Market Overview:

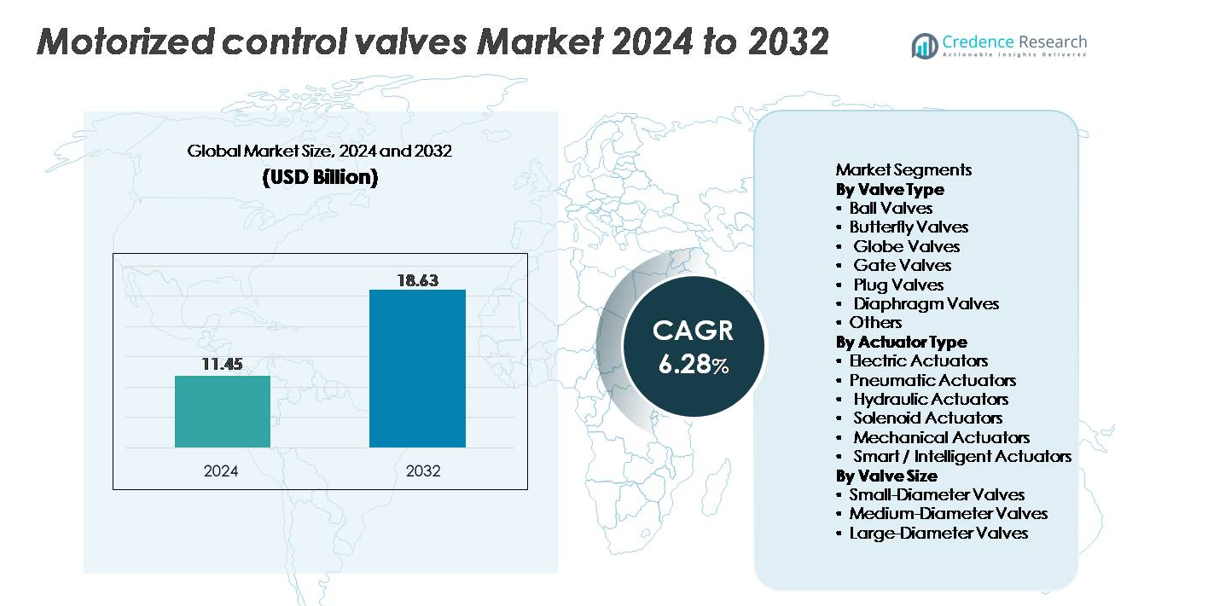

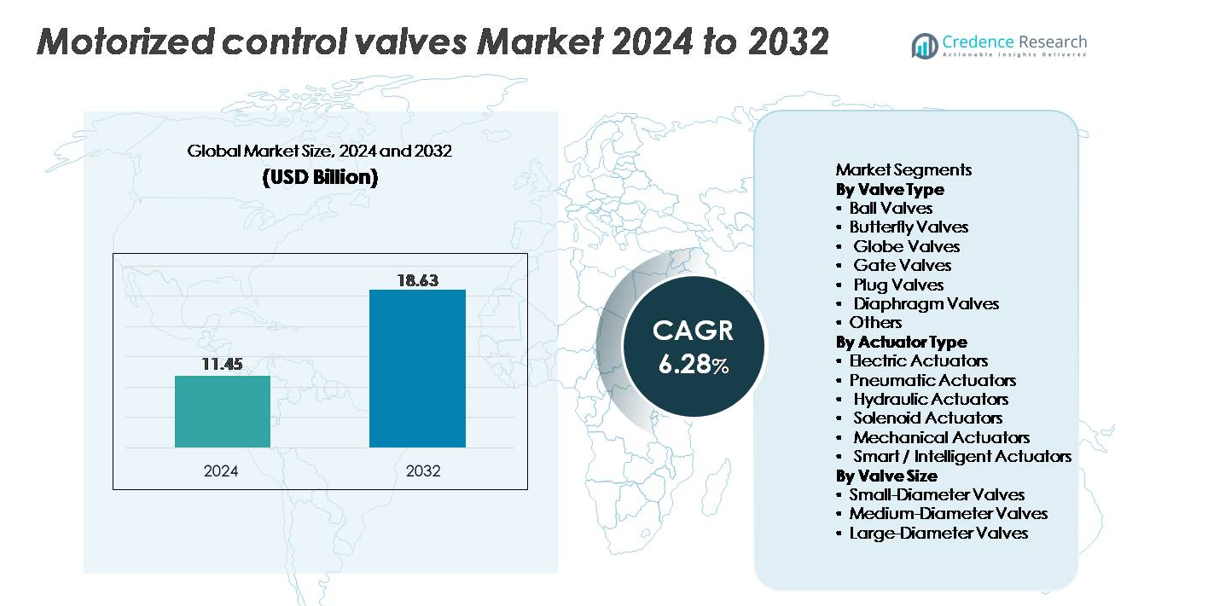

The global Motorized Control Valves market was valued at USD 11.45 billion in 2024 and is projected to reach USD 18.63 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.28% over the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorized Control Valves Market Size 2024 |

USD 11.45 billion |

| Motorized Control Valves Market, CAGR |

6.28% |

| Motorized Control Valves Market Size 2032 |

USD 18.63 billion |

The motorized control valves market is shaped by strong competition among global automation and flow-control specialists, including IMI Precision Engineering, Flowserve, Burkert, Emerson Electric Company, Danfoss, Parker, ARI Group, Rotork, GEMÜ Group, and Samson. These companies lead through advanced actuator technologies, precision flow-control solutions, and expanding portfolios of smart, IIoT-enabled valve systems tailored for industrial automation, water management, and energy applications. Many players emphasize durability, digital diagnostics, and rapid-response service networks to strengthen customer reliability. Regionally, Asia-Pacific remains the largest and most influential market, holding approximately 37% of global share, driven by rapid industrialization, extensive infrastructure development, and strong investments in process automation.

Market Insights

- The global motorized control valves market was valued at USD 11.45 billion in 2024 and is projected to reach USD 18.63 billion by 2032, expanding at a CAGR of 6.28%.

- Market growth is driven by industrial automation, aging water infrastructure upgrades, and rising adoption of electric and intelligent actuators, with medium-diameter valves holding the largest share due to widespread use in industrial pipelines.

- Key trends include the integration of IIoT-enabled smart actuators, energy-efficient designs, and predictive maintenance capabilities that enhance operational reliability across process industries.

- Competitive activity remains strong as leading players such as Emerson, Rotork, Flowserve, Burkert, and GEMÜ prioritize digitalization, product durability, and regional expansion while facing restraints such as high installation costs and integration complexity with legacy systems.

- Asia-Pacific leads the market with 37% share, followed by North America at 28% and Europe at 23%, supported by rapid industrialization, water treatment modernization, and strong automation adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Valve Type:

Ball valves represent the dominant sub-segment, accounting for the largest market share due to their robust shut-off capabilities, low torque requirements, and suitability for automated operation in oil & gas, water treatment, and chemical processing. Their quarter-turn design enables fast actuation and long service life, making them preferred in applications requiring frequent cycling and minimal leakage. Butterfly valves follow closely in high-flow systems, while globe and gate valves maintain relevance in precision control and high-pressure environments. The rising adoption of plug and diaphragm valves in corrosive and sanitary applications further broadens product diversity.

- For instance, Emerson’s Fisher™ Vee-Ball V200 control valve is available in sizes up to NPS 10 and delivers flow coefficients (Cv) as high as 2,250 (for that size range), enabling high capacity automated flow control in demanding industrial systems.

By Actuator Type:

Electric actuators hold the leading market share, driven by their precise positioning, low maintenance needs, and compatibility with digital control systems used across industrial automation. Their ability to integrate with smart monitoring platforms and support variable-speed operation makes them the preferred choice for energy-efficient, feedback-enabled motorized valve systems. Pneumatic actuators remain essential in hazardous or explosive settings, while hydraulic units serve heavy-duty, high-force applications. Solenoid and mechanical actuators cater to cost-sensitive installations, whereas smart/intelligent actuators are gaining traction as industries adopt predictive maintenance and IIoT-based process optimization.

- For instance, Rotork’s IQ3 Pro electric actuator delivers output torques up to 3,000 Nm and offers a data-logger capacity of up to 3,000 records, enabling detailed diagnostics and continuous performance tracking in automated flow-control networks.

By Valve Size:

Medium-diameter valves constitute the dominant sub-segment, largely because they meet the operational needs of widespread industrial pipelines in sectors such as power generation, refining, and chemical manufacturing. Their balanced flow capacity and manageable installation footprint make them suitable for both process control and distribution networks. Small-diameter valves are widely adopted in precision dosing, HVAC systems, and compact machinery, while large-diameter valves serve bulk fluid handling in municipal water infrastructure and midstream energy applications. Increasing investments in utility modernization and industrial automation continue to strengthen demand across all size categories.

Key Growth Drivers:

Expanding Industrial Automation and Process Optimization

Industrial automation is accelerating the adoption of motorized control valves as industries transition from manual to fully automated flow-control systems. Manufacturers in oil & gas, chemicals, pharmaceuticals, food processing, and power generation rely on automated valves to improve real-time control, reduce operational variability, and enhance throughput efficiency. Motorized valves provide precise actuation, faster response times, and easy integration with PLC, SCADA, and DCS networks, supporting increasingly complex process workflows. As factories upgrade legacy equipment and embrace digital transformation, demand intensifies for intelligent valves with adaptive control features, remote diagnostics, and programmable parameters. The growing emphasis on energy efficiency and waste reduction further fuels adoption, as motorized valves help maintain optimal fluid handling conditions under varying loads. Rising regulatory pressures for safety, emission control, and operational compliance strengthen the need for automation-ready flow control technologies, positioning motorized valves as essential components of modern industrial infrastructure.

- For instance, Emerson’s Fisher™ FIELDVUE™ DVC6200 digital valve controller utilizes a linkage-less, non-contact magnetic feedback sensor that eliminates physical contact and wearing parts, enhancing its longevity and reliability, particularly in high-vibration environments.

Rising Demand from Water & Wastewater Infrastructure Modernization

Growth in water and wastewater management systems is a major driver for motorized control valve adoption, supported by global efforts to upgrade aging municipal networks, expand desalination facilities, and implement advanced treatment plants. Motorized valves ensure precise flow regulation, automated isolation, and continuous monitoring across pipelines, filtration units, and treatment chambers. As urban populations expand and industrial water consumption rises, utilities require reliable valves that support remote operation, leak detection, and pressure optimization. Environmental regulations mandating water conservation and pollution control further push utilities toward intelligent valve systems capable of optimizing process efficiency. Infrastructure development programs across emerging economies contribute significantly to demand, particularly for medium- and large-diameter motorized valves used in distribution grids. Integration with smart water management systems and IoT sensors enhances operational visibility, driving continuous upgrades across public and private water management facilities.

- “For instance, an AUMA SA 14.6 electric actuator widely deployed in water and desalination plants for basic open-close duty delivers output torques up to 500 Nm and supports up to 60 starts per hour (S2 – 15 min duty cycle).

Increased Adoption in Energy, Power, and HVAC Applications

The energy and power sectors increasingly employ motorized control valves to support thermal power generation, district heating and cooling networks, and renewable energy systems. These valves ensure precise modulation of steam, condensate, chilled water, and other process fluids, improving system stability and overall energy efficiency. In HVAC and building automation, motorized valves enable zone-level temperature control, automated balancing, and adaptive modulation based on occupancy and load demand. Growing investments in data centers, commercial buildings, and industrial climate-control systems further accelerate adoption. The shift toward electrification and integration of advanced power-cycle technologies generates demand for highly reliable valves capable of operating under high temperature and pressure conditions. As sustainability initiatives encourage the deployment of energy-saving equipment, motorized valves play a key role in optimizing resource consumption across industrial, commercial, and residential environments.

Key Trends & Opportunities:

Growing Integration of Smart, Connected, and IIoT-Enabled Valve Solutions

A major trend shaping the market is the rapid integration of IIoT, edge monitoring, and predictive diagnostics into motorized valve systems. Smart actuators equipped with embedded sensors provide continuous insights into torque, vibration, temperature, cycle counts, and failure signatures, enabling predictive maintenance and reducing unplanned downtime across industrial facilities. Cloud connectivity allows operators to remotely control valves, receive alerts, and optimize performance in real time. This shift supports the development of intelligent process ecosystems, aligning with Industry 4.0 initiatives. Manufacturers are increasingly launching smart valve platforms that seamlessly integrate with plant automation software, offering advanced features such as digital twins, remote calibration, and AI-assisted flow optimization. As industries prioritize data-driven decision-making, demand for connected motorized valves is expected to accelerate significantly.

- For instance, Emerson’s FIELDVUE DVC6200 digital valve controller executes up to 500 samples per second and captures diagnostic signatures with a magnetic, non-contact travel sensor rated for over 100 million cycles, enabling high-precision monitoring and fault detection in automated plants.

Advancements in Energy-Efficient and Low-Maintenance Actuation Technologies

Energy efficiency is emerging as a central theme in the motorized control valves market, driving innovation in electric and intelligent actuator designs. New-generation actuators consume significantly less power, offer self-lubricating mechanisms, and incorporate stepper or brushless motors that deliver high precision with minimal maintenance. Manufacturers are developing low-friction valve seats, torque-optimized gearing, and adaptive control algorithms that reduce energy losses during frequent cycling. These innovations support sustainability goals across industries looking to reduce operational costs and environmental impact. Additionally, compact and modular actuator designs create opportunities in space-constrained or mobile systems, particularly in HVAC, food processing, marine, and small industrial equipment. As energy regulations tighten globally, demand for low-power, long-lifecycle actuation systems continues to grow.

- For instance, Danfoss’s NovoCon® S digital actuator integrates a brushless DC motor with a positioning resolution of 0.1% and operates at power consumption levels below 1.5 W in modulating mode, enabling highly efficient, low-maintenance control in HVAC and building-automation applications.

Expanding Use of Motorized Valves in Renewable Energy and Decarbonization Projects

Renewable energy projects including solar thermal plants, bioenergy facilities, geothermal installations, and hydrogen processing systems are creating new opportunities for motorized control valves. These applications require precise fluid and gas handling under varying pressure and temperature conditions, making advanced automated valves essential for process stability. The growing focus on hydrogen infrastructure (electrolysis, storage, and distribution), carbon capture pipelines, and sustainable district heating systems further boosts demand for motorized valves capable of handling corrosive gases, steam, and high-temperature fluids. As clean-energy investments surge globally, manufacturers that offer rugged, high-performance automated valves for renewable applications stand to benefit from significant long-term growth.

Key Challenges:

High Installation Costs and Complex Integration with Existing Infrastructure

One of the primary challenges for motorized control valves is the high upfront cost associated with installation, configuration, and integration into existing automation systems. Many industrial facilities still operate legacy equipment that lacks the communication interfaces needed for seamless integration with modern motorized valves. Upgrading wiring, control systems, and network protocols can significantly increase project costs and implementation timelines. Additionally, smart or intelligent actuators require skilled technicians for setup, calibration, and ongoing monitoring, creating barriers for smaller operators with limited technical capacity. Budget constraints in municipal water systems and older industrial plants further slow adoption, despite long-term efficiency benefits.

Performance Limitations in Extreme Operating Environments

Motorized control valves can face reliability challenges when deployed in harsh or extreme operating conditions such as high vibration zones, corrosive fluid environments, or high-pressure/temperature applications. Electrical actuators, in particular, may encounter overheating, insulation degradation, or electronic failure when exposed to continuous thermal stress or moisture ingress. Industries such as petrochemicals, mining, and offshore energy require ruggedized valves capable of withstanding aggressive conditions, adding cost and limiting the suitability of standard models. Ensuring long-term durability while maintaining precision control remains a significant engineering challenge, prompting manufacturers to invest in advanced sealing, corrosion-resistant materials, and heavy-duty actuator designs.

Regional Analysis:

North America

North America holds around 28% of the motorized control valves market, driven by extensive industrial automation, advanced process manufacturing, and strong investments in oil & gas, chemical processing, and water treatment. The U.S. leads regional demand, supported by ongoing modernization of pipeline networks, shale gas operations, and power generation facilities adopting automated flow-control technologies. Canada contributes additional growth through upgrades in municipal water infrastructure and rising adoption of intelligent valve systems in mining and energy applications. The region’s high digital readiness and strong presence of automation manufacturers further reinforce its competitive position.

Europe

Europe accounts for nearly 23% of the market, supported by strict regulatory standards for process efficiency, emissions control, and water management. Germany, the UK, Italy, and France lead adoption across chemical, pharmaceutical, and food-processing sectors, where precise fluid handling and automated control systems are mission-critical. The region’s strong focus on decarbonization and renewable energy particularly district heating, hydrogen infrastructure, and biomass plants fuels rising demand for advanced motorized valves. Investments in smart factories under EU Industry 5.0 initiatives further accelerate uptake of electric and intelligent actuators across industrial facilities.

Asia-Pacific

Asia-Pacific dominates the global market with approximately 37% share, driven by large-scale industrialization, expanding manufacturing bases, and rapid infrastructure development. China and India generate significant demand across power generation, oil & gas, water treatment, and chemical processing industries, while Southeast Asia expands adoption in food processing, pharmaceuticals, and electronics. Government-backed investments in municipal water networks, desalination plants, and industrial automation push widespread deployment of motorized valves. Regional manufacturers increasingly adopt smart actuators and IoT-enabled control technologies to enhance productivity, reinforcing APAC’s position as the fastest-growing regional market.

Latin America

Latin America holds roughly 5% of the global market, with demand concentrated in Brazil, Mexico, and Argentina. Growth stems from expanding oil & gas operations, modernization of refinery and petrochemical facilities, and rising investments in water and wastewater treatment infrastructure. Industrial automation is gradually increasing across food processing, mining, and power generation sectors, boosting the use of electric and pneumatic motorized valves. However, economic fluctuations and budget constraints among utilities can slow large-scale automation projects. Despite this, steady industrial expansion and regulatory pressure for water efficiency support long-term market growth.

Middle East & Africa

The Middle East & Africa region represents about 7% of the market, anchored by strong demand from oil & gas projects, desalination plants, and large-scale water distribution systems. Gulf countries continue to invest heavily in advanced automated flow-control technologies to optimize energy and water operations. In Africa, growing urbanization and the development of new power and industrial facilities drive wider adoption of motorized control valves. The region increasingly incorporates smart and corrosion-resistant valve systems capable of handling high-salinity and high-temperature environments, supporting sustained growth in both industrial and municipal applications.

Market Segmentations:

By Valve Type

- Ball Valves

- Butterfly Valves

- Globe Valves

- Gate Valves

- Plug Valves

- Diaphragm Valves

- Others

By Actuator Type

- Electric Actuators

- Pneumatic Actuators

- Hydraulic Actuators

- Solenoid Actuators

- Mechanical Actuators

- Smart / Intelligent Actuators

By Valve Size

- Small-Diameter Valves

- Medium-Diameter Valves

- Large-Diameter Valves

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the motorized control valves market is characterized by a mix of global automation leaders, specialized valve manufacturers, and emerging innovators focusing on intelligent actuation technologies. Companies compete on product reliability, torque efficiency, precision control, and integration capabilities with modern industrial automation systems. Leading players continue to expand portfolios of electric, pneumatic, and smart actuators, emphasizing compact designs, lower maintenance requirements, and enhanced digital connectivity. Strategic activities such as mergers, technology partnerships, and investments in IIoT-enabled valve platforms strengthen market positioning. Manufacturers increasingly target high-growth sectors including water treatment, power generation, chemicals, and HVAC by offering application-specific solutions with improved durability and corrosion resistance. Additionally, global players establish regional manufacturing facilities and service networks to enhance responsiveness and reduce lead times. Innovation in predictive diagnostics, cloud-based monitoring, and adaptive control systems remains a central focus, enabling companies to differentiate through value-added, intelligent valve solutions aligned with Industry 4.0 standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In July 2025, SAMSON AG As part of its major “MainChange” transformation programme, SAMSON began relocating its electronics-manufacturing unit (which assembles valve positioners and automated control components) from its historic HQ to a new state-of-the-art facility in Offenbach am Main; the first products (positioners) are slated to be fully manufactured at the new site starting October 2025.

- In February 2024, IMI Critical Engineering (part of IMI Precision Engineering) celebrated the 25-year milestone of its long-running Valve Doctor™ programme. The company reaffirmed its commitment to training expert valve-engineering professionals to deliver advanced flow-control solutions globally.

Report Coverage:

The research report offers an in-depth analysis based on Valve type, Actuator type, Valve size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see rising adoption of smart and IIoT-enabled motorized valves as industries accelerate digital transformation.

- Electric actuators will gain stronger momentum due to their precision, energy efficiency, and compatibility with modern automation platforms.

- Water and wastewater infrastructure upgrades will continue to generate substantial demand for medium- and large-diameter motorized valves.

- Renewable energy projects, including hydrogen, geothermal, and biomass systems, will increasingly integrate advanced motorized flow-control technologies.

- Predictive maintenance and remote monitoring capabilities will become standard features across new-generation valve systems.

- Manufacturers will prioritize corrosion-resistant materials and ruggedized designs for harsh industrial environments.

- Growth in smart buildings and HVAC automation will boost deployment of compact, electronically controlled valves.

- Emerging economies will accelerate investments in automated industrial processes, expanding market penetration.

- Partnerships between valve manufacturers and automation software providers will intensify to enable seamless system integration.

- Sustainability regulations will drive innovation in energy-efficient actuators and low-leakage valve designs.