Market Overview

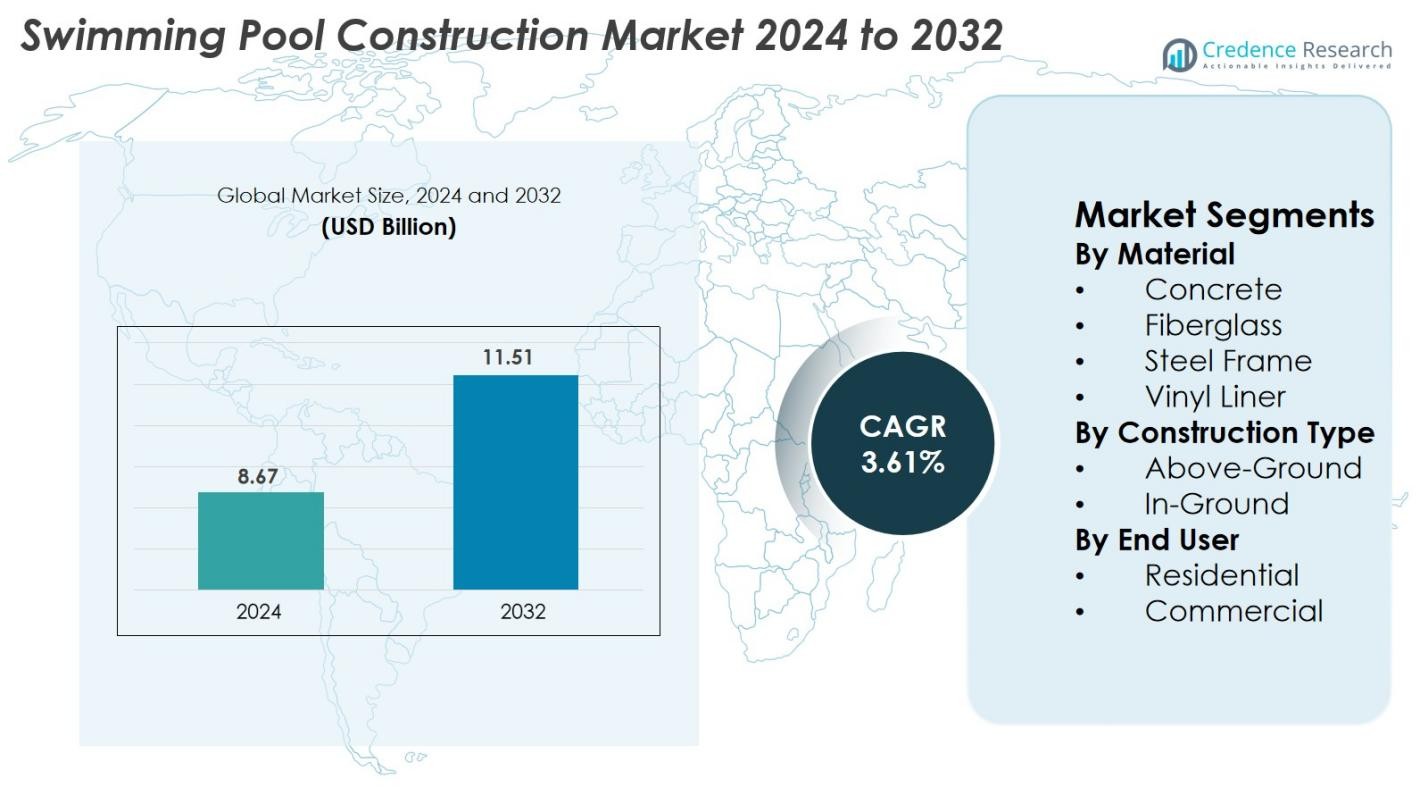

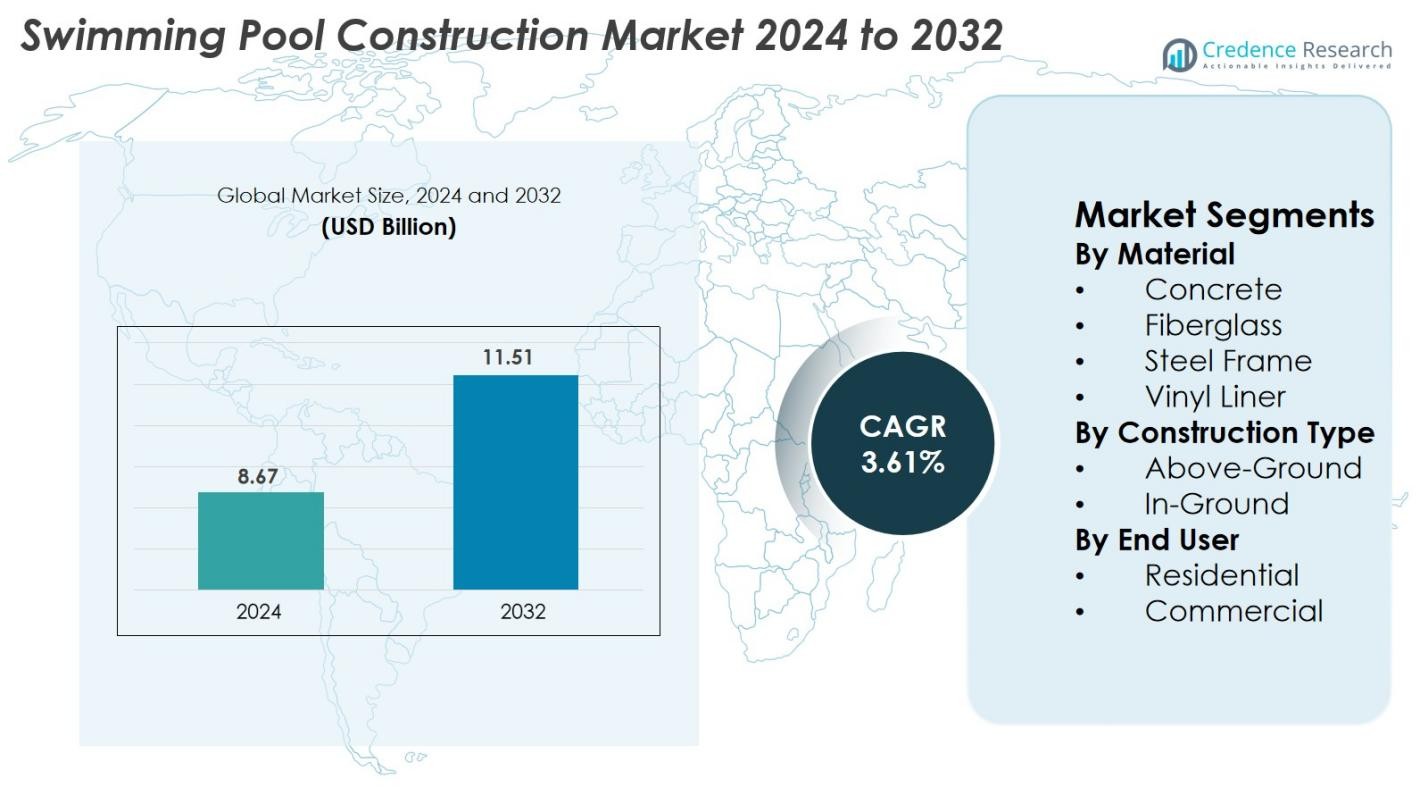

Swimming Pool Construction Market size was valued at USD 8.67 Billion in 2024 and is anticipated to reach USD 11.51 Billion by 2032, at a CAGR of 3.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Swimming Pool Construction Market Size 2024 |

USD 8.67 Billion |

| Swimming Pool Construction Market, CAGR |

3.61% |

| Swimming Pool Construction Market Size 2032 |

USD 11.51 Billion |

The Swimming Pool Construction Market features a strong mix of global and regional players, including Aloha Pools Ltd, Aquamarine Pools, Concord Pools and Spas, Leisure Pools, Millennium Pools Pvt. Ltd, Myrtha Pools, Natare Corporation, Platinum Pools, and Presidential Pools, Spas & Patio, all competing through advanced designs, durable materials, and turnkey installation services. These companies focus on expanding their portfolios with smart automation, energy-efficient systems, and structural innovations to meet rising residential and commercial demand. North America leads the market with over 38% share in 2024, driven by high consumer spending, luxury housing developments, and widespread adoption of in-ground pool systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Swimming Pool Construction Market was valued at USD 8.67 billion in 2024 and is projected to reach USD 11.51 billion by 2032, expanding at a CAGR of 3.61% during the forecast period.

- Rising residential construction, lifestyle upgrades, and demand for home-based recreational amenities drive market growth, with the residential segment accounting for 72% share and concrete material leading with 42% share due to durability and design flexibility.

- Growing adoption of smart automation, energy-efficient systems, and eco-friendly filtration solutions shapes market trends as consumers increasingly prefer low-maintenance and sustainable pool systems.

- Key players including Aloha Pools Ltd, Leisure Pools, Myrtha Pools, Platinum Pools, Aquamarine Pools, and Natare Corporation compete through innovative designs, durable materials, and turnkey installation capabilities to strengthen their market presence.

- Regionally, North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while in-ground pools dominate globally with more than 68% share across new installations.

Market Segmentation Analysis

By Material

The Swimming Pool Construction Market is dominated by the concrete segment, capturing over 42% share in 2024, driven by its superior durability, design flexibility, and suitability for large custom pools. Concrete pools remain the top choice for high-end residential and commercial installations that demand premium aesthetics and long service life. Fiberglass follows due to its low maintenance and quick installation benefits, while vinyl liner pools hold demand in budget-focused residential projects. Steel-frame structures continue to gain traction, supported by growing adoption in modular and semi-permanent pool designs.

- For instance, Shotcrete Technologies has developed high-density shotcrete systems capable of achieving compressive strengths above 8,000 psi, allowing builders to create deeper and more structurally complex concrete pools.

By Construction Type

The in-ground segment leads the Swimming Pool Construction Market with more than 68% share in 2024, driven by increasing investments in luxury homes, landscaped outdoor spaces, and wellness-focused environments. In-ground pools offer long-term durability, structural strength, and extensive customization, making them the preferred option across residential and commercial settings. Above-ground pools sustain steady demand in cost-sensitive households due to lower installation costs and minimal site preparation. Rising urban density and DIY-friendly designs further support the adoption of above-ground pool solutions.

- For instance, Hayward’s AquaRite salt chlorination systems are installed on more than one million pools globally and are designed for in-ground basins up to 150,000 liters of water.

By End User

The residential segment dominated the Swimming Pool Construction Market with 72% share in 2024, driven by rising disposable incomes, lifestyle upgrades, and strong demand for home-based recreational amenities. Home renovation activities and the expansion of premium housing projects continue to fuel residential pool installations. The commercial segment, including hotels, resorts, sports clubs, and wellness centers, is expanding steadily due to growth in tourism, fitness culture, and modernization of hospitality facilities. Increasing construction of Olympic-standard and training pools further contributes to segment growth.

Key Growth Drivers

Rising Residential Construction and Lifestyle Upgrades

The Swimming Pool Construction Market benefits significantly from expanding residential construction and lifestyle modernization across urban and semi-urban areas. Rising disposable incomes and a shift toward premium home amenities have increased the demand for private pools, especially among mid- to high-income households. Homeowners increasingly view pools as value-adding assets that enhance property appeal and support wellness-centric living. Additionally, the trend of creating outdoor recreational spaces, including landscaped backyards, patios, and entertainment zones, drives higher adoption of in-ground and custom-designed pools. The surge in luxury housing communities, gated townships, and villa projects further accelerates swimming pool installations as developers position pools as essential amenities. The renovation market also contributes strongly, with homeowners upgrading older pools using modern materials, energy-efficient pumps, and smart automation. This broad-based residential demand continues to strengthen market growth globally.

· For instance, Hayward’s OmniLogic smart automation platform supports remote control of circulation, heating, and lighting systems, with each high-voltage relay managing individual loads up to 30 A to streamline pool operation in modern homes

Expansion of Hospitality, Leisure, and Wellness Infrastructure

Growth in the hospitality and leisure sectors plays a pivotal role in advancing the Swimming Pool Construction Market. Hotels, luxury resorts, water parks, fitness centers, and recreational clubs increasingly incorporate advanced pool designs to enhance guest experience and differentiate their facilities. The global rise in travel and tourism, including wellness tourism, has accelerated investments in infinity pools, rooftop pools, temperature-controlled pools, and thematic recreational pools. Sports complexes and academies are also constructing Olympic-standard pools to promote competitive swimming and fitness programs. Additionally, wellness centers and spa resorts integrate hydrotherapy pools, plunge pools, and relaxation pools into their service offerings, driving commercial demand. Public sector investments in community swimming facilities, especially in emerging economies, further broaden market expansion. As commercial establishments strive to elevate comfort, aesthetics, and functionality, demand for innovative materials, advanced filtration systems, and smart maintenance solutions continues to rise.

- For instance, Myrtha Pools has supplied over 1,500 competition-standard pools globally using stainless-steel modules engineered to maintain structural precision with sheet thicknesses down to 0.8 mm, making them suitable for Olympic-level facilities.

Technological Advancements and Smart Pool Integration

Rapid technological advancements significantly boost the Swimming Pool Construction Market by improving safety, durability, and operational efficiency. Smart pool systems equipped with IoT sensors, automated filtration, remote monitoring, and app-based controls have become increasingly popular among both residential and commercial users. These features enable real-time water quality monitoring, automated cleaning cycles, and optimized energy usage, reducing long-term operational costs. Advancements in construction materials such as corrosion-resistant steel frames, high-performance concrete, and prefabricated fiberglass shells make pool installation faster and more reliable. Additionally, environmentally friendly solutions like solar pool heaters, variable-speed pumps, and energy-efficient LED lighting support sustainability-focused buyers. Robotic pool cleaners and automated chemical dispensers are also transforming pool maintenance by enhancing convenience and safety. Collectively, these technological innovations are reshaping customer expectations and driving adoption of modern, low-maintenance, and energy-efficient pool systems.

Key Trends & Opportunities

Growing Preference for Sustainable and Eco-Friendly Pool Solutions

Sustainability has emerged as a major trend in the Swimming Pool Construction Market, opening multiple opportunities for eco-friendly designs and technologies. Consumers increasingly prefer solutions that reduce energy consumption, minimize water wastage, and lower environmental impact. Solar heating systems, energy-efficient pumps, regenerative media filters, and saltwater chlorination systems are gaining traction globally. Innovations such as permeable deck materials, rainwater harvesting integration, and recirculation optimization also support environmentally conscious pool operations. Manufacturers are developing low-VOC construction materials, recyclable liners, and long-lasting fiberglass composites to address sustainability concerns. With governments implementing stricter regulations on water usage and energy consumption, builders are adopting green construction practices and high-efficiency systems. This shift toward eco-friendly pool ecosystems is creating substantial opportunities for technology providers, filtration companies, and sustainable construction material manufacturers.

- For instance, Pentair’s variable-speed pumps, such as the IntelliFlo series, operate across a speed range from 450 to 3,450 rpm, enabling significant energy reduction compared to fixed-speed models in residential and commercial pools.

Rising Demand for Customized Designs and Luxury Pool Features

The trend toward customization and luxury pool features continues to reshape the market, particularly in premium residential and hospitality segments. Consumers increasingly demand tailor-made designs such as infinity edges, glass walls, integrated spas, underwater lighting, cascading water features, and advanced landscaping elements. The rise of aesthetic-oriented outdoor living spaces encourages the adoption of premium finishes, mosaic tiles, textured concrete, and decorative lighting. Smart design integrations such as swim-up seating, sun shelves, fire-and-water features, and automatic covers further elevate the value proposition. Architects and designers increasingly collaborate with pool specialists to create experiential spaces that merge relaxation and visual appeal. Luxury hospitality brands are also pushing creative boundaries with rooftop pools, suspended pools, and thematic water installations. These evolving design preferences present strong opportunities for specialized contractors, premium material suppliers, and technology integrators.

· For instance, AGC Glass Europe supplies laminated structural glass panels suitable to support loads required by engineering specifications for demanding applications, enabling safe construction of transparent pool walls in luxury villas and hotel rooftops.

Key Challenges

High Initial Investment and Rising Maintenance Costs

One of the most significant challenges in the Swimming Pool Construction Market is the high upfront cost of installation, which includes excavation, materials, filtration systems, and design features. In-ground pools, especially custom and large-scale builds, require substantial financial investment, limiting their adoption among cost-sensitive consumers. Moreover, ongoing maintenance expenses—such as water treatment, cleaning, chemical balancing, repairs, and energy consumption—add to the long-term cost burden. Economic fluctuations, high labor charges, and rising prices of raw materials like concrete, fiberglass, and steel further elevate project costs. In some markets, increasing utility bills and water scarcity concerns discourage consumers from installing or maintaining swimming pools. Collectively, these financial constraints slow residential adoption and delay upgrade or renovation decisions.

Regulatory Constraints and Water Scarcity Issues

Strict regulatory frameworks related to water usage, safety standards, chemical management, and construction permits present notable challenges for market expansion. Regions facing drought conditions or water shortages impose restrictions on pool construction, filling, and maintenance, significantly impacting demand. Compliance with local building codes, fencing requirements, and filtration standards increases project complexity and cost for both contractors and consumers. Additionally, environmental regulations governing wastewater discharge, chemical handling, and energy efficiency require investment in advanced systems to meet mandatory guidelines. Commercial facilities face even stricter requirements to ensure public health and safety, adding operational overhead. These regulatory limitations, combined with rising environmental concerns, create barriers for new installations and necessitate continuous adaptation by builders and equipment suppliers.

Regional Analysis

North America

North America dominates the Swimming Pool Construction Market with 38% share in 2024, supported by strong residential demand and a well-established culture of home-based recreational amenities. The U.S. leads the region due to high spending on luxury housing, backyard renovations, and smart pool installations. Growing adoption of fiberglass and concrete pools in suburban areas further strengthens market growth. Commercial demand from hotels, fitness clubs, and educational institutions also contributes significantly. Ongoing technological advancements in automation, sustainability-focused solutions, and energy-efficient heating systems continue to accelerate new installations and renovations across the region.

Europe

Europe accounts for 27% share of the Swimming Pool Construction Market in 2024, driven by increasing investments in residential wellness spaces and modernized hospitality infrastructure. Southern European countries such as Spain, Italy, and France dominate installations due to warmer climates and high tourism activity. Demand for eco-friendly pool systems, including energy-efficient pumps, solar heaters, and saltwater chlorination, is rising rapidly. Renovation of aging pool structures in hotels, resorts, and sports facilities also fuels market expansion. Strict environmental regulations encourage the adoption of advanced filtration and water-saving technologies, strengthening Europe’s premium and sustainable pool construction segment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding 24% share in 2024, driven by rapid urbanization, increasing disposable incomes, and expanding real estate development. Countries such as China, Australia, India, and Southeast Asian markets are seeing a surge in luxury housing projects that incorporate in-ground swimming pools as standard amenities. The booming tourism and hospitality sector also fuels demand for resort-style pools, rooftop pools, and themed water attractions. Rising interest in health, fitness, and community recreation centers further boosts installations. Government-backed infrastructure development and foreign investments continue to accelerate commercial pool construction across emerging economies.

Latin America

Latin America captures 7% share of the Swimming Pool Construction Market in 2024, supported by growing residential adoption in Brazil, Mexico, Argentina, and Chile. Rising middle-class incomes and warm climatic conditions contribute to increasing demand for above-ground and in-ground pools. The hospitality and tourism sectors, especially in coastal and high-traffic vacation regions, drive installations of premium pools in hotels and resorts. However, economic volatility and varying construction spending limit rapid expansion. Nonetheless, adoption of modern materials, fiberglass shells, and cost-efficient filtration systems is helping the region steadily strengthen its market position.

Middle East & Africa (MEA)

The Middle East & Africa region holds 4% share of the Swimming Pool Construction Market in 2024, with growth concentrated in the UAE, Saudi Arabia, South Africa, and Egypt. High temperatures and expanding luxury real estate developments drive residential and commercial pool installations. Mega tourism projects, premium resorts, and gated communities increasingly incorporate modern pool designs, including infinity pools and temperature-controlled systems. Water scarcity and regulatory restrictions pose challenges, but advancements in recirculation technology and energy-efficient cleaning systems help mitigate limitations. Rising urbanization in Africa also supports gradual adoption across residential and hospitality sectors.

Market Segmentations

By Material

- Concrete

- Fiberglass

- Steel Frame

- Vinyl Liner

By Construction Type

By End User

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the Swimming Pool Construction Market is characterized by a mix of global manufacturers, regional specialists, and dedicated pool installation companies competing on design innovation, material quality, and turnkey service capabilities. Leading players such as Aloha Pools Ltd, Aquamarine Pools, Concord Pools and Spas, Leisure Pools, Millennium Pools Pvt. Ltd, Myrtha Pools, Natare Corporation, Platinum Pools, and Presidential Pools, Spas & Patio focus on expanding their portfolios with advanced in-ground, fiberglass, and concrete pool solutions. Companies are increasingly integrating smart automation, energy-efficient systems, and sustainable materials to differentiate offerings and address rising consumer demand for modern, low-maintenance pools. Strategic partnerships with real estate developers, resort chains, and fitness centers help strengthen commercial presence, while strong after-sales service, renovation expertise, and customizable design options remain key competitive levers. Continuous investment in technology, robotic cleaning, and high-performance filtration systems further enhances market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Easton Select Group acquired Jackson Pool Service, Inc. (Lexington, Massachusetts), enhancing its pool-construction, renovation & maintenance capabilities in the Greater Boston region.

- In July 2025, Lightview Capital announced a strategic majority investment in three affiliated commercial pool service & construction companies Vermana, Pulexa and nV Pools (all based in Florida).

- In April 2025, Azureon (via its parent O2 Investment Partners) made an investment in and partnership with Northern Pool & Spa of Eliot, Maine, to deepen its Northeast US presence.

Report Coverage

The research report offers an in-depth analysis based on Material, Construction Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady demand as residential construction and home renovation activity continue to rise globally.

- Adoption of smart pool technologies will accelerate, enhancing automation, energy efficiency, and remote monitoring.

- Eco-friendly pool solutions, including solar heating and low-chemical systems, will gain stronger preference among sustainability-focused consumers.

- Commercial installations in hotels, resorts, and sports complexes will expand with growing tourism and wellness infrastructure.

- Prefabricated fiberglass and modular pools will grow in popularity due to faster installation and lower maintenance needs.

- Custom-designed luxury pools with advanced aesthetics and integrated features will see rising adoption.

- Renovation and refurbishment of aging pools will increase as property owners upgrade to modern materials and efficient systems.

- Water-saving technologies and recirculation systems will become essential in regions facing regulatory and environmental pressures.

- Emerging markets in Asia-Pacific and Latin America will contribute significantly to new installations.

- Strategic partnerships between builders, real estate developers, and technology providers will reshape market competitiveness.