential facilities. Commercial applications such as retail outlets, healthcare centers, and educational facilities also show strong growth due to their need for timely delivery.

By Material

The Modular and Prefabricated Construction Market includes steel, wood, and concrete as primary materials. Steel modules lead adoption due to their strength, durability, and suitability for multi-story buildings. It enables efficient load-bearing capacity and faster assembly in large-scale projects. Wood remains important in low-rise residential construction, supported by its cost-effectiveness and sustainability. Concrete modules gain traction in projects requiring high fire resistance, stability, and long lifespan. Each material brings unique advantages, allowing developers to select options based on budget, design, and project scale. This segmentation demonstrates how material choice directly influences performance and market adoption.

Segments:

Based on Product type

Based on Application

- Single family residential

- Multi-family residential

- Offices

- Hospitality

- Retail

- Healthcare

- Others

Based on Material

- Steel

- Wood

- Concrete

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 32% share of the Modular and Prefabricated Construction Market, driven by advanced construction practices and strong adoption of offsite building methods. The United States leads with high demand for modular housing projects and commercial structures, supported by ongoing urban redevelopment initiatives. It benefits from government-backed affordable housing programs and increasing preference for time-efficient construction in major cities. Canada contributes with growth in sustainable building solutions, where modular techniques align with green building standards and energy efficiency goals. Mexico also participates through industrial and commercial projects, where prefabricated units reduce costs and speed up delivery. Strong infrastructure investment and workforce shortages continue to push modular adoption in the region.

Europe

Europe accounts for nearly 27% of the Modular and Prefabricated Construction Market, reflecting its focus on sustainability, energy efficiency, and modern construction practices. Germany, the UK, and the Netherlands dominate regional demand due to rapid adoption of prefabricated housing solutions and government incentives for green buildings. It benefits from strict European Union policies that encourage low-carbon construction and resource efficiency. France and Italy also expand modular use in healthcare and education projects, highlighting the need for fast and flexible construction methods. Scandinavia remains a leader in wood-based modular solutions, reflecting the region’s strong emphasis on sustainability and renewable materials. Europe’s market strength lies in balancing innovation, environmental responsibility, and scalability.

Asia Pacific

Asia Pacific captures about 29% share of the Modular and Prefabricated Construction Market and represents the fastest-growing regional segment. China dominates with massive urbanization and large-scale housing projects supported by government initiatives. It invests heavily in modular high-rise buildings to meet housing needs in major cities. India shows growing adoption through affordable housing programs and smart city projects where modular methods reduce construction time. Japan and South Korea focus on technology-driven prefabrication, integrating robotics and automation to address labor shortages. Southeast Asian countries also expand modular use in infrastructure and hospitality projects. The region’s rapid growth stems from rising population, industrial expansion, and government-led infrastructure investments.

Latin America

Latin America holds nearly 7% share of the Modular and Prefabricated Construction Market, with Brazil and Mexico driving adoption. The region experiences rising demand for affordable housing projects in urban centers, where modular units offer cost-effective and scalable solutions. It benefits from government-backed housing programs that emphasize efficiency and resource optimization. Chile and Argentina also show steady growth in modular construction for education and healthcare facilities. Limited awareness and budget constraints remain challenges, but partnerships with international players improve adoption rates. Growing urbanization and infrastructure investment continue to expand opportunities in the region.

Middle East and Africa

The Middle East and Africa together account for about 5% share of the Modular and Prefabricated Construction Market. The United Arab Emirates and Saudi Arabia lead the region with strong demand from large-scale infrastructure and commercial projects. It supports modular adoption in mega-projects, including smart cities and industrial zones. South Africa drives growth in Africa, focusing on modular schools, healthcare centers, and mining-related infrastructure. Limited infrastructure in some countries poses challenges, but government-backed programs and foreign investment help bridge the gap. Demand for quick, durable, and cost-effective construction solutions ensures gradual growth. The region’s long-term outlook remains positive as it prioritizes modern infrastructure and sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hickory Group

- Algeco (Modulaire Group)

- Laing O’Rourke

- Kiewit Corporation

- Berkeley Modular Limited

- Kleusberg GmbH

- Bouygues Construction

- Guerdon, LLC

- DUB0X

- ACS Group

Competitive Analysis

The competitive landscape of the Modular and Prefabricated Construction Market features leading players such as Bouygues Construction, Laing O’Rourke, ACS Group, Algeco (Modulaire Group), Hickory Group, Kiewit Corporation, Guerdon LLC, Kleusberg GmbH, DUB0X, and Berkeley Modular Limited. These companies compete by focusing on innovation, scalability, and sustainability in modular construction solutions. They emphasize automation, robotics, and Building Information Modeling (BIM) to improve efficiency and reduce project timelines. Sustainability remains central, with firms integrating eco-friendly materials, energy-efficient modules, and waste reduction practices into their projects. Many players expand their reach through acquisitions, joint ventures, and international partnerships to secure large infrastructure and housing contracts. North America and Europe see strong activity from global players, while Asia Pacific attracts investment through rapid urbanization and government-backed housing programs. Competition also includes specialization, where companies deliver tailored solutions for sectors such as healthcare, education, and commercial spaces. This dynamic market pushes leaders to balance cost, speed, and quality while addressing regional regulatory frameworks and growing customer expectations for sustainable, modern construction methods.

Recent Developments

- In August 2025, Modular Construction Industry Global demand for modular high-rise buildings expanded, with permanent modular construction projected to US$90 billion by 2030. The industry prepared to support rising vertical construction needs.

- In May 2025, Kiewit Corporation Selected to design a deep geological repository for spent nuclear fuel in Ontario by Canada’s Nuclear Waste Management Organization—its second major win in nuclear infrastructure.

- In March 2025, Hickory Group Applied its proprietary HBS2 modular system in Melbourne to construct a 43‑storey student residence. The factory-built modules reduced material waste by 30% compared to conventional methods.

- In March 2025, Berkeley Modular Limited (via auction news) purpose-built Kent facility, which had capacity to produce up to 1,000 modular units per year, was publicly valued at £30 million when put up for auction.

- In Nov 2024, Guerdon, LLC Delivered 27 modular homes to displaced Maui wildfire victims, demonstrating rapid and resilient housing response through factory-built units

Report Coverage

The research report offers an in-depth analysis based on Product type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Modular and prefabricated construction will gain ground in affordable housing sectors to meet growing urban demand promptly.

- Increasing adoption of digital technologies such as BIM, AI, and robotics will enhance design precision and production efficiency.

- Hybrid construction models combining on-site and off-site techniques will become more common in complex developments.

- Sustainability requirements will drive greater use of eco-friendly materials and energy-efficient modular systems.

- Healthcare and educational facilities will favor modular approaches for rapid deployment during emergencies or expansion.

- Growth in modular high-rise projects will expand as structural engineering and urban regulations evolve.

- Prefabricated technology will support flexible infrastructure solutions in developing countries investing in smart cities.

- Demand for customizable industrial and commercial modules will rise with increasing business diversification needs.

- Modular construction will integrate renewable energy solutions like solar panels and smart controls for enhanced building performance.

- Workforce development will focus on training professionals in automation and modular assembly for future-ready operations.